Green Methanol Market Report

RA08659

Green Methanol Market by Type (Bio-methanol and E-methanol), Feedstock (Municipal Solid Waste (MSW), Agricultural Waste, Forestry Residues, Carbon Dioxide, and Renewable Hydrogen), Application (Chemical Uses (Formaldehyde, Methanol-to-olefins, Acetic acid, Methyl methacrylate (MMA), Methyl chloride (chloromethane), Others) and Fuel Uses (Gasoline blending, Methyl tert-butyl ether (MTBE), Biodiesel, Dimethyl ether (DME)), End Use Industry (Automotive, Steel Industry, Chemical, Power Generation, and Others) and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022–2031

Global Green Methanol Market Analysis

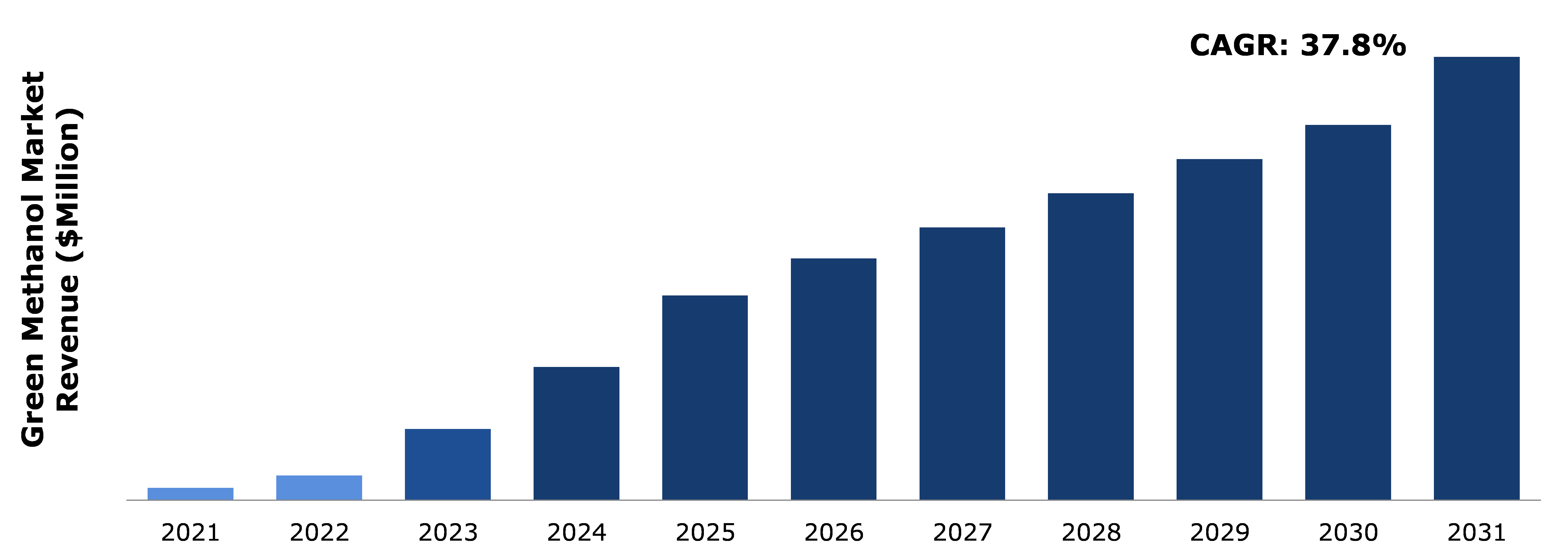

The Global Green Methanol Market Size was $349 million in 2021 and is predicted to grow with a CAGR of 37.8%, by generating a revenue of $12,478.5 million by 2031.

Global Green Methanol Market Synopsis

Green methanol is used as a feedstock for the production of several renewable chemicals, including formaldehyde, acetic acid, and methyl methacrylate. Growth in demand for these chemicals drives the demand for green methanol as a feedstock. This is owing to the fact that green methanol is produced from renewable sources, such as biomass or carbon dioxide, and has a significantly lower carbon footprint compared to traditional methanol produced from fossil fuels. The shift toward renewable chemicals is driven by a combination of factors, including increase in environmental regulations, rise in concerns about climate change, and the need for sustainable alternatives to fossil fuels. In addition to its use as a feedstock for renewable chemicals, green methanol also gaining popularity as a fuel for transportation, particularly in the marine & shipping industries. These are the major factors anticipated to boost the green methanol market in the upcoming years.

However, some of the disadvantages of green methanol include high production costs. the high production costs associated with green methanol production can be a significant restraint on the growth of the green methanol market. The cost of renewable energy sources such as wind and solar power, which are necessary to produce green methanol, can be much higher than the cost of traditional fossil fuel-based energy sources. This, in turn, can make green methanol more expensive to produce, which can lead to higher prices for consumers and make it less competitive compared to traditional methanol.

On the contrary, the green methanol is potential to replace traditional fossil fuels in various applications, including transportation, power generation, and industrial processes. For instance, green methanol can be used as a fuel for cars, buses, and ships.. Green methanol offers several economic and ecological benefits as it helps in mitigating global warming by reducing emissions of greenhouse gases. Moreover, the green methanol market has the potential to create a circular economy. Green methanol can be produced from waste materials, such as agricultural waste & municipal solid waste, which reduces the amount of waste sent to landfills and provides a new source of renewable energy. The green methanol market has significant growth potential due to increase in demand for clean energy sources and need to reduce carbon emissions.

According to regional analysis, the Asia-Pacific green methanol market accounted for the largest market share in 2021. Asia-Pacific has abundance of renewable resources such as solar, wind, and biomass, which can be used to produce green methanol. This makes the region an ideal location for the production of green methanol. Green methanol has a wide range of industrial applications, including as a solvent, antifreeze, and as a feedstock for the production of chemicals such as formaldehyde and acetic acid. This has led to growth in demand for green methanol in regional industries such as pharmaceuticals, plastics, and textiles.

Green Methanol Overview

Green methanol, also known as renewable methanol or bio-methanol, is a type of methanol that is produced using renewable energy sources and sustainable feedstocks such as biomass, carbon dioxide, or captured industrial emissions. Unlike conventional methanol, which is typically produced from non-renewable sources such as natural gas or coal, green methanol is considered to be a low-carbon fuel that can help reduce greenhouse gas emissions and combat climate change. The production of green methanol involves a variety of processes, including gasification, syngas production, and methanol synthesis.

COVID-19 Impact on Global Green Methanol Market

The COVID-19 pandemic has had a significant impact on the global economy and the energy sector, including the green methanol market. The pandemic has disrupted global supply chains, leading to delays in the construction of new green methanol plants or the maintenance of existing ones. This could lead to temporary reduction in production capacity. The pandemic has caused a significant reduction in global travel & transportation, leading to reduction in demand for fuels such as green methanol, which is used primarily as a transportation fuel. Governments around the globe have had to shift their priorities toward healthcare & emergency response during the pandemic, leading to reduction in funding & support for renewable energy projects such as green methanol production. The pandemic has caused significant fluctuations in energy markets, including changes in the price of crude oil and natural gas, which could affect the competitiveness of green methanol as an alternative fuel.. This could lead to increase in demand for green methanol as a renewable energy source in the long term. The impact of COVID-19 pandemic on the green methanol market is complex and multifaceted, and its effects may vary depending on factors such as regional market conditions and government policies.

Rise in Environmental Concerns to Drive the Market Growth

With volatility of oil prices and the potential for supply disruptions, many countries are looking for more secure & reliable energy sources. Green methanol can be produced from a variety of renewable sources such as biomass, waste, and renewable electricity, reducing dependence on traditional fossil fuels. Government regulations and incentives are further driving the green methanol market. Many countries have implemented policies to reduce greenhouse gas emissions and promote the use of renewable energy sources. Incentives such as tax credits, subsidies, and feed-in tariffs are being offered to encourage the production and use of green methanol. In addition, growth in demand for electric vehicles is driving the green methanol market. Green methanol can be used as a fuel cell feedstock, providing a sustainable alternative to hydrogen produced from fossil fuels. These factors are anticipated to drive the market growth.

To know more about global green methanol market drivers, get in touch with our analysts here.

High Production Costs of Green Methanol to Restrain the Market Growth

Production of green methanol currently involves significant investment in technology and infrastructure, which can result in higher production costs compared to traditional fossil fuel-based methanol. This is due to the fact that green methanol is produced from renewable sources such as biomass, carbon dioxide, or renewable electricity, which require specialized equipment and processes.

Increase in Demand for Clean Energy to Drive Excellent Opportunities

The green methanol market presents a significant opportunity in the context of increase in demand for clean energy sources. Green methanol is a form of methanol that is produced from renewable sources such as biomass, carbon capture and utilization, and renewable energy. It has the potential to replace traditional fossil fuels in various industries, including transportation, power generation, and chemical production. Green methanol has a lower carbon footprint compared to traditional methanol, making it an attractive option for companies looking to reduce their greenhouse gas emissions. Moreover, it offers several other advantages, such as improved fuel efficiency and lower maintenance costs. increase in demand for clean energy sources presents a significant opportunity for the green methanol market.

To know more about global green methanol market opportunities, get in touch with our analysts here.

Global Green Methanol Market, by Type

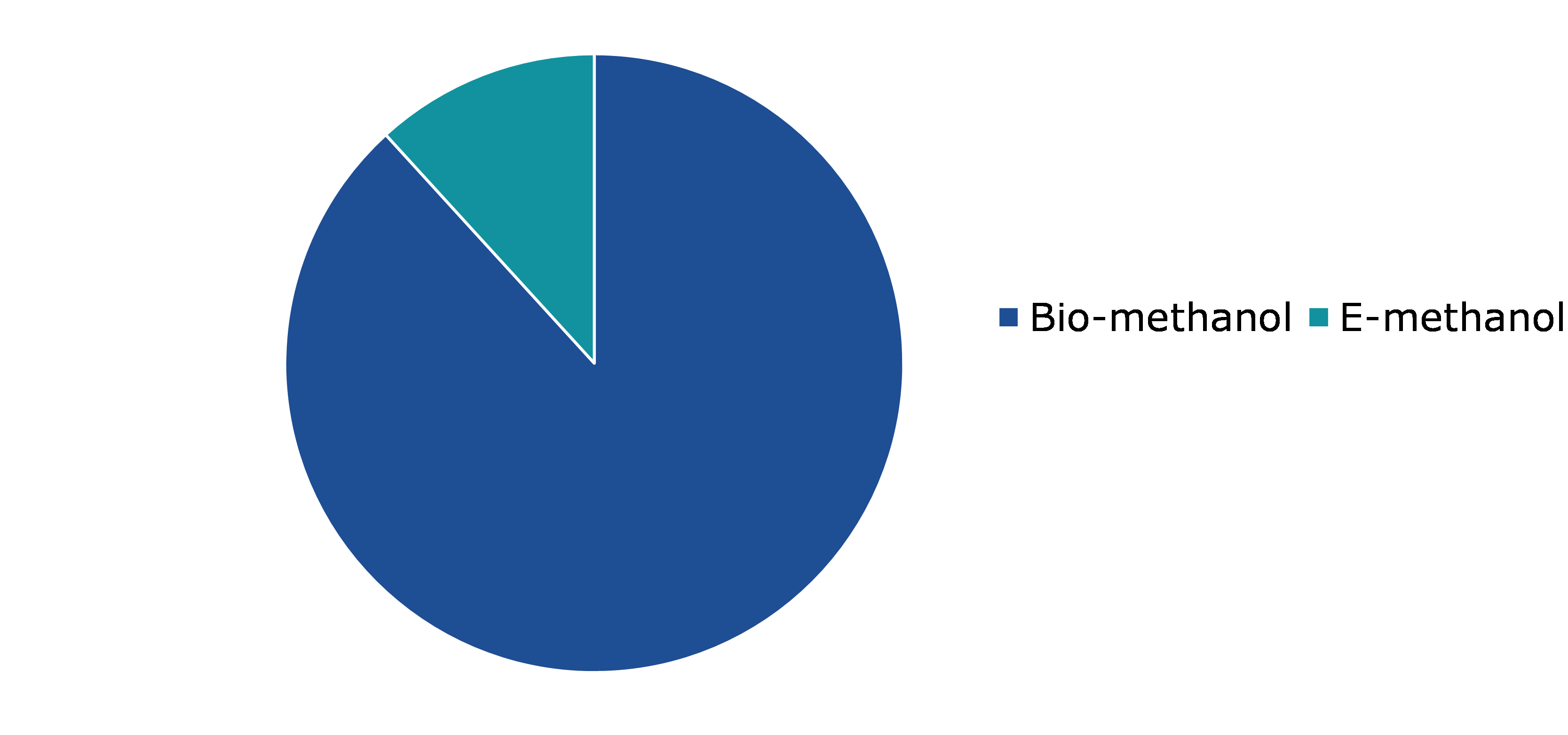

Depending on type, the market has been divided into bio-methanol, and e-methanol. Among these, the bio-methanol subsegment accounted for the highest market share in 2021 whereas the e-methanol subsegment is estimated to show the fastest growth during the forecast period.

Global Green Methanol Market Share, by Type, 2021

Source: Research Dive Analysis

The bio-methanol subtype accounted for the largest market share in 2021. Bio-methanol is a type of methanol that is produced from biomass or waste materials, rather than from fossil fuels. It is considered a green fuel as it has much lower carbon footprint than traditional methanol, which is typically made from natural gas. Bio-methanol is being increasingly used as a substitute for traditional methanol in a wide range of applications, including transportation fuels, chemicals, and power generation. This is being driven by a combination of factors, including government regulations & incentives that encourage the use of renewable fuels, as well as increase in awareness among consumers and businesses about the importance of reducing carbon emissions. Other factors that drive the segmental growth include need for sustainable & renewable energy sources, as well as rise in awareness of the environmental impact of traditional fuels.

The e-methanol subtype is anticipated to show the fastest growth in 2031. The growth of the e-methanol segment is attributed to increase in demand for renewable & sustainable fuels as well as the need to reduce carbon emissions in the transportation sector. E-methanol is a type of green methanol that is produced using renewable energy sources such as wind, solar, or hydroelectric power, and carbon dioxide captured from industrial processes or the atmosphere. E-methanol is considered to be a carbon-neutral fuel as the carbon dioxide emissions released during combustion are equal to the amount of carbon dioxide that was captured during production. This makes it an attractive alternative to fossil fuels such as gasoline and diesel, which are major contributors to greenhouse gas emissions and climate change.

Global Green Methanol Market, by Feedstock

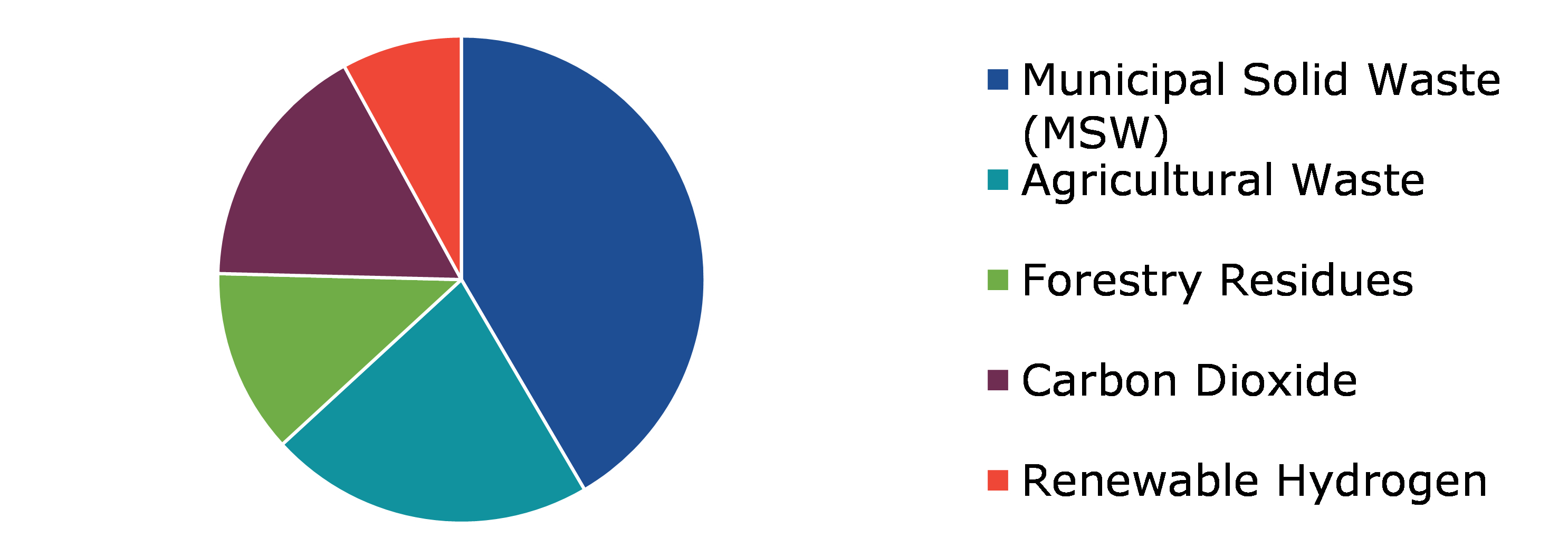

By feedstock, the market has been divided into municipal solid waste (MSW), agricultural waste, forestry residues, carbon dioxide, and renewable hydrogen. Among these, the municipal solid waste (MSW) subsegment accounted for the highest market share in 2021 whereas the carbon dioxide subsegment is estimated to show the fastest growth during the forecast period.

Global Green Methanol Market Size, by Feedstock, 2021

Source: Research Dive Analysis

The municipal solid waste (MSW) subtype accounted for the largest market share in 2021. The production of green methanol, particularly the bio-methanol, from MSW is gaining significant popularity in recent years. This is due to the fact that the production of green methanol from waste streams such as MSW offers opportunities to improve the green methanol plant economics and simplify feedstock logistics. For instance, in September 2022, WasteFuel the leading California-based manufacturer of bio-refineries has converted MSW into low carbon fuels such as green methanol. This technology is named as WasteFuel methanol module that will boost the use of organic waste for the production of green methanol. Such initiatives will boost the production of green methanol that is widely used by shipping companies namely Proman, Maersk, CMA, Stena Line, and others.

The carbon dioxide subtype is anticipated to show the fastest growth in 2031. The production of green methanol with the synthesis of hydrogen and carbon dioxide can help in the development of a carbon-neutral circular economy by reducing the emission of harmful carbon dioxide into the atmosphere. Hence, to mitigate global warming issues, the conversion of carbon dioxide to methanol via a process called CO2 hydrogenation has gained huge popularity in recent years. To produce green methanol, carbon dioxide captured from renewable methods such as direct air capture (DAC) is used which is chemically identical to the methanol produced from fossil fuel sources.

Global Green Methanol Market, by Application

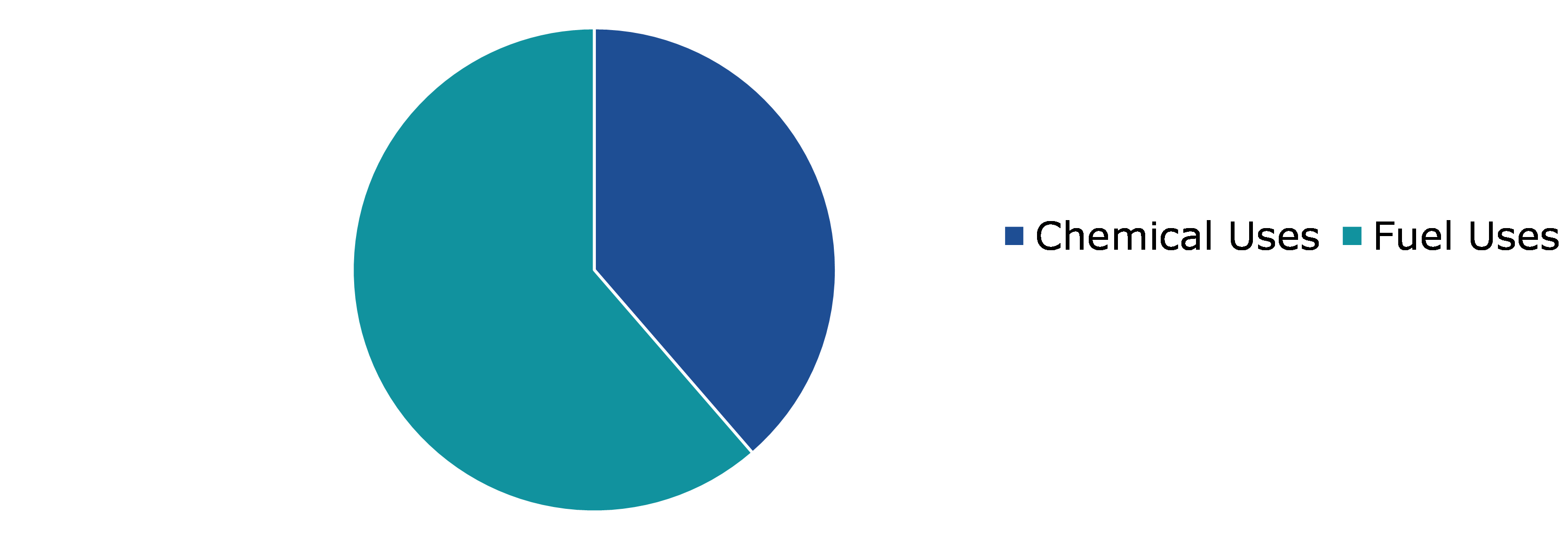

As per application, the market has been divided into chemical uses, and fuel uses. Among these, the chemical uses subsegment is anticipated to show the fastest growth during the forecast period.

Global Methanol Market Forecast, by Application, 2021

Source: Research Dive Analysis

The chemical uses subsegment is estimated to show the fastest growth during the analysis timeframe. The growth of the segment is attributed to increase in demand for sustainable chemicals in various industries, such as plastics, paints, and solvents. The green methanol provides a sustainable alternative to traditional chemical uses, such as oil & natural gas. This is significant as the production of these fossil fuels is associated with notable environmental impacts, including air pollution, water pollution, and greenhouse gas emissions. These factors are anticipated to boost the growth of chemical uses subsegment during the analysis timeframe.

Global Green Methanol Market, by End Use Industry

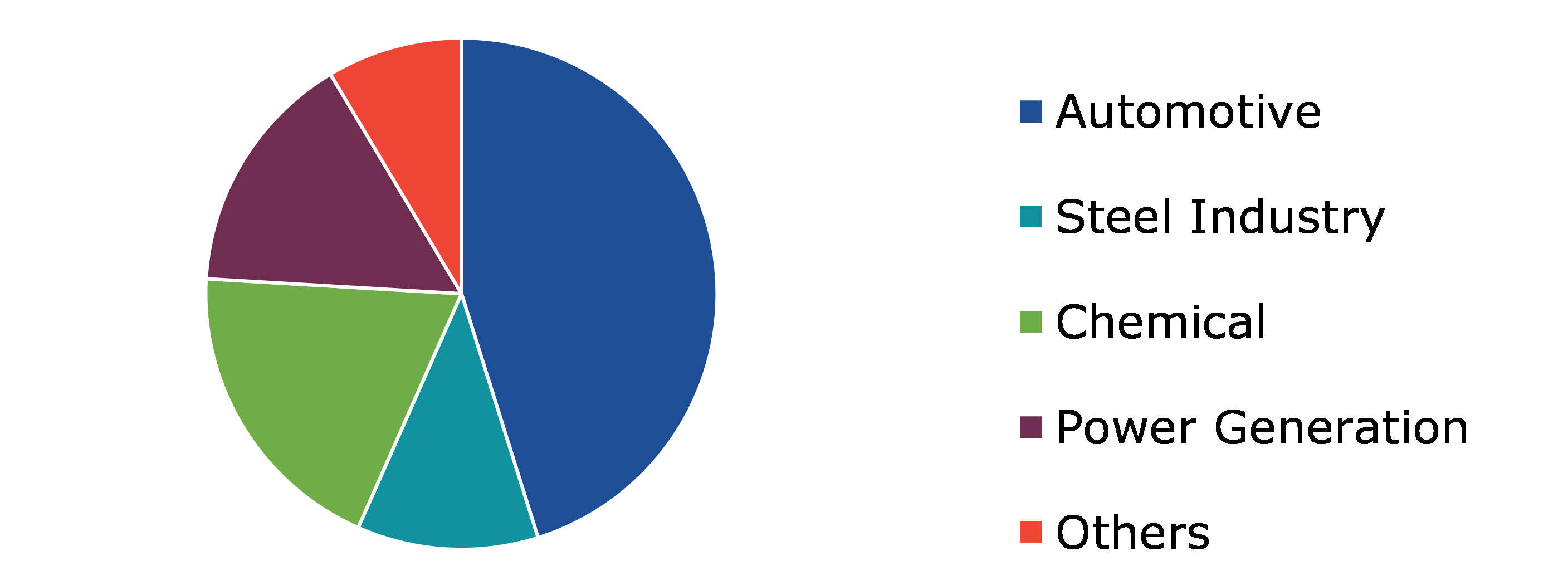

On the basis of end use industry, the market has been divided into automotive, steel industry, chemical, power generation, and others. Among these, the automotive subsegment accounted for highest revenue share in 2021.

Global Methanol Market Growth, by End Use Industry, 2021

Source: Research Dive Analysis

The automotive subsegment accounted for the largest market share in 2021. This growth is attributed to increase in demand for alternative fuel sources to reduce carbon emissions and combat climate change. In the automotive sector, green methanol can be used as a transportation fuel in internal combustion engines or as a fuel cell feedstock in hydrogen fuel cells. It can additionally be blended with gasoline to reduce greenhouse gas emissions and improve fuel efficiency. These factors are anticipated to boost the growth of the automotive subsegment during the analysis timeframe.

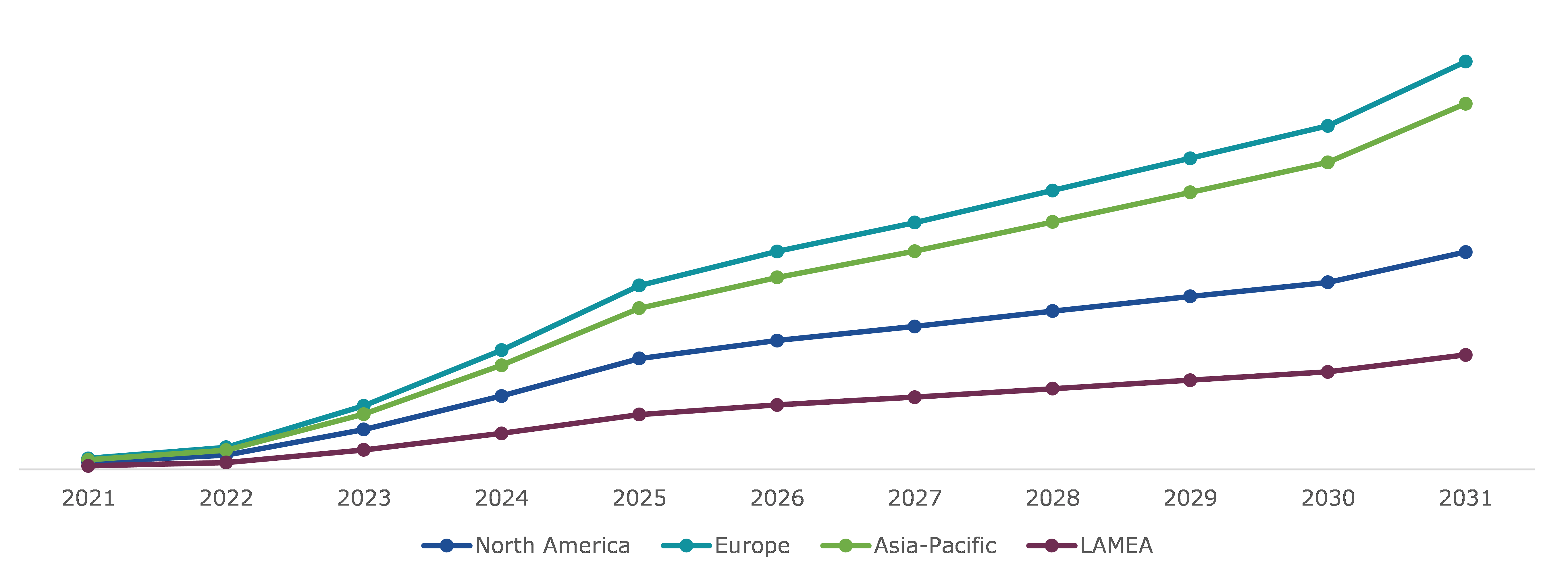

Global Green Methanol Market, Regional Insights

The green methanol market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Green Methanol Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

Market for Green Methanol in Asia-Pacific to Show the Fastest Growth

The Asia-Pacific green methanol market is estimated to show the fastest growth during the forecast period. This growth is attributed to increase in demand for sustainable and renewable energy sources. Asia-Pacific is home to some of the world's largest & fastest-growing economies, including China, India, and Japan. These countries are experiencing a significant increase in demand for energy as they continue to industrialize and develop their economies. Furthermore, Asia-Pacific has a large potential for producing renewable energy sources, including biomass, which can be used to produce green methanol. This creates opportunities for local businesses to enter the market and develop new technologies for producing green methanol. Increase in demand for sustainable and renewable energy sources, coupled with supportive government policies and abundant renewable resources, is driving the growth of the Asia-Pacific green methanol market.

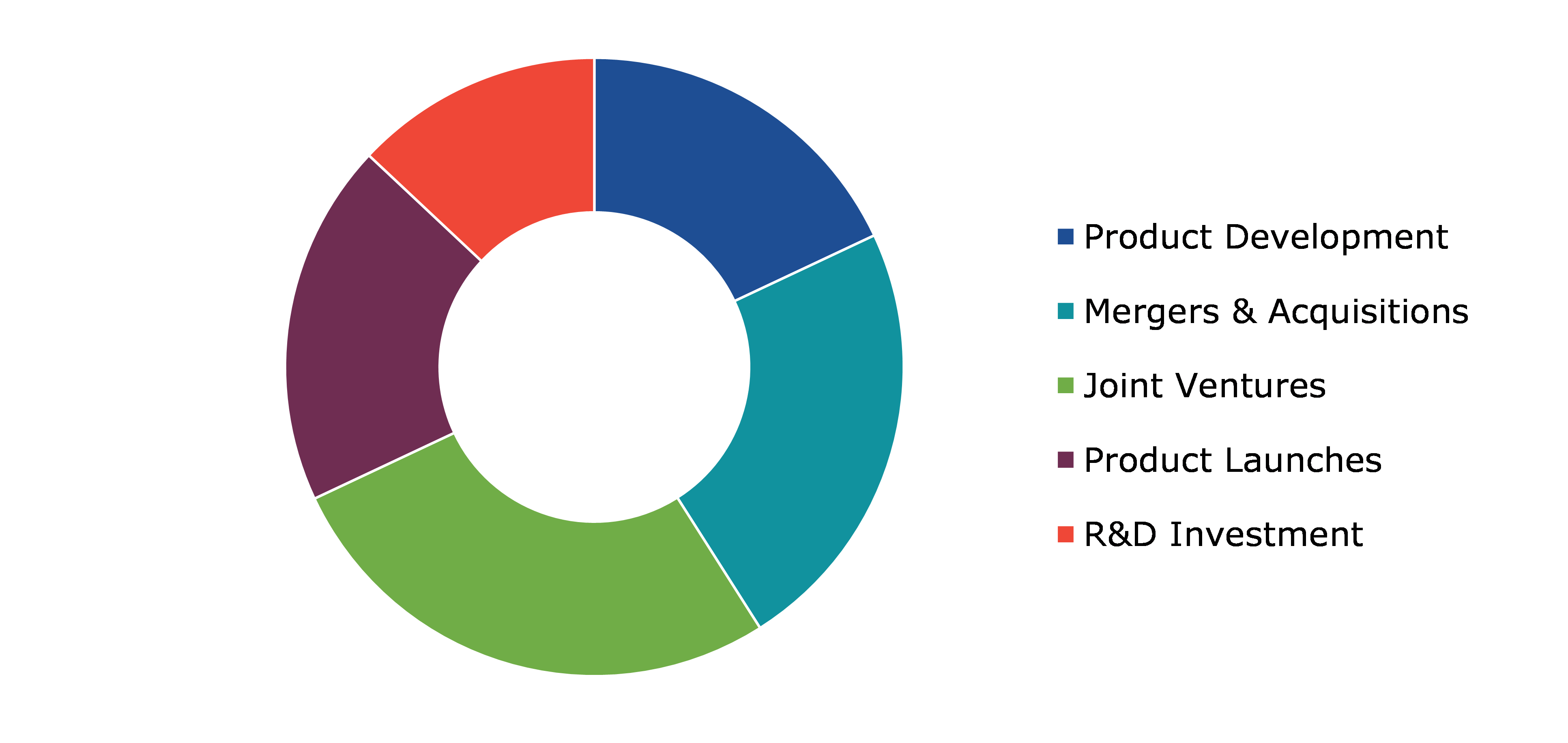

Competitive Scenario in the Global Green Methanol Market

Investment and agreement are common strategies followed by major market players. For instance, in December 2022, Iberdrola, the multinational electric utility company, has planned to invest more than 1.1 billion euros in Australia for the development of green hydrogen and green methanol plant. This project is named as Bell Bay Powerfuels, which is estimated to be one of the largest projects across the globe that will produce 30,000 tons of green methanol for its use as a marine fuel.

Source: Research Dive Analysis

Some of the leading green methanol market players are BASF SE, Methanex Corporation, Carbon Recycling International, Enerkem, Fraunhofer, Innogy, Nordic Green, OCI N.V., Uniper SE, and Vertimass LLC.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Feedstock |

|

| Segmentation by Application |

|

| Segmentation by End Use Industry |

|

| Key Companies Profiled |

|

Q1. What is the size of the global green methanol market?

A. The size of the global green methanol market was over $349 million in 2021 and is projected to reach $12,478.5 million by 2031.

Q2. Which are the major companies in the green methanol markets?

A. BASF SE, Methanex Corporation, Carbon Recycling International, and Enerkem are some of the key players in the global green methanol market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific green methanol market?

A. Asia-Pacific green methanol market is anticipated to grow at 38.9% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Fraunhofer, Innogy, Nordic Green, and OCI N.V. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global green methanol market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on green methanol market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Green Methanol Market Analysis, by Type

5.1.Overview

5.2.Bio-methanol

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.E-methanol

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Green Methanol Market Analysis, by Feedstock

6.1.Overview

6.2.Municipal Solid Waste (MSW)

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Agricultural Waste

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Forestry Residues

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2021-2031

6.4.3.Market share analysis, by country, 2021-2031

6.5.Carbon Dioxide

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region, 2021-2031

6.5.3.Market share analysis, by country, 2021-2031

6.6.Renewable Hydrogen

6.6.1.Definition, key trends, growth factors, and opportunities

6.6.2.Market size analysis, by region, 2021-2031

6.6.3.Market share analysis, by country, 2021-2031

6.7.Research Dive Exclusive Insights

6.7.1.Market attractiveness

6.7.2.Competition heatmap

7.Green Methanol Market Analysis, by Application

7.1.Chemical Uses

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2021-2031

7.1.3.Market share analysis, by country, 2021-2031

7.1.4.Formaldehyde

7.1.4.1.Definition, key trends, growth factors, and opportunities

7.1.4.2.Market size analysis, by region, 2021-2031

7.1.4.3.Market share analysis, by country, 2021-2031

7.1.5.Methanol-to-olefins

7.1.5.1.Definition, key trends, growth factors, and opportunities

7.1.5.2.Market size analysis, by region, 2021-2031

7.1.5.3.Market share analysis, by country, 2021-2031

7.1.6.Acetic acid

7.1.6.1.Definition, key trends, growth factors, and opportunities

7.1.6.2.Market size analysis, by region, 2021-2031

7.1.6.3.Market share analysis, by country, 2021-2031

7.1.7.Methyl methacrylate (MMA)

7.1.7.1.Definition, key trends, growth factors, and opportunities

7.1.7.2.Market size analysis, by region, 2021-2031

7.1.7.3.Market share analysis, by country, 2021-2031

7.1.8.Methyl chloride (chloromethane)

7.1.8.1.Definition, key trends, growth factors, and opportunities

7.1.8.2.Market size analysis, by region, 2021-2031

7.1.8.3.Market share analysis, by country, 2021-2031

7.1.9.Others

7.1.9.1.Definition, key trends, growth factors, and opportunities

7.1.9.2.Market size analysis, by region, 2021-2031

7.1.9.3.Market share analysis, by country, 2021-2031

7.2.Fuel Uses

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2021-2031

7.2.3.Market share analysis, by country, 2021-2031

7.2.4.Gasoline blending

7.2.4.1.Definition, key trends, growth factors, and opportunities

7.2.4.2.Market size analysis, by region, 2021-2031

7.2.4.3.Market share analysis, by country, 2021-2031

7.2.5.Methyl tert-butyl ether (MTBE)

7.2.5.1.Definition, key trends, growth factors, and opportunities

7.2.5.2.Market size analysis, by region, 2021-2031

7.2.5.3.Market share analysis, by country, 2021-2031

7.2.6.Biodiesel

7.2.6.1.Definition, key trends, growth factors, and opportunities

7.2.6.2.Market size analysis, by region, 2021-2031

7.2.6.3.Market share analysis, by country, 2021-2031

7.2.7.Dimethyl ether (DME)

7.2.7.1.Definition, key trends, growth factors, and opportunities

7.2.7.2.Market size analysis, by region, 2021-2031

7.2.7.3.Market share analysis, by country, 2021-2031

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness

7.3.2.Competition heatmap

8.Green Methanol Market Analysis, by End Use Industry

8.1.Automotive

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region, 2021-2031

8.1.3.Market share analysis, by country, 2021-2031

8.2.Steel Industry

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region, 2021-2031

8.2.3.Market share analysis, by country, 2021-2031

8.3.Chemical

8.3.1.Definition, key trends, growth factors, and opportunities

8.3.2.Market size analysis, by region, 2021-2031

8.3.3.Market share analysis, by country, 2021-2031

8.4.Power Generation

8.4.1.Definition, key trends, growth factors, and opportunities

8.4.2.Market size analysis, by region, 2021-2031

8.4.3.Market share analysis, by country, 2021-2031

8.5.Others

8.5.1.Definition, key trends, growth factors, and opportunities

8.5.2.Market size analysis, by region, 2021-2031

8.5.3.Market share analysis, by country, 2021-2031

8.6.Research Dive Exclusive Insights

8.6.1.Market attractiveness

8.6.2.Competition heatmap

9.Methanol Market, by region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Type

9.1.1.2.Market size analysis, by Feedstock

9.1.1.3.Market size analysis, by Application

9.1.1.4.Market size analysis, by End Use Industry

9.1.2.Canada

9.1.2.1.Market size analysis, by Type

9.1.2.2.Market size analysis, by Feedstock

9.1.2.3.Market size analysis, by Application

9.1.2.4.Market size analysis, by End Use Industry

9.1.3.Mexico

9.1.3.1.Market size analysis, by Type

9.1.3.2.Market size analysis, by Feedstock

9.1.3.3.Market size analysis, by Application

9.1.3.4.Market size analysis, by End Use Industry

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Type

9.2.1.2.Market size analysis, by Feedstock

9.2.1.3.Market size analysis, by Application

9.2.1.4.Market size analysis, by End Use Industry

9.2.2.Denmark

9.2.2.1.Market size analysis, by Type

9.2.2.2.Market size analysis, by Feedstock

9.2.2.3.Market size analysis, by Application

9.2.2.4.Market size analysis, by End Use Industry

9.2.3.Netherlands

9.2.3.1.Market size analysis, by Type

9.2.3.2.Market size analysis, by Feedstock

9.2.3.3.Market size analysis, by Application

9.2.3.4.Market size analysis, by End Use Industry

9.2.4.Sweden

9.2.4.1.Market size analysis, by Type

9.2.4.2.Market size analysis, by Feedstock

9.2.4.3.Market size analysis, by Application

9.2.4.4.Market size analysis, by End Use Industry

9.2.5.Spain

9.2.5.1.Market size analysis, by Type

9.2.5.2.Market size analysis, by Feedstock

9.2.5.3.Market size analysis, by Application

9.2.5.4.Market size analysis, by End Use Industry

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Type

9.2.6.2.Market size analysis, by Feedstock

9.2.6.3.Market size analysis, by Application

9.2.6.4.Market size analysis, by End Use Industry

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia-Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Type

9.3.1.2.Market size analysis, by Feedstock

9.3.1.3.Market size analysis, by Application

9.3.1.4.Market size analysis, by End Use Industry

9.3.2.Japan

9.3.2.1.Market size analysis, by Type

9.3.2.2.Market size analysis, by Feedstock

9.3.2.3.Market size analysis, by Application

9.3.2.4.Market size analysis, by End Use Industry

9.3.3.India

9.3.3.1.Market size analysis, by Type

9.3.3.2.Market size analysis, by Feedstock

9.3.3.3.Market size analysis, by Application

9.3.3.4.Market size analysis, by End Use Industry

9.3.4.Australia

9.3.4.1.Market size analysis, by Type

9.3.4.2.Market size analysis, by Feedstock

9.3.4.3.Market size analysis, by Application

9.3.4.4.Market size analysis, by End Use Industry

9.3.5.South Korea

9.3.5.1.Market size analysis, by Type

9.3.5.2.Market size analysis, by Feedstock

9.3.5.3.Market size analysis, by Application

9.3.5.4.Market size analysis, by End Use Industry

9.3.6.Rest of Asia Pacific

9.3.6.1.Market size analysis, by Type

9.3.6.2.Market size analysis, by Feedstock

9.3.6.3.Market size analysis, by Application

9.3.6.4.Market size analysis, by End Use Industry

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Type

9.4.1.2.Market size analysis, by Feedstock

9.4.1.3.Market size analysis, by Application

9.4.1.4.Market size analysis, by End Use Industry

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Type

9.4.2.2.Market size analysis, by Feedstock

9.4.2.3.Market size analysis, by Application

9.4.2.4.Market size analysis, by End Use Industry

9.4.3.UAE

9.4.3.1.Market size analysis, by Type

9.4.3.2.Market size analysis, by Feedstock

9.4.3.3.Market size analysis, by Application

9.4.3.4.Market size analysis, by End Use Industry

9.4.4.South Africa

9.4.4.1.Market size analysis, by Type

9.4.4.2.Market size analysis, by Feedstock

9.4.4.3.Market size analysis, by Application

9.4.4.4.Market size analysis, by End Use Industry

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Type

9.4.5.2.Market size analysis, by Feedstock

9.4.5.3.Market size analysis, by Application

9.4.5.4.Market size analysis, by End Use Industry

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1.BASF SE

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2.Methanex Corporation

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3.Carbon Recycling International

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4.Enerkem Inc.

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5.Fraunhofer

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6.OCI N.V.

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.Innogy

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8.Nordic Green

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.Uniper SE

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10.Vertimass LLC

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

Green methanol is a renewable and sustainable alternative to traditional methanol that is produced from fossil fuels. It is also known as bio-methanol, and it is produced from renewable resources such as biomass or captured carbon dioxide. Green methanol is seen as a critical component in the decarbonization of the transportation sector and other industrial applications. It is also used for power generation. It can be blended with gasoline to reduce emissions and used as a feedstock for the production of chemicals and plastics. The production of green methanol requires a significant amount of energy, which must come from renewable sources to ensure that it is truly sustainable. This energy must be produced from renewable sources, which is a challenge in some regions. Green methanol is highly flammable and requires special handling and storage to ensure safety.

Forecast Analysis of the Global Green Methanol Market

According to the report published by Research Dive, the global green methanol market is anticipated to generate a revenue of $12,478.5 million and grow at a stunning CAGR of 37.8% over the estimated period from 2022 to 2031. The rising government regulations and incentives to reduce dependency on traditional fossil fuels and promote the use of renewable energy resources is expected to bolster the growth of the green methanol market during the analysis period. Moreover, the growing potential of green methanol for a wide range of applications across various industries such as power generation, chemical production, transportation, and many more is expected to create immense growth opportunities for the market over the estimated period. However, the high production costs of green methanol may restrict the growth of the market throughout the forecast timeframe.

The major players of the green methanol market include Vertimass LLC, BASF SE, Uniper SE, Methanex Corporation, OCI N.V., Carbon Recycling International, Enerkem, Nordic Green, Fraunhofer, Innogy, and many more.

Key Developments of the Green Methanol Market

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global green methanol market to grow exponentially. For instance:

- In September 2021, LEGO, a leading manufacturer of plastic-constructed toys, agreed to buy e-methanol for the use of its colorful plastic bricks to provide a substitute for fossil-based plastics. The company would also start using recycled materials from plastic bottles to manufacture its products.

- In March 2023, Maersk, a Danish shipping and logistics company announced its partnership with Shanghai International Port Co., Ltd., a large-scale specialized conglomerate. With this partnership, the companies would study green methanol fuel vessel-to-vessel bunkering to deliver green methanol box ships to Maersk in the coming years between 2023 to 2025.

- In April 2023, Jackson Green, an India-based leading player in the renewable and new energy space won the first project from National Thermal Power Corporation (NTPC) to establish a Methanol synthesis facility in Madhya Pradesh. This facility would have a production capacity of 10 tons per day.

Most Profitable Region

The Asia-Pacific region of the green methanol market is predicted to have the fastest growth over the estimated timeframe. This is mainly because of the greater production capabilities of green methanol in this region using advanced technologies. Moreover, the rising demand for sustainable and renewable energy sources along with supportive government policies in the region is predicted to drive the regional growth of the market during the estimated period.

Covid-19 Impact on the Global Green Methanol Market

The rise of the novel coronavirus has brought several uncertainties across various industries including the green methanol market. This is mainly due to the reduction in production capacity due to the disrupted global supply chains during the pandemic period. Additionally, the outbreak of the pandemic has shifted the governments’ attention toward healthcare & emergencies which has reduced the funding & support for renewable energy projects. All these factors have decreased the growth of the market throughout the crisis.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com