Levodopa Market Report

RA09206

Levodopa Market by Form (Tablets, Capsules, Powder, and Liquid), Route of Administration (Oral and Parenteral), Distribution Channels (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Levodopa, also known as L-DOPA, is a medication primarily used to treat Parkinson's disease, a neurodegenerative disorder affecting movement. Levodopa is a precursor to dopamine, a neurotransmitter crucial for coordinating muscle movement. In Parkinson's disease, dopamine-producing neurons degenerate, leading to movement impairments. Levodopa crosses the blood-brain barrier and is converted into dopamine in the brain, replenishing dopamine levels and alleviating symptoms such as tremors, stiffness, and slowness of movement. However, long-term use can lead to motor fluctuations and dyskinesias, complicating the treatment. To mitigate these issues, levodopa is often combined with carbidopa or benderizine, peripheral dopa decarboxylase inhibitors that prevent levodopa breakdown outside the brain, increasing its availability to the brain and reducing side effects. Despite its efficacy, levodopa does not alter the underlying progression of Parkinson's disease and may lose effectiveness over time. It remains a cornerstone therapy in managing Parkinson's symptoms, enhancing patients' quality of life. Regular monitoring and adjustments by healthcare professionals are essential for optimizing levodopa therapy.

Levodopa Market Analysis

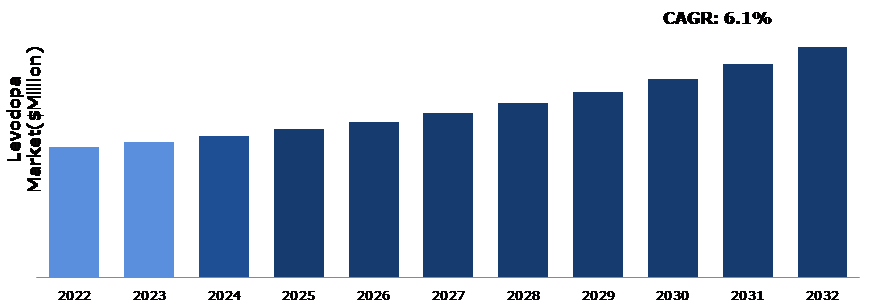

The global levodopa market size was $1,655.4 million in 2022 and is predicted to grow with a CAGR of 6.1%, generating revenue of $2,934.6 million by 2032.

Source: Research Dive Analysis

Innovative Formulations and Efficient Drug Delivery Methods for Levodopa to Drive the Market Growth

The levodopa market is expected to witness significant growth, owing to rise in advancements in the development of novel formulations and efficient drug delivery methods. As a key component in the treatment of Parkinson's disease, levodopa's efficacy in managing symptoms is well-established. However, challenges such as motor fluctuations and dyskinesias have spurred research into innovative formulations and delivery systems to optimize its therapeutic effects. Novel formulations aim to improve levodopa's bioavailability, stability, and duration of action, potentially reducing the frequency of dosing and enhancing patient compliance. Moreover, advancements in drug delivery methods, including transdermal patches, extended-release formulations, and implantable devices, offer promising alternatives to conventional oral administration, providing sustained and controlled release of levodopa while minimizing side effects. These developments not only address existing limitations but also hold the potential to revolutionize Parkinson's disease management, driving the growth of the levodopa market in the coming years.

Shortage of Drug Supply to Restrain the Market Growth

However, potential shortages in drug supply are expected to restrain the growth of the levodopa market. Levodopa is a critical medication for Parkinson's disease management, and any disruption in its availability can significantly impact patient care. Furthermore, factors contributing to supply shortages include manufacturing issues, raw material procurement challenges, regulatory hurdles, and distribution bottlenecks. These shortages not only affect patients' access to essential treatment but also pose financial burdens on healthcare systems and providers. Moreover, shortages can lead to increased reliance on alternative medications or therapeutic strategies, potentially compromising patient outcomes. However, addressing supply chain vulnerabilities and implementing robust contingency plans are imperative to mitigate shortages and drive the growth of the levodopa market.

Advancements in Technology to Drive Excellent Opportunities

Technological advancements in pharmaceuticals are driving significant progress in developing innovative formulations and drug delivery methods for levodopa therapy. Researchers are continuously exploring novel approaches to enhance the efficacy and convenience of levodopa treatment, aiming to address the challenges associated with its administration and optimize patient outcomes. One area of focus is the development of extended-release formulations that provide sustained and controlled release of levodopa, reducing the frequency of dosing and minimizing fluctuations in plasma drug levels. These formulations help improve symptom management and enhance patient adherence to treatment regimens. Moreover, advancements in drug delivery methods, such as transdermal patches, inhalation therapies, and implantable devices, offer alternative routes of administration for levodopa. These delivery systems provide precise dosing, improve drug absorption, and reduce side effects compared to conventional oral formulations.

Furthermore, nanotechnology-based approaches hold promise for targeted drug delivery to specific regions of the brain affected by Parkinson's disease, optimizing levodopa therapy's efficacy while minimizing systemic side effects. The ongoing R&D efforts in technological innovations are reshaping the landscape of levodopa therapy, ushering in a new era of more effective and patient-friendly treatment options for individuals living with Parkinson's disease.

Levodopa Market Share, by Form, 2022

Source: Research Dive Analysis

The tablets segment accounted for the highest market share in 2022. The tablet form segment of the levodopa market is witnessing significant growth driven by several key factors. The convenience and ease of administration offered by tablets make them a preferred choice for patients and healthcare providers, enhancing patient compliance with treatment regimens. In addition, advancements in tablet formulations, including extended-release and combination formulations with adjunctive medications such as carbidopa, improve levodopa's bioavailability and efficacy in managing Parkinson's disease symptoms. Furthermore, increase in prevalence of Parkinson's disease globally, particularly among the aging population, is driving the demand for levodopa tablets as a cornerstone therapy for symptom management. Moreover, rise in healthcare infrastructure and increase in awareness regarding neurological disorders in emerging markets are boosting the adoption of levodopa tablets, driving market growth.

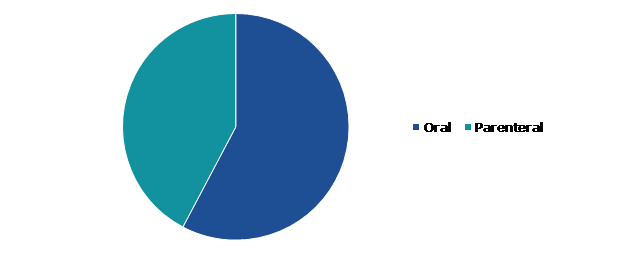

Levodopa Market Share, by Route of Administration, 2022

Source: Research Dive Analysis

The oral segment accounted for the highest market share in 2022. The oral route is the most common and convenient method of drug administration, offering ease of use and familiarity to both patients and healthcare providers. This accessibility promotes higher patient compliance and adherence to treatment regimens, contributing to sustained demand for oral levodopa formulations. Furthermore, ongoing advancements in oral drug delivery technologies, such as extended-release formulations and combination therapies with adjuvants such as carbidopa, are enhancing the efficacy and safety profile of oral levodopa. These innovations aim to address challenges such as motor fluctuations and dyskinesias associated with conventional immediate-release formulations, thereby improving patient outcomes and quality of life. In addition, the oral route's versatility allows for flexible dosing regimens tailored to individual patient needs, driving its widespread adoption in the management of Parkinson's disease.

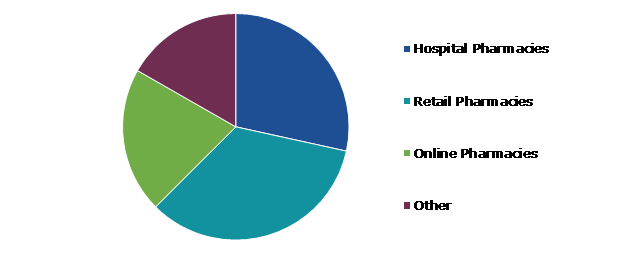

Levodopa Market Share, by Distribution Channels, 2022

Source: Research Dive Analysis

The retail pharmacies segment accounted for the highest market share in 2022. Retail pharmacies serve as crucial intermediaries between manufacturers and end-users, providing accessibility and convenience for patients prescribed levodopa. Moreover, increase in prevalence of Parkinson's disease, coupled with rise in aging population leads to a higher demand for levodopa prescriptions, consequently boosting retail pharmacy sales. Furthermore, advancements in healthcare infrastructure and the expansion of retail pharmacy networks in both developed and emerging markets enhance product availability and patient access. In addition, rise in awareness campaigns and educational initiatives about Parkinson's disease symptoms and treatment options drive patient footfall in retail pharmacies. Moreover, surge in trend toward self-medication and over the counter (OTC) sales of certain medications is expected to stimulate levodopa market growth within the retail pharmacy segment, providing patients with greater autonomy in managing their condition.

Levodopa Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The North America levodopa market share generated the highest revenue in 2022. The North America levodopa market is anticipated to witness significant growth, driven by several key factors. The region has a high prevalence of Parkinson's disease, with an aging population contributing to increased demand for levodopa-based treatments. Moreover, the presence of well-established healthcare infrastructure and robust pharmaceutical regulatory frameworks facilitates the development, manufacturing, and distribution of levodopa medications in North America. Furthermore, ongoing advancements in medical research & technology, particularly in drug formulations and delivery methods, enhance the efficacy and convenience of levodopa therapy, driving the market growth. In addition, initiatives aimed at raising awareness about neurological disorders and improving access to healthcare services drive the market growth in the region.

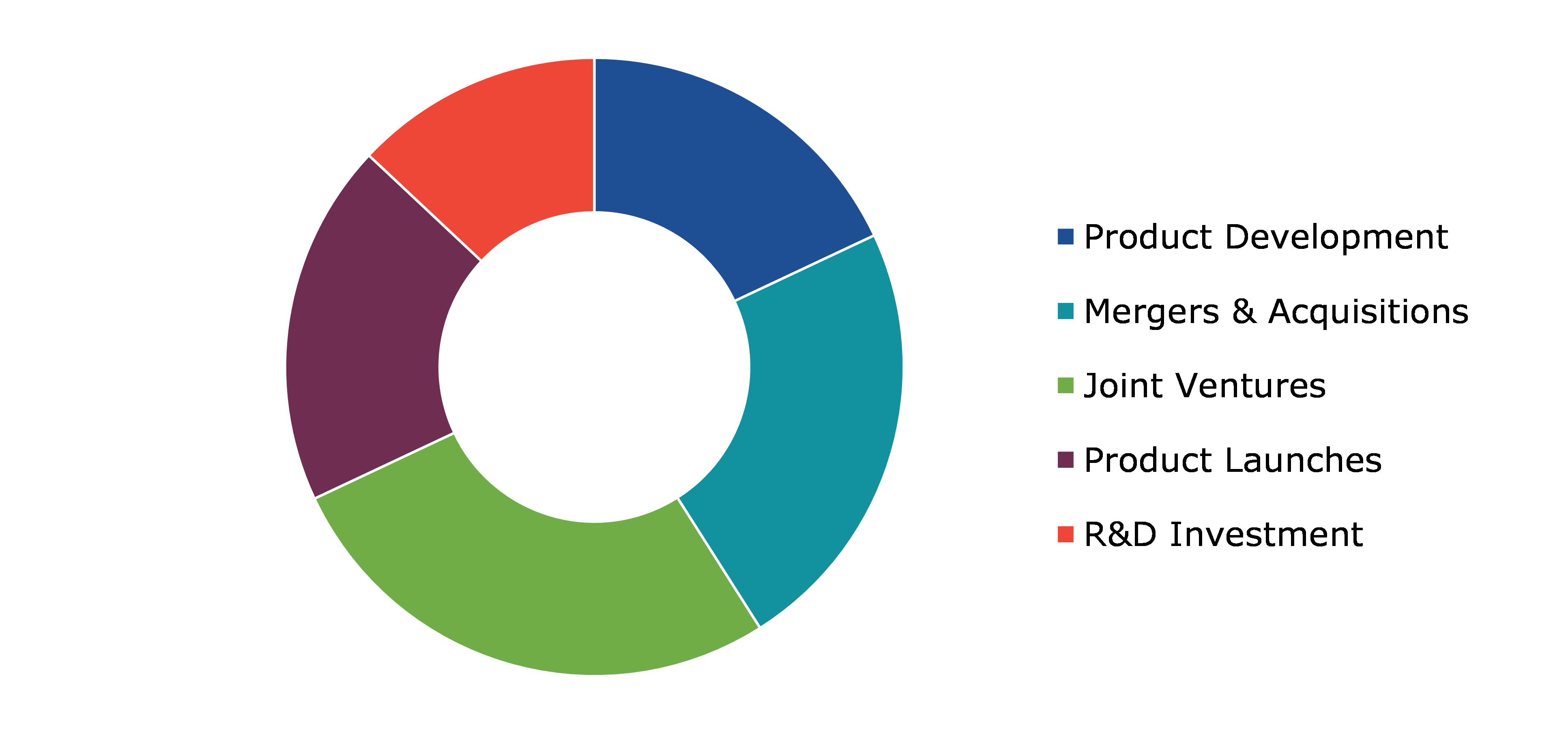

Competitive Scenario in the Levodopa Market

Investment and agreement are common strategies followed by major market players. One of the leading market players in the industry is AbbVie. In April 2021, AbbVie has reported encouraging Phase 2 trial outcomes for its experimental drug, ABBV-951, intended for Parkinson's disease management. ABBV-951, a levodopa-carbidopa intestinal gel (LCIG) administered through a pump system, aims to mitigate motor fluctuations in Parkinson's patients by ensuring continuous medication delivery. These promising results highlight the potential of ABBV-951 in improving treatment outcomes for individuals with Parkinson's disease.

Source: Research Dive Analysis

Key players operating in the levodopa market analysis include Novartis AG, Merck & Co. Inc., Eli Lilly & Company, Bristol-Myers Squibb Co., Teva Pharmaceutical Industries Ltd., Impax Laboratories Inc., Pfizer Inc., UCB SA, Sun Pharmaceutical Industries Ltd., and Mylan NV.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Form |

|

| Segmentation by Route of Administration |

|

|

Segmentation by Distribution Channels

|

|

| Key Companies Profiled |

|

Q1. What is the size of the levodopa market?

A. The size of the levodopa market size was over $1,655.4 million in 2022 and is projected to reach $2,934.6 million by 2032.

Q2. Which are the major companies in the levodopa market?

A. Novartis AG, Merck and Co. Inc., Eli Lilly and Company, and Bristol-Myers Squibb Co are the major companies in the levodopa market.

Q3. Which region, among others, has greater investment opportunities in the near future?

A. Asia-Pacific has great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific levodopa market?

A. The Asia-Pacific levodopa market share is anticipated to grow at 8.7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the leading players in this market.

Q6. Which companies are investing more in R&D practices?

A. Novartis AG, Merck & Co. Inc., Eli Lilly & Company, and Bristol-Myers Squibb Co. are the companies investing more in R&D activities to develop new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global levodopa market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrixes

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of buyers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.6. Competitive rivalry

4.7. PESTLE analysis

4.7.1. Political

4.7.2. Economical

4.7.3. Social

4.7.4. Technological

4.7.5. Legal

4.7.6. Environmental

4.8. Impact of COVID-19 on Levodopa market

4.8.1. Pre-covid market scenario

4.8.2. Post-covid market scenario

5. Levodopa Market Analysis, by Form

5.1. Overview

5.2. Tablets

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Capsules

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Powder

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Liquid

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2022-2032

5.5.3. Market share analysis, by country, 2022-2032

5.6. Research Dive Exclusive Insights

5.6.1. Market attractiveness

5.6.2. Competition heatmap

6. Levodopa Market Analysis, by Route of Administration

6.1. Oral

6.1.1. Definition, key trends, growth factors, and opportunities

6.1.2. Market size analysis, by region, 2022-2032

6.1.3. Market share analysis, by country, 2022-2032

6.2. Parenteral

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Research Dive Exclusive Insights

6.3.1. Market attractiveness

6.3.2. Competition heatmap

7. Levodopa Market Analysis, by Distribution Channels

7.1. Hospital Pharmacies

7.1.1. Definition, key trends, growth factors, and opportunities

7.1.2. Market size analysis, by region, 2022-2032

7.1.3. Market share analysis, by country, 2022-2032

7.2. Retail Pharmacies

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2022-2032

7.2.3. Market share analysis, by country, 2022-2032

7.3. Online Pharmacies

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2022-2032

7.3.3. Market share analysis, by country, 2022-2032

7.4. Others

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2022-2032

7.4.3. Market share analysis, by country, 2022-2032

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Levodopa Market, by Region

8.1. North America

8.1.1. The U.S.

8.1.1.1. Market size analysis, by Form, 2022-2032

8.1.1.2. Market size analysis, by Route of Administration, 2022-2032

8.1.1.3. Market size analysis, by Distribution Channels, 2022-2032

8.1.2. Canada

8.1.2.1. Market size analysis, by Form, 2022-2032

8.1.2.2. Market size analysis, by Route of Administration, 2022-2032

8.1.2.3. Market size analysis, by Distribution Channels, 2022-2032

8.1.3. Mexico

8.1.3.1. Market size analysis, by Form, 2022-2032

8.1.3.2. Market size analysis, by Route of Administration, 2022-2032

8.1.3.3. Market size analysis, by Distribution Channels, 2022-2032

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Form, 2022-2032

8.2.1.2. Market size analysis, by Route of Administration, 2022-2032

8.2.1.3. Market size analysis, by Distribution Channels, 2022-2032

8.2.2. The UK

8.2.2.1. Market size analysis, by Form, 2022-2032

8.2.2.2. Market size analysis, by Route of Administration, 2022-2032

8.2.2.3. Market size analysis, by Distribution Channels, 2022-2032

8.2.3. France

8.2.3.1. Market size analysis, by Form, 2022-2032

8.2.3.2. Market size analysis, by Route of Administration, 2022-2032

8.2.3.3. Market size analysis, by Distribution Channels, 2022-2032

8.2.4. Spain

8.2.4.1. Market size analysis, by Form, 2022-2032

8.2.4.2. Market size analysis, by Route of Administration, 2022-2032

8.2.4.3. Market size analysis, by Distribution Channels, 2022-2032

8.2.5. Italy

8.2.5.1. Market size analysis, by Form, 2022-2032

8.2.5.2. Market size analysis, by Route of Administration, 2022-2032

8.2.5.3. Market size analysis, by Distribution Channels, 2022-2032

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Form, 2022-2032

8.2.6.2. Market size analysis, by Route of Administration, 2022-2032

8.2.6.3. Market size analysis, by Distribution Channels, 2022-2032

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Form, 2022-2032

8.3.1.2. Market size analysis, by Route of Administration, 2022-2032

8.3.1.3. Market size analysis, by Distribution Channels, 2022-2032

8.3.2. Japan

8.3.2.1. Market size analysis, by Form, 2022-2032

8.3.2.2. Market size analysis, by Route of Administration, 2022-2032

8.3.2.3. Market size analysis, by Distribution Channels, 2022-2032

8.3.3. India

8.3.3.1. Market size analysis, by Form, 2022-2032

8.3.3.2. Market size analysis, by Route of Administration, 2022-2032

8.3.3.3. Market size analysis, by Distribution Channels, 2022-2032

8.3.4. Australia

8.3.4.1. Market size analysis, by Form, 2022-2032

8.3.4.2. Market size analysis, by Route of Administration, 2022-2032

8.3.4.3. Market size analysis, by Distribution Channels, 2022-2032

8.3.5. South Korea

8.3.5.1. Market size analysis, by Form, 2022-2032

8.3.5.2. Market size analysis, by Route of Administration, 2022-2032

8.3.5.3. Market size analysis, by Distribution Channels, 2022-2032

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Form, 2022-2032

8.3.6.2. Market size analysis, by Route of Administration, 2022-2032

8.3.6.3. Market size analysis, by Distribution Channels, 2022-2032

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Form, 2022-2032

8.4.1.2. Market size analysis, by Route of Administration, 2022-2032

8.4.1.3. Market size analysis, by Distribution Channels, 2022-2032

8.4.2. Saudi Arabia

8.4.2.1. Market size analysis, by Form, 2022-2032

8.4.2.2. Market size analysis, by Route of Administration, 2022-2032

8.4.2.3. Market size analysis, by Distribution Channels, 2022-2032

8.4.3. The UAE

8.4.3.1. Market size analysis, by Form, 2022-2032

8.4.3.2. Market size analysis, by Route of Administration, 2022-2032

8.4.3.3. Market size analysis, by Distribution Channels, 2022-2032

8.4.4. South Africa

8.4.4.1. Market size analysis, by Form, 2022-2032

8.4.4.2. Market size analysis, by Route of Administration, 2022-2032

8.4.4.3. Market size analysis, by Distribution Channels, 2022-2032

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Form, 2022-2032

8.4.5.2. Market size analysis, by Route of Administration, 2022-2032

8.4.5.3. Market size analysis, by Distribution Channels, 2022-2032

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. Novartis AG

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Merck & Co. Inc.

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Eli Lilly & Company

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Bristol-Myers Squibb Co.

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Teva Pharmaceutical Industries Ltd.

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Impax Laboratories Inc.

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Pfizer Inc.

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. UCB SA

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Sun Pharmaceutical Industries Ltd

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Mylan NV

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com