Rock Drilling Equipment Market Report

RA09240

Rock Drilling Equipment Market by Product (Medium-Sized, Large-Sized, and Heavy-Sized), End-use Industry (Mining and Construction), Manufacturer (OEM and Aftermarket), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Rock Drilling Equipment Market Overview

Rock drilling equipment includes a wide range of technology designed particularly for boring holes and piercing rock formations. These instruments are vital for a variety of industrial applications that require working with hard and abrasive materials. Rock drilling equipment's principal role is to produce apertures in rock surfaces to facilitate exploration, mining, and construction activities. Mining, building, and tunnelling are examples of its common uses. Rock drilling equipment is essential in mining operations for removing minerals and ores from the Earth's crust. It is useful in both open-pit and underground mining operations. This equipment is used in building projects to lay foundations, anchor points, and boreholes, particularly in places with rocky substrates. Tunnel construction relies significantly on rock drilling technologies to penetrate difficult geological formations, paving the way for transportation, utilities, and infrastructure development.

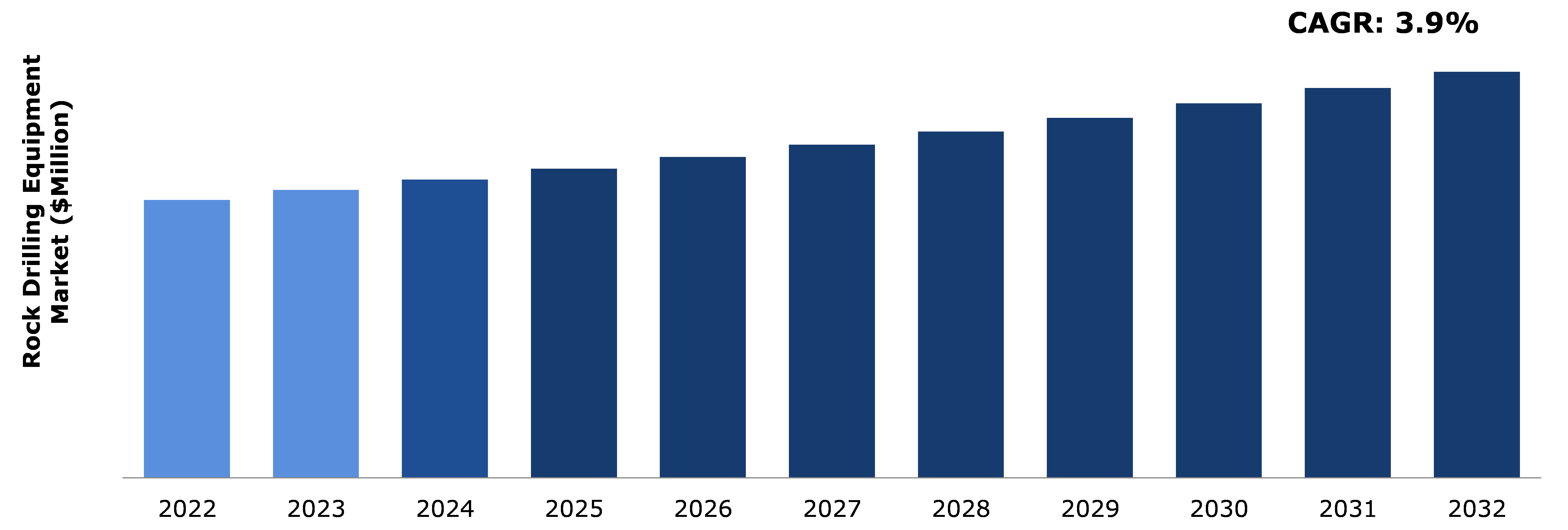

Global Rock Drilling Equipment Market Analysis

The global rock drilling equipment market size was $2,339.1 million in 2022 and is predicted to grow with a CAGR of 3.9%, by generating a revenue of $3,419.2 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on the Global Rock Drilling Equipment Market

One of the major issues hampering the rock drilling equipment sector during the pandemic was a lack of trained labor. Workforce availability was reduced because of lockdowns, social distancing tactics, and health issues. The absence of competent workers impacted not just equipment manufacturing but also the service and maintenance of existing machines. Companies were compelled to respond by introducing strict workplace safety measures, implementing remote work wherever practicable, and investing in training programs to close the skills gap. As a result of the pandemic, demand for rock drilling equipment in the construction and mining industries fluctuated. Some projects were halted owing to economic uncertainty and lockdown measures, while others were delayed in acquiring essential permissions and approvals. Demand volatility led manufacturers to rethink their production techniques and inventory management, necessitating greater flexibility and agility in adjusting to changing market conditions. The pandemic altered the competitive environment of the market for rock drilling equipment.

Increasing Demand from the Mining and Construction Industries to Drive the Market Growth

The growing worldwide population and the continued trend of urbanization stand out as factors driving the increased need for rock drilling equipment. As more people move to cities, there is a greater demand for robust infrastructure development, which includes projects such as roads, bridges, tunnels, and skyscrapers. This increase in building activities needs the use of efficient and cutting-edge rock drilling equipment to dig and prepare construction sites. Simultaneously, the mining industry is enjoying a significant boom due to an increase in demand for minerals and metals across numerous industries, including manufacturing, electronics, and renewable energy. Mining companies are attempting to extract resources in a way that is both efficient and cost-effective, resulting in an increased need for modern rock drilling equipment in their operations. This increase in mining activities adds to the need for rock drilling equipment. Furthermore, the use of new drilling techniques such as directional drilling and geothermal drilling has broadened the application areas for rock drilling equipment. These sophisticated technologies enable precision drilling in a variety of orientations and depths, driving the demand for the use of drilling equipment in geotechnical and environmental applications.

High Wear and Tear of Rock Drilling Equipment to Restrain the Market Growth

The high maintenance cost is one of the main problems associated with the significant wear and tear of consumables in rock drilling equipment. Consumables such as drill bits, rods, and other wear-prone components must be replaced on a regular basis, which raises operational costs. Another important factor that hinders production is maintenance downtime. As the equipment requires more regular repair and consumable replacement, the time spent on maintenance tasks increases, resulting in lower overall operating efficiency. Furthermore, the wear and tear of rock drilling equipment consumables frequently results in decreased drilling performance. As components wear out, so does the precision and efficacy of the drilling process, resulting in longer drilling durations and lower overall output. When parts wear out quickly, the lifespan of rock drilling equipment is affected. Premature equipment failure becomes a major worry, necessitating more frequent replacements or expensive repairs. This not only extends downtime but also raises the financial burden of replacing or repairing costly drilling equipment.

Increasing Focus on Renewable Energy Sources to Drive Excellent Opportunities

The growing dependence on electric vehicles (EVs) and energy storage systems, for example, highlights the vital role that minerals such as lithium, cobalt, and rare earth elements play. These elements are critical components in the manufacture of high-performance batteries that power EVs and serve as energy storage units for renewable energy sources. In these difficult terrains, traditional mining methods may fall short or become economically unviable, emphasizing the need for specialized equipment. This scenario presents a fascinating chance for rock drilling equipment makers to design and construct drilling rigs specifically designed to solve the unique problems provided by hard rock mining for these essential minerals. The complicated processes of extracting minerals from hard rock formations are due to their geological variety, which can vary significantly. These formations may include a variety of minerals inside complicated geological structures, emphasizing the need for drilling equipment that is precise, adaptable, and resilient. Manufacturers are pioneering breakthrough technologies such as directional drilling and enhanced drill bit materials in response to this demand, allowing for more accurate targeting of mineral reserves within hard rock formations.

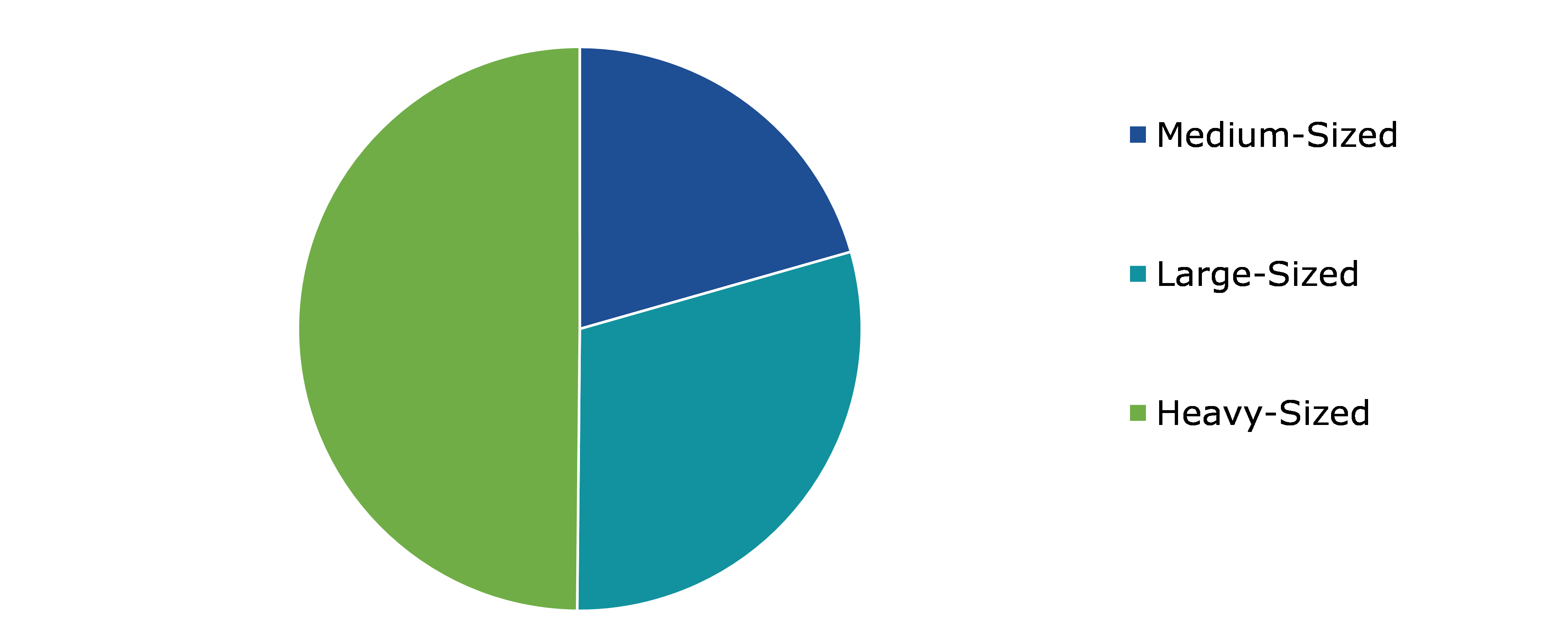

Global Rock Drilling Equipment Market Share, by Product, 2022

Source: Research Dive Analysis

The heavy-sized sub-segment accounted for the highest market share in 2022. The increase in demand from large-scale projects is one of the key factors driving the heavy-sized rock drilling equipment segment growth. Drilling equipment that can manage large workloads is required for mega infrastructural initiatives, large mining operations, and ambitious building projects. Heavy-duty rock drills are built to satisfy these requirements and contribute to the successful completion of such projects. These machines have powerful engines, modern drilling methods, and strong assemblies that allow them to crack challenging rock formations quickly and precisely. Increased productivity not only shortens project schedules but also results in long-term cost benefits. These machines have features such as ergonomic operator cabins, superior dust control systems, and integrated safety standards. The dedication toward safety standards has aided in the rising adoption of large-scale drilling equipment in a variety of sectors. Drilling technology improvements have been critical in the development of large-scale rock drilling equipment. Modern machines have cutting-edge features including automated drilling systems, real-time monitoring, and precise control mechanisms. These technical advancements improve drilling accuracy, minimize downtime, and contribute to safer working conditions.

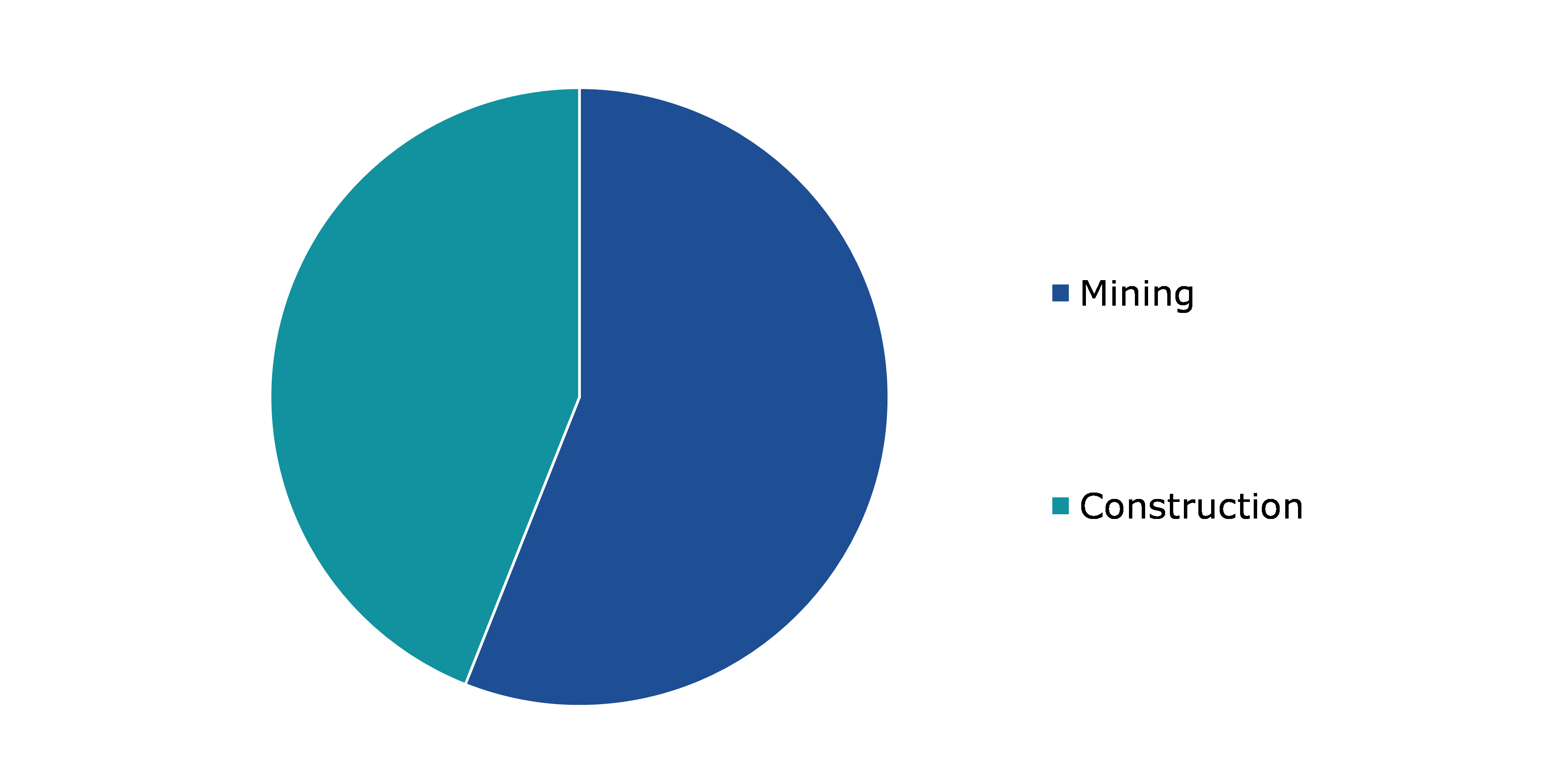

Global Rock Drilling Equipment Market Share, by End-use Industry, 2022

Source: Research Dive Analysis

The mining sub-segment accounted for the highest market share in 2022. Rapid technological breakthroughs have resulted in the creation of advanced rock drilling equipment with improved precision, efficiency, and safety features. These advancements are major factors driving the use of such equipment in mining operations. Modern drilling machines have been equipped with advanced automation, real-time data monitoring, and complex control systems, enabling more accurate and effective drilling. With industrialization, urbanization, and technological breakthroughs, worldwide demand for minerals ranging from basic metals to rare earth elements continues to increase. Mining corporations are rapidly investing in innovative rock drilling equipment to recover minerals from deeper and more difficult geological formations to fulfil this growing demand. Rock drilling equipment helps to reduce costs and boost production in mining operations. These standards apply to rock drilling equipment developed with environmental factors in mind, such as low emissions and minimum environmental effect. Furthermore, the automation and remote-control aspects of current drilling equipment contribute to better operator safety.

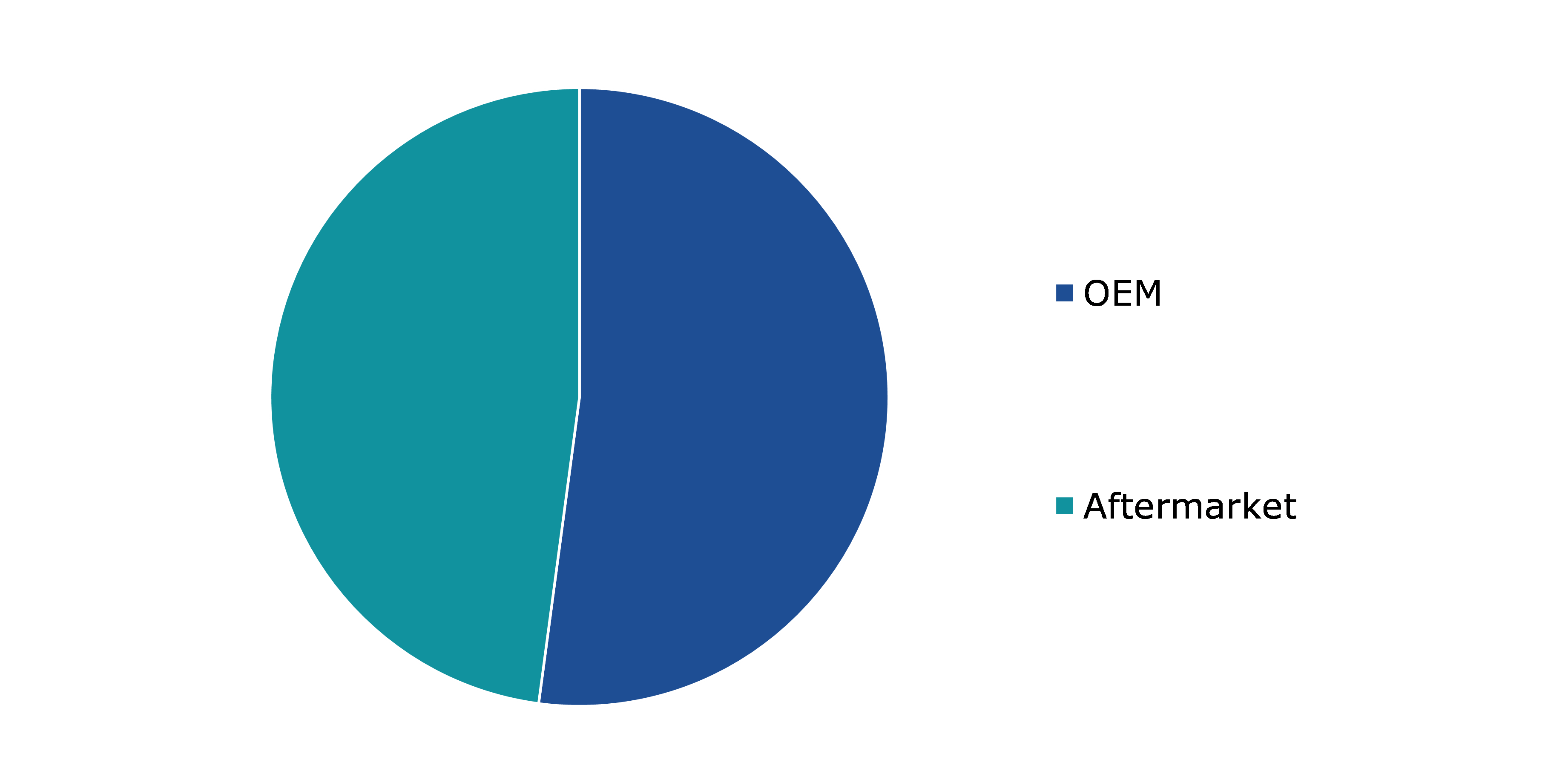

Global Rock Drilling Equipment Market Share, by Manufacturer, 2022

Source: Research Dive Analysis

The OEM sub-segment accounted for the highest market share in 2022. OEMs are well-known for their expertise and in-depth understanding of the industries they service. Original Equipment Manufacturers (OEMs) understand geological issues, diverse rock formations, and the specialized requirements of mining operations when it comes to rock drilling equipment. This knowledge enables them to develop and produce equipment that is specific to the needs of rock drilling. The assurance of product quality is one of the key factors responsible for OEM’s dominance. Throughout the design and production processes, OEMs adhere to high quality control requirements. This commitment toward quality guarantees that the rock drilling equipment fulfils industry requirements, operates reliably, and can survive the tough mining and excavation environments. OEMs give a level of customization that generic equipment vendors frequently lack. The requirements for rock drilling might vary greatly depending on elements such as rock hardness, drilling depth, and environmental conditions.

Global Rock Drilling Equipment Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The Asia-Pacific rock drilling equipment market generated the highest revenue in 2022. The persistent economic expansion and fast infrastructure development across various countries is one of the key factors driving the rock drilling equipment market growth in Asia-Pacific. Countries such as China, India, and Southeast Asian countries are spending extensively on infrastructure projects such as highways, bridges, tunnels, and urban development. This increase in building activities needs modern and efficient rock drilling equipment, resulting in a strong demand for such machinery. Asia-Pacific has rapidly adapted technology advances in rock drilling equipment, boosting industry innovation and efficiency. Manufacturers in the region are investing on R&D to implement cutting-edge technology in drilling machinery like automation, telematics, and artificial intelligence. These developments not only increase drilling precision and speed, but also lead to improved safety measures, transforming the Asia-Pacific market into a center for cutting-edge rock drilling solutions.

Competitive Scenario in the Global Rock Drilling Equipment Market

Product innovation and development of rock drilling equipment are common strategies followed by major market players. For instance, in November 2021, Wuxin Tunnel Installation was the first to commercialize the first independently created double-boom rock drilling rig, which offers a broad range of activities, adaptation of construction methods, high construction efficiency, and efficient control.

Source: Research Dive Analysis

Some of the leading rock drilling equipment market players are Atlas Copco, Hitachi Zosen, Sandvik Construction, Sanyhe International Holdings, Herrenknecht, Furukawa Rock Drill, Kawasaki Heavy, Komatsu, Sunward Equipment Group, China Railway Engineering, and XCMG Group.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by End-use Industry |

|

| Segmentation by Manufacturer |

|

| Key Companies Profiled |

|

Q1. What is the size of the global rock drilling equipment market?

A. The size of the global rock drilling equipment market was $2,339.1 million in 2022 and is projected to reach $3,419.2 million by 2032.

Q2. Which are the major companies in the rock drilling equipment market?

A. Atlas Copco, Hitachi Zosen, Sandvik Construction, Sanyhe International Holdings, Herrenknecht, Furukawa Rock Drill, Kawasaki Heavy, Komatsu, Sunward Equipment Group, China Railway Engineering, and XCMG Group are some of the key players in the global rock drilling equipment market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific rock drilling equipment market?

A. The Asia-Pacific rock drilling equipment market is anticipated to grow at 4.3% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product innovation and development of rock drilling equipment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Hitachi Zosen and Kawasaki Heavy are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on rock drilling equipment market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Rock Drilling Equipment Market Analysis, by Product

5.1. Overview

5.2. Medium-Sized

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Large-Sized

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Heavy-Sized

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Research Dive Exclusive Insights

5.5.1. Market attractiveness

5.5.2. Competition heatmap

6. Rock Drilling Equipment Market Analysis, by End-use Industry

6.1. Overview

6.2. Mining

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Construction

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Rock Drilling Equipment Analysis, by Manufacturer

7.1. Overview

7.2. OEM

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2022-2032

7.2.3. Market share analysis, by country, 2022-2032

7.3. Aftermarket

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2022-2032

7.3.3. Market share analysis, by country, 2022-2032

7.4. Research Dive Exclusive Insights

7.4.1. Market attractiveness

7.4.2. Competition heatmap

8. Rock Drilling Equipment Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Product, 2022-2032

8.1.1.2. Market size analysis, by End-use Industry, 2022-2032

8.1.1.3. Market size analysis, by Manufacturer, 2022-2032

8.1.2. Canada

8.1.2.1. Market size analysis, by Product, 2022-2032

8.1.2.2. Market size analysis, by End-use Industry, 2022-2032

8.1.2.3. Market size analysis, by Manufacturer, 2022-2032

8.1.3. Mexico

8.1.3.1. Market size analysis, by Product, 2022-2032

8.1.3.2. Market size analysis, by End-use Industry, 2022-2032

8.1.3.3. Market size analysis, by Manufacturer, 2022-2032

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Product, 2022-2032

8.2.1.2. Market size analysis, by End-use Industry, 2022-2032

8.2.1.3. Market size analysis, by Manufacturer, 2022-2032

8.2.2. UK

8.2.2.1. Market size analysis, by Product, 2022-2032

8.2.2.2. Market size analysis, by End-use Industry, 2022-2032

8.2.2.3. Market size analysis, by Manufacturer, 2022-2032

8.2.3. France

8.2.3.1. Market size analysis, by Product, 2022-2032

8.2.3.2. Market size analysis, by End-use Industry, 2022-2032

8.2.3.3. Market size analysis, by Manufacturer, 2022-2032

8.2.4. Spain

8.2.4.1. Market size analysis, by Product, 2022-2032

8.2.4.2. Market size analysis, by End-use Industry, 2022-2032

8.2.4.3. Market size analysis, by Manufacturer, 2022-2032

8.2.5. Italy

8.2.5.1. Market size analysis, by Product, 2022-2032

8.2.5.2. Market size analysis, by End-use Industry, 2022-2032

8.2.5.3. Market size analysis, by Manufacturer, 2022-2032

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Product, 2022-2032

8.2.6.2. Market size analysis, by End-use Industry, 2022-2032

8.2.6.3. Market size analysis, by Manufacturer, 2022-2032

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Product, 2022-2032

8.3.1.2. Market size analysis, by End-use Industry, 2022-2032

8.3.1.3. Market size analysis, by Manufacturer, 2022-2032

8.3.2. Japan

8.3.2.1. Market size analysis, by Product, 2022-2032

8.3.2.2. Market size analysis, by End-use Industry, 2022-2032

8.3.2.3. Market size analysis, by Manufacturer, 2022-2032

8.3.3. India

8.3.3.1. Market size analysis, by Product, 2022-2032

8.3.3.2. Market size analysis, by End-use Industry, 2022-2032

8.3.3.3. Market size analysis, by Manufacturer, 2022-2032

8.3.4. Australia

8.3.4.1. Market size analysis, by Product, 2022-2032

8.3.4.2. Market size analysis, by End-use Industry, 2022-2032

8.3.4.3. Market size analysis, by Manufacturer, 2022-2032

8.3.5. Indonesia

8.3.5.1. Market size analysis, by Product, 2022-2032

8.3.5.2. Market size analysis, by End-use Industry, 2022-2032

8.3.5.3. Market size analysis, by Manufacturer, 2022-2032

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Product, 2022-2032

8.3.6.2. Market size analysis, by End-use Industry, 2022-2032

8.3.6.3. Market size analysis, by Manufacturer, 2022-2032

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Product, 2022-2032

8.4.1.2. Market size analysis, by End-use Industry, 2022-2032

8.4.1.3. Market size analysis, by Manufacturer, 2022-2032

8.4.2. UAE

8.4.2.1. Market size analysis, by Product, 2022-2032

8.4.2.2. Market size analysis, by End-use Industry, 2022-2032

8.4.2.3. Market size analysis, by Manufacturer, 2022-2032

8.4.3. South Africa

8.4.3.1. Market size analysis, by Product, 2022-2032

8.4.3.2. Market size analysis, by End-use Industry, 2022-2032

8.4.3.3. Market size analysis, by Manufacturer, 2022-2032

8.4.4. Argentina

8.4.4.1. Market size analysis, by Product, 2022-2032

8.4.4.2. Market size analysis, by End-use Industry, 2022-2032

8.4.4.3. Market size analysis, by Manufacturer, 2022-2032

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Product, 2022-2032

8.4.5.2. Market size analysis, by End-use Industry, 2022-2032

8.4.5.3. Market size analysis, by Manufacturer, 2022-2032

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. Atlas Copco

10.1.1. Overview

10.1.2. Manufacturer segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Hitachi Zosen

10.2.1. Overview

10.2.2. Manufacturer segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Sandvik Construction

10.3.1. Overview

10.3.2. Manufacturer segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Sanyhe International Holdings

10.4.1. Overview

10.4.2. Manufacturer segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Herrenknecht

10.5.1. Overview

10.5.2. Manufacturer segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Furukawa Rock Drill

10.6.1. Overview

10.6.2. Manufacturer segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Kawasaki Heavy

10.7.1. Overview

10.7.2. Manufacturer segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Komatsu

10.8.1. Overview

10.8.2. Manufacturer segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Sunward Equipment Group

10.9.1. Overview

10.9.2. Manufacturer segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. China Railway Engineering

10.10.1. Overview

10.10.2. Manufacturer segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com