Bio-Based Oil Market Report

RA09243

Bio-Based Oil Market by Type (Vegetable Oils, Animal Fats, and Others), Application (Hydraulic Oils, Metalworking Fluids, Chainsaw Oils, Gear Oils, Mold Release Agents, Two-cycle Engine Oils, and Greases), End-use (Industrial, Automotive, Mining, Construction, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Bio-Based Oil Overview

Bio-based oil, also known as biobased oil or renewable oil, is an innovative class of lubricants and fuels generated from renewable biological sources rather than standard petroleum-based products. In an era characterized by growing environmental concerns and the need to decrease reliance on limited fossil fuels, this is increasing the adoption of bio-based oil. This sustainable alternative is obtained from a diverse range of organic ingredients, including vegetable oils, fats from animals, algae, and microbial sources, making it a versatile and environmentally beneficial substitute for conventional oils.

Algae, which are microscopic aquatic creatures, are a pioneering source of bio-based oil. Algae may be grown in a variety of aquatic conditions and are recognized for their high growth rates. Algal oils include fatty acids that may be converted into bio-based products useful for engines, machines, and even aircraft. Algae-based bio-oils have received special attention for their potential to reduce carbon emissions since they can be generated without impacting the demand for food crops and can absorb carbon dioxide throughout their development.

Global Bio-Based Oil Market Analysis

The global bio-based oil market size was $1,747.5 million in 2022 and is predicted to grow with a CAGR of 4.2%, by generating a revenue of $2,630.8 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on the Global Bio-Based Oil Market

The COVID-19 pandemic generated uncertainty in financial markets, affecting investors' willingness to support bio-based oil ventures. Many investors shifted their resources to industries that appeared to be more robust in the face of economic uncertainty. While some bio-based oil projects received finance owing to their long-term sustainability advantages, many experienced difficulties in obtaining sufficient investments. Despite these limitations, the pandemic highlighted the significance of sustainability and the necessity for a robust and diverse supply chain.

As countries around the world faced disruptions in fossil fuel supply and there was growing awareness regarding the environmental effect of traditional oil extraction, the bio-based oil sector found itself in a position to offer a more sustainable solution. This shift in public awareness, as well as the increasing emphasis on environmental sustainability, presented chances for bio-based oil manufacturers to innovate and expand their market reach. The pandemic had a significant influence on consumer awareness and choices. People became more aware regarding health and environmental concerns, which raised demand for sustainable and bio-based products.

Rising Demand for Bio-Based Oil in Energy Independence to Drive the Market Growth

Energy independence is dependent on diversifying energy resources. Along with solar, wind, and hydropower, bio-based oils provide a huge possibility to extend the energy portfolio. Countries may build a more robust and diverse energy infrastructure that is less sensitive to supply chain disruptions by including bio-based oils into their energy mix. The bio-based oil business creates job opportunities at all phases, from cultivation through processing and distribution. This job creation can help reduce unemployment and encourage economic growth, generating a sense of self-reliance and economic freedom. Many countries rely substantially on energy imports, resulting in huge trade imbalances. By increasing the production of bio-based oils, a country may minimize its reliance on foreign oil, hence reducing deficits and improving general economic stability. Crop cultivation for bio-based oil production can bring a considerable economic boost to the agriculture industry. Farmers may diversify their revenue sources by cultivating crops appropriate for oil extraction, thereby renewing rural areas, and contributing to overall economic growth.

Strict Regulatory Compliance to Restrain the Market Growth

Regulatory frameworks and standards are critical in the uptake of bio-based oils. Inconsistent or unclear regulations are expected to hinder the development and marketing of bio-based oils. It is critical to develop comprehensive and standardized rules that encourage the long-term viability and safety of these goods. Furthermore, incentives and regulations that support the use of bio-based oils, such as tax credits or requirements, can assist push their acceptance in a variety of industries. Bio-based oils frequently require certification and labelling in accordance with recognized standards in order to generate customer confidence and ease market access. Various organizations, such as the USDA's Bio Preferred program and the European Union's Ecolabel, provide certification methods that assist customers in identifying items with bio-based content. These certifications require adherence to standards, offering another layer of control to the sector. Regulatory hurdles in international trade can be a substantial impediment for bio-based oils. Standardizing norms and standards across different locations is critical for facilitating worldwide commerce in bio-based oils. Bio-based oils must fulfil specified criteria in order to operate well in a variety of applications. Regulatory organizations must specify these requirements to ensure that bio-based oils may replace conventional oils without sacrificing performance or safety.

Diversification of Raw Materials Sources in Bio-Based Oil to Drive Excellent Opportunities

Diversifying raw material sources allows for the use of a diverse variety of renewable resources. This can comprise a variety of biomass feedstocks such as agricultural wastes, algae, and waste products. Renewable raw materials, as compared to finite fossil fuel resources, contribute to sustainability by encouraging responsible resource use and lowering environmental impact. Diversification of raw materials for bio-based oil production can improve energy security by minimizing reliance on a particular feedstock or area for oil production. Diverse raw materials can meet diverse market needs and applications. Diversification allows firms to respond to changing market demands and laws. Some raw materials may be more suited for biofuels than others. Different source materials produce bio-based oils with varied characteristics. Diversification enables producers to adjust their products to specific market demands. Some sources such as vegetable-based, animal-based, and forestry-based, may generate oils with superior lubricant characteristics, but others may create oils appropriate for biodiesel or cosmetics. Relying on a single supplier for raw materials could compromise supply chain stability. Diversification reduces these risks by spreading the sources over different materials, geographical areas, and providers. This ability to rebound is critical in minimizing the effect of unanticipated occurrences like natural disasters or geopolitical disturbances.

Global Bio-Based Oil Market Share, by Type, 2022

Source: Research Dive Analysis

The vegetable oils sub-segment accounted for the highest market share in 2022. Vegetable oil has dominated the bio-based oil market, securing the majority of its market share. Vegetable oil, derived from various plant sources such as soybeans, palm, and canola, has gained favor for its eco-friendly and sustainable properties. Vegetable oil's versatility is also a significant contributor to its market dominance. It can be tailored for various applications, offering a wide range of viscosity, stability, and lubrication properties, making it an ideal candidate for diverse industrial needs. The bio-based oil can be used in cooking, biofuel production, or as an ingredient in personal care products. The adaptability of vegetable oil contributes to its widespread usage. The market is also expected to hold its dominance during the forecast period owing to its renewable, biodegradable, and versatile nature, that aligns perfectly with the growing demand for sustainable alternatives to traditional petroleum-based oils.

Global Bio-Based Oil Market Share, by Application, 2022

Source: Research Dive Analysis

The hydraulic oils sub-segment accounted for the highest market share in 2022. Bio-based hydraulic fluids, also known as biodegradable hydraulic fluids, have gained significant popularity due to their environmentally friendly properties and versatile applications across various industrial sectors. They exhibit commendable lubricating properties, ensuring smooth and efficient operation of hydraulic systems. Furthermore, these fluids often possess a higher flash point, reducing the risk of combustion and enhancing workplace safety. Their bio-based nature also contributes to a reduction in carbon emissions, aligning with global efforts to combat climate change. The versatility of these fluids makes them suitable for use in a wide range of applications, including construction equipment, agriculture machinery, and manufacturing processes. In addition, stringent environmental regulations and sustainability goals have incentivized the transition from conventional hydraulic fluids to their bio-based counterparts.

Global Bio-Based Oil Market Share, by End-use, 2022

Source: Research Dive Analysis

The automotive sub-segment accounted for the highest market share in 2022. Bio-based oils have become increasingly prevalent within the automotive industry due to their numerous advantages over traditional petroleum-based oils. As the world confronts the challenges of climate change, automakers have been exploring innovative ways to minimize their carbon footprint. Bio-based oils have proven to be a sustainable solution, offering reduced greenhouse gas emissions, lower toxicity, and biodegradability. These properties make them a favored choice for lubricants and hydraulic fluids in vehicles, further solidifying their position in the automotive sector. In addition, governmental regulations and policies that promote cleaner and more sustainable practices in the automotive industry have accelerated the adoption of bio-based oils. Incentives, tax breaks, and stricter emissions standards have encouraged automakers to incorporate these oils into their manufacturing processes.

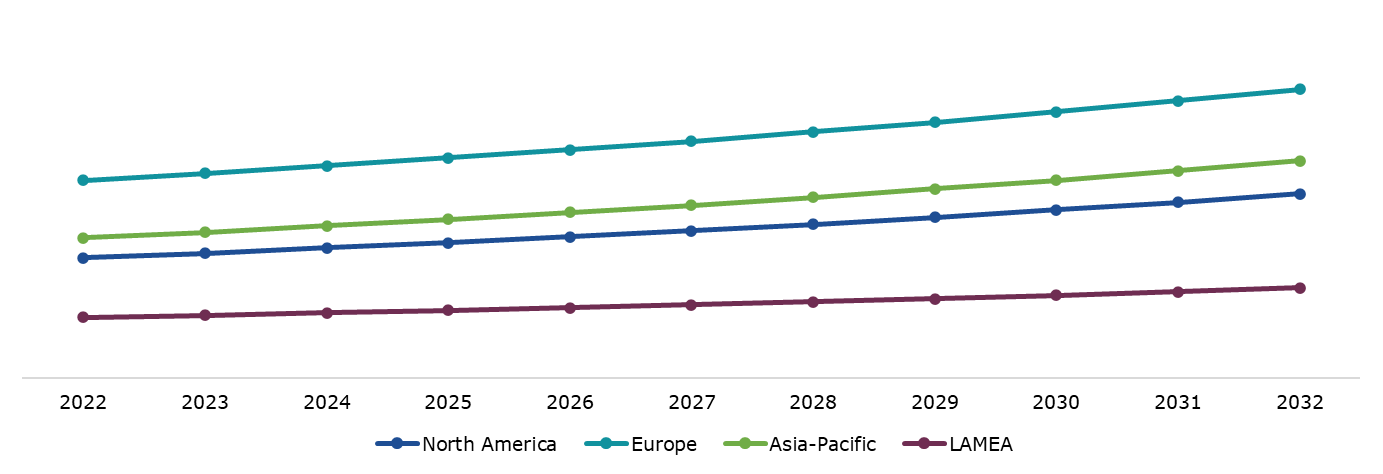

Global Bio-Based Oil Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The North America bio-based oil market generated the highest revenue in 2022. The bio-based oil sector, which focuses on producing oils derived from renewable and sustainable sources, witnessed significant growth and investment in this region. North America's commitment toward environmental sustainability and reducing its carbon footprint has boosted the growth of the bio-based oil industry. Government incentives and regulations promoting the use of renewable resources have created a favorable environment for businesses involved in bio-based oil production. This has attracted both domestic and international companies to invest and expand their operations within the region. Moreover, North America has not only secured the major share of the bio-based oil market but has also contributed to its evolution as a sustainable and economically viable solution for the global market. The rising prominence of bio-based oil industry in North America is shaping the future of renewable and environmentally conscious products in the region.

Competitive Scenario in the Global Bio-Based Oil Market

Product launch, investment, and acquisition are common strategies followed by major market players. For instance, in December 2021, RSC Bio Solutions and Standard Sekiyu Osaka Hatsubaisho Co., Ltd (SSOH) announced a collaboration aimed at meeting the increasing demand for Environmentally Acceptable Lubricants (EALs) in Japan, particularly within the marine and industrial sectors. This strategic partnership represents a significant step forward in addressing the environmental concerns associated with lubricant use in these critical industries. The partnership between RSC Bio Solutions and SSOH is essential, considering the growing awareness of environmental issues and tightening regulations governing lubricant choices within the marine and industrial sectors. By combining RSC Bio Solutions' cutting-edge EAL technology with SSOH's deep understanding of the Japanese market and its distribution network, the collaboration is primed to address these concerns effectively.

Source: Research Dive Analysis

Some of the leading bio-based oil market players are Albemarle Corporation, Chevron Corporation, RSC Bio Solutions, Emery Oleochemicals, Environmental Lubricants Manufacturing Inc., Exxon Mobil Corporation, Panolin AG, Polnox Corporation, Royal Dutch Shell PLC, and Total SE.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Segmentation by End-use |

|

| Key Companies Profiled |

|

Q1. What is the size of the global bio-based oil market?

A. The size of the global bio-based oil market was $1,747.5 million in 2022 and is projected to reach $2,630.8 million by 2032.

Q2. Which are the major companies in the bio-based oil market?

A. Albemarle Corporation, Chevron Corporation, RSC Bio Solutions, Emery Oleochemicals, Environmental Lubricants Manufacturing Inc., Exxon Mobil Corporation, Panolin AG, Polnox Corporation, Royal Dutch Shell PLC, and Total SE are some of the key players in the global bio-based oil market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. North America region possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the North America bio-based oil market?

A. The North America bio-based market is anticipated to grow at 4.4% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Continuous improvement and brand product differentiation are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Panolin AG, Polnox Corporation, Royal Dutch Shell PLC, and Total SE are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global bio-based oil market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Environmental

4.7. Impact of COVID-19 on bio-based oil market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Bio-Based Oil Market Analysis, by Type

5.1. Overview

5.2. Vegetable Oils

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Animal Fats

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Others

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Research Dive Exclusive Insights

5.5.1. Market attractiveness

5.5.2. Competition heatmap

6. Bio-Based Oil Market Analysis, by Application

6.1. Overview

6.2. Hydraulic Oils

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Metalworking Fluids

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Chainsaw Oils

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Gear Oils

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2022-2032

6.5.3. Market share analysis, by country, 2022-2032

6.6. Mold Release Agents

6.6.1. Definition, key trends, growth factors, and opportunities

6.6.2. Market size analysis, by region, 2022-2032

6.6.3. Market share analysis, by country, 2022-2032

6.7. Two-cycle Engine Oils

6.7.1. Definition, key trends, growth factors, and opportunities

6.7.2. Market size analysis, by region, 2022-2032

6.7.3. Market share analysis, by country, 2022-2032

6.8. Greases

6.8.1. Definition, key trends, growth factors, and opportunities

6.8.2. Market size analysis, by region, 2022-2032

6.8.3. Market share analysis, by country, 2022-2032

6.9. Research Dive Exclusive Insights

6.9.1. Market attractiveness

6.9.2. Competition heatmap

7. Bio-Based Oil Market Analysis, by End-use

7.1. Overview

7.2. Industrial

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2022-2032

7.2.3. Market share analysis, by country, 2022-2032

7.3. Automotive

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2022-2032

7.3.3. Market share analysis, by country, 2022-2032

7.4. Mining

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2022-2032

7.4.3. Market share analysis, by country, 2022-2032

7.5. Construction

7.5.1. Definition, key trends, growth factors, and opportunities

7.5.2. Market size analysis, by region, 2022-2032

7.5.3. Market share analysis, by country, 2022-2032

7.6. Others

7.6.1. Definition, key trends, growth factors, and opportunities

7.6.2. Market size analysis, by region, 2022-2032

7.6.3. Market share analysis, by country, 2022-2032

7.7. Research Dive Exclusive Insights

7.7.1. Market attractiveness

7.7.2. Competition heatmap

8. Bio-Based Oil Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Type, 2022-2032

8.1.1.2. Market size analysis, by Application, 2022-2032

8.1.1.3. Market size analysis, by End-use, 2022-2032

8.1.2. Canada

8.1.2.1. Market size analysis, by Type, 2022-2032

8.1.2.2. Market size analysis, by Application, 2022-2032

8.1.2.3. Market size analysis, by End-use, 2022-2032

8.1.3. Mexico

8.1.3.1. Market size analysis, by Type, 2022-2032

8.1.3.2. Market size analysis, by Application, 2022-2032

8.1.3.3. Market size analysis, by End-use, 2022-2032

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Type, 2022-2032

8.2.1.2. Market size analysis, by Application, 2022-2032

8.2.1.3. Market size analysis, by End-use, 2022-2032

8.2.2. UK

8.2.2.1. Market size analysis, by Type, 2022-2032

8.2.2.2. Market size analysis, by Application, 2022-2032

8.2.2.3. Market size analysis, by End-use, 2022-2032

8.2.3. France

8.2.3.1. Market size analysis, by Type, 2022-2032

8.2.3.2. Market size analysis, by Application, 2022-2032

8.2.3.3. Market size analysis, by End-use, 2022-2032

8.2.4. Spain

8.2.4.1. Market size analysis, by Type, 2022-2032

8.2.4.2. Market size analysis, by Application, 2022-2032

8.2.4.3. Market size analysis, by End-use, 2022-2032

8.2.5. Italy

8.2.5.1. Market size analysis, by Type, 2022-2032

8.2.5.2. Market size analysis, by Application, 2022-2032

8.2.5.3. Market size analysis, by End-use, 2022-2032

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Type, 2022-2032

8.2.6.2. Market size analysis, by Application, 2022-2032

8.2.6.3. Market size analysis, by End-use, 2022-2032

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Type, 2022-2032

8.3.1.2. Market size analysis, by Application, 2022-2032

8.3.1.3. Market size analysis, by End-use, 2022-2032

8.3.2. Japan

8.3.2.1. Market size analysis, by Type, 2022-2032

8.3.2.2. Market size analysis, by Application, 2022-2032

8.3.2.3. Market size analysis, by End-use, 2022-2032

8.3.3. India

8.3.3.1. Market size analysis, by Type, 2022-2032

8.3.3.2. Market size analysis, by Application, 2022-2032

8.3.3.3. Market size analysis, by End-use, 2022-2032

8.3.4. Australia

8.3.4.1. Market size analysis, by Type, 2022-2032

8.3.4.2. Market size analysis, by Application, 2022-2032

8.3.4.3. Market size analysis, by End-use, 2022-2032

8.3.5. South Korea

8.3.5.1. Market size analysis, by Type, 2022-2032

8.3.5.2. Market size analysis, by Application, 2022-2032

8.3.5.3. Market size analysis, by End-use, 2022-2032

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by XX, 2022-2032

8.3.6.2. Market size analysis, by XX, 2022-2032

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Type, 2022-2032

8.4.1.2. Market size analysis, by Application, 2022-2032

8.4.1.3. Market size analysis, by End-use, 2022-2032

8.4.2. UAE

8.4.2.1. Market size analysis, by Type, 2022-2032

8.4.2.2. Market size analysis, by Application, 2022-2032

8.4.2.3. Market size analysis, by End-use, 2022-2032

8.4.3. Saudi Arabia

8.4.3.1. Market size analysis, by Type, 2022-2032

8.4.3.2. Market size analysis, by Application, 2022-2032

8.4.3.3. Market size analysis, by End-use, 2022-2032

8.4.4. South Africa

8.4.4.1. Market size analysis, by Type, 2022-2032

8.4.4.2. Market size analysis, by Application, 2022-2032

8.4.4.3. Market size analysis, by End-use, 2022-2032

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Type, 2022-2032

8.4.5.2. Market size analysis, by Application, 2022-2032

8.4.5.3. Market size analysis, by End-use, 2022-2032

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. Albemarle Corporation

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Chevron Corporation

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. RSC Bio Solutions

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Emery Oleochemicals

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Environmental Lubricants Manufacturing Inc.

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Exxon Mobil Corporation

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Panolin AG

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Polnox Corporation

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Royal Dutch Shell PLC

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Total SE

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com