3D Cell Culture Market Report

RA00073

3D Cell Culture Market Product (Scaffold Based 3D Cell Culture, Scaffold Free 3D cell culture, and Microfluidic Organ-on-a-chip Models), Application (Cancer Research, Stem Cell Research, Drug Discovery & Development, and Regenerative Medicine), End User (Biotechnology and Pharmaceutical Companies, Contract Research Laboratories, Hospitals, Diagnostic Centers, and Academic Institutes): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global 3D Cell Culture Market Analysis

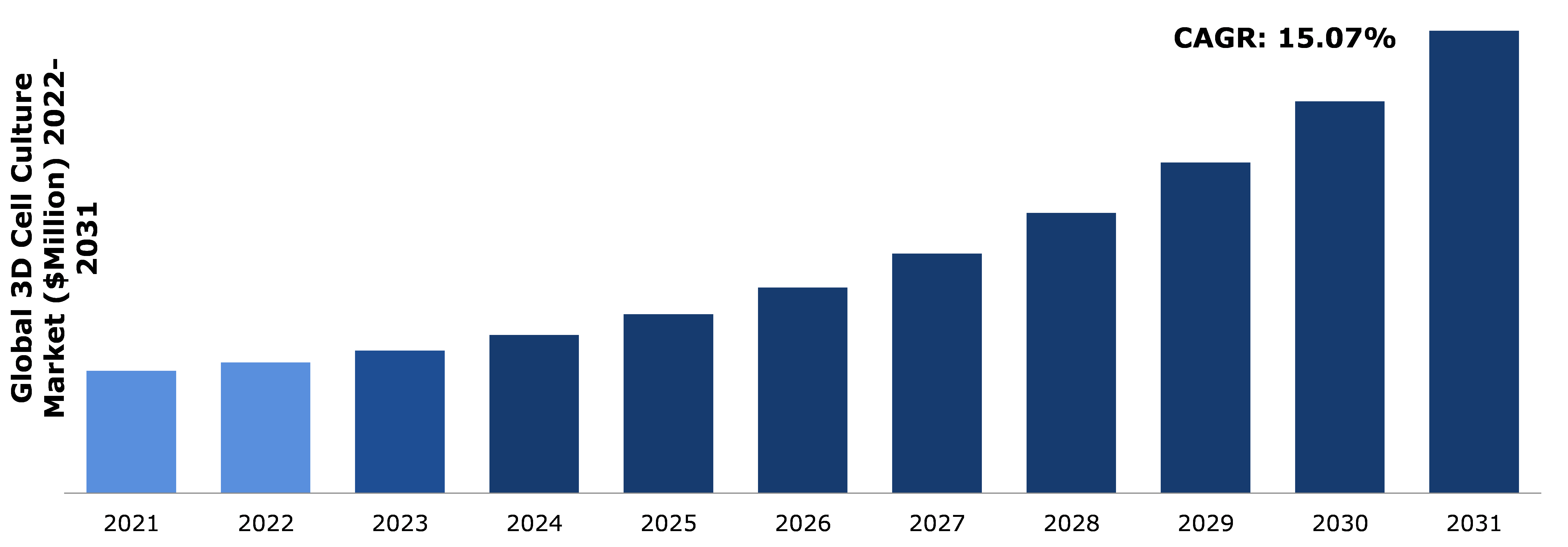

The global 3D cell culture market size was $1,495.0 million in 2021 and is predicted to grow with a CAGR of 15.07%, by generating revenue of $5,656.7 million by 2031.

Global 3D Cell Culture Market Synopsis

Cell culture is the process of growing cells under controlled conditions, usually outside of their natural environment. The target cells are then removed from the live tissue. They are able to maintain their level below the controlled condition as a result. The introduction of advanced cell culture products, increase in awareness regarding rising prevalence of chronic diseases, cell-based vaccines, rise in adoption of single-use technologies, surge in funding for cell-based research are some factors expected to contribute to the global 3D cell culture market share expansion significantly during the forecast period. The global cell culture market is projected to grow as a result of the creation of novel 3D cell culture market growth techniques as well as the rise in demand for these techniques in the biopharmaceutical industry for the production of vaccines and biopharmaceutical drugs.

Additionally, it is anticipated that the global increase in demand for organ transplantation due to the prevalence of chronic diseases and a sedentary lifestyle would support market expansion even more. On the contrary, it is projected that the expenditures involved with implanting 3D cell cultures as opposed to 2D and the inconsistency of the results due to the absence of established methods will restrain the market's expansion.

Microfluidics in 3D cell culture now can create microenvironments that promote tissue development and mimic the tissue-to-tissue contact, mechanical microenvironments of living organs, owing to recent advancements in 3D cell culture. To generate in vitro disease models and eventually take the place of animal models in drug development and toxicity testing, this organ-on-a-chip model enables the study of human physiology in an organ-specific environment. For the purpose of bolstering their market positions, major market participants are forming alliances and working together with pharmaceutical firms. This tactic enables market participants to assess how well their organs-on-chips products work in medication development and other pharmaceutical research procedures. For instance, in November 2021, CN Bio began a research partnership aimed at verifying cutting-edge organ-on-a-chip infection models.

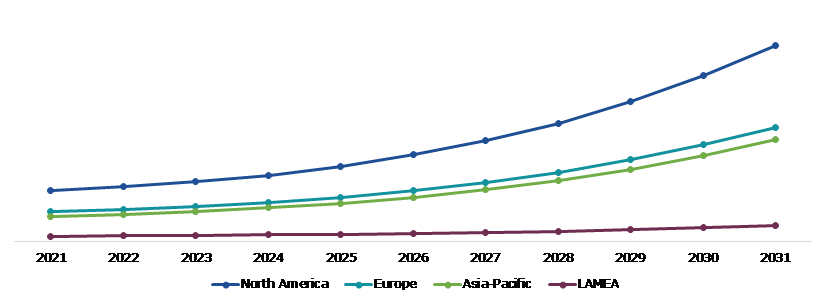

According to regional analysis, the Asia-Pacific 3D cell culture market share accounted for the fastest growth. This is because the Japanese government is focusing more on cell-based regenerative medicine, and the country is also making efforts to introduce new goods to the market.

3D Cell Culture Overview

3D cultures are frequently used in research requiring in vivo model systems to evaluate the effects of an outside drug on body tissues and organs since they can precisely imitate the microarchitecture of organs and morphology. As 3-D cell culture techniques are used to create 3-D organotypic structures using biomimetic tissue constructions, many research organizations have adopted the technique for their research activities. COVID-19, cancer, and other clinical disorders can now be studied using 3D tissue-engineered models as a feasible alternative to conventional methods. This also exhibits tremendous promise in providing a very straightforward and affordable in vitro tumor-host environment when compared to 2D techniques.

COVID-19 Impact on Global 3D Cell Culture Market

The COVID-19, which was mostly unknown when the epidemic began in Wuhan (China) in December 2019, quickly became a global pandemic. The COVID-19 epidemic has put a strain on healthcare systems all over the globe. After the WHO declared the COVID-19 outbreak a pandemic, a number of established pharmaceutical and biopharmaceutical businesses ramped up their R&D and production efforts to create and sell test kits, vaccines, and treatments against the SARS-CoV-2 virus. Globally, viral vaccines based on cell culture are used to immunize individuals against illnesses. Mammalian cell lines are now employed in research to cultivate the SARS-CoV-2 virus. Culture media are a source of nutrients and component cells needed in bioproduction to generate therapies with the necessary degree of pharmacological efficacy under regulated environmental circumstances. Scaffolds, bioreactors, vessels, and other 3D cell culture items assist researchers in studying cellular activity in order to simulate in vivo circumstances.

However, in October 2021, the Lonza Group AG Company took a new initiative. Lonza Group AG (Switzerland) and CN Bio Innovations (UK) have announced a distribution agreement for pre-validated hepatocytes to be used on CN Bio's unique PhysioMimix Organ-On-a-Chip (OOC) portfolio of single and multi-organ microphysiological systems (MPS).

The Global 3D Cell Culture Market is Predicted to Grow owing to its Versatile Properties such as High Strength and Low Price

Rise in global awareness about oncological diseases such as lung cancer, skin cancer, and others is one of the major reasons driving the 3D cell culture market demand. 3D cell culture is an important aspect of oncology since it is used in clinical trials and helps to understand cell physiology. Furthermore, 3D cell culture is employed in drug development since it offers data on numerous biological pathways. Government and non-government organizations are boosting funding aid and support for cancer research, resulting in significant expansion of the 3D cell culture market trend.

To know more about global 3D cell culture market drivers, get in touch with our analysts here.

Substitutes such as 2D Cell Culture, and Scarcity of Qualified Specialists are Expected to Restrain the Global 3D Cell Culture Market Growth

The costs of 3D cell cultures are frequently kept high, which de-motivates end-users to acquire the equipment. Furthermore, linkage to historical 2D culture data, high expenses associated with assay validation, and analytical methodologies are some of the valid concerns. The coating on the 3D models prevents the reagents from penetrating the center of the spheroid. Furthermore, erroneous results were produced when the assays employed were subpar. The above hindrance would prevent new end-users and limit market penetration.

Significant Developments in the Diagnosis and Treatment of Neuromuscular diseases are Expected to Create Enormous Opportunities for the Global 3D Cell Culture Market

Diagnosis and treatment of neuromuscular disease (NMD) require accurate modeling of the microphysiological circumstances. However, replicating the entire spinal-locomotion circuit in vitro is extremely challenging. However, recent improvements in neuromuscular-reproducing in-vitro systems using 3D cell-culture procedures are more dependable. Furthermore, advancements in 3D cell culture for recreating the whole spinal-locomotion circuit and neurodegenerative processes are expected to open attractive potential for global 3D cell culture market growth.

To know more about global 3D cell culture market opportunities, get in touch with our analysts here.

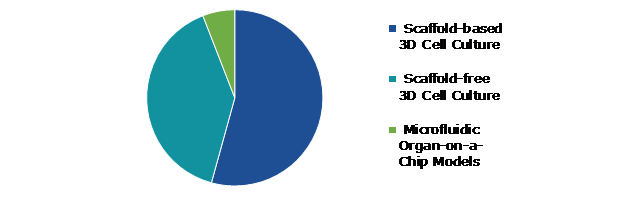

Global 3D Cell Culture Market Share, by Product

Based on product, the market has been divided into scaffold-based 3D cell culture, scaffold free 3D cell culture, and microfluidic organ-on-a-chip models. Among these, the scaffold-based platforms sub-segment accounted for the highest market share in 2021, whereas the microfluidic organ-on-a-chip models sub-segment is estimated to show the fastest growth during the forecast period.

Global 3D Cell Culture Market Size, by Product, 2021

Source: Research Dive Analysis

Scaffold-based 3D cell culture sub-type is anticipated to have a dominant market share in 2021. In 3-dimensional cell culture-based research, the use of hydrogels as scaffolds enables the inclusion of complex biochemical and mechanical indications as a mirror of the natural extracellular matrix. Additionally, the introduction of novel products and the growing demand for hydrogel developments to provide stable platforms for studying human and cellular physiology are anticipated to fuel 3D cell culture market size growth in the upcoming years.

Microfluidic organ-on-a-chip models sub-type is anticipated to show the fastest growth in 2031. The scale of the cultured environment inside the microchip is specific to cell size. The microfluidic (organ-on-a-chip) is a crucial instrument that can provide several major benefits for cell culture systems. It also aids in simulating organ physiology. Furthermore, the incorporation of microfluidics provides significant advancements in a wide range of sectors, including fundamental biological research and screening biosensors. The demand for scaffold-based 3D cell cultures is expected to increase as a result of the key advantages of scaffolds in 3D cell culture, including the availability of attachment points and structural rigidity. Additionally, 3D cell culture is widely used in stem cell research and the majority of drug development fields, which is predicted to further boost the growth of the global market.

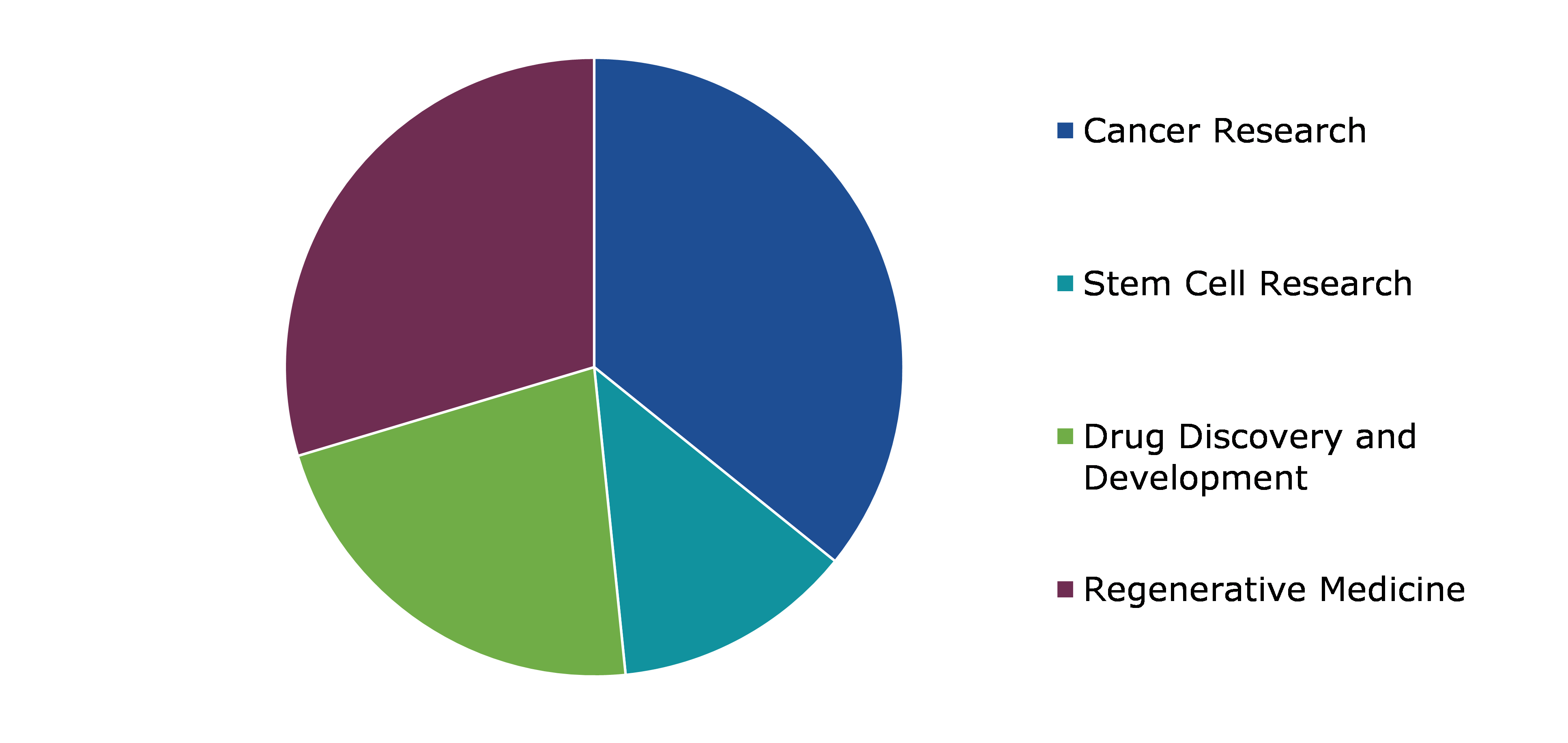

Global 3D Cell Culture Market Value, by Application

Based on application, the market has been divided into cancer research, stem cell research, drug discovery & development, and regenerative medicine. Among these, the cancer research sub-segment accounted for the highest revenue share in 2021.

Global 3D Cell Culture Market Growth, by Application, 2021

Source: Research Dive Analysis

The cancer research sub-segment is anticipated to have a dominant market share in 2021. Factors such as increased cancer prevalence, increased pharmaceutical company partnerships, and growing cancer research are expected to increase demand for cancer research. Furthermore, the massive development in the elderly population is expected to drive the need for cancer research activities, which will eventually fuel the expansion of the 3D cell culture market. 3D printing offers the potential to integrate various inorganic materials into specialized items. Scientists in regenerative medicine are concentrating increasingly on automated 3D bio-assembly of micro-tissues, which is expected to boost worldwide demand for 3D cell culture.

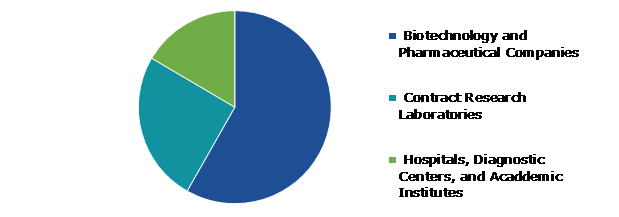

Global 3D Cell Culture Market Forecast, by End User

Based on end user, the market has been divided into biotechnology and pharmaceutical companies, contract research laboratories, hospitals, diagnostic centers, and academic institutes. Among these, the biotechnology and pharmaceutical companies sub-segment accounted for the highest revenue share in 2021.

Global 3D Cell Culture Market Size, by End-user, 2021

Source: Research Dive Analysis

The Biotechnology and Pharmaceutical Companies sub-segment is anticipated to have a dominant market share in 2021. Biotechnology and pharmaceutical companies are expected to have the greatest CAGR throughout the estimated timeframe. The causes include an increase in preference for alternative testing models over animal approaches, increased R&D investment in these industries, and the existence of a significant number of pharmaceutical and biotechnology firms.

Global 3D Cell Culture Market Trends, Regional Insights

The 3D cell culture market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global 3D Cell Culture Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for 3D Cell Culture in North America to be the Most Dominant

The North America region dominated the global 3D cell culture market size in 2021.The region will retain its leading position throughout the forecast period due to the availability of government and private funding for the development of advanced 3D cell culture models, high healthcare expenditure, and the presence of a large number of universities and research organizations investigating various stem cell-based approaches.

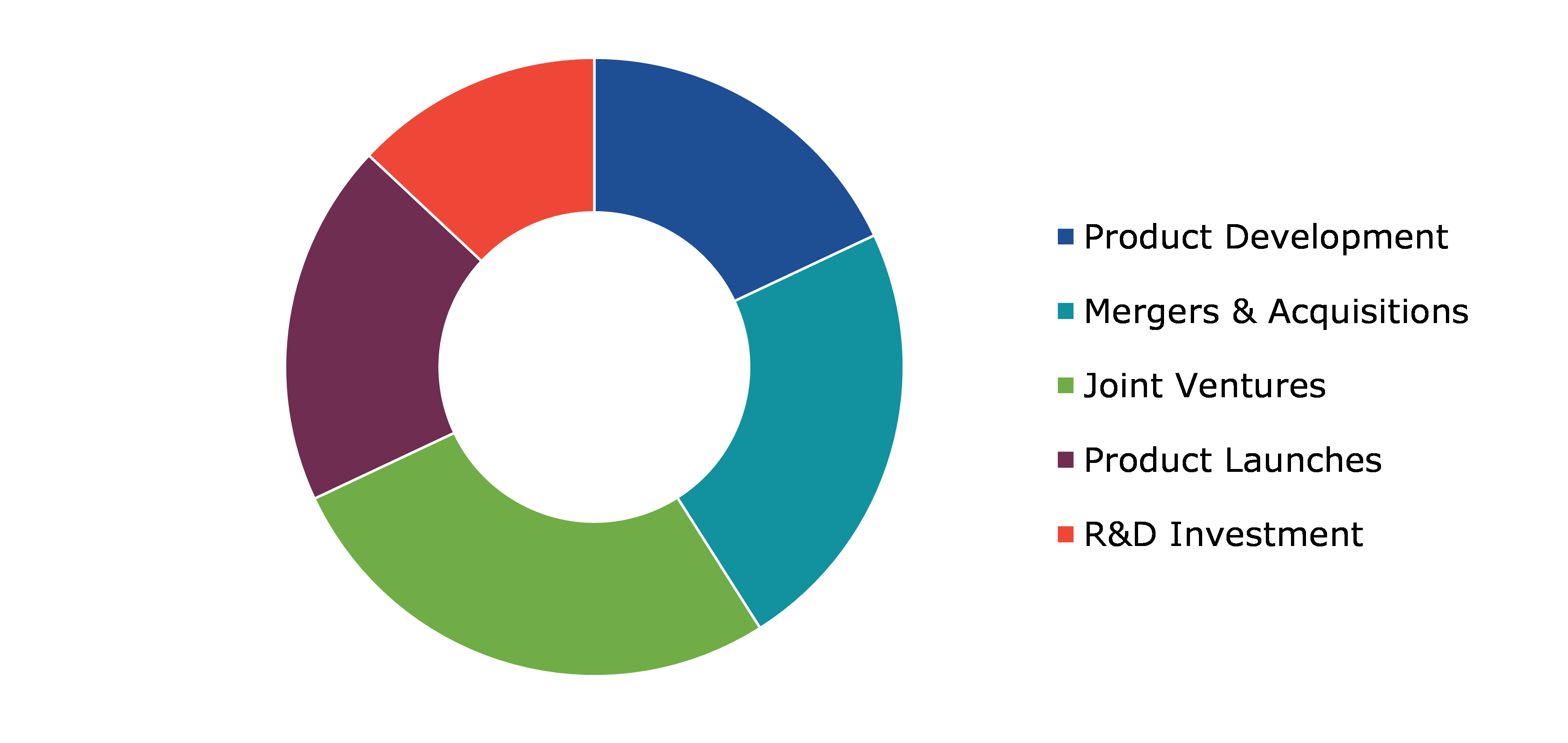

Competitive Scenario in the Global 3D Cell Culture Market

Investment and agreement are common strategies followed by major market players. For instance, in March 2021, Thermo Fisher Scientific Inc. (US) intended to invest around USD 600 million in increasing its bioprocess manufacturing capabilities in the Americas, Europe, and Asia.

Source: Research Dive Analysis

Some of the leading 3D cell culture market players are Corning Incorporated, Thermo Fisher Scientific, TissUse GmbH, 3D Biotek, Hµrel Corporation, QGel SA, SynVivo, Advanced BioMatrix, Greiner Bio-One International, and Lonza

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by Application |

|

| Segmentation by End user |

|

| Key Companies Profiled |

|

Q1. What is the size of the global 3D cell culture market?

A. The size of the global 3D cell culture market share was over$1,495.0 million in 2021 and is projected to reach $5,656.7 million by 2031.

Q2. Which are the major companies in the 3D cell culture market?

A. QGel, SynVivo, and Lonza AG are some of the key players in the global 3D cell culture market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific 3D cell culture market?

A. Asia-Pacific 3D cell culture market size is anticipated to grow at 15.61% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological advancements and product development are the two key strategies adopted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Corning Incorporated, Thermo Fisher Scientific, and TissUse companies are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global 3D cell culture market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on 3D Cell Culture Market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.3D cell culture market Analysis, by Product

5.1.Overview

5.2.Scaffold Based 3D Cell Culture

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3.Scaffold Free 3D cell culture

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4.Microfluidic Organ-on-a-chip Models

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region

5.4.3.Market share analysis, by country

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.3D cell culture market Analysis, by Application

6.1.Cancer Research

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region

6.1.3.Market share analysis, by country

6.2.Stem Cell Research

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region

6.2.3.Market share analysis, by country

6.3.Drug Discovery & Development

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region

6.3.3.Market share analysis, by country

6.4.Regenerative Medicine

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region

6.4.3.Market share analysis, by country

6.5.Research Dive Exclusive Insights

6.5.1.Market attractiveness

6.5.2.Competition heatmap

7.3D cell culture market Analysis, by End user

7.1.Biotechnology and Pharmaceutical Companies

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region

7.1.3.Market share analysis, by country

7.2.Contract Research Laboratories

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region

7.2.3.Market share analysis, by country

7.3.Hospitals, Diagnostic Centers, and Academic Institutes

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region

7.3.3.Market share analysis, by country

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.3D cell culture market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Product

8.1.1.2.Market size analysis, by Application

8.1.1.3.Market size analysis, by End user

8.1.2.Canada

8.1.2.1.Market size analysis, by Product

8.1.2.2.Market size analysis, by Application

8.1.2.3.Market size analysis, by End user

8.1.3.Mexico

8.1.3.1.Market size analysis, by Product

8.1.3.2.Market size analysis, by Application

8.1.3.3.Market size analysis, by End user

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Product

8.2.1.2.Market size analysis, by Application

8.2.1.3.Market size analysis, by End user

8.2.2.UK

8.2.2.1.Market size analysis, by Product

8.2.2.2.Market size analysis, by Application

8.2.2.3.Market size analysis, by End user

8.2.3.France

8.2.3.1.Market size analysis, by Product

8.2.3.2.Market size analysis, by Application

8.2.3.3.Market size analysis, by End user

8.2.4.Spain

8.2.4.1.Market size analysis, by Product

8.2.4.2.Market size analysis, by Application

8.2.4.3.Market size analysis, by End user

8.2.5.Italy

8.2.5.1.Market size analysis, by Product

8.2.5.2.Market size analysis, by Application

8.2.5.3.Market size analysis, by End user

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Product

8.2.6.2.Market size analysis, by Application

8.2.6.3.Market size analysis, by End user

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Product

8.3.1.2.Market size analysis, by Application

8.3.1.3.Market size analysis, by End user

8.3.2.Japan

8.3.2.1.Market size analysis, by Product

8.3.2.2.Market size analysis, by Application

8.3.2.3.Market size analysis, by End user

8.3.3.India

8.3.3.1.Market size analysis, by Product

8.3.3.2.Market size analysis, by Application

8.3.3.3.Market size analysis, by End user

8.3.4.Australia

8.3.4.1.Market size analysis, by Product

8.3.4.2.Market size analysis, by Application

8.3.4.3.Market size analysis, by End user

8.3.5.South Korea

8.3.5.1.Market size analysis, by Product

8.3.5.2.Market size analysis, by Application

8.3.5.3.Market size analysis, by End user

8.3.6.Rest of Asia Pacific

8.3.6.1.Market size analysis, by Product

8.3.6.2.Market size analysis, by Application

8.3.6.3.Market size analysis, by End user

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Product

8.4.1.2.Market size analysis, by Application

8.4.1.3.Market size analysis, by End user

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Product

8.4.2.2.Market size analysis, by Application

8.4.2.3.Market size analysis, by End user

8.4.3.UAE

8.4.3.1.Market size analysis, by Product

8.4.3.2.Market size analysis, by Application

8.4.3.3.Market size analysis, by End user

8.4.4.South Africa

8.4.4.1.Market size analysis, by Product

8.4.4.2.Market size analysis, by Application

8.4.4.3.Market size analysis, by End user

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Product

8.4.5.2.Market size analysis, by Application

8.4.5.3.Market size analysis, by End user

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Corning Incorporated

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.1.7.Research Dive Analyst View

10.2.Thermo Fisher Scientific

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.2.7.Research Dive Analyst View

10.3.3D Biotek

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.3.7.Research Dive Analyst View

10.4.TissUse GmbH

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.4.7.Research Dive Analyst View

10.5.Hµrel Corporation

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.5.7.Research Dive Analyst View

10.6.QGel SA

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.6.7.Research Dive Analyst View

10.7.SynVivo

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.7.7.Research Dive Analyst View

10.8.Advanced BioMatrix

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.8.7.Research Dive Analyst View

10.9.Greiner Bio-One International

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.9.7.Research Dive Analyst View

10.10.Lonza

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

10.10.7.Research Dive Analyst View

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

Over the past couple of years, the life sciences sector has seen a tremendous shift. Cell culture involves the use of growing cells in a controlled environment to understand how cells respond to their surroundings. Currently, a number of cell cultures are available, and based on their features and intended uses, some may be best suited than others. Amongst them, 3D cell culture has become more popular due to its unique and practical properties as compared to the traditional cell culture method.

Cells developed in three-dimensional cell culture models are physiologically relevant. They have made various advancements in several studies of biological mechanisms including proliferation, cell morphology, cell number monitoring, differentiation, viability, and others. Thus, 3D cell cultures are useful for analysing and studying the etiology of disorders, which enables their use in scientific research. The benefits that 3D cell culture offers over traditional 2D cell cultures in terms of cell-to-matrix and cell-to-cell interactions are mainly responsible for this growth rate. Due to advancements in technology that are improving 3D cell culture, the global 3D cell culture market is growing rapidly.

Newest Insights in the 3D Cell Culture Market

The number of patients suffering from oncological diseases like lung cancer, skin cancer, and others has increased greatly in the last few years. These patients have benefited from new advancements in the field of 3D cell culture. As per a report by Research Dive, the global 3D cell culture market is expected to surpass a revenue of $5,656.7 million in the 2022-2031 timeframe. The North America 3D cell culture market is expected to perceive foremost and dominant growth in the years to come. This is because the region has significant financial support from private and government organizations for the development of innovative 3D cell culture models and the presence of many universities and research organizations studying various stem cell-based methods in the region.

How are Market Players Responding to the Rising Demand for 3D Cell Culture?

Market players are greatly investing in pioneering research and inventions to develop innovative and advanced 3D cell culture techniques. Some of the foremost players in the 3D cell culture market are Thermo Fisher Scientific, Corning Incorporated, 3D Biotek, TissUse GmbH, QGel SA, Hµrel Corporation, SynVivo, Advanced BioMatrix, Lonza, Greiner Bio-One International, and others. These players are focused on planning and devising tactics such as mergers and acquisitions, collaborations, novel advances, and partnerships to reach a notable position in the global market.

For instance,

- In August 2021, Amerigo Scientific, a distribution company that specialises in supplying crucial items and services to the biomedical and life science research sectors, expanded its cell culture portfolio with the introduction of 3D Cell Culture for scientific usage. This novel 3D cell culture system may be utilised in research areas like the evaluation of nanomaterials, medicine, drug discovery, and basic life science.

- In January 2021, Jellagen Limited, a biotechnology company that manufactures next-generation collagen products sourced from Jellyfish for application in 2D and 3D cell culture and medical devices, launched a 3D hydrogel. JellaGel offers customers a natural, non-mammalian, consistent, biochemically simple, and simple-to-use hydrogel that can revolutionise their research.

- In December 2020, eNuvio, a designer and producer of novel cutting-edge tools for the drug discovery, life science research, and safety assessment markets, announced the launch of the EB-Plate, the first ever completely reusable 3D cell culture microplate in the market. With this launch, eNuvio aims to obtain a leading position in the 3D cell culture market.

COVID-19 Impact on the Global 3D Cell Culture Market

The unpredicted rise of the coronavirus pandemic in 2020 has positively impacted the global 3D cell culture market. The COVID-19 pandemic has put a burden on the world's healthcare systems. After the WHO declared the COVID-19 outbreak a pandemic, well-known biopharmaceutical and pharmaceutical companies increased their production and R&D efforts to create and sell vaccines, test kits, and therapies against the SARS-CoV-2 virus. Viral vaccines made from cell cultures are being utilized to immunize people against diseases all over the world. The SARS-CoV-2 virus is now grown in research using mammalian cell lines. In order to produce treatments with the necessary level of pharmacological activity under controlled environmental conditions, culture mediums are a source of nutrients and component cells. Researchers can analyse biological activity using bioreactors, scaffolds, vessels, and other 3D cell culture techniques to mimic in vivo conditions. All these factors are projected to drive the growth of the 3D cell culture market in the forthcoming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com