Microcontroller Market Report

RA08655

Microcontroller Market by Bit Class (8-bit, 16-bit, 32-bit, and Others), Application (Computer, Automotive, Consumer, Government, Industrial, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022–2031

Global Microcontroller Market Analysis

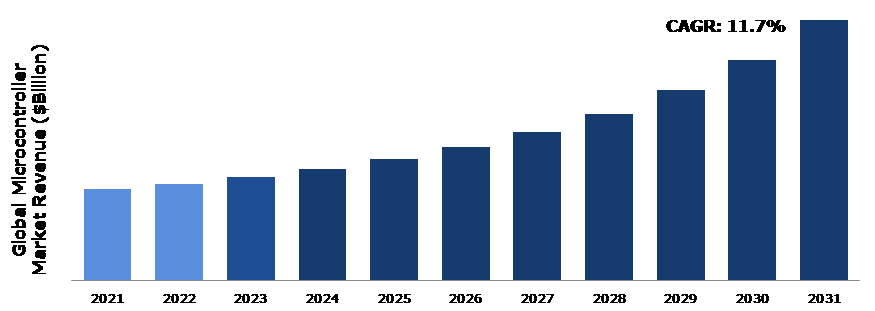

The Global Microcontroller Market Size was $19.6 billion in 2021 and is predicted to grow with a CAGR of 11.7%, by generating a revenue of $56.3 billion by 2031.

Global Microcontroller Market Synopsis

The microcontroller market is experiencing significant growth owing to numerous factors including increasing demand for automation and smart devices, growth of the internet of things (IoT), and others. The need for microcontrollers is increasing rapidly as industries strive to automate equipment and procedures. Microcontrollers are necessary for the operation of all smart appliances, smart houses, and smart cars. The need for microcontrollers has increased along with the rapid development of the Internet of Things (IoT), which entails connecting items to the internet to enable data interchange and automation. The essential elements of Internet of Things (IoT) devices that allow them to communicate and interact with their surroundings are microcontrollers.

Rising security concerns and strict regulatory compliances are expected to hamper the microcontroller market. The risk of security breaches is growing along with the expansion of IoT applications and connected devices. Security must be considered while designing microcontrollers to safeguard against unauthorized access and data breaches. Moreover, the automotive and medical device industries have several rules and standards that apply to the microcontroller industry. These regulations must be followed, which can be time-consuming and expensive for manufacturers.

Despite the challenges faced by manufacturers in the microcontroller market, there are also several opportunities for growth and innovation. Expansion into emerging markets is one such opportunity as nations develops their economies and adopt advanced technologies. Moreover, the demand for microcontrollers in these emerging markets is growing. Manufacturers can expand into these markets to tap into new customer segments and increase revenue.

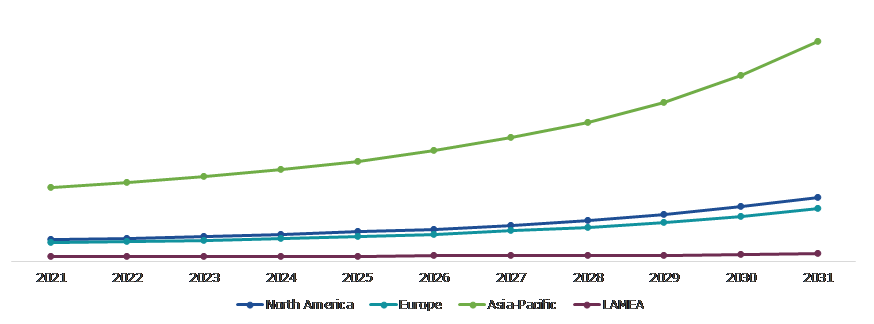

According to regional analysis, the Asia-Pacific microcontroller market accounted for the highest market share in 2021 and is projected to maintain its dominance over the forecast period. China, India, Japan, and South Korea are among the largest and fastest-growing economies in the world. The need for microcontrollers is rising in these countries as these economies continue to expand and the demand for electronics rises.

Microcontroller Market Overview

A microcontroller is a compact computer system that has a single chip with an integrated central processing unit (CPU), memory, and input/output peripherals. In embedded systems, which are computer systems built into other products or devices, microcontrollers are frequently employed. Microcontrollers are used in a wide range of applications including consumer electronics, medical equipment, automotive electronics, industrial control systems, and smart home appliances. They perform the tasks of analyzing and storing data as well as controlling the operation of sensors and motors.

COVID-19 Impact on Microcontroller Market

The market for microcontrollers has been significantly impacted by the COVID-19 outbreak. Early in 2020, the market briefly witnessed a dip when global supply chains were disrupted, and output slowed as a result of manufacturing closures and shipment delays. Nonetheless, the market swiftly recovered as a result of the pandemic's increased demand for microcontrollers. The pandemic has sped up the uptake of digital and remote technologies, including the Internet of Things (IoT) and smart home appliances, which primarily rely on microcontrollers. The need for microcontrollers in gadgets like laptops, tablets, and smartphones has expanded along with the number of individuals working from home. As healthcare professionals and academics worked to create new diagnostic and treatment technologies, the market for medical devices witnessed a surge in demand for microcontrollers. Microcontrollers are essential to the operation of a number of medical devices, including ventilators and infusion pumps. The COVID-19 pandemic has had a mixed impact on the microcontroller market. The pandemic affected supply and production chains in some ways, but it also increased demand for microcontrollers in a range of applications.

Increasing Demand for Automotive and Consumer Electronics to Drive the Microcontroller Market Growth

Modern automobiles include a variety of electronics such as advanced driver assistance systems (ADAS) and engine control units. These systems require microcontrollers to function properly, which has raised demand for microcontrollers in the automobile sector. In addition, microcontroller demand has increased along with the proliferation of gadgets like smartphones, smartwatches, and smart TVs. The essential elements of these gadgets that provide them functionality and user interaction are microcontrollers. The demand for energy-efficient microcontrollers is growing along with growing concerns about energy use and environmental sustainability. Low-power microcontrollers are perfect for battery-operated gadgets like wearables, Internet of Things (IoT) devices, and smart home appliances.

Limited Processing Power and Memory to Limit the Growth of the Microcontroller Market

Although powerful and versatile, microcontrollers have less processing power and memory than other computing devices. As a result, engineers might have to use numerous microcontrollers in a single system, which would increase prices and complexity and limit their ability to tackle complicated tasks. Moreover, microcontrollers are characterized by a short product life cycle. This can make it challenging for companies to stay competitive and maintain market share and can lead to rapid product obsolescence.

Rising Demand from Medical Sector is Anticipated to Offer Lucrative Growth Opportunities to Microcontroller Market Players

Microcontrollers are utilized in a wide range of medical devices and equipment, including blood glucose monitors, pacemakers, and ventilators, and thus play a significant role in the medical industry. During the pandemic many manufacturers used microcontrollers to manage the operation of ventilators as demand for them increased. The microcontroller in ventilators regulates the air and oxygen flow going into the patient's lungs, making sure they get proper amount of oxygen. During the COVID-19 outbreak, microcontrollers were essential in the medical field. Diagnostic devices including thermometers, pulse oximeters, and blood glucose monitors also employ microcontrollers. For data processing and accurate readings, which are essential for medical diagnosis and treatment, these devices rely on microcontrollers.

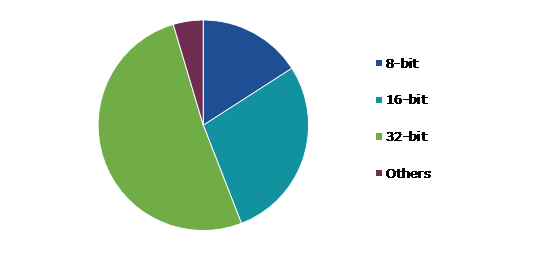

Global Microcontroller Market, by Bit Class

Based on bit class, the market is further divided into 8-bit, 16-bit, 32-bit, and Others. Among this 32-bit sub-segment accounted for the largest market share in 2021.

Global Microcontroller Market Share, by Bit Class, 2021

The 32-bit sub-segment accounted for the largest market share in 2021 and is anticipated to show the highest CAGR during the forecast period. 32-bit microcontrollers (MCUs) have many benefits that make them desirable for usage in a variety of applications. Compared to 8-bit and 16-bit MCUs, 32-bit MCUs offer more processing capability, enabling them to tackle more complicated jobs and run code more quickly. The rapid advancement of the semiconductor industry has facilitated the development of more cutting-edge and powerful 32-bit microcontrollers with smaller footprints, lower power consumption, and higher levels of integration. The demand for MCUs that can handle these systems is rising as more businesses adopt automation and robotics. The processing power and real-time control these systems need to function properly can be provided by 32-bit MCUs.

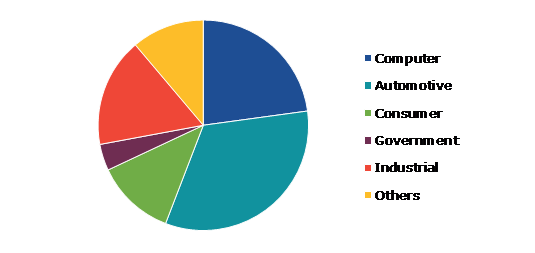

Global Microcontroller Market, by Application

Based on application, the global microcontroller market has been divided into computer, automotive, consumer, government, industrial, and others. Among these, the automotive sub-segment accounted for the largest market share in 2021.

Global Microcontroller Market Size, by Application, 2021

The automotive sub-segment accounted for the largest market share in 2021. The use of microcontrollers is expected to increase in the automotive industry due to their ability to provide advanced features, improve vehicle performance, and enhance safety. Microcontrollers are used to control a range of ADAS features, including adaptive cruise control, lane departure warning, and collision avoidance systems. These systems help improve driver safety and reduce accidents on the road. As the trend towards electrification continues, microcontrollers will become even more important in controlling the complex systems required to manage battery performance, charging, and electric motor control.

Global Microcontroller Market, Regional Insights

The microcontroller market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Microcontroller Market Size & Forecast, by Region, 2021-2031 (USD Billion)

Asia-Pacific Dominated the Microcontroller Market in 2021

The Asia-Pacific region dominated the global microcontroller market in 2021. The region has robust manufacturing abilities with countries such as China, South Korea, Japan, and Taiwan being key producers of microcontrollers. Due to their developed electronics industry, these nations can supply huge quantities of microcontrollers to a variety of industries. In the last several years, China has become a hub for consumer electronics manufacturing, including microcontrollers. The country's well-established manufacturing infrastructure and supply chain enable the mass manufacture of microcontrollers at cost-effective levels. In addition, the Asia-Pacific region is home to some of the largest producers of consumer electronics worldwide, including Samsung, LG, and Sony. These businesses need a high number of microcontrollers for their products, which include TVs, tablets, and smartphones. Thus, microcontroller demand has increased in this region due to a rise in demand for these products.

Global Microcontroller Market Competitive Scenario

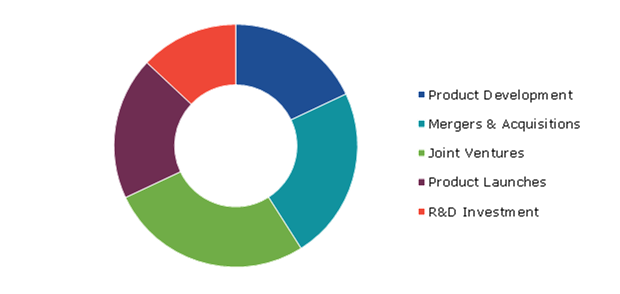

Joint ventures, investment, merger & acquisition, product development, and technological development are the common strategies followed by major microcontroller market players. For instance, in 2023, Infineon Technologies AG and United Microelectronics Corporation extended automotive partnership with long-term agreement for 40nm eNVM microcontroller production.

Some of the leading players in microcontroller market are NXP Semiconductors, Renesas Electronics Corporation., STMicroelectronics, Infineon Technologies AG, Microchip Technology Inc., Texas Instruments, Nuvoton Technology Corporation, GigaDevice, SAMSUNG, and Silicon Laboratories.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Bit Class

|

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the microcontroller market?

A. The global microcontroller market size was over $19.6 billion in 2021 ¬¬and is anticipated to reach $56.3 billion by 2031.

Q2. Which are the leading companies in the microcontroller market?

A. NXP Semiconductors, Renesas Electronics Corporation., and Infineon Technologies AG are some of the key players in the global microcontroller market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising market growth in the coming years.

Q4. What is the growth rate of the Asia-Pacific market?

A. The Asia-Pacific microcontroller market is anticipated to grow at 12.0% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product innovations, business expansions, and technological advancements are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Nuvoton Technology Corporation, SAMSUNG, and Texas Instruments investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global microcontroller market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Legal

4.6.6.Environmental

4.7.Impact of COVID-19 on microcontroller market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Microcontroller Market Analysis, by Bit Class

5.1.Overview

5.2.8-bit

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region,2021-2031

5.2.3.Market share analysis, by country,2021-2031

5.3.16-bit

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region,2021-2031

5.3.3.Market share analysis, by country,2021-2031

5.4.32-bit

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region,2021-2031

5.4.3.Market share analysis, by country,2021-2031

5.5.Others

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region,2021-2031

5.5.3.Market share analysis, by country,2021-2031

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.Microcontroller Market Analysis, by Application

6.1.Computer

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region,2021-2031

6.1.3.Market share analysis, by country,2021-2031

6.2.Automotive

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region,2021-2031

6.2.3.Market share analysis, by country,2021-2031

6.3.Consumer

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region,2021-2031

6.3.3.Market share analysis, by country,2021-2031

6.4.Government

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region,2021-2031

6.4.3.Market share analysis, by country,2021-2031

6.5.Industrial

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region,2021-2031

6.5.3.Market share analysis, by country,2021-2031

6.6.Others

6.6.1.Definition, key trends, growth factors, and opportunities

6.6.2.Market size analysis, by region,2021-2031

6.6.3.Market share analysis, by country,2021-2031

6.7.Research Dive Exclusive Insights

6.7.1.Market attractiveness

6.7.2.Competition heatmap

7.Microcontroller Market, by region

7.1.North America

7.1.1.U.S.

7.1.2.Market size analysis, by Bit Class,2021-2031

7.1.3.Market size analysis, by Application,2021-2031

7.1.4.Canada

7.1.5.Market size analysis, by Bit Class,2021-2031

7.1.6.Market size analysis, by Application,2021-2031

7.1.7.Mexico

7.1.8.Market size analysis, by Bit Class,2021-2031

7.1.9.Market size analysis, by Application,2021-2031

7.1.10.Research Dive Exclusive Insights

7.1.10.1.Market attractiveness

7.1.10.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.2.Market size analysis, by Bit Class,2021-2031

7.2.3.Market size analysis, by Application,2021-2031

7.2.4.UK

7.2.5.Market size analysis, by Bit Class,2021-2031

7.2.6.Market size analysis, by Application,2021-2031

7.2.7.France

7.2.8.Market size analysis, by Bit Class,2021-2031

7.2.9.Market size analysis, by Application,2021-2031

7.2.10.Spain

7.2.11.Market size analysis, by Bit Class,2021-2031

7.2.12.Market size analysis, by Application,2021-2031

7.2.13.Italy

7.2.14.Market size analysis, by Bit Class,2021-2031

7.2.15.Market size analysis, by Application,2021-2031

7.2.16.Rest of Europe

7.2.17.Market size analysis, by Bit Class,2021-2031

7.2.18.Market size analysis, by Application,2021-2031

7.2.19.Research Dive Exclusive Insights

7.2.19.1.Market attractiveness

7.2.19.2.Competition heatmap

7.3.Asia Pacific

7.3.1.China

7.3.2.Market size analysis, by Bit Class,2021-2031

7.3.3.Market size analysis, by Application,2021-2031

7.3.4.Japan

7.3.5.Market size analysis, by Bit Class,2021-2031

7.3.6.Market size analysis, by Application,2021-2031

7.3.7.India

7.3.8.Market size analysis, by Bit Class,2021-2031

7.3.9.Market size analysis, by Application,2021-2031

7.3.10.Australia

7.3.11.Market size analysis, by Bit Class,2021-2031

7.3.12.Market size analysis, by Application,2021-2031

7.3.13.South Korea

7.3.14.Market size analysis, by Bit Class,2021-2031

7.3.15.Market size analysis, by Application,2021-2031

7.3.16.Rest of Asia Pacific

7.3.17.Market size analysis, by Bit Class,2021-2031

7.3.18.Market size analysis, by Application,2021-2031

7.3.19.Research Dive Exclusive Insights

7.3.19.1.Market attractiveness

7.3.19.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.2.Market size analysis, by Bit Class,2021-2031

7.4.3.Market size analysis, by Application,2021-2031

7.4.4.Saudi Arabia

7.4.5.Market size analysis, by Bit Class,2021-2031

7.4.6.Market size analysis, by Application,2021-2031

7.4.7.UAE

7.4.8.Market size analysis, by Bit Class,2021-2031

7.4.9.Market size analysis, by Application,2021-2031

7.4.10.South Africa

7.4.11.Market size analysis, by Bit Class,2021-2031

7.4.12.Market size analysis, by Application,2021-2031

7.4.13.Rest of LAMEA

7.4.14.Market size analysis, by Bit Class,2021-2031

7.4.15.Market size analysis, by Application,2021-2031

7.4.16.Research Dive Exclusive Insights

7.4.16.1.Market attractiveness

7.4.16.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.NXP Semiconductors

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Renesas Electronics Corporation

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.STMicroelectronics

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Infineon Technologies AG

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Microchip Technology Inc.

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Texas Instruments

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Nuvoton Technology Corporation

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.GigaDevice

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.SAMSUNG

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Silicon Laboratories.

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

10.Appendix

10.1.Parent & peer market analysis

10.2.Premium insights from industry experts

10.3.Related reports

Microcontrollers have significantly improved in recent years in terms of both performance and functionality. A microcontroller is a tiny computer with memory, input/output peripherals, and a processor on a single integrated circuit. They have a wide range of uses, from consumer electronics to industrial automation to automobile systems.

Microcontrollers can now be employed in a wider variety of applications because of the increased power and energy efficiency brought on by technological breakthroughs. The microcontroller market has grown as a result of the rising demand for Internet of Things (IoT) devices, which require microcontrollers in order to function. As a result, the microcontroller market is expected to continue growing in the coming years, driven by the increasing adoption of IoT devices and the growing demand for smart homes and smart cities.

Newest Insights in the Microcontroller Market

As per a report by Research Dive, the global microcontroller market is expected to grow at a CAGR of 11.7% and generate revenue of $56.3 billion by 2031. The microcontroller market is growing rapidly as a result of rising demand for automation and smart devices, as well as the expansion of the Internet of Things. They are necessary for the operation of modern homes, automobiles, and appliances. The IoT has also raised the demand for microcontrollers, which allow for automation and data transmission. Microcontrollers are essential parts of Internet of Things (IoT) devices that enable communication and environmental interaction.

The Asia-Pacific region dominated the global microcontroller market in 2021, with countries such as China, South Korea, Japan, and Taiwan being key producers. These nations have robust manufacturing capabilities and a developed electronics industry, enabling the mass production of microcontrollers for various industries.

How are Market Players Responding to the Rising Demand for Microcontroller?

Market players are responding to the rising demand for microcontrollers by investing in research and development to develop more advanced and efficient microcontrollers. In addition, market players are increasingly focusing on strategic partnerships and collaborations with other players in the industry to leverage their strengths and expand their reach.

Some of the foremost players in the microcontroller market are STMicroelectronics, NXP Semiconductors, Nuvoton Technology Corporation, Renesas Electronics Corporation., SAMSUNG, Infineon Technologies AG, Microchip Technology Inc., Texas Instruments, GigaDevice, and Silicon Laboratories., and others. These players are focused on implementing strategies such as mergers and acquisitions, novel developments, collaborations, and partnerships to reach a leading position in the global market.

For instance:

- In October 2022, Microchip, a leading provider of microcontroller and analog semiconductors, launched a new line of Arm-based PIC microcontrollers specifically designed to simplify the addition of Bluetooth Low Energy (BLE) connectivity.

- In November 2022, NXP Semiconductor, a leading semiconductor manufacturer, launched its MCX N family of microcontrollers after merging its LPC and Kinetis lines. The high-end family of microcontrollers features a dual Cortex M33 architecture that runs at 150MHz and includes accelerators for neural networks, digital signal processing, peripheral managers for error checking and memory.

- In April 2023, Renesas, a leading semiconductor manufacturer, announced the launch of a new 22-nm microcontroller that integrates Bluetooth 5.3 Low Energy with a software-defined radio. The microcontroller is designed to meet the growing demand for low-power wireless connectivity in a wide range of applications, including IoT, wearables, and healthcare.

COVID-19 Impact on the Global Microcontroller Market

The COVID-19 pandemic made a moderate impact on the global microcontroller market. Early in 2020, the market saw a brief decline due to plant closures and global supply chain disruptions. The market swiftly recovered, though, thanks to a rise in demand for microcontrollers brought on by the quick uptake of digital and remote technologies like the Internet of Things and smart home appliances. As more people choose to work from home, the demand for microcontrollers also increased in laptops, tablets, and smartphones. The pandemic also caused a spike in demand for microcontroller-based medical devices, like ventilators and infusion pumps. In a nutshell, the pandemic had an impact on the supply and manufacturing chains, but it also led to a rise in demand for microcontrollers across a range of applications, thus fueling the growth of the global microcontroller market.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com