Non-animal Alternative Testing Market Report

RA08549

Non-animal Alternative Testing Market by Technology (Cell Culture Technology, High Throughput Technology, Molecular Imaging, and Omic Technology), Method (Cellular Assay, Biochemical Assay, In Silico, and Ex-vivo), End-user (Pharmaceutical Industry, Cosmetics & Household Products, Diagnostics, Chemical Industry, and Food Industry), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021-2030

Global Non-animal Alternative Testing Market Analysis

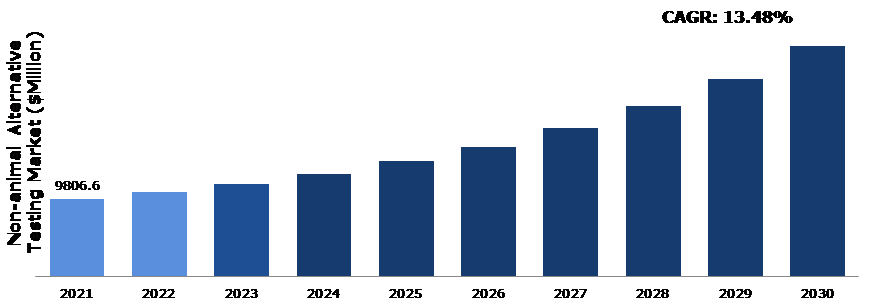

The global non-animal alternative testing market share was $9,806.6 million in 2021 and is predicted to grow with a CAGR of 13.48%, by generating a revenue of $29,390.3 million by 2030.

Global Non-animal Alternative Testing Market Synopsis

Elevated risk of chronic diseases among millennial, especially older population is estimated to increase the non-animal alternative testing market share in the predicted time. Pre-clinical studies give data regarding the safety and efficacy of possible medicine before testing the drug on humans, these studies need adequate preclinical models to compare it with the actual population to achieve acceptable findings. Researchers are obtaining information on possible medication toxicity and dosage by performing tests on animals. These tests on animals are opposed by the animal activist which increases non-animal alternative testing market demand.

Lack of understanding about the technology used as an alternative for animal testing among many researchers is anticipated to hinder the non-animal alternative testing market expansion in the projected timeframe.

The cosmetic industry has enormous presence, establishing a non-animal alternative testing technique would facilitate the experimenting of product as virtual approach will be applied. Moreover, as no animals would be involved, no animal activists will protest against the cosmetic products, which will save time and enhance the demand for the products.

Non-animal Alternative Testing Overview

Non-animal alternative testing is an approach for substituting animals that are used in experimentation such as clinical studies for drug development with algorithms and computational programs to avoid animal cruelty and maintain ethical practices along with attaining maximum accuracy of the experiments such as finding potential drug molecule.

COVID-19 Impact on Non-animal Alternative Testing Market

In the recent pandemic, the pharmaceutical market has witnessed growth due to increase in the demand for medicine as pandemic made people aware about the importance of being healthy and having strong immunity. Many drug developers abstained from working in direct contact with animal and human during pre-clinical trials amid pandemic which aided growth of the non-animal alternative testing market during the COVID-19 pandemic. The need for development of vaccine at such a rapid rate promoted alternative methods of testing drugs rather than testing on animals. However, during the pandemic, supply chain halted to an extent that the availability of even basic necessity such as food was difficult. Technology such as ‘in silico’ does not require much or any physical contact, so testing vaccines and other drugs on a computer-based simulation was more feasible than using animals.

Increasing Cases of Chronis Diseases to Boost the Market Growth

Pre-clinical studies provide data about the safety and efficacy of potential drug before testing the drug on humans, these studies need proper preclinical models to compare it with the actual population to get appropriate results. Researchers are gaining insights on potential drug toxicity and dosing by conducting studies on animals. Therefore, due to increase in the need for drug discovery & drug development, the need for animal model is increasing. Organizations such as PETA and Cruelty-Free International pressurize the end-use industry to shift from animal models to alternative methods where no animal is involved, tortured, and used in any way that harms the animal as well the sentiments of people. Using animals in researches of cosmetics, food, chemicals, and others is strongly protested by animal rights organizations. Increasing media campaigns to stop animal cruelty is expected to drive the market growth. These organizations are operating with government agencies and end-use industries to provide funding for development of alternative technologies for testing drugs for example, incorporating Artificial Intelligence (AI). New legislations are being created in various countries which are expected to drive growth of the non-animal alternative testing market.

Lack of Awareness about the Use of Non-animal Alternative Testing among Researchers to Restrain the Market Growth

Non-animal alternative testing is a new and rising technology and not many scientists are aware regarding its appropriate functioning and utilization. The cost of adopting non-animal alternative testing method is high. Thus, this issue is projected to hinder the non-animal alternative testing market share in the forecast period.

Development of Product Portfolio by Major Companies to Fuel the Market Growth

Developing strategies regarding the market penetration and acquiring more market share by collaborating with end-users to understand the market requirements by focusing on research and development operations are expected to drive the market growth. The cosmetic industry has a huge presence, developing a non-animal alternative testing method will ease the experimentation of product as virtual method will be used. Moreover, as no animals will be involved, no animal activists will protest against the products, which will save time and increase the demand for the products. Technological advancements such as CADD, in silico drug design, and digital twin technology will aid the adoption of non-animal alternative testing. These technologies are used to create a digital simulation which is the exact replica of the object under observation and produce results of the impact of external environment on the object (cells, drugs, and organs).

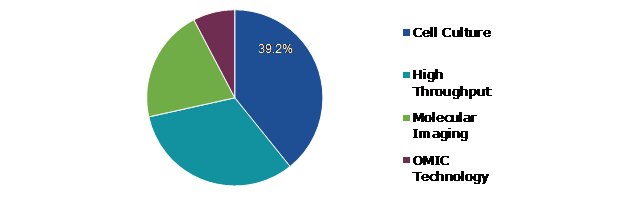

Global Non-animal Alternative Testing Market Share, by Technology

Based on technology, the market has been divided into cell culture technology, high throughput technology, molecular imaging, and omic technology. Among these, the cell culture technology sub-segment accounted for the highest market share in 2021, whereas the omic technology sub-segment is estimated to show the fastest growth during the forecast period.

Global Non-animal Alternative Testing Market Size, by Technology, 2021

Source: Research Dive Analysis

The cell culture technology sub-segment is anticipated to have a dominant market share and generate a revenue of $11,025 million by 2030, growing from $3,845.5 million in 2021. The sub-segment growth is because researchers frequently use cell culture technologies to assess lot of test findings at once. With this approach, numerous pharmacological tests are carried out on eukaryotic cells, preferably human cells that have been cultivated under carefully controlled in vitro conditions to replicate the environment of the human body. Such factors are likely to drive the non-animal alternative testing market size in future.

The omic technology sub-segment is anticipated to show the fastest growth and shall generate a revenue of $2,714.6 million by 2030, increasing from $753.9 million in 2021. The sub-segment growth is due to the fact that omic technology provides a thorough examination of medication interactions with human cells, which also aids in understanding the genetics of diseased cells. With this information, scientists can create drugs that are simple to target the affected cell's defective gene. Such factors are anticipated to generate huge revenues for the non-animal alternative testing market share.

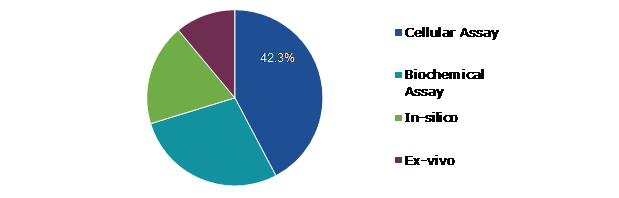

Global Non-animal Alternative Testing Market Trends, by Method

The global non-animal alternative market by method is segmented into cellular assay, biochemical assay, in silico, and ex-vivo. The cellular assay sub-segment is projected to generate maximum revenue and the ex-vivo sub-segment to generate fastest growth.

Global Non-animal Alternative Testing Market Value, by Method, 2021

Source: Research Dive Analysis

Source: Research Dive AnalysisThe cellular assay sub-segment is anticipated to have a dominant market share and generate a revenue of $12,004.7 million by 2030, growing from $4,145.7 million in 2021. The sub-segment is projected to show a significant rise in demand for researching and examining a significant volume of human cellular data during pre-clinical studies will cause this market to grow significantly in the future.

The ex-vivo sub segment is anticipated to show the fastest growth and shall generate a revenue of $3,613.9 million by 2030, increasing from $1,084.2 million in 2021. Increase in the revenue of the sub-segment is due to cosmetic companies conducting sensitivity tests on the cosmetic items in response to the rapidly expanding demand for artificial organs in the cosmetics business. In order to simulate the human environment and serve as a model for product testing, numerous human organs are created in vitro. By doing so, the cosmetics business may minimize the usage of animal models and avoid any moral dilemmas. Such factors are likely to boost the non-animal alternative testing market value in future.

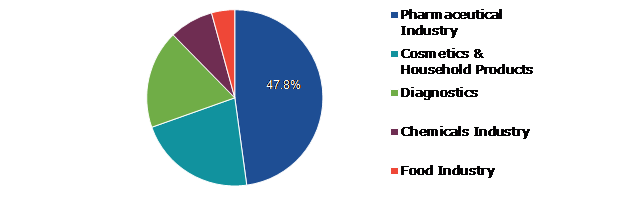

Global Non-animal Alternative Testing Market Growth, by End-user Industry

Based on end-use industry, the market has been divided into pharmaceutical industry, cosmetics & household products, diagnostics, chemical industry, and food industry. The pharmaceutical industry sub-segment is projected to generate maximum revenue and the chemical industry is expected to register the fastest growth.

Global Non-animal Alternative Testing Market Size, by End-user Industry, 2021

Source: Research Dive Analysis

The pharmaceutical industry sub-segment is anticipated to have a dominant market share and generate a revenue of $13,621.5 million by 2030, growing from $4,691.4 million in 2021.The sub-segment growth is due to the pharmaceutical industry expanding its research and development efforts to create new medications for a variety of ailments. Further encouraging firms to employ in silico drug testing techniques to avoid any form of ethics issue is rising opposition to using animals for drug testing. Therefore non animal alternative market is expected to witness exponential growth in future.

The chemical industry sub-segment is anticipated to show the fastest growth and shall generate a revenue of $2,670.8 million by 2030, increasing from $792.6 million in 2021.The sub-segment growth is attributed to increasing usage of various chemicals in the production of goods for human consumption. Prior to being suitable for human use, chemicals must first undergo sensitivity and effectiveness testing. Such factors are anticipated to increase the market revenue in the stipulated time.

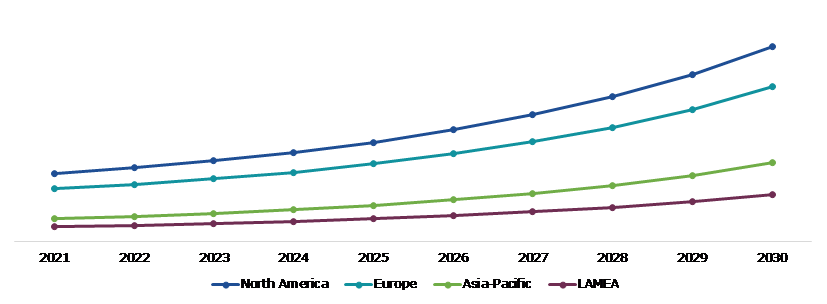

Global Non-animal Alternative Testing Market Forecast, by Region

The non-animal alternative testing market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Non-animal Alternative Testing Market Size & Forecast, by Region, 2021-2030 (USD Million)

Source: Research Dive Analysis

The Market for Non-animal Alternative Testing in North America to be the Most Dominant

The North America non-animal alternative market accounted $4,216.8 million in 2021 and is projected to grow with a CAGR of 12.85%. Major non-animal alternative testing companies such as Abbott Laboratories are present in the area, which is thought to be a contributing factor to the expansion. The market for non-animal alternative testing is also anticipated to develop in the coming years due to the ageing population and the prevalence of chronic diseases among them.

The Market for Non-animal Alternative Testing in Asia-Pacific to Witness Fastest Growth

The Asia-Pacific non-animal alternative testing market is expected to witness fastest growth and register a revenue of $4,878.8 million in 2030 the predicted time. Due to rising moral concerns about animal suffering, the region is subject to a developing ban on using animals in pre-clinical testing. In addition, leading market participants are increasingly investing in the introduction of new products in the region in order to support the development of research facilities and activities there. In the coming years, these factors are projected to fuel the market expansion for non-animal alternative testing.

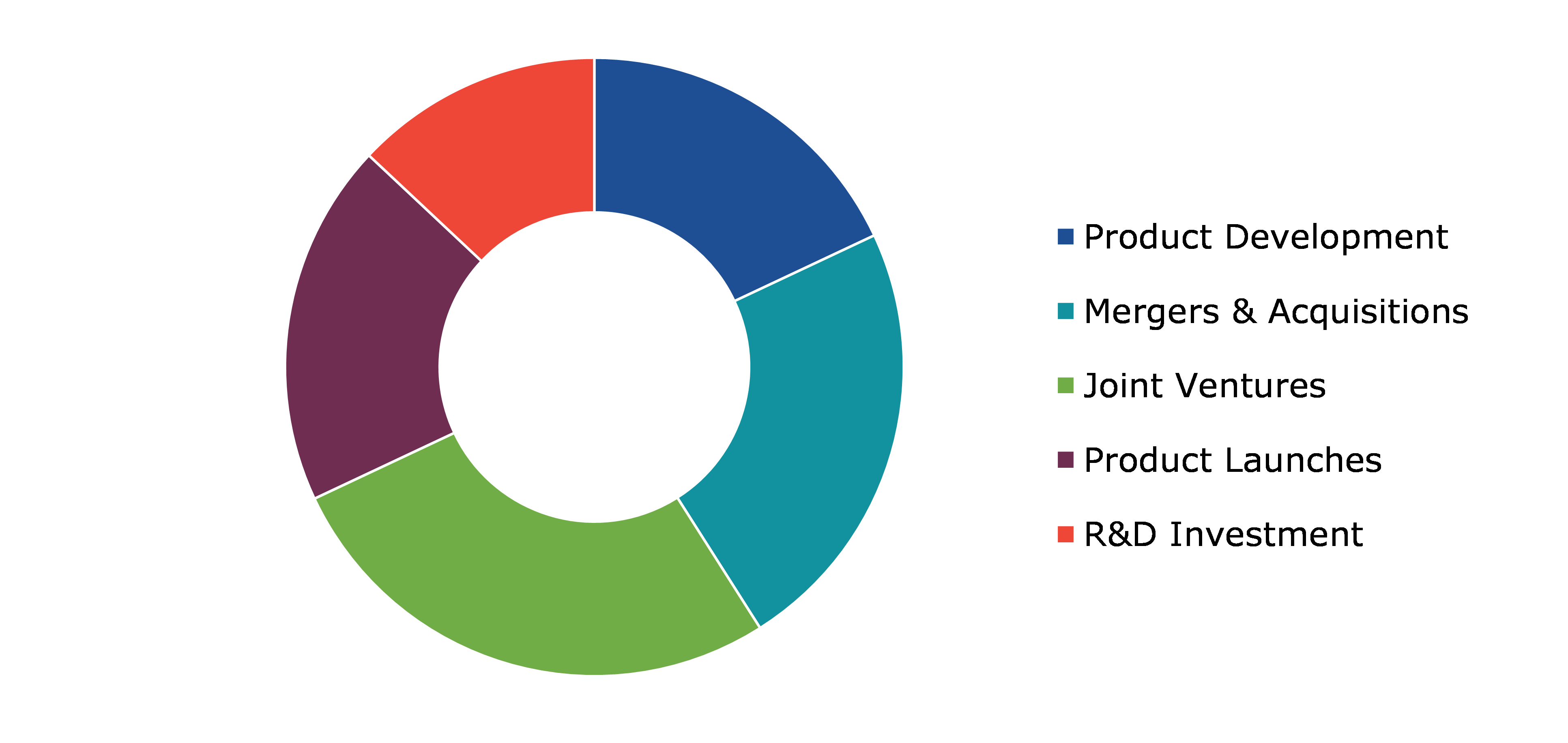

Competitive Scenario in the Global Non-animal Alternative Testing Market

Product launches and acquisitions are common strategies followed by major market players. For instance, on July 05, 2022, Evotec SE announced that the strategic transaction to acquire Rigenerand Srl, signed in May 2022, has been completed. Based out of Medolla, Italy, the cell technology company with leading edge in the field of cGMP manufacturing of cell therapies.

Source: Research Dive Analysis

Some of the major companies involved in the non-animal alternative testing market are VITROCELL Systems GmbH, Evotec SE, Biovit, MB Research Laboratories, Emulate, Inc., TARA Biosystems, Inc., Bio-Rad Laboratories, Inc., Abbott, Hurel Corporation, and TissUse GmbH.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Technology |

|

| Segmentation by Method |

|

| Segmentation by End-user |

|

| Key Companies Profiled |

|

Q1. What is non-animal alternative testing examples?

A. Non-animal alternative testing examples are cell culture technology and in silico drug design.

Q2. What does non-animal alternative testing do?

A. Non-animal alternative testing helps in replacing animals test models with computer software during pre-clinical trials of any new product.

Q3. What is the size of non-animal alternative testing market?

A. The global non-animal alternative testing market was valued at $9,080.1 million in 2020, and is projected to reach $29,390.2 million by 2030, registering a CAGR of 13.0%.

Q4. What will be the growth rate of the Asia-Pacific non-animal alternative testing market?

A. Asia-Pacific non-animal alternative testing market is anticipated to grow at 15.27% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Evotec, Biovit, Abbott Laboratories, Hurel Corporation, and Tissues GmbH are the companies investing more on R&D practices.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Non-Animal Alternative Testing Market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Non-Animal Alternative Testing Market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Non-Animal Alternative Testing Market Analysis, by Technology

5.1.Overview

5.2.Cell Culture Technology

5.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.2.2.Market size analysis, by region, 2021-2030

5.2.3.Market share analysis, by country, 2021-2030

5.3.High Throughput Technology

5.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.3.2.Market size analysis, by region, 2021-2030

5.3.3.Market share analysis, by country, 2021-2030

5.4.Molecular Imaging

5.4.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.4.2.Market size analysis, by region, 2021-2030

5.4.3.Market share analysis, by country, 2021-2030

5.5.Omic Technology

5.5.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.5.2.Market size analysis, by region, 2021-2030

5.5.3.Market share analysis, by country, 2021-2030

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness, 2021-2030

5.6.2.Competition heatmap, 2021-2030

6.Non-Animal Alternative Testing Market Analysis, by Method

6.1.Cellular Assay

6.1.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.1.2.Market size analysis, by region, 2021-2030

6.1.3.Market share analysis, by country, 2021-2030

6.2.Biochemical Assay

6.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.2.2.Market size analysis, by region, 2021-2030

6.2.3.Market share analysis, by country, 2021-2030

6.3.In Silico

6.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.3.2.Market size analysis, by region, 2021-2030

6.3.3.Market share analysis, by country, 2021-2030

6.4.Ex-vivo

6.4.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.4.2.Market size analysis, by region, 2021-2030

6.4.3.Market share analysis, by country, 2021-2030

6.5.Research Dive Exclusive Insights

6.5.1.Market attractiveness, 2021-2030

6.5.2.Competition heatmap, 2021-2030

7.Non-Animal Alternative Testing Market Analysis, by End-user

7.1.Pharmaceutical Industry

7.1.1.Definition, key trends, growth factors, and opportunities, 2021-2030

7.1.2.Market size analysis, by region, 2021-2030

7.1.3.Market share analysis, by country, 2021-2030

7.2.Cosmetics & Household Products

7.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

7.2.2.Market size analysis, by region, 2021-2030

7.2.3.Market share analysis, by country, 2021-2030

7.3.Diagnostics

7.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

7.3.2.Market size analysis, by region, 2021-2030

7.3.3.Market share analysis, by country, 2021-2030

7.4.Chemical Industry

7.4.1.Definition, key trends, growth factors, and opportunities, 2021-2030

7.4.2.Market size analysis, by region, 2021-2030

7.4.3.Market share analysis, by country, 2021-2030

7.5.Food Industry

7.5.1.Definition, key trends, growth factors, and opportunities, 2021-2030

7.5.2.Market size analysis, by region, 2021-2030

7.5.3.Market share analysis, by country, 2021-2030

7.6.Research Dive Exclusive Insights

7.6.1.Market attractiveness, 2021-2030

7.6.2.Competition heatmap, 2021-2030

8.Non-Animal Alternative Testing Market Analysis, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Technology, 2021-2030

8.1.1.2.Market size analysis, by Method, 2021-2030

8.1.1.3.Market size analysis, by End-user, 2021-2030

8.1.2.Canada

8.1.2.1.Market size analysis, by Technology, 2021-2030

8.1.2.2.Market size analysis, by Method, 2021-2030

8.1.2.3.Market size analysis, by End-user, 2021-2030

8.1.3.Mexico

8.1.3.1.Market size analysis, by Technology, 2021-2030

8.1.3.2.Market size analysis, by Method, 2021-2030

8.1.3.3.Market size analysis, by End-user, 2021-2030

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness, 2021-2030

8.1.4.2.Competition heatmap, 2021-2030

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Technology, 2021-2030

8.2.1.2.Market size analysis, by Method, 2021-2030

8.2.1.3.Market size analysis, by End-user, 2021-2030

8.2.2.U.K.

8.2.2.1.Market size analysis, by Technology, 2021-2030

8.2.2.2.Market size analysis, by Method, 2021-2030

8.2.2.3.Market size analysis, by End-user, 2021-2030

8.2.3.France

8.2.3.1.Market size analysis, by Technology, 2021-2030

8.2.3.2.Market size analysis, by Method, 2021-2030

8.2.3.3.Market size analysis, by End-user, 2021-2030

8.2.4.Spain

8.2.4.1.Market size analysis, by Technology, 2021-2030

8.2.4.2.Market size analysis, by Method, 2021-2030

8.2.4.3.Market size analysis, by End-user, 2021-2030

8.2.5.Italy

8.2.5.1.Market size analysis, by Technology, 2021-2030

8.2.5.2.Market size analysis, by Method, 2021-2030

8.2.5.3.Market size analysis, by End-user, 2021-2030

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Technology, 2021-2030

8.2.6.2.Market size analysis, by Method, 2021-2030

8.2.6.3.Market size analysis, by End-user, 2021-2030

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness, 2021-2030

8.2.7.2.Competition heatmap, 2021-2030

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Technology, 2021-2030

8.3.1.2.Market size analysis, by Method, 2021-2030

8.3.1.3.Market size analysis, by End-user, 2021-2030

8.3.2.Japan

8.3.2.1.Market size analysis, by Technology, 2021-2030

8.3.2.2.Market size analysis, by Method, 2021-2030

8.3.2.3.Market size analysis, by End-user, 2021-2030

8.3.3.India

8.3.3.1.Market size analysis, by Technology, 2021-2030

8.3.3.2.Market size analysis, by Method, 2021-2030

8.3.3.3.Market size analysis, by End-user, 2021-2030

8.3.4.Australia

8.3.4.1.Market size analysis, by Technology, 2021-2030

8.3.4.2.Market size analysis, by Method, 2021-2030

8.3.4.3.Market size analysis, by End-user, 2021-2030

8.3.5.South Korea

8.3.5.1.Market size analysis, by Technology, 2021-2030

8.3.5.2.Market size analysis, by Method, 2021-2030

8.3.5.3.Market size analysis, by End-user, 2021-2030

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Technology, 2021-2030

8.3.6.2.Market size analysis, by Method, 2021-2030

8.3.6.3.Market size analysis, by End-user, 2021-2030

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness, 2021-2030

8.3.7.2.Competition heatmap, 2021-2030

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Technology, 2021-2030

8.4.1.2.Market size analysis, by Method, 2021-2030

8.4.1.3.Market size analysis, by End-user, 2021-2030

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Technology, 2021-2030

8.4.2.2.Market size analysis, by Method, 2021-2030

8.4.2.3.Market size analysis, by End-user, 2021-2030

8.4.3.UAE

8.4.3.1.Market size analysis, by Technology, 2021-2030

8.4.3.2.Market size analysis, by Method, 2021-2030

8.4.3.3.Market size analysis, by End-user, 2021-2030

8.4.4.South Africa

8.4.4.1.Market size analysis, by Technology, 2021-2030

8.4.4.2.Market size analysis, by Method, 2021-2030

8.4.4.3.Market size analysis, by End-user, 2021-2030

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Technology, 2021-2030

8.4.5.2.Market size analysis, by Method, 2021-2030

8.4.5.3.Market size analysis, by End-user, 2021-2030

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness, 2021-2030

8.4.6.2.Competition heatmap, 2021-2030

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1. Vitrocell Systems GMBH

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Evotec

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3. Biovit

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4. MB Research Laboratory

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5. Emulate, Inc.

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6. Tara Biosystems

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Bio- Rad

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8. Abbott Laboratories

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Hurel Corporation

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Tissues GmbH

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

Non-animal alternative testing are modern techniques which are extensively used in scientific research purposes including applications like that of drug development, chemical testing, cosmetic product testing, and others. Computer programs these days are equipped with advanced systems on the basis of immense chemical databases that can predict the toxicity of a chemical, which consequently reduces or eliminates the need for animal testing. Various technologies involved in non-animal alternative testing include high throughput technology, cell culture technology, omic technology, and others.

Forecast Analysis of the Global Non-Animal Alternative Testing Market

Growing cases of chronic diseases along with the adoption of unhealthy eating habits among people across the globe are expected to drive the growth of the market during the forecast period, 2021-2030. In addition, increasing ethical issues linked with the use of animals for product testing is further expected to bolster the growth of the non-animal alternative testing. Moreover, persistent enhancements in existing and new non-animal alternative testing products are expected to create ample opportunities for the growth of the market. However, lack of awareness about non-animal alternative testing is expected to impede the growth of the market in the upcoming years.

According to the report published by Research Dive, the global non-animal alternative testing market is expected to garner a revenue of $29,390.20 million by 2030, growing rapidly at a CAGR of 13.0% during the forecast period 2021-2030. The major players of the market include VITROCELL Systems GmbH, Biovit, Evotec SE, MB Research Laboratories, TARA Biosystems, Inc., Emulate, Inc., Bio-Rad Laboratories, Inc., Hurel Corporation, Abbott, TissUse GmbH, and many more.

Key Trends & Developments of the Non-animal Alternative Testing Market

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global non-animal alternative testing market to grow exponentially. For instance,

- In March 2021, CELLINK, a Swedish 3D bioprinter manufacturer, acquired MatTek Corporation, a US-based life science technologies company and a dominant leader in non-animal alternative drug testing model, in order to accelerate CELLINK’s existing product workflow and advance its research into animal cruelty-free cellular testing models.

- In August 2021, the U.S. Environmental Protection Agency (EPA), an independent executive agency of the United States federal government tasked with environmental protection matters, collaborated with Unilever, a British multinational consumer goods company, in order to inspect constructive ways to evaluate chemical risks associated with consumer products so as to reduce the dependence on the use of animals.

- In October 2021, SenzaGen AB, a Sweden-based biotechnology company specializing in immunology, technology and genomics, acquired VitroScreen, an Italy-based innovative contract research company, in order to accelerate SenZagen’s growth strategy and maximize its presence in the global non-animal alternative testing market.

COVID-19 Impact on the Market

The outbreak of coronavirus has had a positive impact on the growth of the global non-animal alternative testing market, owing to the prevalence of lockdowns in various countries across the globe. During lockdown researchers avoided working in a wet laboratories, in order to restrict themselves from making any contact with humans or animals during pre-clinical testing of the drugs for maximum safety, accuracy, and efficiency. Hence, the demand for non-animal alternative testing techniques like microarrays, exponentially increased due to its requirement of minimal human contact.

Most Profitable Region of the Market

The North America region is expected to dominate the global non-animal alternative testing market, and grow at a CAGR of 12.85% during the forecast period. Prevalence of chronic diseases and rising chronic cases in this region is expected to drive the growth of the market. In addition, huge presence of non-animal alternative testing companies in the region is further expected to stimulate the growth of the regional non-animal alternative testing market during the forecast period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com