Gypsum And Drywall Market Report

RA08764

Gypsum and Drywall Market by Product (Wallboard, Ceiling Board, Pre-decorated Board, and Others), End User (Commercial and Residential), Thickness (1/2 Inch, 5/8 Inch, and More than 5/8 Inch), and Region (North America, Europe, Asia-Pacific, and LAMEA): Opportunity Analysis and Industry Forecast, 2023-2032

Gypsum & Drywall Overview

Gypsum is a naturally occurring mineral made of calcium sulfate dihydrate, with a chemical formula that makes it a useful aid in a range of industries. Is derived from the Greek word ‘gypsos,’ which means ‘plaster,’ emphasizing its historic and vital utilization in construction and different uses. Gypsum appears in its natural state as a soft, white or grayish rock that may be readily processed into a fine powder. Gypsum and drywall are panels of various chemical materials used to prepare the interior walls or ceiling. The combinations used may be tailored to make the wall fire resistant, water resistant, durable, and soundproof.

Furthermore, the continuous surface of gypsum and drywall expands its applicability for numerous interior decorations. Gypsum board is regularly utilized in the construction sector due to its features like fire resistance, sound attenuation, and durability. It is specially used as the floor layer of indoors partitions and ceilings, as a base for ceramic, plastic, and metallic tiles for exterior soffits; for elevator and different shaft enclosures; as area-separation partitions between constructing units; and to provide fire safety for structural elements.

Global Gypsum & Drywall Market Analysis

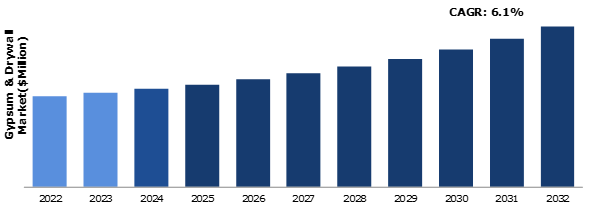

The global gypsum & drywall market size was $29,290.5 million in 2022 and is predicted to grow with a CAGR of 6.1%, by generating a revenue of $51,910.7 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Gypsum & Drywall Market

The COVID-19 impact on gypsum & drywall market hampered the expansion of the drywall and gypsum board industry. As nations implemented lockdowns and restrictions, the sector encountered supply chain disruptions, labor shortages, and project timetable delays. The construction industry experienced a slowdown as many projects were placed on hold or canceled. Furthermore, post-pandemic trends emphasized sustainability and energy efficiency, which presented opportunities for lightweight and eco-friendly gypsum board solutions. Manufacturers responded by investing in R&D to create greener alternatives, incorporating recycled materials and optimizing production processes, thus catering to the rising demand for environmentally responsible construction materials.

Rising Demand from the Construction Sector to Drive the Market Growth

The gypsum & drywall market growth has been experiencing substantial growth, largely driven by the increasing demand from the construction sector. There is a growing demand for residential and commercial constructions owing to the rapid industrialization. This surge in construction activities, along with the trend toward urbanization, has led to a soaring demand for environment friendly and cost-effective constructing materials. Drywall and gypsum boards, with their ease of installation, versatility, and favorable fire-resistant properties, have become go-to choices for architects, builders, and constructors globally. Furthermore, the rise in environmental awareness has also contributed to the popularity of these materials. Gypsum, being a natural mineral, is an environmentally friendly option for construction, and its use helps reduce the dependency on more resource-intensive materials. In addition, drywall's excellent thermal insulation and soundproofing capabilities align with the increasing focus on sustainable and energy-efficient building practices. All these are the major factors projected to drive the market growth in the upcoming years.

To know more about global gypsum & drywall market drivers, get in touch with our analysts here.

Challenges in Processing Gypsum to Restrain the Market Growth

Challenges in processing gypsum have the potential to restrain the market growth despite its increasing demand. One of the primary obstacles lies in the complex drying process required to remove the inherent moisture from gypsum, which can be time-consuming and resource-intensive. In addition, the abrasive nature of gypsum can lead to wear and tear on processing equipment, necessitating frequent maintenance and replacement, adding to operational costs. Another significant challenge is the high energy consumption associated with the processing methods, impacting overall production costs and environmental sustainability. All these factors are anticipated to restrict the market growth during the forecast period. To overcome these restraints, continuous efforts are needed to develop more efficient and eco-friendly processing techniques, ensuring a sustainable growth trajectory for the gypsum industry in the face of these challenges.

Technological Advancements to Drive Excellent Opportunities

The advent of technological advancements in lightweight and eco-friendly gypsum board presents excellent opportunities for the construction industry. As sustainability becomes a crucial consideration in modern building practices, the demand for environmentally responsible construction materials is on the rise. Lightweight gypsum boards, made possible through innovative manufacturing techniques, offer easier handling and installation, reducing labor and transportation costs. Moreover, their enhanced thermal insulation properties contribute to energy efficiency, aligning with green building standards and regulations. With a focus on reducing the environmental impact, eco-friendly gypsum boards, which incorporate recycled materials and low-carbon production processes, are gaining traction among environmentally conscious consumers and construction companies. These advancements not only meet the market's sustainability expectations but also open new avenues for growth and market expansion, attracting investments and driving the development of greener, more sustainable gypsum board solutions.

To know more about global gypsum & drywall market opportunities, get in touch with our analysts here.

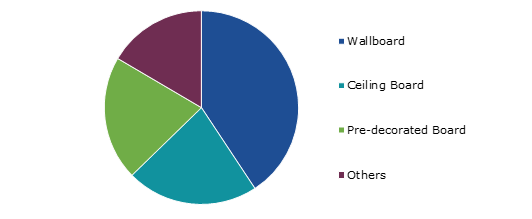

Global Gypsum & Drywall Market Share, by Product, 2022

Source: Research Dive Analysis

The wallboard sub-segment accounted for the highest market share in 2022. The usage of wallboard in suspended ceilings and non-load-bearing walls is expanding, which is driving its demand. Wallboard is transforming both residential and commercial building as it gains popularity as a superior alternative to traditional plaster and wood solutions. Due to the increase in development of commercial and residential installations across the world, wallboard comprised the largest segment. In addition, the rising use of wallboards in wrapping the interior and exterior of buildings, due to their thickness and fire-resistant core materials, is boosting the expansion of the gypsum & drywall market. Wallboards have been the most popular product category due to their general acceptance as an alternative to plaster. Rising demand for environmentally friendly building is expected to increase product demand in the upcoming years. Furthermore, the product's continuing innovation is expected to increase its acceptance in high-end building applications. These boards are often utilized in commercial applications because they offer superior surface durability and color retention while providing for flexibility in changing workspace designs.

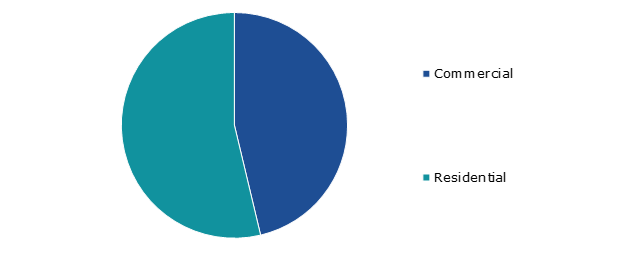

Global Gypsum & Drywall Market Share, by End User, 2022

Source: Research Dive Analysis

The residential sub-segment accounted for the highest market share in 2022. Due to rising disposable income levels and rapid urbanization, residential building is one of the most important industries in emerging countries such as China, India, and Brazil. Rapidly expanding residential sector in these countries has resulted in an increase in demand for different building materials, including gypsum, which is utilized as a component of walls, ceilings, and roofs. Depending on its intended usage by architects or builders, the product is used not only as drywall but also as pre-decorated boards or wallboards. In advertising, gypsum is utilized to replicate the look and feel of actual brick or stone. Drywall may also be used to mimic the appearance and feel of actual brick or stone.

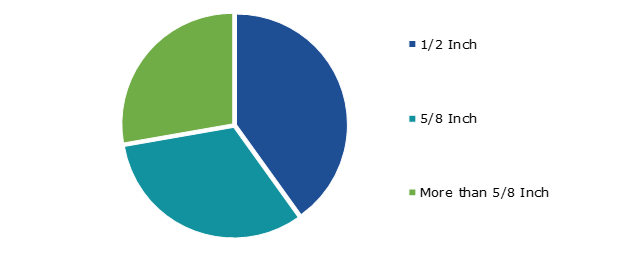

Global Gypsum & Drywall Market Share, by Thickness, 2022

Source: Research Dive Analysis

The 1/2 inch sub-segment accounted for the highest market share in 2022. Gypsum and drywall, both available in a 1/2 inch thickness, are vital materials for interior wall and ceiling applications in modern construction. Gypsum, a naturally occurring mineral, is ground into a powder and positioned between layers of thick paper to shape the core of drywall. The 1/2-inch thickness achieves a compromise between structural integrity and adaptability, making it appropriate for a wide range of residential and industrial projects. 1/2 inch gypsum board or drywall has been a popular alternative due to its ease of set up and great fire resistance, offering a clean and paintable floor that promotes efficient finishing and customization. Its widespread availability and low cost make it a building standard, providing a practical and dependable alternative for creating visually beautiful and long-lasting interiors. All these factors are projected to drive the 1/2 inch thickness segment growth during the forecast period.

Global Gypsum & Drywall Market Size & Forecast, by Region 2022- 2032 ($Million)

Source: Research Dive Analysis

The North America gypsum & drywall market share generated the highest revenue in 2022. There is a rising demand for sustainable construction methods due to the widespread adoption of cutting-edge technologies and the availability of competent personnel. Growing spending on residential and commercial constructions in the region is a key driver of the market expansion. Furthermore, the demand for gypsum or drywall is further driven by the presence of major manufacturers in the region. The rising use of affordable building materials, the expansion of renovation and construction projects in commercial, industrial, and institutional buildings, and the rising public demand for luxurious houses provided with modern comforts are some of the key factors boosting the North America gypsum & drywall market growth.

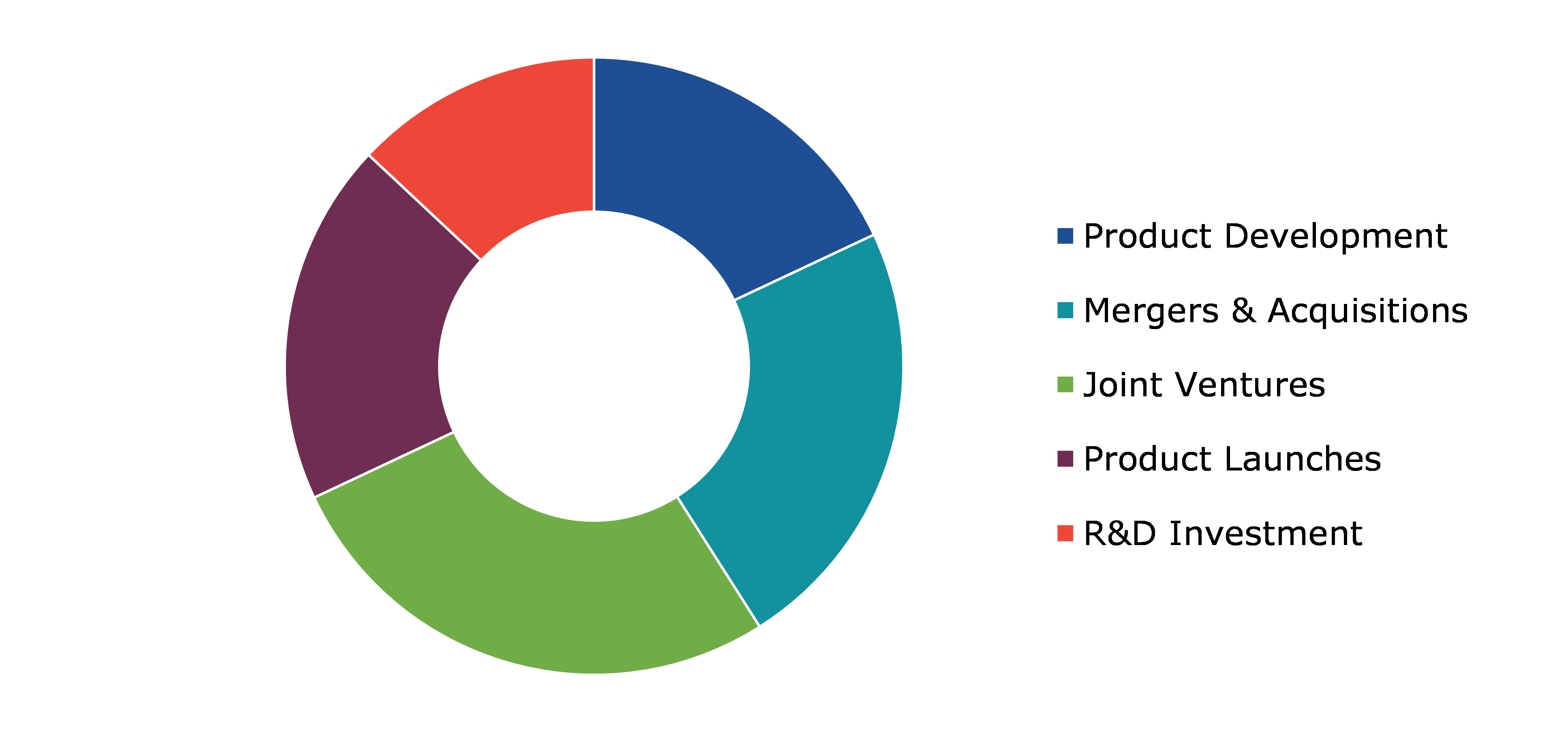

Competitive Scenario in the Global Gypsum & Drywall Market

Investment and agreement are common strategies followed by major market players. For instance, in October 2022, USGKnauf announced plans to build a new gypsum wallboard mill in Huedin, Cluj County. The investment is intended to help the Romanian government's 'energy savings offensive' by supporting a rehabilitation effort for the country's housing stock.

Source: Research Dive Analysis

Some of the leading gypsum & board market analysis players are Saint-Gobain, USG Corporation., TECNI-GYPSUM, NATIONAL GYPPSUM (NGC), Knauf Gips KG, GYPLAC SA, BEIJING NEW BUILDINGS MATERIAL (GROUP) CO. LTD., American Gypsum Company LLC, Lafarge Group, and Global Mining Company LLC (GMC).

| Aspect | Particulars |

| Historical Market Estimations | 2020-2022 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by End User |

|

|

Segmentation by Thickness

|

|

| Key Companies Profiled |

|

Q1. What is the size of the global gypsum & drywall market?

A. The size of the global gypsum & drywall market size was over $29,290.5 million in 2022 and is projected to reach $51,910.7 million by 2032.

Q2. Which are the major companies in the gypsum & drywall market?

A. Saint-Gobain, USG Corporation., and TECNI-GYPSUM are some of the key players in the global gypsum & drywall market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. : What will be the growth rate of the Asia-Pacific gypsum & drywall market?

A. Asia-Pacific gypsum & drywall market share is anticipated to grow at 7.6% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. : Saint-Gobain, USG Corporation., and TECNI-GYPSUM are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global gypsum & drywall market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on gypsum & drywall market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Gypsum & Drywall Market Analysis, by Product

5.1.Overview

5.2.Wallboard

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2022-2032

5.2.3.Market share analysis, by country, 2022-2032

5.3.Ceiling Board

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2022-2032

5.3.3.Market share analysis, by country, 2022-2032

5.4.Pre-decorated Board

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2022-2032

5.4.3.Market share analysis, by country, 2022-2032

5.5.Others

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2022-2032

5.5.3.Market share analysis, by country, 2022-2032

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.Gypsum & Drywall Market Analysis, by End User

6.1.Commercial

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2022-2032

6.1.3.Market share analysis, by country, 2022-2032

6.2.Residential

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2022-2032

6.2.3.Market share analysis, by country, 2022-2032

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness

6.3.2.Competition heatmap

7.Gypsum & Drywall Market Analysis, by Thickness

7.1.1/2 Inch

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2022-2032

7.1.3.Market share analysis, by country, 2022-2032

7.2.5/8 Inch

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2022-2032

7.2.3.Market share analysis, by country, 2022-2032

7.3.More than 5/8 Inch

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2022-2032

7.3.3.Market share analysis, by country, 2022-2032

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.Gypsum & Drywall Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Product, 2022-2032

8.1.1.2.Market size analysis, by End User, 2022-2032

8.1.1.3.Market size analysis, by Thickness, 2022-2032

8.1.2.Canada

8.1.2.1.Market size analysis, by Product, 2022-2032

8.1.2.2.Market size analysis, by End User, 2022-2032

8.1.2.3.Market size analysis, by Thickness, 2022-2032

8.1.3.Mexico

8.1.3.1.Market size analysis, by Product, 2022-2032

8.1.3.2.Market size analysis, by End User, 2022-2032

8.1.3.3.Market size analysis, by Thickness, 2022-2032

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Product, 2022-2032

8.2.1.2.Market size analysis, by End User, 2022-2032

8.2.1.3.Market size analysis, by Thickness, 2022-2032

8.2.2.UK

8.2.2.1.Market size analysis, by Product, 2022-2032

8.2.2.2.Market size analysis, by End User, 2022-2032

8.2.2.3.Market size analysis, by Thickness, 2022-2032

8.2.3.France

8.2.3.1.Market size analysis, by Product, 2022-2032

8.2.3.2.Market size analysis, by End User, 2022-2032

8.2.3.3.Market size analysis, by Thickness, 2022-2032

8.2.4.Spain

8.2.4.1.Market size analysis, by Product, 2022-2032

8.2.4.2.Market size analysis, by End User, 2022-2032

8.2.4.3.Market size analysis, by Thickness, 2022-2032

8.2.5.Italy

8.2.5.1.Market size analysis, by Product, 2022-2032

8.2.5.2.Market size analysis, by End User, 2022-2032

8.2.5.3.Market size analysis, by Thickness, 2022-2032

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Product, 2022-2032

8.2.6.2.Market size analysis, by End User, 2022-2032

8.2.6.3.Market size analysis, by Thickness, 2022-2032

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Product, 2022-2032

8.3.1.2.Market size analysis, by End User, 2022-2032

8.3.1.3.Market size analysis, by Thickness, 2022-2032

8.3.2.Japan

8.3.2.1.Market size analysis, by Product, 2022-2032

8.3.2.2.Market size analysis, by End User, 2022-2032

8.3.2.3.Market size analysis, by Thickness, 2022-2032

8.3.3.India

8.3.3.1.Market size analysis, by Product, 2022-2032

8.3.3.2.Market size analysis, by End User, 2022-2032

8.3.3.3.Market size analysis, by Thickness, 2022-2032

8.3.4.Australia

8.3.4.1.Market size analysis, by Product, 2022-2032

8.3.4.2.Market size analysis, by End User, 2022-2032

8.3.4.3.Market size analysis, by Thickness, 2022-2032

8.3.5.South Korea

8.3.5.1.Market size analysis, by Product, 2022-2032

8.3.5.2.Market size analysis, by End User, 2022-2032

8.3.5.3.Market size analysis, by Thickness, 2022-2032

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Product, 2022-2032

8.3.6.2.Market size analysis, by End User, 2022-2032

8.3.6.3.Market size analysis, by Thickness, 2022-2032

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Product, 2022-2032

8.4.1.2.Market size analysis, by End User, 2022-2032

8.4.1.3.Market size analysis, by Thickness, 2022-2032

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Product, 2022-2032

8.4.2.2.Market size analysis, by End User, 2022-2032

8.4.2.3.Market size analysis, by Thickness, 2022-2032

8.4.3.UAE

8.4.3.1.Market size analysis, by Product, 2022-2032

8.4.3.2.Market size analysis, by End User, 2022-2032

8.4.3.3.Market size analysis, by Thickness, 2022-2032

8.4.4.South Africa

8.4.4.1.Market size analysis, by Product, 2022-2032

8.4.4.2.Market size analysis, by End User, 2022-2032

8.4.4.3.Market size analysis, by Thickness, 2022-2032

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Product, 2022-2032

8.4.5.2.Market size analysis, by End User, 2022-2032

8.4.5.3.Market size analysis, by Thickness, 2022-2032

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2022

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2022

10.Company Profiles

10.1.Saint-Gobain

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.USG Corporation.

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.TECNI-GYPSUM

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.NATIONAL GYPPSUM (NGC)

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Knauf Gips KG

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.GYPLAC SA

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.BEIJING NEW BUILDINGS MATERIAL (GROUP) CO. LTD.

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.American Gypsum Company LLC

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Lafarge Group

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Global Mining Company LLC (GMC)

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com