Commercial Lending Market Report

RA08579

Commercial Lending Market by Type (Secured and Unsecured), Organization Size (SMEs and Large Enterprises), Providers (Bank and NBFC), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Commercial Lending Market Analysis

The global commercial lending market is anticipated to garner $27,406.6 billion in the 2021–2028 timeframe, growing from $9,712.8 billion in 2020, at a healthy CAGR of 14.4%.

Market Synopsis

The rapid growth in the number of startups across the globe is anticipated to boost the global commercial lending market. Additionally, acquisitions and business expansion by key market players are anticipated to boost the market growth.

However, the stringent qualifying criteria is anticipated to hamper the market growth in the near future.

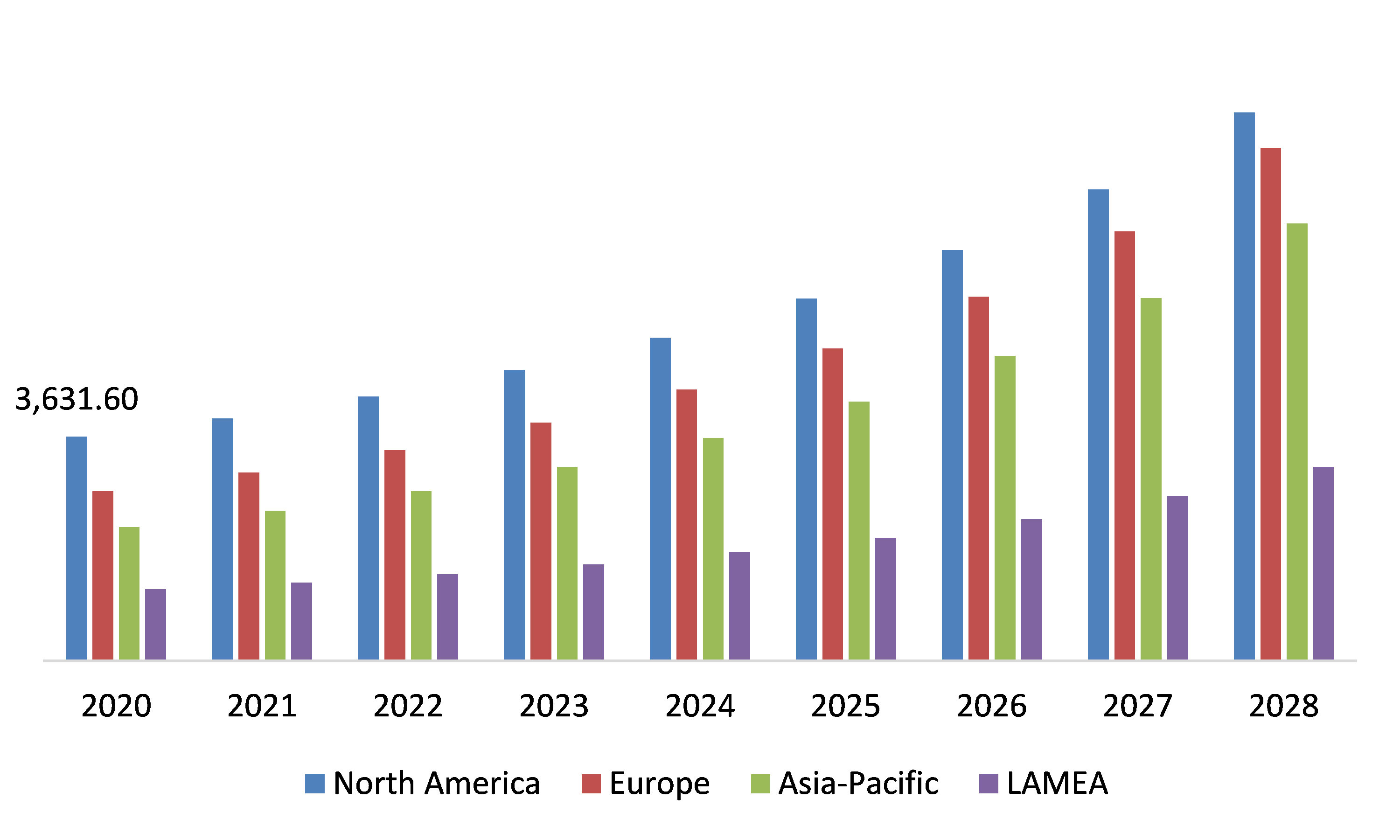

According to the regional analysis of the market, the Asia-Pacific commercial lending market is anticipated to grow at a CAGR of 16.5%, by generating a revenue of $7,081.9 billion during the review period.

Commercial Lending Overview

Commercial lending is majorly all about the borrowing money from the banks or the NBFC for the development of the business expenses, equipment purchase, or for real estate. The commercial loans can range from 15 to 30 years of span. This majorly helps the organizations who have just started the business and further want to expand or add any of the above mentioned resource.

Impact Analysis of COVID-19 on the Global Commercial Lending Market

The COVID-19 pandemic has had a large impact on the commercial lending industry, owing to an increase in commercial and industrial loans as a result of the majority of enterprises going out of business because of the epidemic. Additionally, the engagement of SMEs in commercial lending had a significant role in this increasing development. Many banks reported being stunned as a result of the surge in commercial loans during the pandemic, which occurred when businesses required additional financing. Because of this, commercial lending has experienced significant growth throughout the global health crisis, which has become one of the most important growth factors in the industry.

Low Interest Rates are Projected to Drive the Market Growth

Commercial lending has the lowest interest rates of any loan option available, allowing business owners to access crucial funding while keeping lower administrative costs than other lending options. Furthermore, interest rates for commercial financing are often lower than those on other types of unsecured borrowing. Because fixed monthly installments may be used accurately in company planning and forecasting, borrowers can structure their business's financing with a little more assurance if they choose to have fixed monthly repayments. Furthermore, commercial lending payment plans are typically extended for several years, allowing a corporation to devote its resources to other critical business matters such as sales, overhead management, and employee training. The result is that this is a significant driving force in the commercial loan industry.

To know more about global commercial lending market drivers, get in touch with our analysts here.

Non Performance of Organizations Anticipated to Restrain the Market Growth

Commercial loan options, with their ability to provide flexible long-term lending, are a primary driver of the market. Furthermore, the industry is likely to see an increase in collaborations between digital lending organizations and FinTech companies for payment collection. Whereas the increase in the amount of non-performing assets (NPA), particularly during the pandemic, has, on the other hand, slowed the market's expansion.

Advancements in the Technology are Anticipated to Create Growth Opportunities

The rate of technological innovation in the sector of commercial lending has accelerated, and the internet lending industry has grown at an astonishing rate over the last couple of years, according to industry analysts. Loans are being initiated online in greater numbers than ever before, whether for company or personal reasons. Since there has been an increase in the demand for commercial loans, online lenders have begun to implement technologies such as artificial intelligence, blockchain, and machine learning to improve the customer experience when applying for commercial loans while also making the process faster and more efficient.

To know more about global commercial lending market opportunities, get in touch with our analysts here.

Based on type, the market has been divided into secured and Unsecured. Unsecured sub-segment is anticipated to grow at the fastest CAGR during the forecast period. Download PDF Sample ReportCommercial Lending Market

By Type

Source: Research Dive Analysis

The unsecured sub-segment is anticipated to grow at the fastest CAGR of 16.0% and is anticipated to reach $15,647.8 billion during the forecast period growing from $4,963.8 billion in 2020.

Various businesses are turning to unsecured loans to help them expand their operations. In fact, unsecured loans are now the most popular type of loan available. This is good news for businesses of all sizes. Unsecured loans offer low interest rates and easy access to credit. They are also a good option for businesses that do not need a lot of credit protection or whose credit score are not very high. This trend is likely to continue as the economy continues to struggle. Many small businesses lack the resources to secure more traditional types of loans, like secured loans or lines of credit. Unsecured loans provide an affordable and easy way for them to get started.

Commercial Lending Market

By Organization sizeBased on organization size, the analysis has been divided into SMEs and Large Enterprises. Out of these, SMEs is anticipated to experience the fastest growth.

Source: Research Dive Analysis

The SMEs sub-segment of the global commercial lending market is anticipated to grow at the fastest CAGR of 16.9% and reach $13,148.4 billion by 2028, growing from $3,907.2 billion in 2020.

In the recent years, the number of SMEs has grown largely across the globe. The key factor that hampers the growth of these organizations is the funding and the initial investments. However, due to the commercial lending, these companies are able to get the fundings and grow. Unsecured loans and the loans provided by the banks are boosting the number of start-up enterprises along with the existing medium size enterprises. Additionally, various kinds of benefits that are being offered by the governments across the globe is another key factor that has boosted the SMEs growth in the recent years.

Commercial Lending Market

By ProvidersBased on providers, the analysis has been divided into banks and NBFC. Out of these, NBFC sub-segment is anticipated to grow at the fastest CAGR during the forecast period.

Source: Research Dive Analysis

The NBFC sub-segment of the global commercial lending market is anticipated to grow at a CAGR of 15.9% and reach $14,263.8 billion by 2028, growing from $4,569.1 billion in 2020.

NBFCs have been one of the major drivers of the commercial lending market in recent years. This is significant as NBFCs are typically smaller and more nimble than traditional banks, which gives them an advantage when it comes to providing quick and easy loans to businesses. The slowdown in the economy has had a dampening effect on the overall growth of the commercial lending market, but NBFCs remain a major force. The sector has seen an increase in demand for credit from small- and medium-sized enterprises (SMEs), driven by strong demand from this segment for working capital and other short-term needs. Additionally, NBFCs are increasingly providing credit products targeted at specific segments of the market, such as retail and agriculture.

Global Commercial Lending Market, Regional Insights:

The commercial lending market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Asia-Pacific Commercial Lending Market is Anticipated to Experience the Fastest Growth Rate

Commercial lending market in the Asia-Pacific region is anticipated to grow at the highest CAGR of 16.5% and reach $7,081.9 billion in 2028.

The Asia-Pacific commercial lending market growth is majorly attributed to the growing number of small and medium industries in this region. Additionally, the number of technological advancements taking place in this region is another key factor driving the Asia-Pacific region market growth over the forecast period.

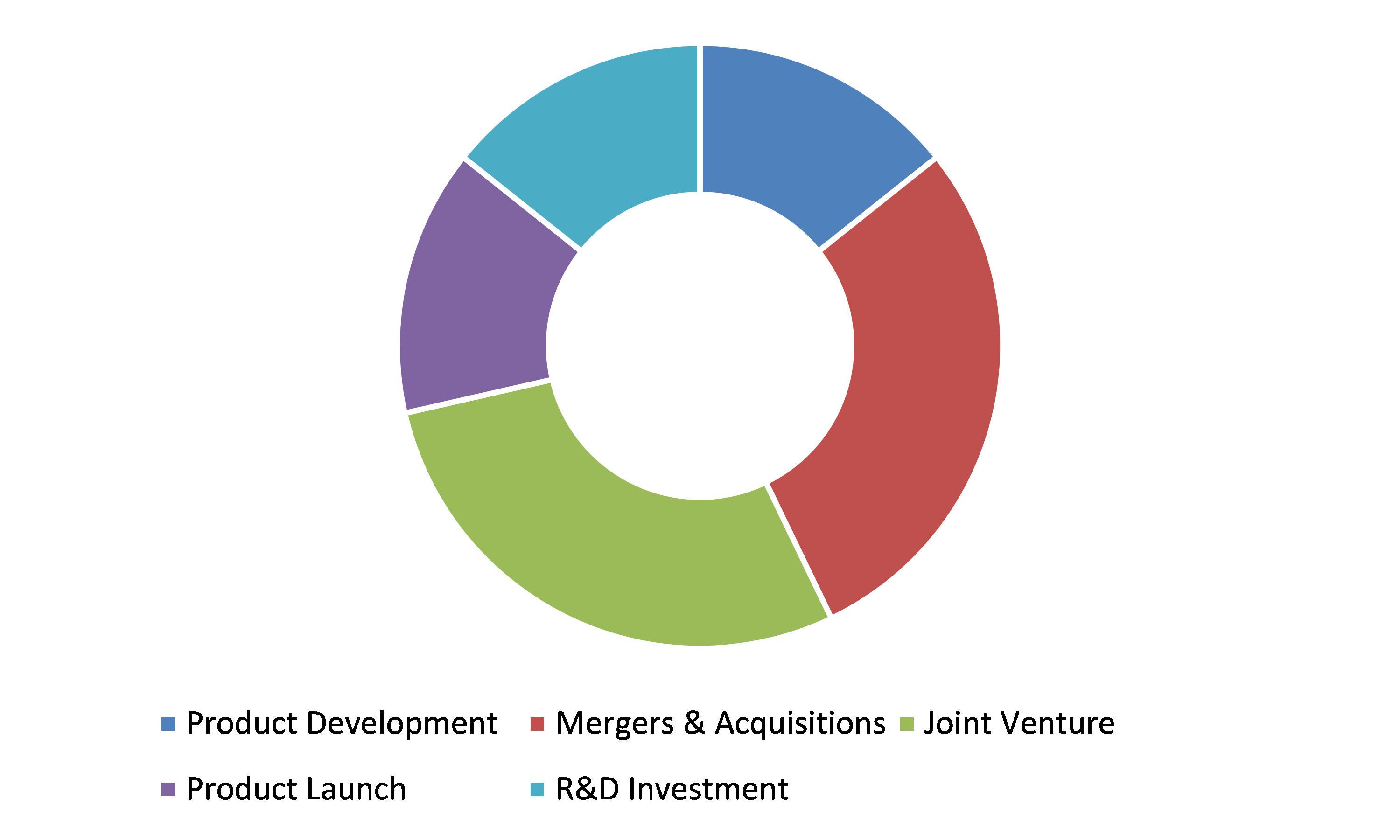

Competitive Scenario in the Global Commercial Lending Market

Product advancements, innovations, and business expansion are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading commercial lending market players are Merchant Capital, American Express Company, Fundbox, Credit Suisse, Funding Circle, Goldman Sachs, Kabbage, Fundation Group LLC, LoanBuilder, and OnDeck.

Porter’s Five Forces Analysis for the Global Commercial Lending Market:

- Bargaining Power of Suppliers: The number of commercial lending players is high.

Thus, the bargaining power suppliers is low. - Bargaining Power of Buyers: Buyers have little bargaining power because establishing commercial lending requires a large capital investment.

Thus, the bargaining power of the buyers is low. - Threat of New Entrants: The companies entering commercial lending market have to deal with high investment cost.

Thus, the threat of the new entrants is moderate. - Threat of Substitutes: The availability of the alternatives for the commercial lending is very low.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is extensive mainly because the number of players operating in commercial lending industry is concentrating on acquiring number of customer base.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Organization Size |

|

| Segmentation by Providers |

|

| Key Companies Profiled |

|

Q1. What is the size of the global commercial lending market?

A. The size of the global commercial lending market was over $9,712.8 billion in 2020 and is projected to reach $27,406.6 billion by 2028.

Q2. Which are the major companies in the commercial lending market?

A. Fundbox, Credit Suisse, Funding Circle, and Goldman Sachs are some of the major companies operating in the global commercial lending market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific commercial lending market?

A. The growth rate of the Asia-Pacific commercial lending market is 16.5%.

Q5. What are the strategies opted by the leading players in this market?

A. Product innovations, technological advancements, and business expansions are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Fundbox, Credit Suisse, Funding Circle, and Goldman Sachs companies are investing more on R&D practices.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Type trends

2.3.Organization Size trends

2.4.Providers trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Source landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Commercial Lending Market, by Type

4.1.Secured

4.1.1.Market size and forecast, by region, 2021-2028

4.1.2.Comparative market share analysis, 2021 & 2028

4.2.Unsecured

4.2.1.Market size and forecast, by region, 2021-2028

4.2.2.Comparative market share analysis, 2021 & 2028

5.Commercial Lending Market, by Organization Sizes

5.1.Small and Medium Enterprises

5.1.1.Market size and forecast, by region, 2021-2028

5.1.2.Comparative market share analysis, 2021 & 2028

5.2.Large Enterprises

5.2.1.Market size and forecast, by region, 2021-2028

5.2.2.Comparative market share analysis, 2021 & 2028

6.Commercial Lending Market, by Providers

6.1.Bank

6.1.1.Market size and forecast, by region, 2021-2028

6.1.2.Comparative market share analysis, 2021 & 2028

6.2.NBFC

6.2.1.Market size and forecast, by region, 2021-2028

6.2.2.Comparative market share analysis, 2021 & 2028

7.Commercial Lending Market, by Region

7.1.North America

7.1.1.Market size and forecast, by Type, 2021-2028

7.1.2.Market size and forecast, by Organization Size, 2021-2028

7.1.3.Market size and forecast, by Providers 2021-2028

7.1.4.Market size and forecast, by country, 2021-2028

7.1.5.Comparative market share analysis, 2021 & 2028

7.1.6.U.S.

7.1.6.1.Market size and forecast, by Type, 2021-2028

7.1.6.2.Market size and forecast, by Organization Size, 2021-2028

7.1.6.3.Market size and forecast, by Providers, 2021-2028

7.1.6.4.Comparative market share analysis, 2021 & 2028

7.1.7.Canada

7.1.7.1.Market size and forecast, by Type, 2021-2028

7.1.7.2.Market size and forecast, by Organization Size, 2021-2028

7.1.7.3.Market size and forecast, by Providers, 2021-2028

7.1.7.4.Comparative market share analysis, 2021 & 2028

7.1.8.Mexico

7.1.8.1.Market size and forecast, by Type, 2021-2028

7.1.8.2.Market size and forecast, by Organization Size, 2021-2028

7.1.8.3.Market size and forecast, by Providers, 2021-2028

7.1.8.4.Comparative market share analysis, 2021 & 2028

7.2.Europe

7.2.1.Market size and forecast, by Type, 2021-2028

7.2.2.Market size and forecast, by Organization Size, 2021-2028

7.2.3.Market size and forecast, by Providers, 2021-2028

7.2.4.Market size and forecast, by country, 2021-2028

7.2.5.Comparative market share analysis, 2021 & 2028

7.2.6.UK

7.2.6.1.Market size and forecast, by Type, 2021-2028

7.2.6.2.Market size and forecast, by Organization Size, 2021-2028

7.2.6.3.Market size and forecast, by Providers, 2021-2028

7.2.6.4.Comparative market share analysis, 2021 & 2028

7.2.7.Germany

7.2.7.1.Market size and forecast, by Type, 2021-2028

7.2.7.2.Market size and forecast, by Organization Size, 2021-2028

7.2.7.3.Market size and forecast, by Providers, 2021-2028

7.2.7.4.Comparative market share analysis, 2021 & 2028

7.2.8.France

7.2.8.1.Market size and forecast, by Type, 2021-2028

7.2.8.2.Market size and forecast, by Organization Size, 2021-2028

7.2.8.3.Market size and forecast, by Providers, 2021-2028

7.2.8.4.Comparative market share analysis, 2021 & 2028

7.2.9.Spain

7.2.9.1.Market size and forecast, by Type, 2021-2028

7.2.9.2.Market size and forecast, by Organization Size, 2021-2028

7.2.9.3.Market size and forecast, by Providers, 2021-2028

7.2.9.4.Comparative market share analysis, 2021 & 2028

7.2.10.Italy

7.2.10.1.Market size and forecast, by Type, 2021-2028

7.2.10.2.Market size and forecast, by Organization Size, 2021-2028

7.2.10.3.Market size and forecast, by Providers, 2021-2028

7.2.10.4.Comparative market share analysis, 2021 & 2028

7.2.11.Rest of Europe

7.2.11.1.Market size and forecast, by Type, 2021-2028

7.2.11.2.Market size and forecast, by Organization Size, 2021-2028

7.2.11.3.Market size and forecast, by Providers, 2021-2028

7.2.11.4.Comparative market share analysis, 2021 & 2028

7.3.Asia Pacific

7.3.1.Market size and forecast, by Type, 2021-2028

7.3.2.Market size and forecast, by Organization Size, 2021-2028

7.3.3.Market size and forecast, by Providers, 2021-2028

7.3.4.Market size and forecast, by country, 2021-2028

7.3.5.Comparative market share analysis, 2021 & 2028

7.3.6.India

7.3.6.1.Market size and forecast, by Type, 2021-2028

7.3.6.2.Market size and forecast, by Organization Size, 2021-2028

7.3.6.3.Market size and forecast, by Providers, 2021-2028

7.3.6.4.Comparative market share analysis, 2021 & 2028

7.3.7.China

7.3.7.1.Market size and forecast, by Type, 2021-2028

7.3.7.2.Market size and forecast, by Organization Size, 2021-2028

7.3.7.3.Market size and forecast, by Providers, 2021-2028

7.3.7.4.Comparative market share analysis, 2021 & 2028

7.3.8.Japan

7.3.8.1.Market size and forecast, by Type, 2021-2028

7.3.8.2.Market size and forecast, by Organization Size, 2021-2028

7.3.8.3.Market size and forecast, by Providers, 2021-2028

7.3.8.4.Comparative market share analysis, 2021 & 2028

7.3.9.South Korea

7.3.9.1.Market size and forecast, by Type, 2021-2028

7.3.9.2.Market size and forecast, by Organization Size, 2021-2028

7.3.9.3.Market size and forecast, by Providers, 2021-2028

7.3.9.4.Comparative market share analysis, 2021 & 2028

7.3.10.Australia

7.3.10.1.Market size and forecast, by Type, 2021-2028

7.3.10.2.Market size and forecast, by Organization Size, 2021-2028

7.3.10.3.Market size and forecast, by Providers, 2021-2028

7.3.10.4.Comparative market share analysis, 2021 & 2028

7.3.11.Rest of Asia-Pacific

7.3.11.1.Market size and forecast, by Type, 2021-2028

7.3.11.2.Market size and forecast, by Organization Size, 2021-2028

7.3.11.3.Market size and forecast, by Providers, 2021-2028

7.3.11.4.Comparative market share analysis, 2021 & 2028

7.4.LAMEA

7.4.1.Market size and forecast, by Type, 2021-2028

7.4.2.Market size and forecast, by Organization Size, 2021-2028

7.4.3.Market size and forecast, by Providers, 2021-2028

7.4.4.Market size and forecast, by country, 2021-2028

7.4.5.Comparative market share analysis, 2021 & 2028

7.4.6.Brazil

7.4.6.1.Market size and forecast, by Type, 2021-2028

7.4.6.2.Market size and forecast, by Organization Size, 2021-2028

7.4.6.3.Market size and forecast, by Providers, 2021-2028

7.4.6.4.Comparative market share analysis, 2021 & 2028

7.4.7.Saudi Arabia

7.4.7.1.Market size and forecast, by Type, 2021-2028

7.4.7.2.Market size and forecast, by Organization Size, 2021-2028

7.4.7.3.Market size and forecast, by Providers, 2021-2028

7.4.7.4.Comparative market share analysis, 2021 & 2028

7.4.8.South Africa

7.4.8.1.Market size and forecast, by Type, 2021-2028

7.4.8.2.Market size and forecast, by Organization Size, 2021-2028

7.4.8.3.Market size and forecast, by Providers, 2021-2028

7.4.8.4.Comparative market share analysis, 2021 & 2028

7.4.9.Rest of LAMEA

7.4.9.1.Market size and forecast, by Type, 2021-2028

7.4.9.2.Market size and forecast, by Organization Size, 2021-2028

7.4.9.3.Market size and forecast, by Providers, 2021-2028

7.4.9.4.Comparative market share analysis, 2021 & 2028

8.Company profiles

8.1.American Express Company

8.1.1.Business overview

8.1.2.Financial performance

8.1.3.Product portfolio

8.1.4.Recent strategic moves & developments

8.1.5.SWOT analysis

8.2.Credit Suisse Group AG

8.2.1.Business overview

8.2.2.Financial performance

8.2.3.Product portfolio

8.2.4.Recent strategic moves & developments

8.2.5.SWOT analysis

8.3.Fundation Group LLC

8.3.1.Business overview

8.3.2.Financial performance

8.3.3.Product portfolio

8.3.4.Recent strategic moves & developments

8.3.5.SWOT analysis

8.4.Fundbox

8.4.1.Business overview

8.4.2.Financial performance

8.4.3.Product portfolio

8.4.4.Recent strategic moves & developments

8.4.5.SWOT analysis

8.5.Funding Circle

8.5.1.Business overview

8.5.2.Financial performance

8.5.3.Product portfolio

8.5.4.Recent strategic moves & developments

8.5.5.SWOT analysis

8.6.GOLDMAN SACHS

8.6.1.Business overview

8.6.2.Financial performance

8.6.3.Product portfolio

8.6.4.Recent strategic moves & developments

8.6.5.SWOT analysis

8.7.Kabbage Funding

8.7.1.Business overview

8.7.2.Financial performance

8.7.3.Product portfolio

8.7.4.Recent strategic moves & developments

8.7.5.SWOT analysis

8.8.LoanBuilder

8.8.1.Business overview

8.8.2.Financial performance

8.8.3.Product portfolio

8.8.4.Recent strategic moves & developments

8.8.5.SWOT analysis

8.9.Merchant Capital

8.9.1.Business overview

8.9.2.Financial performance

8.9.3.Product portfolio

8.9.4.Recent strategic moves & developments

8.9.5.SWOT analysis

8.10.OnDeck

8.10.1.Business overview

8.10.2.Financial performance

8.10.3.Product portfolio

8.10.4.Recent strategic moves & developments

8.10.5.SWOT analysis

A commercial loan is a type of short-term or long-term financial instrument that business owners avail of to address their capital needs. The repayment span of these loans ranges from 15 to 30 years in commercial lending. The sanctioned loan amount can be used by organizations to increase the working capital, meet operational costs, build new infrastructure, acquire new machinery, and other such expenditures. Commercial lending majorly helps enterprises that have just started the business and further want to add or expand any of the above mentioned resource. The demand for commercial loans is increasing rapidly as online lenders have started to implement technologies such as blockchain, machine learning, and artificial intelligence to improve the customer experience, which is driving the commercial lending market growth.

COVID-19 Impact on Commercial Lending Market

The outbreak of COVID-19 across the globe has favorably impacted the global commercial lending market growth. The positive growth of the market is majorly owing to the increase in industrial and commercial loans due to many enterprises going out of business during the pandemic period. Besides, the engagement of small & medium-sized enterprises (SMEs) in commercial lending had a crucial role in this increasing development. Moreover, banks reported being stunned due to the surge in commercial loans in the trying times, which occurred when businesses required additional financing. All these factors have significantly impacted the growth of the commercial lending industry in the COVID-19 crisis.

Commercial lending Market Trends and Developments

The companies operating in the global industry are adopting several growth strategies and business tactics such as partnerships, collaboration, business vs expansion, and product launches to obtain a leading position in the global industry, which is predicted to drive the global commercial lending market growth in the upcoming years.

For instance, in November 2021, Fundbox, a San Franciso-based financial services platform that offers loans & financial products to small businesses, raised $100 million in a Series D funding round at a valuation of $1.1 billion. The aim of the company is to solve SMBs’ working capital needs through its payments and credit offerings.

In December 2021, Kabbage, an online financial technology company, announced the launch of ‘Kabbage Funding’ to offer eligible small & medium-sized businesses flexible lines of credit from $1,000 and $150,000 with the strong backing of American Express. Kabbage Funding helps small businesses to apply for loans in minutes to access working capital 24/7 and help manage cash flow of their company.

In February 2022, Funding Circle, the largest online small business loans provider and a commercial lender, entered into a partnership with Chaser, the credit control and accounts receivable software company, to help their customers to easily apply for a loan from the peer-to-peer lending platform. The aim of Funding Circle and Chaser behind the partnership is to help small & mid-sized businesses around the world to improve their cash flow.

Forecast Analysis of Global Market

The global commercial lending market is projected to witness an exponential growth over the forecast period, owing to the continuous technological innovations in the commercial lending sector and the astonishing growth in the internet lending industry. Conversely, the non-performance of organizations and the stringent qualifying criteria for commercial lending are expected to hamper the market growth in the projected timeframe.

The lowest interest rates associated with commercial lending which allow business owners to access crucial funding and the increasing growth in the number of startups around the world are the significant factors and commercial lending market trends estimated to bolster the growth of the global market in the coming future. According to a latest report published by Research Dive, the global commercial lending market is expected to garner $27,406.6 billion during the forecast period (2021-2028). Regionally, the Asia-Pacific market is estimated to grow at the fastest rate by 2028, owing to the increase in the number of small and medium industries and technological advancements taking place in the region.

The key players functioning in the global market include Merchant Capital, Fundbox, American Express Company, Credit Suisse, Goldman Sachs, Funding Circle, Kabbage, LoanBuilder, Fundation Group LLC, and OnDeck.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com