Global 3D Metrology Market Report

RA08544

Global 3D Metrology Market by Offering (Software, Hardware, and Services), Products (Coordinate Measuring Machine (CMM), Optical Digitizer & Scanner (ODS), Video Measuring Machine (VMM), and 3D Automated Optical Inspection (AOI) System), Application (Quality Control & Inspection, Reverse Engineering, Virtual Simulation, and Others), End-use (Aerospace, Automotive, Medical, Construction & Engineering, Heavy Machinery, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

3D Metrology Market Analysis

The global 3D metrology market is anticipated to garner $6,647.9 million in the 2021–2028 timeframe, growing from $ 3,711.1 million in 2020, at a healthy CAGR 7.8%.

Market Synopsis

The 3D metrology market is expected to grow due to product advancements, acquisitions, and business expansion by key market players and also the market positioning of companies in an industry using their growth and innovation scores as highlighted to increase the adoption of 3D Metrology for various applications.

The main impediment is high cost associated with the 3D metrology.

According to the regional analysis of the market, the Asia Pacific 3D metrology market is anticipated to grow at a CAGR of 9.4%, by generating a revenue of $1,716.5 million during the review period.

3D Metrology Overview

3D metrology is becoming an essential component of any quality control, optimization, and cost-effective process, particularly in manufacturing. The scientific study of physical measurements is known as 3D metrology. Precision measurement of tools, fixtures, and machine components is included in the context of manufacturing. It is used to measure length, distance, and height (three axes x, y, and z) by acquiring geometric surface points of an object, which provides infinitely more data than traditional measurement methods. These measurements are frequently obtained using a coordinate measuring machine (CMM). Moreover, the increasing global R&D spending on launching and developing new metrology products and solutions provides measurement companies with new business opportunities.

COVID-19 Impact on 3D Metrology Market

The ongoing COVID-19 has had a negative impact on the global 3D metrology market. This is because the majority of electronic device raw material manufacturers were dispersed throughout China. Furthermore, travel and cargo movement restrictions imposed by a number of countries have caused supply chain disruptions and fluctuations in raw material prices. Furthermore, the imposition of lockdown on manufacturing processes across major industries is expected to stymie global 3D metrology market growth. The COVID-19 pandemic has had a significant impact on the CMM value chain. The pandemic has had a negative impact on the United States, China, India, and Japan, which account for a sizable share of global CMM manufacturing. The energy and power industries, as well as the aerospace industry, are experiencing low demand, which is expected to continue in the short term due to the global slowdown.

3D Data Increasingly being Used in Modelling and Analytical Applications Projected to Drive the Market Growth

Rapid industrial development drives the need for advanced testing technologies and instruments to conduct R&D and manufacture a large number of complex mechanical parts used in precision machinery, numerical machine control tools, auto parts, aerospace equipment, and other applications. CMMs are precision instruments that are widely used to inspect and measure complex mechanical parts in three dimensions: length, width, and height. Aerospace and defense, automotive, heavy machinery, medical, electronics, and energy & power are just a few of the industries that use 3D modelling. These intelligent models constructed from 3D objects collect data points with metrology 3D scanners or CMMs, which are then used for modelling. The manage data measured by CMM, which is changed into measurement data such as position, diameter, distance, angle, is important in the manufacturing industry as this data directly impacts product quality and performance. Because of advancements in data-gathering sensor technology and improved measurement and inspection software solutions, 3D metrology has become a viable and cost-effective method. At the moment, 3D scanners are used in conjunction with CMMs. Dimensional metrology solutions such as 3D laser scanners, white-light scanners, and laser trackers are widely used for faster and higher-precision results. All of these technologies have made data collection easier and faster, resulting in precise product measurements. Small laser trackers can precisely measure large objects, which have applications in the automotive, aerospace, and heavy machinery industries.

To know more about global 3D metrology market drivers, get in touch with our analysts here.

The Design Complexity and High Cost Associated with the Manufacturing of the Metrology Products are Main Restraining Factors for The Market

Manufacturers are constantly faced with both design and cost challenges of 3D metrology products in order to meet the evolving needs of end-users. These are some factors that can hinder the growth of the market.

Rise In Demand from the End-use Industry for Solutions to Minimize the Inspection Delay in Production Process to Create Growth Opportunities

The aviation and automotive industries are experiencing robust growth, also the speedy industrialization and urbanization worldwide act as key driving forces for the 3D metrology market growth. There has been a growing acceptance of 3D testing and 3D metrology in the manufacturing industry to gain detailed information and run full-field evaluations market share. Nonetheless, increasing applications of 3D metrology in industrial activities such as assembly inspection, quality checks, and measurement of various tools, sheet metal parts, plastic, and castings would support market growth over the review period. For instance, Hexagon, a specializing in hardware and software digital reality solution, announced in February 2020, that its Manufacturing Intelligence division had launched a new product Captura, an entry-level optical CMM that offers intuitive and cost-effective solutions for the multisensor measurement of small to medium parts. The automotive industry's ongoing digital transformation, as well as the distribution of electric and hybrid electric vehicles, is hastening the retrofitting of devices and equipment embedded with various test and measurement equipment. Some of the major end-use applications that require advanced automated test and measuring equipment to meet modern testing requirements are data centers, advanced telecom infrastructure, and automotive. Because data centers use a variety of complex electronics devices, a large number of test and measurement equipment is used to monitor device condition, calibration service, and data transmission condition. The demand for the 3D metrology is increasing from different industries which is creating opportunities of the growth.

To know more about global 3D metrology market opportunities, get in touch with our analysts here.

Global 3D Metrology Market

By Offering

Based on offering, the market has been divided into software, Hardware, and services. Hardware sub-segment accounted for the highest revenue share in 2020, and software sub-segment is predicted to show the fastest growth during the forecast period. Download PDF Sample Report

Products: Research Dive Analysis

The hardware sub-segment is anticipated to have a dominant market share and generate a revenue of $2,582.0 million by 2028, growing from $1,478.6 million in 2020. Hardware services in a variety of industries, including aerospace, automotive, medical, and archaeological architecture, aid in the improvement of manufacturing processes. In addition, the use of hardware such as vision systems, CMMs, laser trackers, and structured-light scanners aids in the quality and measurement inspection process. These factors are expected to boost 3D metrology market growth.

The software sub-segment is anticipated to have the fastest growth and generate a revenue of $2,402.9 million by 2028, growing from $1,300.4 million in 2020, with the healthy CAGR of 8.2%. The growth can be attributed to features such as data accumulation and measurement across multiple sources. It also offers self-explanatory and comprehensive textual and graphical reports that can be used to evaluate real-time deviation and identify production trends. In addition, the use of CAD/CAM tools for design purposes necessitates the use of tooling, sheet metal, and production engineering. These factors are expected to drive global demand for 3D metrology software.

Global 3D Metrology Market

By ProductBased on products, the analysis has been divided into Coordinate Measuring Machine (CMM), optical digitizer & scanner (ODS), video measuring machine (VMM), and 3D automated optical inspection (AOI) system. Out of these, coordinate measuring machine sub-segment is predicted to be the most dominant and optical digitizer & scanner sub-segment is anticipated to show the fastest growth during the forecast period.

Products: Research Dive Analysis

The coordinate measuring machine (CMM) sub-segment of the global 3D metrology market is anticipated to have a dominant market share and surpass $2,495.7 million by 2028, with an increase from $1,467.0 million in 2020. CMMs are traditional metrology tools used for quality inspection in a variety of industry verticals. These types of product costs are very low in comparison to other metrology equipment. In this competitive market, end-users require advanced metrology services to reduce errors and improve product quality and lifecycle. As a result, dimensional measuring techniques are becoming more refined. Furthermore, end-user industries such as automotive and aerospace require stringent quality inspections and have incorporated dimensional metrology equipment as a key enabler for increased productivity.

The optical digitizer & scanner (ODS) sub-segment of the global 3D metrology market is anticipated to have the fastest growth and surpass $1,735.0 million by 2028, with an increase from $924.3 million in 2020, with highest CAGR of 8.4%. Non-contact metrology systems that use a scanning technique based on white light or a laser are known as optical scanners and digitizers. They use software to obtain an object's coordinate points and reconstruct them into an image. Inspection, reverse engineering, and dimensional measurements are the most common uses of optical scanners and digitizers. These devices have higher accuracy and reliability when measuring complex and difficult-to-reach features. The global optical digitizer & scanner market is being driven by advancements in probe technology, accuracy, integration methods, and software in the manufacturing of high-tech optical digitizers and scanners. Forensics, heritage restoration, law & investigation, medical, 3D printing, and 3D surveying are some of the emerging applications of the optical digitizer, and the market is benefiting from the growing application area of the optical digitizer.

Global 3D Metrology Market

By ApplicationBased on application, the analysis has been divided into quality control & inspection, reverse engineering, virtual simulation, and others. Among these, quality control & inspection sub-segment is predicted to be the most dominant sub-segment and virtual simulation sub-segment is anticipated to have the fastest growth during the forecast period.

Products: Research Dive Analysis

The quality control & inspection sub-segment of the global 3D metrology market is anticipated to have a dominant market share and surpass $2,565.9 million by 2028, with an increase from $1,477.2 million in 2020. The goal of quality control is to measure the dimensions of manufactured parts to ensure that they meet quality standards. It is a necessary but difficult task for manufacturers during the manufacturing process. When it comes to maintaining the quality of precision machinery parts, quality inspection is extremely important. Quality control is an essential step in the manufacturing process. Coordinate measurement machines (CMMs) have been used for decades in operations that require greater precision. The demand for the 3D metrology is increasing day by day across the globe due to the accuracy of a 3D scanners for small parts, and also some industries require greater precision such as aerospace. With this level of accuracy and repeatability, 3D scanning is viable in the majority of situations. Only a few examples include injection moulding, machined components, and metal or plastic extrusion.

The virtual simulation sub-segment of the global 3D metrology market is anticipated to have the fastest growth and surpass $1,363.1 million by 2028, with an increase from $705.3 million in 2020, with the CAGR 8.8%. The demand for the virtual simulation is increasing due to the use of the 3D virtual simulation in different fields such as in smart tech to compute the required sensor positions for all inspection characteristics and CAD surfaces. Additionally, it also helps in fast automated measurement and many others are application. Thus, the demand for the virtual simulation will grow in future as well.

Global 3D Metrology Market

By End UseBased on end-use, the analysis has been divided into aerospace, Automotive, medical, construction & engineering, heavy machinery, and others. Among these, Automotive sub-segment is predicted to be the most dominant sub-segment and medical sub-segment is anticipated to have the fastest growth during the forecast period.

Products: Research Dive Analysis

The automotive sub-segment of the global 3D metrology market is anticipated to have a dominant market share and surpass $2,146.3 million by 2028, with an increase from $1,253.1 million in 2020. Automotive companies are the key users of dimensional 3D metrology equipment due to the wide inspections required. Recent trends in manufacturing facility automation have increased the demand for dimensional metrology devices, mostly 3D measuring machines and optical digital scanners, because these systems offer a high degree of accuracy, flexibility, high-precision measurement, and size.

The medical sub-segment of the global 3D metrology market is anticipated to have the fastest growth and surpass $1,052.4 million by 2028, with an increase from $528.1 million in 2020, with the CAGR 9.2%. The use of 3D metrology technologies in the medical and dental fields has skyrocketed. This is due to the free-flowing, organic shapes that are nearly impossible to measure with standard measurement devices. Another growth driver is the broad range of applications, which includes product design, medical treatment, and scientific research. Over the years, several organizations have provided 3D models to doctors, design engineers, manufacturing engineers, researchers, and scientists.

Global 3D Metrology Market

By RegionThe 3D metrology market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Products: Research Dive Analysis

The Market for 3D Metrology in North America to be the Most Dominant

The North America 3D metrology market accounted $1,464.0 million in 2020 and is projected to register a revenue of $2,356.7 million by 2028. In terms of the value of the 3D metrology market, North America ranks first. The market is being driven by vast technological advances and automation in the region's manufacturing sectors. With a strong presence of pharmaceutical, automotive, and aerospace equipment manufacturers, the United States leads the region's 3D metrology market. Furthermore, faster automation of automotive manufacturing facilities generates significant market demand. Moreover, the high demand for the metrological technologies from the region's thriving manufacturing sector validates the 3D metrology market size.

The Market for 3D Metrology in Asia-Pacific will be the Fastest Growing in Forecast Period

The Asia-Pacific 3D metrology market accounted $846.9 million in 2020 and is projected to register a revenue of $1,716.5 million by 2028. The Asia-Pacific is expected to grow at a significant CAGR 9.4%, over the forecast period. The growing adoption of 3D metrology automobile and electronics manufacturers for various applications such as virtual simulation, reverse engineering, and quality control & inspection is attributed to the market share. The region serves as a distribution center for a variety of industrial products such as manufacturing equipment, food processing equipment, transportation equipment, and consumer goods. Furthermore, the region's 3D metrology market share is growing due to the growing use of 3D metrology in various power generation and industrial applications such as raw casting, forging inspection, mould & die design, and inspection of power generation components.

Competitive Scenario in the Global 3D Metrology Market

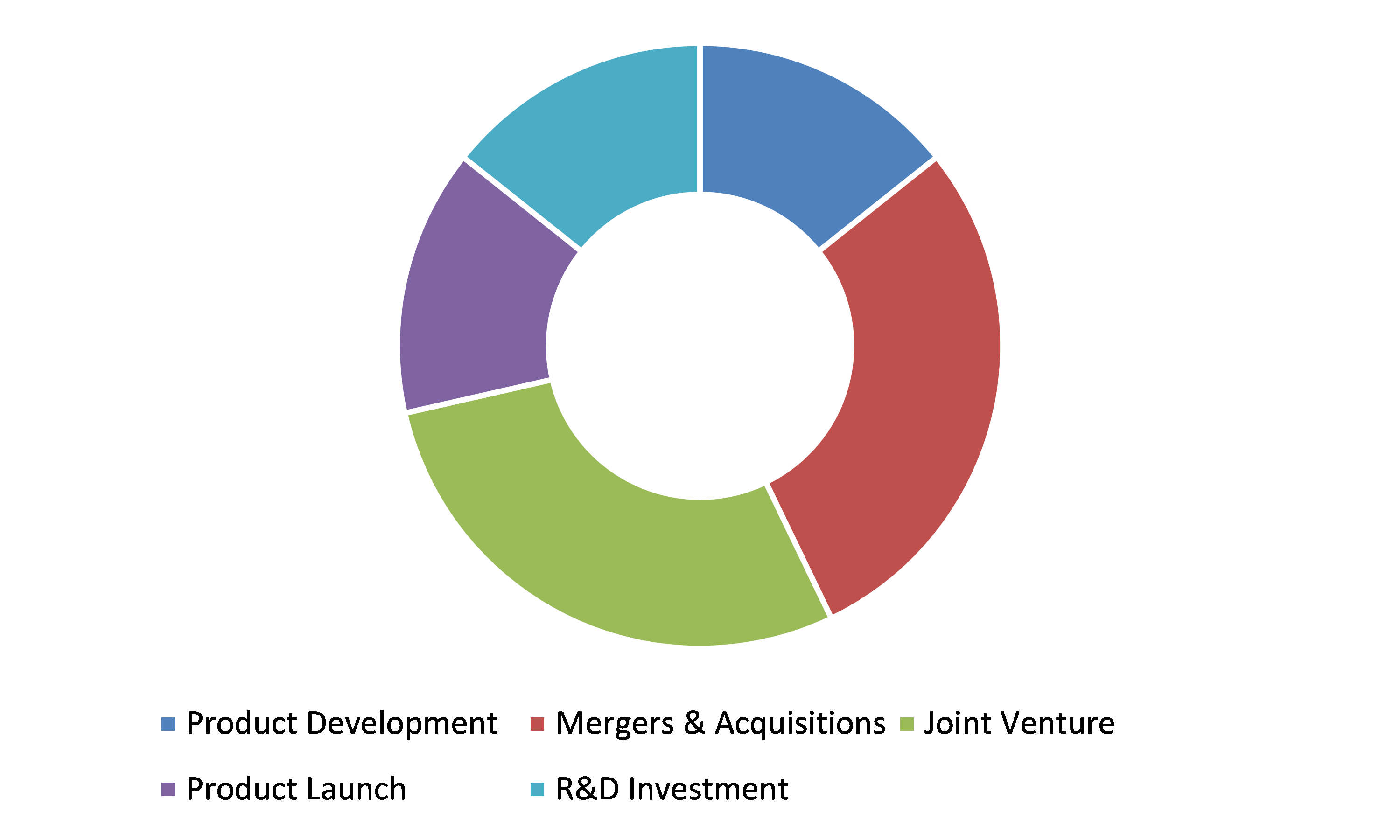

Product advancements, innovations, and business expansion are common strategies followed by major market players.

Products: Research Dive Analysis

Some of the leading 3D metrology market players are Hexagon, FARO Technologies, KEYENCE Corp., Jenoptik, Nikon Corp., Mitutoyo Corp., ZEISS Group, KLA Corp., Perceptron, Renishaw, and 3D Systems, Inc.

Porter’s Five Forces Analysis for the Global 3D Metrology Market:

- Bargaining Power of Suppliers: There is small number of suppliers in the 3D metrology market and the availability of raw materials and product dependency is high,, also there is high demand for 3D metrology from various countries in order to reduce the cost impact.

Thus, the bargaining power suppliers is high. - Bargaining Power of Buyers: Buyers have little bargaining power because establishing a 3D Metrology requires a large capital investment. However, high cost associated with the technologies will restrict the user to adopt the technologies.

Thus, the bargaining power of the buyers is low. - Threat of New Entrants: The companies entering 3D Metrology market have to deal with high investment cost and adhere to the environmental regulations as well.

Thus, the threat of the new entrants is low. - Threat of Substitutes: There are alternative method available in the market. In industry, a variety of inspection equipment is available to capture the points on a surface that will anticipate manufacturing form error. However, the 3D metrology market demand is increasing continuously in the market.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is extensive mainly because the number of players operating in 3D Metrology industry are focusing on enhancing the efficiency of the battery, business expansion, and product innovations.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Offering |

|

| Segmentation by Products |

|

| Segmentation by Application |

|

| Segmentation by End-Use |

|

| Key Companies Profiled |

|

Q1. What is the size of the global 3D metrology market?

A. The size of the global 3D metrology market was over $3,711.1 million in 2020 and is projected to reach $ 6,647.9 million by 2028.

Q2. Which are the major companies in the 3D Metrology market?

A. Hexagon, FARO Technologies, KEYENCE Corp., Jenoptik, and Nikon Corp, are some of the major companies operating in the global 3D metrology market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific 3D metrology market?

A. The growth rate of the Asia-Pacific 3D metrology market is 9.4%.

Q5. What are the strategies opted by the leading players in this market?

A. Product innovations, technological advancements, and business expansions are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Hexagon, FARO Technologies, KEYENCE Corp., Jenoptik, and Nikon Corp, companies are investing more on R&D practices.

Q7. What is 3D metrology?

A. The scientific study of physical measurement is known as 3D metrology.

Q8. What is 3D measurement?

A. 3D measurement is a metrology process that collects 3D data from physical objects, such as their shapes, textures, geometries, and colors, using various types of 3D measurement tools, such as 3D scanners.

Q9. What is a metrology scanner?

A. Metrology scanner refers to the device that is equipped with the laser and used for the 3D inspection.

Q10. What is GOM scanning?

A. The GOM Scan 1 is a small structured light scanner that can be used to create precise scan meshes. The advanced GOM and ZEISS technologies are packed into the compact shape and robust design. Blue light technology from GOM and the stereo camera principle collect data for GOM Inspect software analysis. This sensor is designed to provide high-precision 3D data.

Q11. How do you measure a 3D?

A. The standard format for reporting three-dimensional measurements is as follows: Height x Width x Depth or Diameter.

Q12. How does 3D scanning work?

A. Laser triangulation is the basis for 3D scanners. A laser beam is projected at a known angle onto a target to be measured; the projected image is viewed by a camera at a known offset from the laser.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By type trends

2.3.By Product type trends

2.4.By Application type trends

2.5.By end-user trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.End Use landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Strategic overview

4.3D Metrology Market, by Offering

4.1.Hardware

4.1.1.Market size and forecast, by region, 2020-2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.Software

4.2.1.Market size and forecast, by region, 2020-2028

4.2.2.Comparative market share analysis, 2020 & 2028

4.3.Services

4.3.1.Market size and forecast, by region, 2020-2028

4.3.2.Comparative market share analysis, 2020 & 2028

5.3D Metrology Market, by Product

5.1.Coordinate Measuring Machine (CMM)

5.1.1.Market size and forecast, by region, 2020-2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Optical Digitizer and Scanner (ODS)

5.2.1.Market size and forecast, by region, 2020-2028

5.2.2.Comparative market share analysis, 2020 & 2028

5.3.Video Measuring Machine (VMM)

5.3.1.Market size and forecast, by region, 2020-2028

5.3.2.Comparative market share analysis, 2020 & 2028

5.4.3D Automated Optical Inspection (AOI) System

5.4.1.Market size and forecast, by region, 2020-2028

5.4.2.Comparative market share analysis, 2020 & 2028

6.3D Metrology Market, by Application

6.1.Quality Control and Inspection

6.1.1.Market size and forecast, by region, 2020-2028

6.1.2.Comparative market share analysis, 2020 & 2028

6.2.Reverse Engineering

6.2.1.Market size and forecast, by region, 2020-2028

6.2.2.Comparative market share analysis, 2020 & 2028

6.3.Virtual Simulation

6.3.1.Market size and forecast, by region, 2020-2028

6.3.2.Comparative market share analysis, 2020 & 2028

6.4.Others

6.4.1.Market size and forecast, by region, 2020-2028

6.4.2.Comparative market share analysis, 2020 & 2028

7.3D Metrology Market, by End Use

7.1.Aerospace

7.1.1.Others Market size and forecast, by region, 2020-2028

7.1.2.Comparative market share analysis, 2020 & 2028

7.2.Automotive

7.2.1.Market size and forecast, by region, 2020-2028

7.2.2.Comparative market share analysis, 2020 & 2028

7.3.Medical

7.3.1.Market size and forecast, by region, 2020-2028

7.3.2.Comparative market share analysis, 2020 & 2028

7.4. Construction and Engineering

7.4.1.Market size and forecast, by region, 2020-2028

7.4.2.Comparative market share analysis, 2020 & 2028

7.5. Heavy Machinery

7.5.1.Market size and forecast, by region, 2020-2028

7.5.2.Comparative market share analysis, 2020 & 2028

7.6.Others

7.6.1.Market size and forecast, by region, 2020-2028

7.6.2.Comparative market share analysis, 2020 & 2028

8.3D Metrology Market, by Region

8.1.North America

8.1.1.Market size and forecast, by Offering, 2020-2028

8.1.2.Market size and forecast, by Product, 2020-2028

8.1.3.Market size and forecast, by Application, 2020-2028

8.1.4.Market size and forecast, by End Use, 2020-2028

8.1.5.Market size and forecast, by Country, 2020-2028

8.1.6.Comparative market share analysis, 2020 & 2028

8.1.7.U.S.

8.1.7.1.Market size and forecast, by Offering, 2020-2028

8.1.7.2.Market size and forecast, by Product, 2020-2028

8.1.7.3.Market size and forecast, by Application, 2020-2028

8.1.7.4.Market size and forecast, by End Use, 2020-2028

8.1.8.Canada

8.1.8.1.Market size and forecast, by Offering, 2020-2028

8.1.8.2.Market size and forecast, by Product, 2020-2028

8.1.8.3.Market size and forecast, by Application, 2020-2028

8.1.8.4.Market size and forecast, by End Use, 2020-2028

8.1.9.Mexico

8.1.9.1.Market size and forecast, by Offering, 2020-2028

8.1.9.2.Market size and forecast, by Product, 2020-2028

8.1.9.3.Market size and forecast, by Application, 2020-2028

8.1.9.4.Market size and forecast, by End Use, 2020-2028

8.2.Europe

8.2.1.Market size and forecast, by Offering, 2020-2028

8.2.2.Market size and forecast, by Product, 2020-2028

8.2.3.Market size and forecast, by Application, 2020-2028

8.2.4.Market size and forecast, by End Use, 2020-2028

8.2.5.Market size and forecast, by Country, 2020-2028

8.2.6.Comparative market share analysis, 2020 & 2028

8.2.7.Germany

8.2.7.1.Market size and forecast, by Offering, 2020-2028

8.2.7.2.Market size and forecast, by Product, 2020-2028

8.2.7.3.Market size and forecast, by Application, 2020-2028

8.2.7.4.Market size and forecast, by End Use, 2020-2028

8.2.8.UK

8.2.8.1.Market size and forecast, by Offering, 2020-2028

8.2.8.2.Market size and forecast, by Product, 2020-2028

8.2.8.3.Market size and forecast, by Application, 2020-2028

8.2.8.4.Market size and forecast, by End Use, 2020-2028

8.2.9.France

8.2.9.1.Market size and forecast, by Offering, 2020-2028

8.2.9.2.Market size and forecast, by Product, 2020-2028

8.2.9.3.Market size and forecast, by Application, 2020-2028

8.2.9.4.Market size and forecast, by End Use, 2020-2028

8.2.10.Italy

8.2.10.1.Market size and forecast, by Offering, 2020-2028

8.2.10.2.Market size and forecast, by Product, 2020-2028

8.2.10.3.Market size and forecast, by Application, 2020-2028

8.2.10.4.Market size and forecast, by End Use, 2020-2028

8.2.11.Spain

8.2.11.1.Market size and forecast, by Offering, 2020-2028

8.2.11.2.Market size and forecast, by Product, 2020-2028

8.2.11.3.Market size and forecast, by Application, 2020-2028

8.2.11.4.Market size and forecast, by End Use, 2020-2028

8.2.12.Rest of Europe

8.2.12.1.Market size and forecast, by Offering, 2020-2028

8.2.12.2.Market size and forecast, by Product, 2020-2028

8.2.12.3.Market size and forecast, by Application, 2020-2028

8.2.12.4.Market size and forecast, by End Use, 2020-2028

8.3.Asia-Pacific

8.3.1.Market size and forecast, by Offering, 2020-2028

8.3.2.Market size and forecast, by Product, 2020-2028

8.3.3.Market size and forecast, by Application, 2020-2028

8.3.4.Market size and forecast, by End Use, 2020-2028

8.3.5.Market size and forecast, by country, 2020-2028

8.3.6.Comparative market share analysis, 2020 & 2028

8.3.7.China

8.3.7.1.Market size and forecast, by Offering, 2020-2028

8.3.7.2.Market size and forecast, by Product, 2020-2028

8.3.7.3.Market size and forecast, by Application, 2020-2028

8.3.7.4.Market size and forecast, by End Use, 2020-2028

8.3.8.Japan

8.3.8.1.Market size and forecast, by Offering, 2020-2028

8.3.8.2.Market size and forecast, by Product, 2020-2028

8.3.8.3.Market size and forecast, by Application, 2020-2028

8.3.8.4.Market size and forecast, by End Use, 2020-2028

8.3.9.India

8.3.9.1.Market size and forecast, by Offering, 2020-2028

8.3.9.2.Market size and forecast, by Product, 2020-2028

8.3.9.3.Market size and forecast, by Application, 2020-2028

8.3.9.4.Market size and forecast, by End Use, 2020-2028

8.3.10.South Korea

8.3.10.1.Market size and forecast, by Offering, 2020-2028

8.3.10.2.Market size and forecast, by Product, 2020-2028

8.3.10.3.Market size and forecast, by Application, 2020-2028

8.3.10.4.Market size and forecast, by End Use, 2020-2028

8.3.11.Australia

8.3.11.1.Market size and forecast, by Offering, 2020-2028

8.3.11.2.Market size and forecast, by Product, 2020-2028

8.3.11.3.Market size and forecast, by Application, 2020-2028

8.3.11.4.Market size and forecast, by End Use, 2020-2028

8.3.12.Rest of Asia Pacific

8.3.12.1.Market size and forecast, by Offering, 2020-2028

8.3.12.2.Market size and forecast, by Product, 2020-2028

8.3.12.3.Market size and forecast, by Application, 2020-2028

8.3.12.4.Market size and forecast, by End Use, 2020-2028

8.4.LAMEA

8.4.1.Market size and forecast, by Offering, 2020-2028

8.4.2.Market size and forecast, by Product, 2020-2028

8.4.3.Market size and forecast, by Application, 2020-2028

8.4.4.Market size and forecast, by Application, 2020-2028

8.4.5.Market size and forecast, by End Use, 2020-2028

8.4.6.Latin America

8.4.6.1.Market size and forecast, by Offering, 2020-2028

8.4.6.2.Market size and forecast, by Product, 2020-2028

8.4.6.3.Market size and forecast, by Application, 2020-2028

8.4.6.4.Market size and forecast, by End Use, 2020-2028

8.4.7.Middle East

8.4.7.1.Market size and forecast, by Offering, 2020-2028

8.4.7.2.Market size and forecast, by Product, 2020-2028

8.4.7.3.Market size and forecast, by Application, 2020-2028

8.4.7.4.Market size and forecast, by End Use, 2020-2028

8.4.8.Africa

8.4.8.1.Market size and forecast, by Offering, 2020-2028

8.4.8.2.Market size and forecast, by Product, 2020-2028

8.4.8.3.Market size and forecast, by Application, 2020-2028

8.4.8.4.Market size and forecast, by End Use, 2020-2028

9.Company profiles

9.1.Hexagon

9.1.1.Business overview

9.1.2.Financial performance

9.1.3.Product portfolio

9.1.4.Recent strategic moves & developments

9.1.5.SWOT analysis

9.2.FARO Technologies

9.2.1.Business overview

9.2.2.Financial performance

9.2.3.Product portfolio

9.2.4.Recent strategic moves & developments

9.2.5.SWOT analysis

9.3.KEYENCE Corp.

9.3.1.Business overview

9.3.2.Financial performance

9.3.3.Product portfolio

9.3.4.Recent strategic moves & developments

9.3.5.SWOT analysis

9.4.Jenoptik

9.4.1.Business overview

9.4.2.Financial performance

9.4.3.Product portfolio

9.4.4.Recent strategic moves & developments

9.4.5.SWOT analysis

9.5.Mitutoyo Corp

9.5.1.Business overview

9.5.2.Financial performance

9.5.3.Product portfolio

9.5.4.Recent strategic moves & developments

9.5.5.SWOT analysis

9.6.ZEISS Group

9.6.1.Business overview

9.6.2.Financial performance

9.6.3.Product portfolio

9.6.4.Recent strategic moves & developments

9.6.5.SWOT analysis

9.7.KLA Corp

9.7.1.Business overview

9.7.2.Financial performance

9.7.3.Product portfolio

9.7.4.Recent strategic moves & developments

9.7.5.SWOT analysis

9.8.Perceptron

9.8.1.Business overview

9.8.2.Financial performance

9.8.3.Product portfolio

9.8.4.Recent strategic moves & developments

9.8.5.SWOT analysis

9.9.Renishaw

9.9.1.Business overview

9.9.2.Financial performance

9.9.3.Product portfolio

9.9.4.Recent strategic moves & developments

9.9.5.SWOT analysis

9.10.3D Systems, Inc

9.10.1.Business overview

9.10.2.Financial performance

9.10.3.Product portfolio

9.10.4.Recent strategic moves & developments

9.10.5.SWOT analysis

3D metrology consists of a range of scanning technologies used for quality control, optimization, and other manufacturing and production applications. One of the most effective forms of 3D metrology utilizes structured blue light to separate unwanted ambient lighting, and stereoscopic cameras to scan and measure parts precisely. Some common steps involved in a 3D scan are sensor positioning and measurement, evaluation, and reports & results. The reasons for high preference of 3D metrology are that they’re cheaper than the traditional measurement tools like coordinate measuring machines (CMMs), wide measurement coverage, and in-process inspection to measure parts during production.

Forecast Analysis:

Increasing product enhancements and strategic acquisitions by key market players are the major factors anticipated to drive the 3D metrology market growth during the forecast period. In addition, rapid use of 3D in modelling and analytical applications in aerospace and defense, heavy machinery, automotive, electronics, medical, and other industries is projected to offer ample market growth opportunities. Moreover, advancements in data-gathering sensor technology along with improved inspection and measurement software solutions is expected to further bolster the 3D metrology market growth by 2028. However, high costs associated with the 3D metrology is the main factor to hinder the market growth.

Regionally, the North America 3D metrology market is estimated to have the largest share and register a revenue of $2,356.7 million by 2028 million in the 2021-2028 timeframe due to vast technological advances and automation in the manufacturing sectors. In addition, the existence of prominent automotive, pharmaceutical, and aerospace equipment manufacturers is yet another factor predicted to accelerate the market growth in the North America region during the analysis years.

According to the report published by Research Dive, the global 3D metrology market is expected to surpass $6,647.9 million and grow at 7.8% CAGR in the 2021–2028 timeframe. Some prominent market players include ZEISS Group, 3D Systems, Inc., FARO Technologies, KLA Corp., KEYENCE Corp., Nikon Corp., Hexagon, Perceptron, Renishaw, Jenoptik, Mitutoyo Corp., and many others.

Covid-19 Impact on the Market:

The onset of the coronavirus has had an adverse impact on the global 3D metrology market due to strict travel bans and lockdowns imposed by governments across the world. This posed great difficulties for the electronic device raw material manufacturers that were dispersed from China. In addition, cargo movement restrictions led to supply chain disruptions and fluctuations in raw materials’ prices. Moreover, delayed manufacturing processes and negative impact on CMM manufacturing units in countries like India, Japan, China, and the United States led to declined demand for 3D metrology in modelling and analytical applications in industries like aerospace, medical, electronics, etc. These factors are projected to hamper the 3D metrology market growth during the pandemic.

Prominent Market Developments:

The prominent organizations operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the 3D metrology market to flourish. For instance:

In December 2020, Vivo, a leading smartphone player, announced its partnership with Zeiss, an internationally leading technology enterprise, to develop breakthrough mobile imaging technology to allow professional-grade photography experience. This strategic collaboration utilized Vivo’s expertise in manufacturing flawless smartphone cameras and Zeiss’s distinctive imaging prowess.

In September 2020, Perceptron Inc., a renowned 3D automated metrology solutions provider, announced its acquisition by Atlas Copco, a leading provider of feasible productivity solutions. The acquisition was aimed to leverage Perceptron’s technology and benefit its global customers with Atlas Copco’s leadership position across wide-ranged industrial sectors and its significant existence in the machine vision space.

In May 2021, API, a leader in laser tracker technology, announced its collaboration with Mitutoyo Corp., a multinational innovative precision measurement solutions provider, to distribute its portable dimensional metrology equipment throughout the latter’s global client network and level up its brand name besides reducing production times and enhancing portable measurement hardware and software.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com