Frozen Chicken Market Report

RA09226

Frozen Chicken Market by Type (Chicken Breast, Chicken Thigh, Chicken Drumstick, Chicken Wings, and Others), Product (Chicken Nuggets, Chicken Popcorn, Chicken Fingers, and Chicken Patty), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, and Online Retail), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Frozen Chicken Overview

Frozen chicken refers to chicken meat that has been thoroughly chilled to a temperature below freezing point and stored at low temperature to maintain its freshness and prevent bacterial growth. The process involves rapidly lowering the temperature of the chicken to freeze it, usually to around -18 degrees Celsius (0 degrees Fahrenheit) or lower. Freezing is a common method of preserving chicken and other meats, as it helps extend the shelf life of the product by inhibiting the growth of microorganisms that can cause spoilage. It also helps to maintain the nutritional quality of the chicken.

Frozen chicken is widely available in grocery stores and is convenient for consumers, as it can be stored for an extended period without significant deterioration in quality. Before cooking, frozen chicken should be thawed properly to ensure even cooking and to maintain the texture and flavor of the meat.

Global Frozen Chicken Market Analysis

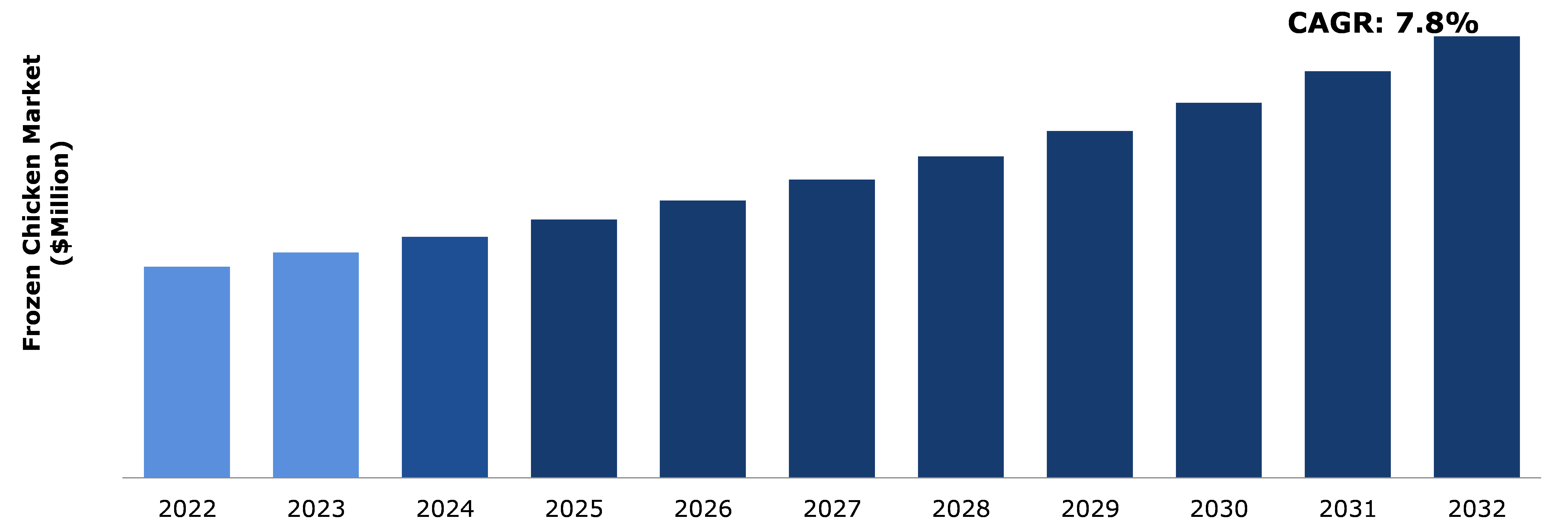

The global frozen chicken market size was $22,200.0 million in 2022 and is predicted to grow with a CAGR of 7.8%, by generating a revenue of $46,468.4 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on the Global Frozen Chicken Market

The COVID-19 pandemic had a significant impact on the frozen chicken market as lockdowns, restrictions, and disruptions in transportation and logistics made it challenging to source, process, and distribute frozen chicken products. This also led to delays, increased costs, and shortages of frozen chicken in the market. Initially, there was a surge in demand as consumers stockpiled food items, including frozen chicken, due to uncertainty about food availability. However, as the economic impact of the pandemic set in, some consumers shifted to more affordable options, impacting the demand for premium frozen chicken products. There were concerns about food safety and hygiene during the pandemic, which impacted consumer preferences. People were more conscious regarding the source and handling of food products, including frozen chicken. This led to an increase in demand for products with clear labeling, certifications, and assurances of safety.

The closure of restaurants and foodservice establishments significantly impacted the demand for frozen chicken products, which are commonly used in these settings. Several suppliers had to turn towards retail channels to compensate for the loss of business from restaurants. International trade was also affected due to these factors. Restrictions on cross-border trade and transportation led to challenges in exporting and importing frozen chicken products. Import-dependent countries faced difficulties in maintaining a steady supply. Governments and regulatory bodies implemented various measures to ensure food safety and hygiene during the pandemic. These changes impacted the operations and compliance requirements for businesses in the frozen chicken market.

Rising Demand for Protein-rich Foods to Drive the Market Growth

As consumers become more health-conscious, there is a growing awareness regarding the role of protein in maintaining a balanced diet. Proteins are essential for muscle development, immune system function and overall well-being. Frozen chicken offers convenience to consumers as it can be stored for longer periods without the risk of spoilage. This makes it a readily available source of protein that can be easily accessed and prepared at any time. Moreover, modern lifestyles, characterized by busy schedules and limited time for meal preparation, drive the demand for convenient and quick-to-cook food options. Frozen chicken fits well into this lifestyle, providing a time-saving solution for those seeking protein-rich meals. The globalization of food trends has introduced diverse culinary preferences and a demand for a variety of protein sources. Frozen chicken being a versatile product, can be incorporated into various cuisines, catering to a wide range of tastes and preferences. The frozen food industry has benefited from improvements in supply chain and distribution systems, ensuring a reliable and consistent availability of frozen chicken products in retail outlets. Furthermore, the longer shelf life of frozen chicken reduces the likelihood of food waste compared to fresh alternatives. Consumers can buy in bulk and store frozen chicken for an extended period, reducing the need for frequent grocery shopping. These factors collectively contribute to a growing global market for frozen chicken.

Quality and Safety Concerns to Restrain the Market Growth

Quality and safety issues of frozen chicken products is a critical concern. Frozen chicken must be stored at consistently low temperatures to prevent thawing and subsequent bacterial growth. Temperature fluctuations during storage or transportation can lead to freezer burn, which affects the texture and flavor of the chicken. Repeated thawing and refreezing of frozen chicken can cause significant quality deterioration. When the chicken thaws, ice crystals can damage the cell structure, leading to a loss of moisture and a decline in texture and flavor. Moreover, proper hygiene and sanitation are essential to prevent contamination of frozen chicken. Contaminants can include bacteria, viruses, parasites, and chemicals. Inadequate packaging and sealing can allow air to enter the packaging, leading to freezer burn. Any interruption in the cold chain, such as delays or equipment malfunctions, can lead to temperature fluctuations and compromise product safety, which is anticipated to hamper the frozen chicken market growth.

Globalization of Cold Chain Logistics and Infrastructure Development to Drive Excellent Opportunities

As the demand for frozen chicken products grows, there is a need for an expanded and efficient cold chain infrastructure. Investment opportunities exist in the development of temperature-controlled storage facilities, transportation, and distribution networks. Developing advanced cold storage technologies, such as automated storage and retrieval systems, can enhance the efficiency of the cold chain. This includes refrigerated trucks and containers that can maintain the required temperature throughout the supply chain. Furthermore, implementing technology solutions like IoT (Internet of Things) sensors and real-time monitoring systems can help track and manage the temperature conditions of frozen chicken products during transportation and storage. With a growing emphasis on sustainability, there are opportunities to invest in energy-efficient cold chain solutions. This includes exploring renewable energy sources for powering cold storage facilities and transportation. Developing innovative and sustainable packaging solutions for frozen chicken products can enhance shelf life, reduce waste, and appeal to environmentally conscious consumers.

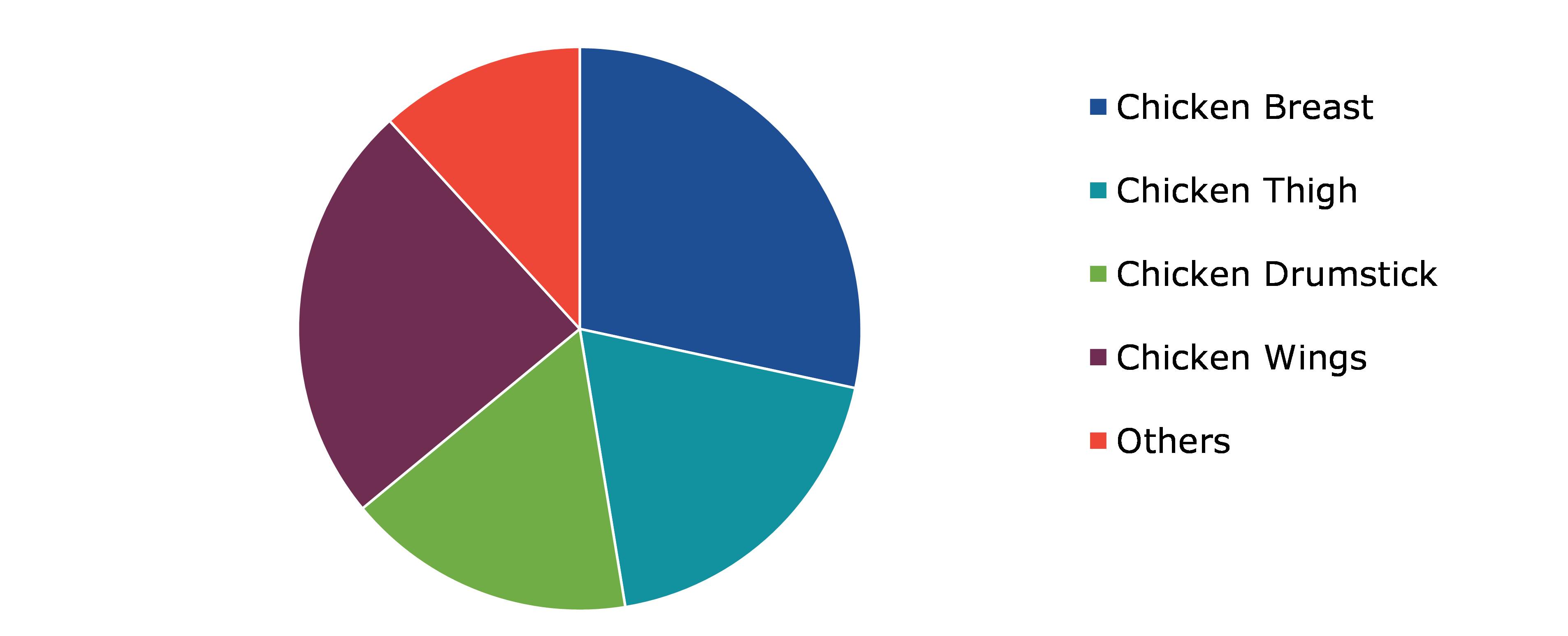

Global Frozen Chicken Market Share, by Type, 2022

Source: Research Dive Analysis

The chicken drumstick sub-segment accounted for the highest market share in 2022. Chicken drumsticks are popular due to their taste and convenience. They are easy to cook and are often considered a tasty part of the chicken. Drumsticks can be used in various recipes from grilling and frying to baking and slow cooking, making them versatile for different cuisines. This depends on the efficiency of the supply chain, including sourcing, processing, and distribution. The pricing of frozen chicken drumsticks compared to other protein sources plays a significant role. Competitive pricing can attract price-sensitive consumers. Effective marketing strategies, advertising campaigns, and promotions can also influence consumer choices. Branding that emphasizes quality, safety, and taste can be significant. Different cultures have varying preferences for chicken cuts and preparations. Understanding regional and global demand can help companies tailor their offerings. Meeting and exceeding regulatory quality and safety standards is essential. Consumers are increasingly concerned about the source and safety of their food. Furthermore, advancements in freezing technologies that preserve the texture and taste of chicken can contribute to the popularity of frozen chicken products.

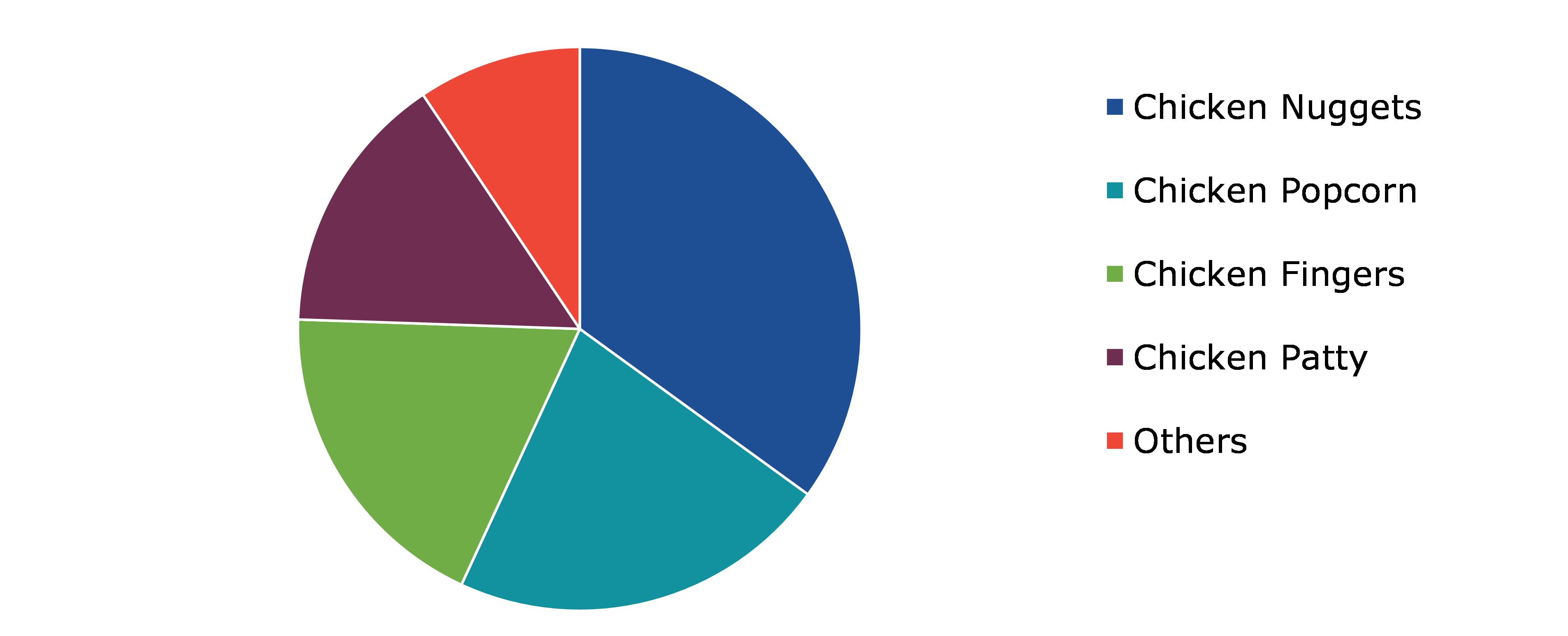

Global Frozen Chicken Market Share, by Product, 2022

Source: Research Dive Analysis

The chicken nuggets sub-segment accounted for the highest market share in 2022. Chicken nuggets are known for their convenience and ease of preparation. They are often pre-cooked and require minimal cooking time, making them a quick and convenient option for busy consumers. Chicken nuggets are a popular choice among children and many parents choose them as a kid-friendly option. The small, bite-sized pieces and familiar taste make chicken nuggets a go-to option for family meals. Moreover, manufacturers continually innovate by introducing new flavors, coatings, and varieties of chicken nuggets. This innovation makes the product appealing for consumers and helps cater to different taste preferences. With a growing trend toward convenience foods, frozen chicken products, including nuggets, are in demand. Consumers are increasingly looking for quick and easy meal solutions, and frozen chicken products fit into this lifestyle. Effective marketing and branding strategies play a crucial role in promoting chicken nuggets. Brands often emphasize factors such as quality, taste, and convenience to create a positive perception among consumers. With an increasing focus on health & wellness, some manufacturers are offering healthier versions of chicken nuggets. This may include options with lower fat content, whole-grain coatings, or organic ingredients, catering to health-conscious consumers.

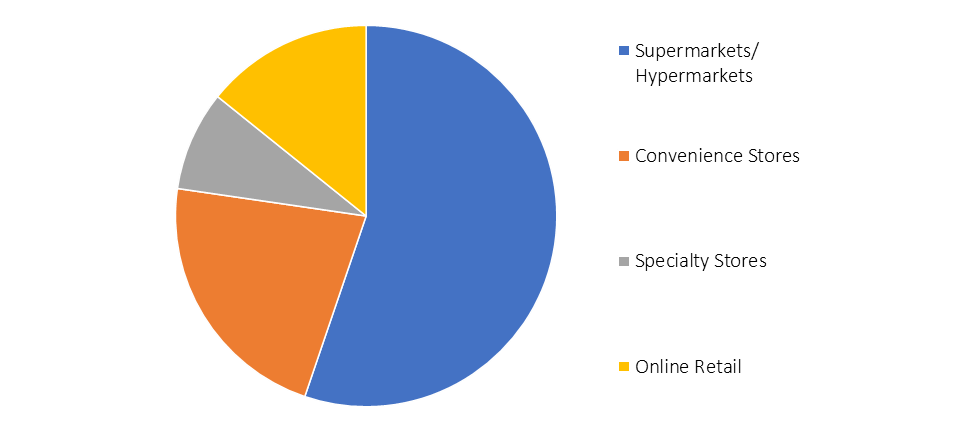

Global Frozen Chicken Market Share, by Distribution Channel, 2022

Source: Research Dive Analysis

The supermarkets/hypermarkets sub-segment accounted for the highest market share in 2022. Supermarkets and hypermarkets provide a convenient one-stop shopping experience, making it easier for consumers to access a wide variety of frozen chicken products. Supermarkets and hypermarkets typically offer a wide range of frozen chicken products, including different species, cuts, and preparation methods. This variety allows consumers to choose products that match their preferences and dietary requirements. These large retail formats often have the advantage of bulk purchasing and efficient supply chain management, which can result in competitive pricing for frozen chicken products. Price-conscious consumers are attracted to these stores due to cost-effective shopping. Supermarkets and hypermarkets usually have rigorous quality control standards in place, ensuring the frozen chicken products they sell meet safety and quality standards. Well-known supermarket and hypermarket chains have established brand trust among consumers. Supermarkets and hypermarkets frequently run promotions, discounts, and loyalty programs that attract budget-conscious consumers. These benefits are anticipated to drive increased sales of frozen chicken products.

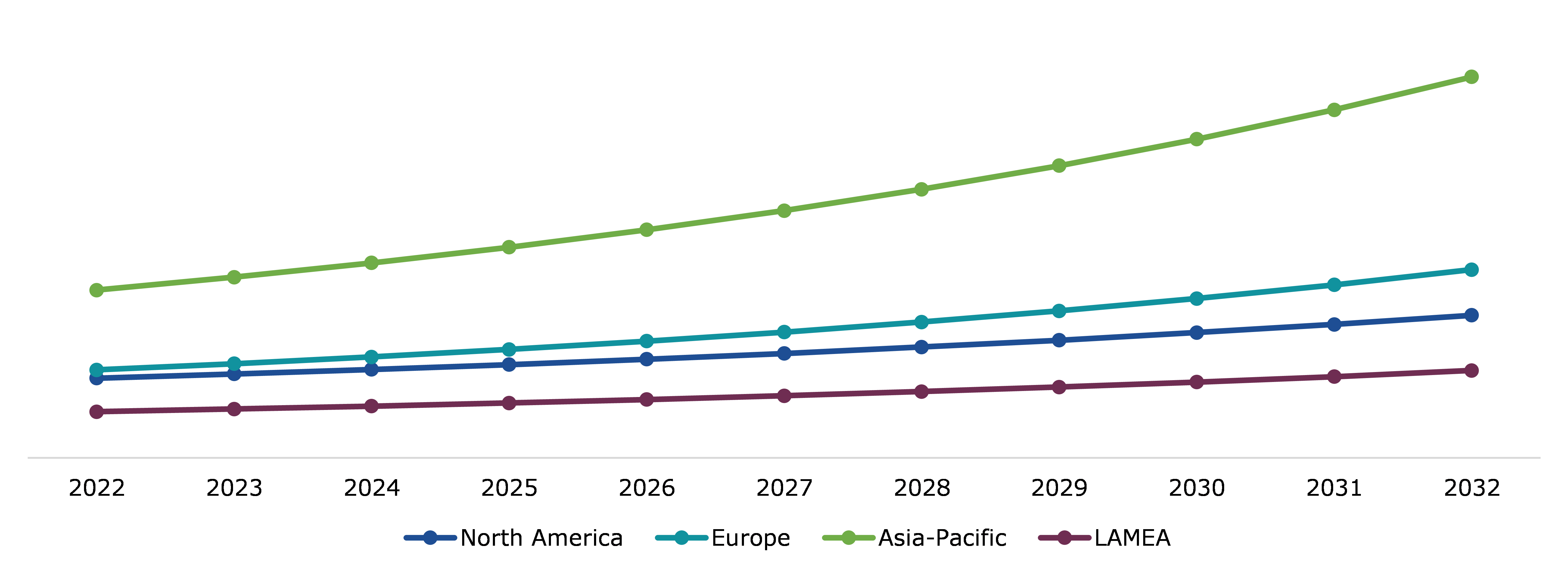

Global Frozen Chicken Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The Asia-Pacific frozen chicken market generated the highest revenue in 2022. Increasing consumer awareness regarding the nutritional benefits of chicken, along with changing dietary preferences, are factors driving the demand for frozen chicken products in the region. Urbanization and the adoption of busier lifestyles have led to a higher demand for convenient and easy-to-prepare food items, including frozen chicken. The globalization of supply chains has facilitated the availability of a wide variety of frozen chicken products from different parts of the world in Asia-Pacific. Improvements in cold chain logistics and storage technologies have enhanced the efficiency of the frozen chicken supply chain, ensuring the quality and safety of products during transportation and storage. Companies in the regional frozen chicken market have been focusing on product innovation, introducing new flavors, packaging formats, and ready-to-cook options to cater to diverse consumer preferences. The growth of e-commerce platforms has provided consumers with easier access to a wide range of frozen chicken products, contributing to market expansion in Asia-Pacific. Cultural preferences and culinary traditions in the region, where chicken is a staple in many diets, have driven the demand for frozen chicken products.

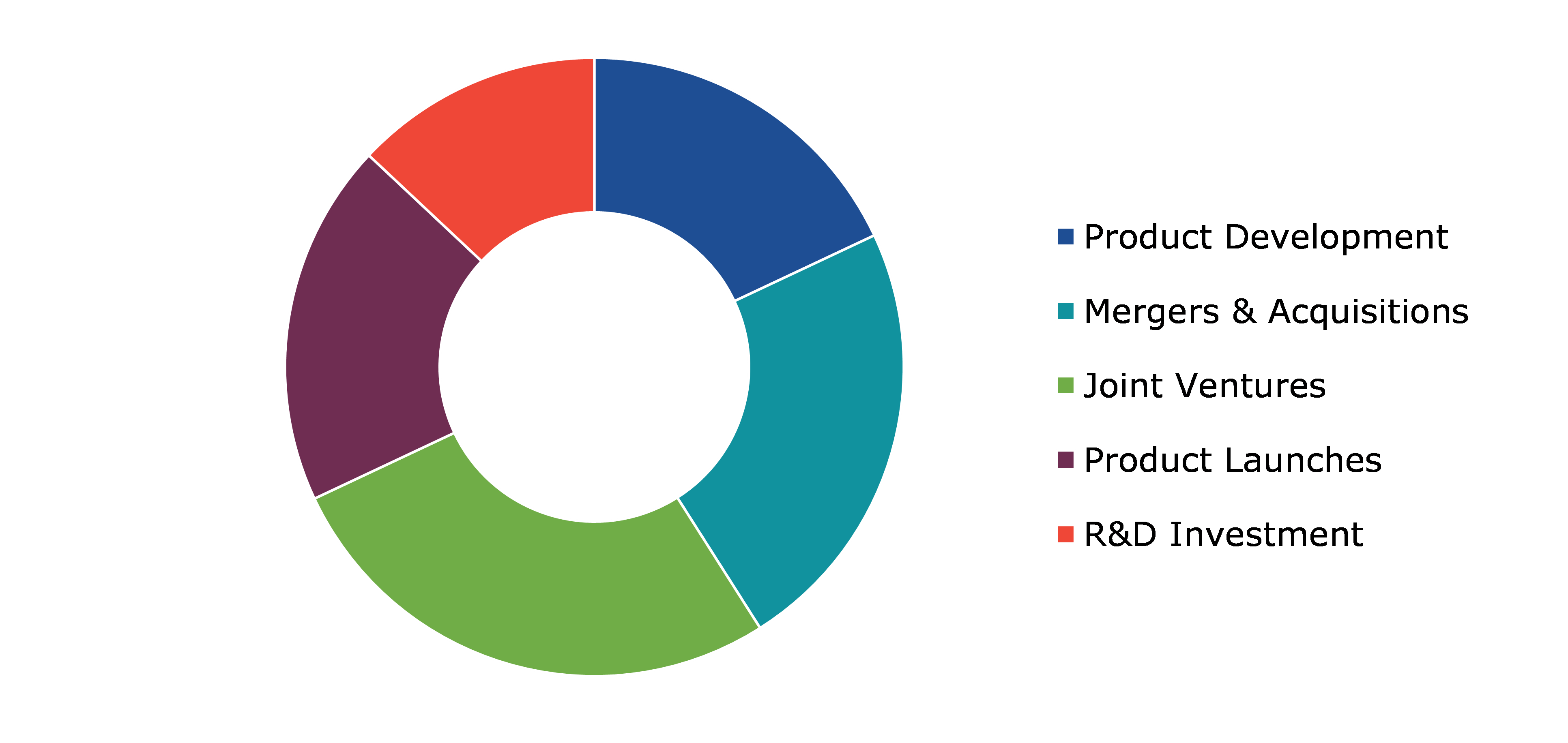

Competitive Scenario in the Global Frozen Chicken Market

Investment and agreement are common strategies followed by major market players. For instance, on November 4, 2023, Tyson Brand voluntarily recalled approximately 30,000 pounds of frozen, fully cooked chicken ‘Fun Nuggets.’ This includes Tyson Brand fully cooked ‘Fun Nuggets’ sold to retailers in 29-ounce packages. Though, no other Tyson brand products were affected.

Source: Research Dive Analysis

Some of the companies operating in the frozen chicken market are Tyson Foods, Inc., JBS S.A., Cargill, Incorporated, Farbest Foods, Perdue Farms, Sanderson Farms, Inc., Hormel Foods Corporation, Inghams Group Limited, BRF S.A., and Pilgrim's Pride Corporation.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Product |

|

| Segmentation by Distribution Channel |

|

| Key Companies Profiled |

|

Q1. What is the size of the global frozen chicken market?

A. The size of the global frozen chicken market was over $22,200.0 million in 2022 and is projected to reach $46,468.4 million by 2032.

Q2. Which are the major companies in the frozen chicken market?

A. Tyson Foods, Inc., JBS S.A., and Cargill, Incorporated are some of the key players in the global frozen chicken market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific frozen chicken market?

A. The Asia-Pacific frozen chicken market is anticipated to grow at 8.6% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Farbest Foods, Perdue Farms, and Sanderson Farms, Inc. are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global frozen chicken market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on frozen chicken market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Frozen Chicken Market Analysis, by Type

5.1. Overview

5.2. Chicken Breast

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Chicken Thigh

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Chicken Drumstick

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Chicken Wings

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2022-2032

5.5.3. Market share analysis, by country, 2022-2032

5.6. Others

5.6.1. Definition, key trends, growth factors, and opportunities

5.6.2. Market size analysis, by region, 2022-2032

5.6.3. Market share analysis, by country, 2022-2032

5.7. Research Dive Exclusive Insights

5.7.1. Market attractiveness

5.7.2. Competition heatmap

6. Frozen Chicken Market Analysis, by Product

6.1. Overview

6.2. Chicken Nuggets

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Chicken Popcorn

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Chicken Fingers

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Chicken Patty

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2022-2032

6.5.3. Market share analysis, by country, 2022-2032

6.6. Others

6.6.1. Definition, key trends, growth factors, and opportunities

6.6.2. Market size analysis, by region, 2022-2032

6.6.3. Market share analysis, by country, 2022-2032

6.7. Research Dive Exclusive Insights

6.7.1. Market attractiveness

6.7.2. Competition heatmap

7. Frozen Chicken Market Analysis, by Distribution Channel

7.1. Supermarkets/Hypermarkets

7.1.1. Definition, key trends, growth factors, and opportunities

7.1.2. Market size analysis, by region, 2022-2032

7.1.3. Market share analysis, by country, 2022-2032

7.2. Convenience Stores

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2022-2032

7.2.3. Market share analysis, by country, 2022-2032

7.3. Specialty Stores

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2022-2032

7.3.3. Market share analysis, by country, 2022-2032

7.4. Online Retail

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2022-2032

7.4.3. Market share analysis, by country, 2022-2032

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Frozen Chicken Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Type, 2022-2032

8.1.1.2. Market size analysis, by Product, 2022-2032

8.1.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.2. Canada

8.1.2.1. Market size analysis, by Type, 2022-2032

8.1.2.2. Market size analysis, by Product, 2022-2032

8.1.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.3. Mexico

8.1.3.1. Market size analysis, by Type, 2022-2032

8.1.3.2. Market size analysis, by Product, 2022-2032

8.1.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Type, 2022-2032

8.2.1.2. Market size analysis, by Product, 2022-2032

8.2.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.2. UK

8.2.2.1. Market size analysis, by Type, 2022-2032

8.2.2.2. Market size analysis, by Product, 2022-2032

8.2.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.3. France

8.2.3.1. Market size analysis, by Type, 2022-2032

8.2.3.2. Market size analysis, by Product, 2022-2032

8.2.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.4. Spain

8.2.4.1. Market size analysis, by Type, 2022-2032

8.2.4.2. Market size analysis, by Product, 2022-2032

8.2.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.5. Italy

8.2.5.1. Market size analysis, by Type, 2022-2032

8.2.5.2. Market size analysis, by Product, 2022-2032

8.2.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Type, 2022-2032

8.2.6.2. Market size analysis, by Product, 2022-2032

8.2.6.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Type, 2022-2032

8.3.1.2. Market size analysis, by Product, 2022-2032

8.3.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.2. Japan

8.3.2.1. Market size analysis, by Type, 2022-2032

8.3.2.2. Market size analysis, by Product, 2022-2032

8.3.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.3. India

8.3.3.1. Market size analysis, by Type, 2022-2032

8.3.3.2. Market size analysis, by Product, 2022-2032

8.3.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.4. Australia

8.3.4.1. Market size analysis, by Type, 2022-2032

8.3.4.2. Market size analysis, by Product, 2022-2032

8.3.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.5. South Korea

8.3.5.1. Market size analysis, by Type, 2022-2032

8.3.5.2. Market size analysis, by Product, 2022-2032

8.3.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Type, 2022-2032

8.3.6.2. Market size analysis, by Product, 2022-2032

8.3.6.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Type, 2022-2032

8.4.1.2. Market size analysis, by Product, 2022-2032

8.4.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.2. Saudi Arabia

8.4.2.1. Market size analysis, by Type, 2022-2032

8.4.2.2. Market size analysis, by Product, 2022-2032

8.4.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.3. UAE

8.4.3.1. Market size analysis, by Type, 2022-2032

8.4.3.2. Market size analysis, by Product, 2022-2032

8.4.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.4. South Africa

8.4.4.1. Market size analysis, by Type, 2022-2032

8.4.4.2. Market size analysis, by Product, 2022-2032

8.4.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Type, 2022-2032

8.4.5.2. Market size analysis, by Product, 2022-2032

8.4.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. Tyson Foods, Inc.

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. JBS S.A.

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Cargill, Incorporated

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Farbest Foods

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Perdue Farms

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Sanderson Farms, Inc.

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Hormel Foods Corporation

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Inghams Group Limited

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. BRF S.A.

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Pilgrim's Pride Corporation

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com