Global Gasification Market Report

RA08695

Global Gasification Market by Type (Fixed Bed, Fluidized Bed, and Entrained Flow), Feedstock (Coal, Petroleum, Gas, Petcoke, Biomass, and Waste), Feed Type (Dry Feed and Slurry), Gasifier Medium (Air, Oxygen, and Vapor), Application (Electricity, Chemicals, Fertilizers, Liquid Fuels, Synthetic Natural Gas (SNG), and Hydrogen), and Region (North America, Europe, Asia-Pacific, and LAMEA): Opportunity Analysis and Industry Forecast, 2023-2032

Gasification Overview

Organic waste and compost are transformed into syngas and chemicals like methane, ethylene, fatty acids, detergents, and plasticizers through the thermochemical process known as gasification. Syngas, also referred to as producer gas, synthetic gas, synthesis gas, and product gas, is made up primarily of the hydrocarbons CH4, C2H4, and C2H6 and contains very less amount of tars, H2S, and NH3. By oxidizing pelletized or crushed biomass with a gasification agent in a gasifier plant, the biomass gasification process produces combustible gases. An efficient and productive method for producing hydrogen from feedstock is gasification. Using catalysis, syngas is converted in a gasification reaction, followed by gas separation and purification.

Syngas or synthesis gas is the result of the thermochemical process known as gasification, which transforms carbon-based resources like coal, biomass, or waste into a gas mixture. In this method, the feedstock is heated to high temperatures while being exposed to steam or controlled amounts of oxygen, which combines with the carbonaceous material to create a gaseous byproduct.

Global Gasification Market Analysis

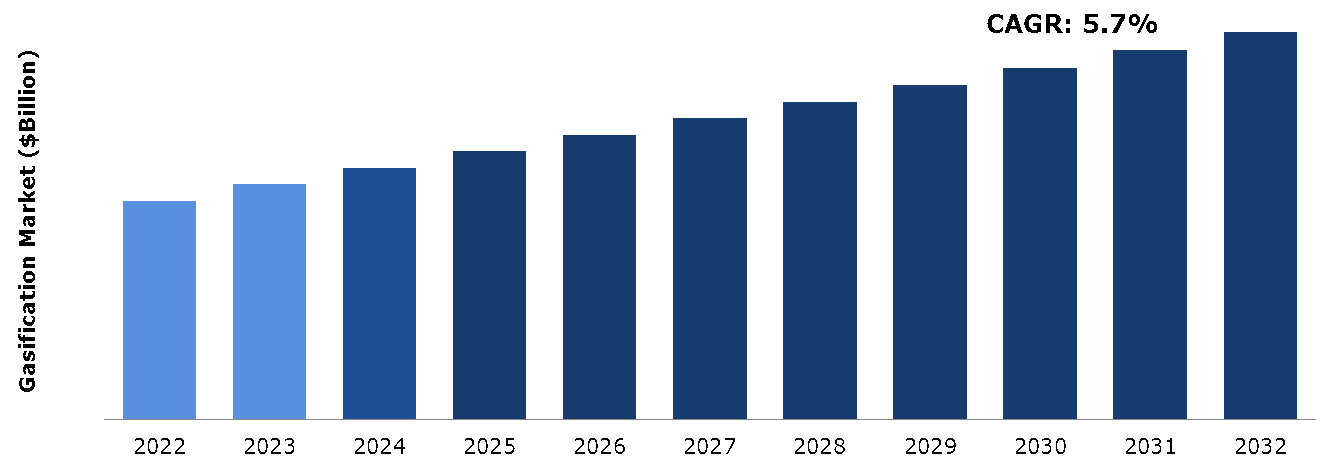

The global gasification market size was $472.2 billion in 2022 and is predicted to grow with a CAGR of 5.7%, by generating a revenue of $836.6 billion by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Gasification Market

The COVID-19 pandemic led to changes in energy demand patterns, with fluctuations in electricity consumption and disruptions in industrial activities. These changes impacted the business case for gasification projects, especially those focused on power generation or industrial applications. The pandemic highlighted importance of resilience and sustainability in energy systems. There is an increase in emphasis on clean and resilient energy solutions, including gasification, as part of the post-pandemic recovery and future planning. This renewed focus may drive policy support and investment in gasification technologies. The COVID-19 impact on the gasification market could differ between locations and rely on a variety of factors, including the pandemic's intensity and duration, government measures, and the pace of the overall economic recovery. The pandemic has resulted in a significant decrease in industrial activity, leading to lower demand for syngas-based products such as chemicals, fertilizers, and transportation fuels. This reduction in demand has affected the profitability of gasification projects.

Rising Demand for Oil Gases to Drive the Market Growth

The growing concern over climate change and the need to reduce greenhouse gas emissions has led to an increase in focus on cleaner energy sources. Gasification offers a way to convert fossil fuels, such as coal or petroleum coke, into syngas, which can be used as a cleaner-burning fuel. The increasing use of syngas in petrol engines to produce hydrogen and methanol and convert them to synthetic fuels is growing awareness among the general population about the environmental impact of traditional energy sources. Gasification presents an opportunity to reduce pollution and mitigate the negative effects associated with burning fossil fuels, as it enables the capture and treatment of pollutants before they are released into the atmosphere. Clean gas is produced in the process by refining corrosive ash elements such as chlorides and potassium, which can cause a variety of problems in the feedstock. Furthermore, the utility of gasifying fossil fuels for generating electrical power at the residential and industrial levels is growing in popularity. Rising demand for power owing to increasing global population, rapid industrialization and urbanization, increasing establishment of chemical manufacturing facilities, rising scope of application in waste management, and expansion of the coal industry is projected to drive the overall gasification market growth during the forecast period.

To know more about global gasification market drivers, get in touch with our analysts here.

Limited Infrastructure and High Cost to Restrain the Market Growth

Gasification requires a consistent and reliable supply of feedstock such as coal, biomass, or municipal solid waste. Availability and access to suitable feedstock can be a constraint in certain regions, limiting the viability of gasification projects. In addition, competition for feedstock resources from other industries, such as the agricultural or bioenergy sectors, can further restrict its availability and increase costs. Regulation and policy frameworks pertaining to energy, emissions, and waste management have an impact on the gasification sector. Regulations that are inconsistent or unfavorable can limit the development of the gasification sector. Gasification projects may face difficult business conditions due to uncertainty surrounding carbon pricing, renewable energy incentives, and waste management regulations.

Advancements in Technology to Drive Excellent Opportunities

Gasification is becoming more popular as a clean energy replacement due to rising environmental consciousness and increased awareness of sustainability. Gasification processes are being installed in production and manufacturing facilities due to rapid industrialization, developing power, chemical, oil, and gas industries, and technological advancements. Demand for gasification is rising quickly in the municipal sector due to the widespread use of gasification for waste disposal and the recycling of complex compost.

In addition, gasifiers are a versatile, effective, and dependable choice for thermal applications because they can be easily retrofitted into already installed and operational gas-fueled equipment, like furnaces and boilers, in order to switch fossil fuels out for syngas. The production of electricity from fossil fuels, methane, liquid fuels, and ammonia is largely accomplished through gasification processes. These key factors are expected to drive revenue growth of the global gasification market during the forecast period.

To know more about global gasification market opportunities, get in touch with our analysts here.

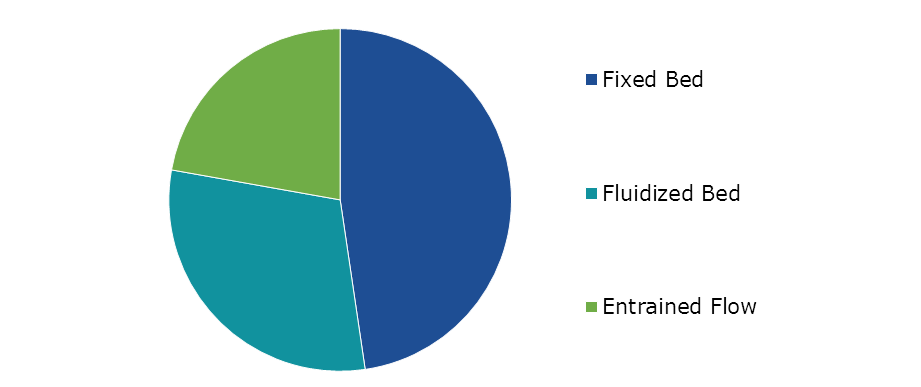

Global Gasification Market Share, by Type, 2022

Source: Research Dive Analysis

The fixed bed sub-segment accounted for the highest market share in 2022. The fixed bed segment in the gasification market is primarily driven by the increasing demand for clean and sustainable energy solutions. In this process, the feedstock is loaded onto a fixed bed, and a controlled amount of oxygen or steam is introduced to initiate the gasification reactions. The fixed bed design allows for better control of the process parameters and enables the utilization of a wide range of feedstock materials.

Furthermore, fixed bed gasifiers are known for their high energy efficiency, as they can achieve high conversion rates of carbonaceous materials into syngas. This makes them an attractive option for power generation and industrial applications, where energy efficiency is crucial for cost-effective operations. Moreover, gasification offers several environmental benefits compared to traditional combustion processes. It allows for the capture and removal of pollutants, such as sulfur and nitrogen compounds, resulting in cleaner syngas production. The fixed bed configuration provides better control over the gasification reactions, enabling the optimization of the process for reduced emissions and environmental impact.

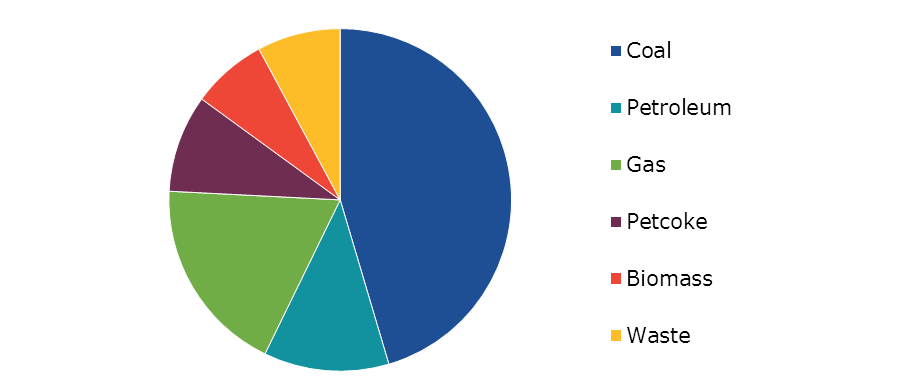

Global Gasification Market Size, by Feedstock, 2022

Source: Research Dive Analysis

The coal sub-segment accounted for the highest market share in 2022. Coal is one of the most abundant fossil fuels globally and many countries have significant coal reserves. These reserves provide a reliable and accessible source of feedstock for gasification processes. Moreover, coal gasification offers an opportunity for countries to enhance their energy security by utilizing domestic coal reserves. It reduces dependence on imported energy sources, thereby ensuring a more self-reliant energy supply. In addition, syngas derived from coal gasification can be utilized in a wide range of applications. It can be used as a fuel for power generation, producing electricity with lower emissions compared to traditional coal-fired power plants.

In addition, syngas can be used as a feedstock for the production of chemicals, fertilizers, and transportation fuels. While coal is considered a high-carbon fuel source, gasification technologies can help mitigate some environmental concerns. Integrated Gasification Combined Cycle (IGCC) power plants, for example, can capture and store carbon emissions, reducing greenhouse gas emissions compared to conventional coal-fired power plants. Ongoing advancements in gasification technologies have improved efficiency and reduced environmental impacts. These advancements have made coal gasification more economically viable and environmentally sustainable, driving the growth of the coal segment in the gasification market.

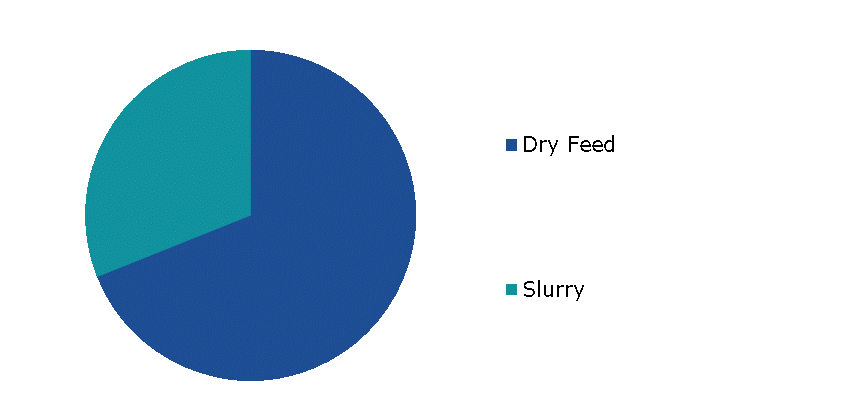

Global Gasification Market Growth, by Feed Type, 2022

Source: Research Dive Analysis

The dry feed sub-segment accounted for the highest market share in 2022. Dry feed gasification technology allows for the use of a wide range of feedstocks, including coal, petroleum coke, biomass, and municipal solid waste. The availability and abundance of these feedstocks make dry feed gasification an attractive option for various industries. Moreover, dry feed gasification systems are known for their flexibility and efficiency in converting a variety of feedstocks into syngas. These systems can handle different types of dry feed materials without the need for extensive pre-processing or moisture removal, which can reduce overall costs.

Furthermore, gasification with dry feed can offer environmental benefits compared to traditional combustion methods. It enables cleaner and more efficient energy production by reducing emissions of pollutants such as sulfur dioxide, nitrogen oxides, and particulate matter. In addition, dry feed gasification provides a solution for waste management by converting waste materials, such as biomass or municipal solid waste, into syngas. This process helps to reduce landfill usage, mitigate environmental pollution, and potentially generate revenue from waste streams.

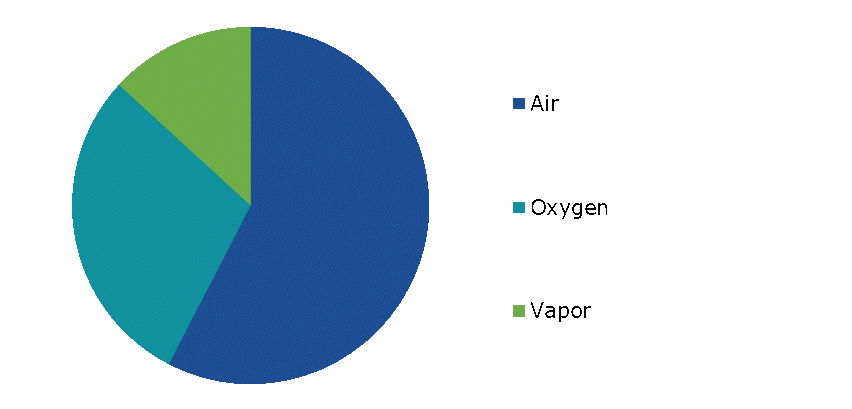

Global Gasification Market Demand, by Gasifier Medium, 2022

Source: Research Dive Analysis

The air sub-segment accounted for the highest market share in 2022. Air is abundantly available and does not require additional costs for its production or purification. It is a cost-effective oxidizing agent compared to other alternatives such as oxygen. Moreover, the use of air as an oxidizing agent provides flexibility in terms of feedstock selection. Air gasification can be used with a wide range of feedstocks, including coal, biomass, and municipal solid waste. This flexibility makes air gasification a versatile option for different industries. Gasification can utilize various feedstocks, including coal, biomass, municipal solid waste, and petroleum coke. This fuel flexibility provides opportunities for diversification, reduces dependence on specific fuel sources, and promotes resource efficiency.

Gasification can help address waste management challenges by converting waste materials, such as municipal solid waste and agricultural residues, into syngas. Air gasification is a well-established technology with a long history of industrial applications. It has been widely used in various industries, including power generation, chemicals, and fuel production. The maturity of the technology reduces implementation risks and provides confidence to investors and stakeholders.

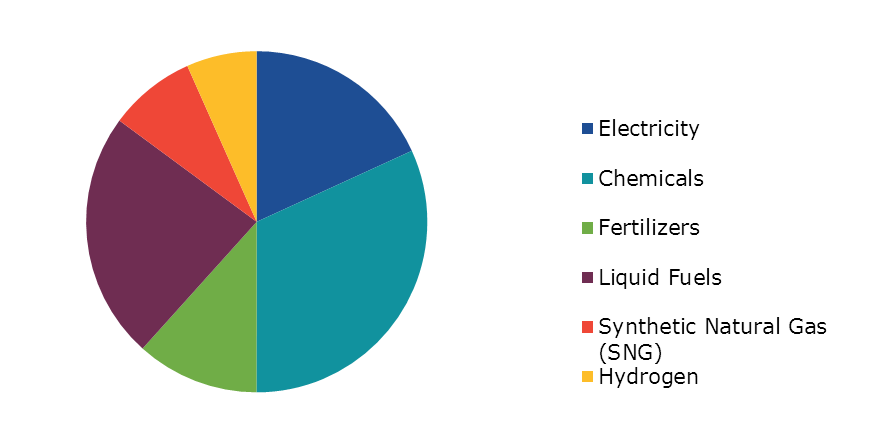

Global Gasification Market Analysis, by Application, 2022

Source: Research Dive Analysis

The chemicals sub-segment accounted for the highest market share in 2022, owing to the increasing demand for chemicals derived from alternative feedstocks and the need for sustainable and efficient production processes. Gasification is a process that converts carbon-based materials such as coal, biomass, or waste into synthesis gas (syngas), which is a mixture of hydrogen, carbon monoxide, and other gases. It provides a flexible and versatile platform for the production of various chemicals. Syngas derived from gasification can be further processed to produce a wide range of chemical products, including methanol, ammonia, hydrogen, dimethyl ether (DME), synthetic natural gas (SNG), and others.

Moreover, gasification enables the utilization of diverse feedstocks. It can convert not only coal but also biomass, municipal solid waste, petroleum coke, and other carbon-containing materials into valuable chemicals. This flexibility allows for the diversification of feedstock sources, reducing dependency on fossil fuels and enabling the use of sustainable and renewable feedstocks. Furthermore, gasification processes can be designed to capture and utilize carbon dioxide (CO2) emissions. By integrating carbon capture and storage (CCS) or carbon capture and utilization (CCU) technologies, gasification plants can reduce greenhouse gas emissions and contribute to climate change mitigation efforts. This aspect is increasingly important as the industry aims to reduce its environmental footprint and transition to a more sustainable future.

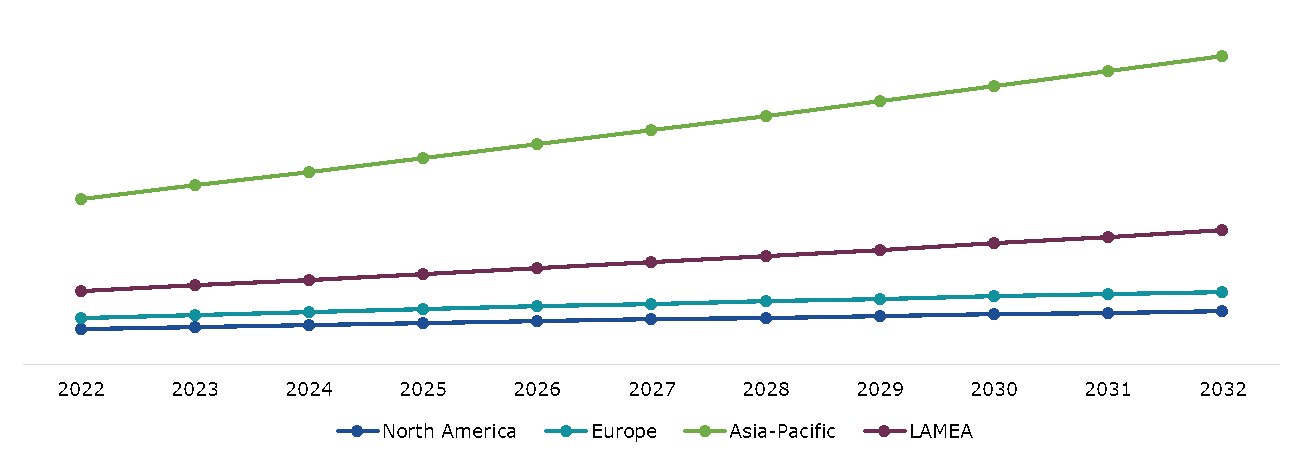

Global Gasification Market Size & Forecast, by Region, 2022-2032 ($Billion)

Source: Research Dive Analysis

The Asia-Pacific gasification market generated the highest revenue in 2022. Asia-Pacific has experienced substantial economic growth in the last few years, leading to increased energy demands. Gasification offers an efficient and flexible way to convert various feedstocks into synthesis gas (syngas), which can be used for power generation, industrial processes, and chemical production. The region's industrial sector, particularly in countries like China, India, and Indonesia, is expanding rapidly. Gasification technologies provide opportunities for these industries to utilize coal, biomass, and other carbon-based feedstocks to produce heat, electricity, and chemicals. Many countries in Asia-Pacific possess significant coal reserves.

Gasification can help unlock the value of these coal resources by converting them into syngas, which can be utilized as a cleaner and more efficient energy source compared to traditional coal combustion. Gasification offers the potential to mitigate environmental concerns associated with coal and other carbon-intensive feedstocks. By converting coal into syngas, gasification allows for the capture and storage of carbon dioxide (CO2) emissions, reducing greenhouse gas emissions and minimizing the environmental impact. Governments in the region have been implementing various policies and initiatives to promote cleaner and more sustainable energy solutions. Gasification technologies often receive support through subsidies, incentives, and R&D funding, encouraging their adoption and deployment.

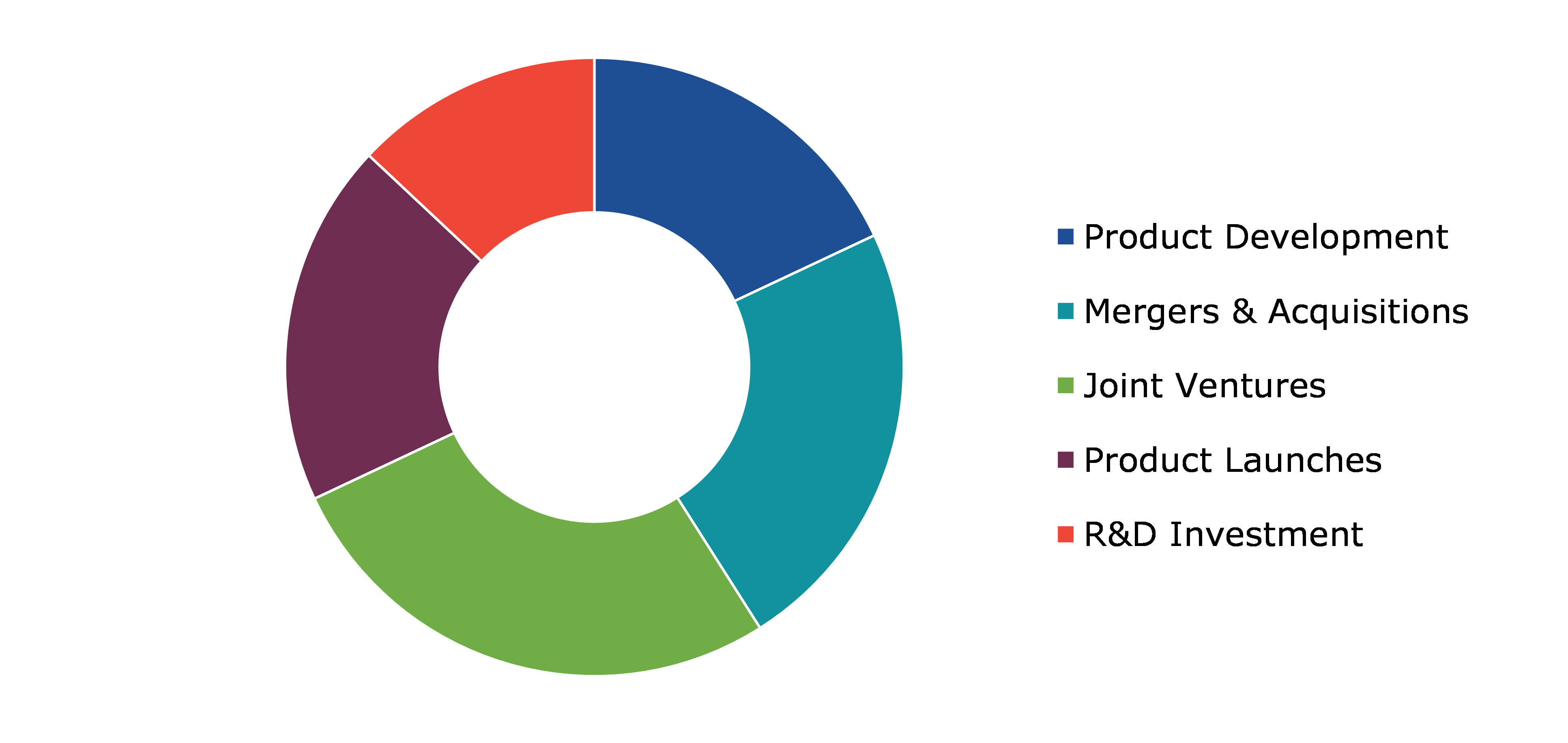

Competitive Scenario in the Global Gasification Market

Investment and agreement are common strategies followed by major market players. In August 2021, Mitsubishi Power took part in a project to create a supply chain for sustainable aviation fuel made from wood biomass gasification combined with FT synthesis technology on a commercial scale.

Source: Research Dive Analysis

Some of the leading gasification market players are Royal Dutch Shell, Air Liquide, General Electric, Mitsubishi Heavy Industries, SEDIN Engineering Company Limited, Siemens, CB&I, KBR, Thyssenkrupp AG, and Synthesis Energy Systems Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Feedstock |

|

|

Segmentation by Feed Type

|

|

| Segmentation by Gasifier Medium |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global gasification market?

A. The size of the global gasification market was over $472.20 billion in 2022 and is projected to reach $836.60 billion by 2032.

Q2. Which are the major companies in the gasification market?

A. Royal Dutch Shell and Air Liquide are some of the key players in the global gasification market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific gasification market?

A. Asia-Pacific gasification market is anticipated to grow at 6.2% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. General Electric and Mitsubishi Heavy Industries are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global gasification market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Gasification market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Gasification Market Analysis, by Type

5.1.Overview

5.2.Fixed Bed

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region,2022-2032

5.2.3.Market share analysis, by country,2022-2032

5.3.Fluidized Bed

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region,2022-2032

5.3.3.Market share analysis, by country,2022-2032

5.4.Entrained Flow

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region,2022-2032

5.4.3.Market share analysis, by country,2022-2032

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Gasification Market Analysis, by Feedstock

6.1.Overview

6.2.Coal

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region,2022-2032

6.3.Market share analysis, by country,2022-2032

6.4.Petroleum

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region,2022-2032

6.4.3.Market share analysis, by country,2022-2032

6.5.Gas

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region,2022-2032

6.5.3.Market share analysis, by country,2022-2032

6.6.Petcoke

6.6.1.Definition, key trends, growth factors, and opportunities

6.6.2.Market size analysis, by region,2022-2032

6.6.3.Market share analysis, by country,2022-2032

6.7.Biomass

6.7.1.Definition, key trends, growth factors, and opportunities

6.7.2.Market size analysis, by region,2022-2032

6.7.3.Market share analysis, by country,2022-2032

6.8.Waste

6.8.1.Definition, key trends, growth factors, and opportunities

6.8.2.Market size analysis, by region,2022-2032

6.8.3.Market share analysis, by country,2022-2032

6.9.Research Dive Exclusive Insights

6.9.1.Market attractiveness

6.9.2.Competition heatmap

7.Gasification Market Analysis, by Feed Type

7.1.Overview

7.2.Dry

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region,2022-2032

7.3.Market share analysis, by country,2022-2032

7.4.Slurry

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region,2022-2032

7.4.3.Market share analysis, by country,2022-2032

7.5.Research Dive Exclusive Insights

7.5.1.Market attractiveness

7.5.2.Competition heatmap

8.Gasification Market Analysis, by Gasifier Medium

8.1.Overview

8.2.Air

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region,2022-2032

8.3.Market share analysis, by country,2022-2032

8.4.Oxygen

8.4.1.Definition, key trends, growth factors, and opportunities

8.4.2.Market size analysis, by region,2022-2032

8.4.3.Market share analysis, by country,2022-2032

8.5.Vapor

8.5.1.Definition, key trends, growth factors, and opportunities

8.5.2.Market size analysis, by region,2022-2032

8.5.3.Market share analysis, by country,2022-2032

8.6.Research Dive Exclusive Insights

8.6.1.Market attractiveness

8.6.2.Competition heatmap

9.Gasification Market Analysis, by Application

9.1.Overview

9.2.Electricity

9.2.1.Definition, key trends, growth factors, and opportunities

9.2.2.Market size analysis, by region,2022-2032

9.3.Market share analysis, by country,2022-2032

9.4.Chemicals

9.4.1.Definition, key trends, growth factors, and opportunities

9.4.2.Market size analysis, by region,2022-2032

9.4.3.Market share analysis, by country,2022-2032

9.5.Fertilizers

9.5.1.Definition, key trends, growth factors, and opportunities

9.5.2.Market size analysis, by region,2022-2032

9.5.3.Market share analysis, by country,2022-2032

9.6.Liquid Fuels

9.6.1.Definition, key trends, growth factors, and opportunities

9.6.2.Market size analysis, by region,2022-2032

9.6.3.Market share analysis, by country,2022-2032

9.7.Synthetic Natural Gas (SNG)

9.7.1.Definition, key trends, growth factors, and opportunities

9.7.2.Market size analysis, by region,2022-2032

9.7.3.Market share analysis, by country,2022-2032

9.8.Hydrogen

9.8.1.Definition, key trends, growth factors, and opportunities

9.8.2.Market size analysis, by region,2022-2032

9.8.3.Market share analysis, by country,2022-2032

9.9.Research Dive Exclusive Insights

9.9.1.Market attractiveness

9.9.2.Competition heatmap

10.Gasification Market, by Region

10.1.North America

10.1.1.U.S.

10.1.1.1.Market size analysis, by Type,2022-2032

10.1.1.2.Market size analysis, by Feedstock,2022-2032

10.1.1.3.Market size analysis, by Feed Type,2022-2032

10.1.1.4.Market size analysis, by Gasifier Medium,2022-2032

10.1.1.5.Market size analysis, by Application,2022-2032

10.1.2.Canada

10.1.2.1.Market size analysis, by Type,2022-2032

10.1.2.2.Market size analysis, by Feedstock,2022-2032

10.1.2.3.Market size analysis, by Feed Type,2022-2032

10.1.2.4.Market size analysis, by Gasifier Medium,2022-2032

10.1.2.5.Market size analysis, by Application,2022-2032

10.1.3.Mexico

10.1.3.1.Market size analysis, by Type,2022-2032

10.1.3.2.Market size analysis, by Feedstock,2022-2032

10.1.3.3.Market size analysis, by Feed Type,2022-2032

10.1.3.4.Market size analysis, by Gasifier Medium,2022-2032

10.1.3.5.Market size analysis, by Application,2022-2032

10.1.4.Research Dive Exclusive Insights

10.1.4.1.Market attractiveness

10.1.4.2.Competition heatmap

10.2.Europe

10.2.1.Germany

10.2.1.1.Market size analysis, by Type,2022-2032

10.2.1.2.Market size analysis, by Feedstock,2022-2032

10.2.1.3.Market size analysis, by Feed Type,2022-2032

10.2.1.4.Market size analysis, by Gasifier Medium,2022-2032

10.2.1.5.Market size analysis, by Application,2022-2032

10.2.2.UK

10.2.2.1.Market size analysis, by Type,2022-2032

10.2.2.2.Market size analysis, by Feedstock,2022-2032

10.2.2.3.Market size analysis, by Feed Type,2022-2032

10.2.2.4.Market size analysis, by Gasifier Medium,2022-2032

10.2.2.5.Market size analysis, by Application,2022-2032

10.2.3.France

10.2.3.1.Market size analysis, by Type,2022-2032

10.2.3.2.Market size analysis, by Feedstock,2022-2032

10.2.3.3.Market size analysis, by Feed Type,2022-2032

10.2.3.4.Market size analysis, by Gasifier Medium,2022-2032

10.2.3.5.Market size analysis, by Application,2022-2032

10.2.4.Spain

10.2.4.1.Market size analysis, by Type,2022-2032

10.2.4.2.Market size analysis, by Feedstock,2022-2032

10.2.4.3.Market size analysis, by Feed Type,2022-2032

10.2.4.4.Market size analysis, by Gasifier Medium,2022-2032

10.2.4.5.Market size analysis, by Application,2022-2032

10.2.5.Italy

10.2.5.1.Market size analysis, by Type,2022-2032

10.2.5.2.Market size analysis, by Feedstock,2022-2032

10.2.5.3.Market size analysis, by Feed Type,2022-2032

10.2.5.4.Market size analysis, by Gasifier Medium,2022-2032

10.2.5.5.Market size analysis, by Application,2022-2032

10.2.6.Rest of Europe

10.2.6.1. Market size analysis, by Type,2022-2032

10.2.6.2.Market size analysis, by Feedstock,2022-2032

10.2.6.3.Market size analysis, by Feed Type,2022-2032

10.2.6.4.Market size analysis, by Gasifier Medium,2022-2032

10.2.6.5.Market size analysis, by Application,2022-2032

10.2.7.Research Dive Exclusive Insights

10.2.7.1.Market attractiveness

10.2.7.2.Competition heatmap

10.3.Asia-Pacific

10.3.1.China

10.3.1.1.Market size analysis, by Type,2022-2032

10.3.1.2.Market size analysis, by Feedstock,2022-2032

10.3.1.3.Market size analysis, by Feed Type,2022-2032

10.3.1.4.Market size analysis, by Gasifier Medium,2022-2032

10.3.1.5.Market size analysis, by Application,2022-2032

10.3.2.Japan

10.3.2.1.Market size analysis, by Type,2022-2032

10.3.2.2.Market size analysis, by Feedstock,2022-2032

10.3.2.3.Market size analysis, by Feed Type,2022-2032

10.3.2.4.Market size analysis, by Gasifier Medium,2022-2032

10.3.2.5.Market size analysis, by Application,2022-2032

10.3.3.India

10.3.3.1.Market size analysis, by Type,2022-2032

10.3.3.2.Market size analysis, by Feedstock,2022-2032

10.3.3.3.Market size analysis, by Feed Type,2022-2032

10.3.3.4.Market size analysis, by Gasifier Medium,2022-2032

10.3.3.5.Market size analysis, by Application,2022-2032

10.3.4.Australia

10.3.4.1.Market size analysis, by Type,2022-2032

10.3.4.2.Market size analysis, by Feedstock,2022-2032

10.3.4.3.Market size analysis, by Feed Type,2022-2032

10.3.4.4.Market size analysis, by Gasifier Medium,2022-2032

10.3.4.5.Market size analysis, by Application,2022-2032

10.3.5.South Korea

10.3.5.1.Market size analysis, by Type,2022-2032

10.3.5.2.Market size analysis, by Feedstock,2022-2032

10.3.5.3.Market size analysis, by Feed Type,2022-2032

10.3.5.4.Market size analysis, by Gasifier Medium,2022-2032

10.3.5.5.Market size analysis, by Application,2022-2032

10.3.6.Rest of Asia-Pacific

10.3.6.1.Market size analysis, by Type,2022-2032

10.3.6.2.Market size analysis, by Feedstock,2022-2032

10.3.6.3.Market size analysis, by Feed Type,2022-2032

10.3.6.4.Market size analysis, by Gasifier Medium,2022-2032

10.3.6.5.Market size analysis, by Application,2022-2032

10.3.7.Research Dive Exclusive Insights

10.3.7.1.Market attractiveness

10.3.7.2.Competition heatmap

10.4.LAMEA

10.4.1.Brazil

10.4.1.1.Market size analysis, by Type,2022-2032

10.4.1.2.Market size analysis, by Feedstock,2022-2032

10.4.1.3.Market size analysis, by Feed Type,2022-2032

10.4.1.4.Market size analysis, by Gasifier Medium,2022-2032

10.4.1.5.Market size analysis, by Application,2022-2032

10.4.2.Saudi Arabia

10.4.2.1.Market size analysis, by Type,2022-2032

10.4.2.2.Market size analysis, by Feedstock,2022-2032

10.4.2.3.Market size analysis, by Feed Type,2022-2032

10.4.2.4.Market size analysis, by Gasifier Medium,2022-2032

10.4.2.5.Market size analysis, by Application,2022-2032

10.4.3.UAE

10.4.3.1.Market size analysis, by Type,2022-2032

10.4.3.2.Market size analysis, by Feedstock,2022-2032

10.4.3.3.Market size analysis, by Feed Type,2022-2032

10.4.3.4.Market size analysis, by Gasifier Medium,2022-2032

10.4.3.5.Market size analysis, by Application,2022-2032

10.4.4.South Africa

10.4.4.1.Market size analysis, by Type,2022-2032

10.4.4.2.Market size analysis, by Feedstock,2022-2032

10.4.4.3.Market size analysis, by Feed Type,2022-2032

10.4.4.4.Market size analysis, by Gasifier Medium,2022-2032

10.4.4.5.Market size analysis, by Application,2022-2032

10.4.5.Rest of LAMEA

10.4.5.1.Market size analysis, by Type,2022-2032

10.4.5.2.Market size analysis, by Feedstock,2022-2032

10.4.5.3.Market size analysis, by Feed Type,2022-2032

10.4.5.4.Market size analysis, by Gasifier Medium,2022-2032

10.4.5.5.Market size analysis, by Application,2022-2032

10.4.6.Research Dive Exclusive Insights

10.4.6.1.Market attractiveness

10.4.6.2.Competition heatmap

11.Competitive Landscape

11.1.Top winning strategies, 2022

11.1.1.By strategy

11.1.2.By year

11.2.Strategic overview

11.3.Market share analysis, 2022

12.Company Profiles

12.1.Royal Dutch Shell

12.1.1.Overview

12.1.2.Business segments

12.1.3.Product portfolio

12.1.4.Financial performance

12.1.5.Recent developments

12.1.6.SWOT analysis

12.2.Air Liquide

12.2.1.Overview

12.2.2.Business segments

12.2.3.Product portfolio

12.2.4.Financial performance

12.2.5.Recent developments

12.2.6.SWOT analysis

12.3.General Electric

12.3.1.Overview

12.3.2.Business segments

12.3.3.Product portfolio

12.3.4.Financial performance

12.3.5.Recent developments

12.3.6.SWOT analysis

12.4.Mitsubishi Heavy Industries

12.4.1.Overview

12.4.2.Business segments

12.4.3.Product portfolio

12.4.4.Financial performance

12.4.5.Recent developments

12.4.6.SWOT analysis

12.5.SEDIN Engineering Company Limited.

12.5.1.Overview

12.5.2.Business segments

12.5.3.Product portfolio

12.5.4.Financial performance

12.5.5.Recent developments

12.5.6.SWOT analysis

12.6.Siemens

12.6.1.Overview

12.6.2.Business segments

12.6.3.Product portfolio

12.6.4.Financial performance

12.6.5.Recent developments

12.6.6.SWOT analysis

12.7.CB&I

12.7.1.Overview

12.7.2.Business segments

12.7.3.Product portfolio

12.7.4.Financial performance

12.7.5.Recent developments

12.7.6.SWOT analysis

12.8.KBR.

12.8.1.Overview

12.8.2.Business segments

12.8.3.Product portfolio

12.8.4.Financial performance

12.8.5.Recent developments

12.8.6.SWOT analysis

12.9.Thyssenkrupp AG

12.9.1.Overview

12.9.2.Business segments

12.9.3.Product portfolio

12.9.4.Financial performance

12.9.5.Recent developments

12.9.6.SWOT analysis

12.10.Synthesis Energy Systems Inc.

12.10.1.Overview

12.10.2.Business segments

12.10.3.Product portfolio

12.10.4.Financial performance

12.10.5.Recent developments

12.10.6.SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com