Yacht Coatings Market Report

RA09221

Yacht Coatings Market by Type (Anti-Fouling Coatings, Anti-Corrosion Coatings, and Foul Release Coatings), Size (Small Yachts (From 10 to 24 Meters), Large Yachts (From 24 to 40 Meters), Super Yachts (From 40 to 60 Meters), and Mega Yachts (Above 60 Meters)), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Yacht Coatings Overview

Yacht coatings refers to a specialized type of protective coatings meticulously formulated for application on yachts, catering to the unique challenges posed by marine environments. These coatings exhibit specific functional properties aimed at safeguarding yachts from the corrosive effects of saltwater or freshwater, UV radiation, fouling, and harsh weather conditions. By acting as a protective barrier, yacht coatings contribute to the longevity of vessels, reducing maintenance needs and enhancing overall durability.

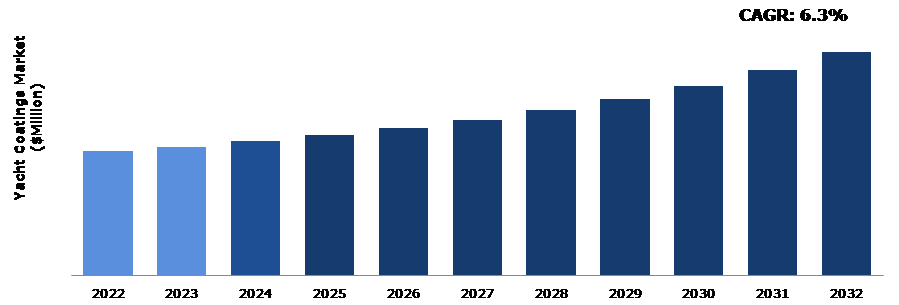

Global Yacht Coatings Market Analysis

The global yacht coatings market size was $5,468.2 million in 2022 and is predicted to grow with a CAGR of 6.3%, by generating a revenue of $9,877.1 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on the Global Yacht Coatings Market

The yacht coatings market has experienced substantial effects due to the widespread impact of the COVID-19 pandemic. One of the most prominent effects has been the disruption in the manufacturing of new yachts, triggered by the temporary closures of factories and studios. Therefore, the usual flow of new vessels entering the market has been impeded, leading to a tangible decrease in the supply of new yachts available. This reduction in the availability of new yachts has directly influenced the yacht coatings sector. With fewer new vessels being produced, the demand for fresh coatings reduced, creating a shift in the industry's dynamics. Yacht manufacturers, compelled to halt production temporarily, had to cope with challenges in meeting the coatings needs of their clients in the post-pandemic period. This led to a reevaluation of strategies and an increased focus on alternative opportunities within the yacht industry. In the post-pandemic period, the yacht coatings industry is experiencing a promising resurgence characterized by positive developments. The gradual recovery of economies worldwide and the resurgence of various industries are contributing to a steady rebound in the demand for specialized yacht coatings.

Increasing Demand for Luxury Yachts to Drive the Market Growth

The dynamic trends shaping the luxury yacht industry are significantly influencing the yacht coatings market. The increasing popularity of dayboats, particularly as an affordable choice for families and couples seeking a yachting experience, is driving demand for coatings that balance cost-effectiveness with high performance. Yacht coatings manufacturers are prompted to innovate solutions that cater to the unique requirements of dayboats, ensuring durability, aesthetics, and protection against the elements such as abrasion and wear, saltwater exposure, and others. Moreover, the integration of technology and intelligent systems in luxury yachts is a pivotal driver for the yacht coatings market growth. With a growing emphasis on safety and enhanced sailing experiences, yacht owners and enthusiasts are increasingly seeking coatings that not only provide protection but also seamlessly integrate with advanced onboard technologies. The demand for yacht coatings is evolving to address the challenges posed by smart systems, ensuring compatibility with the ever-more sophisticated equipment found onboard. This shift reflects a desire for coatings that complement and enhance the functionality of modern yacht technologies, offering a comprehensive solution for both protection and seamless integration.

Stringent Environmental Regulations to Restrain the Market Growth

The yacht coatings sector is facing significant challenges from more rigorous environmental rules aimed at reducing the use of harmful chemicals in marine paints. As worldwide environmental awareness increases, regulatory agencies are implementing stronger standards to mitigate the negative impact of traditional coatings on marine habitats. Compliance with these rules provides a daunting challenge for yacht painting makers. Coatings formulation and production may involve traversing complex regulatory systems to fulfill eco-friendly criteria. Hence, the yacht coatings market is projected to face challenges due to constraints in accessing and formulating specific coatings. This limitation is anticipated to impede the industry's capacity to cater to the diverse requirements of boat owners.

Advancements in Coatings Technology to Drive Excellent Opportunities

The yacht coatings industry is experiencing several growth opportunities, driven by the rapid advancements in coatings technology. Innovations in materials, formulations, and application techniques are reshaping the industry, presenting yacht owners and manufacturers with a spectrum of benefits, including enhanced performance, increased durability, and expanded aesthetic possibilities. A major factor creating these opportunities is the development of advanced nano-coatings. Breakthroughs in nanotechnology enable the creation of coatings that exhibit superior resistance to environmental elements, abrasion, and fouling. Beyond providing long-lasting protection, these nano-coatings contribute to increased fuel efficiency by minimizing drag in the water, thereby optimizing vessel performance. An exemplary illustration of this progress is evident in the initiatives of industry leaders like Tnemec Company, Inc. The recent launch of their HullClad line of coatings signifies a commitment toward pushing the boundaries of protective coatings. Specifically designed to safeguard ships and vessels' hulls in the most challenging underwater marine environments, this innovation exemplifies the industry's dedication toward leveraging cutting-edge technology for enhanced maritime protection. As the yacht coatings sector continues to embrace these advancements, it positions itself at the forefront of technological progress, ready to capitalize on the numerous opportunities that lie ahead.

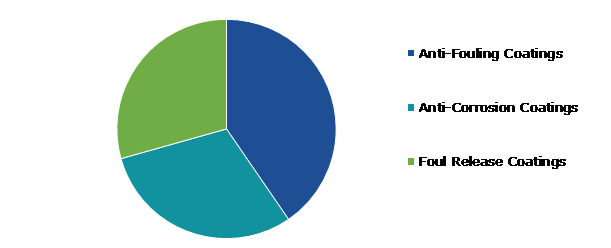

Global Yacht Coatings Market Share, by Type, 2022

Source: Research Dive Analysis

The anti-fouling coatings sub-segment accounted for the highest market share in 2022. This specialized category of coatings plays a pivotal role in maintaining the performance and durability of vessels by combating the adverse effects of marine growth on the underwater hull. Not only do these coatings act as a robust defense against marine organisms that can impede a vessel's efficiency, but they also serve as a protective barrier, mitigating hull corrosion and maintaining the structural integrity of the ship. Particularly crucial for merchant ships, where hull condition directly influences fuel efficiency, anti-fouling coatings ensure a smooth and clean hull surface. By reducing frictional resistance caused by water flow, these coatings significantly decrease engine workload, ultimately leading to enhanced fuel efficiency and operational cost savings.

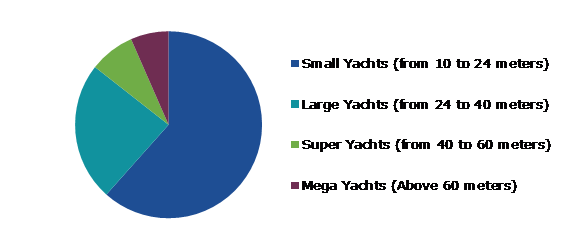

Global Yacht Coatings Market Share, by Size, 2022

Source: Research Dive Analysis

The small yachts (from 10 to 24 meters) sub-segment accounted for the highest market share in 2022. The rising demand for fishing and pleasure riding is creating a significant growth trajectory for small yachts within the yacht coatings market, particularly those ranging from 10 to 24 meters. As per the National Marine Manufacturers Association, the robust contribution of entertainment and pleasure boating, generating over $100 billion for the U.S. economy, highlights the immense potential for small yachts in this segment. Government initiatives worldwide to foster marine tourism through increased investment, infrastructure development, and regulatory reforms are opening up lucrative avenues for small yachts. Manufacturers in this category are strategically positioning themselves to capitalize on the rising interest of the younger generation in adventurous outdoor activities, making small yachts not only a practical choice but also an appealing one.

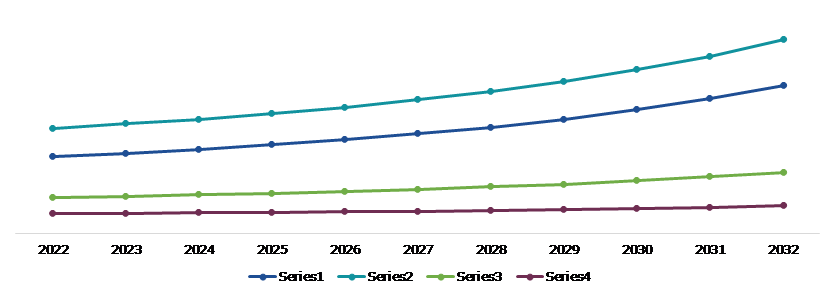

Global Yacht Coatings Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

Europe accounted for a dominant market share in 2022. Europe stands at the forefront of the global yacht coatings market, boasting a prominent lead driven by robust industrial activity in the region's thriving marine sector. The substantial presence of key participants in the coatings business further develops Europe's influence, with active engagement in the development of yacht coatings that seamlessly blend both decorative and practical features. The region's dominance can be attributed to its rich maritime heritage, a robust network of shipyards, and a keen focus on innovation. European manufacturers, leveraging their expertise and technological expertise, are consistently shaping the yacht coatings market by introducing solutions that cater to the diverse needs of yacht owners. As a hub for marine excellence, Europe continues to set industry standards, driving advancements in both aesthetics and functionality within the global yacht coatings landscape.

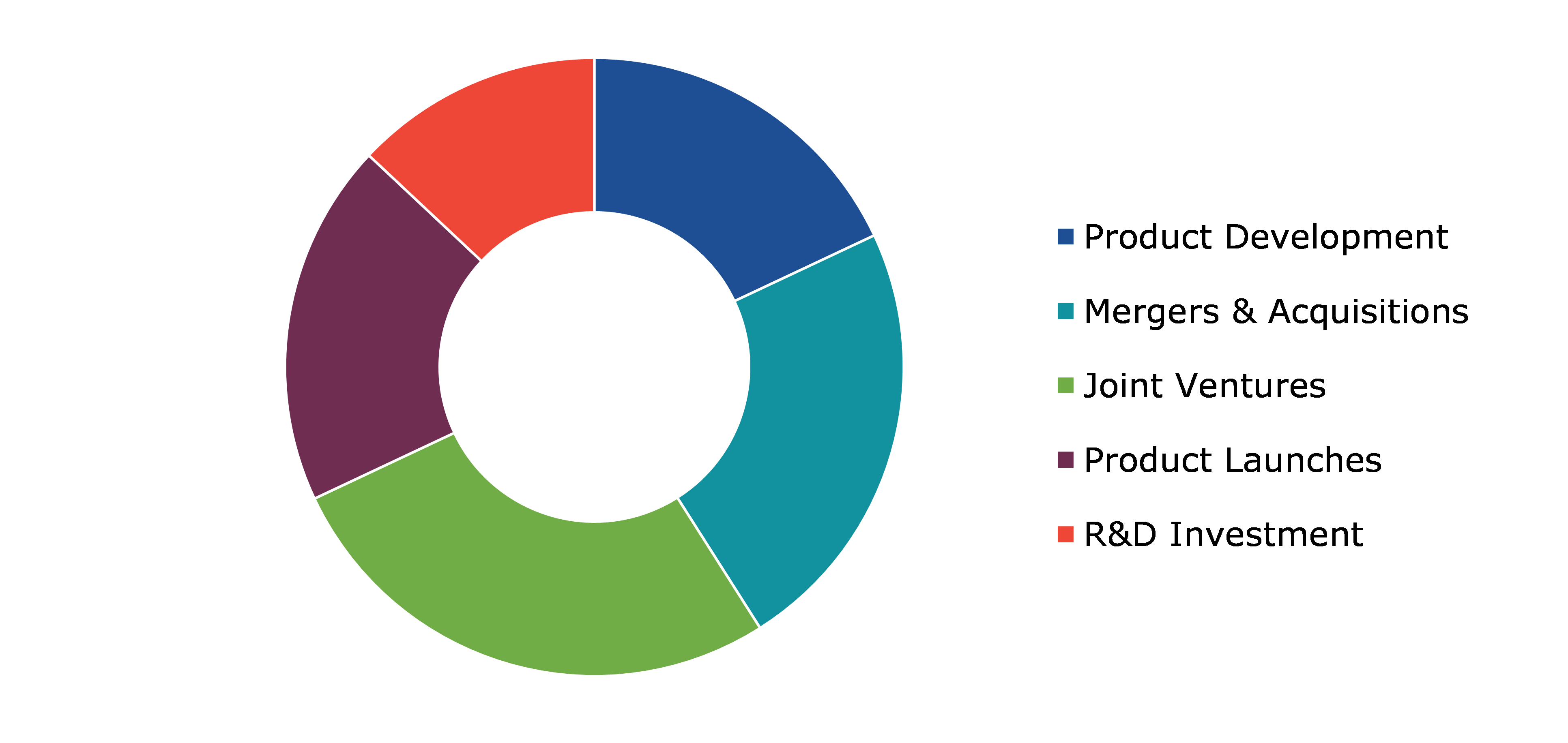

Competitive Scenario in the Global Yacht Coatings Market

Product launch, investment, and acquisition are common strategies followed by major market players. For instance, in 2023, Tnemec Company, Inc., a prominent manufacturer with a century-long legacy in producing high-performance protective coatings, unveiled its HullClad line of coatings. This product line was specifically designed to safeguard the hulls of ships and vessels operating in the most challenging underwater marine environments.

Source: Research Dive Analysis

Some of the leading yacht coatings market players are AkzoNobel, Jotun, PPG Industries, Inc, Epifanes NA Inc, Boero Bartolomeo S.p.A, Alexseal Yacht Coatings, The Sherwin-Williams Company, Chugoku Marine Paints Ltd, Hempel UK Ltd., and Engineered Marine Coatings LLC.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

|

Segmentation by Size

|

|

| Key Companies Profiled |

|

Q1. What is the size of the global yacht coatings market?

A. The size of the global yacht coatings market was $5,468.2 million in 2022 and is projected to reach $9,877.1 million by 2032.

Q2. Which are the major companies in the yacht coatings market?

A. AkzoNobel, Jotun, and PPG Industries are some of the key players in the global yacht coatings market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the North America yacht coatings market?

A. The North America yacht coatings market is anticipated to grow at 7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product launches and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Boero Bartolomeo S.p.A, Alexseal Yacht Coatings, The Sherwin-Williams Company, and Chugoku Marine Paints Ltd are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global Yacht Coatings market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on Yacht Coatings market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Yacht Coatings Market Analysis, by Type

5.1. Overview

5.2. Anti-Fouling Coatings

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Anti-Corrosion Coatings

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Foul Release Coatings

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Research Dive Exclusive Insights

5.5.1. Market attractiveness

5.5.2. Competition heatmap

6. Yacht Coatings Market Analysis, by Size

6.1. Overview

6.2. Small Yacht (From 10 to 24 Meters)

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Large Yacht (From 24 to 40 Meters)

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Super Yacht (From 40 to 60 Meters)

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Mega Yacht (Above 60 Meters)

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2022-2032

6.5.3. Market share analysis, by country, 2022-2032

6.6. Research Dive Exclusive Insights

6.6.1. Market attractiveness

6.6.2. Competition heatmap

7. Yacht Coatings Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Type, 2022-2032

7.1.1.2. Market size analysis, by Size, 2022-2032

7.1.2. Canada

7.1.2.1. Market size analysis, by Type, 2022-2032

7.1.2.2. Market size analysis, by Size, 2022-2032

7.1.3. Mexico

7.1.3.1. Market size analysis, by Type, 2022-2032

7.1.3.2. Market size analysis, by Size, 2022-2032

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Type, 2022-2032

7.2.1.2. Market size analysis, by Size, 2022-2032

7.2.2. UK

7.2.2.1. Market size analysis, by Type, 2022-2032

7.2.2.2. Market size analysis, by Size, 2022-2032

7.2.3. France

7.2.3.1. Market size analysis, by Type, 2022-2032

7.2.3.2. Market size analysis, by Size, 2022-2032

7.2.4. Spain

7.2.4.1. Market size analysis, by Type, 2022-2032

7.2.4.2. Market size analysis, by Size, 2022-2032

7.2.5. Italy

7.2.5.1. Market size analysis, by Type, 2022-2032

7.2.5.2. Market size analysis, by Size, 2022-2032

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Type, 2022-2032

7.2.6.2. Market size analysis, by Size, 2022-2032

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Type, 2022-2032

7.3.1.2. Market size analysis, by Size, 2022-2032

7.3.2. Japan

7.3.2.1. Market size analysis, by Type, 2022-2032

7.3.2.2. Market size analysis, by Size, 2022-2032

7.3.3. India

7.3.3.1. Market size analysis, by Type, 2022-2032

7.3.3.2. Market size analysis, by Size, 2022-2032

7.3.4. Australia

7.3.4.1. Market size analysis, by Type, 2022-2032

7.3.4.2. Market size analysis, by Size, 2022-2032

7.3.5. South Korea

7.3.5.1. Market size analysis, by Type, 2022-2032

7.3.5.2. Market size analysis, by Size, 2022-2032

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Type, 2022-2032

7.3.6.2. Market size analysis, by Size, 2022-2032

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Type, 2022-2032

7.4.1.2. Market size analysis, by Size, 2022-2032

7.4.2. UAE

7.4.2.1. Market size analysis, by Type, 2022-2032

7.4.2.2. Market size analysis, by Size, 2022-2032

7.4.3. Saudi Arabia

7.4.3.1. Market size analysis, by Type, 2022-2032

7.4.3.2. Market size analysis, by Size, 2022-2032

7.4.4. South Africa

7.4.4.1. Market size analysis, by Type, 2022-2032

7.4.4.2. Market size analysis, by Size, 2022-2032

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Type, 2022-2032

7.4.5.2. Market size analysis, by Size, 2022-2032

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. AkzoNobel

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Jotun

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. PPG Industries, Inc

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. Epifanes NA Inc

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Boero Bartolomeo S.p.A

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Alexseal Yacht Coatings

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. The Sherwin-Williams Company

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. Chugoku Marine Paints Ltd

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Hempel UK Ltd.

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Engineered Marine Coatings LLC

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com