Machine Learning In Pharmaceutical Industry Market Report

RA08668

Machine Learning in Pharmaceutical Industry Market by Component (Solution and Services), Enterprise Size (SMEs and Large Enterprises), Deployment (Cloud and On-premise), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Machine Learning in Pharmaceutical Industry Market Analysis

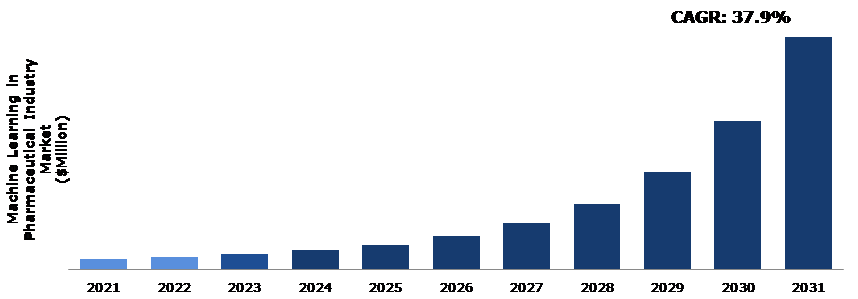

The Global Machine Learning in Pharmaceutical Industry Market Size was $1,233.4 million in 2021 and is predicted to grow with a CAGR of 37.9%, by generating a revenue of $26,151.8 million by 2031.

Global Machine Learning in Pharmaceutical Industry Market Synopsis

Machine learning can accelerate the drug discovery process by identifying potential targets for drug development and predicting the properties of potential drug candidates. The amount of data being generated in the pharmaceutical industry is growing rapidly, from genomic data to clinical trial data. Machine Learning (ML) can help to process and analyze large volumes of data and uncover patterns that would be difficult or impossible to identify through manual analysis. Drug discovery is an expensive and time-consuming process, entrenched with a high degree of uncertainty that a drug will succeed. Machine learning can help to accelerate the drug discovery process by identifying promising drug candidates and potential targets, reducing the time and resources needed for development. As genetics and disease continues to grow, there is increasing interest in developing personalized medicines that target specific patient populations. Machine learning can help to identify biomarkers and other factors that are predictive of patient response, enabling more targeted and effective treatments. These factors are anticipated to boost the machine learning in pharmaceutical industry market growth in the upcoming years.

However, there are ethical concerns bounding the use of ML in the pharmaceutical industry. For example, machine learning models may be used to identify patients for clinical trials, but this could lead to selection bias if the data used to train the models is not diverse. In addition, it can be expensive to create machine learning models for the pharmaceutical industry. Especially for startups or businesses with low funding.

Machine learning algorithms have enormous potential to revolutionize the drug discovery process in the pharmaceutical industry. By analyzing vast amounts of data, including genomic data, chemical structures, and clinical trial results, machine learning algorithms can help pharmaceutical companies identify potential drug candidates more efficiently and accurately. For instance, machine learning algorithms can be trained on large datasets of known drug molecules to identify features that are associated with their efficacy or toxicity. Once these features have been identified, algorithms can be used to screen large databases of potential drug candidates to identify those with similar properties. These are the factors anticipated to create growth opportunities in the machine learning in pharmaceutical industry market size during the forecast period.

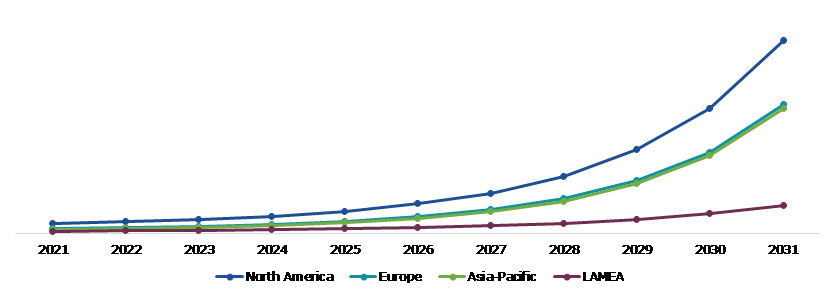

According to regional analysis, the North America machine learning in pharmaceutical industry market analysis accounted for a dominant market share in 2021. The pharmaceutical industry in North America has been a leader in adopting machine learning technologies for various applications, including drug discovery, clinical trials, and personalized medicine.

Machine Learning in Pharmaceutical Industry Overview

Machine learning has become increasingly important in the pharmaceutical industry as a tool for drug discovery and development. In general, ML algorithms can be used to analyze and interpret large data sets, identify patterns and correlations, and make predictions based on those patterns. In the context of drug development, ML has the potential to accelerate the process of identifying potential drug candidates and predicting their efficacy and safety.

COVID-19 Impact on Global Machine Learning in Pharmaceutical Industry Market

The COVID-19 impact on global machine learning in pharmaceutical industry market had a significant. Machine learning has played a crucial role in the development of treatments and vaccines in the pharmaceutical industry. ML has been used in the identification of potential drug candidates for COVID-19. Machine learning algorithms can analyze large amounts of data from existing drugs, genetic databases, and clinical trials to identify molecules that have the potential to be effective against the virus. This has helped to speed up the drug discovery process, which can take years, and has led to the rapid development of several new treatments for COVID-19. In addition, machine learning has been used in clinical trials to identify patients who are most likely to benefit from a particular treatment. By analyzing patient data and biomarkers, machine learning algorithms can predict which patients are likely to respond positively to a treatment, which can help to improve the success rates of clinical trials and reduce the time and cost involved in bringing new treatments to market. Machine learning has also been used in vaccine development during the pandemic. By analyzing genetic data from the virus, machine learning algorithms can identify potential targets for vaccines and predict how the virus is likely to evolve over time, which can help to ensure that vaccines remain effective. The machine learning has played a crucial role in the pharmaceutical industry's response to the COVID-19 pandemic, and it is likely to continue to be a key technology in the development of new treatments and vaccines in the future.

Improving Medical Diagnosis of Machine Learning in the Pharmaceutical Sector to Drive the Market Growth

Machine learning has the potential to revolutionize the pharmaceutical industry by improving medical diagnosis. The pharmaceutical industry generates a massive amount of data from various sources, such as clinical trials, patient records, and molecular databases. Machine learning algorithms can efficiently process this data and uncover valuable insights that can aid in the diagnosis of diseases. Machine learning algorithms can help pharmaceutical companies to develop personalized medicine based on the patient's genetic makeup, lifestyle, and medical history. This approach can improve the accuracy of diagnosis and treatment, resulting in better patient outcomes. Machine learning can help accelerate the drug discovery process by predicting the potential efficacy and safety of new drugs. This can save time and resources and reduce the risk of failure during clinical trials. Machine learning algorithms can analyze medical images, such as CT scans and MRIs, to detect abnormalities and aid in the diagnosis of diseases. This approach can improve the accuracy of diagnosis and reduce the need for invasive procedures. The machine learning is poised to make a significant impact on the pharmaceutical industry by improving medical diagnosis, accelerating drug discovery, and improving patient outcomes.

To know more about global machine learning in pharmaceutical industry market drivers, get in touch with our analysts here.

Regulatory and Legal Challenges Over Machine Learning in the Pharmaceutical Sector to Restrain the Market Growth

The pharmaceutical industry is heavily regulated, and there are strict rules and regulations that need to be followed for drug development, clinical trials, and commercialization. ML models in the pharmaceutical industry need to comply with various regulatory standards set by various regulatory authorities such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA). The models need to meet the requirements of good laboratory practices (GLP) and good clinical practices (GCP) to ensure the safety and efficacy of drugs. However, the challenge lies in the fact that ML models are often black-box models, which makes it difficult to explain how they make decisions. Therefore, regulatory authorities may require more transparency and accountability from ML models to ensure that they are reliable, which is anticipated to hamper the machine learning in pharmaceutical industry market growth.

Personalized Treatment/Behavioral Modification to Drive Excellent Growth Opportunities

Machine learning has tremendous potential in the pharmaceutical industry, especially in the field of personalized medicine. Personalized medicine involves customizing medical treatments to individual patients based on their unique characteristics, such as genetic makeup, lifestyle, and medical history. Machine learning algorithms can analyze large amounts of data from patients and identify patterns and relationships that are not immediately apparent to humans. By analyzing a patient's genetic makeup, medical history, and other factors, machine learning algorithms can identify the treatments that are most likely to be effective for that patient. This can help doctors make more informed decisions about which treatments to prescribe and can improve patient outcomes.

To know more about global machine learning in pharmaceutical industry market opportunities, get in touch with our analysts here.

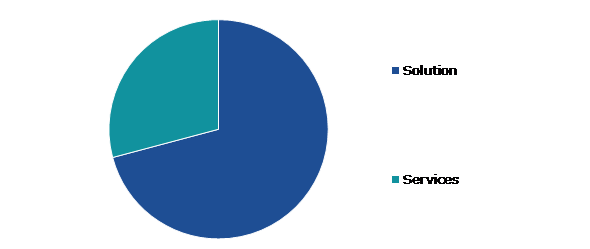

Global Machine Learning in Pharmaceutical Industry Market, by Component

Based on component, the market has been divided into solution and services. Among these, the solution sub-segment accounted for the highest machine learning in pharmaceutical industry market share in 2021, whereas the services sub-segment is estimated to show the fastest growth during the forecast period.

Global Machine Learning in Pharmaceutical Industry Market Share, by Component 2021

Source: Research Dive Analysis

The solution sub-segment accounted for a dominant market share in 2021. The solution segment is essential to address the challenges posed by complex diseases such as cancer and neurological disorders. Machine learning solutions have been used by the pharmaceutical industry to enhance drug development, clinical trials, and personalized treatment. Large amounts of data can be analyzed using machine learning algorithms, which can then be used to forecast which compounds are most likely to have therapeutic benefits. This can shorten the process of finding new drugs and lower the price for pharmaceutical companies. By identifying patients who are most likely to respond to a novel medicine or forecast which individuals are at risk for adverse outcomes, machine learning algorithms can aid in the optimization of clinical trial designs. This can speed up and lower the cost of clinical trials while also enhancing patient outcomes.

The services sub-segment is anticipated to show the fastest growth by 2031. The growing demand for more efficient and effective drug development and discovery processes is expected to drive the segment growth. Pharmaceutical companies are under increasing pressure to reduce the time and cost of bringing new drugs to market, while also improving the safety and efficacy of their products. Machine learning services are transforming the pharmaceutical industry by enabling more accurate predictions of drug efficacy and safety, as well as more efficient drug discovery and clinical trial processes. The growing demand for more efficient and effective drug development processes, along with the potential of machine learning to transform the industry, is driving the growth of the services segment.

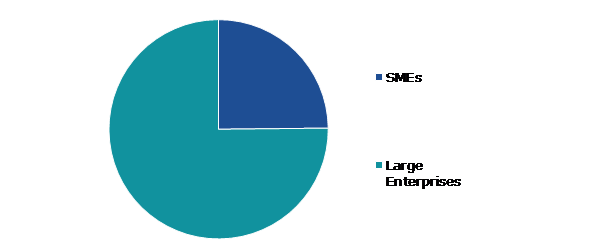

Global Machine Learning in Pharmaceutical Industry Market, by Enterprise Size

Based on enterprise size, the market has been divided into SMEs and large enterprises. Among these, the large enterprises sub-segment accounted for the highest revenue share in 2021.

Global Machine Learning in Pharmaceutical Industry Market Growth, by Enterprise Size, 2021

Source: Research Dive Analysis

The large enterprises sub-segment accounted for a dominant machine learning in pharmaceutical industry market share in 2021. The pharmaceutical industry is rapidly adopting machine learning (ML) technologies to improve drug discovery, clinical trials, and patient outcomes. The large enterprises need to stay competitive and leverage the vast amounts of data generated throughout the drug development process. Large pharmaceutical companies have access to extensive data sets, including clinical trial data, electronic health records, genomic data, and chemical databases. Machine learning algorithms can analyze these large data sets and identify patterns and insights that can be used to develop new drugs, optimize clinical trials, and personalize treatment plans for patients. In addition, large pharmaceutical companies have the resources to invest in developing and implementing ML models and technologies. These factors are anticipated to boost the machine learning in pharmaceutical industry market demand of large enterprises sub-segment during the forecast timeframe.

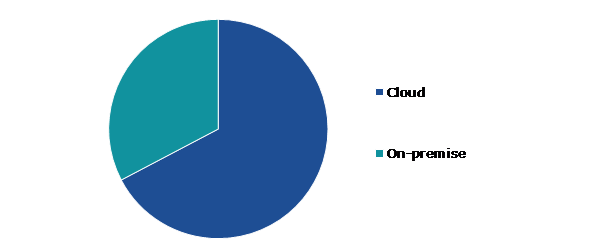

Global Machine Learning in Pharmaceutical Industry Market, by Deployment

Based on deployment, the market has been divided into cloud and on-premise. Among these, the cloud sub-segment accounted for highest revenue share in 2021.

Global Machine Learning in Pharmaceutical Industry Market Size, by Deployment, 2021

Source: Research Dive Analysis

The cloud sub-segment accounted for a dominant market share in 2021. The use of cloud computing in the pharmaceutical industry has been growing rapidly, driven by several factors including the need for secure and scalable data storage and processing, the need to access real-time data from multiple sources, and the desire to reduce infrastructure costs. Machine learning, which involves the use of algorithms and statistical models to analyze and learn from data, is one area of the pharmaceutical industry where cloud computing is playing an increasingly important role. The increasing availability of large amounts of data is driving the demand for cloud segment. The pharmaceutical industry generates massive amounts of data, from clinical trial data to electronic health records, genomic data, and others. These factors are anticipated to boost the machine learning in pharmaceutical industry market trend of cloud sub-segment during the analysis timeframe.

Global Machine Learning in Pharmaceutical Industry Market, Regional Insights

The machine learning in pharmaceutical industry market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Machine Learning in Pharmaceutical Industry Market Size & Forecast, by region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Machine Learning in Pharmaceutical Industry in North America was the Most Dominant

The North America machine learning in pharmaceutical industry market accounted for a dominant market share in 2021. The pharmaceutical industry has always been at the forefront of technological advancements. North America has been able to leverage its advanced technological infrastructure to develop and implement machine learning algorithms that can analyze vast amounts of data quickly and accurately. North America has some of the most advanced research capabilities in the world. With top-tier universities and research centers, the region has been able to develop cutting-edge technologies in machine learning that have been successfully applied in the pharmaceutical industry. Collaboration between pharmaceutical companies and technology firms has been influential in the adoption of machine learning in the industry. North America has a strong culture of collaboration, which has enabled companies to work together to develop new solutions and technologies. The North America pharmaceutical industry is highly competitive, and companies are constantly investing in R&D to stay ahead of the curve. This investment has resulted in the development of new machine learning applications that can improve drug discovery, clinical trials, and patient outcomes.

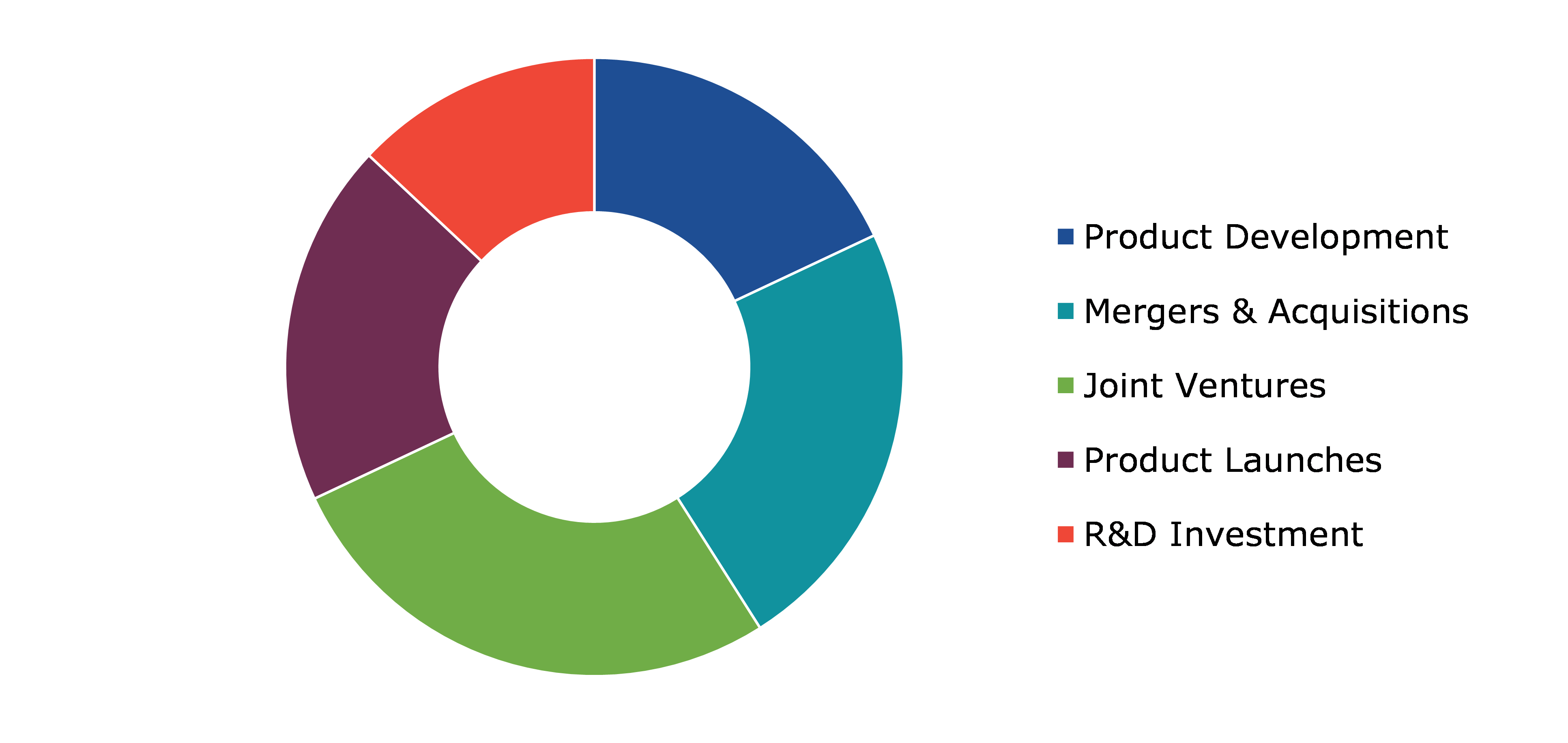

Competitive Scenario in the Global Machine Learning in Pharmaceutical Industry Market

Investment and agreement are common strategies followed by major market players. For instance, in April 2022, the biopharmaceutical company Ardelyx released IBSRELA, the first and only NHE3 inhibitor for the treatment of irritable bowel syndrome with constipation (IBS-C) in adults. IBSRELA is the first Ardelyx medication to get the U.S. Food and Drug Administration approval.

Source: Research Dive Analysis

Some of the leading machine learning in pharmaceutical industry market players are Cyclica Inc., BioSymetrics Inc., Cloud Pharmaceuticals, Inc., Deep Genomics, Atomwise Inc., Alphabet Inc., NVIDIA Corporation, International Business Machines Corporation, Microsoft Corporation, and IBM.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Component

|

|

|

|

|

| Segmentation by Deployment |

|

| Key Companies Profiled |

|

Q1. What is the size of the global machine learning in pharmaceutical industry market?

A. The size of the global machine learning in pharmaceutical industry market was over $1,233.4 million in 2021 and is projected to reach $26,151.8 million by 2031.

Q2. Which are the major companies in the machine learning in pharmaceutical industry market?

A. Cyclica Inc., BioSymetrics Inc., and Cloud Pharmaceuticals, Inc. are some of the key players in the global machine learning in pharmaceutical industry market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific machine learning in pharmaceutical industry market?

A. Asia-Pacific machine learning in pharmaceutical industry market is anticipated to grow at 42.4% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Deep Genomics, Deep Genomics, and Atomwise Inc. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Machine Learning in Pharmaceutical Industry market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Machine Learning in Pharmaceutical Industry market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Machine Learning in Pharmaceutical Industry Market Analysis, by Component

5.1.Overview

5.2.Solution

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region,2021-2031

5.2.3.Market share analysis, by country,2021-2031

5.3.Services

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region,2021-2031

5.3.3.Market share analysis, by country,2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Machine Learning in Pharmaceutical Industry Market Analysis, by Enterprise Size

6.1.SMEs

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region,2021-2031

6.1.3.Market share analysis, by country,2021-2031

6.2.Large Enterprises

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region,2021-2031

6.2.3.Market share analysis, by country,2021-2031

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness

6.3.2.Competition heatmap

7.Machine Learning in Pharmaceutical Industry Market Analysis, by Deployment

7.1.Cloud

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region,2021-2031

7.1.3.Market share analysis, by country,2021-2031

7.2.On-premise

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region,2021-2031

7.2.3.Market share analysis, by country,2021-2031

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness

7.3.2.Competition heatmap

8.Machine Learning in Pharmaceutical Industry Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Component, 2021-2031

8.1.1.2.Market size analysis, by Enterprise Size, 2021-2031

8.1.1.3.Market size analysis, by Deployment, 2021-2031

8.1.2.Canada

8.1.2.1.Market size analysis, by Component, 2021-2031

8.1.2.2.Market size analysis, by Enterprise Size, 2021-2031

8.1.2.3.Market size analysis, by Deployment, 2021-2031

8.1.3.Mexico

8.1.3.1.Market size analysis, by Component, 2021-2031

8.1.3.2.Market size analysis, by Enterprise Size, 2021-2031

8.1.3.3.Market size analysis, by Deployment, 2021-2031

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Component, 2021-2031

8.2.1.2.Market size analysis, by Enterprise Size, 2021-2031

8.2.1.3.Market size analysis, by Deployment, 2021-2031

8.2.2.UK

8.2.2.1.Market size analysis, by Component, 2021-2031

8.2.2.2.Market size analysis, by Enterprise Size, 2021-2031

8.2.2.3.Market size analysis, by Deployment, 2021-2031

8.2.3.France

8.2.3.1.Market size analysis, by Component, 2021-2031

8.2.3.2.Market size analysis, by Enterprise Size,2021-2031

8.2.3.3.Market size analysis, by Deployment, 2021-2031

8.2.4.Spain

8.2.4.1.Market size analysis, by Component, 2021-2031

8.2.4.2.Market size analysis, by Enterprise Size, 2021-2031

8.2.4.3.Market size analysis, by Deployment, 2021-2031

8.2.5.Italy

8.2.5.1.Market size analysis, by Component, 2021-2031

8.2.5.2.Market size analysis, by Enterprise Size, 2021-2031

8.2.5.3.Market size analysis, by Deployment, 2021-2031

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Component, 2021-2031

8.2.6.2.Market size analysis, by Enterprise Size, 2021-2031

8.2.6.3.Market size analysis, by Deployment, 2021-2031

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Component, 2021-2031

8.3.1.2.Market size analysis, by Enterprise Size, 2021-2031

8.3.1.3.Market size analysis, by Deployment, 2021-2031

8.3.2.Japan

8.3.2.1.Market size analysis, by Component, 2021-2031

8.3.2.2.Market size analysis, by Enterprise Size, 2021-2031

8.3.2.3.Market size analysis, by Deployment, 2021-2031

8.3.3.India

8.3.3.1.Market size analysis, by Component, 2021-2031

8.3.3.2.Market size analysis, by Enterprise Size, 2021-2031

8.3.3.3.Market size analysis, by Deployment, 2021-2031

8.3.4.Australia

8.3.4.1.Market size analysis, by Component, 2021-2031

8.3.4.2.Market size analysis, by Enterprise Size, 2021-2031

8.3.4.3.Market size analysis, by Deployment, 2021-2031

8.3.5.South Korea

8.3.5.1.Market size analysis, by Component, 2021-2031

8.3.5.2.Market size analysis, by Enterprise Size, 2021-2031

8.3.5.3.Market size analysis, by Deployment, 2021-2031

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Component, 2021-2031

8.3.6.2.Market size analysis, by Enterprise Size, 2021-2031

8.3.6.3.Market size analysis, by Deployment, 2021-2031

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Component, 2021-2031

8.4.1.2.Market size analysis, by Enterprise Size, 2021-2031

8.4.1.3.Market size analysis, by Deployment, 2021-2031

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Component, 2021-2031

8.4.2.2.Market size analysis, by Enterprise Size, 2021-2031

8.4.2.3.Market size analysis, by Deployment, 2021-2031

8.4.3.UAE

8.4.3.1.Market size analysis, by Component, 2021-2031

8.4.3.2.Market size analysis, by Enterprise Size, 2021-2031

8.4.3.3.Market size analysis, by Deployment, 2021-2031

8.4.4.South Africa

8.4.4.1.Market size analysis, by Component, 2021-2031

8.4.4.2.Market size analysis, by Enterprise Size, 2021-2031

8.4.4.3.Market size analysis, by Deployment, 2021-2031

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Component, 2021-2031

8.4.5.2.Market size analysis, by Enterprise Size, 2021-2031

8.4.5.3.Market size analysis, by Deployment, 2021-2031

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Cyclica Inc.

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.BioSymetrics Inc.

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Cloud Pharmaceuticals, Inc.

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Deep Genomics

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Atomwise Inc.

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Alphabet Inc.

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.NVIDIA Corporation

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.International Business Machines Corporation

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Microsoft Corporation

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.IBM

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

Machine learning in pharmaceutical industry can help in various ways including easier and quicker disease diagnosis, simplified drug discovery, accurate clinical trials, and advanced medical record-keeping. Using predictive analysis techniques, machine learning can help in identifying the discrepancies at each stage and help in solving them by adopting ingenious solutions.

Forecast Analysis of the Machine Learning in Pharmaceutical Industry Market

The increasing volume of data generated by the medical and healthcare sector is expected to be the primary growth driver of the global machine learning in pharmaceutical industry market in the forecast years. Along with this, increasing adoption of machine learning to accelerate the drug discovery processes is expected to push the market further. Also, personalized treatment/behavioral modification is predicted to offer numerous investment and growth opportunities to the market in the analysis timeframe. However, the regulatory and legal challenges over machine learning may restrain the growth of the machine learning in pharmaceutical industry market in the forecast period.

Regionally, the machine learning in pharmaceutical industry market in the North America region is expected to be the most dominant by 2031. The growing development of cutting-edge technologies in machine learning in the United States of America is anticipated to become the main growth driver of the market in this region.

According to the report published by Research Dive, the global machine learning in pharmaceutical industry market is expected to gather a revenue of $26,151.8 million by 2031 and grow at 37.9% CAGR in the 2022-2031 timeframe. Some prominent market players include Cyclica Inc., Atomwise Inc., International Business Machines Corporation, BioSymetrics Inc., Alphabet Inc., Microsoft Corporation, Cloud Pharmaceuticals, Inc., NVIDIA Corporation, IBM, Deep Genomics, and many others.

Covid-19 Impact on the Machine Learning in Pharmaceutical Industry Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The machine learning in pharmaceutical industry market, however, has been an exception. Machine learning and similar technologies were increasingly being used during the pandemic for quicker drug discovery and completing the clinical trials accurately and in a shorter time span. This increased the demand for machine learning techniques in the medical sector which helped the market to grow in the pandemic period.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the machine learning in pharmaceutical industry market to flourish. For instance:

- In January 2023, Microsoft, a global technology giant, announced a collaboration with VinBrain, Vietnam’s leading healthcare software company. This collaboration is aimed at introducing artificial intelligence in the healthcare sector and developing smart data sharing platforms. This collaboration is expected to help both the companies to expand their market share in the long run.

- In March 2023, Medtronic, a global medical device company, announced that it was partnering with NVIDIA, a leading technology. This partnership is aimed at building a “smart” AI-powered platform for medical devices. This collaboration will help both the companies to cater to the demands of the medical sector comprehensively in the near future.

- In May 2023, Recursion Pharmaceutical, a leading biotechnology company, announced the acquisition of two preclinical trials firms, Cyclica and Valance. This acquisition by Recursion has been done with the aim of introducing predictive analysis techniques during clinical trials of drug development. The acquisition is predicted to help Recursion immensely in the coming period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com