Human Serum Albumin (HSA) Market Report

RA08669

Human Serum Albumin (HSA) Market by Type (Plasma Derived and Recombinant), Application (Therapeutic Use, Drug Delivery, Genetic Disease, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Human Serum Albumin (HSA) Market Analysis

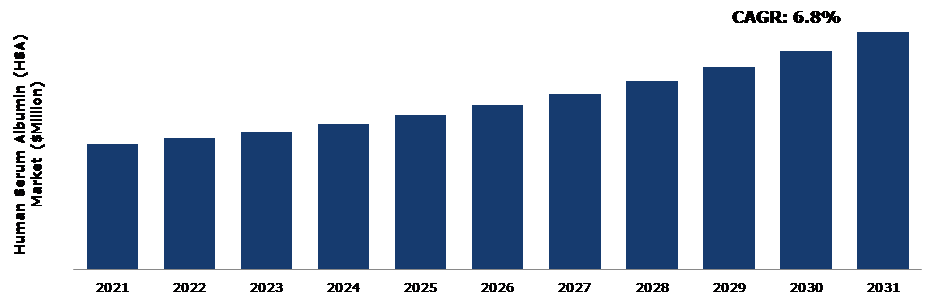

The Global Human Serum Albumin (HSA) Market Size was $3,762.30 million in 2021 and is predicted to grow with a CAGR of 6.8%, by generating a revenue of $7,124.90 million by 2031.

Global Human Serum Albumin (HSA) Market Synopsis

The increasing awareness about blood-related disorders, such as anemia, hypovolemia, and liver diseases, has increased the demand for HSA as it is used in the treatment of these disorders. Additionally, human serum albumin is also used as a plasma expander in cases of shock, trauma, and burns, which further drives the demand for this product. People are becoming more conscious about their health and well-being, which has led to an increase in the number of people seeking medical attention and treatment. The growing awareness about blood-related disorders and the increasing demand for effective treatments are the key drivers of the human serum albumin market. These factors are anticipated to boost the human serum albumin (HSA) market growth in the upcoming years.

However, some of the disadvantages of human serum albumin (HSA) include limited accessibility. Also, the high cost of HSA can limit its availability and accessibility, particularly in developing countries where healthcare budgets may be limited. This can make it difficult for patients who require HSA therapy to access the treatment they need. The acquisition of albumin requires a complex and time-consuming process, including the collection of human plasma, purification, and testing to ensure its quality and safety. This results in high costs, which are passed on to the consumers.

HSA is also being used in the development of new diagnostic tests and therapies, which are expected to increase the demand for HSA and drive the growth of the market. The market for HSA is expected to grow due to various factors, such as the increasing prevalence of chronic diseases, the growing number of surgical procedures and blood transfusions, and the increasing use of HSA in the development of new drugs and biopharmaceuticals. The increasing focus on the development of new treatments and therapies that use HSA is also expected to drive market growth in the coming years. Additionally, the growing demand for HSA in developing countries is expected to provide significant growth opportunities for the market.

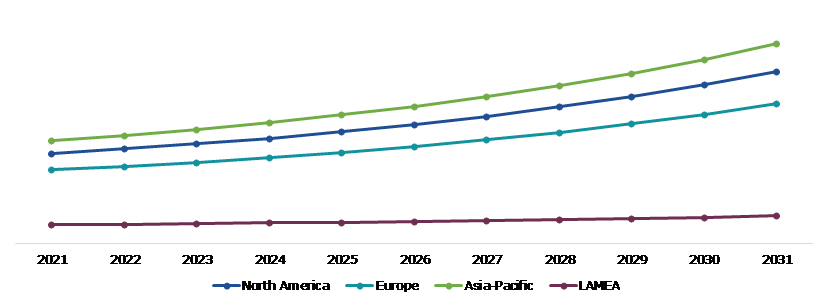

According to regional analysis, the Asia-Pacific human serum albumin (HSA) market size accounted for highest market share in 2021. Asia-Pacific has a well-established healthcare infrastructure and a high prevalence of chronic diseases such as diabetes and cancer. This has led to a growing demand for human serum albumin in the region, as the protein is used in the treatment of various medical conditions. This region has helped the growth of the human serum albumin market in Asia-Pacific, as demand for protein continues to increase.

Human Serum Albumin (HSA) Overview

Human serum albumin (HSA) is a protein that is found in human blood plasma and is the most abundant protein in the plasma. It plays a crucial role in maintaining blood volume and transporting various substances, such as hormones, drugs, and nutrients, throughout the body. The global human serum albumin market is expected to grow significantly in the coming years, due to the increasing demand for human serum albumin in various medical applications, such as the treatment of edema, hypovolemic shock, and liver diseases.

COVID-19 Impact on Global Human Serum Albumin (HSA) Market

The COVID-19 pandemic has had a significant impact on the human serum albumin market. Due to the sudden increase in demand for medical supplies, including human serum albumin, there was a shortage in the market. This shortage was primarily caused by disruptions in the supply chain, as well as an increase in the demand for human serum albumin for the treatment of critically ill COVID-19 patients. Additionally, the pandemic has also led to a slowdown in the production and distribution of human serum albumin, as many manufacturing facilities were temporarily shut down or had limited operations due to safety concerns. This has further exacerbated the shortage of human serum albumin in the market. On the other hand, the COVID-19 impact on human serum albumin (HSA) market has also led to an increase in research and development activities for the development of alternative sources of human serum albumin, such as recombinant human serum albumin. This has created new opportunities for growth in the market. Furthermore, the COVID-19 pandemic has had a mixed impact on the human serum albumin market. While it has created a shortage in the market due to disruptions in the supply chain and a slowdown in production and distribution, it has also led to new opportunities for growth in the market through research and development activities for alternative sources of human serum albumin. These initiatives are predicted to drive the human serum albumin (HSA) market demand during the analysis timeframe.

Increased Demand for Medical Treatments and Diagnostic Procedures to Drive the Market Growth

The rising incidence of chronic diseases, such as liver cirrhosis, kidney diseases, and cancer, leads to a higher demand for human serum albumin as it is used to treat these conditions. The aging population is more susceptible to chronic diseases, which in turn drives the demand for human serum albumin as it is a critical component in the treatment of these diseases. Furthermore, the increasing demand for biopharmaceuticals, such as vaccines, monoclonal antibodies, and gene therapies, drives the demand for human serum albumin as it is used as a carrier protein in these treatments. Moreover, the increasing number of blood transfusions, due to rising incidences of accidents and injuries, drives the demand for human serum albumin as it is an essential component in blood transfusions. The increasing investment in R&D for the development of new treatments and diagnostic procedures, as well as for the improvement of existing treatments, drives the demand for human serum albumin.

To know more about global human serum albumin (HSA) market drivers, get in touch with our analysts here.

Strict Government Regulations in Developing Countries Restrict Human Serum Albumin (HSA) Therapeutic Product Use

Despite increased prevalence of hypoalbuminemia and hypovolemia worldwide, albumin usage is limited by variables such as supply chain disruptions and manufacturing difficulties. In addition to these factors, there are also concerns about the safety and efficacy of albumin products, which can limit their use in certain patient populations. For example, albumin products derived from human blood may carry a risk of infectious disease transmission, while albumin products derived from genetically modified organisms may raise concerns about the long-term effects of these products on human health, which is anticipated to hamper the human serum albumin (HSA) market growth.

Use of Human Serum Albumin (HSA) in Biopharmaceutical Treatments to Drive Excellent Opportunities

Human serum albumin (HSA) is widely used in the biopharmaceutical treatment of various diseases, such as cancer, kidney diseases, and cirrhosis, which lead to decreased albumin levels. Opportunities in the human serum albumin market include the development of new biopharmaceuticals that can effectively treat decreased albumin levels and the development of new methods for the production of human serum albumin that are more efficient and cost-effective. Additionally, there is potential for the development of biopharmaceuticals that can treat albumin levels in specific populations, such as pediatrics, pregnant women, and the elderly. Furthermore, the human serum albumin market offers significant opportunities for the development and growth of biopharmaceuticals and the trend is expected to continue to in the future.

To know more about global human serum albumin (HSA) market opportunities, get in touch with our analysts here.

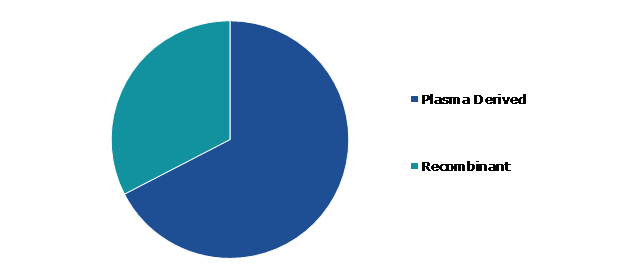

Global Human Serum Albumin (HSA) Market, by Type

Based on type, the market has been divided into plasma derived and recombinant. Among these, the recombinant sub-segment accounted for the highest market share in 2021 and is estimated to show the fastest growth during the forecast period.

Global Human Serum Albumin (HSA) Market Share, by Type, 2021

Source: Research Dive Analysis

The Plasma derived sub-type accounted for a highest market share in 2021. Plasma-derived concentrates are made from human blood which is donated by healthy volunteers and screened for safety. The number of people suffering from uncommon diseases has increased significantly, necessitating the use of specialized therapeutic treatments such as plasma derived therapy. The pandemic outbreak was an example of a rare disease in the world that was attempted to be treated with plasma-derived therapy. The number of plasma collection units has increased worldwide as the number of therapeutic procedures that use this blood component has increased. The rapidly increasing demand for plasma therapeutic procedures has significantly increased the market size. People's increased awareness of the available plasma derived therapeutic options has also resulted in greater acceptance of these techniques.

The recombinant sub-type is anticipated to show the fastest growth by 2031. Recombinant human serum albumin (HSA) is produced using recombinant DNA technology. It is an important therapeutic protein that is widely used in the pharmaceutical industry for the treatment of a range of conditions, including hypovolemia, cirrhosis, and treatment of shock. The demand for human serum albumin (HSA) is expected to grow significantly in the coming years, due to several factors such as increasing demand for albumin-based therapies, the growing use of recombinant human serum albumin in cell culture media, and the increasing adoption of recombinant technology in the production of therapeutic proteins. Additionally, the demand for rHSA is expected to increase due to its effectiveness in reducing blood loss during surgery and improving wound healing.

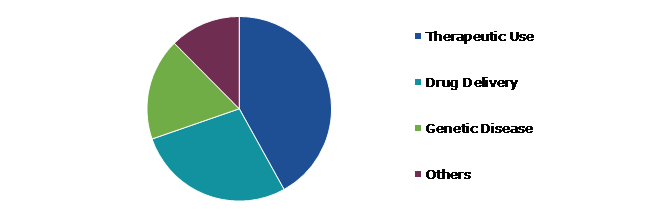

Global Human Serum Albumin (HSA) Market, by Application

Based on application, the market has been divided into therapeutic use, drug delivery, genetic disease, and others. Among these, the therapeutic use sub-segment accounted for highest revenue share in 2021, whereas the drug delivery sub-segment is estimated to show the fastest growth during the forecast period.

Global Human Serum Albumin (HSA) Market Size, by Application, 2021

Source: Research Dive Analysis

The therapeutic use sub-segment accounted for the largest human serum albumin (HSA) market share in 2021 and is anticipated to show the fastest growth during the forecast period. Human serum albumin is a protein that is naturally found in human blood and is used in a wide range of therapeutic applications. It is used to treat a variety of medical conditions, including liver disease, burns, treatment of shock, and kidney disease. In addition, it is also used as a plasma expander in the treatment of hypovolemia. The use of human serum albumin in therapeutic applications is growing, as new uses for the protein are discovered and as the demand for more effective treatments for a variety of medical conditions continues to increase. These factors are anticipated to boost the growth of therapeutic sub-segment during the analysis timeframe.

Global Human Serum Albumin (HSA) Market, Regional Insights

The human serum albumin (HSA) market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Human Serum Albumin (HSA) Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Human Serum Albumin (HSA) in Asia-Pacific was Most Dominant in 2021

The Asia-Pacific human serum albumin (HSA) market analysis accounted for the largest market share in 2021. Asia-Pacific is expected to continue its growth in the human serum albumin market due to the high prevalence of chronic diseases and an aging population. The demand for human serum albumin is expected to increase due to the growing number of surgeries, an increase in plasma donations, and a rise in research and development activities in the region. Additionally, the presence of major market players and favorable government policies are also expected to contribute to market growth in Asia-pacific. The region is home to a large number of pharmaceutical and biotechnology companies, which are major users of human serum albumin. These companies rely on human serum albumin for a wide range of applications, including drug formulation, cell culture, and medical device manufacturing.

Competitive Scenario in the Global Human Serum Albumin (HSA) Market

Investment and agreement are common strategies followed by major market players. For instance, in March 2021, Albumedix Ltd., a firm that delivers cutting-edge therapeutics and is a global leader in recombinant human albumin (rHA), and FUJIFILM Wako Pure Chemical Company, a recognized and long-standing provider of reagents, have signed a distribution agreement.

Source: Research Dive Analysis

Some of the leading human serum albumin (HSA) market players are Grifols, S.A., CSL Behring, Biotest, Takeda Pharmaceutical Company Limited. Baxter, Octapharma Brasil Ltda, Bio Group Co., Ltd., Kedrion S.p.A, Thermo Fisher Scientific, and Novozymes.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global human serum albumin (HSA) market?

A. The size of the global human serum albumin (HSA) market was over $3,762.30 million in 2021 and is projected to reach $7,124.90 million by 2031.

Q2. Which are the major companies in the human serum albumin (HSA) market?

A. Grifols, S.A., CSL Behring, and Biotest are some of the key players in the global human serum albumin (HSA) market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific human serum albumin (HSA) market?

A. Asia-Pacific human serum albumin (HSA) market is anticipated to grow at 7.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Takeda Pharmaceutical Company Limited., Baxter, and Octapharma Brasil Ltda are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global human serum albumin (HSA) market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on human serum albumin (HSA) market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Human Serum Albumin (HSA) Market Analysis, by Type

5.1.Overview

5.2.Plasma Derived

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country,2021-2031

5.3.Recombinant

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country,2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Human Serum Albumin (HSA) Market Analysis, by Application

6.1.Therapeutic use

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2021-2031

6.1.3.Market share analysis, by country,2021-2031

6.2.Therapeutic use

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country,2021-2031

6.3.Genetic disease

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country,2021-2031

6.4.Others

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2021-2031

6.4.3.Market share analysis, by country,2021-2031

6.5.Research Dive Exclusive Insights

6.5.1.Market attractiveness

6.5.2.Competition heatmap

7.Human Serum Albumin (HSA) Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type, 2021-2031

7.1.1.2.Market size analysis, by Application, 2021-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Type, 2021-2031

7.1.2.2.Market size analysis, by Application, 2021-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Type, 2021-2031

7.1.3.2.Market size analysis, by Application, 2021-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type, 2021-2031

7.2.1.2.Market size analysis, by Application, 2021-2031

7.2.2.UK

7.2.2.1.Market size analysis, by Type, 2021-2031

7.2.2.2.Market size analysis, by Application, 2021-2031

7.2.3.France

7.2.3.1.Market size analysis, by Type, 2021-2031

7.2.3.2.Market size analysis, by Application, 2021-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Type, 2021-2031

7.2.4.2.Market size analysis, by Application, 2021-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Type, 2021-2031

7.2.5.2.Market size analysis, by Application, 2021-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type, 2021-2031

7.2.6.2.Market size analysis, by Application, 2021-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type, 2021-2031

7.3.1.2.Market size analysis, by Application, 2021-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Type, 2021-2031

7.3.2.2.Market size analysis, by Application, 2021-2031

7.3.3.India

7.3.3.1.Market size analysis, by Type, 2021-2031

7.3.3.2.Market size analysis, by Application, 2021-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Type, 2021-2031

7.3.4.2.Market size analysis, by Application, 2021-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type, 2021-2031

7.3.5.2.Market size analysis, by Application, 2021-2031

7.3.6.Rest of Asia Pacific

7.3.6.1.Market size analysis, by Type, 2021-2031

7.3.6.2.Market size analysis, by Application, 2021-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type, 2021-2031

7.4.1.2.Market size analysis, by Application, 2021-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type, 2021-2031

7.4.2.2.Market size analysis, by Application, 2021-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Type, 2021-2031

7.4.3.2.Market size analysis, by Application, 2021-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type, 2021-2031

7.4.4.2.Market size analysis, by Application, 2021-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type, 2021-2031

7.4.5.2.Market size analysis, by Application, 2021-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Grifols, S.A.

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.CSL Behring

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Biotest

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Takeda Pharmaceutical Company Limited

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Baxter

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Octapharma Brasil Ltda

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Bio Group Co., Ltd.

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Kedrion S.p.A

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.Thermo Fisher Scientific

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Novozymes

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

Human serum albumin, the most important and abundantly found protein in blood plasma, is responsible for transport of almost all the vital compounds found in the body, including hormones, fatty acids, etc. Human serum albumin is primarily produced in liver and is monomeric in nature. The ability of human serum albumin to bind drug molecules without introducing any toxicity in those molecules has made it quite popular in the pharmaceutical industry.

Forecast Analysis of the Human Serum Albumin (HSA) Market

In recent years, there has been an increase in the awareness about blood-related disorders such as anemia, hypovolemia, etc. which is expected to be the primary growth driver of the global human serum albumin (HSA) market in the forecast years. Along with this, a surge in the demand for medical demands and diagnostic procedures is expected to push the market further. Also, growing usage of human serum albumin in biopharmaceutical treatments is predicted to offer numerous investment and growth opportunities to the market in the analysis timeframe. However, strict government regulations in developing countries may restrain the growth of the human serum albumin (HSA) market in the forecast period.

Regionally, the human serum albumin (HSA) market in the Asia-Pacific region is expected to be the most dominant by 2031. The growing prevalence of chronic diseases related to blood and an increasing proportion of the aging population in this region are anticipated to become the main growth drivers of the market in this region.

According to the report published by Research Dive, the global human serum albumin (HSA) market is expected to gather a revenue of $7,124.90 million by 2031 and grow at 6.8% CAGR in the 2022-2031 timeframe. Some prominent market players include Grifols, S.A., Baxter, Kedrion S.p.A, CSL Behring, Octapharma Brasil Ltd., Thermo Fisher Scientific, Biotest, Bio Group Co., Ltd., Novozymes, Takeda Pharmaceutical Company Limited, and many others.

Covid-19 Impact on the Human Serum Albumin (HSA) Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The human serum albumin (HSA) market, however, faced a moderate impact of the pandemic. Shutdown of human albumin production and distribution companies led to disruptions in global supply chains which affected the steady supply of human serum albumin. However, at the same time, there was a marked increase in research related to human serum albumin which helped in the growth of the market during the pandemic period.

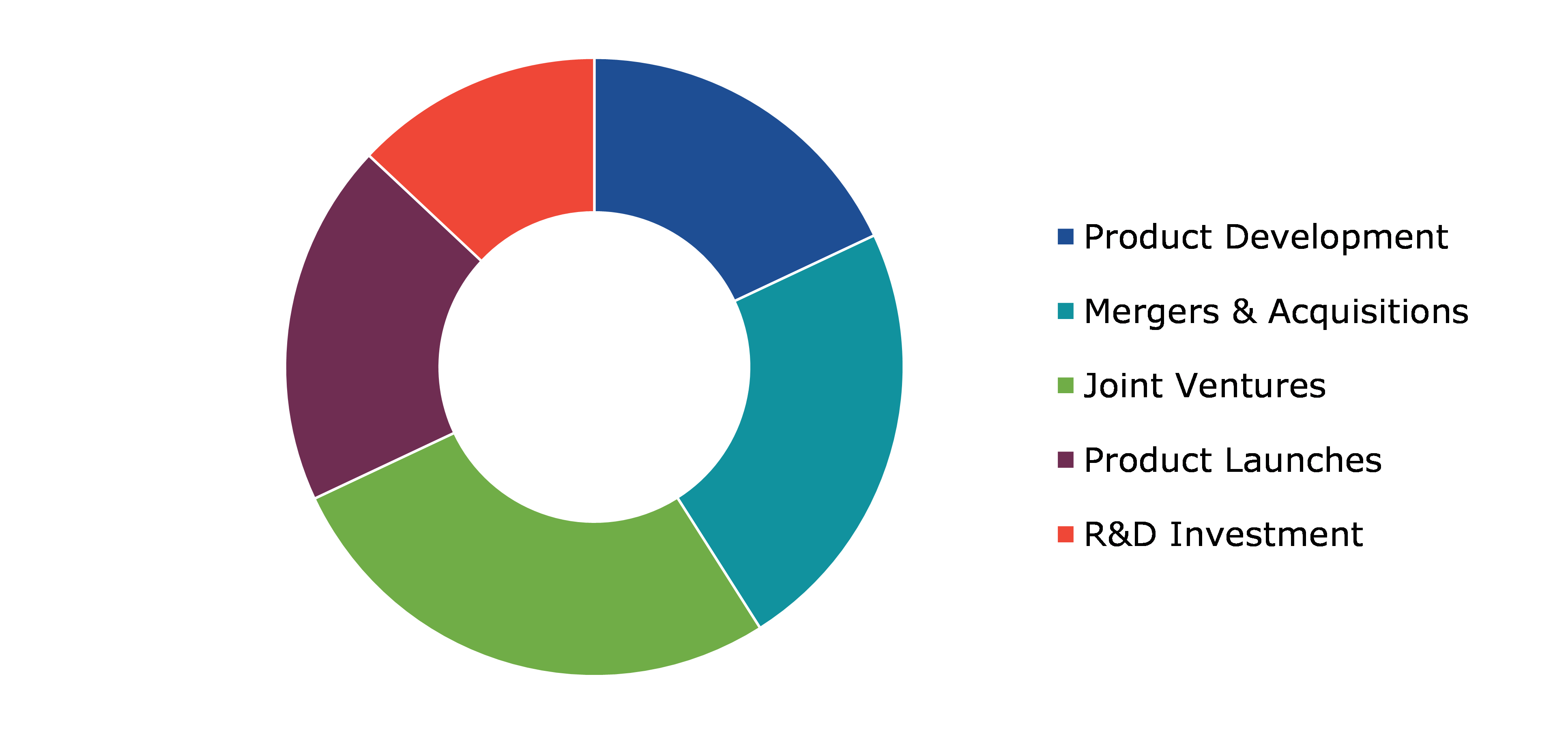

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the human serum albumin (HSA) market to flourish. For instance:

- In March 2021, Albumedix, a UK-based biotechnology company, announced that it was collaborating with FUJIFILM Wako Pure Chemical Corporation, a medical products manufacturing company. This collaboration is expected to offer numerous growth opportunities to both the companies, especially in the Chinese and Japanese markets.

- In August 2022, Sartorius, a laboratory instruments manufacturing company, announced the acquisition of Albumedix, a leading biotech firm. This acquisition is predicted to help Sartorius to expand its market share substantially in the coming period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com