Toasted Flour Market Report

RA09208

Toasted Flour Market by Type (Soybean Flour, Corn Flour, Wheat Flour, and Others), Application (Bread & Bakery Products, Noodles & Pasta, Crackers, Cookies, and Biscuits, Animal Feed, and Others), Distribution Channel (Hypermarkets, Convenience Stores, and Online Stores), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Toasted Flour Overview

Toasted flour refers to flour that has been subjected to dry heat, usually in an oven or on a stovetop, until it develops a golden brown color and a nutty aroma. It involves meticulously toasting flour until it reaches a desired golden-brown color, filling it with a depth of flavor and scent that separates it from its untoasted counterpart. This technique, however, takes a precise balance of heat and time to produce the best toasting, since it may quickly transition from a rich nuttiness to an acidic bitterness if left untreated. With centuries of history, toasted flour has made its way into a variety of cuisines throughout the world, adding depth and character to recipes for both chefs and amateur cooks. The fascination of toasted flour stems from its transforming abilities, which elevate the modest ingredient from a simple thickening agent to a flavor enhancer. As heat penetrates the flour, Maillard reactions take place, resulting in the production of novel chemicals that add to its specific flavor profile. The sugars in the flour caramelize, adding a slight sweetness, while the proteins undergo browning, providing pleasant aromas similar to roasted nuts or caramel. This flavor combination gives depth and richness to a variety of foods, including sauces and gravies, baked products, and desserts.

Global Toasted Flour Market Analysis

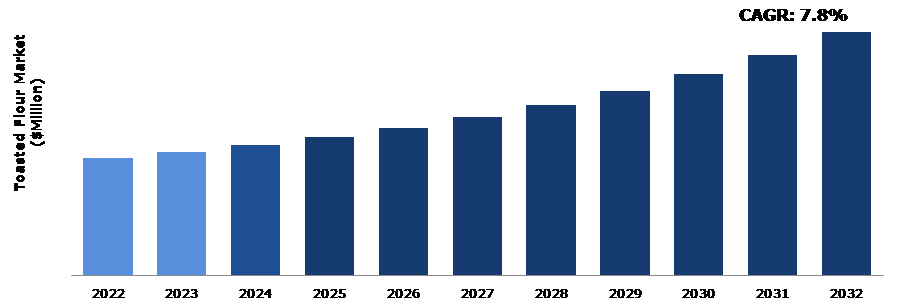

The global toasted flour market size was $60,417.00 million in 2022 and is predicted to grow with a CAGR of 7.8%, by generating a revenue of $125,415.80 million by 2032.

Source: Research Dive Analysis

Increasing Demand for Toasted Flour in Bakery Products to Drive the Market Growth

The Maillard reaction is an important process in cooking that transforms the flavor of toasted flour. When exposed to heat, amino acids and sugars undergo a chemical reaction, resulting in the formation of a wide range of tasty molecules. This reaction in toasted flour generates a wonderful blend of nutty and caramelized flavors that add rich depth and complexity to recipes, resulting in a symphony of taste sensations on the palette.. Furthermore, the degree of toasting determines the flavor character of toasted flour. The spectrum of toasted flour hues ranges from a delicate golden hue to a deep chestnut brown, reflecting different levels of flavor development. The length and temperature of toasting determine the quantity of Maillard reactions and caramelization, which influence the final flavor and scent of the flour. In addition to the Maillard process, the volatilization of aromatic chemicals influences the flavor alteration in toasted flour. As the flour is toasted, the volatile compounds responsible for scent are released and diffused into the surrounding environment. These fragrant molecules, which range from floral to earthy, add to the sensory experience of toasted flour, increasing its attractiveness on both the culinary and olfactory levels. Furthermore, the type of flour used in the toasting process provides unique flavor qualities to the finished product. Whether made from wheat, rice, corn, or other grains, each flour variation has its own distinct flavor profile, which is determined by factors such as grain content and processing processes.

Alteration in the Nutritional Composition of the Flour to Restrain the Market Growth

One of the main challenges in changing the nutritional content of flour lies in ensuring the added nutrients remain stable during processing. When enhancing wheat with essential vitamins, minerals, or other nutrients, it is crucial to grasp how these compounds might break down or diminish during milling, mixing, and baking. For example, heat-sensitive vitamins such as vitamin C and some B vitamins might degrade when exposed to high temperatures during toasting, potentially resulting in decreased nutritional value and changed flavor profiles. Therefore, preserving the integrity and bioavailability of added nutrients throughout the manufacturing phases is a substantial difficulty in developing nutritionally enriched flour with acceptable flavor results. The complex matrix of flour, which includes carbohydrates, proteins, lipids, and other components, might affect the stability and bioavailability of additional nutrients. The way fortifying chemicals interact with the flour matrix can affect the sensory qualities of the final product, including its flavor. For example, the presence of certain minerals or protein fortifiers may interact with gluten proteins in wheat flour, modifying its rheological characteristics and influencing the texture and flavor of toasted goods.

Advancements in Processing and Culinary Applications of Toasted Flour to Drive Excellent Opportunities

Developments in food processing technology are essential for realizing the innovative potential of toasted flour. Cutting-edge milling procedures, such as precision toasting and micronization, allow producers to achieve maximum flavor retention and texture while maintaining the flour's nutritional integrity. Furthermore, developments in packaging technology, such as modified atmosphere packaging (MAP), increase the shelf life of toasted flour products, assuring freshness and quality throughout the distribution chain. The use of automation and robots in production processes improves efficiency and uniformity, allowing novel toasted flour solutions to scale to meet expanding market needs. Toasted flour innovation extends beyond typical baking uses to include a wide variety of gourmet innovations and flavor combinations. Chefs and culinary inventors are continually experimenting with toasted flour to create new recipes in a variety of cuisines, from spicy meals like toasted flour-crusted chicken to decadent sweets like toasted flour-infused ice cream. Fusion cuisine, which combines traditional techniques with modern twists, is an interesting path for innovation, providing customers with unique culinary experiences that highlight the versatility and adaptation of toasted flour in varied culinary traditions.

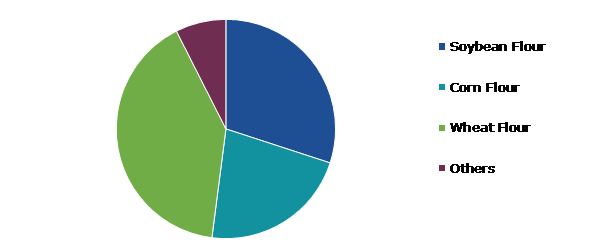

Global Toasted Flour Market Share, by Type, 2022

Source: Research Dive Analysis

The wheat flour sub-segment accounted for the highest market share in 2022. The wheat flour type segment has emerged as the dominant player in the market, capturing the highest market share compared to other segments. This dominance highlights the widespread popularity and versatility of wheat flour across various culinary applications. With its wide availability, affordability, and diverse range of uses in baking, cooking, and food processing, wheat flour continues to maintain a strong foothold in the market. Its widespread adoption by consumers and food manufacturers has solidified its position as the leading sub-segment, driving significant growth and revenue within the industry.

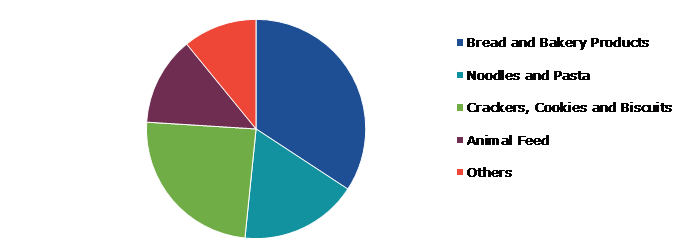

Global Toasted Flour Market Share, by Application, 2022

Source: Research Dive Analysis

The bread & bakery products sub-segment accounted for the highest market share in 2022. Within the toasted flour market, the bread & bakery products sub-segment has emerged as the frontrunner, achieving the highest market share. This dominance reflects the widespread consumer preference for toasted flour in the production of various bread and bakery items. From artisanal bread to pastries and cakes, toasted flour adds a unique depth of flavor and texture, enhancing the overall sensory experience for consumers. The versatility of toasted flour in creating a wide range of baked goods has solidified its position as a staple ingredient in the bakery industry, driving significant growth and revenue within the market segment.

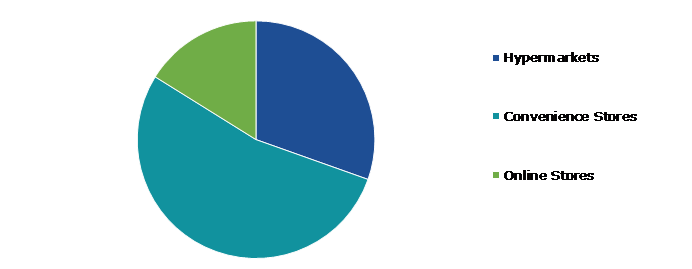

Global Toasted Flour Market Share, by Distribution Channel, 2022

Source: Research Dive Analysis

The convenience stores sub-segment accounted for the highest market share in 2022. The convenience stores sub-segment emerges as the dominant player in the toasted flour market, capturing the highest market share. This dominance highlights the growing consumer preference for convenient shopping options and the increasing popularity of toasted flour products among urban and on-the-go consumers. Convenience stores offer a convenient and accessible retail channel for customers to purchase toasted flour-based products such as bread, pastries, and snacks. With their extended operating hours, convenient locations, and diverse product offerings, convenience stores have become a preferred destination for consumers seeking quick and easy access to toasted flour products, driving significant growth of the sub-segment.

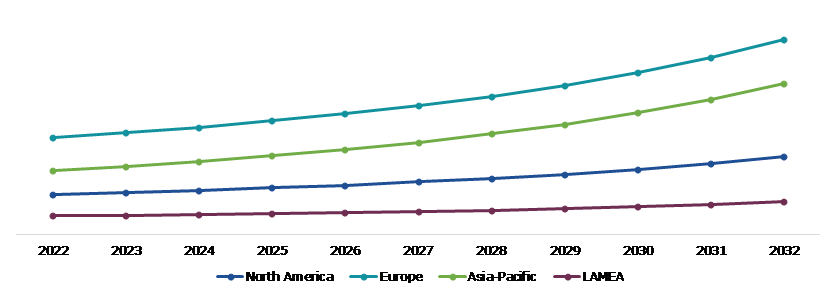

Global Toasted Flour Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The Europe toasted flour market generated the highest revenue in 2022. Europe emerges as the dominant market player in the toasted flour industry, with the highest market share. This dominance highlights the region's rich culinary heritage, where toasted flour has been a staple ingredient in traditional European cuisines for centuries. European consumers highly value artisanal baking and premium food products, particularly cherishing the distinctive flavor and texture that toasted flour brings to their favorite dishes. In addition, the region's thriving food manufacturing sector and well-established distribution networks contribute to the widespread availability and accessibility of toasted flour products across Europe, further enhancing its market leadership position.

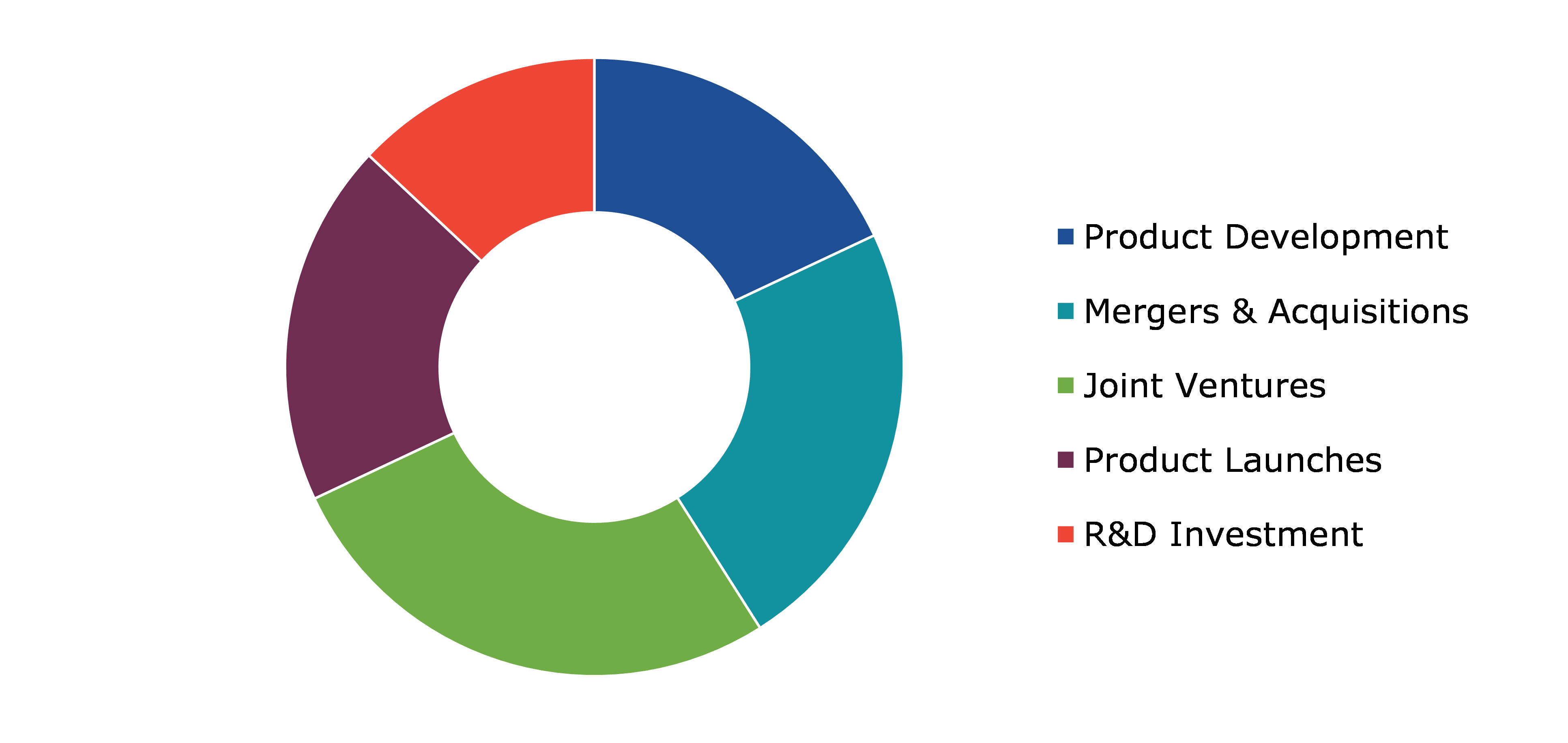

Competitive Scenario in the Global Toasted Flour Market

Product launches, investment, and acquisition are common strategies followed by major market players. The competitive situation in the global toasted flour market is characterized by intense rivalry among key players attempting to gain market share and dominance. With increasing consumer demand for premium and artisanal baked goods, along with a growing emphasis on natural and flavorful ingredients, competition within the market has intensified. Key factors driving competition include product quality, innovation, pricing strategies, distribution networks, and marketing efforts. Leading players in the market are continuously innovating to differentiate their offerings and cater to evolving consumer preferences. This includes the development of new toasted flour variants, such as whole grain and gluten-free options, as well as the introduction of value-added products with enhanced nutritional profiles.

Source: Research Dive Analysis

Some of the leading toasted flour market players are Montana, Nutrigerm, Archer-Daniels-Midland Company, ITC Limited, Cargill Inc., Bob's Red Mill Natural Foods Inc., Ardent Mills Corporate, King Arthur Flour Company Inc., Conagra Brands Inc., and Bunge Milling Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Segmentation by Distribution Channel |

|

| Key Companies Profiled |

|

Q1. What is the size of the global toasted flour market?

A. The size of the global toasted flour market was $60,417.00 million in 2022 and is projected to reach $125,415.80 million by 2032.

Q2. Which are the major companies in the toasted flour market?

A. Montana, Nutrigerm, Archer-Daniels-Midland Company, and ITC Limited are some of the key players in the global toasted flour market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment and acquisition opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific toasted flour market?

A. The Asia-Pacific toasted flour market is anticipated to grow at 9.2% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product launches and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. ITC Limited, Cargill Inc., and Bob's Red Mill Natural Foods Inc. are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global toasted flour market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on toasted flour market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Toasted Flour Market Analysis, By Type

5.1. Overview

5.2. Soybean Flour

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Corn Flour

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Wheat Flour

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Others

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2022-2032

5.5.3. Market share analysis, by country, 2022-2032

5.6. Research Dive Exclusive Insights

5.6.1. Market attractiveness

5.6.2. Competition heatmap

6. Toasted Flour Market Analysis, by Application

6.1. Overview

6.2. Bread & Bakery Products

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Noodles & Pasta

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Crackers, Cookies, and Biscuits

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Animal Feed

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2022-2032

6.5.3. Market share analysis, by country, 2022-2032

6.6. Others

6.6.1. Definition, key trends, growth factors, and opportunities

6.6.2. Market size analysis, by region, 2022-2032

6.6.3. Market share analysis, by country, 2022-2032

6.7. Research Dive Exclusive Insights

6.7.1. Market attractiveness

6.7.2. Competition heatmap

7. Toasted Flour Market Analysis, by Distribution Channel

7.1. Overview

7.2. Hypermarkets

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2022-2032

7.2.3. Market share analysis, by country, 2022-2032

7.3. Convenience Stores

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2022-2032

7.3.3. Market share analysis, by country, 2022-2032

7.4. Online Stores

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2022-2032

7.4.3. Market share analysis, by country, 2022-2032

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Toasted Flour Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Type, 2022-2032

8.1.1.2. Market size analysis, by Application, 2022-2032

8.1.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.2. Canada

8.1.2.1. Market size analysis, by Type, 2022-2032

8.1.2.2. Market size analysis, by Application, 2022-2032

8.1.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.3. Mexico

8.1.3.1. Market size analysis, by Type, 2022-2032

8.1.3.2. Market size analysis, by Application, 2022-2032

8.1.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Type, 2022-2032

8.2.1.2. Market size analysis, by Application, 2022-2032

8.2.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.2. UK

8.2.2.1. Market size analysis, by Type, 2022-2032

8.2.2.2. Market size analysis, by Application, 2022-2032

8.2.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.3. France

8.2.3.1. Market size analysis, by Type, 2022-2032

8.2.3.2. Market size analysis, by Application, 2022-2032

8.2.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.4. Spain

8.2.4.1. Market size analysis, by Type, 2022-2032

8.2.4.2. Market size analysis, by Application, 2022-2032

8.2.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.5. Italy

8.2.5.1. Market size analysis, by Type, 2022-2032

8.2.5.2. Market size analysis, by Application, 2022-2032

8.2.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Type, 2022-2032

8.2.6.2. Market size analysis, by Application, 2022-2032

8.2.6.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Type, 2022-2032

8.3.1.2. Market size analysis, by Application, 2022-2032

8.3.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.2. Japan

8.3.2.1. Market size analysis, by Type, 2022-2032

8.3.2.2. Market size analysis, by Application, 2022-2032

8.3.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.3. India

8.3.3.1. Market size analysis, by Type, 2022-2032

8.3.3.2. Market size analysis, by Application, 2022-2032

8.3.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.4. Australia

8.3.4.1. Market size analysis, by Type, 2022-2032

8.3.4.2. Market size analysis, by Application, 2022-2032

8.3.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.5. South Korea

8.3.5.1. Market size analysis, by Type, 2022-2032

8.3.5.2. Market size analysis, by Application, 2022-2032

8.3.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Type, 2022-2032

8.3.6.2. Market size analysis, by Application, 2022-2032

8.3.6.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Type, 2022-2032

8.4.1.2. Market size analysis, by Application, 2022-2032

8.4.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.2. UAE

8.4.2.1. Market size analysis, by Type, 2022-2032

8.4.2.2. Market size analysis, by Application, 2022-2032

8.4.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.3. Saudi Arabia

8.4.3.1. Market size analysis, by Type, 2022-2032

8.4.3.2. Market size analysis, by Application, 2022-2032

8.4.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.4. South Africa

8.4.4.1. Market size analysis, by Type, 2022-2032

8.4.4.2. Market size analysis, by Application, 2022-2032

8.4.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Type, 2022-2032

8.4.5.2. Market size analysis, by Application, 2022-2032

8.4.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. Montana

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Nutrigerm

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Archer-Daniels-Midland Company

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. ITC Limited

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Cargill Inc.

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Bob's Red Mill Natural Foods Inc.

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Ardent Mills Corporate

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. King Arthur Flour Company Inc.

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Conagra Brands Inc.

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Bunge Milling Inc.

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com