Flavored Alcohol Market Report

RA09190

Flavored Alcohol Market by Type (Vodka, Rum, Whiskey, Wine, Beer, and Others), Flavor (Pineapple, Passion Fruit, Black Currant, Lime, Apple, Cherry, and Others), Distribution Channel (Supermarket/Hypermarket, Specialty Retailers, Convenience Stores, E-Commerce, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Flavored Alcohol Overview

Flavored alcohol, often known as flavored spirits or liqueurs, is a type of alcoholic beverage that has been infused with various tastes, herbs, spices, fruits, or other natural and artificial components to improve its taste and scent. These beverages are well-known for their diverse flavor profiles and can be consumed directly or included as important ingredients in cocktails and mixed drinks.

Liqueurs are sweetened spirits infused with a variety of flavors. They often have a lower alcohol content than straight spirits and can range from fruity (e.g., strawberry liqueur) to herbal (e.g., Chartreuse) to coffee-based (e.g., Kahlúa). Vodka is a popular base for flavor infusion, resulting in a wide range of options such as fruit-flavored vodka (e.g., raspberry, peach), spice-infused vodka (e.g., cinnamon), and even dessert-inspired flavors (e.g., whipped cream). Whiskey can be infused with various flavors, including honey, cinnamon, apple, and others, creating flavored whiskey variants. Flavored rum is infused with ingredients like coconut, pineapple, or spices to create tropical and spiced rum varieties. Gin can be infused with botanicals and herbs to create unique flavor profiles. Examples include sloe gin and various botanical gin infusions. Tequila can be infused with fruits like lime or mango to create flavored tequila options. These are fruit-based spirits, such as apple or cherry brandy, infused with the essence of the fruit.

Global Flavored Alcohol Market Analysis

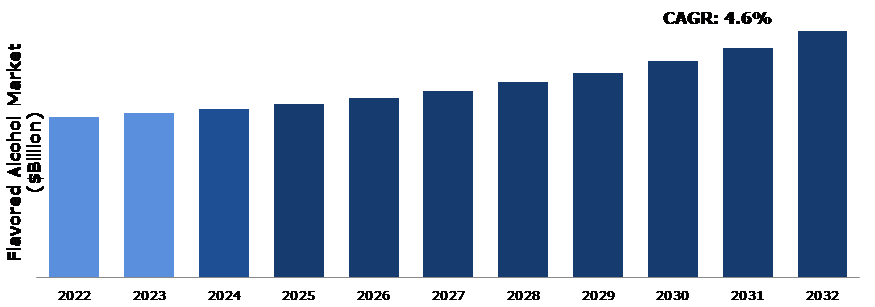

The global flavored alcohol market size was $1,167.4 billion in 2022 and is predicted to grow with a CAGR of 4.6%, by generating a revenue of $1,793.7 billion by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Flavored Alcohol Market

The COVID-19 pandemic significantly affected almost all industries globally. During the pandemic, the alcoholic drinks industry has seen a loss in business and a decrease in worldwide alcohol consumption. Restrictions on socializing and closure of all restaurants, nightclubs, and pubs during the pandemic led to drop in purchase and consumption of alcohol. Due to the entire shutdown of non-essential places, alcohol sales in bars, nightclubs, pubs, and restaurants were also impacted. Consumer drinking habits shifted dramatically during the COVID-19. Consumers used to enjoy alcoholic beverages at restaurants and pubs, but this transitioned to home consumption. According to the NCBI, the e-commerce sector was constantly rising as a result of COVID-19 constraints for the on-trade channel (in stores). In several countries, including China, the UK, Poland, and Italy, on-premise alcohol sales decreased during the pandemic compared to prior years; however, e-commerce sales of alcoholic beverages increased in the second half of 2020.

Rising Demand for High-End Flavored Spirit Specially Among Millennial Population to Drive the Market Growth

Consumer demand for high-end flavored spirits and more expensive drinks has increased due to rising disposable income and willingness to spend on desired products. Therefore, there is a greater demand for flavored spirits. Over the years, whisky has remained a popular alcoholic beverage among many drinkers, establishing a prominent position among luxury mixers. High sales of high-end and super-premium items is also driving demand for flavored spirits. Millennials are known for their daring and experimental eating and drinking habits. This generation seeks out distinct flavor experiences and appreciates experimenting with new items. Craft products appeal to millennials because they appreciate authenticity. Flavored spirits made by tiny, artisanal distilleries or with distinct flavor profiles may appeal to this age group. According to a recent Pennsylvania University research, 63% of males and 57% of women drank alcoholic beverages in 2022. Therefore, the market for flavored spirits is likely to expand in the upcoming years.

Industry Saturation and Competition from Other Alternatives to Restrain the Market Growth

The flavored spirits industry has seen an increase in the number of brands offering flavored choices. As more companies enter the market, competition heats up, making it difficult for new or smaller businesses to obtain exposure and market share. For example, the most popular spirits are baijiu, whiskey, and vodka, which accounted for 23%, 17%, and 14% of total alcohol consumption, respectively. Alcoholic products, notably flavored spirits, frequently have restricted shelf space in retailers. Because of the dominance of major brands and their wide product portfolios, the availability and visibility of lesser-known or niche-flavored spirits might be limited. All these factors are anticipated to hamper the market revenue growth during the forecast period.

Increasing Popularity of a Wide Range of Hybrid Alcohol Beverages to Drive Excellent Opportunities

Alcoholic beverage manufacturers have begun introducing ready-to-drink (RTD) hybrid beverages to meet evolving consumer preferences and tastes. These mixed beverages are alcoholic cocktails that incorporate components from numerous beverage categories. These are made with appealing flavor ingredients and manufacturing procedures in conjunction with diverse drinks. These firms create beers or spirits in wine barrels to impart a distinct flavor. In the spirits industry, hybrid cocktails made with tea and rum mixed with vodka are popular. Some of the popular hybrid alcohol drinks are Kahlua Midnight (rum and Kahlua), Malibu Red (rum and tequila), and Absolut Tune, which have raised customer demand as these RTD beverages are premium alcoholic drinks. Beer tastes have an important role in determining market growth since customers are much more open and adaptable to experimenting. Beer is a popular multi-generational product category since different beer flavors are associated with different generations. Tasting rooms for alcoholic beverages are becoming increasingly popular as a way for consumers to taste new flavors and contribute to crowd-sourcing beer innovations. This popular category is attracting new clients as industry players focus more on manufacturing RTD alcoholic beverages.

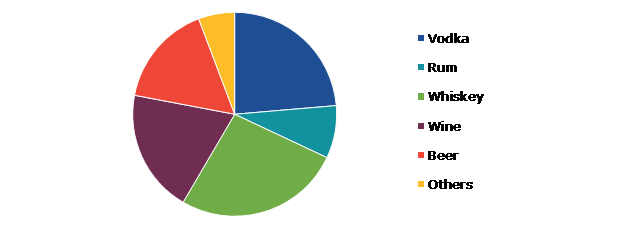

Global Flavored Alcohol Market Share, by Type, 2022

Source: Research Dive Analysis

The whiskey sub-segment accounted for the highest market share in 2022. The market is being driven ahead by the demand for variety in scotch whiskey from developing regions, as well as the demand for lower alcohol kinds and organic whiskey among health-conscious users. Furthermore, with a growing emphasis on healthy living around the world, individuals choose to consume top brands. In addition, prominent market participants have started a new trend of organic whiskey. Bainbridge Organic Distillers, for example, has created artisan-distilled spirits from U.S. DA-certified organic wheat, barley, triticale, and corn cultivated specifically for their distillery. Furthermore, the superiority of their grains is reflected in the quality of each of their products. Organic whiskey is mostly made from grains such as malt barley, maize, wheat, and rye. Consumers prefer the top brands in whiskey due to the brand image and the quality offered by these brands.

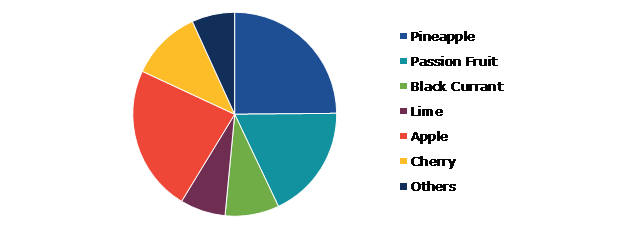

Global Flavored Alcohol Market Share, by Flavor, 2022

Source: Research Dive Analysis

The pineapple sub-segment accounted for the highest market share in 2022. Consumers prefer pineapple-flavored alcoholic beverages such as pineapple-infused rum, pineapple vodka, pineapple liqueurs, and pineapple-flavored cocktails such as the Pia Colada. Pineapple's sweet and tropical flavor provides a refreshing and fruity aspect to a variety of alcoholic beverages, making it a popular choice for both mixed drinks and standalone flavored spirits. However, the dominance of a specific flavor might still fluctuate depending on regional preferences and alcoholic beverage business trends.

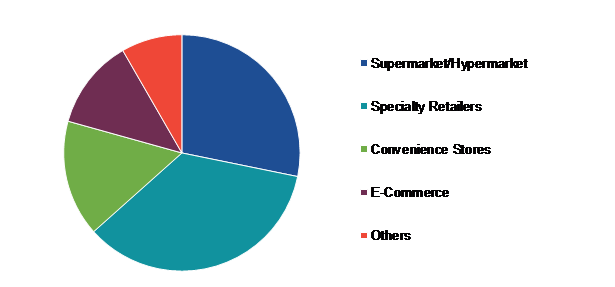

Global Flavored Alcohol Market Share, by Distribution Channel, 2022

Source: Research Dive Analysis

The supermarket/hypermarket sub-segment accounted for the highest market share in 2022 Supermarkets are becoming more popular due to the availability of a large variety of alcoholic beverages under one roof. Customers choose to buy on-sale alcoholic beverages that have health benefits owing to limited intake. Furthermore, products are placed close to one another, allowing shoppers to quickly compare them and decide which item to purchase. Supermarkets' appeal is increased further by urbanization, an increase in the working-class population, and competitive prices. Customers can purchase goods from these distribution channels at reasonable pricing, and they are usually located in convenient areas. Therefore, consumers can fulfill all of their purchasing needs while saving time.

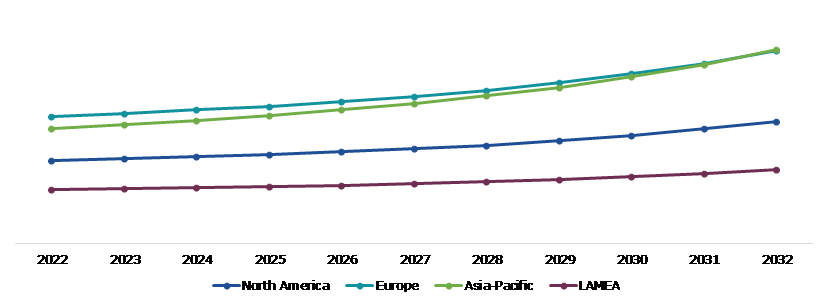

Global Flavored Alcohol Market Size & Forecast, by Region, 2022-2032 ($Billion)

Source: Research Dive Analysis

The Europe flavored alcohol market generated the highest revenue in 2022. Demand for flavored spirits, such as flavored vodkas, gins, and rums, has grown significantly throughout Europe. Consumers' interest in unusual and new flavors has increased, resulting in the launch of diverse flavored alternatives by both established and artisan distilleries. The emergence of cocktail culture in Europe, particularly in major cities such as London, Paris, and Berlin, has led to an increase in demand for flavored spirits and liqueurs. These goods are frequently utilized by mixologists and bartenders to produce signature cocktails. The Europe flavored alcohol market is expected to increase slowly in the upcoming years as well. Manufacturers are attempting to launch new and unique forms; therefore, flavored alcohol companies are making rapid development in terms of developing innovative spreading possibilities. The market for alcoholic flavors is expected to grow rapidly during the forecast period, owing to significant investments made by market players in social media marketing and promotional activities aimed at increasing plant-based trends and consumers' desire to consume more healthy nutritional food products.

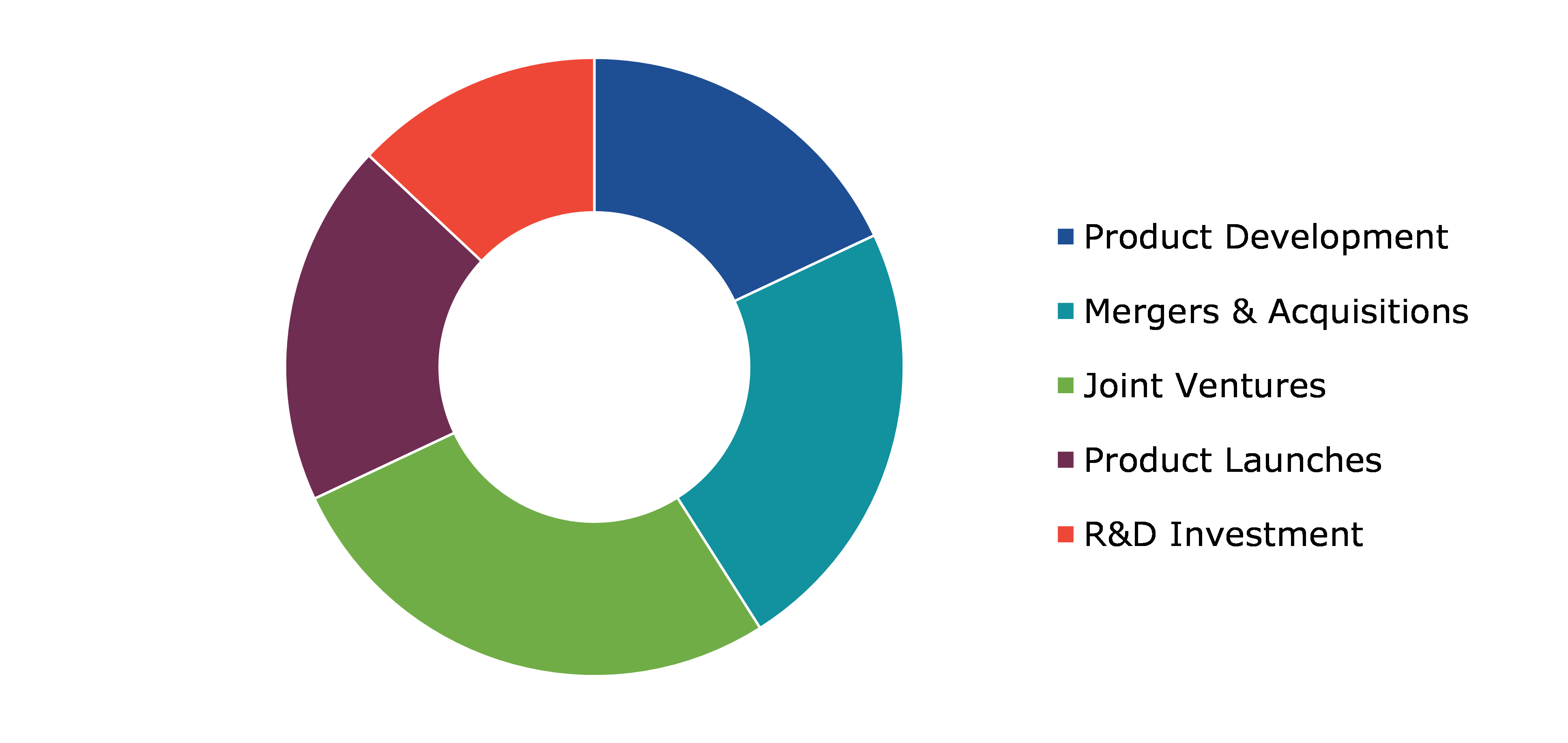

Competitive Scenario in the Global Flavored Alcohol Market

Investment and agreement are common strategies followed by major market players. One of the leading market players in the industry is Symrise AG. In April 2021, Symrise AG launched a new range of alcoholic flavors for beverages, including whiskey, rum, gin, and tequila flavors. The company aims to cater to the growing demand for premium flavored alcoholic beverages.

Source: Research Dive Analysis

Some of the companies operating in the flavored alcohol market are Kerry Group, Cargill Inc., ADM, Givaudan, Symrise AG, TOSHEV, Austria Juice, MANE, Dakini Health Foods, and Castel Group.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Flavor |

|

|

Segmentation by Distribution Channel

|

|

| Key Companies Profiled |

|

Q1. What is the size of the global flavored alcohol market?

A. The size of the global flavored alcohol market was over $1,167.4 billion in 2022 and is projected to reach $1,793.7 billion by 2032.

Q2. Which are the major companies in the flavored alcohol market?

A. Kerry Group, Cargill Inc., and ADM are some of the key players in the global flavored alcohol market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific flavored alcohol market?

A. The Asia-Pacific flavored alcohol market is anticipated to grow at 5.6% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Beekeeper AG, Sociabble, Inc., and Social Chorus. Inc. are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global flavored alcohol market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Environmental

4.7. Impact of COVID-19 on flavored alcohol market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Flavored Alcohol Market Analysis, by Type

5.1. Overview

5.2. Vodka

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Rum

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Whiskey

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Wine

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2022-2032

5.5.3. Market share analysis, by country, 2022-2032

5.6. Beer

5.6.1. Definition, key trends, growth factors, and opportunities

5.6.2. Market size analysis, by region, 2022-2032

5.6.3. Market share analysis, by country, 2022-2032

5.7. Others

5.7.1. Definition, key trends, growth factors, and opportunities

5.7.2. Market size analysis, by region, 2022-2032

5.7.3. Market share analysis, by country, 2022-2032

5.8. Research Dive Exclusive Insights

5.8.1. Market attractiveness

5.8.2. Competition heatmap

6. Flavored Alcohol Market Analysis, by Flavor

6.1. Pineapple

6.1.1. Definition, key trends, growth factors, and opportunities

6.1.2. Market size analysis, by region, 2022-2032

6.1.3. Market share analysis, by country, 2022-2032

6.2. Passion Fruit

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Black Currant

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Lime

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Apple

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2022-2032

6.5.3. Market share analysis, by country, 2022-2032

6.6. Cherry

6.6.1. Definition, key trends, growth factors, and opportunities

6.6.2. Market size analysis, by region, 2022-2032

6.6.3. Market share analysis, by country, 2022-2032

6.7. Others

6.7.1. Definition, key trends, growth factors, and opportunities

6.7.2. Market size analysis, by region, 2022-2032

6.7.3. Market share analysis, by country, 2022-2032

6.8. Research Dive Exclusive Insights

6.8.1. Market attractiveness

6.8.2. Competition heatmap

7. Flavored Alcohol Market Analysis, by Distribution Channel

7.1. Supermarket/Hypermarket

7.1.1. Definition, key trends, growth factors, and opportunities

7.1.2. Market size analysis, by region, 2022-2032

7.1.3. Market share analysis, by country, 2022-2032

7.2. Specialty Retailers

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2022-2032

7.2.3. Market share analysis, by country, 2022-2032

7.3. Convenience Stores

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2022-2032

7.3.3. Market share analysis, by country, 2022-2032

7.4. E-Commerce

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2022-2032

7.4.3. Market share analysis, by country, 2022-2032

7.5. Others

7.5.1. Definition, key trends, growth factors, and opportunities

7.5.2. Market size analysis, by region, 2022-2032

7.5.3. Market share analysis, by country, 2022-2032

7.6. Research Dive Exclusive Insights

7.6.1. Market attractiveness

7.6.2. Competition heatmap

8. Flavored Alcohol Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Type, 2022-2032

8.1.1.2. Market size analysis, by Flavor, 2022-2032

8.1.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.2. Canada

8.1.2.1. Market size analysis, by Type, 2022-2032

8.1.2.2. Market size analysis, by Flavor, 2022-2032

8.1.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.3. Mexico

8.1.3.1. Market size analysis, by Type, 2022-2032

8.1.3.2. Market size analysis, by Flavor, 2022-2032

8.1.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Type, 2022-2032

8.2.1.2. Market size analysis, by Flavor, 2022-2032

8.2.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.2. UK

8.2.2.1. Market size analysis, by Type, 2022-2032

8.2.2.2. Market size analysis, by Flavor, 2022-2032

8.2.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.3. France

8.2.3.1. Market size analysis, by Type, 2022-2032

8.2.3.2. Market size analysis, by Flavor, 2022-2032

8.2.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.4. Spain

8.2.4.1. Market size analysis, by Type, 2022-2032

8.2.4.2. Market size analysis, by Flavor, 2022-2032

8.2.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.5. Italy

8.2.5.1. Market size analysis, by Type, 2022-2032

8.2.5.2. Market size analysis, by Flavor, 2022-2032

8.2.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Type, 2022-2032

8.2.6.2. Market size analysis, by Flavor, 2022-2032

8.2.6.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Type, 2022-2032

8.3.1.2. Market size analysis, by Flavor, 2022-2032

8.3.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.2. Japan

8.3.2.1. Market size analysis, by Type, 2022-2032

8.3.2.2. Market size analysis, by Flavor, 2022-2032

8.3.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.3. India

8.3.3.1. Market size analysis, by Type, 2022-2032

8.3.3.2. Market size analysis, by Flavor, 2022-2032

8.3.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.4. Australia

8.3.4.1. Market size analysis, by Type, 2022-2032

8.3.4.2. Market size analysis, by Flavor, 2022-2032

8.3.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.5. South Korea

8.3.5.1. Market size analysis, by Type, 2022-2032

8.3.5.2. Market size analysis, by Flavor, 2022-2032

8.3.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Type, 2022-2032

8.3.6.2. Market size analysis, by Flavor, 2022-2032

8.3.6.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Type, 2022-2032

8.4.1.2. Market size analysis, by Flavor, 2022-2032

8.4.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.2. Saudi Arabia

8.4.2.1. Market size analysis, by Type, 2022-2032

8.4.2.2. Market size analysis, by Flavor, 2022-2032

8.4.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.3. UAE

8.4.3.1. Market size analysis, by Type, 2022-2032

8.4.3.2. Market size analysis, by Flavor, 2022-2032

8.4.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.4. South Africa

8.4.4.1. Market size analysis, by Type, 2022-2032

8.4.4.2. Market size analysis, by Flavor, 2022-2032

8.4.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Type, 2022-2032

8.4.5.2. Market size analysis, by Flavor, 2022-2032

8.4.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. Kerry Group

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Cargill Inc.

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. ADM

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Givaudan

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Symrise AG

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. TOSHEV

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Austria Juice

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. MANE

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Dakini Health Foods

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Castel Group

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com