Forklift Battery Market Report

RA00070

Forklift Battery Market, by Type (Lead–Acid, Lithium ion (Li-ion), and Others), by Application (Construction, Manufacturing, Warehouses, Retail & Wholesale Stores, and Others), Regional Analysis (North America, Europe, Asia-Pacific, LAMEA), Global Opportunity Analysis and Industry Forecast, 2019–2026

Update Available On-Demand

Global Forklift Battery Industry Outlook 2026:

The global Forklift Battery Market forecast is expected to be $7,191.9 million by 2026, increasing from $4,231.0 million in 2018 at a CAGR of 6.6%. Europe market share is anticipated to rise at a CAGR of 6.8% by generating a revenue of $1,970.6 by 2026. Asia-Pacific Market size will generate a revenue of $2,704.2 million by 2026.

A Forklift truck is one of the majorly used powered industrial trucks for lifting heavy items, which is a lot easier than manual lifting. Forklift trucks are primarily powered by electricity, propane, diesel or gasoline. Electric forklift trucks are dependent on the electric forklift battery to operate, these batteries are easy to maintain and available at a lower cost. These industrial forklift batteries (traction battery) are majorly used in forklifts, platform pallet trucks and pallet truck.

Market Drivers and Restraints:

Cloud based innovation in forklift batteries along with massive growth in demand for forklifts are projected to boost the global forklift battery market. Extensive growth in demand for forklifts across the globe is one of the significant factors expected to boost the forklift battery market growth. For instance, as per study conducted by Solus Group, the global demand for forklifts has doubled between the years 2009 and 2018. Technical innovations such as smart grid energy battery services along with cloud-based forklift battery are anticipated to boost the demand for forklift battery. For instance, ACT (Advanced Charging technologies) are offering proactive and predictive forklift batteries with features such as, customized report and analytics, automated alerts and automatic data upload with 24/7 access.

Price volatility in lead and threat of substitutes such as gasoline and propane are predicted to pose a severe threat to the global traction battery market

Daily price fluctuation of lead is one of the significant factors that obstruct the growth of forklift battery market. In addition, substitutes such as gasoline or propane forklifts are anticipated to restrain the demand for global market.

Market Opportunities:

Growing global opportunities for Forklift Battery industry

Currently, solar based forklift batteries with energy storage system are projected to boost the growth of forklift battery market. In this technology, solar panels take up sunlight, and the energy is generated and further stored in these batteries. The California government is investing a large amount of funds in solar power. Moreover, California is recognized as a leading region in using Forklift Batteries with Solar energy. Therefore, solar powered forklift batteries are anticipated to create vast opportunities to boost the forklift battery market.

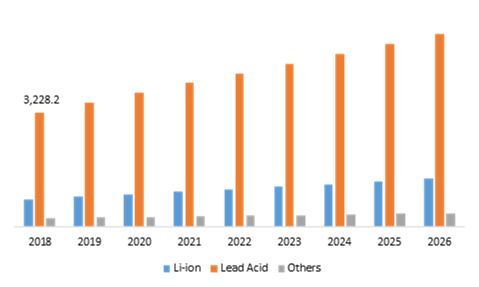

Forklift Battery Market Segmentations, by Type:

Lithium ion (Li-ion) segment will be most lucrative till 2026

Source: Research Dive Analysis

Lead-acid segment has the most significant share in the market and it has generated a revenue of $3,228.2 million in 2018 and is anticipated to generate a revenue of $5,462.3 million by 2026. This is majorly because Lead-acid batteries are lower cost and provide advantages such as high flexibility in severe environmental conditions involving vibrations and dirt.

Lithium ion forklift batteries market is the fastest growing market and it will register a revenue of $1,348.5 Million in 2026. Lithium ion (Li-ion) has integrated features such as maximum lifespan, and productivity along with low cost battery maintenance. Lithium ion forklift battery has a recharge efficiency of 98%+ that drives energy savings as well as decreases damaging effects of heating batteries.

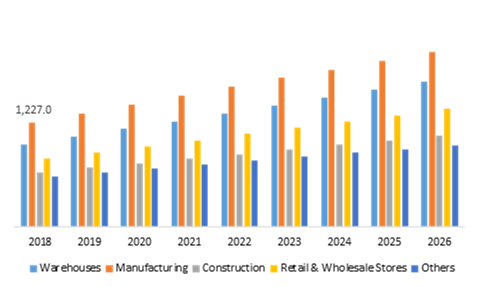

Forklift Battery Market, by Application:

Manufacturing segment will register revenue of $2,066.2 million by 2026

Source: Research Dive Analysis

Manufacturing segment, has the major share for the forklift battery market and it will register a revenue of $2,066.2 million during the projected period. Growing focus toward smoothing the operations in production plant and high usage of smart appliances among manufacturing industry are anticipated to boost the growth of manufacturing sector which is attributed to high demand for forklift batteries across the globe.

Warehouse segment is the most significantly growing sector in the forklift battery market and it has generated a revenue of $973.1 million by 2018 and, it will register a revenue of $1,711.7 Million in 2026, at healthy CAGR of 7.0%; this is mainly because electric forklifts are preferable for inventory management since they don’t emit noxious fumes like the gas-powered forklifts.

Forklift Battery Market system, by Region:

Europe Forklift Battery Market Overview 2026:

Europe region will have lucrative opportunities for the market investors to grow over the coming years

Europe market share is anticipated to rise at a CAGR of 6.8% by generating a revenue of $1,970.6 by 2026. This is majorly because construction projects will continue to grow in Europe in the upcoming years. Moreover, this region provides high potential for the market mainly due to the presence of highly integrated manufacturing and inventory management facilities.

Asia-Pacific Forklift Battery Market Forecast 2026:

Asia-Pacific Market size will generate a revenue of $2,704.2 million by 2026. Major growth in renewable power generation capacity, falling battery prices (nearly 50% in three years) and enormous growth in logistics operations in countries such as China Japan and India are projected to significantly drive the growth of market. In addition, due to rapid growth in urbanization, attributed to rising demand for constructions along with need of fast and efficient logistics operations, the demand for forklifts is increasing in the Asian countries. This, in turn, is anticipated to fuel the demand for forklift batteries throughout the projected period.

Key Participants in global Forklift Battery Market:

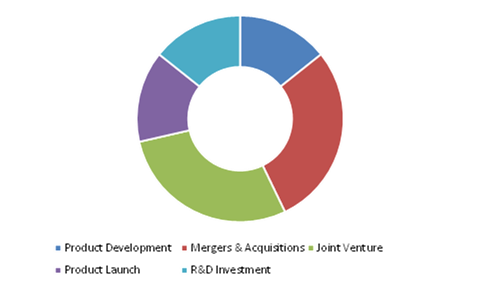

Merger & acquisition and advanced product development are the frequent strategies followed by the market players

Source: Research Dive Analysis

Some of the significant forklift battery market players include Crown Equipment Corporation, East Penn Manufacturing Company, ENERSYS., EXIDE INDUSTRIES LTD., Microtex Energy Private Limited, Navitas System, LLC Corporate., Saft, Southwest Battery Company, Storage Battery Systems, LLC. and Johnson Controls.

Market Players prefer inorganic growth strategies to expand into local markets. Merger & acquisition and advanced product development are the frequent strategies followed by established organizations, for instance, DC Power Solutions offers forklift battery preventative maintenance for keeping the balance between water and sulfuric acid.

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2018 |

| Forecast timeline for Market Projection | 2019-2026 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Countries Covered | U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, and Saudi Arabia |

| Key Companies Profiled |

|

Source: Research Dive Analysis

Q1. What is the size of Forklift Battery Market system?

A. The global Forklift Battery Market system size was over $4,231.0 million in 2018, and is projected to reach $7,191.9 million by 2026.

Q2. Which are the leading companies in the Forklift Battery Market system?

A. ENERSYS.and EXIDE INDUSTRIES LTD. are some of the key players in the global Forklift Battery Market system.

Q3. Which region possesses greater investment opportunities in the coming future?

A. Europe region possess great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of Asia-Pacific market?

A. Europe Forklift Battery Market system is anticipated to grow at 7.0% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological advancements, product development, along with joint ventures are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Southwest Battery Company, Saft and Storage Battery Systems, LLC companies are investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Battery Type trends

2.3. Application trends

3. Market Overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Pricing overview

3.8.1. By Battery Type

3.8.2. By Application

3.9. Market value chain analysis

3.9.1. Stress point analysis

3.9.2. Raw material analysis

3.9.3. Manufacturing process

3.9.4. Distribution channel analysis

3.9.5. Operating vendors

3.9.5.1. Raw material suppliers

3.9.5.2. Product manufacturers

3.9.5.3. Product distributors

3.10. Strategic overview

4. Forklift Battery Market, by Forklift Battery Type

4.1. Lead-acid

4.1.1. Market size and forecast, by region, 2018-2026

4.1.2. Comparative market share analysis, 2018 & 2026

4.2. Lithium ion (Li-ion)

4.2.1. Market size and forecast, by region, 2018-2026

4.2.2. Comparative market share analysis, 2018 & 2026

4.3. Others

4.3.1. Market size and forecast, by region, 2018-2026

4.3.2. Comparative market share analysis, 2018 & 2026

5. Forklift Battery Market, by Application

5.1. Construction

5.1.1. Market size and forecast, by region, 2018-2026

5.1.2. Comparative market share analysis, 2018 & 2026

5.2. Manufacturing

5.2.1. Market size and forecast, by region, 2018-2026

5.2.2. Comparative market share analysis, 2018 & 2026

5.3. Warehouses

5.3.1. Market size and forecast, by region, 2018-2026

5.3.2. Comparative market share analysis, 2018 & 2026

5.4. Retail & Wholesale Stores

5.4.1. Market size and forecast, by region, 2018-2026

5.4.2. Comparative market share analysis, 2018 & 2026

5.5. Others

5.5.1. Market size and forecast, by region, 2018-2026

5.5.2. Comparative market share analysis, 2018 & 2026

6. Forklift Battery Market, by Region

6.1. North America

6.1.1. Market size and forecast, by forklift battery type, 2018-2026

6.1.2. Market size and forecast, by application, 2018-2026

6.1.3. Market size and forecast, by country, 2018-2026

6.1.4. Comparative market share analysis, 2018 & 2026

6.1.5. U.S.

6.1.5.1. Market size and forecast, by forklift battery type, 2018-2026

6.1.5.2. Market size and forecast, by application, 2018-2026

6.1.5.3. Comparative market share analysis, 2018 & 2026

6.1.6. Canada

6.1.6.1. Market size and forecast, by forklift battery type, 2018-2026

6.1.6.2. Market size and forecast, by application, 2018-2026

6.1.6.3. Comparative market share analysis, 2018 & 2026

6.2. Europe

6.2.1. Market size and forecast, by forklift battery type, 2018-2026

6.2.2. Market size and forecast, by application, 2018-2026

6.2.3. Market size and forecast, by country, 2018-2026

6.2.4. Comparative market share analysis, 2018 & 2026

6.2.5. Germany

6.2.5.1. Market size and forecast, by forklift battery type, 2018-2026

6.2.5.2. Market size and forecast, by application, 2018-2026

6.2.5.3. Comparative market share analysis, 2018 & 2026

6.2.6. UK

6.2.6.1. Market size and forecast, by forklift battery type, 2018-2026

6.2.6.2. Market size and forecast, by application, 2018-2026

6.2.6.3. Comparative market share analysis, 2018 & 2026

6.2.7. France

6.2.7.1. Market size and forecast, by forklift battery type, 2018-2026

6.2.7.2. Market size and forecast, by application, 2018-2026

6.2.7.3. Comparative market share analysis, 2018 & 2026

6.2.8. Spain

6.2.8.1. Market size and forecast, by forklift battery type, 2018-2026

6.2.8.2. Market size and forecast, by application, 2018-2026

6.2.8.3. Comparative market share analysis, 2018 & 2026

6.2.9. Italy

6.2.9.1. Market size and forecast, by forklift battery type, 2018-2026

6.2.9.2. Market size and forecast, by application, 2018-2026

6.2.9.3. Comparative market share analysis, 2018 & 2026

6.2.10. Rest of Europe

6.2.10.1. Market size and forecast, by forklift battery type, 2018-2026

6.2.10.2. Market size and forecast, by application, 2018-2026

6.2.10.3. Comparative market share analysis, 2018 & 2026

6.3. Asia Pacific

6.3.1. Market size and forecast, by forklift battery type, 2018-2026

6.3.2. Market size and forecast, by application, 2018-2026

6.3.3. Market size and forecast, by country, 2018-2026

6.3.4. Comparative market share analysis, 2018 & 2026

6.3.5. China

6.3.5.1. Market size and forecast, by forklift battery type, 2018-2026

6.3.5.2. Market size and forecast, by application, 2018-2026

6.3.5.3. Comparative market share analysis, 2018 & 2026

6.3.6. India

6.3.6.1. Market size and forecast, by forklift battery type, 2018-2026

6.3.6.2. Market size and forecast, by application, 2018-2026

6.3.6.3. Comparative market share analysis, 2018 & 2026

6.3.7. Australia

6.3.7.1. Market size and forecast, by forklift battery type, 2018-2026

6.3.7.2. Market size and forecast, by application, 2018-2026

6.3.7.3. Comparative market share analysis, 2018 & 2026

6.3.8. Rest of Asia Pacific

6.3.8.1. Market size and forecast, by forklift battery type, 2018-2026

6.3.8.2. Market size and forecast, by application, 2018-2026

6.3.8.3. Comparative market share analysis, 2018 & 2026

6.4. LAMEA

6.4.1. Market size and forecast, by forklift battery type, 2018-2026

6.4.2. Market size and forecast, by application, 2018-2026

6.4.3. Market size and forecast, by country, 2018-2026

6.4.4. Comparative market share analysis, 2018 & 2026

6.4.5. Latin America

6.4.5.1. Market size and forecast, by forklift battery type, 2018-2026

6.4.5.2. Market size and forecast, by application, 2018-2026

6.4.5.3. Comparative market share analysis, 2018 & 2026

6.4.6. Middle East

6.4.6.1. Market size and forecast, by forklift battery type, 2018-2026

6.4.6.2. Market size and forecast, by application, 2018-2026

6.4.6.3. Comparative market share analysis, 2018 & 2026

6.4.7. Africa

6.4.7.1. Market size and forecast, by forklift battery type, 2018-2026

6.4.7.2. Market size and forecast, by application, 2018-2026

6.4.7.3. Comparative market share analysis, 2018 & 2026

7. Company Profiles

7.1. EnerSys

7.1.1. Business overview

7.1.2. Financial performance

7.1.3. Product portfolio

7.1.4. Recent strategic moves & developments

7.1.5. SWOT analysis

7.2. Crown Equipment Corporation

7.2.1. Business overview

7.2.2. Financial performance

7.2.3. Product portfolio

7.2.4. Recent strategic moves & developments

7.2.5. SWOT analysis

7.3. East Penn Manufacturing Company

7.3.1. Business overview

7.3.2. Financial performance

7.3.3. Product portfolio

7.3.4. Recent strategic moves & developments

7.3.5. SWOT analysis

7.4. EXIDE INDUSTRIES LTD.

7.4.1. Business overview

7.4.2. Financial performance

7.4.3. Product portfolio

7.4.4. Recent strategic moves & developments

7.4.5. SWOT analysis

7.5. Hoppecke Microtex Energy Private Limited

7.5.1. Business overview

7.5.2. Financial performance

7.5.3. Product portfolio

7.5.4. Recent strategic moves & developments

7.5.5. SWOT analysis

7.6. Navitas Systems

7.6.1. Business overview

7.6.2. Financial performance

7.6.3. Product portfolio

7.6.4. Recent strategic moves & developments

7.6.5. SWOT analysis

7.7. Saft

7.7.1. Business overview

7.7.2. Financial performance

7.7.3. Product portfolio

7.7.4. Recent strategic moves & developments

7.7.5. SWOT analysis

7.8. Southwest Battery Company

7.8.1. Business overview

7.8.2. Financial performance

7.8.3. Product portfolio

7.8.4. Recent strategic moves & developments

7.8.5. SWOT analysis

7.9. SBS Storage Battery Systems, LLC

7.9.1. Business overview

7.9.2. Financial performance

7.9.3. Product portfolio

7.9.4. Recent strategic moves & developments

7.9.5. SWOT analysis

7.10. Johnson Controls

7.10.1. Business overview

7.10.2. Financial performance

7.10.3. Product portfolio

7.10.4. Recent strategic moves & developments

7.10.5. SWOT analysis

Introduction

A Forklift truck is one of the majorly used powered industrial truck for lifting of heavy items rapidly and an entire inventory reducing the pain points of manual lifting. Forklift trucks are mostly powered by electricity, propane, diesel or gasoline. As they need constant power supply to function properly, deep cycle industrial grade batteries are used that can be discharged up to 80% on a regular basis. A variety of industrial batteries ranging from size to density are used by the forklift trucks. Electric forklift trucks dependent on the batteries to operate which are easy to maintenance and lower cost.

There are two main choices in the forklift battery industry—the lead-acid battery and the industry newbie Lithium Ion (Li Ion). They operate in their own ways respective to their own systems, setups, charging requirements, and price tags. Studies have estimated that lead acids will be the industry leader throughout the upcoming years due to its affordable price and weight. A report by Research Dive has predicted that Lead-acid segment has the significant share in the global forklift battery market and it has generated a revenue of $3,228.2 Million in 2018 and is anticipated to generate revenue of $5,462.3 Million by 2026.

Growth Drivers and Opportunities – A Precise Outlook

The end-users of battery-powered forklifts are the automotive, mechanical, logistics, food and beverage, timber, chemical, paper printing, wholesale and retail companies. Owing to their low GHG emissions and noise levels, electric forklifts are preferred by the most of the end-users. Its ability to decrease the requirement on fuel and reduce cost makes the electric forklifts more preferable. For instance, the cost of propelling an electric forklift is 50% less than the cost of propelling an internal combustion engine (ICE) forklift and also have a longer lifespan than ICE forklifts.

“The usage of lead-acid batteries in material handling equipment is cost-efficient and offers high resilience in harsh environments that involve chemicals, dirt, and vibration. Lead-acid batteries require low maintenance than other types of batteries. Planning for the use of lead-acid batteries and their replacement is consistent, simple, and predictable. Technical innovations such as the advent of fast charging during operator downtime improve the cost efficiency of electric forklifts and their batteries”, opines a senior analyst at Technavio, a leading technology research and advisory company.

An all-encompassing rise in demand for forklifts across the globe is one of the significant factor boosting the growth of the forklift battery market. Moreover, technical innovations such as smart grid energy battery services along with cloud based forklift battery are anticipated to boost the demand for forklift battery. One relatable example is the Advanced Charging technologies or ACT that are offering proactive and predictive forklift batteries with advanced features such as customized report and analytics, automated alerts and automatic data upload with 24/7 access.

Another factor influencing the growth of the market is the convenience of solar powered forklift batteries. The solar panels absorb the sunlight, the energy gets converted and then generated into forklift batteries. California is recognized as leading country in using Forklift Batteries with Solar energy.

Lithium Ion segment is also influencing the global market of forklift battery with its integrated features such as maximum lifespan, more efficient, and productivity along with low cost battery maintenance. This battery is more energy efficient and cost effective. Lithium ion forklift battery has recharge efficiency of 98%+ that drives energy savings as well as decreases damaging effects of heating batteries. This has made the forklift battery market the fastest growing segment.

Asia-Pacific to Reign the Market

Significant progress in renewable power generation capacity, falling battery prices (nearly 50% in three years) and enormous growth in logistics operations in countries such as China Japan and India is going to influence the market. In addition, rapid growth in urbanization attributed to rising demand for constructions along with need of fast and efficient logistics operations, the demand for forklifts is increasing in the Asian countries.

Recent Developments - Mergers and Acquisition

- Mitsubishi Caterpillar Forklift America Inc. (MCFA), a leading manufacturer of forklifts under the Jungheinrich® brand, has launched its Jungheinrich Lithium-ion battery technology in January, 2020.

- AeroVironment Inc. has launched a patent-pending advanced version of its ConnectRx for its PosiCharge ProCore line of electric forklift chargers for the material handling industry.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com