Solvent Based Laminating Adhesives Market Report

RA09183

Solvent Based Laminating Adhesives Market by Material (Polyethylene Terephthalate (PET) and Others), Application (Food Packaging, Medical & Healthcare, Cosmetic Products, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Solvent Based Laminating Adhesives Overview

Solvent based laminating adhesives stands as a versatile and widely utilized adhesive in industries such as packaging, printing, and laminating. This adhesives type is formulated by dissolving adhesives components in a solvent, resulting in a liquid adhesive that can be seamlessly applied to an extensive range of materials. The key characteristic of this adhesive lies in its ability to form a robust bond between materials after the solvent evaporates, leaving behind a hardened adhesives layer. Solvent based laminating adhesives offers strength and efficiency. The adhesives are characterized by a strong odor, necessitating the use of well-ventilated areas to mitigate potential health concerns for individuals involved in the application process. Furthermore, the solvent used in the adhesive’s formulation can be flammable, emphasizing the importance of adhering to safety protocols and conducting operations in environments equipped to handle the associated risks.

Solvent based adhesives are a highly versatile solution with a broad spectrum of applications, showcasing their efficacy in both basic and high-performance tasks across diverse industries. The inherent adaptability of solvent based adhesives makes them an ideal choice for demanding applications such as food packaging, medicinal products packaging, etc., that require quality performance characteristics.

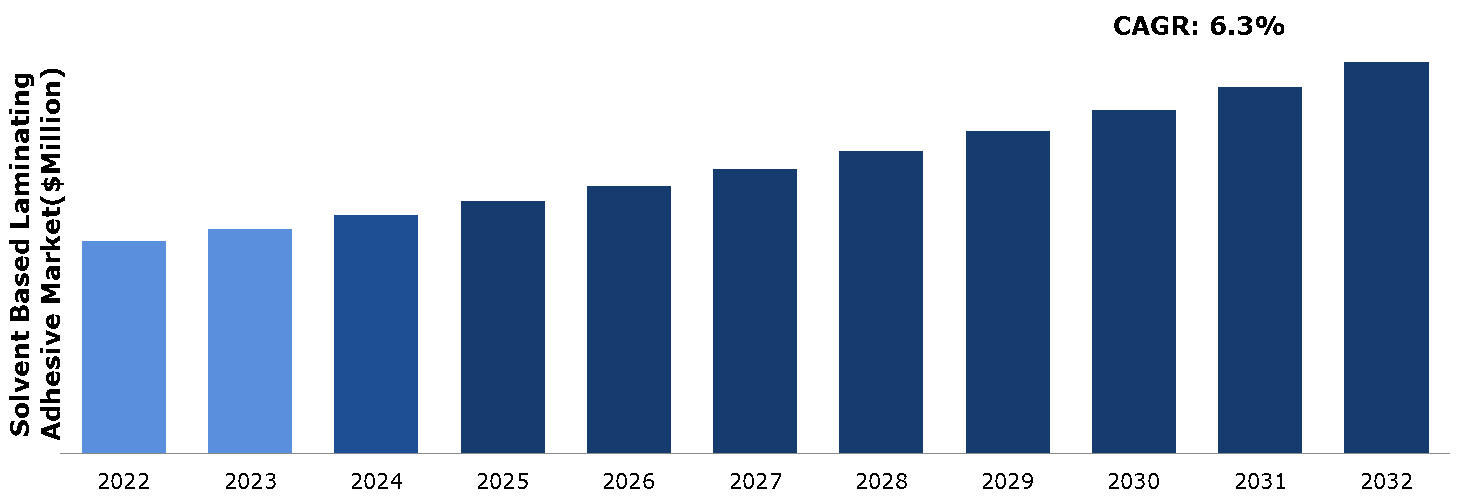

Global Solvent Based Adhesives Market Analysis

The global solvent based adhesives market size was $1,412.5 million in 2022 and is predicted to grow with a CAGR of 6.3%, by generating a revenue of $2,599.3 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Solvent Based Laminating Adhesives Market

The COVID-19 pandemic exerted a multifaceted impact on the use and production of solvent based adhesives, influencing various aspects of supply chains, demand dynamics, and operational paradigms within industries reliant on these adhesives. The pandemic disrupted the supply chain, with restrictions on the movement of goods and the closure of manufacturing facilities contributing to challenges in the sourcing and distribution of raw materials essential for solvent based adhesives production. These disruptions, coupled with workforce limitations imposed by health and safety measures, have resulted in delays and shortages, affecting industries that heavily depend on solvent-based adhesives for their manufacturing processes.

However, the pandemic catalyzed innovation and adaptation within the adhesives industry. Manufacturers of solvent based adhesives responded to market demands by developing formulations with reduced environmental impact, lower volatile organic compounds (VOCs) emissions, and improved safety profiles. This shift aligns with broader industry trends toward sustainable and eco-friendly solutions, reflecting a recognition of the importance of environmental responsibility in the post-pandemic landscape.

Rising Demand for Solvent Based Laminating Adhesives in Food & Beverages to Drive the Market Growth

The food and beverage industry's growing need for solvent based laminating adhesives is crucial since these adhesives guarantee the integrity and security of packaging for consumable goods. Within this industry, solvent based laminating adhesives have grown in popularity because of their special qualities and capacity to solve certain problems related to food packaging. The necessity for high-performance packaging in the food and beverage industry is another factor driving the demand for solvent based laminating adhesives. Because of these adhesives’ resilience to oils, moisture, and other environmental elements, the packaging is guaranteed to stay safe and undamaged even under trying circumstances. Consequently, they are essential in prolonging the life of perishable products and averting infection. The effective and economical application techniques of solvent based laminating adhesives make them preferred choice for packaging. The adhesives can be applied with a variety of tools, including rollers and sprayers, enabling a smooth integration into current production procedures. Solvent based adhesives have the advantage of quick drying times, which increase productivity and save manufacturing costs.

Fluctuating Raw Material Prices to Restrain the Market Growth

The market for solvent based laminating adhesives faces a significant challenge in the form of fluctuating raw material prices. The prices of key raw materials used in the production of these adhesives can be volatile, impacting production costs and, subsequently, market dynamics. This volatility poses several challenges to the growth and stability of the market. The fluctuation in raw material prices impacts on the manufacturing costs. The production of solvent based laminating adhesives relies on various components, and any sudden increase in the prices of these raw materials can lead to elevated production expenses. This may result in higher overall costs for the end products. Customers and end-users of solvent based laminating adhesives may also be impacted by the price volatility. Increased production costs may be passed on to consumers in the form of higher prices for laminated products. This can influence purchasing decisions and potentially lead to a shift towards alternative adhesives technologies or products, impacting the market share of solvent based laminating adhesives.

Increasing Demand for Advanced Flexible Packaging to Drive Excellent Opportunities

The increasing demand for advanced flexible packaging presents a significant opportunity for the growth of the solvent based laminating adhesives market. Flexible packaging has been a popular option in many different industries because of its advantages in terms of sustainability, cost-effectiveness, and versatility. Packaging solutions that improve product safety, shelf life, and aesthetic appeal while still being convenient are becoming more and more important as customer preferences change. Solvent based laminating adhesives play a pivotal role in meeting these evolving demands and are poised to capitalize on the expanding market for advanced flexible packaging. Flexible packaging has extensive application in various industries, including food & beverage, pharmaceutical, and personal care. It contributes to environmental sustainability by providing benefits like lower material consumption, lighter packaging, and more effective transportation. The firm bonding capabilities and versatility of solvent based laminating adhesives make them an ideal choice for a wide range of substrates. This allows them to easily meet the demands of flexible packaging applications.

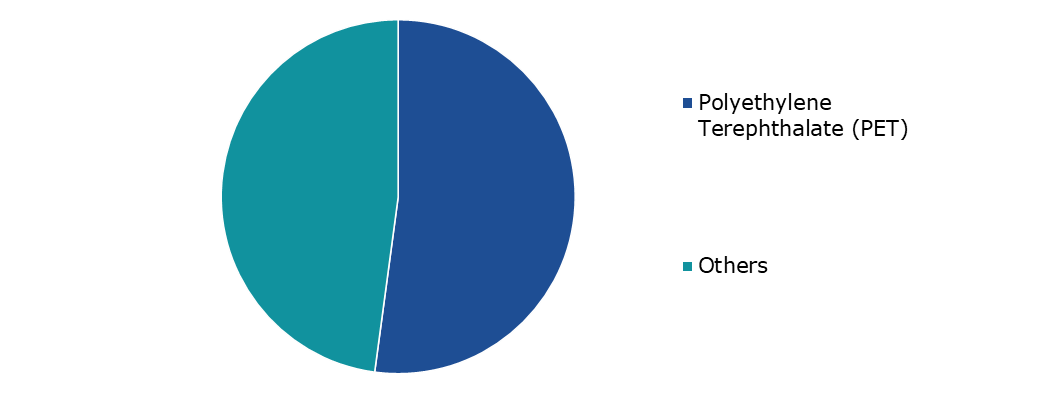

Global Solvent Based Laminating Adhesives Market Share, by Material, 2022

Source: Research Dive Analysis

The polyethylene terephthalate (PET) sub-segment accounted for the highest market share in 2022. Polyethylene terephthalate (PET) has emerged as a versatile material, finding extensive applications across diverse industries, with its utilization notably prominent in packaging. Renowned for its attributes such as clarity, strength, and recyclability, PET has become a preferred choice in laminating adhesives, particularly serving as a substrate in flexible packaging solutions. The decision on the adhesive’s selection hinges on a multitude of factors, ranging from specific application requirements to the nature of substrate materials and desired performance characteristics. Advancements in adhesives technologies have further catalyzed this trend, providing manufacturers with a spectrum of options to provide solutions according to specific application demands. As the packaging landscape continues to evolve, PET's versatility and compatibility with innovative adhesives formulations escalates its adoption for enhanced packaging performance, meeting the demands of a dynamic and competitive market.

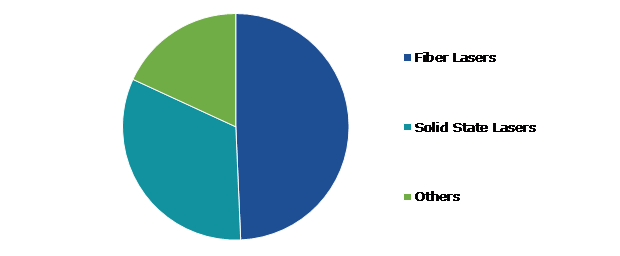

Global Solvent Based Laminating Adhesives Market Share, by Application, 2022

Source: Research Dive Analysis

The food packaging sub-segment accounted for the highest market share in 2022. The escalating demand for flexible food packaging is emerging as a significant driver propelling the growth of the solvent based laminating adhesives market. Flexible packaging has become increasingly popular in the food industry due to its lightweight nature, cost-effectiveness, and versatility in accommodating various product shapes and sizes. Solvent based laminating adhesives, with their bonding properties and adaptability, are playing a pivotal role in meeting the stringent requirements of flexible food packaging applications. Furthermore, solvent based laminating adhesives offer exceptional barrier properties, providing an effective shield against external factors such as moisture, oxygen, and light. This is particularly vital in food packaging, where maintaining the quality and safety of the enclosed products is paramount. The versatility of solvent based adhesives allows for the bonding of diverse substrates, enabling the creation of multi-layered packaging structures that address specific packaging requirements.

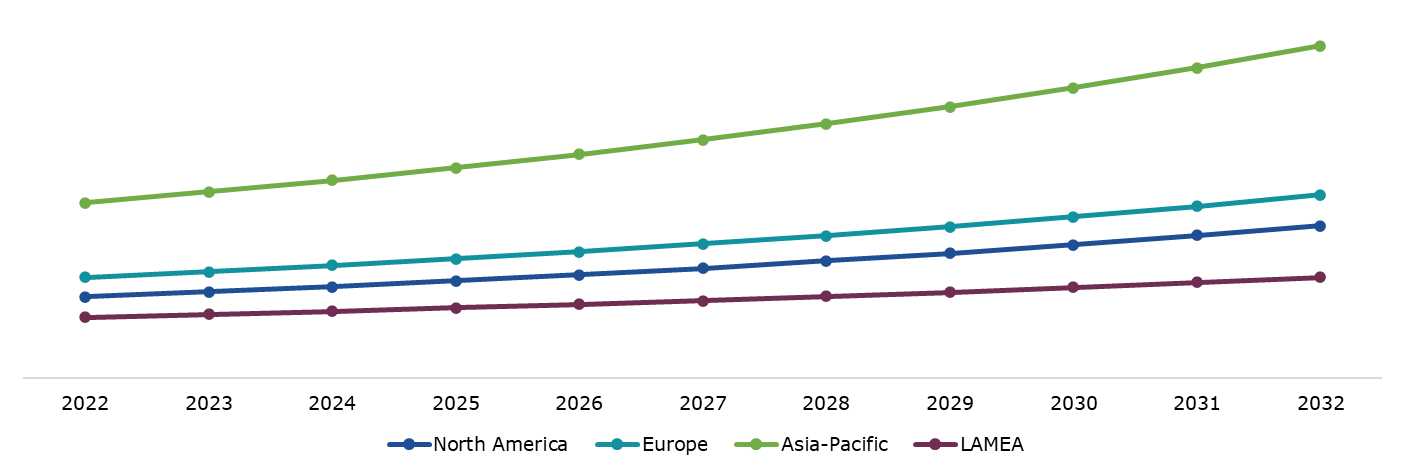

Global Solvent Based Laminating Adhesives Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The Asia-Pacific solvent based laminating adhesives market generated the highest revenue in 2022. Asia-Pacific region is experiencing an upswing in the solvent based laminating adhesives market, driven by the dynamic expansion of the manufacturing and industrial landscape in this region. This surge in growth is particularly evident in industries such as automotive, electronics, and textiles, these industries are undergoing rapid development. In these sectors laminating adhesives play a crucial role in diverse applications, ranging from bonding materials in automotive interiors to assembling electronic components. The adaptability and versatility of solvent based adhesives make them highly suitable for meeting the varied manufacturing needs prevalent across these industries, contributing significantly to their widespread adoption throughout the industrial spectrum. Furthermore, the Asia-Pacific region's industrial landscape is witnessing a continuous expansion, creating a conducive environment for the growth of the solvent based laminating adhesives market. As manufacturing activities thrive, the demand for adhesives that can meet the stringent requirements of diverse applications continues to rise. Solvent based laminating adhesives, with their proven track record of versatility, reliability, and aesthetic enhancement, are well-positioned to capitalize on these opportunities and establish themselves as integral components in the region's industrial ecosystem.

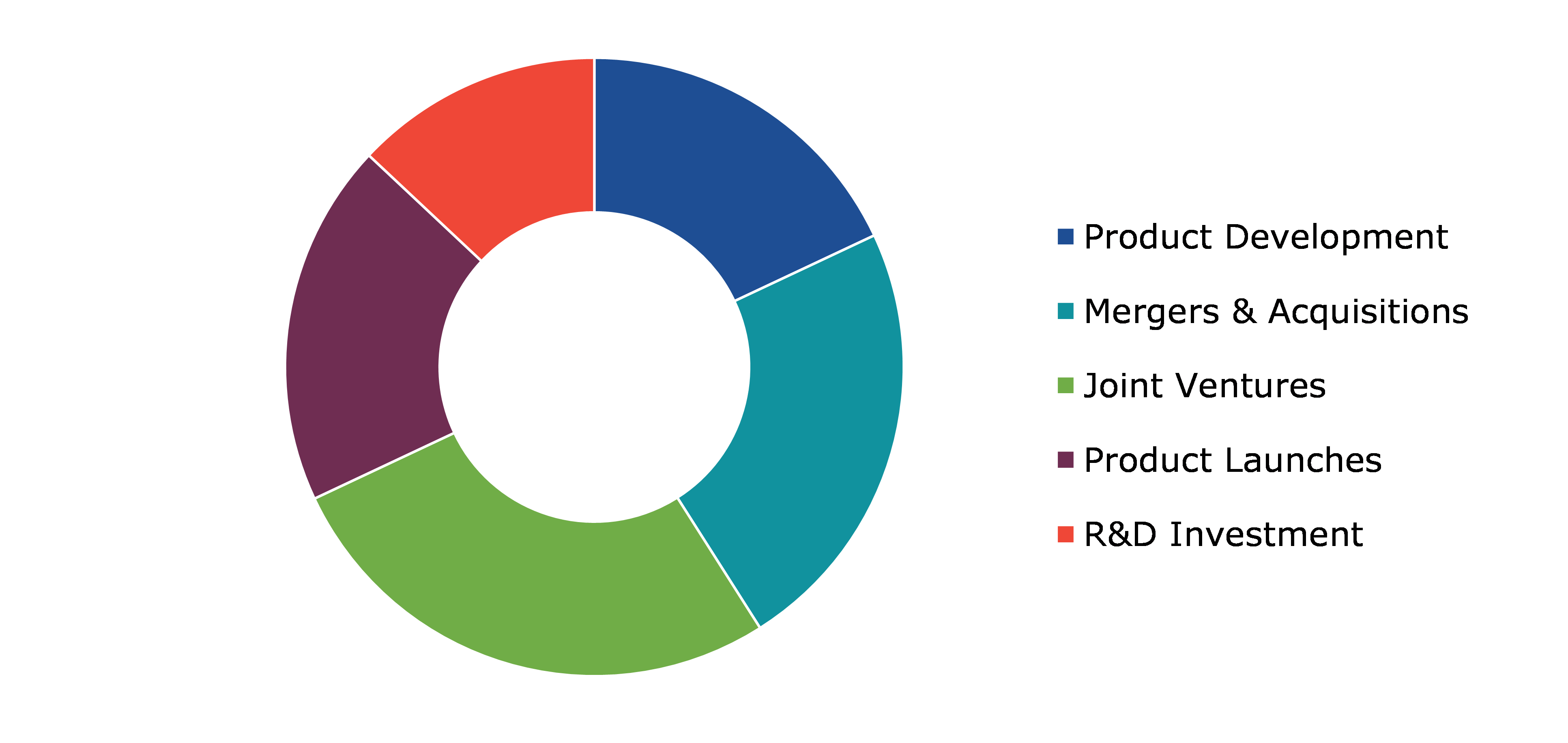

Competitive Scenario in the Global Solvent Based Laminating Adhesives Market

Product launch, investment, and acquisition are common strategies followed by major market players. For instance, in June 2022, Toyo-Morton, a Japanese manufacturer of laminating adhesives and a member of the Toyo Ink Group, has recently enhanced its laminating adhesives portfolio to introduce a range of food-safe products, reinforcing its commitment to delivering high-quality and compliant solutions. Notably, these new additions to the portfolio are distinguished by their exclusion of epoxy silanes and organic tin compounds, aligning with evolving industry standards and addressing growing concerns about food safety. The updated portfolio encompasses two key series: the solvent based Tomoflex and the solvent-free Ecoad series of laminating adhesives. These products cater to a diverse array of multilayer flexible packaging applications, demonstrating versatility in meeting the demands of various packaging scenarios. Specifically, the Tomoflex solvent based series introduces the TM-2470 formulation, designed with precision for liquid pouch applications. This particular adhesive variant is tailored to suit the unique requirements of packaging for liquids such as soups, frozen foods, pickled items, and noodles, emphasizing Toyo-Morton's commitment to providing solutions that align with the diverse needs of the food packaging industry. Additionally, within the Tomoflex series, the TM-3040 adhesives emerges as a fitting choice for dry food packaging applications. Its compatibility extends to the packaging of snack foods, candies, and pet foods, showcasing the adaptability of Toyo-Morton's laminating adhesives in addressing a broad spectrum of dry food packaging requirements.

Source: Research Dive Analysis

Some of the leading solvent based laminating adhesives market players are Henkel Corporation, Arkema Group, Ashland, Dow Chemical Company, Evonik Industries, H.B. Fuller, 3M, COIM Group, Flint Group, and Morchem.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Material |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global solvent based laminating adhesives market?

A. The size of the global solvent based laminating adhesives market was $1,412.5 million in 2022 and is projected to reach $2,599.3 million by 2032.

Q2. Which are the major companies in the solvent based laminating adhesives market?

A. Henkel Corporation, Arkema Group, Ashland, Dow Chemical Company, Evonik Industries, H.B. Fuller, 3M, COIM Group, Flint Group, and Morchem are some of the key players in the global solvent based laminating adhesives market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia Pacific region possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia Pacific solvent based laminating adhesives market?

A. The Asia-Pacific solvent based laminating adhesives market is anticipated to grow at 6.7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Continuous improvement and brand product differentiation are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Henkel Corporation, Arkema Group, and H.B. Fuller are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global solvent based laminating adhesive market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Environmental

4.7. Impact of COVID-19 on solvent based laminating adhesive market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Solvent Based Laminating Adhesive Market Analysis, by Material

5.1. Overview

5.2. Polyethylene Terephthalate (PET)

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Others

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Solvent Based Laminating Adhesive Market Analysis, by Application

6.1. Overview

6.2. Food Packaging

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Medical & Healthcare

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Cosmetic Products

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Others

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2022-2032

6.5.3. Market share analysis, by country, 2022-2032

6.6. Research Dive Exclusive Insights

6.6.1. Market attractiveness

6.6.2. Competition heatmap

7. Solvent Based Laminating Adhesive Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by material, 2022-2032

7.1.1.2. Market size analysis, by application, 2022-2032

7.1.2. Canada

7.1.2.1. Market size analysis, by material, 2022-2032

7.1.2.2. Market size analysis, by application, 2022-2032

7.1.3. Mexico

7.1.3.1. Market size analysis, by material, 2022-2032

7.1.3.2. Market size analysis, by application, 2022-2032

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by material, 2022-2032

7.2.1.2. Market size analysis, by application, 2022-2032

7.2.2. UK

7.2.2.1. Market size analysis, by material, 2022-2032

7.2.2.2. Market size analysis, by application, 2022-2032

7.2.3. France

7.2.3.1. Market size analysis, by material, 2022-2032

7.2.3.2. Market size analysis, by application, 2022-2032

7.2.4. Spain

7.2.4.1. Market size analysis, by material, 2022-2032

7.2.4.2. Market size analysis, by application, 2022-2032

7.2.5. Italy

7.2.5.1. Market size analysis, by material, 2022-2032

7.2.5.2. Market size analysis, by application, 2022-2032

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by material, 2022-2032

7.2.6.2. Market size analysis, by application, 2022-2032

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by material, 2022-2032

7.3.1.2. Market size analysis, by application, 2022-2032

7.3.2. Japan

7.3.2.1. Market size analysis, by material, 2022-2032

7.3.2.2. Market size analysis, by application, 2022-2032

7.3.3. India

7.3.3.1. Market size analysis, by material, 2022-2032

7.3.3.2. Market size analysis, by application, 2022-2032

7.3.4. Australia

7.3.4.1. Market size analysis, by material, 2022-2032

7.3.4.2. Market size analysis, by application, 2022-2032

7.3.5. South Korea

7.3.5.1. Market size analysis, by material, 2022-2032

7.3.5.2. Market size analysis, by application, 2022-2032

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by material, 2022-2032

7.3.6.2. Market size analysis, by application, 2022-2032

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by material, 2022-2032

7.4.1.2. Market size analysis, by application, 2022-2032

7.4.2. UAE

7.4.2.1. Market size analysis, by material, 2022-2032

7.4.2.2. Market size analysis, by application, 2022-2032

7.4.3. Saudi Arabia

7.4.3.1. Market size analysis, by material, 2022-2032

7.4.3.2. Market size analysis, by application, 2022-2032

7.4.4. South Africa

7.4.4.1. Market size analysis, by material, 2022-2032

7.4.4.2. Market size analysis, by application, 2022-2032

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by material, 2022-2032

7.4.5.2. Market size analysis, by application, 2022-2032

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. Henkel Corporation

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Arkema Group

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. Ashland

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. Dow Chemical Company

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Evonik Industries

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. H.B. Fuller

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. 3M

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. COIM Group

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Flint Group

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Morchem

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com