Global Hemp Seed Market Report

RA08750

Global Hemp Seed Market by Source (Conventional and Organic), Form (Shelled Hemp Seed, Hemp Seed Protein, Hemp Seed Oil, Whole Hemp Seed, Hulled Hemp Seed, Hemp Protein Powder, and Others), Application (Food & Beverages, Nutritional Supplements, Cosmetics, Pharmaceuticals, Textiles, Personal Care Products, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Opportunity Analysis and Industry Forecast, 2023-2032

Hemp Seed Overview

Hemp seeds are small, brown seeds of the Cannabis sativa plant that are rich in fiber, protein, healthy fats, and minerals. They are widely accessible in the form of whole seeds, shelled seeds, hemp oil, and protein powder. Hemp seeds have many health advantages, including improving immunity, boosting metabolism, and treating conditions including chronic pain, inflammation, and insomnia. They are widely utilized in foods, drinks, nutritional supplements, medicines, cosmetics, and other products. A wide range of health advantages of raw hemp include improved blood circulation and immunity, rapid healing from illness or injury, and weight loss. They include the most concentrated balance of enzymes, vitamins, vital fats, and proteins, as well as a lack of saturated fats, sugar, and carbohydrates.

Global Hemp Seed Market Analysis

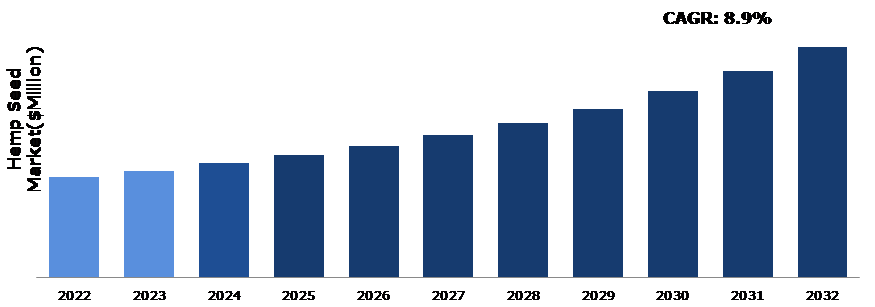

The global hemp seed market size was $5,123.3 million in 2022 and is predicted to grow with a CAGR of 8.9%, by generating a revenue of $11,729.3 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Hemp Seed Market

The COVID-19 impact on hemp seed market had a global influence on numerous enterprises due to its different socioeconomic impacts. The pandemic also had a significant impact on the hemp seed market. With global lockdowns and disruptions in the supply chain, the industry faced challenges in production, distribution, and trade. However, the demand for hemp seed products, known for their nutritional value and potential health benefits, has remained high. As the world recovers from the pandemic, the hemp seed market is expected to regain momentum and witness continued growth in the upcoming years. Hemp Seed. In the post-pandemic period, people are gradually transitioning towards a new normal, focusing on rebuilding their health and well-being. Hemp seeds continue to serve as a valuable addition to post-pandemic dietary habits. These versatile seeds offer a range of benefits that can support individuals in their journey towards health & well-being. Post-pandemic recovery involves prioritizing physical and mental health, as well as sustainability. hemp seed offer a nutritious and sustainable option for individuals seeking to rebuild their health and well-being in the wake of COVID-19. By embracing the potential benefits of hemp seeds, individuals can take proactive steps towards a healthier future. The post-pandemic recovery phase necessitates a focus on physical and mental health, along with sustainability. Hemp seeds present an ideal solution for individuals aiming to rebuild their well-being after the impact of COVID-19. With their nutrient-rich composition and sustainable cultivation methods, hemp seed offers an eco-friendly option. By embracing the potential benefits of hemp seeds, individuals can proactively take steps towards a healthier and more sustainable future.

Rising Demand for Hemp Based Supplements and Personal Care Products to Drive Market Growth

Hemp-based supplements and personal care items have emerged as key market drivers, adding to the hemp industry's expansion and demand. These products use hemps of various qualities and meet the rising need for natural, plant-based alternatives in the health and wellness industries. Hemp-based supplements are gaining traction due to their rich nutritional profile and potential health benefits. Hemp seeds are a powerhouse of essential fatty acids, proteins, vitamins, minerals, and fiber, making them a valuable ingredient for dietary supplements. Consumers are increasingly seeking natural and organic options to support their overall well-being, and hemp-based supplements align with these preferences. The market is witnessing an expanding range of hemp-derived supplements, including hemp oil capsules, hemp protein powders, and hemp seed oil extracts, catering to different dietary needs and preferences. Hemp seeds surpass chia and flax seeds as they contain both GLA (gamma-linoleic acid) and CLA (conjugated linoleic acid). It also provides a good fatty acid ratio, 10 necessary amino acids, and a lot of fiber. Hemp seeds are high in phosphorus, sodium, potassium, magnesium, calcium, iron, sulfur, and zinc. Furthermore, when compared to other plant protein sources, hemp is considered allergy-free. All these factors projected to drive the hemp seed market growth during the forecast period.

To know more about global hemp seed market drivers, get in touch with our analysts here.

High Production Cost and Strict Regulations and Policies to Restrain the Market Growth

The production of hemp seed can be a costly process due to various reasons. Hemp cultivation requires specific agricultural practices, including suitable soil conditions, irrigation systems, and pest control measures. These requirements may add to the overall production expenses. In addition, harvesting and processing hemp seed require specialized equipment and labor, further increasing the production costs. The high production costs can affect the competitiveness of hemp seed products in the market and potentially limit their growth. The hemp seed market is regulated by stringent rules and policies that vary by authority. Hemp is under inspection as it is derived from the Cannabis sativa plant, which has a botanical similarity to marijuana. Regulatory organizations contributed compliance constraints on enterprises through licensing rules, testing methods, and labelling norms. Navigating these complicated and developing laws can be difficult, particularly for new entrants. Stringent laws function as entry hurdles and are expected to restrict the expansion of the hemp seed market growth during the forecast period.

Innovation Product Development from Industrial Hemp to Drive Excellent Opportunities

Industrial hemp is being used to create novel products by businesses and academic organizations as hemp growing becomes more legal. Biofuel is one of these applications, and experts predict that it will see rapid expansion in the upcoming years. Biofuels have become more well-liked as a result of rising oil prices (for both petrol and diesel), as well as increased concerns about global warming. Hemp biodiesel, which can be used in any diesel-powered vehicle, is produced using hemp seed extract. Hemp can also be used as a sustainable alternative to traditional materials in manufacturing processes. Hemp fibers can be incorporated into various industries such as textiles, construction, automotive, and paper production, offering strength, durability, and thermal properties. Bioplastic is another product which allows for the growing of industrial hemp. Hemp bioplastics are created by combining used hemp seed with cannabidiol oil (CDD). Rising consumer demand for environmentally friendly products, as well as corporate and government initiatives and assistance, are projected to drive the expansion of hemp-based biofuel and bioplastic further creating several growth opportunities for major players operating in the market.

To know more about global hemp seed market opportunities, get in touch with our analysts here.

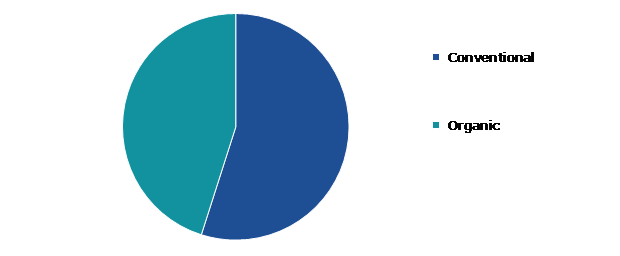

Global Hemp Seed Market Share, by Source, 2022

Source: Research Dive Analysis

The conventional sub-segment accounted for the highest market share in 2022. This is due to the high manufacturing of the product using raw materials derived from conventional farming. Furthermore, conventional farming enables farmers to produce more on less land since the practice improves crop health and yield, adding to the high market share. In addition, a non-genetically modified organisms (GMO) crop grown without the use of pesticides is hemp grown conventionally. Compared to certified organic hemp, conventional hemp does not require the same exacting inspections and regulations. They are therefore less expensive than hemp organic products. The textile and pulp & paper sectors are increasingly using hemp that has been cultivated conventionally. Their demand has also grown owing to their application in construction materials, bioplastics, furniture, and biofuel. All these factors are projected to drive the growth of the conventional segment during the forecast period.

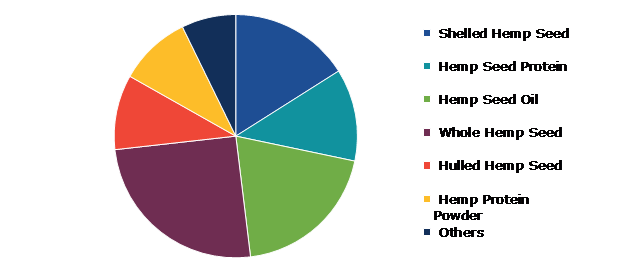

Global Hemp Seed Market Size, by Form, 2022

Source: Research Dive Analysis

The whole hemp seed sub-segment accounted for the highest market share in 2022. The hemp sector expansion and rising market presence are being driven by whole hemp seed, a key industry driver. Whole hemp seeds are gaining popularity because of its nutritional richness, adaptability, and possible uses. One of the significant factors driving the whole hemp seed segment growth is its outstanding nutritional profile. Hemp seeds are high in important fatty acids, such as omega-3 and omega-6, which are required for good health. They also contain high-quality proteins, giving them an excellent source of plant-based protein. Furthermore, hemp seeds are high in vitamins, minerals, and dietary fiber, adding to a well-balanced nutritional profile. The rising consumer desire for nutrient-dense diets and plant-based protein alternatives has boosted the whole hemp seed market growth.

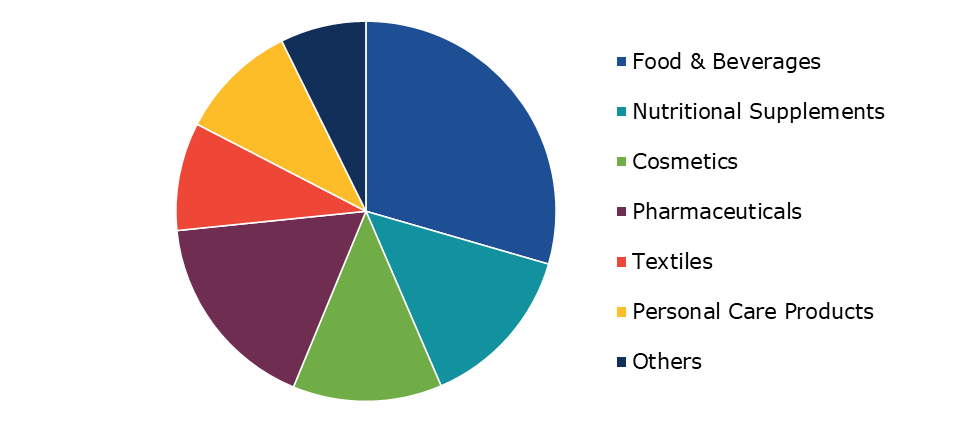

Global Hemp Seed Market Analysis, by Application, 2022

Source: Research Dive Analysis

The food & beverages sub-segment accounted for the highest market share in 2022. Hemp is increasingly being utilized in food items because it includes vital fatty acids (linoleic and linolenic acid), vitamin E, and minerals such as phosphorus, potassium, salt, magnesium, calcium, zinc, salt, iron, and protein. Hemp is most commonly ingested as hemp seed, either raw or roasted. The rising intake of plant-based protein due to the global popularity of veganism is predicted to boost the demand for hemp-based processed food products such as snacks, flour, and cheese. In addition, its role in enhancing digestion is expected to drive the desire for food goods due to the presence of highly digestible fiber. Popular hemp-based foods include hemp tortilla chips, hemp corn chips, and hemp hearts. Hemp is utilized as a morning cereal because of its nutrient-rich profile of essential fatty acids, which are necessary for normal physiological functioning. Furthermore, hemp snacks are projected to see an increase in demand as post-exercise food in the future due to their high protein content.

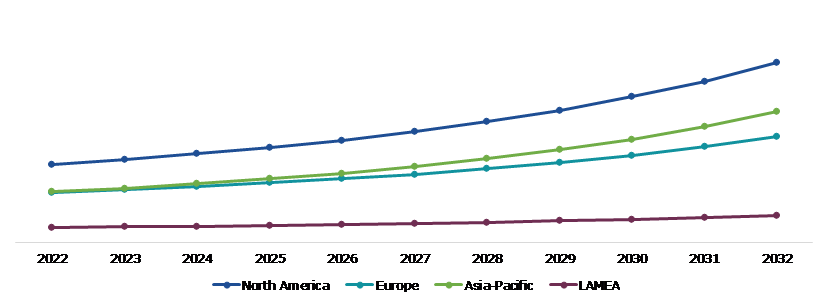

Global Hemp Seed Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The North America hemp seed market generated the highest revenue in 2022. Most of the authorized use of hemp seed oil, as well as favorable laws governed by the regional government, are contributing to the region's highest share. Therefore, the product's popularity among the health-conscious populace is growing, driving the regional market expansion. Furthermore, the existence of a large population suffering from mental illness is leading to an increase in the usage of hemp seed oil, which is adding to the rise of the market growth in the region. North America has witnessed a significant surge in the hemp seed market share due to increasing consumer demand for health-conscious and sustainable products. The region's favorable regulatory environment, along with the versatility and nutritional benefits of hemp seeds, has boosted their popularity and contributed to the regional market growth.

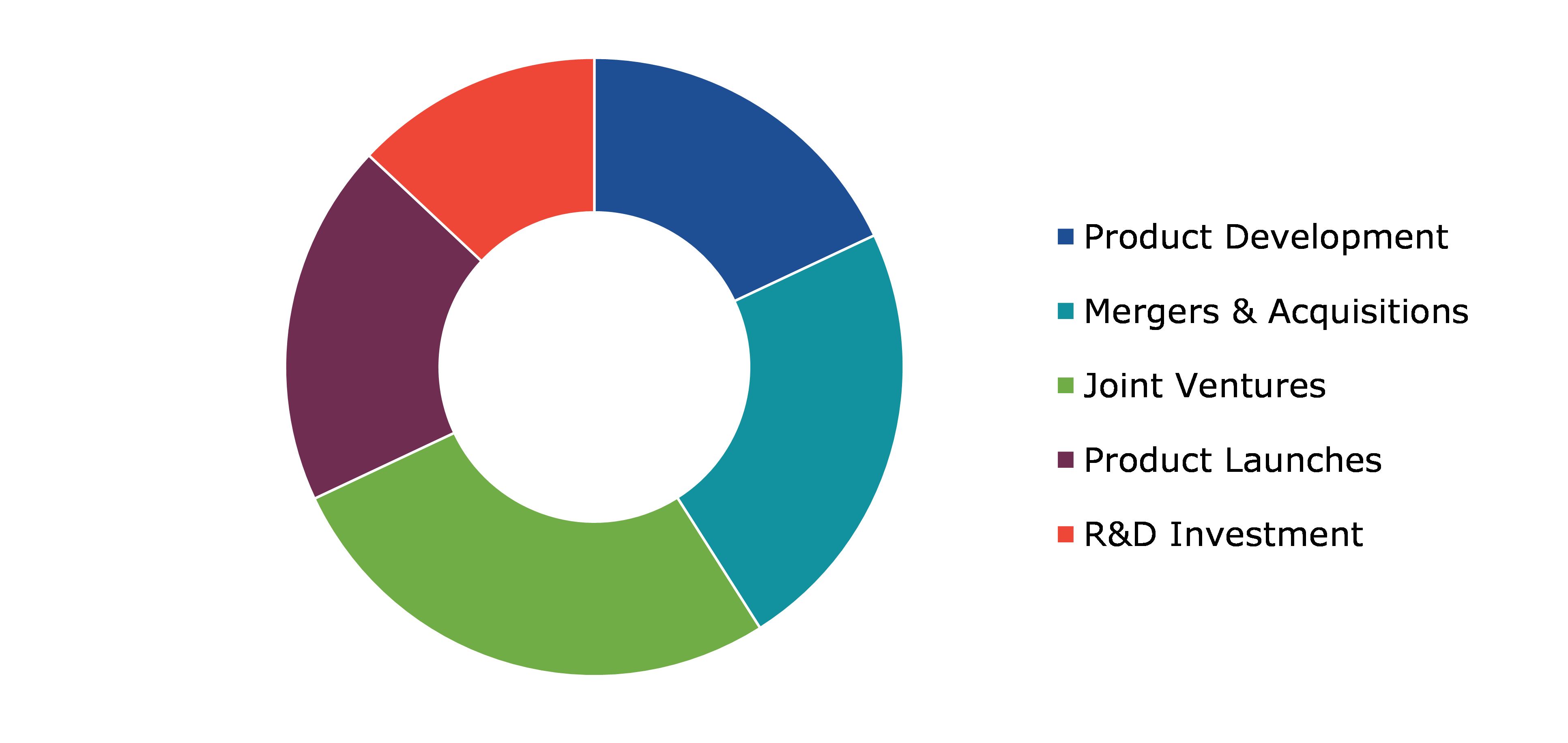

Competitive Scenario in the Global Hemp Seed Market

Investment and agreement are common strategies followed by major market players. For instance, in March 2021, Yooma Wellness Inc., a distributor and marketer of hemp-derived and cannabis wellness products, announced the purchase of Socati Corp, a company that specializes in the production of high-quality hemp extracts and ingredients for various industries. The firm took this step to expand its worldwide accessibility.

Source: Research Dive Analysis

Some of the leading hemp seed market analysis players are MH medical hemp, Naturally Splendid Enterprises Ltd., Manitoba Harvest Hemp Foods, NAVITAS ORGANICS, Plains Industrial Hemp Processing Ltd, Hush Brands Inc., Green Source MKT, HempFlax Group B.V., GenCanna Global USA, Inc., and Ecofibre.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Source |

|

| Segmentation by Form |

|

|

Segmentation by Application

|

|

| Key Companies Profiled |

|

Q1. What is the size of the global hemp seed market?

A. The global hemp seed market size was over $5,123.3 million in 2022 and is projected to reach $11,729.3 million by 2032.

Q2. Which are the major companies in the hemp seed market?

A. Nutiva Inc., Connoills LLC, Manitoba Harvest, and Sky Organics are some of the key players in the global hemp seed market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific hemp seed market?

A. Asia-Pacific hemp seed market share is anticipated to grow at 10.3% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Nutiva Inc., Connoills LLC, Manitoba Harvest, and Sky Organics are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global hemp seed market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on hemp seeds market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Hemp Seed Analysis, by Source

5.1.Overview

5.2.Conventional

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2022-2032

5.2.3.Market share analysis, by country, 2022-2032

5.3.Organic

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2022-2032

5.3.3.Market share analysis, by country, 2022-2032

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Hemp Seed Analysis, by Form

6.1.Shelled Hemp Seed

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2022-2032

6.1.3.Market share analysis, by country, 2022-2032

6.2.Hemp Seed Protein

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2022-2032

6.2.3.Market share analysis, by country, 2022-2032

6.3.Hemp Seed Oil

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2022-2032

6.3.3.Market share analysis, by country, 2022-2032

6.4.Whole Hemp Seed

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2022-2032

6.4.3.Market share analysis, by country, 2022-2032

6.5.Hulled Hemp Seed

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region, 2022-2032

6.5.3.Market share analysis, by country, 2022-2032

6.6.Hemp Protein Powder

6.6.1.Definition, key trends, growth factors, and opportunities

6.6.2.Market size analysis, by region, 2022-2032

6.6.3.Market share analysis, by country, 2022-2032

6.7.Others

6.7.1.Definition, key trends, growth factors, and opportunities

6.7.2.Market size analysis, by region, 2022-2032

6.7.3.Market share analysis, by country, 2022-2032

6.8.Research Dive Exclusive Insights

6.8.1.Market attractiveness

6.8.2.Competition heatmap

7.Hemp Seed Analysis, by Application

7.1.Food & Beverages

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2022-2032

7.1.3.Market share analysis, by country, 2022-2032

7.2.Nutritional Supplements

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2022-2032

7.2.3.Market share analysis, by country, 2022-2032

7.3.Cosmetics

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2022-2032

7.3.3.Market share analysis, by country, 2022-2032

7.4.Pharmaceuticals

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region, 2022-2032

7.4.3.Market share analysis, by country, 2022-2032

7.5.Textiles

7.5.1.Definition, key trends, growth factors, and opportunities

7.5.2.Market size analysis, by region, 2022-2032

7.5.3.Market share analysis, by country, 2022-2032

7.6.Personal Care Products

7.6.1.Definition, key trends, growth factors, and opportunities

7.6.2.Market size analysis, by region, 2022-2032

7.6.3.Market share analysis, by country, 2022-2032

7.7.Others

7.7.1.Definition, key trends, growth factors, and opportunities

7.7.2.Market size analysis, by region, 2022-2032

7.7.3.Market share analysis, by country, 2022-2032

7.8.Research Dive Exclusive Insights

7.8.1.Market attractiveness

7.8.2.Competition heatmap

8.Hemp Seed Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Source, 2022-2032

8.1.1.2.Market size analysis, by Form, 2022-2032

8.1.1.3.Market size analysis, by Application, 2022-2032

8.1.2.Canada

8.1.2.1.Market size analysis, by Source, 2022-2032

8.1.2.2.Market size analysis, by Form, 2022-2032

8.1.2.3.Market size analysis, by Application, 2022-2032

8.1.3.Mexico

8.1.3.1.Market size analysis, by Source, 2022-2032

8.1.3.2.Market size analysis, by Form, 2022-2032

8.1.3.3.Market size analysis, by Application, 2022-2032

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Source, 2022-2032

8.2.1.2.Market size analysis, by Form, 2022-2032

8.2.1.3.Market size analysis, by Application, 2022-2032

8.2.2.UK

8.2.2.1.Market size analysis, by Source, 2022-2032

8.2.2.2.Market size analysis, by Form, 2022-2032

8.2.2.3.Market size analysis, by Application, 2022-2032

8.2.3.France

8.2.3.1.Market size analysis, by Source, 2022-2032

8.2.3.2.Market size analysis, by Form, 2022-2032

8.2.3.3.Market size analysis, by Application, 2022-2032

8.2.4.Spain

8.2.4.1.Market size analysis, by Source, 2022-2032

8.2.4.2.Market size analysis, by Form, 2022-2032

8.2.4.3.Market size analysis, by Application, 2022-2032

8.2.5.Italy

8.2.5.1.Market size analysis, by Source, 2022-2032

8.2.5.2.Market size analysis, by Form, 2022-2032

8.2.5.3.Market size analysis, by Application, 2022-2032

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Source, 2022-2032

8.2.6.2.Market size analysis, by Form, 2022-2032

8.2.6.3.Market size analysis, by Application, 2022-2032

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Source, 2022-2032

8.3.1.2.Market size analysis, by Form, 2022-2032

8.3.1.3.Market size analysis, by Application, 2022-2032

8.3.2.Japan

8.3.2.1.Market size analysis, by Source, 2022-2032

8.3.2.2.Market size analysis, by Form, 2022-2032

8.3.2.3.Market size analysis, by Application, 2022-2032

8.3.3.India

8.3.3.1.Market size analysis, by Source, 2022-2032

8.3.3.2.Market size analysis, by Form, 2022-2032

8.3.3.3.Market size analysis, by Application, 2022-2032

8.3.4.Australia

8.3.4.1.Market size analysis, by Source, 2022-2032

8.3.4.2.Market size analysis, by Form, 2022-2032

8.3.4.3.Market size analysis, by Application, 2022-2032

8.3.5.South Korea

8.3.5.1.Market size analysis, by Source, 2022-2032

8.3.5.2.Market size analysis, by Form, 2022-2032

8.3.5.3.Market size analysis, by Application, 2022-2032

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Source, 2022-2032

8.3.6.2.Market size analysis, by Form, 2022-2032

8.3.6.3.Market size analysis, by Application, 2022-2032

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Source, 2022-2032

8.4.1.2.Market size analysis, by Form, 2022-2032

8.4.1.3.Market size analysis, by Application, 2022-2032

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Source, 2022-2032

8.4.2.2.Market size analysis, by Form, 2022-2032

8.4.2.3.Market size analysis, by Application, 2022-2032

8.4.3.UAE

8.4.3.1.Market size analysis, by Source, 2022-2032

8.4.3.2.Market size analysis, by Form, 2022-2032

8.4.3.3.Market size analysis, by Application, 2022-2032

8.4.4.South Africa

8.4.4.1.Market size analysis, by Source, 2022-2032

8.4.4.2.Market size analysis, by Form, 2022-2032

8.4.4.3.Market size analysis, by Application, 2022-2032

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Source, 2022-2032

8.4.5.2.Market size analysis, by Form, 2022-2032

8.4.5.3.Market size analysis, by Application, 2022-2032

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2022

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2022

10.Company Profiles

10.1.MH medical hemp

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Naturally Splendid Enterprises Ltd.

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Manitoba Harvest Hemp Foods

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.NAVITAS ORGANICS

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Plains Industrial Hemp Processing Ltd

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Hush Brands Inc.

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Green Source MKT

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.HempFlax Group B.V.

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.GenCanna Global USA, Inc.

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Ecofibre

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com