Global Vegan Chocolate Market Report

RA08758

Global Vegan Chocolate Market by Type (Dark, Milk, and White), Product (Molded Bars, Chips & Bites, and Boxed), Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Online Stores, and Convenience Stores), and Region (North America, Europe, Asia-Pacific, and LAMEA): Opportunity Analysis and Industry Forecast, 2023-2032

Vegan Chocolate Overview

Vegan chocolate refers to chocolate products that are made without any animal-derived ingredients or by-products. Traditional chocolate often contains milk or milk powder, which makes it unsuitable for those following a vegan lifestyle. Vegan chocolate, on the contrary, is made with alternative ingredients such as plant-based milk (like almond, soy, or oat milk) and natural sweeteners (such as agave syrup or coconut sugar) to achieve a similar taste and texture to conventional chocolate. In addition to being free from animal products, vegan chocolate is also typically produced without using any other animal-related processes. This means that it is not processed with equipment that handles dairy or other non-vegan ingredients, reducing the risk of cross-contamination.

Vegan chocolate comes in various forms, including chocolate bars, truffles, chocolate chips, and cocoa powder. It has become increasingly popular as more people adopt vegan or plant-based diets and seek out alternatives to traditional chocolate products.

Global Vegan Chocolate Market Analysis

The global vegan chocolate market size was $585.8 million in 2022 and is predicted to grow with a CAGR of 13.1%, by generating a revenue of $1,960.9 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Vegan Chocolate Market

Before the COVID-19 pandemic, the vegan chocolate market was experiencing steady growth and increasing consumer demand. Rising health consciousness, ethical considerations, and a growing vegan population were driving the demand for plant-based food products, including vegan chocolates. Many consumers were actively seeking out dairy-free and animal-free alternatives, leading to the expansion of the vegan chocolate market.

The COVID-19 pandemic has had a significant impact on various sectors, including the food industry. The pandemic had both positive and negative impacts on the vegan chocolate market. Initially, during the lockdowns and restrictions, the overall food & beverage industry faced challenges due to supply chain disruptions, reduced consumer spending, and temporary store closures. This also affected the vegan chocolate market, causing a decline in sales. However, consumers started prioritizing health & wellness, and there was an increase in emphasis on plant-based diets. This trend benefited the vegan chocolate market, as more people turned to plant-based alternatives.

Increasing Vegan and Plant-Based Diets to Drive the Market Growth

The number of people adopting veganism and plant-based diets has been steadily rising. Veganism is a lifestyle that avoids the consumption of animal-derived products, including dairy and eggs, which are commonly found in traditional chocolate. Therefore, consumers following these diets look for vegan alternatives, including chocolate, to align with their ethical beliefs and dietary preferences. Moreover, many consumers are becoming more conscious about the ethical implications of their food choices. They are concerned about animal welfare and the environmental impact of animal agriculture. By choosing vegan chocolate, consumers can enjoy their favorite treat without supporting practices they find objectionable.

Furthermore, health considerations also play a role in the growing demand for vegan chocolate. Some consumers adopt plant-based diets for health reasons, such as reducing cholesterol levels or managing weight. Vegan chocolate, typically made with natural ingredients and free from animal fats, offers a perceived healthier alternative to traditional chocolate. In addition, the rising demand for vegan chocolate has boosted product innovation in the food industry. Manufacturers are developing a wide range of plant-based ingredients and techniques to create vegan chocolates that closely resemble their non-vegan counterparts in taste, texture, and appearance. This expanding variety of vegan chocolate options has attracted both vegans and non-vegans who are curious to explore plant-based alternatives.

To know more about global vegan chocolate market drivers, get in touch with our analysts here.

Limited Availability of Ingredients to Restrain the Market Growth

The limited availability of specific ingredients can disrupt the supply chain for vegan chocolate manufacturers. If certain plant-based alternatives are not available in sufficient quantities, it can lead to delays in production or increased costs due to the need to source from alternative suppliers. Moreover, the dependency on a limited range of ingredients may increase the vulnerability of the supply chain due to external factors like climate change, crop failures, or natural disasters. Some traditional chocolate additives, such as butter, are derived from animal products. Vegan chocolate manufacturers often need to find suitable plant-based alternatives to achieve similar taste, texture, and quality. However, these alternatives may not be readily available or may come at a higher cost compared to their animal-derived counterparts. This limitation can impact the feasibility and affordability of producing vegan chocolate on a larger scale, which is anticipated to hamper the vegan chocolate market growth in the upcoming years.

Growing Consumer Demand for Innovative Flavors and Varieties to Drive Excellent Opportunities

The demand for vegan chocolate is rising as more individuals adopt vegan or vegetarian lifestyles. This segment of consumers actively seeks plant-based alternatives, creating a growing market niche for companies to tap into. Moreover, many consumers are turning to vegan chocolate as a healthier alternative to traditional chocolate. Vegan chocolate is often free from dairy, cholesterol, and other animal-based ingredients, making it appealing to health-conscious individuals. Companies can capitalize on this trend by promoting the health benefits of their vegan chocolate products. Furthermore, vegan chocolate allows for the exploration of a wide range of ingredient combinations. Companies can experiment with various fruits, nuts, seeds, spices, and extracts to create unique flavor profiles. For example, they can incorporate ingredients like coconut, almonds, hazelnuts, goji berries, matcha, or even chili peppers to add exciting and distinctive tastes to their chocolates.

Moreover, vegan chocolate provides a platform to incorporate superfoods and functional ingredients known for their health benefits. This can include ingredients like cacao nibs, acai berries, maca powder, spirulina, turmeric, or adaptogens. By incorporating these ingredients, companies can create chocolates that appeal to health-conscious consumers looking for indulgence with added nutritional value. The vegan chocolate market provides ample opportunities for companies to showcase their creativity and innovation by developing unique flavors and varieties.

To know more about global vegan chocolate market opportunities, get in touch with our analysts here.

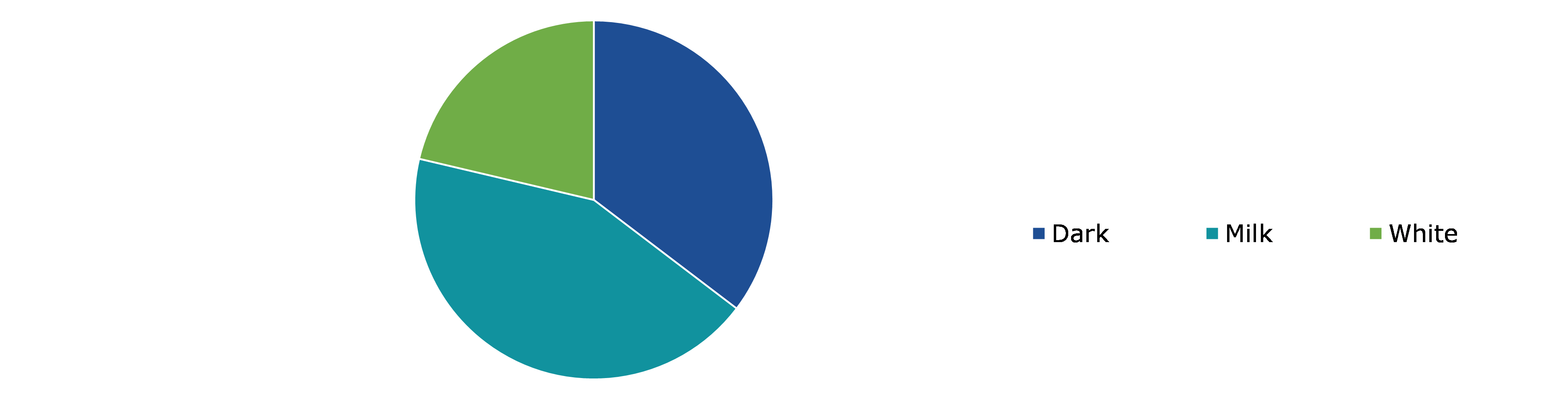

Global Vegan Chocolate Market Share, by Type, 2022

Source: Research Dive Analysis

The milk sub-segment accounted for the highest market share in 2022. Plant-based milk alternatives are often perceived as healthier options compared to dairy milk due to factors such as lower saturated fat content and potential allergen avoidance. As health-conscious consumers seek out healthier food choices, the demand for vegan chocolate made with plant-based milk increases. Moreover, veganism is often associated with animal welfare and environmental sustainability. Many consumers choose vegan products, including vegan chocolate, to support cruelty-free practices and reduce their ecological footprint. Using plant-based milk aligns with these values and promotes sustainability. Furthermore, manufacturers have improved the taste and texture of plant-based milk alternatives over the years, making them more appealing to consumers.

The availability of a wide range of flavorful and creamy plant-based milk has encouraged the use of these alternatives in vegan chocolate, providing consumers with a satisfying taste experience. Moreover, increasing marketing efforts and consumer education about the benefits of plant-based milk alternatives have raised awareness and understanding among consumers. As more people become aware of the various milk alternatives and their benefits, the demand for vegan chocolate made with plant-based milks is likely to grow.

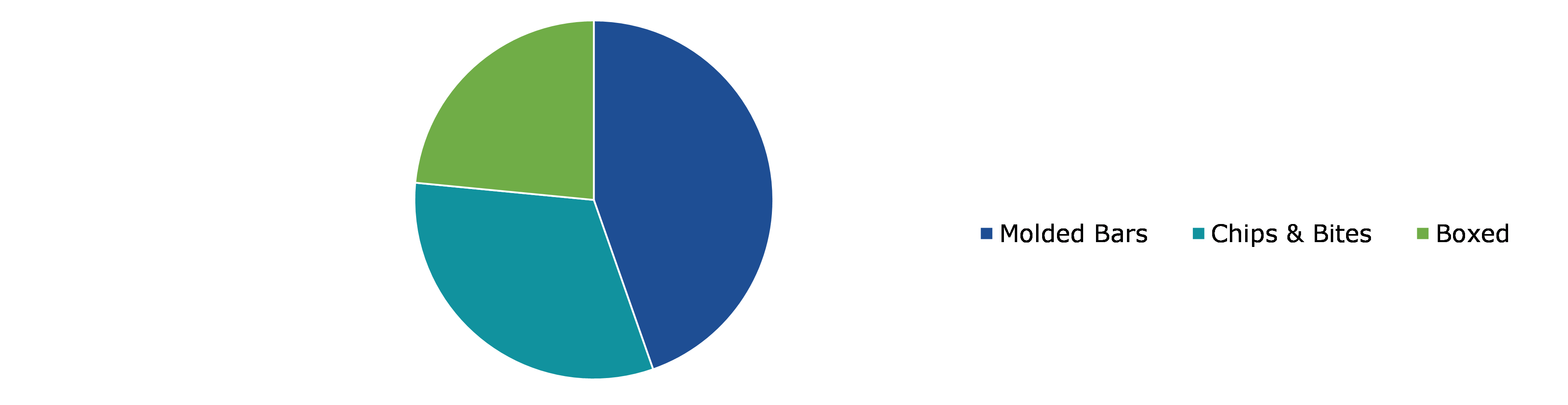

Global Vegan Chocolate Market Share, by Product, 2022

Source: Research Dive Analysis

The molded bars sub-segment accounted for the highest market share in 2022. Molded bars are typically individually wrapped, making them easily portable and convenient for on-the-go consumption. This aspect appeals to consumers with busy lifestyles, who seek convenient snacking options. Consumers are becoming more health-conscious and are seeking healthier alternatives to traditional chocolate bars. Molded bars in the vegan chocolate segment often incorporate natural and organic ingredients, lower sugar content, and other health-focused attributes, making them appealing to health-conscious individuals. Furthermore, manufacturers in the vegan chocolate market are constantly innovating to meet consumer demands and preferences.

Molded bars allow for creative and eye-catching designs, shapes, and flavors. This versatility in product offerings attracts consumers and creates a unique selling point for manufacturers. Moreover, the availability of a wide range of plant-based ingredients suitable for vegan chocolate production has contributed to the growth of the molded bars segment. Ingredients such as almond milk, coconut milk, rice milk, and various plant-based sweeteners provide manufacturers with options to create diverse flavors and textures in molded bars.

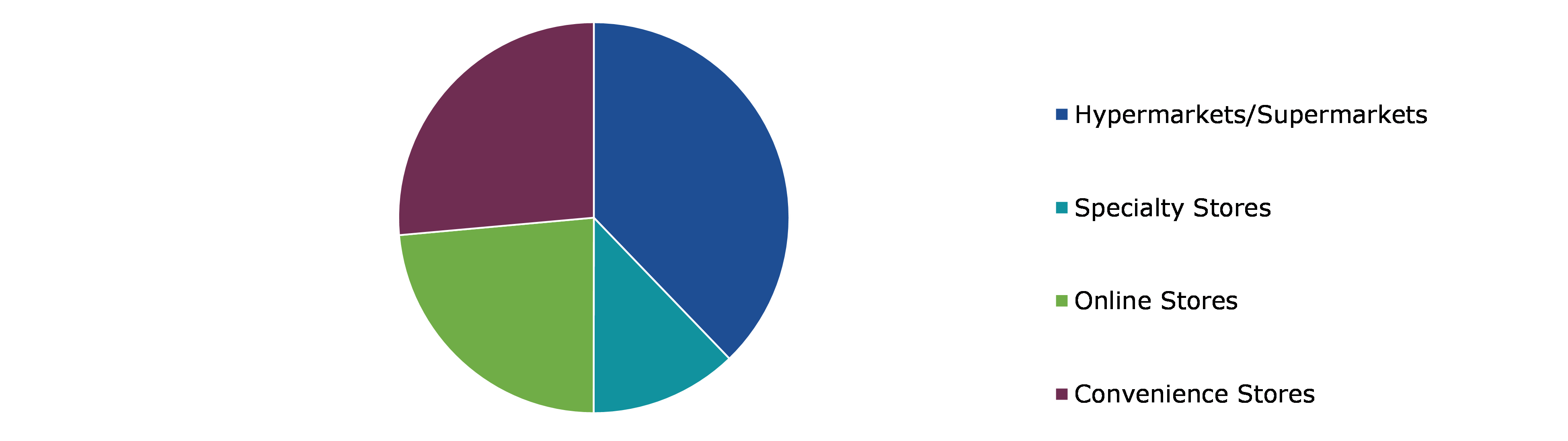

Global Vegan Chocolate Market Share, by Distribution Channel, 2022

Source: Research Dive Analysis

The hypermarkets/supermarkets sub-segment accounted for the highest market share in 2022. Growing consumer interest and demand for vegan and plant-based products, including vegan chocolate, are driving the hypermarkets/supermarkets segment growth. People are increasingly adopting vegan lifestyles or seeking vegan alternatives due to health, ethical, and environmental concerns. Moreover, hypermarkets and supermarkets offer a wide range of products, making them an ideal platform for introducing and promoting vegan chocolate. Manufacturers and suppliers are expanding their vegan chocolate product lines, and hypermarkets/supermarkets provide the shelf space and distribution channels to make these products easily accessible to consumers.

Furthermore, hypermarkets/supermarkets often stock a variety of brands, including both established and emerging vegan chocolate brands. This diversity of options appeals to consumers with different preferences and allows for healthy competition among manufacturers. Hypermarkets/supermarkets are convenient locations for consumers to shop for their regular groceries while also exploring and purchasing vegan products. These retail outlets are typically easily accessible and have longer operating hours compared to specialized stores, making them a convenient one-stop shop for consumers.

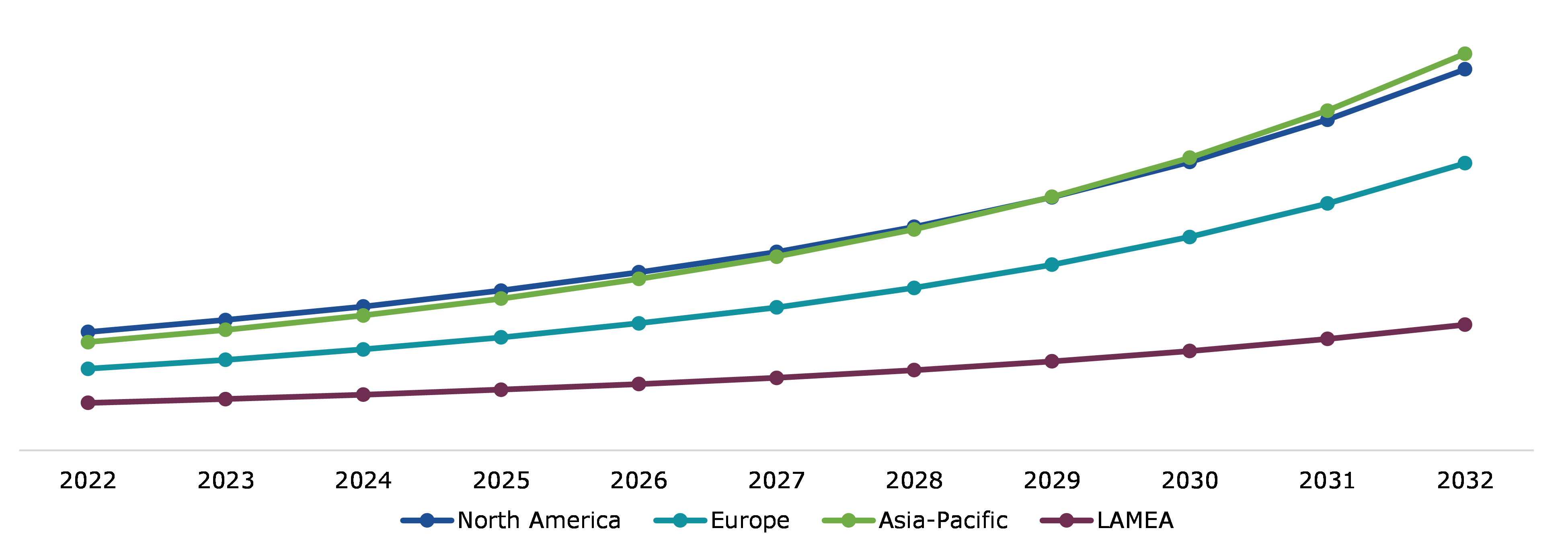

Global Vegan Chocolate Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The North America vegan chocolate market generated the highest revenue in 2022. Increasing awareness about health & wellness is a significant driver for the vegan chocolate market demand. Consumers in North America are increasingly seeking healthier alternatives to traditional chocolate products, and vegan chocolates are often perceived as a healthier option due to their plant-based ingredients and absence of animal-derived components. Moreover, the adoption of vegan and plant-based diets has been on the rise in North America. Many consumers are choosing to follow a vegan lifestyle for various reasons, including animal welfare, environmental concerns, and personal health. Therefore, there is a growing demand for vegan chocolate products that cater to this dietary preference. Furthermore, conscious consumerism is gaining traction in the region, with more consumers prioritizing ethically produced and sustainably sourced products. Vegan chocolates, especially those made with fair-trade and organic ingredients, align with these consumer preferences, contributing to the growth of the regional market.

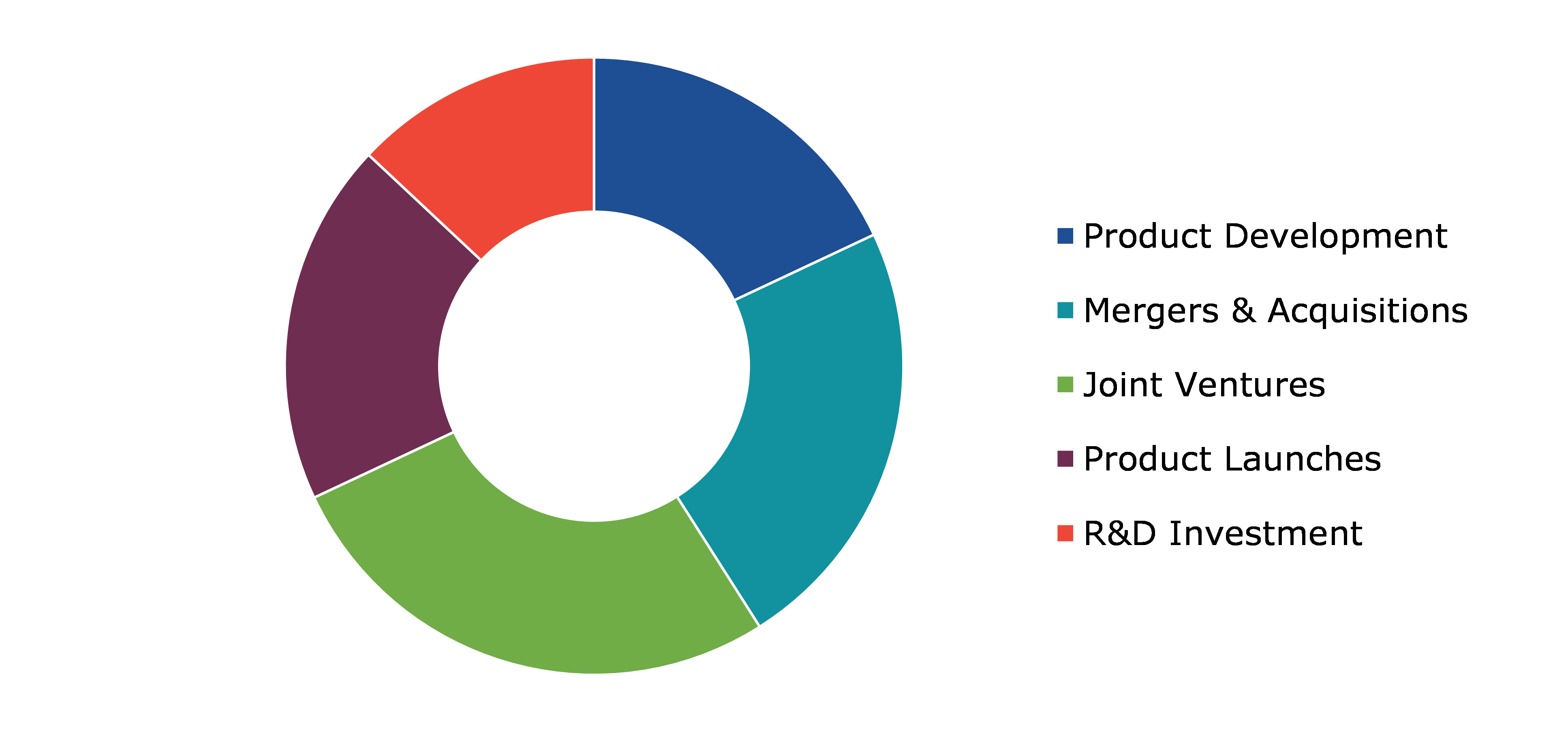

Competitive Scenario in the Global Vegan Chocolate Market

Investment and agreement are common strategies followed by major market players. In February 2022, Cadbury introduced its inaugural plant-based vegan chocolate known as the Cadbury Plant Bar. The chocolate is available in two attractive flavors: smooth chocolate and salted caramel. These bars are certified vegan and feature a delightful combination of cocoa, almond paste, and rice extract. They guarantee a luxuriously smooth texture and encompass all the delightful qualities of chocolate.

Source: Research Dive Analysis

Some of the leading vegan chocolate market players are Alter Eco, Mondelēz International, Barry Callebaut, Nestlé, Endorfin Foods, Evolved Chocolate, Chocoladefabriken Lindt & Sprüngli AG, Taza Chocolate, Montezuma’s Direct Ltd., and Endangered Species Chocolate, LLC.

| Aspect | Particulars |

| Historical Market Estimations | 2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Product |

|

|

Segmentation by Distribution Channel

|

|

| Key Companies Profiled |

|

Q1. What is the size of the global vegan chocolate market?

A. The size of the global vegan chocolate market was over $585.8 million in 2022 and is projected to reach $1,960.9 million by 2032.

Q2. Which are the major companies in the vegan chocolate market?

A. Alter Eco and Mondelēz International are some of the key players in the global vegan chocolate market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific vegan chocolate market?

A. Asia-Pacific vegan chocolate market is anticipated to grow at 14.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Barry Callebaut, Nestlé, and Endorfin Foods are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global vegan chocolate market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on vegan chocolate market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Vegan Chocolate Market Analysis, by Type

5.1.Overview

5.2.Dark

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2022-2032

5.2.3.Market share analysis, by country, 2022-2032

5.3.Milk

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2022-2032

5.3.3.Market share analysis, by country, 2022-2032

5.4.White

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2022-2032

5.4.3.Market share analysis, by country, 2022-2032

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Vegan Chocolate Market Analysis, by Product

6.1.Molded Bars

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2022-2032

6.1.3.Market share analysis, by country, 2022-2032

6.2.Chips & Bites

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2022-2032

6.2.3.Market share analysis, by country, 2022-2032

6.3.Boxed

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2022-2032

6.3.3.Market share analysis, by country, 2022-2032

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Vegan Chocolate Market Analysis, by Distribution Channel

7.1.Hypermarkets/Supermarkets

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2022-2032

7.1.3.Market share analysis, by country, 2022-2032

7.2.Specialty Stores

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2022-2032

7.2.3.Market share analysis, by country, 2022-2032

7.3.Online Stores

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2022-2032

7.3.3.Market share analysis, by country, 2022-2032

7.4.Convenience Stores

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region, 2022-2032

7.4.3.Market share analysis, by country, 2022-2032

7.5.Research Dive Exclusive Insights

7.5.1.Market attractiveness

7.5.2.Competition heatmap

8.Vegan Chocolate Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Type, 2022-2032

8.1.1.2.Market size analysis, by Product, 2022-2032

8.1.1.3.Market size analysis, by Distribution Channel, 2022-2032

8.1.2.Canada

8.1.2.1.Market size analysis, by Type, 2022-2032

8.1.2.2.Market size analysis, by Product, 2022-2032

8.1.2.3.Market size analysis, by Distribution Channel, 2022-2032

8.1.3.Mexico

8.1.3.1.Market size analysis, by Type, 2022-2032

8.1.3.2.Market size analysis, by Product, 2022-2032

8.1.3.3.Market size analysis, by Distribution Channel, 2022-2032

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Type, 2022-2032

8.2.1.2.Market size analysis, by Product, 2022-2032

8.2.1.3.Market size analysis, by Distribution Channel, 2022-2032

8.2.2.UK

8.2.2.1.Market size analysis, by Type, 2022-2032

8.2.2.2.Market size analysis, by Product, 2022-2032

8.2.2.3.Market size analysis, by Distribution Channel, 2022-2032

8.2.3.France

8.2.3.1.Market size analysis, by Type, 2022-2032

8.2.3.2.Market size analysis, by Product, 2022-2032

8.2.3.3.Market size analysis, by Distribution Channel, 2022-2032

8.2.4.Spain

8.2.4.1.Market size analysis, by Type, 2022-2032

8.2.4.2.Market size analysis, by Product, 2022-2032

8.2.4.3.Market size analysis, by Distribution Channel, 2022-2032

8.2.5.Italy

8.2.5.1.Market size analysis, by Type, 2022-2032

8.2.5.2.Market size analysis, by Product, 2022-2032

8.2.5.3.Market size analysis, by Distribution Channel, 2022-2032

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Type, 2022-2032

8.2.6.2.Market size analysis, by Product, 2022-2032

8.2.6.3.Market size analysis, by Distribution Channel, 2022-2032

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Type, 2022-2032

8.3.1.2.Market size analysis, by Product, 2022-2032

8.3.1.3.Market size analysis, by Distribution Channel, 2022-2032

8.3.2.Japan

8.3.2.1.Market size analysis, by Type, 2022-2032

8.3.2.2.Market size analysis, by Product, 2022-2032

8.3.2.3.Market size analysis, by Distribution Channel, 2022-2032

8.3.3.India

8.3.3.1.Market size analysis, by Type, 2022-2032

8.3.3.2.Market size analysis, by Product, 2022-2032

8.3.3.3.Market size analysis, by Distribution Channel, 2022-2032

8.3.4.Australia

8.3.4.1.Market size analysis, by Type, 2022-2032

8.3.4.2.Market size analysis, by Product, 2022-2032

8.3.4.3.Market size analysis, by Distribution Channel, 2022-2032

8.3.5.South Korea

8.3.5.1.Market size analysis, by Type, 2022-2032

8.3.5.2.Market size analysis, by Product, 2022-2032

8.3.5.3.Market size analysis, by Distribution Channel, 2022-2032

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Type, 2022-2032

8.3.6.2.Market size analysis, by Product, 2022-2032

8.3.6.3.Market size analysis, by Distribution Channel, 2022-2032

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Type, 2022-2032

8.4.1.2.Market size analysis, by Product, 2022-2032

8.4.1.3.Market size analysis, by Distribution Channel, 2022-2032

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Type, 2022-2032

8.4.2.2.Market size analysis, by Product, 2022-2032

8.4.2.3.Market size analysis, by Distribution Channel, 2022-2032

8.4.3.UAE

8.4.3.1.Market size analysis, by Type, 2022-2032

8.4.3.2.Market size analysis, by Product, 2022-2032

8.4.3.3.Market size analysis, by Distribution Channel, 2022-2032

8.4.4.South Africa

8.4.4.1.Market size analysis, by Type, 2022-2032

8.4.4.2.Market size analysis, by Product, 2022-2032

8.4.4.3.Market size analysis, by Distribution Channel, 2022-2032

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Type, 2022-2032

8.4.5.2.Market size analysis, by Product, 2022-2032

8.4.5.3.Market size analysis, by Distribution Channel, 2022-2032

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2022

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2022

10.Company Profiles

10.1.Alter Eco

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Mondelēz International

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Barry Callebaut

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Nestlé

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Endorfin Foods

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Evolved Chocolate

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Chocoladefabriken Lindt & Sprüngli AG

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Taza Chocolate

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Montezuma’s Direct Ltd.

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Endangered Species Chocolate, LLC.

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com