Fuselage Market Report

RA09204

Fuselage Market by Application (Monocoque shell, Semi-Monocoque Shell, and Others), By Application (Narrow-body Aircraft, Wide-body Aircraft, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Fuselage Overview

A fuselage is an aircraft's core structure or body, which includes the cabin, cargo space, and other critical components. It acts as the aircraft's structural support and houses important equipment such as flight controls, avionics, and propulsion. The fuselage is normally cylindrical or oval, with the goal of reducing drag and improving aerodynamic performance. It is made of lightweight yet durable materials such as aluminum, composite materials, or a mix of the two, to maintain strength and structural integrity while keeping weight to a minimum. The fuselage design differs according to the kind of aircraft and its intended function, whether it is a commercial airliner, a military aircraft, or a general aviation plane. In commercial airliners, the fuselage is separated into compartments for passengers, cargo, and crew members. The passenger cabin is the main part where passengers sit, including rows of seats, overhead bins, and facilities such as lavatories and galleys. The cargo hold, which is placed beneath the main deck or in designated compartments, holds baggage, freight, and other cargo goods. Crew rest spaces, flight deck access doors, and emergency exits are strategically placed throughout the fuselage to assist efficient operations and passenger safety.

Global Fuselage Market Analysis

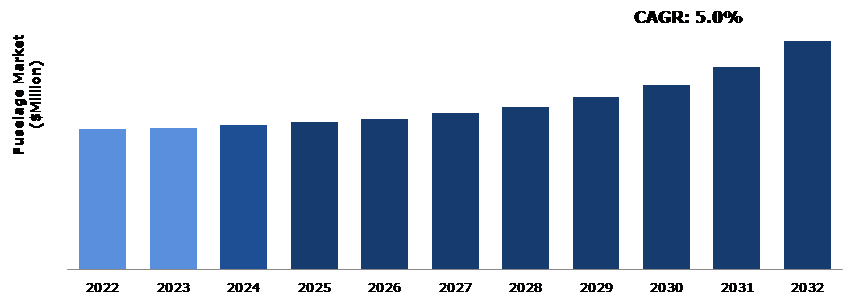

The global fuselage market size was $9,482.9 million in 2022 and is predicted to grow with a CAGR of 5.0%, generating a revenue of $15,417.8 million by 2032.

Source: Research Dive Analysis

Aerodynamic Efficiency in Fuselage to Drive the Market Growth

At the basis of fuselage aerodynamics is the concept of decreasing drag, a force that opposes an aircraft's forward motion. Drag is largely caused by airflow separation and turbulence around the fuselage surface, therefore streamlined design is critical for reducing its effects. The form of the fuselage is an important component in determining aerodynamic efficiency. Aerodynamicists attempt to create fuselages with smooth, streamlined curves that encourage laminar airflow and minimize drag. This involves enhancing cross-sectional shapes, gradually narrowing the fuselage toward the back, and minimizing surface irregularities such as protruding antennae or inadequately integrated components. Furthermore, the fuselage's aspect ratio, which is defined as the ratio of length to diameter or breadth, has a substantial influence on aerodynamic performance. Long, thin fuselages have lower drag coefficients than shorter, broader ones as they have less frontal area compared to volume. It is essential to find a middle ground when optimizing aspect ratio, considering both aerodynamic benefits & structural strength, and payload capacity. Excessively long fuselage potentially compromises the stability of the aircraft and restricts interior space. Furthermore, advances in materials research have a significant impact on fuselage aerodynamic performance. Lightweight composite materials provide higher strength-to-weight ratios than typical metallic alloys, allowing for sleeker, more aerodynamic fuselage designs. Composites decrease structural weight, lowering inertial forces, and allowing for faster cruising speeds, which contributes to increased fuel economy & lower environmental impact.

Strict Regulatory Compliance to Restrain the Market Growth

The aviation business is subject to a slew of regulations & norms imposed by national and international organizations such as the Federal Aviation Administration (FAA), the European Union Aviation Safety Agency (EASA), and the International Civil Aviation Organization (ICAO). Navigating this complicated regulatory system necessitates substantial experience and resources, which provide difficulties for fuselage manufacturers, particularly smaller enterprises with limited capacities. Certification of fuselage components and manufacturing processes is a laborious and time-consuming process. To receive regulatory approval, companies follow certain rules and criteria. This process necessitates comprehensive documentation, testing, and validation processes, all of which require significant expenditures of time, people, and money. Fuselage production requires a complicated supply chain that includes several suppliers and subcontractors responsible for delivering various components & materials. Ensuring regulatory compliance across the supply chain creates considerable challenges, as businesses actively monitor & audit suppliers to ensure adherence to relevant legislation and quality requirements. Furthermore, supply chain disruptions, such as shortages or faults in crucial components, compromise compliance efforts and cause production delays.

Technological Advancements in Fuselage to Drive Excellent Opportunities

Developments in materials research have transformed fuselage design, allowing for lighter yet stronger constructions. Carbon fiber reinforced polymers (CFRPs), for instance, have high strength-to-weight ratios, which improve fuel economy and reduce emissions. The introduction of advanced composite materials has increased design freedom, allowing for more complex geometries and optimized aerodynamics. Furthermore, the development of self-healing materials promises to reduce maintenance costs while increasing aircraft longevity, creating a tempting prospect for future fuselage innovation. In combination with material improvements, unique manufacturing processes have evolved, optimizing the manufacturing process, and encouraging increased efficiency. Additive manufacturing, often known as 3D printing, has gained popularity for its capacity to produce advanced components with little waste. This technology provides rapid prototyping and customization, allowing for iterative design improvements and shorter time-to-market. Furthermore, automated manufacturing procedures, including robotic assembly lines, improve accuracy & uniformity while reducing human error, resulting in higher overall fuselage quality & dependability. Technological improvements have improved the structural integrity and safety characteristics of current fuselages. Engineers use advanced modelling and simulation tools to perform detailed evaluations and optimize designs for optimal strength and durability. Furthermore, incorporation of sensor technology allows for real-time monitoring of structural health, which aids in predictive maintenance & preventative repairs.

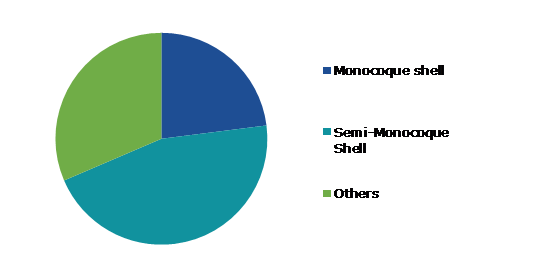

Global Fuselage Market Share, by Structure Type, 2022

Source: Research Dive Analysis

The semi-monocoque shell segment accounted for the highest market share in 2022. A semi-monocoque shell is a structural design typically found in airplane fuselages. In this design, the fuselages outside skin (or shell), interior frames and stringers, contribute to the overall strength of the structure. Semi-monocoque structures distribute loads more effectively than other methods of construction. The combination of internal framing (bulkheads, stringers, and frames) and an exterior skin gives great strength & rigidity, allowing the fuselage to endure a wide range of aerodynamic and structural loads during flight. Semi-monocoque structures possess a lower weight compared to full-monocoque structures. By integrating a framework of bulkheads and stringers in addition to the outer skin, the structure's overall weight is reduced while maintaining enough strength & rigidity. The internal framework of bulkheads and stringers allows for greater flexibility in design. Designers easily modify the layout and dimensions of the internal structure to accommodate different cabin configurations, cargo arrangements, and structural requirements without sacrificing overall strength.

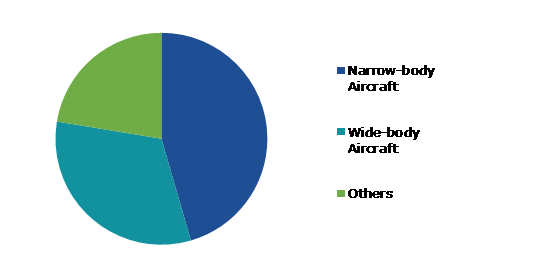

Global Fuselage Market Share, by Application, 2022

Source: Research Dive Analysis

The narrow-body aircraft segment accounted for the highest market share in 2022. Narrow-body aircraft have a single aisle and are primarily utilized for short- to medium-haul trips. Airlines seek aircraft with the optimal mix of operating costs and passenger capacity. Narrow-body planes are often more cost-effective for short to medium-haul flights than wide-body aircraft. Moreover, rise in fuel prices and environmental concerns have increased demand for fuel-efficient airplanes. Manufacturers concentrate on designing narrow-body planes with advanced engines and aerodynamics to increase fuel efficiency. Airlines customize their fleet choices to their route networks. Narrow-body aircraft are appropriate for routes with low demand or airport facilities that do not accept larger planes. Advances in materials research, production technologies (such as additive manufacturing), and design software help to create fuselage structures that are lighter, stronger, and more cost effective.

Global Fuselage Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The North America fuselage market generated the highest revenue in 2022. The fuselage market in North America is rapidly expanding. This is due to rise in demand for aircraft in the commercial and military sectors. The fuselage market is propelled forward by renowned aircraft manufacturers such as Boeing and Lockheed Martin, both of which are based in the region. The number of airplanes utilized for private and corporate purposes in the region is on the rise. This is due to rise in the number of high-net-worth individuals and enterprises in the area, thus increasing the demand for fuselages.

The surge in the number of aircraft utilized for leisure and tourism in the region has been observed. This is attributed to rise in the influx of tourists visiting the area, consequently leading to an increased demand for fuselages. Furthermore, the region is witnessing an increase in the number of airplanes utilized for freight transport. This is attributable to rise in the number of e-commerce businesses in the region, thus increasing the demand for fuselages. Overall, the fuselage market in North America is experiencing substantial growth due to rise in demand from the commercial & military sectors and increase in the number of high-net-worth individuals & organizations, tourists, and e-commerce companies in the area.

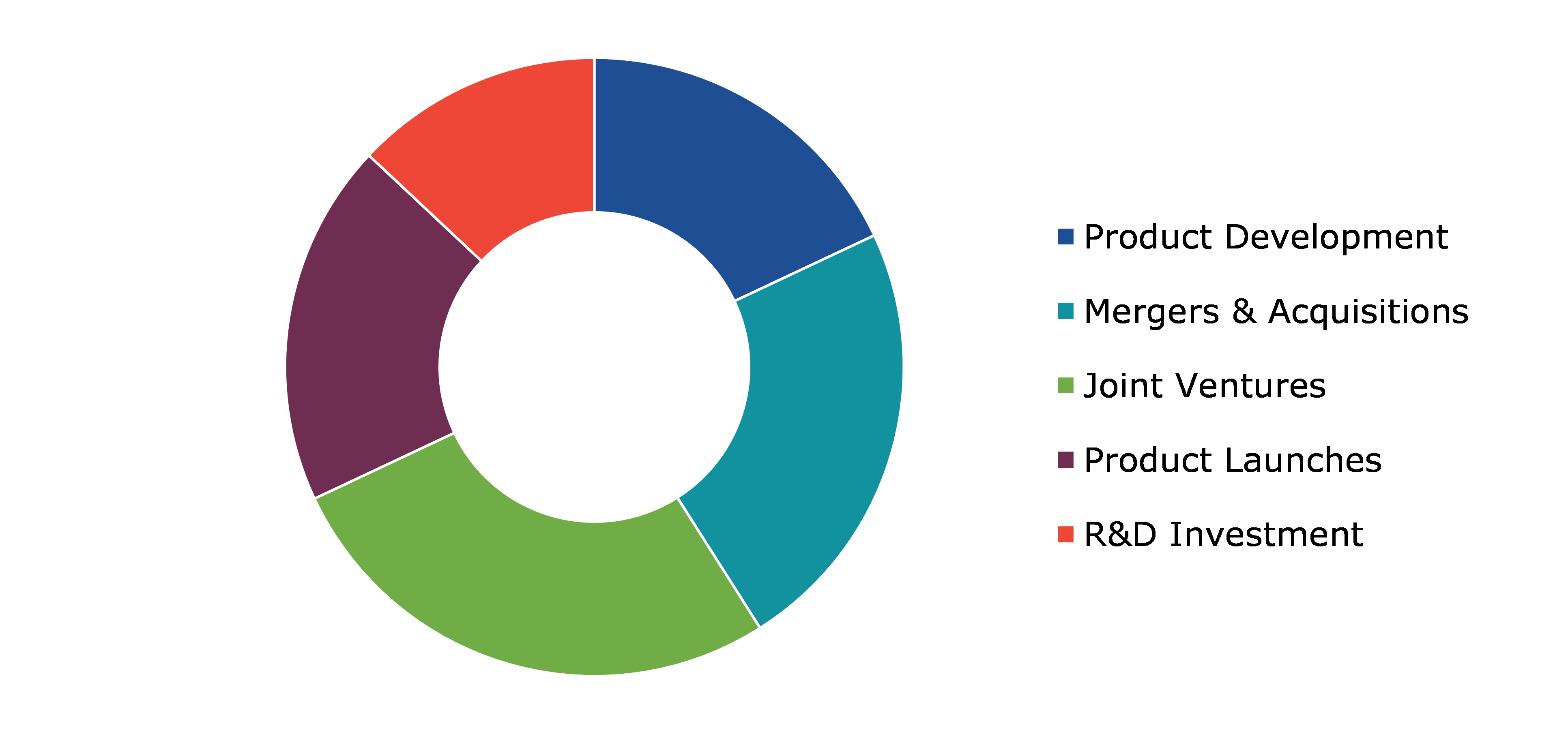

Competitive Scenario in the Global Fuselage Market

Technological Innovation, partnerships & collaborations are common strategies followed by major market players. For instance, Jun 12, 2023, Agritech startup Fuselage Innovations had been selected for the UK Government's Global Entrepreneurship Programme (GEP), making the Kerala-based company eligible for relocation to the European nation. Fuselage, which provides drone-based agricultural surveillance and spraying solutions, qualifies mentorship by experienced entrepreneurs and introduction to key networks, courtesy the GEP that lends business support to non-UK firms.

Source: Research Dive Analysis

Some of the leading fuselage market players are Latécoère,, Safran Landing Systems, GKN Aerospace, Aernnova, Goodrich Corp, Easterline, Ostseestaal GmbH & Co., Airbus, Lockheed Martin Corporation, and Triumph Group Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Structure Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global fuselage market?

A. The size of the global fuselage market was $9,482.9 million in 2022 and is projected to reach $15,417.8 million by 2032.

Q2. Which are the major companies in the fuselage market?

A. Airbus & Latécoère are some of the key players in the global fuselage market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific fuselage market?

A. The Asian-pacific fuselage market is anticipated to grow at 5.9% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological innovation, partnerships & collaborations are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more in R&D practices?

A. Airbus are the companies investing more in R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global fuselage market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on fuselage market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Fuselage Market Analysis, By Structure Type

5.1. Overview

5.2. Monocoque shell

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Semi-Monocoque Shell

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Others

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Research Dive Exclusive Insights

5.5.1. Market attractiveness

5.5.2. Competition heatmap

6. Fuselage Market Analysis, by Application

6.1. Overview

6.2. Narrow-body Aircraft

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Wide-body Aircraft

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Others

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Research Dive Exclusive Insights

6.5.1. Market attractiveness

6.5.2. Competition heatmap

7. Fuselage Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Structure Type, 2022-2032

7.1.1.2. Market size analysis, by Application, 2022-2032

7.1.2. Canada

7.1.2.1. Market size analysis, by Structure Type, 2022-2032

7.1.2.2. Market size analysis, by Application, 2022-2032

7.1.3. Mexico

7.1.3.1. Market size analysis, by Structure Type, 2022-2032

7.1.3.2. Market size analysis, by Application, 2022-2032

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Structure Type, 2022-2032

7.2.1.2. Market size analysis, by Application, 2022-2032

7.2.2. UK

7.2.2.1. Market size analysis, by Structure Type, 2022-2032

7.2.2.2. Market size analysis, by Application, 2022-2032

7.2.3. France

7.2.3.1. Market size analysis, by Structure Type, 2022-2032

7.2.3.2. Market size analysis, by Application, 2022-2032

7.2.4. Spain

7.2.4.1. Market size analysis, by Structure Type, 2022-2032

7.2.4.2. Market size analysis, by Application, 2022-2032

7.2.5. Italy

7.2.5.1. Market size analysis, by Structure Type, 2022-2032

7.2.5.2. Market size analysis, by Application, 2022-2032

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Structure Type, 2022-2032

7.2.6.2. Market size analysis, by Application, 2022-2032

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Structure Type, 2022-2032

7.3.1.2. Market size analysis, by Application, 2022-2032

7.3.2. Japan

7.3.2.1. Market size analysis, by Structure Type, 2022-2032

7.3.2.2. Market size analysis, by Application, 2022-2032

7.3.3. India

7.3.3.1. Market size analysis, by Structure Type, 2022-2032

7.3.3.2. Market size analysis, by Application, 2022-2032

7.3.4. Australia

7.3.4.1. Market size analysis, by Structure Type, 2022-2032

7.3.4.2. Market size analysis, by Application, 2022-2032

7.3.5. Indonesia

7.3.5.1. Market size analysis, by Structure Type, 2022-2032

7.3.5.2. Market size analysis, by Application, 2022-2032

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Structure Type, 2022-2032

7.3.6.2. Market size analysis, by Application, 2022-2032

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Structure Type, 2022-2032

7.4.1.2. Market size analysis, by Application, 2022-2032

7.4.2. UAE

7.4.2.1. Market size analysis, by Structure Type, 2022-2032

7.4.2.2. Market size analysis, by Application, 2022-2032

7.4.3. South Africa

7.4.3.1. Market size analysis, by Structure Type, 2022-2032

7.4.3.2. Market size analysis, by Application, 2022-2032

7.4.4. Argentina

7.4.4.1. Market size analysis, by Structure Type, 2022-2032

7.4.4.2. Market size analysis, by Application, 2022-2032

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Structure Type, 2022-2032

7.4.5.2. Market size analysis, by Application, 2022-2032

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. Latécoère

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Safran Landing Systems

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. GKN Aerospace

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. Aernnova

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Easterline

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Ostseestaal GmbH & Co.

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. Airbus

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. Lockheed Martin Corporation

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Triumph Group Inc

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Goodrich Corp

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com