Anchoring And Fixing Market Report

RA09228

Anchoring and Fixing Market by Product Type (Cementitious Fixing, Resin Fixing and Others), Sector (Residential, Commercial, Industrial, and Infrastructure), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Anchoring and Fixing Overview

Anchoring refers to the process of using an anchor to secure a boat or ship to the bed of a body of water to prevent it from drifting. The anchor acts as a heavy object that digs into the seabed, providing stability. Fixing generally means the process of repairing or making something secure and stable. For example, fixing a broken chair or fixing a loose screw. Anchoring is a cognitive bias where individuals rely too heavily on the first piece of information encountered (the "anchor") when making decisions. Subsequent decisions are often influenced by this anchor, even if it is irrelevant to the decision at hand. Fixing can refer to the act of arranging or organizing something, such as fixing a meeting, fixing a date, or fixing a problem. Fixing is a step in traditional film photography where chemicals are used to make an image permanent and prevent further exposure to light. In psychology and decision-making, anchoring refers to the cognitive bias where people rely heavily on the first piece of information encountered (the "anchor") when making decisions. In construction, anchoring involves securing a structure to a foundation or another supporting structure to prevent movement.

Global Anchoring and Fixing Market Analysis

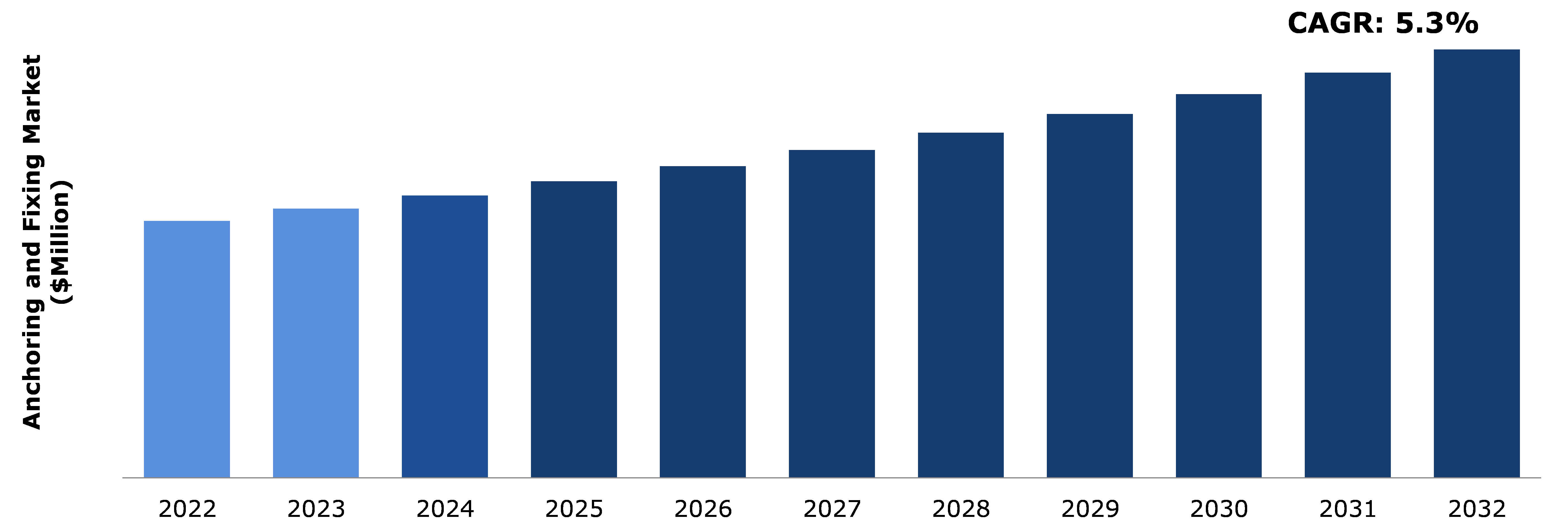

The global anchoring and fixing market size was $10810.7 million in 2022 and is predicted to grow with a CAGR of 5.3%, by generating a revenue of $18032.5 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on the Global Anchoring and Fixing Market

The COVID-19 pandemic had a significant impact on the anchoring and fixing market as lockdowns, restrictions, and disruptions in transportation and logistics made it challenging to source, process, and distribute anchoring and fixing products. The anchoring and fixing market is closely tied to the construction industry. During the initial phases of the pandemic, many construction projects were delayed or temporarily halted due to lockdowns, labor shortages, and supply chain disruptions. Construction activities are sensitive to economic downturns, and the uncertainty caused by the pandemic may have led to a decrease in new construction projects. The production and distribution of anchoring and fixing products could have been affected by disruptions in the global supply chain. Restrictions on movement, factory closures, and transportation challenges may have led to delays in the availability of these products.

Depending on the type of anchoring and fixing products, there might have been a shift in demand. For example, demand for products related to home renovations or improvements may have increased as people spent more time at home, while demand for products related to commercial construction may have decreased. The pandemic may have accelerated trends in the construction industry, such as the adoption of digital technologies and innovations to improve efficiency. Companies in the anchoring and fixing market may have had to adapt their processes and products to meet new requirements.

Increasing Demand for Construction and Infrastructure Development to Drive the Market Growth

The anchoring and fixing market is closely tied to the construction and infrastructure sectors. As construction activities increase, the demand for anchors and fixings for securing structures also rises. Growth in residential, commercial, and industrial construction projects contributes significantly to the market. Urbanization leads to increased construction activities as more people move to urban areas. This, in turn, drives the demand for anchors and fixings in the construction of residential and commercial buildings. Moreover, government initiatives and investments in infrastructure development play a crucial role. Large-scale projects such as highways, bridges, and public facilities often require significant anchoring and fixing solutions. Innovations in construction materials and technology lead to the development of new and improved anchoring and fixing products. As construction methods evolve, there is a continuous need for advanced anchoring solutions. Stringent safety regulations and building codes require the use of high-quality anchors and fixings to ensure the stability and safety of structures. Compliance with these regulations drives the demand for reliable anchoring solutions. The growth of the real estate sector, including residential and commercial properties, contributes significantly to the demand for anchors and fixings. Developers require these products to ensure the stability and longevity of their constructions. These factors collectively contribute to a growing global market for anchoring and fixing.

Regulatory Constraints to Restrain the Market Growth

Anchoring and fixing methods often involve the use of materials and substances that may have environmental implications. Regulatory compliance may necessitate the use of environmentally friendly or low-impact materials, proper waste disposal practices, and adherence to guidelines that mitigate environmental risks. Meeting these requirements can add complexity to projects and may limit the choice of materials and methods. Safety is a primary concern in industries that involve anchoring and fixing, such as construction and manufacturing. Regulatory bodies often set strict safety standards to prevent accidents and ensure the well-being of workers and the public. Complying with these regulations may require additional safety measures and equipment, which can increase project costs and complexity. Building codes and standards are established to ensure the structural integrity and safety of buildings and infrastructure. Compliance with these codes is essential for obtaining permits and approvals. However, these codes can vary regionally and may be subject to updates, requiring constant monitoring and adaptation to stay in compliance., which is anticipated to hamper the anchoring and fixing market growth.

Technological Advancements and Increased Focus on Safety to Drive Excellent Opportunities

Integration of sensors and smart technologies into anchoring and fixing solutions can enhance their performance and provide real-time monitoring capabilities. Smart anchors that can detect changes in load, temperature, or structural integrity and alert users to potential issues. The application of nanotechnology in developing fixing materials can lead to stronger and more durable solutions. Nanomaterials with superior bonding properties can improve the overall strength and reliability of anchoring systems. Utilizing 3D printing technology to create customized anchors and fixing solutions tailored to specific project requirements. Faster prototyping and production of unique designs that meet the exact needs of different applications. Augmented reality (AR) can be employed to assist technicians and construction workers in accurately installing anchoring and fixing solutions. Virtual overlays can guide users through the installation process, ensuring precision and reducing the likelihood of errors. Implementing robotics for the installation and maintenance of anchoring systems, especially in large-scale projects. Robots equipped with precision tools can streamline the installation process and perform routine maintenance tasks. Developing eco-friendly anchors and fixing materials that align with sustainability goals. Materials that are recyclable, biodegradable, or produced with minimal environmental impact can appeal to environmentally conscious consumers. Moreover, staying abreast of technological advancements and incorporating them into anchoring and fixing solutions can enhance product performance, increase efficiency, and open up new markets for innovative solutions in the construction and infrastructure industries.

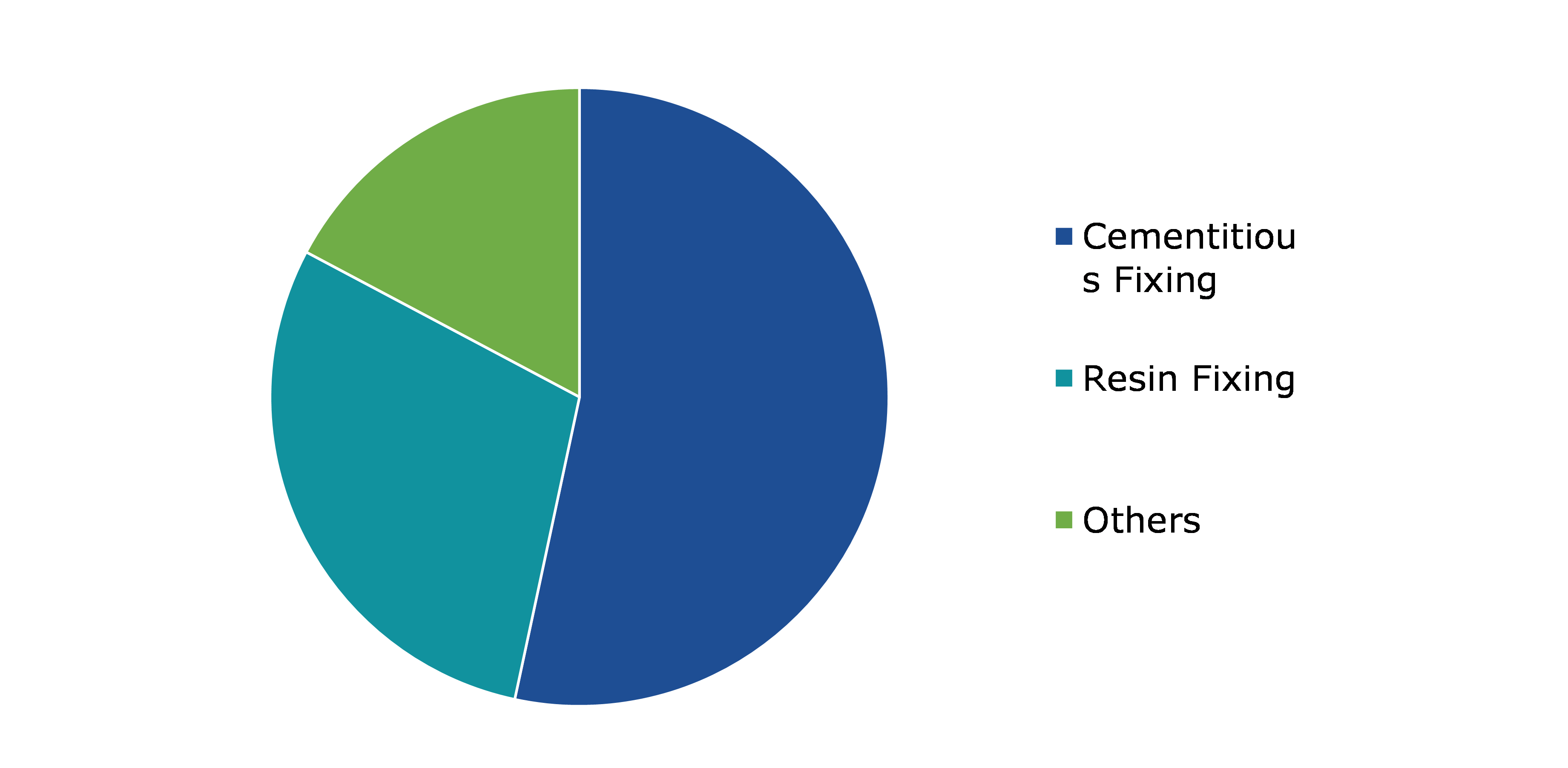

Global Anchoring and Fixing Market Share, by Product Type, 2022

Source: Research Dive Analysis

The cementitious fixing sub-segment accounted for the highest market share in 2022. The demand for cementitious fixing products is closely tied to the overall growth of the construction industry. As construction activities increase, there is a higher demand for anchoring and fixing solutions, including cementitious products. Large-scale infrastructure projects, such as bridges, highways, airports, and other public infrastructure, often require reliable anchoring and fixing solutions. Cementitious fixing products are preferred for their strength and durability in such applications. Rapid urbanization in many parts of the world leads to increased construction activities, both residential and commercial. This drives the demand for anchoring and fixing solutions, particularly those that offer reliable and long-lasting performance. The enforcement of strict building codes and regulations, emphasizing safety and structural integrity, encourages the use of high-quality anchoring and fixing solutions. Cementitious products often meet or exceed these standards. Cementitious fixing systems offer advantages such as high load-bearing capacity, resistance to chemical and environmental factors, and ease of installation. These features make them attractive to builders and contractors for a wide range of applications.

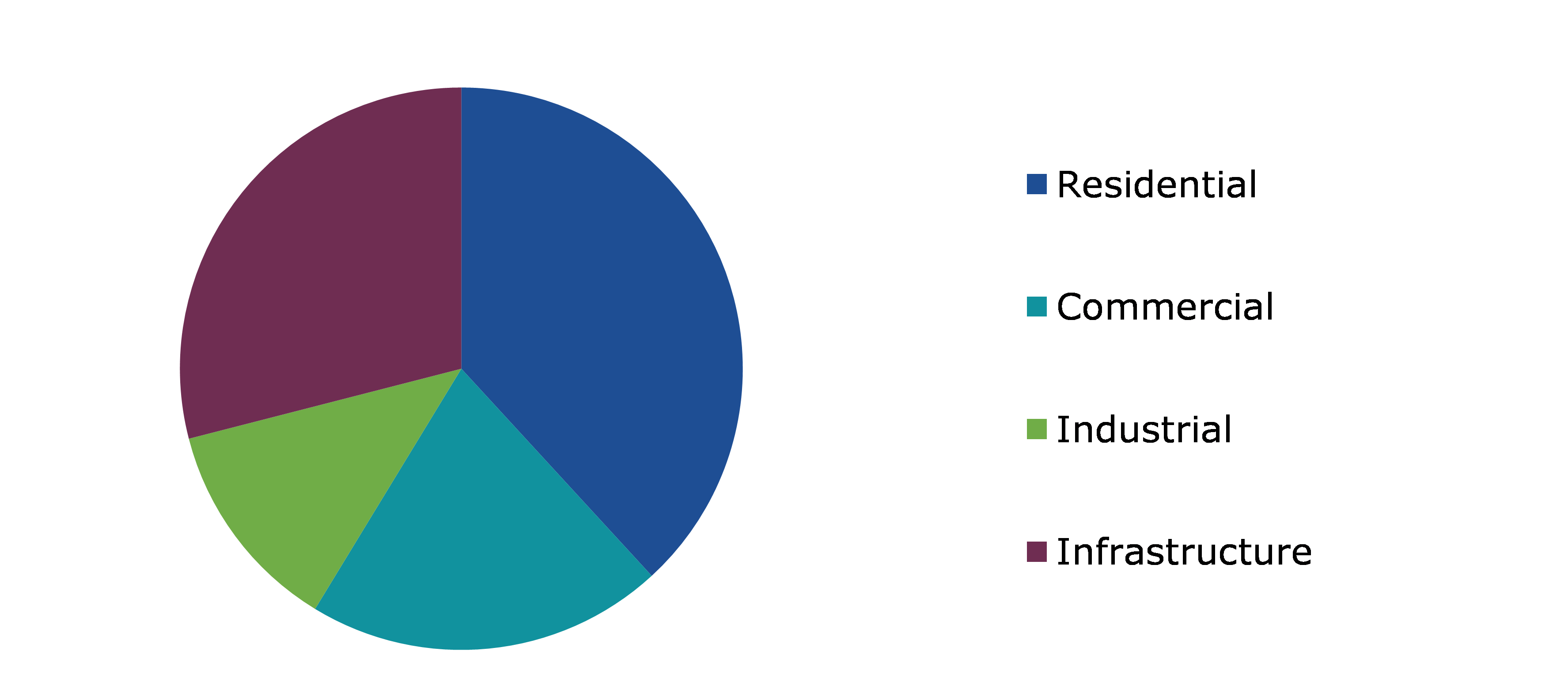

Global Anchoring and Fixing Market Share, by Sector, 2022

Source: Research Dive Analysis

The residential sub-segment accounted for the highest market share in 2022. Residential construction is heavily influenced by broader trends in the construction and real estate markets. Economic factors, population growth, and urbanization can drive demand for new residential buildings, impacting the need for anchoring and fixing solutions. Changes in building codes and regulations can drive the adoption of new anchoring and fixing technologies. Stricter codes may require more advanced and secure anchoring solutions, influencing the market. Innovations in anchoring and fixing technologies can drive market growth. New materials, designs, and installation methods that improve efficiency, durability, and safety are likely to be well-received in the residential construction sector. As awareness of safety and sustainability increases, there may be a growing demand for anchoring and fixing solutions that not only provide structural stability but also adhere to environmentally friendly and safety standards. Residential construction often follows or is influenced by infrastructure development projects. Increased investment in infrastructure can lead to more residential projects, boosting the demand for anchoring and fixing products. Changing consumer preferences, such as a growing interest in smart homes or energy-efficient solutions, can influence the choice of anchoring and fixing products in the residential market.

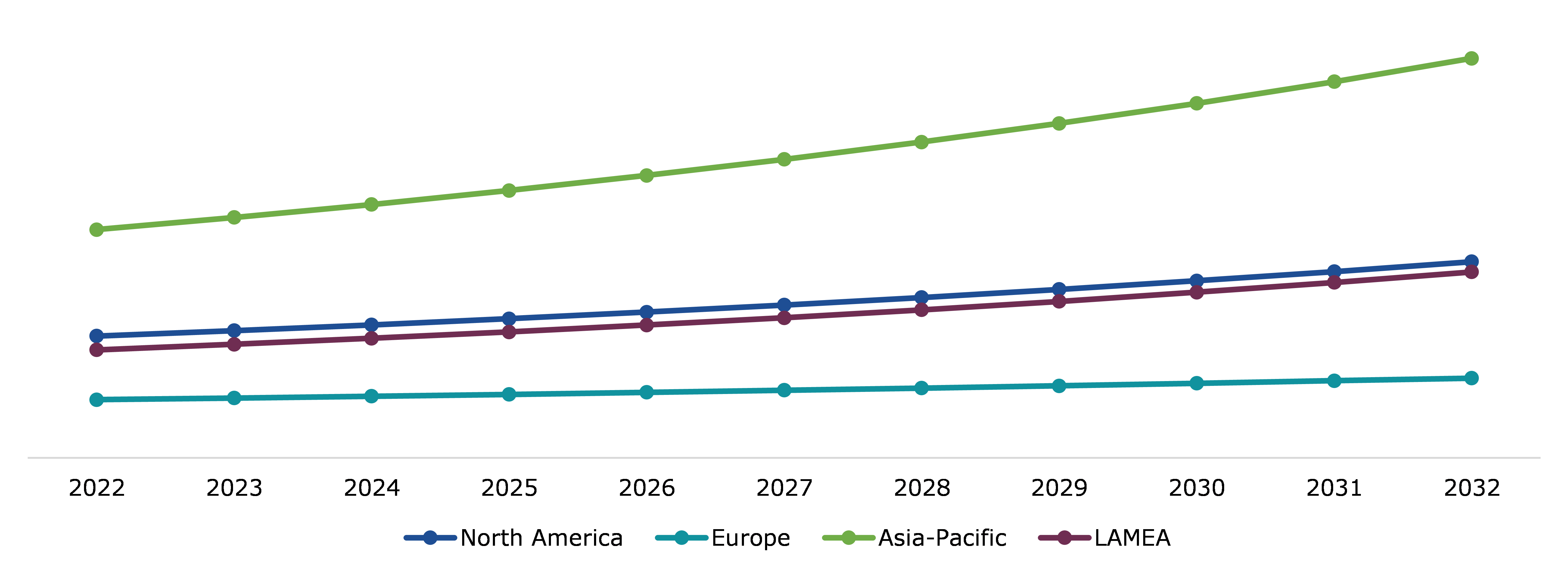

Global Anchoring and Fixing Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The Asia-Pacific anchoring and fixing market generated the highest revenue in 2022. The Asia-Pacific region has been experiencing significant infrastructure development, driven by urbanization, economic growth, and government initiatives. Large-scale projects such as roads, bridges, airports, and buildings contribute to the demand for anchoring and fixing solutions. The construction industry in the Asia-Pacific region has been expanding rapidly. Increased construction activities, both in residential and commercial sectors, lead to a higher demand for anchoring and fixing products for various applications. Governments in the Asia-Pacific region often introduce and enforce building codes and standards to ensure the safety and quality of construction projects. Compliance with these regulations may drive the adoption of specific anchoring and fixing products that meet the required standards. Advances in construction technology and materials may influence the anchoring and fixing market. Innovative solutions that offer improved efficiency, durability, and ease of installation may gain traction in the market. The Asia-Pacific region is prone to natural disasters such as earthquakes and typhoons. This can drive the demand for anchoring and fixing solutions that enhance the resilience of structures against such events.

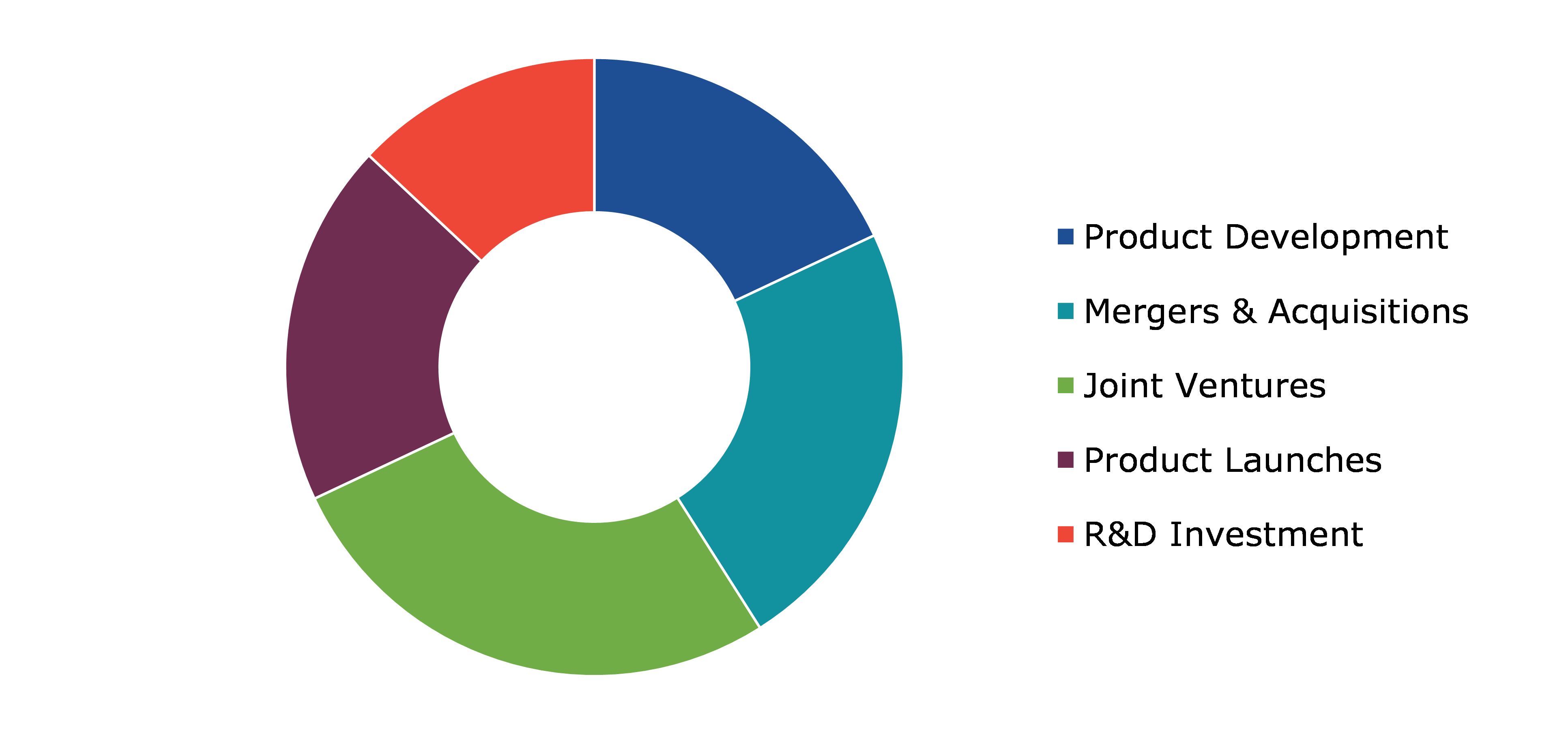

Competitive Scenario in the Global Anchoring and Fixing Market

Investment and agreement are common strategies followed by major market players. In March 2022, Berger Fosroc Ltd, a joint venture between Fosroc International Ltd and Berger Paints Bangladesh, opened a construction chemicals factory in Bangladesh.

Source: Research Dive Analysis

Some of the companies operating in the anchoring and fixing market are Bayshield International IBM, Bostik (Arkema), Elmrr, Five Star Products Inc., Fosroc Inc., Gantrex, GCP Applied Technologies Inc., GRUPA SELENA, Henkel AG & Co. KGaA and LATICRETE International Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product Type |

|

| Segmentation by Sector |

|

| Key Companies Profiled |

|

Q1. What is the size of the global anchoring and fixing market?

A. The size of the global anchoring and fixing market was over $ 10810.7 million in 2022 and is projected to reach $ 18032.5 million by 2032.

Q2. Which are the major companies in the anchoring and fixing market?

A. Bayshield International IBM, Bostik (Arkema), and Elmrr,Company are some of the key players in the global anchoring and fixing market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific anchoring and fixing market?

A. The Asia-Pacific anchoring and fixing market is anticipated to grow at 5.8% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Five Star Products Inc., Fosroc Inc., Gantrex are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global anchoring and fixing market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Environmental

4.7. Impact of COVID-19 on anchoring and fixing market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Anchoring and Fixing Market Analysis, by Product Type

5.1. Overview

5.2. Cementitious Fixing

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Resin Fixing

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Other

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Research Dive Exclusive Insights

5.5.1. Market attractiveness

5.5.2. Competition heatmap

6. Anchoring and Fixing Market Analysis, by Sector

6.1. Residential

6.1.1. Definition, key trends, growth factors, and opportunities

6.1.2. Market size analysis, by region, 2022-2032

6.1.3. Market share analysis, by country, 2022-2032

6.2. Commercial

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Industrial

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Infrastructure

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Research Dive Exclusive Insights

6.5.1. Market attractiveness

6.5.2. Competition heatmap

7. Anchoring and Fixing Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Product Type, 2022-2032

7.1.1.2. Market size analysis, by Sector, 2022-2032

7.1.2. Canada

7.1.2.1. Market size analysis, by Product Type, 2022-2032

7.1.2.2. Market size analysis, by Sector, 2022-2032

7.1.3. Mexico

7.1.3.1. Market size analysis, by Product Type, 2022-2032

7.1.3.2. Market size analysis, by Sector, 2022-2032

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Product Type, 2022-2032

7.2.1.2. Market size analysis, by Sector, 2022-2032

7.2.2. UK

7.2.2.1. Market size analysis, by Product Type, 2022-2032

7.2.2.2. Market size analysis, by Sector, 2022-2032

7.2.3. France

7.2.3.1. Market size analysis, by Product Type, 2022-2032

7.2.3.2. Market size analysis, by Sector, 2022-2032

7.2.4. Spain

7.2.4.1. Market size analysis, by Product Type, 2022-2032

7.2.4.2. Market size analysis, by Sector, 2022-2032

7.2.5. Italy

7.2.5.1. Market size analysis, by Product Type, 2022-2032

7.2.5.2. Market size analysis, by Sector, 2022-2032

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Product Type, 2022-2032

7.2.6.2. Market size analysis, by Sector, 2022-2032

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Product Type, 2022-2032

7.3.1.2. Market size analysis, by Sector, 2022-2032

7.3.2. Japan

7.3.2.1. Market size analysis, by Product Type, 2022-2032

7.3.2.2. Market size analysis, by Sector, 2022-2032

7.3.3. India

7.3.3.1. Market size analysis, by Product Type, 2022-2032

7.3.3.2. Market size analysis, by Sector, 2022-2032

7.3.4. Australia

7.3.4.1. Market size analysis, by Product Type, 2022-2032

7.3.4.2. Market size analysis, by Sector, 2022-2032

7.3.5. South Korea

7.3.5.1. Market size analysis, by Product Type, 2022-2032

7.3.5.2. Market size analysis, by Sector, 2022-2032

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Product Type, 2022-2032

7.3.6.2. Market size analysis, by Sector, 2022-2032

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Product Type, 2022-2032

7.4.1.2. Market size analysis, by Sector, 2022-2032

7.4.2. Saudi Arabia

7.4.2.1. Market size analysis, by Product Type, 2022-2032

7.4.2.2. Market size analysis, by Sector, 2022-2032

7.4.3. UAE

7.4.3.1. Market size analysis, by Product Type, 2022-2032

7.4.3.2. Market size analysis, by Sector, 2022-2032

7.4.4. South Africa

7.4.4.1. Market size analysis, by Product Type, 2022-2032

7.4.4.2. Market size analysis, by Sector, 2022-2032

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Product Type, 2022-2032

7.4.5.2. Market size analysis, by Sector, 2022-2032

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. Bayshield International IBM

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Bostik (Arkema)

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. Elmrr

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. Five Star Products Inc

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Fosroc Inc.

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Gantrex

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. GCP Applied Technologies Inc.

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. GRUPA SELENA

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Henkel AG & Co. KGaA

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. LATICRETE International Inc.

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com