Engineered Stone Market Report

RA08585

Engineered Stone Market by Type (Engineered Quartz, Polymer Concrete, and Engineered Marble Stone), Application (Flooring, Wall Cladding, Cut-to-size Items, and Others), End-use Industry (Residential and Commercial), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021-2030

Global Engineered Stone Market Analysis

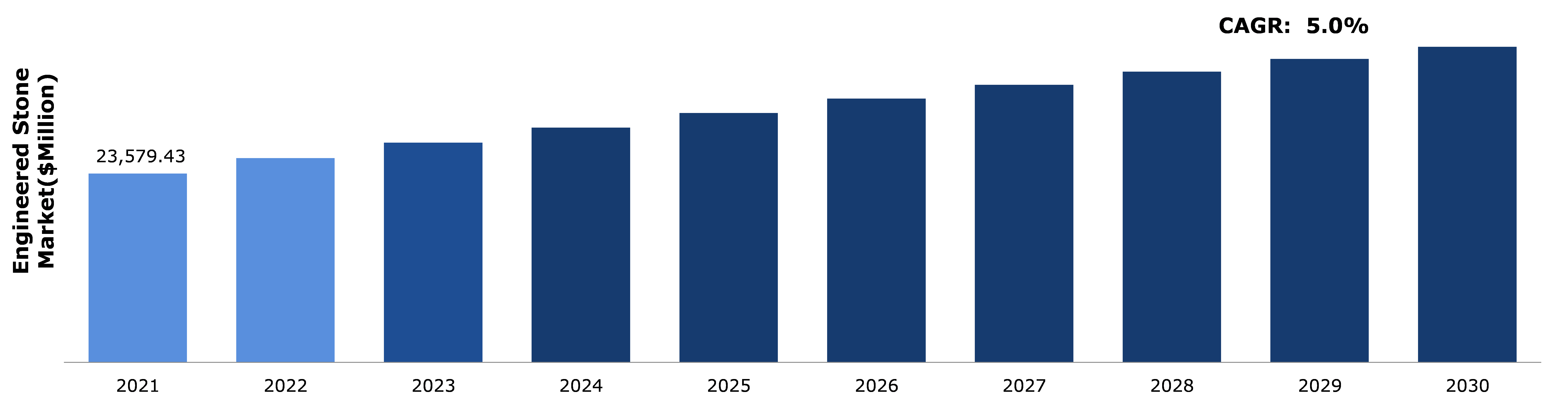

The global engineered stone market is predicted to be valued at $39,410.8 million by 2030, surging from $23,579.4 million in 2021, at a noteworthy CAGR of 5.0%.

Market Synopsis

Engineered stone market is gaining huge popularity as engineered stones such as engineered quartz find wide range of applications in many different areas including residential places, kitchen countertops, flooring & wall cladding, fireplaces, and others. Engineered stones have limitless design potential, creativity, and exhibit high strength & durability.

However, lack of heat resistance capacity in engineered stone is likely to restrain engineered stone market size growth in the predicted timeframe.

The versatile characteristics of engineered stones such as timeless appeal and immense beauty are estimated to attract huge growth opportunities. Engineered stone adds elegance and aesthetic to any space whether it is an architectural design or ornamental design structures such as statues. In addition, recent advancements in engineered stone quarrying, extraction, and fabrication process such as sandblasting, 3D modeling, and detailed surface work have made engineered stones easier to use and durable which is anticipated to boost the engineered stone market share during the analysis timeframe.

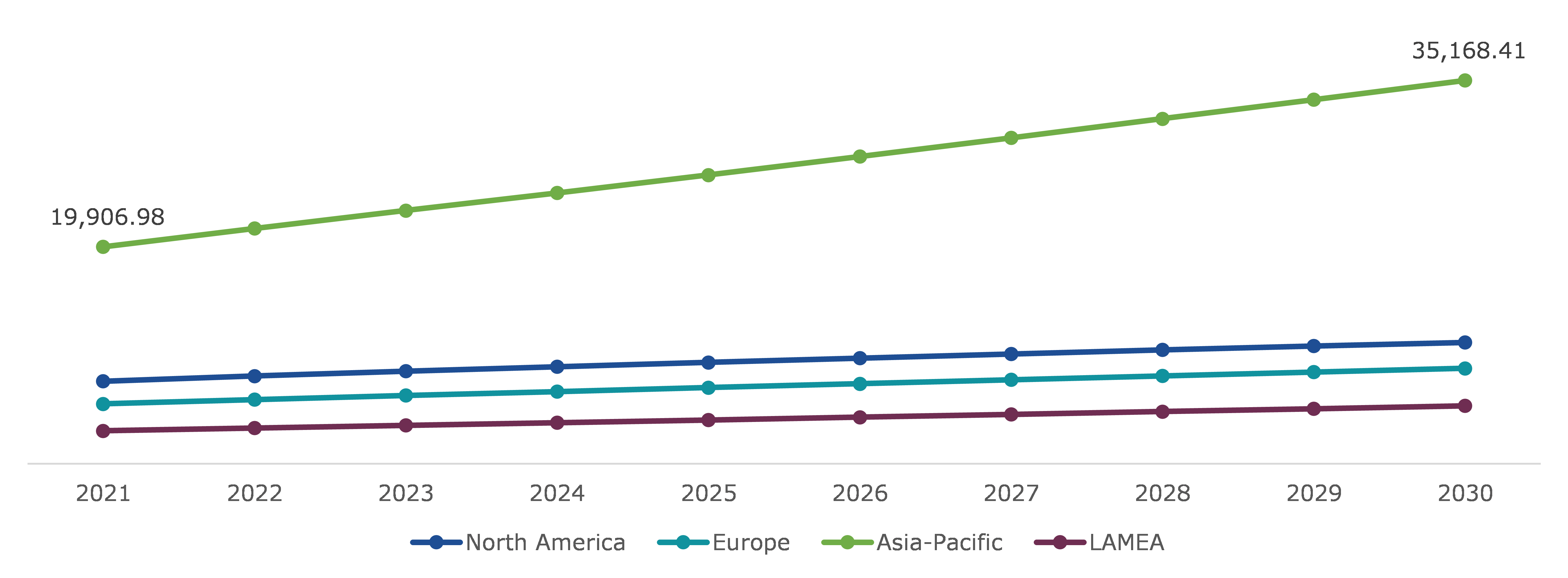

According to regional analysis, the engineered stone market for Asia-Pacific region generated considerable market share in the forecast time period from 2021-2030. The regional growth is attributed to growing construction activities and remodeling activities in both commercial and residential sectors which has boosted engineered stone market demand.

Engineered Stone Overview

Engineered stone is created using aggregates of granite, quartzite, or other natural stones along with a blend of resins and colors. Engineered slabs are made up of 90% pulverized natural quartz and a very little amount of polyresin (around 10%). The brand and manufacturer affect the percentages. In addition to being nonporous and resistant to bacteria and viruses, engineered stone has many other excellent qualities. Additionally, engineered stone is considered as one of the fastest-growing surfacing materials.

COVID-19 Impact on Engineered Stone Market

The global crisis caused by COVID-19 pandemic has negatively affected the engineered stone market and brought real challenges for its functioning. For instance, the quarry activities, processing facilities, logistics, and administrative offices in engineered stone industry had to suspend their operations to contain the pandemic. The lockdown imposed across various countries forced the engineered stone manufacturers to go into complete lockdown mode that led to economic crisis and laying off employees. The companies were unable to meet the demand from ongoing essential construction projects such as building of hospitals due to transport restrictions and reluctance of workers to work due to the fear of COVID-19 virus. The import-export of engineered stone was negatively impacted that has led to drastic decline in the demand from domestic and foreign market. All these factors have negatively impacted the engineered stone market size during the pandemic.

Wide Range of Applications of Engineered Stone to Drive the Market Growth

Engineered stone finds variety of applications in the interior spaces of home such as kitchen, bathroom, living room, and others. Also, engineered stone’s nonporous nature, combined with its antifungal and antibacterial properties, make it a fantastic choice for commercial applications like restaurants and doctor's offices. Apart from this, engineered stones have tremendous strength and hardness which makes it even a popular stone for commercial purposes such as offices and commercial malls. Engineered stones generally have hardness of 7 out of 10 and can withstand scratches from tempered steel, iron, and glass. Examples of such stones include Quartz and FriTech from Lucciare. Apart from strength and porosity, engineered stones are difficult to stain with any color material which marks it a perfect choice for kitchen countertops. All these properties and applications of engineered stones are predicted to drive engineered stone market revenue growth in the coming time period.

To know more about global engineered stone market drivers, get in touch with our analysts here.

Lack of Heat Resistance Capacity of Engineered Stone to Restrain Market Growth

Engineered stone has the disadvantage of not being as heat resistant as natural stone like quartzite or granite. Given that it is made of a combination of stone and resin, exposure to intense heat (such as a hot pan straight from the stove or oven) may weaken or damage the material's surface, making it more prone to splitting. This factor is likely to hinder engineered stone market size growth in the anticipated time span.

Sharp Rise in Construction Activities Across the World to Generate Enormous Opportunities

The building & construction sector has experienced remarkable growth as a result of the recent acceleration of urbanization, the development of smart cities, and the development of large-scale projects. Engineered stones like Engineered Quartz and Caesarstone are often used in the residential and commercial sectors for infrastructure upgrades, as well as for construction and remodeling projects. Due to its attractiveness and ease of maintenance, it is frequently used for table tops, wall claddings, floors, vanity tops, wainscot, and other surfaces. The advent of more environmentally friendly choices for construction or decoration is further likely to speed up the expansion of the engineered stone market in the future.

To know more about global engineered stone market opportunities, get in touch with our analysts here.

Global Engineered Stone Market, by Type

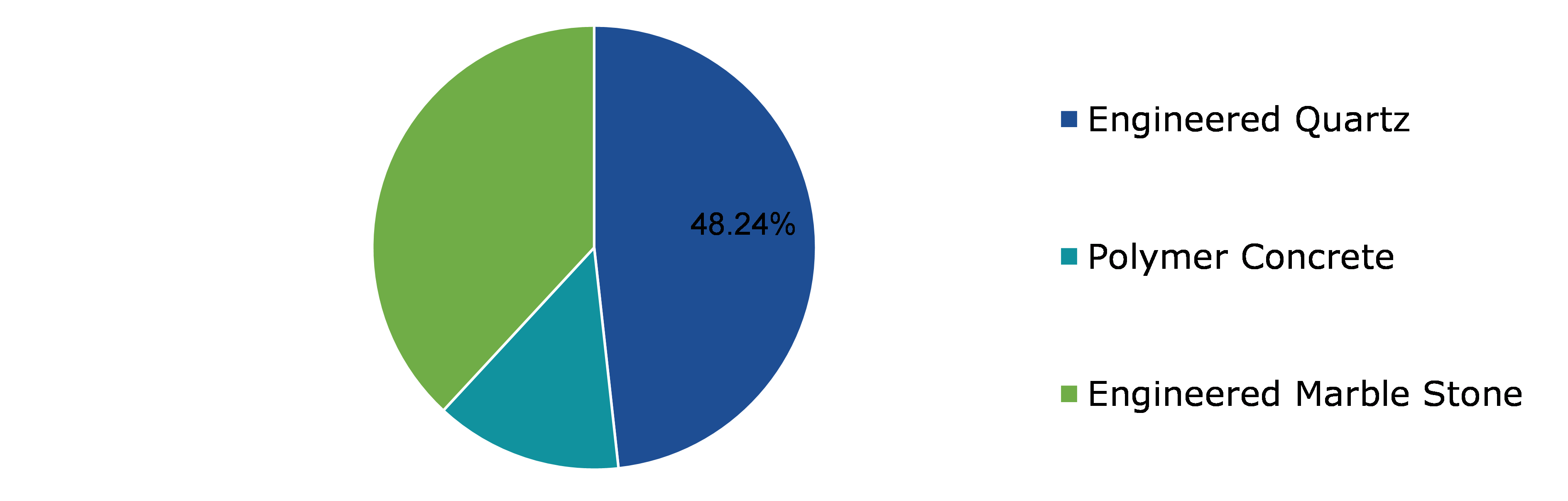

Based on type, the market has been divided into engineered quartz, polymer concrete, and engineered marble stone. Among these, the engineered quartz sub-segment accounted for the highest revenue share in 2021 and engineered marble stone is estimated to show the fastest growth during the forecast period.

Global Engineered Stone Market Share, by Type, 2021

Source: Research Dive Analysis

The engineered quartz sub-segment experienced highest revenue in 2021. This is because engineered quartz is known for outstanding hardness, abrasion resistance, and elegance. In both residential and commercial structures, quartz stone is widely used for flooring. The stone has many different properties such as high sustainability, slick-proof, and adaptable to any environment as a result.

The engineered marble stone sub-segment is anticipated to have the fastest growth in the forecast time period. In comparison to naturally occurring marble, engineered marble is a more environmentally friendly material because it uses less petroleum. Not only is engineered stone utilized for kitchen worktops, but also for flooring and backsplash tiles.

Global Engineered Stone Market, by Application

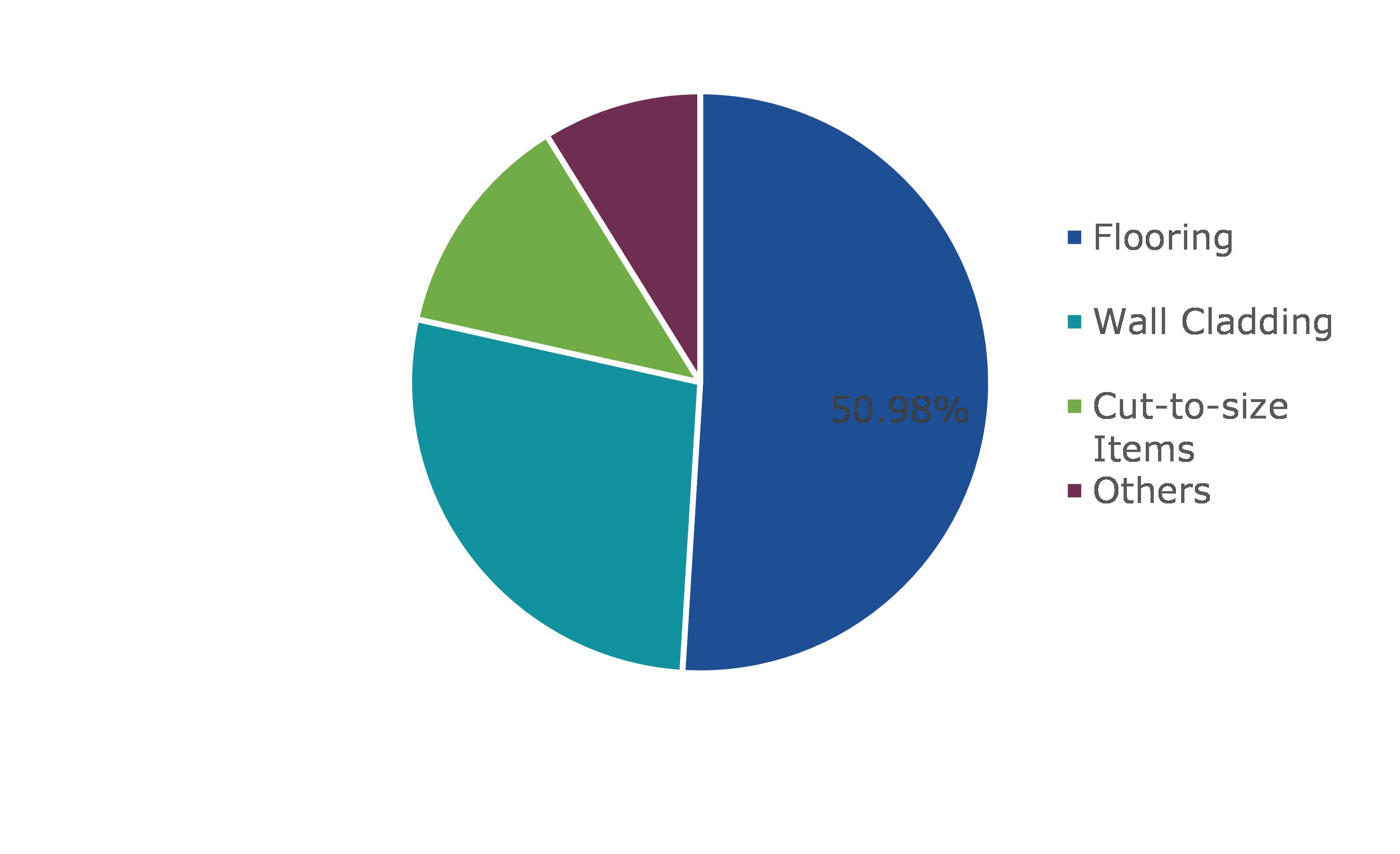

Based on application, the market has been divided into flooring, wall cladding, cut-to-size items, and others. Among these, the flooring sub-segment accounted for the highest market share in 2020 and is estimated to show the fastest growth during 2021-2030.

Global Engineered Stone Market Share, by Application, 2021

Source: Research Dive Analysis

The flooring sub-segment is anticipated to have a dominant market share in 2030. Due to its longevity, beauty, and enhanced property value, engineered stone is frequently utilized for flooring in both the residential and commercial sectors. Caesarstone and engineered marble stone are few of the common engineered stones chosen for flooring. Grey, gold, and black are the three most common colors of slate, and they are suitable for use in both dry and damp locations.

Global Engineered Stone Market, by End-use Industry

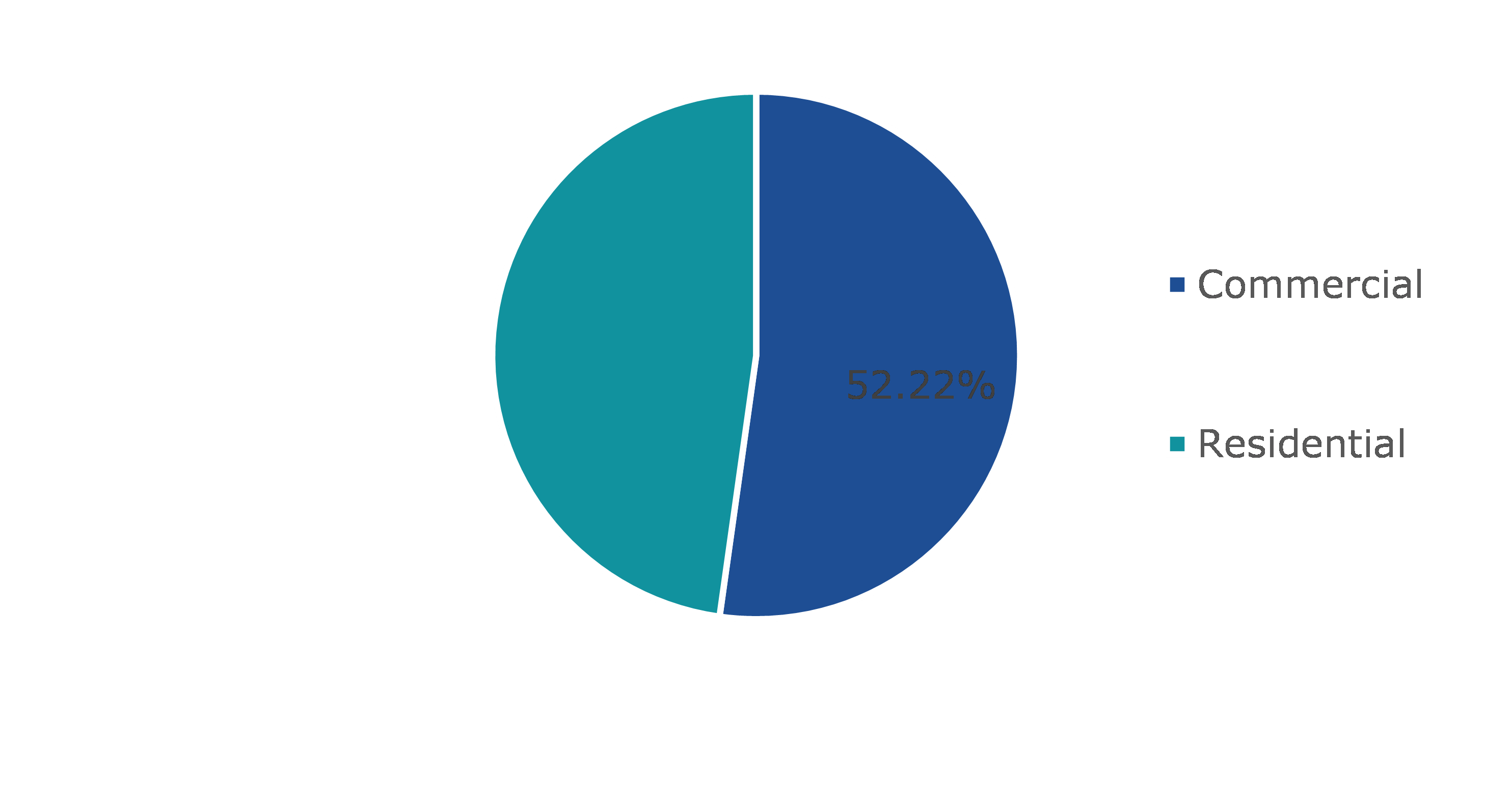

Based on end-use industry, the market is further classified into residential and commercial. Among these, the commercial sub-segment is anticipated to have a dominant market share and residential sub-segment is projected to have fastest growth.

Global Engineered Stone Market Share, by End-use Industry, 2021

Source: Research Dive Analysis

Commercial sub-segment is anticipated to have highest market share in the forecast time period in 2030. The sub-segment growth is majorly due to growing construction activities in commercial building sectors. The demand for engineered stones have increased significantly for commercial buildings as engineered stones are less expensive. Also, engineered stones offer variations in color, texture, and sizes. All these factors are anticipated to have a positive growth in the forecast time period.

Global Engineered Stone Market, Regional Insights

The engineered stone market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Engineered Stone Market Size and Forecast, By Region, 2021 to 2030 ($ Million)

Source: Research Dive Analysis

The Market for Engineered Stone in Asia-Pacific to be the Most Dominant and Show the Fastest Growth

The Asia-Pacific engineered stone market is expected to garner for major market share in the predicted time period. Growing construction activities owing to rapid urbanization & industrialization are estimated to boost the demand for engineered stones for flooring, wall cladding, memorial arts, civil works, and others. The presence of leading engineered stone producers namely India and China are estimated to boost the Asia-Pacific engineered stone market size.

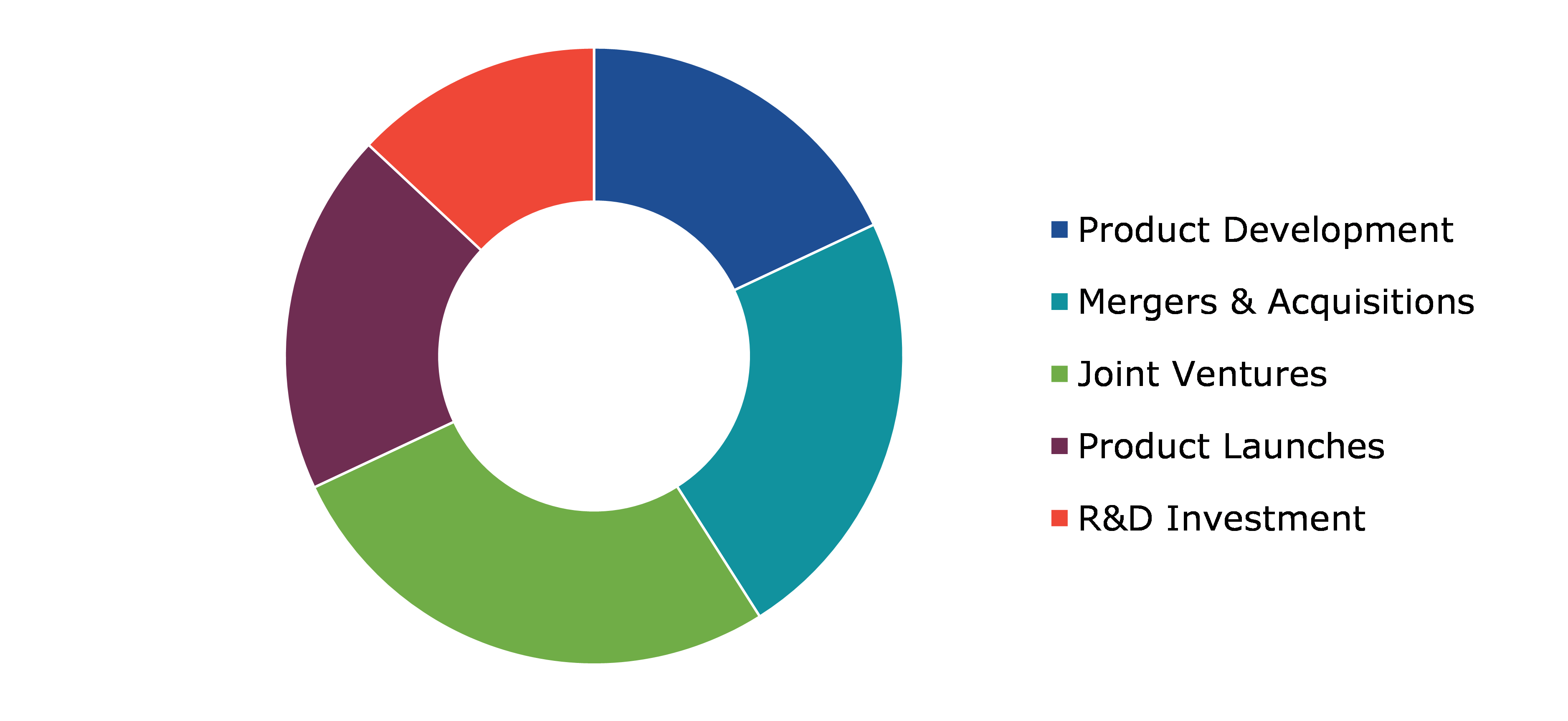

Competitive Scenario in the Global Engineered Stone Market

Investment and acquisition are common strategies followed by major market players. For instance, according to an official news published by Nuovvo, an engineered stone company, the company aims to develop and launch a new engineered stone shower tray by the end of 2022. The shower tray will be made entirely from engineered stone and intends to use nanotechnology in the manufacturing process.

Source: Research Dive Analysis

Some of the leading engineered stone market players are LG Hausys, Johnson Marble & Quartz, Technistone A.S., Caesarstone Ltd., Belenco, Quarella Group Ltd, Quartzforms, Stone Italiana S.p.A, Vicostone, and Diresco.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2021-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Segmentation by End Use Industry |

|

| Key Companies Profiled |

|

Q1. What is the size of the global engineered stone market?

A. The global engineered stone market is predicted to be valued at $39,410.8 million by 2030, surging from $23,579.4 million in 2021, at a noteworthy CAGR of 5.0%.

Q2. Which are the major companies in the engineered stone market?

A. ARO Granite Industries Ltd., Dimpomar, and Dermitzakis Bros S. A. are some of the key players in the global engineered stone market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What are the strategies opted by the leading players in this market?

A. Investment and acquisition are the two key strategies opted by the operating companies in this market.

Q5. Which companies are investing more on R&D practices?

A. Levantina Asociados de Minerales, S.A., Margraf Spa, and Polycor Inc. are the companies investing more on R&D practices.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on engineered stone market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Engineered stone market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Engineered stone Market, by Type

5.1.Overview

5.1.1.Market size and forecast, by type

5.2.Engineered Quartz

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2022-2030

5.2.3.Market share analysis, by country 2022 & 2030

5.3.Polymer Concrete

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2022-2030

5.3.3.Market share analysis, by country 2022 & 2030

5.4.Engineered Marble Stone

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region, 2022-2030

5.4.3.Market share analysis, by country 2022 & 2030

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Engineered Stone Market, by Application

6.1.Overview

6.1.1.Market size and forecast, by application

6.2.Flooring

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region, 2022-2030

6.2.3.Market share analysis, by country 2022 & 2030

6.3.Wall Cladding

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region, 2022-2030

6.3.3.Market share analysis, by country 2022 & 2030

6.4.Cut-to-size Items

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by region, 2022-2030

6.4.3.Market share analysis, by country 2022 & 2030

6.5.Others

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by region, 2022-2030

6.5.3.Market share analysis, by country 2022 & 2030

6.6.Research Dive Exclusive Insights

6.6.1.Market attractiveness

6.6.2.Competition heatmap

7.Engineered stone Market, by End Use Industry

7.1.Overview

7.1.1.Market size and forecast, by type

7.2.Residential

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by region, 2022-2030

7.2.3.Market share analysis, by country 2022 & 2030

7.3.Commercial

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by region, 2022-2030

7.3.3.Market share analysis, by country 2022 & 2030

8.Engineered Stone Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Type

8.1.1.2.Market size analysis, by Application

8.1.1.3.Market size analysis, by End Use Industry

8.1.2.Canada

8.1.2.1.Market size analysis, by Type

8.1.2.2.Market size analysis, by Application

8.1.2.3.Market size analysis, by End Use Industry

8.1.3.Mexico

8.1.3.1.Market size analysis, by Type

8.1.3.2.Market size analysis, by Application

8.1.3.3.Market size analysis, by End Use Industry

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Type

8.2.1.2.Market size analysis, by Application

8.2.2.UK

8.2.2.1.Market size analysis, by Type

8.2.2.2.Market size analysis, by Application

8.2.2.3.Market size analysis, by End Use Industry

8.2.3.France

8.2.3.1.Market size analysis, by Type

8.2.3.2.Market size analysis, by Application

8.2.3.3.Market size analysis, by End Use Industry

8.2.4.Spain

8.2.4.1.Market size analysis, by Type

8.2.4.2.Market size analysis, by Application

8.2.4.3.Market size analysis, by End Use Industry

8.2.5.Italy

8.2.5.1.Market size analysis, by Type

8.2.5.2.Market size analysis, by Application

8.2.5.3.Market size analysis, by End Use Industry

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Type

8.2.6.2.Market size analysis, by Application

8.2.6.3.Market size analysis, by End Use Industry

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Type

8.3.1.2.Market size analysis, by Application

8.3.1.3.Market size analysis, by End Use Industry

8.3.2.Japan

8.3.2.1.Market size analysis, by Type

8.3.2.2.Market size analysis, by Application

8.3.2.3.Market size analysis, by End Use Industry

8.3.3.India

8.3.3.1.Market size analysis, by Type

8.3.3.2.Market size analysis, by Application

8.3.3.3.Market size analysis, by End Use Industry

8.3.4.Australia

8.3.4.1.Market size analysis, by Type

8.3.4.2.Market size analysis, by Application

8.3.4.3.Market size analysis, by End Use Industry

8.3.5.South Korea

8.3.5.1.Market size analysis, by Type

8.3.5.2.Market size analysis, by Application

8.3.5.3.Market size analysis, by End Use Industry

8.3.6.Rest of Asia Pacific

8.3.6.1.Market size analysis, by Type

8.3.6.2.Market size analysis, by Application

8.3.6.3.Market size analysis, by End Use Industry

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Type

8.4.1.2.Market size analysis, by Application

8.4.1.3.Market size analysis, by End Use Industry

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Type

8.4.2.2.Market size analysis, by Application

8.4.2.3.Market size analysis, by End Use Industry

8.4.3.UAE

8.4.3.1.Market size analysis, by Type

8.4.3.2.Market size analysis, by Application

8.4.3.3.Market size analysis, by End Use Industry

8.4.4.South Africa

8.4.4.1.Market size analysis, by Type

8.4.4.2.Market size analysis, by Application

8.4.4.3.Market size analysis, by End Use Industry

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Type

8.4.5.2.Market size analysis, by Application

8.4.5.3.Market size analysis, by End Use Industry

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.LG Hausys

10.1.1.Overview

10.1.2.Business segments

10.1.3.Type portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Johnson Marble & Quartz

10.2.1.Overview

10.2.2.Business segments

10.2.3.Type portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Technistone A.S.

10.3.1.Overview

10.3.2.Business segments

10.3.3.Type portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Caesarstone Ltd.

10.4.1.Overview

10.4.2.Business segments

10.4.3.Type portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Belenco

10.5.1.Overview

10.5.2.Business segments

10.5.3.Type portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Quarella Group Ltd

10.6.1.Overview

10.6.2.Business segments

10.6.3.Type portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Quartzforms

10.7.1.Overview

10.7.2.Business segments

10.7.3.Type portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Stone Italiana S.p.A

10.8.1.Overview

10.8.2.Business segments

10.8.3.Type portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.VICOSTONE

10.9.1.Overview

10.9.2.Business segments

10.9.3.Type portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Diresco

10.10.1.Overview

10.10.2.Business segments

10.10.3.Type portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

The pace at which the construction sector is progressively leaping has no bounds. Engineering, construction, and building materials have a vital role to play in every construction project and engineered stone is amongst the most opted materials in the industry today. Engineered stone or quartz is a man-made product produced usually from natural ingredients, by merging quartz or granite combinations with pigments and resins. Engineered quartz slabs are manufactured by mixing approximately 90% crushed natural quartz with 10% polyresin. Even though, these proportions might vary to some extent depending on the particular quartz brand. Engineered stone is not only magnificent, modern, and classic but also offers a number of benefits such as attractive, hygienic, and stress-free maintenance. Also, engineered stones are greatly opted nowadays as an ideal eco-friendly option for countertop surfaces in residential projects.

The global engineered stone market is obtaining enormous acceptance as engineered stones for instance, engineered quartz is being used in a broad wide range of application areas in numerous different spaces such as in residential homes for kitchen countertops, fireplaces, flooring & wall cladding, and many others. Engineered stones also have unlimited design prospective, creative appearance, and also possess great strength and durability. Hence, their demand is escalating rapidly in the construction sector.

Newest Insights in the Engineered Stone Market

As per a report by Research Dive, the global engineered stone market is expected to grow with 5.0% CAGR, surpassing $39,410.8 million in the 2022–2030 timeframe. The Asia-Pacific engineered stone market is expected to perceive foremost and rapid growth in the years to come. This is because, the region has a gigantic demand for engineered stone for applications in wall cladding, flooring, civil works, memorial arts, and other areas owing to the growing construction activities due to rapid urbanization & industrialization. The existence of foremost engineered stone manufacturers in India and China in this region is also expected to boost the market growth further in the years to come.

How are Market Players Responding to the Rising Demand for Engineered Stone?

Market players are greatly investing in innovative product launches to cater the rising demand for engineered stone. Some of the leading players of the engineered stone market are Quarella Group Ltd, Stone Italiana S.p.A, Diresco, Vicostone, Johnson Marble & Quartz, Belenco, Quartzforms, LG Hausys, Technistone A.S., Caesarstone Ltd., and others. These players are focused on planning and devising tactics such as mergers and acquisitions, collaborations, novel advances, and partnerships to reach a foremost position in the global market.

For instance,

- In June 2021, an Omani-Indian joint venture, a collaboration among Oman Investment Authority and the State Bank of India, commercially launched innovative engineered quartz stone products production factory at Sohar Free Zone – an investment that will further fortify the Sultanate’s credentials as a foremost producer and exporter of natural as well as engineered stones for the worldwide construction sector.

- In September 2021, the Engineered Stone Group, a foremost US-based ultra-premium branded manufacturer of engineered stone, proclaimed that it has acquired Fiora as well as Nuovvo, two of Europe's prominent producers of bathroom products.

- In March 2022, Hafele, an international firm offering hardware and fitting systems and electronic access control systems, launched robust, multipurpose, and artistically workable Terra Quartz surfaces for an extensive range of home applications.

COVID-19 Impact on the Global Engineered Stone Market

The abrupt rise of the coronavirus pandemic in 2020 has negatively impacted the global engineered stone market. During the pandemic period, the processing services, quarry activities, logistics and supply chains, and managerial offices in the engineered stone sector were forced to suspend their processes to avert the spread of the virus. The lockdown restrictions implemented across several countries also impacted many construction projects worldwide. The construction companies were unable to cater the demands for construction materials during the pandemic. The import-export activities of engineered stones were undesirably impacted, which resulted in a drastic downfall in the global market growth in the pandemic period. Moreover, with the relaxation of the pandemic since the end of 2021, many construction industries using engineered stone in their projects have resumed their normal functioning, which is projected to shove the growth of the engineered stone market in the upcoming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com