In-vitro Fertilization Microscopes Market Report

RA08639

In-vitro Fertilization Microscopes Market by Type (Upright Microscope, Inverted Microscope, Stereo Microscope, and Embryo Microscope), End User (Clinical and Academic Research), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global In-vitro Fertilization Microscopes Market Analysis

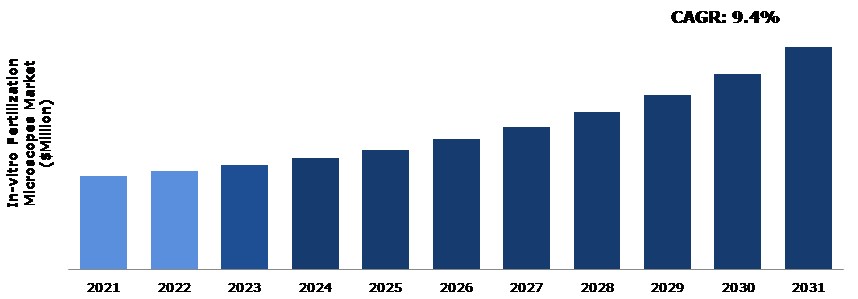

The Global In-Vitro Fertilization Microscope Market Size was $105.4 million in 2021 and is expected to grow with a CAGR of 9.4%, by generating a revenue of $250.4 million by 2031.

Global In-vitro Fertilization Microscopes Market Synopsis

In-vitro fertilization microscopes are used for various procedures. They are primarily used to visualize and assess sperm vitality tests (morphology, motility, and viability) and sperm preparation. Inverted microscope used in fertility treatment save time and money in sample preparation, this factor drives the in-vitro fertilization microscopes market growth. The rise in cases of infertility worldwide is providing a significant impetus to the growth of the in vitro fertilization market. According to the World Health Organization (WHO), approximately 48 million couples and 186 million individuals worldwide suffer from infertility. During the forecast period, this is projected to continue to drive demand for in-vitro fertilization microscopes market. These factors are anticipated to boost the in-vitro fertilization microscope industry growth in the upcoming years.

However, some of the limitations of stereo microscopes include several discrete magnifications, a single fixed magnification, or a zoom magnification system. This may be difficult to manipulate however with experience, it may become easier. These factors are anticipated to hinder the In-vitro fertilization microscopes industry growth.

Growing innovation in IVF microscope technology is a key factor driving market growth. Furthermore, increased R&D activity in the field of microscopy is propelling the market forward. Furthermore, the growth in emphasis on regenerative medicine and nanotechnology research is boosting market growth. The market is being driven by an expanding application scope and a strong demand for technologically advanced magnification devices. The market is expected to expand due to high demand from the healthcare industry and boost the in-vitro fertilization microscopes market opportunity in upcoming years.

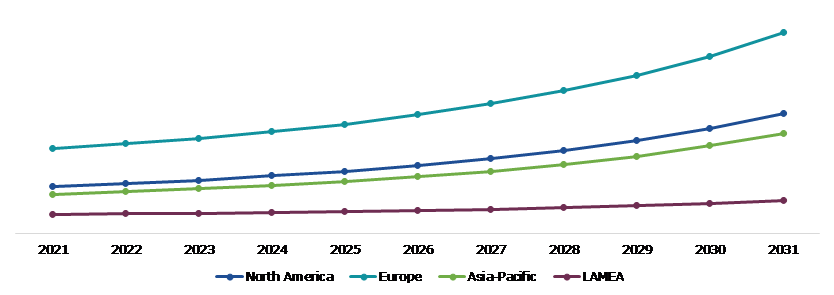

According to regional analysis, the Europe In-vitro fertilization microscopes market size accounted for highest market share in 2021 due to factors such as growing fertility tourism, legal reforms, and product innovation. Time-lapse technology with clinic-designed algorithms have seen widespread adoption in the region.

In-vitro Fertilization Microscope Overview

In vitro fertilization (IVF) is a complex set of procedures used to improve fertility, prevent genetic problems, and aid in childbirth. During IVF, mature eggs are extracted from the ovaries and fertilized in a laboratory with sperm. In-vitro fertilization microscopes are used for a variety of procedures, including sperm analysis, oocyte preparation, in-vitro fertilization, and overall embryo analysis. The increasing success rate of in-vitro fertilization procedures, as well as the availability of financial assistance are expected to drive market growth.

COVID-19 Impact on Global In-vitro Fertilization Microscope Market

The COVID-19 pandemic brought several uncertainties leading to severe economic losses as various businesses across the world were standstill. This ultimately lowered the demand for microscopes due to disruptions in supply chain, closure of manufacturing company, as well as economic slowdown across several countries. In addition, the import-export restrictions were laid down on major microscopes’ producing countries such as the U.S. and China. For instance, sanitization of goods being imported from China was imposed by several countries. Owing to social distance standards and delays in the fertilization process, the COVID-19 pandemic had a negative impact on the market. Since IVF patients must visit the clinic every week, IVF procedures were suspended throughout the pandemic. The World Health Organization's (WHO) declared the COVID-19 a pandemic in March 2020. The fertility societies around the world recommended that IVF treatment be discontinued, with the exception of essential medical fertility preservation. IVF center operations resumed after measures such as decontaminating & validating equipment, ensuring adequate staffing, and completing risk assessments were implemented.

The Growth in Awareness of In-vitro Fertilization is a Major Factor Driving the market growth

Growth in awareness of in-vitro fertilization is a major factor driving the in-vitro fertilization microscopes market growth. WHO recognizes that providing high-quality family planning services, including fertility care, is a critical component of reproductive health. Recognizing the significance of infertility and its impact on people's quality of life and well-being, WHO is committed to addressing infertility and fertility care by developing guidelines on the prevention, diagnosis, and treatment of male and female infertility, as part of the global norms and standards of quality care related to fertility care. IVF is the most common fertility treatment used when the fallopian tubes are severely damaged or absent, or there is unexplained or male-factor infertility. Owing to its high success rate, IVF is used more frequently in recent years as a first line of therapy for all causes of infertility. The proportion of live births per egg retrieval for women under 35 is 54.5%. The proportion of live births per egg retrieval for women aged 35 to 37 is 41.1%. The proportion of live births per egg retrieval for women aged 38 to 40 is 26.7%.

To know more about global In-vitro fertilization microscopes market drivers, get in touch with our analysts here.

The High Cost of Microscopes is the Main Challenge that is expected to impede market growth

However, the high cost and risks associated with IVF and ICSI treatment are some of the factors that are expected to limit the growth of the IVF microscopes market during the forecast period. For example, according to data published by the reproductive science center, a rare condition known as "Imprinting disorders" was linked to some IVF procedures, and it was estimated that the risk of such disorders with IVF treatment was around 2% to 5% per 15,000 births using IVF technique, whereas the risk in general cases was 1 in 15000 normal births. As a result, such potential risks and birth defects associated with IVF treatment can stymie global adoption of the IVF or ICSI procedure.

R&D investment and Technological Advancement are Anticipated to Create Lucrative Opportunities for the Market

The increasing success rate of in-vitro fertilization procedures as well as the availability of financial aid are expected to drive market growth. Furthermore, product innovations are increasing treatment efficiency and are expected to reduce procedure costs. Some of the significant market advancements include improved microscopic examination quality through high contrast and innovations in IVF microscope-related equipment. For instance, the Indian Institute of Technology (IIT), Hyderabad received funding from the Government of India's Department of Science and Technology (DST) to develop an IoT-based 3D printed Time-lapse smart microscope for embryo monitoring in IVF clinics.

To know more about global In-vitro fertilization microscopes market opportunities, get in touch with our analysts here.

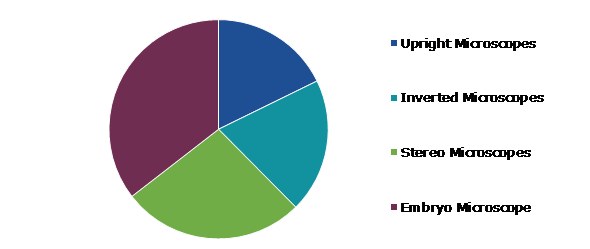

Global In-vitro Fertilization Microscope Market, by Type

By type, the market has been divided into upright microscope, inverted microscope, stereo microscope, and embryo microscope. Among these, the embryo microscope segment accounted for the highest market share in 2021 is estimated to show the fastest growth during the forecast period.

Global In-vitro Fertilization Microscopes Market Size, by Type, 2021

Source: Research Dive Analysis

The embryo microscope segment is had a dominant market share in 2021. In embryo microscope, there is a camera and computer system designed to capture images of embryos grown in an incubator during in-vitro fertilization cycles. These images, which were captured by a camera as the embryos developed in their culture dish, are displayed on a computer screen in the IVF lab. The new microscope system has the added benefit of allowing all of these observations to be made without removing the embryos from their incubator. This keeps the embryos in a controlled environment, where they grow faster.

The stereo microscope segment is anticipated to show the second fastest growth by 2031. A stereomicroscope, sometimes called a dissecting microscope or a binocular inspection microscope, is a low-power compound instrument used for a closer examination of three-dimensional specimens that is possible with a hand lens. Stereo Microscopes produce a high-quality image with a full three-dimensional effect by viewing the specimen from different angles. It typically has a large depth of field and a long working distance, allowing for simple mechanical interaction with the specimen. Moreover, there is no lateral reversal of the image, as with most other compound microscopes, so spatial relationship within the specimen can be easily appreciated.

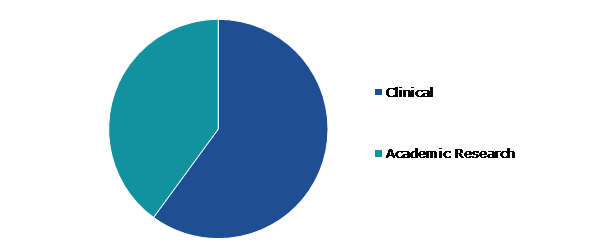

Global In-vitro Fertilization Microscopes Market, by End-user

By end user, the market is divided into clinical and academic research. Among these, the clinical segment accounted for highest revenue share in 2021.

Global In-vitro Fertilization Microscopes Market Share, by End User, 2021

Source: Research Dive Analysis

The clinical segment accounted for the highest market share in 2021. IVF clinics offer a variety of services, including healthy oocyte identification, sperm analysis, ICSI, embryo monitoring, and embryo freezing & storage. Moreover, there is a trend of developing products for use in IVF clinics and receiving private investor investments in IVF clinics. Mojo, a fertility tech startup, received around USD 1.8 million in funding in November 2019. The startup is developing a product that combines AI software and microscopy hardware to aid in sperm selection by focusing on the count, morphology, and speed of the sperm. These factors are anticipated to boost the growth of clinical segment during the analysis timeframe.

Global In-vitro Fertilization Microscopes Market, Regional Insights

The In-vitro fertilization microscopes market was analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Global In-vitro Fertilization Microscopes Market Size & Forecast, by Region, 2021-2031 ($ Million)

Source: Research Dive Analysis

The Market for In-vitro Fertilization Microscope in Europe to be the Most Dominant

The Europe In-vitro fertilization microscopes market accounted for highest market share in 2021. Companies in the region are implementing a variety of strategies, such as product launches and research initiatives to drive the growth of the IVF microscope market during the forecast period. Nikon Microscopes, for example, launched ECLIPSE Ti2-U IVF in August 2021 for the initial procedures in Intracytoplasmic Sperm Injection (ICSI). The market for IVF microscopes in Asia-Pacific is expected to grow the fastest during the forecast period, owing to key factors such as increased awareness and availability of IVF services. The presence of a large population and increased awareness about IVF are two key factors contributing to clinics' increased demand for microscopes.

Competitive Scenario in the Global In-vitro Fertilization Microscope Market

Investment and agreement are common strategies followed by major market players. For instance, in June 2020, the Global Fertility Alliance now partnered Zeiss and Hamilton Throne. The Global Fertility Alliance is committed to assisting in the standardization of ART (Assisted Reproductive Treatment) laboratory processes. The alliance's current members are Merck KGaA, Illumina Inc., and Genea Limited.

Source: Research Dive Analysis

Some of the leading in-vitro fertilization microscope market players are Linkam Scientific Instruments, Olympus Corporation, Leica Microsystems, Meiji Techno, Zeiss, Euromex Microscopen B.V., Labomed Europe B.V., Nikon Corporation, Narishige Group, Eppendorf AG, and Hamilton Thorne Ltd.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Regional Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

Q1. What is the size of the global in-vitro fertilization microscope market?

A. The size of the global In-vitro fertilization microscopes market was over $105.4 million in 2021 and is projected to reach $250.4 million by 2031.

Q2. Which are the major companies in the in-vitro fertilization microscope market?

A. Linkam Scientific Instruments, Olympus Corporation, and Leica Microsystems are some of the key players in the global in-vitro fertilization microscope market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What is expected to be the growth rate of the Asia-Pacific In-vitro fertilization microscope market?

A. Asia-Pacific In-vitro fertilization microscope market is anticipated to grow at 10.2% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Linkam Scientific Instruments, Nikon Corporation, and Olympus Corporation are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global In-vitro Fertilization Microscopes Market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on In-vitro fertilization microscopes market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.In-vitro Fertilization Microscopes Market Analysis, by Type

5.1.Overview

5.2.Upright Microscope

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Inverted Microscope

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Stereo Microscope

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2021-2031

5.4.3.Market share analysis, by country, 2021-2031

5.5.Embryo Microscope

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2021-2031

5.5.3.Market share analysis, by country, 2021-2031

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6. In-vitro Fertilization Microscopes Market Analysis, by End-user

6.1.Overview

6.2.Clinical

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Academic Research

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.In-vitro Fertilization Microscopes Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type, 2021-2031

7.1.1.2.Market size analysis, by End-user, 2021-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Type, 2021-2031

7.1.2.2.Market size analysis, by End-user, 2021-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Type, 2021-2031

7.1.3.2.Market size analysis, by End-user, 2021-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type, 2021-2031

7.2.1.2.Market size analysis, by End-user, 2021-2031

7.2.2.UK

7.2.2.1.Market size analysis, by Type, 2021-2031

7.2.2.2.Market size analysis, by End-user, 2021-2031

7.2.3.France

7.2.3.1.Market size analysis, by Type, 2021-2031

7.2.3.2.Market size analysis, by End-user, 2021-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Type, 2021-2031

7.2.4.2.Market size analysis, by End-user, 2021-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Type, 2021-2031

7.2.5.2.Market size analysis, by End-user, 2021-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type, 2021-2031

7.2.6.2.Market size analysis, by End-user, 2021-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type, 2021-2031

7.3.1.2.Market size analysis, by End-user, 2021-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Type, 2021-2031

7.3.2.2.Market size analysis, by End-user, 2021-2031

7.3.3.India

7.3.3.1.Market size analysis, by Type, 2021-2031

7.3.3.2.Market size analysis, by End-user, 2021-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Type, 2021-2031

7.3.4.2.Market size analysis, by End-user, 2021-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type, 2021-2031

7.3.5.2.Market size analysis, by End-user, 2021-2031

7.3.6.Rest of Asia Pacific

7.3.6.1.Market size analysis, by Type, 2021-2031

7.3.6.2.Market size analysis, by End-user, 2021-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type, 2021-2031

7.4.1.2.Market size analysis, by End-user, 2021-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type, 2021-2031

7.4.2.2.Market size analysis, by End-user, 2021-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Type, 2021-2031

7.4.3.2.Market size analysis, by End-user, 2021-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type, 2021-2031

7.4.4.2.Market size analysis, by End-user, 2021-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type, 2021-2031

7.4.5.2.Market size analysis, by End-user, 2021-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Linkam Scientific Instruments

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Olympus Corporation

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Leica Microsystems

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Meiji Techno

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Zeiss

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Euromex Microscopen B.V.

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Labomed Europe B.V.

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Nikon Corporation

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.Narishige Group

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Eppendorf AG

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

10.Appendix

10.1.Parent & peer market analysis

10.2.Premium insights from industry experts

10.3.Related reports

In-vitro fertilization (IVF) is a complex medical procedure that helps couples who are struggling with infertility to conceive a child. This process involves the fertilization of an egg outside of the body in a laboratory dish, and the resulting embryos are then transferred back into the uterus to establish a pregnancy. The success of IVF is highly dependent on the accuracy and precision of the procedures carried out during the process. One essential tool in IVF is the microscope, which is used to view and manipulate eggs and embryos. In-vitro fertilization microscopes are used for various procedures such as oocyte preparation, sperm analysis, overall embryo analysis, and many more.

There exist various types of microscopes used in IVF including inverted microscopes, stereomicroscopes, and many more. One of the newest technologies in IVF microscopy is the time-lapse microscope which allows embryologists to observe the development of embryos over time. IVF microscopes play a major role in providing a stable environment to ensure that the eggs and embryos are not damaged during the examination. Moreover, they include ergonomic design, easy-to-use controls, and the ability to capture images and videos of samples. The microscopes help in magnifying the samples to a high degree while maintaining clarity and focus.

Forecast Analysis of the Global In-Vitro Fertilization Microscopes Market

According to the report published by Research Dive, the global in-vitro fertilization microscopes market is anticipated to generate a revenue of $250.4 million and grow at a striking CAGR of 9.4% during the estimated timeframe from 2022-2031.

The increasing awareness of in-vitro fertilization among individuals across the globe and the growing emphasis on providing high-quality family planning services such development of fertility care is expected to foster the growth of the in-vitro fertilization microscopes market over the analysis timeframe. Moreover, the increasing launch of innovative products with technological advancements and the rising investments in the R&D activities of in-vitro fertilization is expected to create massive growth opportunities for the market throughout the estimated period. However, the high cost and risk associated with IVF and ICSI treatment may restrict the growth of the market over the forecast timeframe.

The major players of the in-vitro fertilization microscopes market include Hamilton Thorne Ltd., Linkam Scientific Instruments, Eppendorf AG, Olympus Corporation, Narishige Group, Leica Microsystems, Nikon Corporation, Meiji Techno, Labomed Europe B.V., Euromex Microscopen B.V., and many more.

Key Developments of the Market

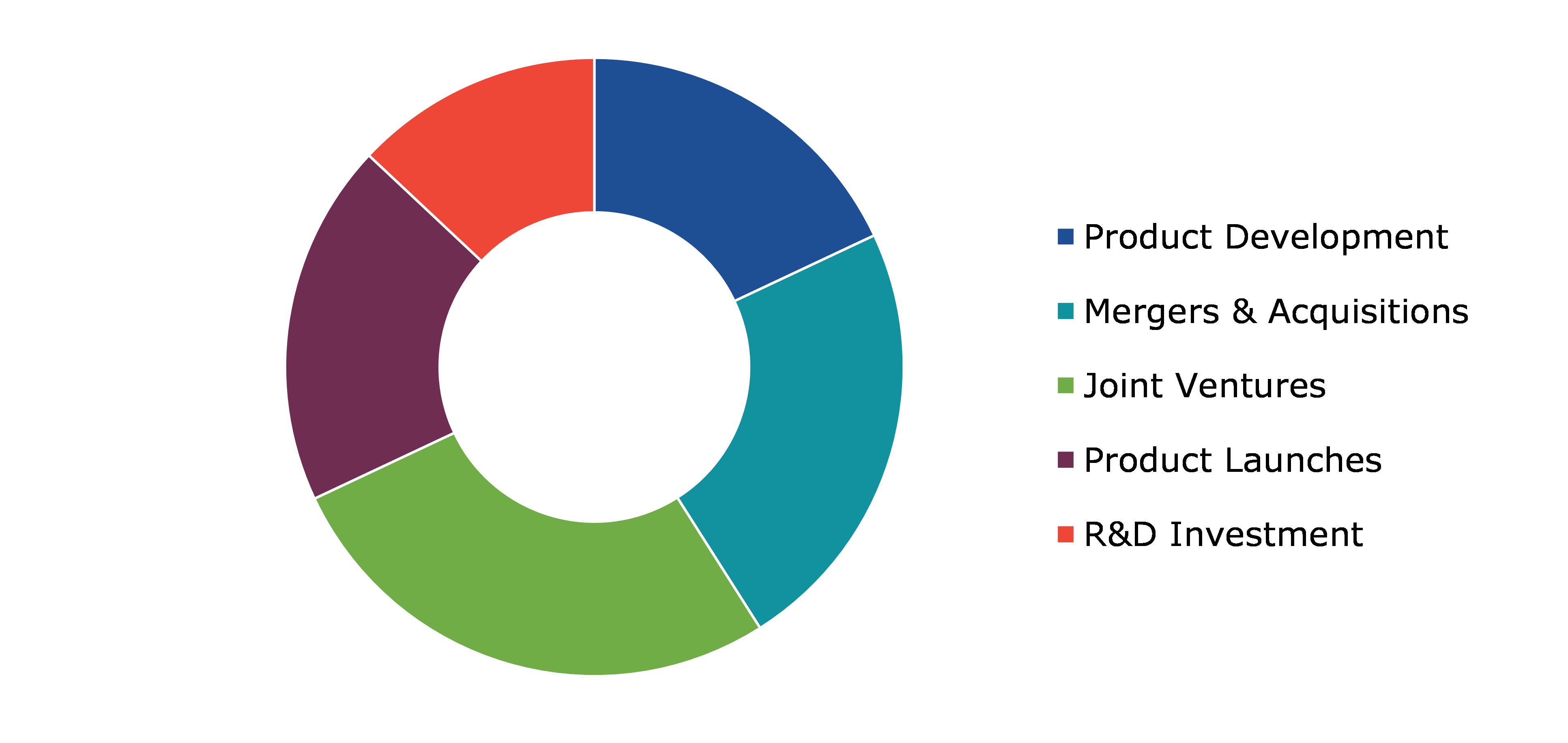

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global in-vitro fertilization microscopes market to grow exponentially. For instance:

- In July 2022, Esco Lifesciences Group, a leading manufacturer and service provider of life science tools announced its acquisition of Evidence Solution, a leading software company that offers In Vitro Fertilization (IVF) management technologies and quality management systems. With this acquisition, the companies aimed to expand their product portfolio by providing a wide range of innovative IVF solutions.

- In November 2022, Nikon India, a leading provider of imaging lenses made an entry into the healthcare sector through the System Product Microscopy business by launching a new product namely, AXR Point scanning confocal microscope that provides the most accurate view of the object with the field of view of 25mm in one single shot.

- In December 2022, Leica Microsystems, a leading German microscope manufacturing company, announced its partnership with Applied Scientific Instrumentation (ASI), a company committed to the advancement of science. With this partnership, the companies aimed to commercialize single-objective light-sheet microscopy. This partnership would offer microscopes with high-speed volumetric imaging to capture fast dynamics in three dimensions by combining gentle imaging, and conventional sample preparation.

Most Profitable Region

The Europe region of the in-vitro fertilization microscopes market held the highest market share in 2021. This is mainly due to the growing implementation of various innovative strategies such as product launches and research initiatives across the region. Moreover, the rising awareness of in-vitro fertilization among people in the region is predicted to drive the regional growth of the market throughout the analysis period.

Covid-19 Impact on the In-Vitro Fertilization Microscopes Market

The rise of the Covid-19 pandemic has brought severe uncertainties across various businesses. It has also devastated the in-vitro fertilization microscopes market. This is mainly due to the shutdown of various manufacturing companies, disruptions in supply chains, and the economic slowdown across several countries during the pandemic. In addition, many IVF-specialized clinics were suspended to check the spread of the virus as patients need to visit the clinic frequently during the procedure. All these factors have declined the growth of the market throughout the crisis.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com