Residential Water Meters Market Report

RA09220

Residential Water Meters Market by Type (Standard Water Meter and Smart Water Meter), Distribution Channel (Online and Offline), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Residential Water Meters Market Overview

A residential water meter is a precision instrument designed for measuring the quantity of water supplied to the consumers. Beyond its primary function of accurately gauging water usage, the residential water meter also plays a pivotal role in monitoring the efficiency of water distribution systems. Serving as the final link between consumers and water authorities, these meters ensure the equitable distribution of water resources and contribute to the financial sustainability of water supply projects. Water meters can be broadly categorized as either water meters or flow meters. While traditional water meters measure the volume of water passing through, flow meters measure the rate of flow. Modern equipment allow both flow rate measurement with water meters and volume assessment with flow meters.

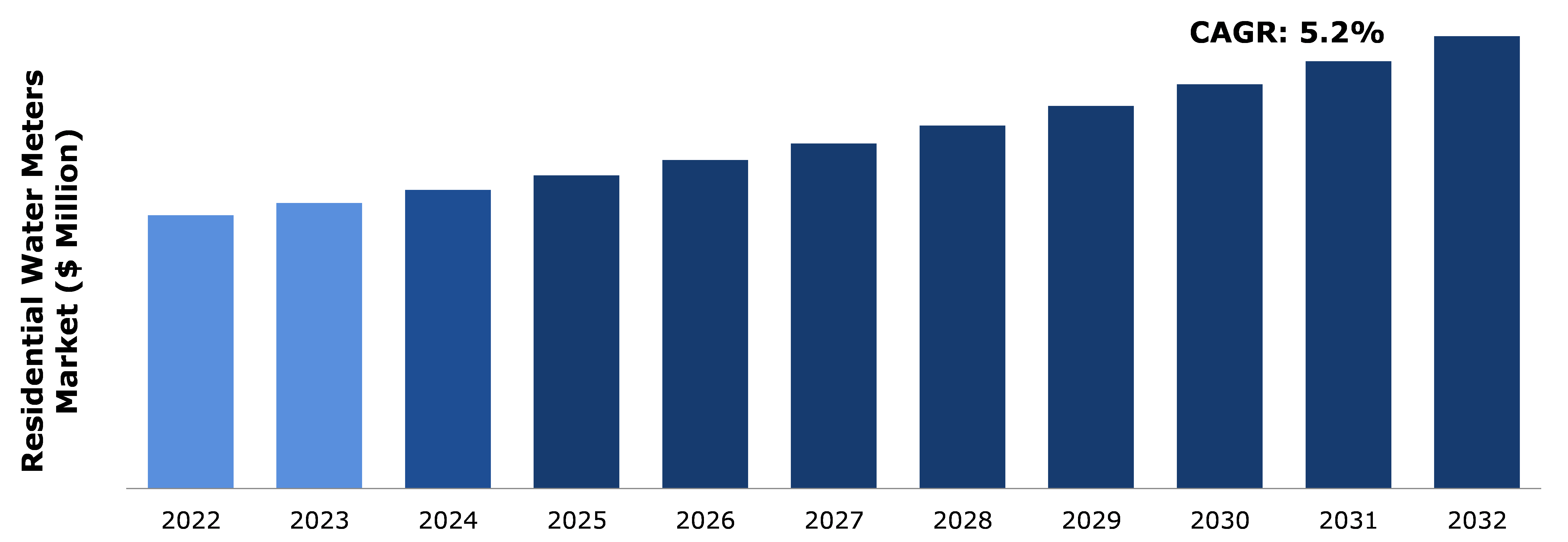

Global Residential Water Meters Market Analysis

The global residential water meters market size was $11,250.0 million in 2022 and is predicted to grow with a CAGR of 5.2%, by generating a revenue of $18,622.3 million by 2032.

Source: Research Dive Analysis

Leak Detection and Accurate Measurement of Water Consumption to Drive the Market Growth

Residential water meters are designed to accurately measure water consumption at the individual household level. These meters are equipped with advanced features such as leakage alerts and real-time monitoring. Residential water meters provide precise measurements, ensuring residents are billed accurately for their water usage. In addition, these meters are equipped with advanced technology to detect leaks in pipes, enabling homeowners to take immediate action and prevent water wastage.

Also, the water meters have a user-friendly interface, making it easy for residents to monitor their water consumption and take proactive steps toward conservation. For instance, AquaFlow Technologies specializes in smart water metering solutions for residential properties. Their meters are designed to not only measure water consumption but also provide valuable insights for efficient water management. AquaFlow's meters offer smart monitoring capabilities, allowing residents to track their water usage in real-time through a mobile app or an online portal. Also, these meters provide detailed analytics on water consumption patterns, enabling homeowners and housing societies to identify and address potential wastage. These factors are anticipated to boost the residential water meters market growth in the upcoming years.

High Maintenance Cost and Vulnerability to External Influences to Restrain the Market Growth

Residential water meters play a crucial role in monitoring water consumption and promoting conservation. However, challenges exist, notably with mechanical water meters. Their susceptibility to external influences, such as variations in water flow and pressure, compromises accuracy, leading to potential errors. Moreover, despite their long service life, mechanical water meters pose a challenge in terms of high maintenance costs. The intricacies of the mechanical structure make repairs difficult, necessitating skilled technicians and contributing to increased maintenance expenses.

While these meters offer stability, reliability, and cost-effectiveness, the trade-offs in measurement accuracy and vulnerability to external factors highlight the need for advancements in metering technologies. These factors are anticipated to restrain the residential water meters market growth during the forecast period.

Advancements in Smart Water Meters to Drive Excellent Opportunities

The growing popularity of smart water meters owing to their ability for dynamic water billing, rationing water consumption, and others are anticipated to generate excellent growth opportunities for the key market players. Smart water meters facilitate real-time monitoring of individual households, eliminating the need for manual meter readings. This two-way communication system enables dynamic billing based on actual consumption, reducing operational complexities and cutting costs associated with traditional billing procedures. In addition, modern IoT-enabled water flow meters with remote valve control offer the opportunity to regulate water flow and manage consumption efficiently. This is particularly valuable during droughts or for industrial processes that require optimization.

Smart meters allow rationing based on consumption thresholds and time of use, contributing to water conservation efforts. Also, smart meters empower consumers to track and analyze their water consumption patterns, identifying inefficiencies and potential leaks. Through IoT platforms, users can receive alerts for abnormal consumption, enabling them to take prompt action, repair leaks, and adopt water-saving practices. In addition, two-way interaction of smart water meters provides clear visibility to water utilities and consumers regarding consumption patterns and the effectiveness of conservation programs. These factors are anticipated to have a positive impact on residential water meters industry during the forecast years.

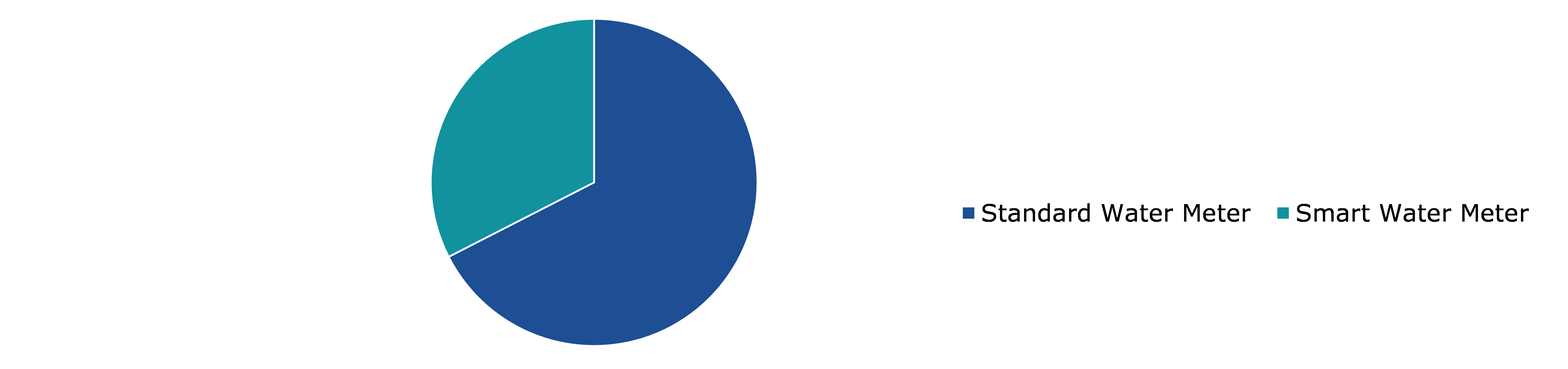

Global Residential Water Meters Market Share, by Type, 2022

Source: Research Dive Analysis

The standard water meter sub-segment accounted for the highest market share in 2022. Simplicity, reliability, and ease of installation & maintenance are some of the factors driving the residential water meters demand. Standard water meters possess a long history of reliability and simplicity. These meters are usually mechanical devices with fewer components, making them less prone to technological malfunctions.

Water utilities may prefer the proven track record of traditional meters to avoid potential issues associated with the complexity of smart metering systems. Also, standard water meters are often easier to install and maintain compared to smart meters. The installation process for traditional meters is familiar to technicians, and maintenance tasks are typically easy. This ease can be an attractive feature, especially in areas with limited technical expertise.

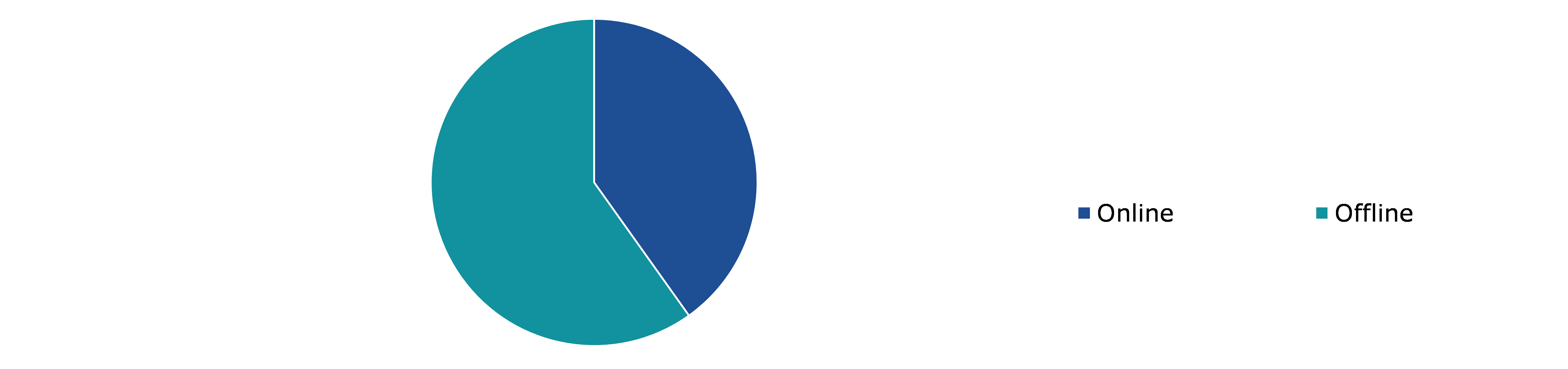

Global Residential Water Meters Market Share, by Distribution Channel, 2022

Source: Research Dive Analysis

The offline sub-segment accounted for the highest market share in 2022. The offline purchase of water meters is popular as it offers technical consultation as well as hands-on product inspection associated with residential water meters. For instance, installing water metering systems can be complex, and technical consultation is often required during the purchasing process. Thus, the offline purchase allows potential buyers to engage in face-to-face conversations with sales representatives or technical experts who can guide on selecting the right type and model of water meter for their specific requirements.

In addition, inspecting physical products, especially the mechanical parts present in water meters is necessary in the purchasing of water meters. By purchasing offline, utility managers and engineers can physically examine the meters, assess build quality, check specifications, and ensure that the chosen meters meet the necessary standards and regulatory requirements. These factors are anticipated to drive the growth of the offline sub-segment in the residential water meters market during the forecast period.

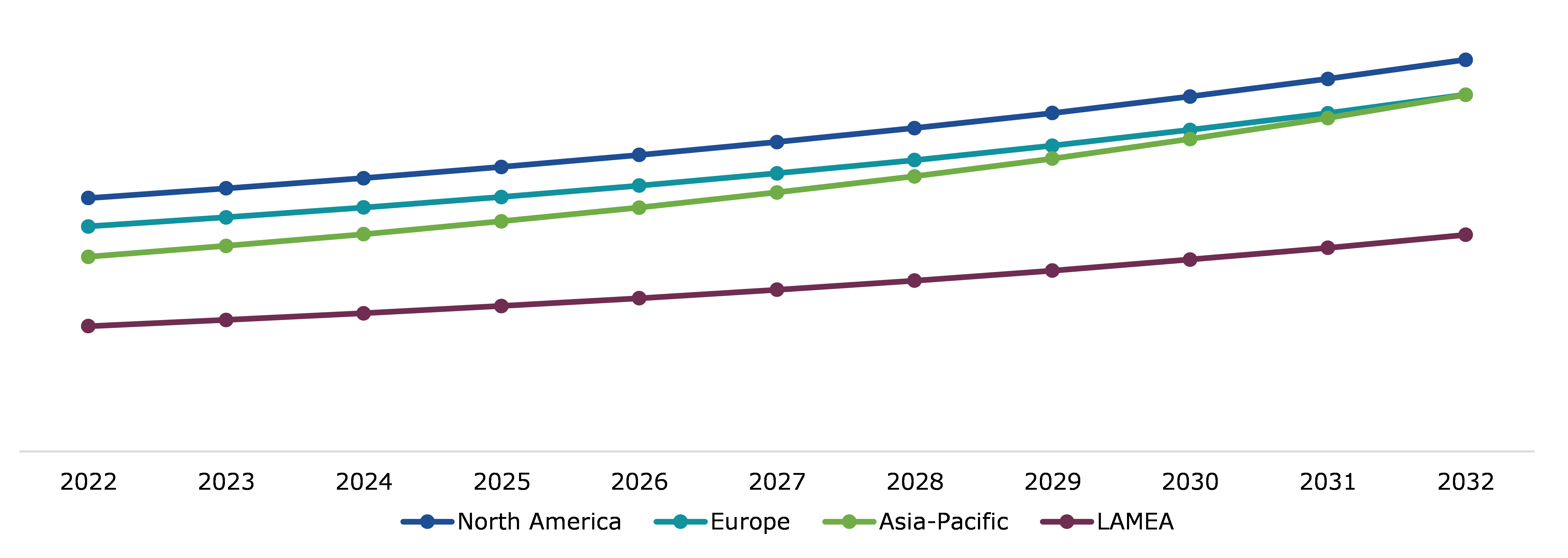

Global Residential Water Meters Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive

The North America residential water meters market generated the highest revenue in 2022. The installation of residential water meters is quite popular in countries namely the U.S., Canada, and Mexico. This is because particularly the western parts of the U.S., has faced water scarcity and drought conditions in the past due to dry and semi-arid climates. Water meters play a crucial role in managing and conserving water resources. By accurately measuring water consumption at the household and industrial levels, consumers can implement effective conservation measures and promote responsible water use. Also, these countries have well-established regulatory frameworks for water management.

Water utilities in these countries are often required to adhere to specific standards and regulations, including accurate measurement and reporting of water usage. Water meters help utilities comply with these regulations and demonstrate accountability in resource management. These factors are anticipated to drive the North America residential water meter market growth in the upcoming years.

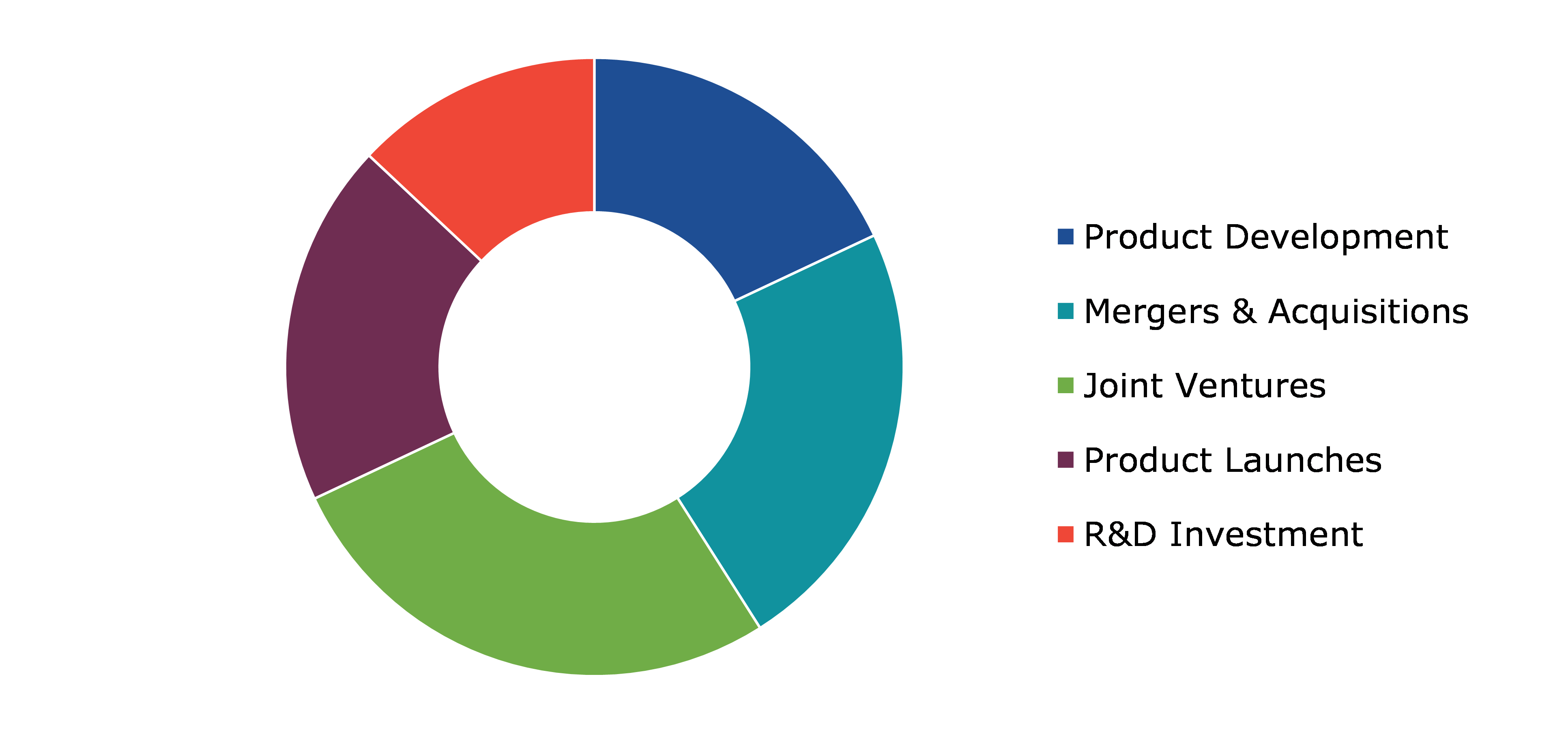

Competitive Scenario in the Global Residential Water Meters Market

Product launch, business expansion, and technological advancements are common strategies followed by major market players. For instance, in June 2023, The Water Services Regulation Authority, in England, accelerated the rollout of 462,000 smart water meters. Under the seven smart water meter schemes, $2.8 billion water meter installation plan was approved by Britain’s water regulator Ofwat. The installation of a total 462,000 water meters is estimated to be completed by 2025.

Source: Research Dive

Some of the leading residential water meters market players are Apator SA, Arad Group, Badger Meter, Inc., Kamstrup A/S, Elster Group GmbH, Itron Inc., Xylem Inc., Honeywell International Inc., Master Meter, Inc., and Mueller Systems, LLC.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Distribution Channel |

|

| Key Companies Profiled |

|

Q1. What is the size of the global residential water meters market?

A. The size of the global residential water meters market was $11,250.0 million in 2022 and is projected to reach $18,622.3 million by 2032.

Q2. Which are the major companies in the residential water meters market?

A. Apator SA, Arad Group, Badger Meter, Inc., and Kamstrup A/S are some of the key players in the global residential water meters market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific residential water meters market?

A. The Asia-Pacific residential water meters market is anticipated to grow at 6.3% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Partnership, product launch, and technological advancements are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Elster Group GmbH, Itron Inc., Xylem Inc., Honeywell International Inc., and Master Meter, Inc. are the companies investing more in R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on residential water meters market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Residential Water Meters Market Analysis, by Type

5.1. Overview

5.1.1. Standard Water Meter

5.1.2. Definition, key trends, growth factors, and opportunities

5.1.3. Market size analysis, by region, 2022-2032

5.1.4. Market share analysis, by country, 2022-2032

5.2. Smart Water Meter

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Research Dive Exclusive Insights

5.3.1. Market attractiveness

5.3.2. Competition heatmap

6. Residential Water Meters Market Analysis, by Distribution Channel

6.1. Overview

6.2. Online

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Offline

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Residential Water Meters Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Type, 2022-2032

7.1.1.2. Market size analysis, by Distribution Channel, 2022-2032

7.1.2. Canada

7.1.2.1. Market size analysis, by Type, 2022-2032

7.1.2.2. Market size analysis, by Distribution Channel, 2022-2032

7.1.3. Mexico

7.1.3.1. Market size analysis, by Type, 2022-2032

7.1.3.2. Market size analysis, by Distribution Channel, 2022-2032

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Type, 2022-2032

7.2.1.2. Market size analysis, by Distribution Channel, 2022-2032

7.2.2. UK

7.2.2.1. Market size analysis, by Type, 2022-2032

7.2.2.2. Market size analysis, by Distribution Channel, 2022-2032

7.2.3. France

7.2.3.1. Market size analysis, by Type, 2022-2032

7.2.3.2. Market size analysis, by Distribution Channel, 2022-2032

7.2.4. Spain

7.2.4.1. Market size analysis, by Type, 2022-2032

7.2.4.2. Market size analysis, by Distribution Channel, 2022-2032

7.2.5. Italy

7.2.5.1. Market size analysis, by Type, 2022-2032

7.2.5.2. Market size analysis, by Distribution Channel, 2022-2032

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Type, 2022-2032

7.2.6.2. Market size analysis, by Distribution Channel, 2022-2032

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Type, 2022-2032

7.3.1.2. Market size analysis, by Distribution Channel, 2022-2032

7.3.2. Japan

7.3.2.1. Market size analysis, by Type, 2022-2032

7.3.2.2. Market size analysis, by Distribution Channel, 2022-2032

7.3.3. India

7.3.3.1. Market size analysis, by Type, 2022-2032

7.3.3.2. Market size analysis, by Distribution Channel, 2022-2032

7.3.4. South Korea

7.3.4.1. Market size analysis, by Type, 2022-2032

7.3.4.2. Market size analysis, by Distribution Channel, 2022-2032

7.3.5. Australia

7.3.5.1. Market size analysis, by Type, 2022-2032

7.3.5.2. Market size analysis, by Distribution Channel, 2022-2032

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Type, 2022-2032

7.3.6.2. Market size analysis, by Distribution Channel, 2022-2032

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Type, 2022-2032

7.4.1.2. Market size analysis, by Distribution Channel, 2022-2032

7.4.2. UAE

7.4.2.1. Market size analysis, by Type, 2022-2032

7.4.2.2. Market size analysis, by Distribution Channel, 2022-2032

7.4.3. Saudi Arabia

7.4.3.1. Market size analysis, by Type, 2022-2032

7.4.3.2. Market size analysis, by Distribution Channel, 2022-2032

7.4.4. South Africa

7.4.4.1. Market size analysis, by Type, 2022-2032

7.4.4.2. Market size analysis, by Distribution Channel, 2022-2032

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Type, 2022-2032

7.4.5.2. Market size analysis, by Distribution Channel, 2022-2032

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. Apator SA

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Arad Group

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. Badger Meter, Inc.

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. Kamstrup A/S

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Elster Group GmbH

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Itron Inc.

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. Xylem Inc.

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. Honeywell International Inc.

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Master Meter, Inc.

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Mueller Systems, LLC

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com