Probiotics Market Report

RA03951

Probiotics Market by Ingredient (Bacteria, and Yeast), Application (Probiotic Supplements, Animal Feed, and Food and Beverages), End User (Human and Animal), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Probiotics Market Analysis

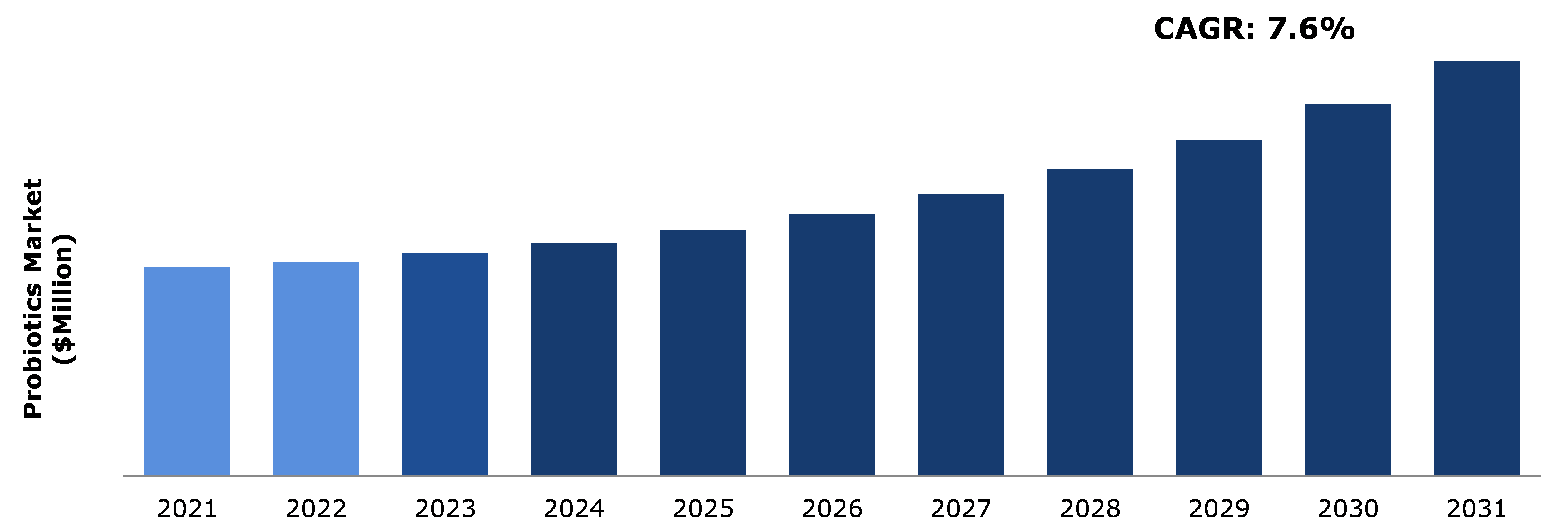

The Global Probiotics Market Size was $53,046.8 million in 2021 and is predicted to grow with a CAGR of 7.6%, by generating a revenue of $105,336.5 million by 2031.

Global Probiotics Market Synopsis

Probiotics assist digestion with several advantages such as sustaining gut health and enhancing immunity, circumventing obesity, weight management, and others. The growing awareness about health benefits is anticipated to drive the industry in the upcoming years. Consumers' rising health consciousness, along with the rise of veganism, is influencing them to choose a plant-based diet. Therefore, significant industry players are introducing plant-based probiotics to increase their consumer base. Furthermore, leading companies' increasing investment on R&D of innovative products is expected to positively affect the market growth. For instance, in February 2020, Amorepacific Group opened its new Green Tea Probiotics Research Centre to further research on lactobacillus, which was recently discovered in a Jeju organic green tea farm. These factors are anticipated to boost the probiotics industry growth in the upcoming years.

However, some of the disadvantages of probiotics include a lack of standardization in the regulation. There is a lack of standardization in the regulation of probiotic products across various countries, making it challenging for companies to launch their products in different markets. For instance, the European Union has strict regulations on health claims, requiring scientific evidence to back up any claims made on packaging or advertising. Similarly, in the U.S., the Food and Drug Administration (FDA) does not have a specific category for probiotics, and manufacturers need to navigate a complex regulatory framework that applies to dietary supplements, drugs, and foods. These factors are expected to restrain the market growth during the forecast period.

The use of probiotics in probiotic formulations is anticipated to gain significant market share. Innovations in probiotic formulations can also help to overcome some of the challenges associated with these probiotic products, such as the need for refrigeration and concerns about viability. By developing more robust formulations, manufacturers can address the concerns and offer consumers a wider range of options for incorporating probiotics into their daily routines. In addition, advancements in probiotic technology may further enable manufacturers to target specific health conditions or populations such as athletes, children, and the elderly. For example, probiotics formulated for athletes may contain strains that support immune function and aid in muscle recovery, while formulations for children may focus on improving digestive health and supporting cognitive development.

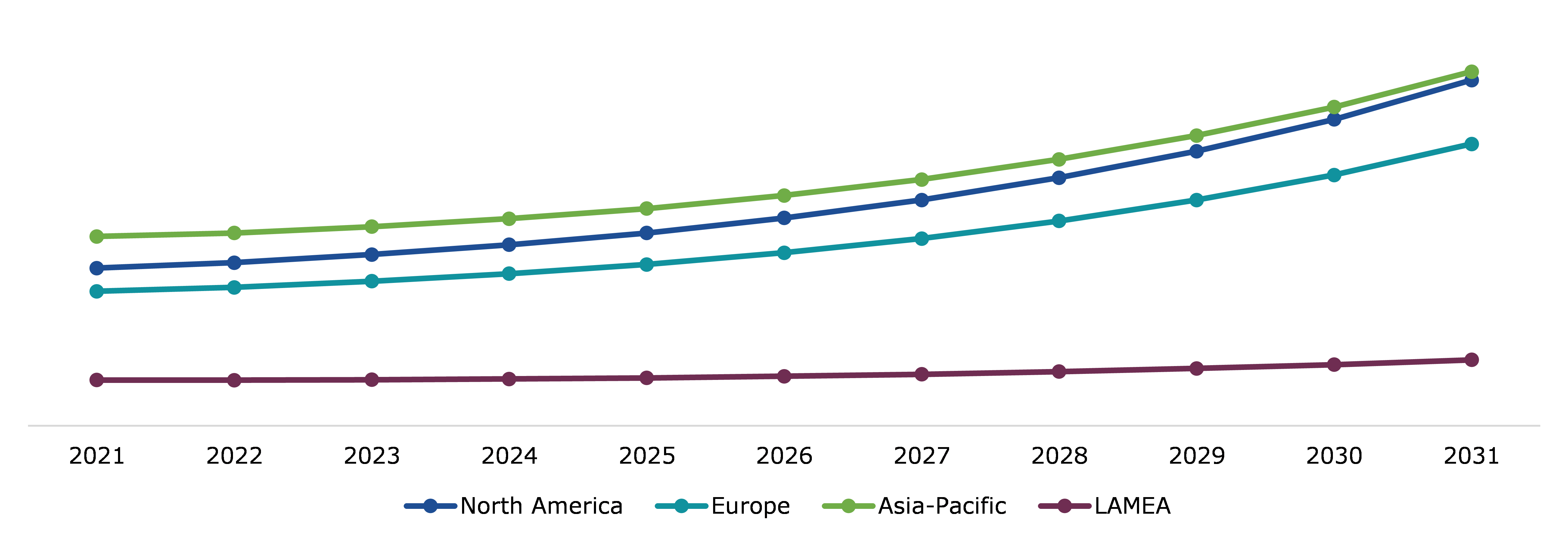

According to regional analysis, the Asia-Pacific probiotics market accounted for a dominating market share in 2021. The growth of the probiotics market in Asia-Pacific is attributed to the rising demand for functional food and dietary supplements, increasing consumer awareness about the benefits of probiotics, and a growing focus on preventive healthcare. Furthermore, the region's large population and increase in disposable income levels are driving the demand for probiotics, especially in countries such as China and India.

Probiotics Overview

Probiotics are live microorganisms that offer health benefits when consumed in adequate amounts. They are mostly found in fermented foods such as yogurt, kefir, sauerkraut, kimchi, and others. Probiotics are believed to improve gut health, boost the immune system, and alleviate certain digestive disorders. The increase in demand for functional and nutritional food products is driving the growth of the probiotics market. Probiotics are increasingly being incorporated into food and beverages like dairy products, infant formula, and dietary supplements. The growing awareness of the health benefits of probiotics and their ability to improve gut health is also driving demand for probiotic products.

COVID-19 Impact on Global Probiotics Market

The COVID-19 pandemic had a significant impact on the probiotics market as the market witnessed a surge in demand for products that improve immunity. Moreover, there has been an increase in demand for probiotics as people are becoming more health-conscious and looking for ways to boost their immune systems. During the pandemic, the supply chain disruptions and manufacturing delays caused by the pandemic led to shortages of some probiotic products. In addition, the closure of gyms and health food stores during the lockdowns has also affected the distribution and sales of probiotics. Overall, the probiotics market has shown resilience and is expected to continue to grow in the post-pandemic period. As a result of these factors, large product launches are occurring to cater to the growing demand. Probiotics provide several health advantages, including improved intestinal health, reduced acidity, weight maintenance, and increased immunity. Therefore, many individuals choose probiotics to prepare and defend their bodies from coronavirus infection. This aspect boosted the growth of the probiotic market during the pandemic period. For instance, in April 2020, Meluka Australia, an ASX-listed Eve Investment subsidiary, introduced a new product, Meluka honey and probiotic tonic. According to the company, it is the first of its kind in the domestic market. These initiatives are predicted to drive the probiotics market size during the forecast timeframe.

Growing Applications of Probiotics and Rising Health Conscious Population to Drive the Market Growth

With the growing demand for natural and organic products, consumers are increasingly looking for natural and organic products that are free from artificial additives and preservatives. Probiotics are a natural way to improve gut health and are therefore in high demand. There is a growing awareness among the population about the health benefits of probiotics, including improved digestion, strengthened immune system, and reduced risk of chronic diseases. This has led to an increase in the demand for probiotic supplements and foods. Probiotics are also being increasingly used in the animal feed industry to improve the health and growth of livestock. This has led to an increase in the demand for probiotics and further contributed to the growth of the probiotics market. Probiotic products are becoming increasingly available in supermarkets, health food stores, and online platforms as well. This has made it easier for consumers to access these products and has contributed to the growth of the probiotics market.

To know more about global probiotics market drivers, get in touch with our analysts here.

Lack of Proper Regulations and Consumer Perception of Probiotics to Restrain the Market Growth

The popularity of probiotics has grown, and some consumers are still doubtful about their effectiveness, which is expected to limit the market growth. In addition, there is a lack of standardization in the probiotics industry, with varying strains and dosages, making it difficult for consumers to choose the right product. This can lead to confusion and mistrust in the market. Furthermore, some consumers may not be willing to pay the higher prices associated with probiotic supplements and may prefer to obtain their probiotics from natural sources such as fermented foods, which is anticipated to hamper the probiotics market growth during the forecast period.

Use of Probiotics as a Replacement to Pharmaceutical Agents to Drive Excellent Opportunities

The increase in demand for probiotics has helped the customers' preference for products with proven various health benefits. The growing awareness of the benefits associated with probiotics for health restoration has raised customer expectations of probiotics. This desire for a natural, safe, and cost-effective alternative to medicines has resulted in the use of probiotics as pharmaceutical agents. Furthermore, probiotics' beneficial effects as pharmaceutical agents appear to be dose- and strain-dependent. Clinical trials have shown that they can treat some health problems or diseases in humans. Therefore, the consumption of fermented dairy products containing probiotic cultures provides a variety of health benefits in a variety of clinical conditions, including rotavirus-associated diarrhea, antibiotic-associated diarrhea, inflammatory bowel disease, irritable bowel syndrome (IBS), cancer, allergenic diseases, Helicobacter pylori infection, and lactose intolerance.

To know more about global probiotics market opportunities, get in touch with our analysts here.

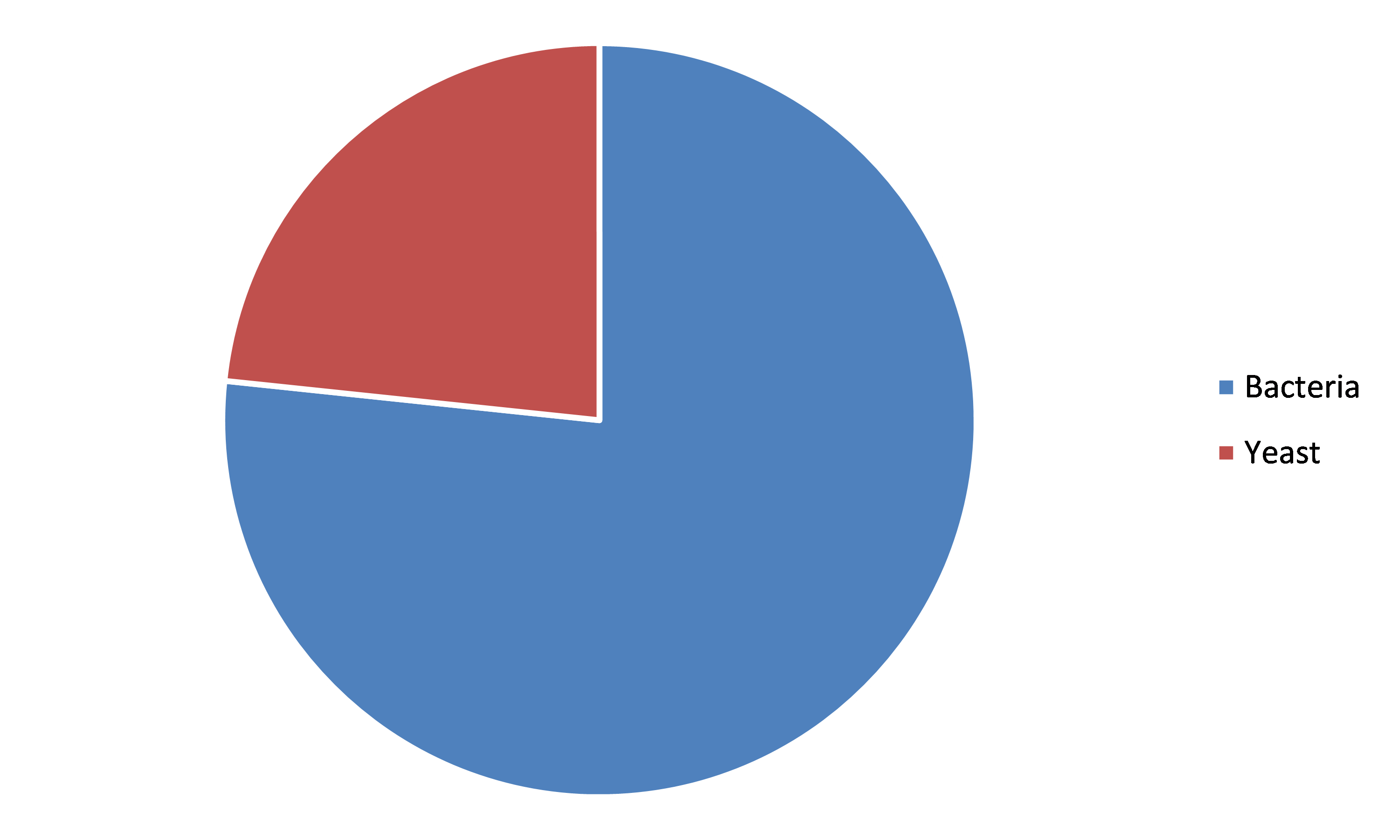

Global Probiotics Market, by Ingredient

Based on ingredient, the market has been divided into bacteria and yeast. Among these, the bacteria sub-segment accounted for the highest market share in 2021 and is estimated to show the fastest growth during the forecast period.

Global Probiotics Market Size, by Ingredient, 2021

Source: Research Dive Analysis

The bacteria sub-type accounted for a dominant market share in 2021 and is expected to show the fastest growth in 2031. Bacteria-based probiotics have been extensively researched and are widely recognized for their health benefits. In fact, they are easier to produce and more cost-effective than yeast-based probiotics.Most probiotics are bacterial in nature, with lactobacillus or lactic acid bacteria being the most common. These components are mostly used in fermented foods including kefir, sauerkraut, yoghurt, and kimchi. Another important application sector for bacterial components is dietary supplements.

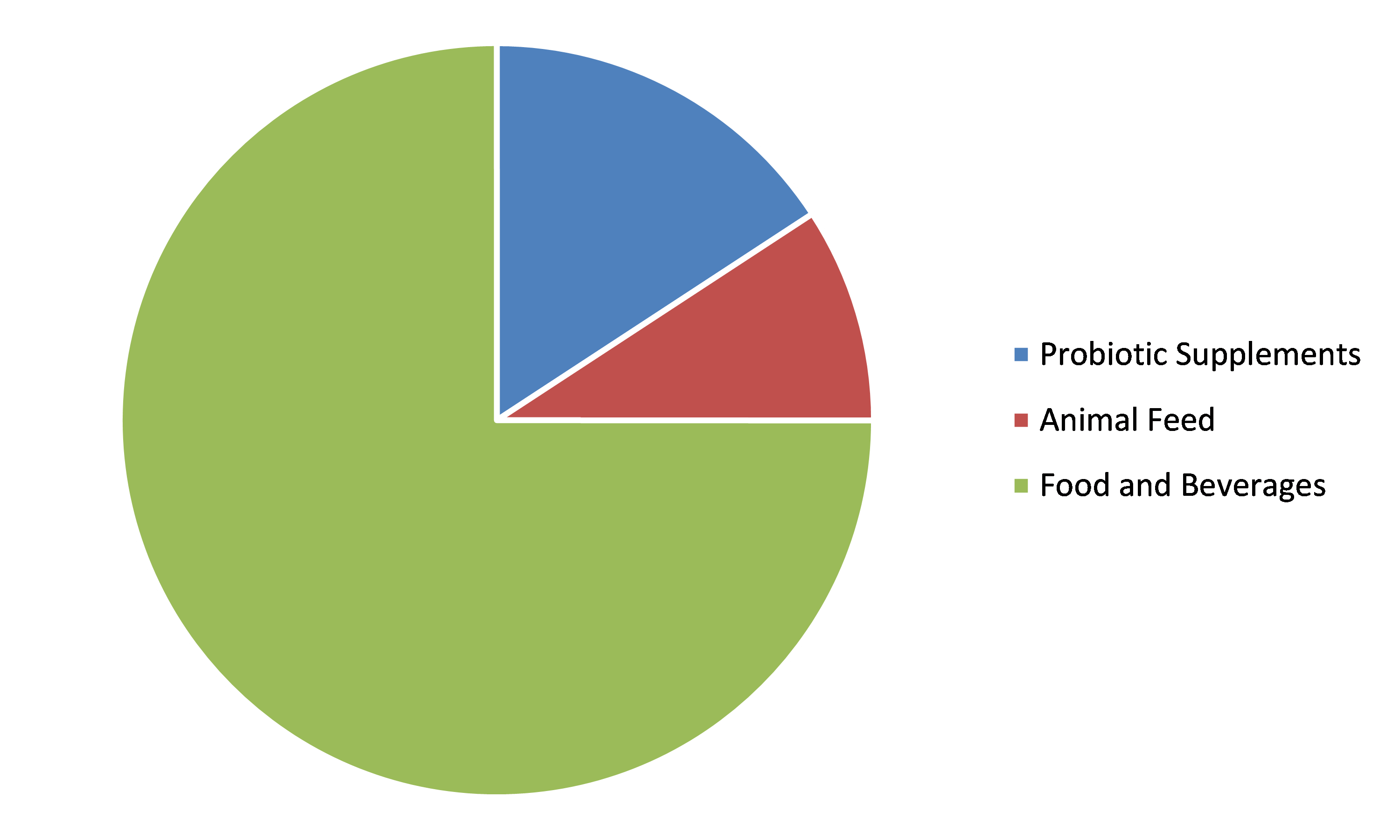

Global Probiotics Market, by Application

Based on application, the market has been divided into probiotic supplements, animal feed, and food and beverages. Among these, the food and beverages sub-segment accounted for the highest revenue share in 2021.

Global Probiotics Market Share, by Application, 2021

Source: Research Dive Analysis

The food and beverages sub-segment accounted for a dominant market share in 2021. The use of probiotics in food and beverages has increased significantly in recent years due to a rise in consumer awareness and interest in the health benefits of these products. Many food and beverage companies are incorporating probiotics into their products, including yogurt, kefir, kombucha, and other functional foods and drinks. This trend is expected to continue, as consumers increasingly look for products that offer health benefits beyond basic nutrition. In addition, the growing demand for natural and organic products is driving the market for probiotics, as these products are often seen as a more natural and healthier alternative to traditional supplements and medications. These factors are anticipated to boost the growth of the food and beverages sub-segment during the forecast timeframe.

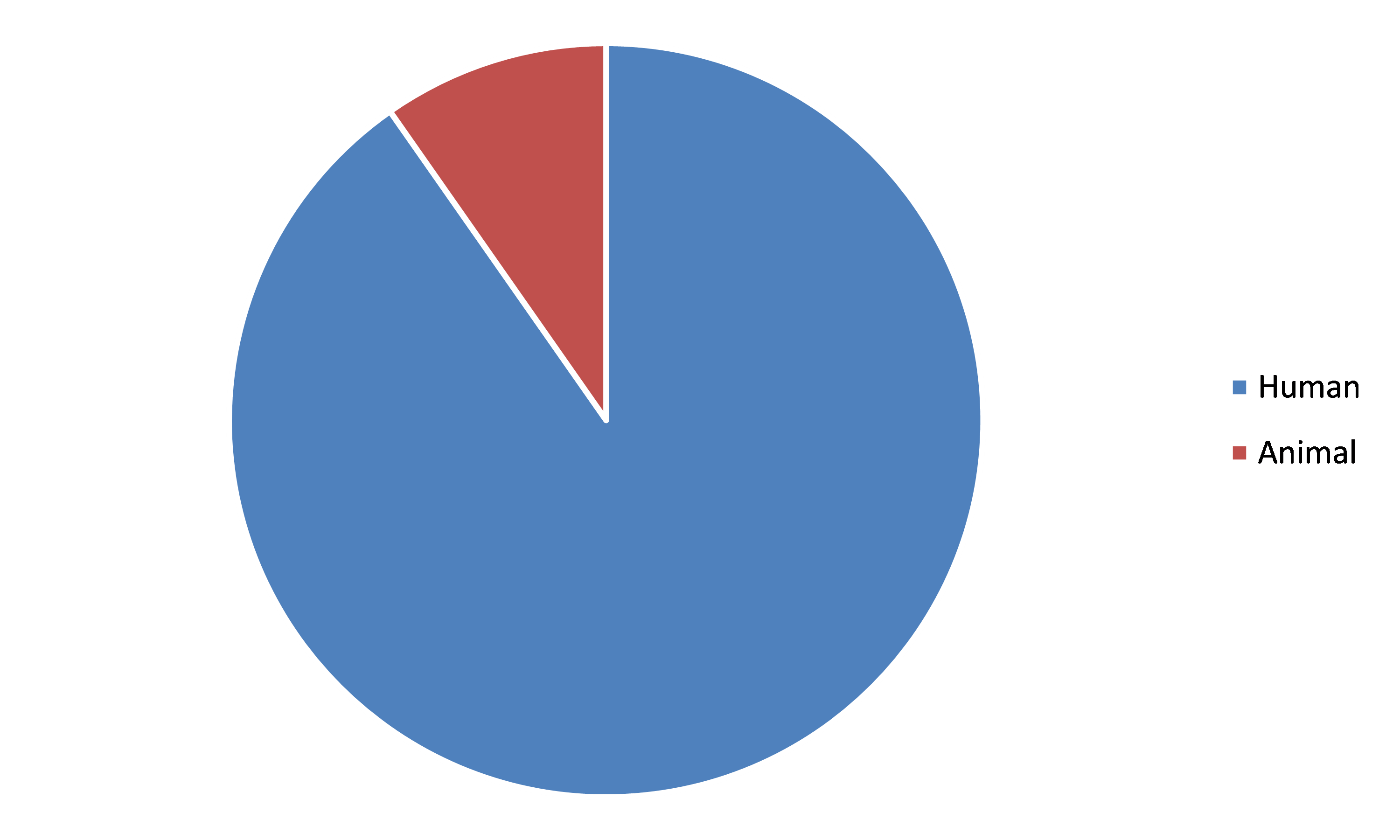

Global Probiotics Market, by End User

Based on end user, the market has been divided into human and animal. Among these, the human sub-segment accounted for the highest revenue share in 2021.

Global Probiotics Market Growth, by End User, 2021

Source: Research Dive Analysis

The human sub-segment accounted for a dominant market share in 2021. Increasing health awareness, rising consumer demand for natural and healthy food products, and the growing popularity of functional food and beverages are driving the growth of the probiotics market. Probiotics are known to offer several health benefits, including improving digestion, boosting the immune system, reducing the risk of allergies, and preventing infections, which makes them an attractive option for consumers. Furthermore, the increase in the prevalence of lifestyle diseases, such as obesity and diabetes, has led to a rise in the demand for probiotics as a preventive measure. These factors are anticipated to boost the growth of the human sub-segment during the forecast periods.

Global Probiotics Market, Regional Insights

The probiotics market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Probiotics Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Probiotics Market in Asia-Pacific to be the Most Dominant

The Asia-Pacific probiotics market accounted for a dominating market share in 2021. Probiotics are used in traditional medicine, particularly in countries such as Japan, China, and Korea. This has helped in an increase in awareness and acceptance of probiotics in the region. Furthermore, the rise in the middle-class population and increase in disposable income in countries like India, China, and Indonesia has led to a shift towards a healthier lifestyle and diet, which includes the consumption of functional foods like probiotics. In addition, the increase in the prevalence of digestive disorders such as irritable bowel syndrome and inflammatory bowel disease, as well as the growing demand for dietary supplements and nutraceuticals, is also driving the growth of the probiotics market in Asia-Pacific. Consumers in this region are increasingly adopting healthy food habits, leading to a surge in demand for functional foods and supplements. The region is also witnessing an increase in R&D activities to develop novel and effective probiotic strains for different applications, further driving the market growth.

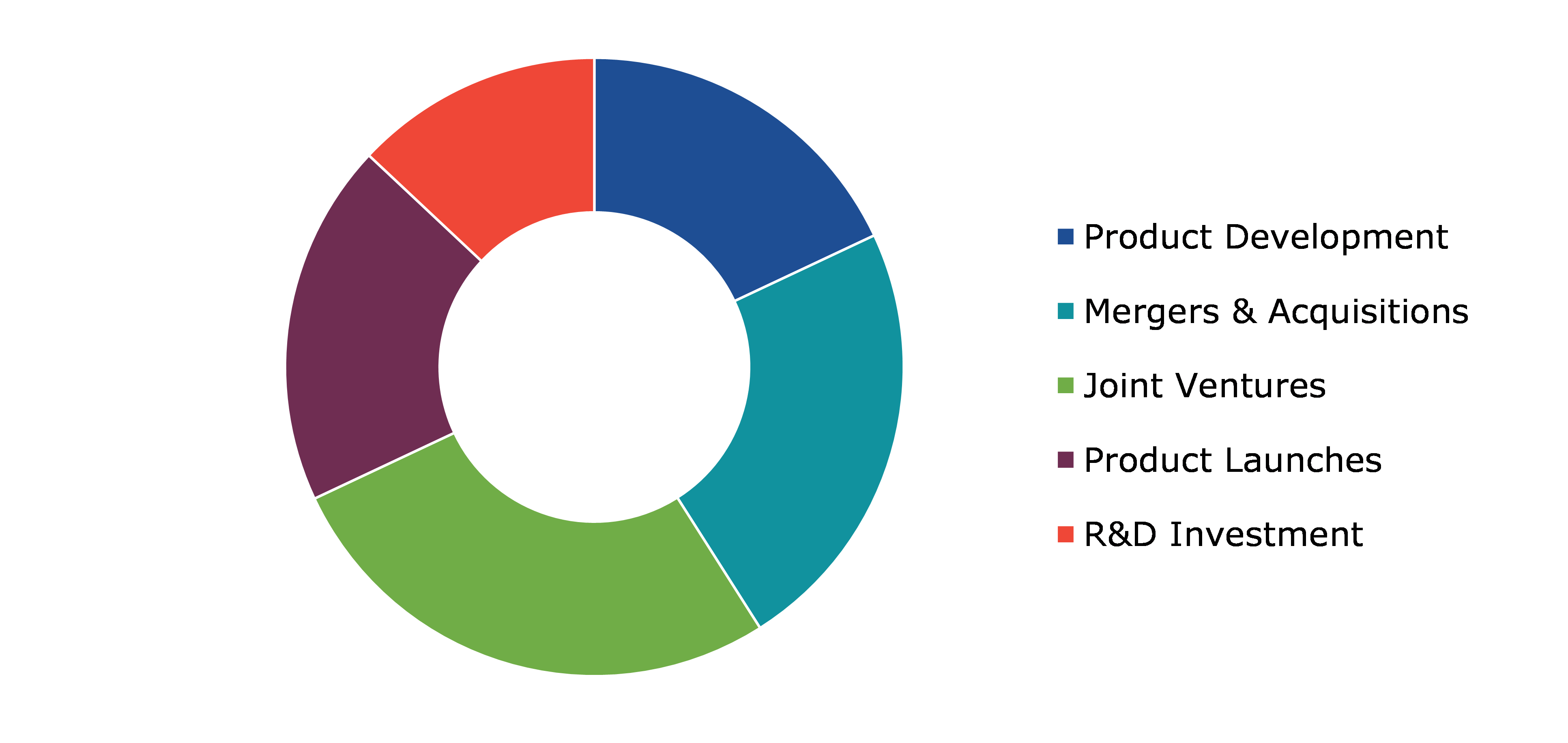

Competitive Scenario in the Global Probiotics Market

Investment and agreement are common strategies followed by major market players. For instance, in August 2022, BioGaia, a biotechnology firm, created probiotic products and is growing its product range with new bacterial strains produced in collaboration with its wholly-owned subsidiary MetabonGen.

Source: Research Dive Analysis

Some of the leading probiotics market players are Arla Foods, Inc., BioGaia AB, Chr. Hansen Holding A/S, Danone, Danisco A/S, General Mills Inc., i-Health Inc., Lallemand Inc., Lifeway Foods, Inc., and Mother Dairy Fruit & Vegetable Pvt. Limited.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Ingredient |

|

| Segmentation by Application |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

Q1. What is the size of the global probiotics market?

A. The size of the global probiotics market was over $53,046.8 million in 2021 and is projected to reach $105,336.5 million by 2031.

Q2. Which are the major companies in the probiotics market?

A. Arla Foods, Inc., BioGaia AB, and Chr. Hansen Holding A/S are some of the key players in the global probiotics market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific probiotics market?

A. Asia-Pacific probiotics market is anticipated to grow at 7.0% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Aqusition and merger are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more in R&D practices?

A. Danone, General Mills Inc., and Mother Dairy Fruit & Vegetable Pvt. Ltd. are the companies investing more in R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Probiotics market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Probiotics market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Probiotics Market Analysis, by Ingredient

5.1.Overview

5.2.Bacteria

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3.Yeast

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Probiotics Market Analysis, by Application

6.1.Probiotic Supplements

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region

6.1.3.Market share analysis, by country

6.2.Animal Feed

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region

6.2.3.Market share analysis, by country

6.3.Food and Beverages

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region

6.3.3.Market share analysis, by country

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Probiotics Market Analysis, by End User

7.1.Human

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region

7.1.3.Market share analysis, by country

7.2.Animal

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region

7.2.3.Market share analysis, by country

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness

7.3.2.Competition heatmap

8.Probiotics Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Ingredient

8.1.1.2.Market size analysis, by Application

8.1.1.3.Market size analysis, by End User

8.1.2.Canada

8.1.2.1.Market size analysis, by Ingredient

8.1.2.2.Market size analysis, by Application

8.1.2.3.Market size analysis, by End User

8.1.3.Mexico

8.1.3.1.Market size analysis, by Ingredient

8.1.3.2.Market size analysis, by Application

8.1.3.3.Market size analysis, by End User

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Ingredient

8.2.1.2.Market size analysis, by Application

8.2.1.3.Market size analysis, by End User

8.2.2.UK

8.2.2.1.Market size analysis, by Ingredient

8.2.2.2.Market size analysis, by Application

8.2.2.3.Market size analysis, by End User

8.2.3.France

8.2.3.1.Market size analysis, by Ingredient

8.2.3.2.Market size analysis, by Application

8.2.3.3.Market size analysis, by End User

8.2.4.Spain

8.2.4.1.Market size analysis, by Ingredient

8.2.4.2.Market size analysis, by Application

8.2.4.3.Market size analysis, by End User

8.2.5.Italy

8.2.5.1.Market size analysis, by Ingredient

8.2.5.2.Market size analysis, by Application

8.2.5.3.Market size analysis, by End User

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Ingredient

8.2.6.2.Market size analysis, by Application

8.2.6.3.Market size analysis, by End User

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Ingredient

8.3.1.2.Market size analysis, by Application

8.3.1.3.Market size analysis, by End User

8.3.2.Japan

8.3.2.1.Market size analysis, by Ingredient

8.3.2.2.Market size analysis, by Application

8.3.2.3.Market size analysis, by End User

8.3.3.India

8.3.3.1.Market size analysis, by Ingredient

8.3.3.2.Market size analysis, by Application

8.3.3.3.Market size analysis, by End User

8.3.4.Australia

8.3.4.1.Market size analysis, by Ingredient

8.3.4.2.Market size analysis, by Application

8.3.4.3.Market size analysis, by End User

8.3.5.South Korea

8.3.5.1.Market size analysis, by Ingredient

8.3.5.2.Market size analysis, by Application

8.3.5.3.Market size analysis, by End User

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Ingredient

8.3.6.2.Market size analysis, by Application

8.3.6.3.Market size analysis, by End User

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Ingredient

8.4.1.2.Market size analysis, by Application

8.4.1.3.Market size analysis, by End User

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Ingredient

8.4.2.2.Market size analysis, by Application

8.4.2.3.Market size analysis, by End User

8.4.3.UAE

8.4.3.1.Market size analysis, by Ingredient

8.4.3.2.Market size analysis, by Application

8.4.3.3.Market size analysis, by End User

8.4.4.South Africa

8.4.4.1.Market size analysis, by Ingredient

8.4.4.2.Market size analysis, by Application

8.4.4.3.Market size analysis, by End User

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Ingredient

8.4.5.2.Market size analysis, by Application

8.4.5.3.Market size analysis, by End User

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Arla Foods, Inc.

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.BioGaia AB

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Chr. Hansen Holding A/S

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Danone

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Danisco A/S

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.General Mills Inc.

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.i-Health Inc.

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Lallemand Inc.

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Lifeway Foods, Inc.

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Mother Dairy Fruit & Vegetable Pvt. Ltd.

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

Probiotics are nothing but “good” bacteria that have numerous health benefits, especially for gut health. To be specific, probiotics help in improving gastrointestinal discomfort, enhancing immunity, circumventing obesity, weight management, etc. Probiotics are widely used in fermented foods, dairy products, pickled vegetables, meat items and beverages. Along with direct use in food items, probiotics are also increasingly used nowadays in dietary supplements.

Forecast Analysis of the Probiotics Market

In recent years, growing use of probiotics as a replacement to pharmaceuticals agents is expected to be the primary growth drivers of the global probiotics market in the forecast years. Along with this, growing application of probiotics in natural and organic food products is anticipated to offer numerous investment and growth opportunities to the market in the analysis timeframe. Additionally, growing health consciousness among the global populations is anticipated to push the market higher in the 2022-2031 period. However, lack of proper regulations may restrain the growth of the probiotics market in the forecast period.

Regionally, the probiotics market in the Asia-Pacific region is expected to be the most dominant one by 2031. The rise in the middle-class population and increase in disposable income in countries like India, China, and Indonesia are projected to be the two main factors behind the growth of the market in this region.

According to the report published by Research Dive, the probiotics market is expected to gather a revenue of $105,336.5 million by 2031 and grow at 7.6% CAGR in the 2022–2031 timeframe. Some prominent market players include Arla Foods, Inc., anisco A/S, Lallemand Inc., BioGaia AB, General Mills Inc., Lifeway Foods, Inc., Chr. Hansen Holding A/S, i-Health Inc., Mother Dairy Fruit & Vegetable Pvt. Limited., and Danone, and many others.

Covid-19 Impact on the Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The probiotics market, however, has been an exception to this trend. The growing awareness about the importance of having a healthy diet and strong immunity has led to an increase in demand for probiotics. This surge in demand has augmented the growth rate of the market in the forecast.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the probiotics market to flourish. For instance:

- In June 2021, Probi, a probiotics company, announced a partnership with Oriflame, a cosmetics company. This collaboration is aimed at launching Probi’s probiotics supplement called Probi Digestis®. With this launch, both the companies will get a significant lead over their competitors in the probiotics market.

- In November 2021, ADM, a nutrition company, announced the acquisition of Deerland Probiotics & Enzymes, a leading probiotics company. This acquisition is predicted to aid ADM to consolidate its lead in the probiotics market and expand its business globally.

- In April 2022, IFF, a leading biosciences company, announced the acquisition of Health Wright Products, a dietary supplements company. This acquisition is predicted to help IFF to cater to the demands of the market comprehensively and increase its market share substantially in the next few years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com