Global Concrete Densifier Market Report

RA08532

Global Concrete Densifier Market by Type (Sodium Silicate, Potassium Silicate, and Lithium Silicate), Method (Dry and Wet), Construction Type (New Construction and Renovation), End Use (Residential and Non-Residential), and Region (North America, Europe, Asia-Pacific, and LAMEA): Opportunity Analysis and Industry Forecast, 2023-2032

Concrete Densifier Overview

A concrete densifier is a chemical hardener that is most usually applied on top of the concrete slab after placement. Using a densifier, whether polished or unpolished, is a cost-effective approach to increasing the strength, endurance, and longevity of a concrete slab. Concrete densifiers are commonly used on unfinished concrete slabs as part of the refinement process of concrete polishing. The concrete densifier fills pore spaces in the concrete slab and enhances its surface strength. A densifier works by entering the surface of a concrete and combining inert chemicals and sand particles into a crystalline link. The surface density and abrasion resistance of the concrete surface are considerably boosted by connecting these loose and weak elements more closely together. Chemical densifiers are used on both polished and unpolished concrete to prevent dust from settling on the concrete surface and make the surface less porous to liquid spillage.

Concrete densifiers are chemical compounds used in construction to increase the strength and durability of concrete structures. These compounds can be employed in existing construction projects to improve the quality of the concrete or in new construction projects to impart durability and strengthen the structures. The use of concrete densifiers provides various advantages such as they increase the hardness and density of concrete, making it less prone to wear and tear. This makes concrete densifier an excellent option for high-footfall areas such as warehouses, factories, and parking lots. Also, densifiers reduce the porosity of concrete, making it more resistant to water penetration and fracture formation. This contributes to the structure's longevity and lowers maintenance expenses.

Global Concrete Densifier Market Analysis

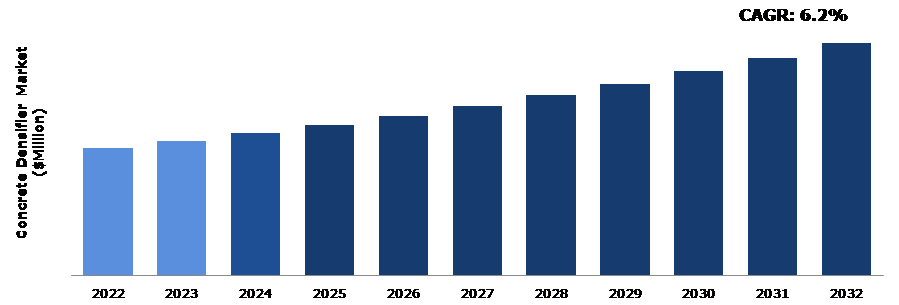

The global concrete densifier market size was $844.7 million in 2022 and is predicted to grow with a CAGR of 6.2%, by generating a revenue of $1,537.00 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Concrete Densifier Market

The global crisis caused by the COVID-19 pandemic negatively affected the concrete densifier market and brought real challenges to its functioning. However, the global outbreak caused unprecedented disruptions in manufacturing activities due to nationwide lockdowns.

As the world continues to recover from the pandemic, the building industry is gradually resuming its normal operations. Governments are investing in infrastructure projects to encourage economic growth and create jobs. During the pandemic, the Indian government undertook a number of steps to enhance the construction industry and drive economic growth. The Smart Cities Mission was one such program. This program aims to develop and transform numerous cities around the country into smart and sustainable urban centers. The Smart Cities Mission aimed to improve infrastructure, improve quality of life, and promote economic activity in selected cities by leveraging modern technology and data-driven solutions.

Growing Construction Activity Around the Globe to Drive the Market Growth

The rapid growth of the global concrete densifier market is primarily caused by an increase in global construction activity. The population growth in emerging economies like China and India is causing the construction industry to expand rapidly Therefore, these factors are fueling a high demand for low-maintenance, durable flooring with polished and appealing floors in residential and commercial spaces. The demand for smooth, aesthetically pleasing flooring at cost-effective prices is rising as a result of remodeling and reconstruction projects in the residential and commercial sectors. This is anticipated to drive the growth of the concrete densifier market over the course of the forecast period.

To know more about global concrete densifier market drivers, get in touch with our analysts here.

Acidic Damage to Concrete to Restrain the Market Growth

Despite the advantages of utilizing chemical densifiers in concrete, it is vital to highlight that these products have limitations. Densified concrete is tougher and denser, but it is still vulnerable to environmental degradation. Chemical densifiers, for example, may be ineffective in preventing acid damage, particularly when the acid concentration is high, and the exposure is frequent and regular. Excessive exposure to severe temperatures and abrasive materials can potentially damage densified concrete.

Increased Construction Activities Worldwide to Drive Excellent Opportunities

The demand for housing, a basic human need, is rising as a result of population growth. It is predicted that the rapid urbanization and rising demand for affordable housing will propel the concrete densifier market's expansion. For instance, Pradhan Mantri Awas Yojana's Affordable Rental Housing Complexes (ARHC) provide decent housing at a reasonable cost to India's urban, poor population. The advantages of using concrete densifier floors, including their high reflectivity, slip resistance, affordability, and stain resistance, may also create lucrative market opportunities for industry participants in the years to come. The LEED (Leadership in Energy and Environmental Design) friendly concrete densifier floors allow for sustainable building construction without the release of volatile organic compounds. These essential advantages may also create profitable market opportunities for the market's players in the years to come.

To know more about global concrete densifier market opportunities, get in touch with our analysts here.

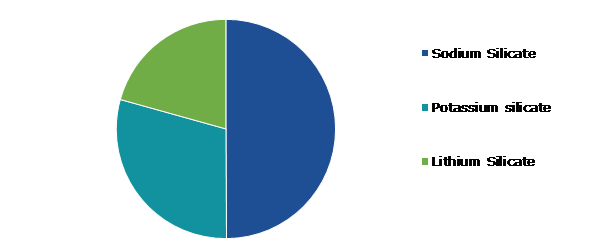

Global Concrete Densifier Market Share, by Type, 2022

Source: Research Dive Analysis

The sodium silicate sub-segment accounted for the highest market share in 2022. Sodium silicate-based concrete densifier is a specially prepared liquid that penetrates deep into concrete surfaces by capillary action and chemically reacts to generate a highly dense and long-lasting sealed floor. Sodium silicate densifiers offer numerous advantages in addition to giving a superior finish and reinforcing the concrete. Unlike other surface treatments and water repellants, sodium silicate penetrates the concrete and changes the molecular structure. Concrete surfaces treated with a sodium silicate densifier are appropriate for high-traffic areas because of their increased abrasion resistance. The smoother concrete surface also makes polishing easier, as well as cleaning and maintaining the floor convenient. The lower porosity contributes to the concrete's durability.

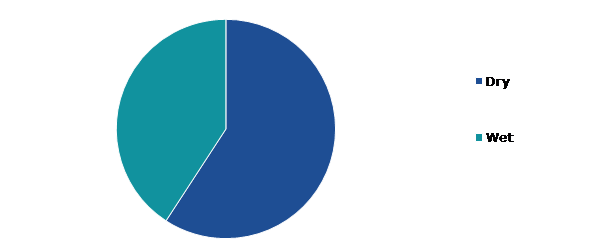

Global Concrete Densifier Market Size, by Method, 2022

Source: Research Dive Analysis

The dry sub-segment accounted for the highest market share in 2022. The dry approach is less expensive because it uses less product to produce the desired outcome. This is due to the fact that the densifier is used in its concentrated form, with no water dilution or overspray. As a result, there is less waste, and the entire application process is more efficient. In addition, the dry approach is less dirty than the wet one since there is no overspray or densifier runoff. This makes it a better choice for interior applications or situations where water cannot be used.

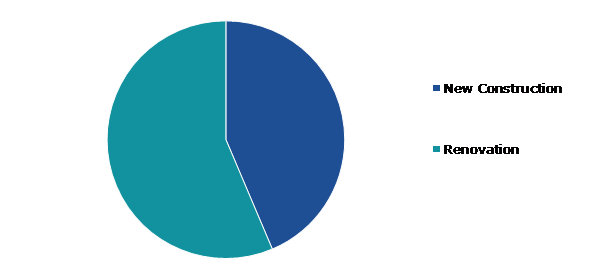

Global Concrete Densifier Market Growth, by Construction Type, 2022

Source: Research Dive Analysis

The renovation sub-segment accounted for the highest market share in 2022. The rising demand for renovation has contributed to the high demand in the concrete densifier market. As more homeowners upgrade and enhance their houses, concrete densifiers have been in great demand as a way to decorate the durability and aesthetic appeal of their concrete floors. Concrete densifiers provide a cost-effective and green solution for homeowners who need to renovate their concrete flooring. By densifying the concrete, house owners can acquire a refined and clean surface that is both aesthetically pleasing and sturdy.

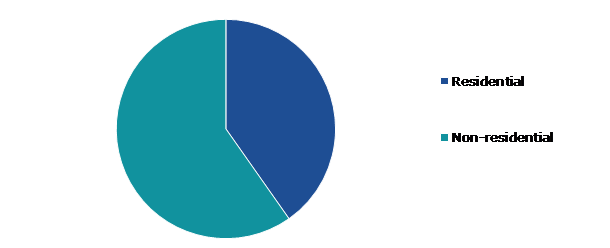

Global Concrete Densifier Market Analysis, by End-use, 2022

Source: Research Dive Analysis

The non-residential sub-segment accounted for the highest market share in 2022. The non-residential concrete densifier sub-segment is experiencing growth due to the high demand for concrete densifiers from hospitals, industrial complexes, restaurants, shopping malls, and other public places. The use of concrete densifiers in these non-residential areas offers several advantages, along with a sparkly and smooth appearance, durability, and longevity. These benefits are driving the non-residential concrete densifier market.

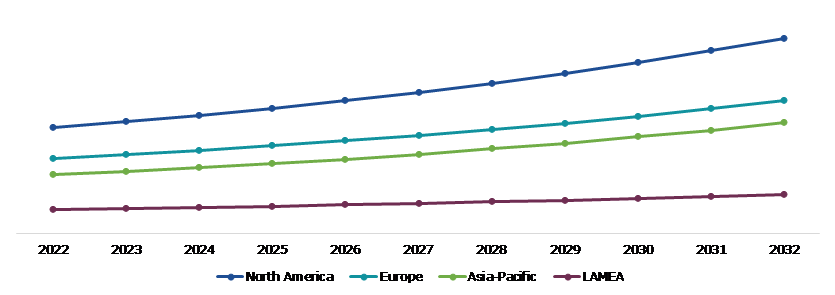

Global Concrete Densifier Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The North America concrete densifier market generated the highest revenue in 2022. North America is known for its highly advanced technology and infrastructure. The concrete densifier market in the region is predicted to grow significantly over the forecast period as a result of increased construction activity, driving demand for concrete densifiers. Also, increased industrialization and rapid urbanization are expected to drive the demand from the commercial sector segment over the forecast period. For instance, The Hudson Yards development in Manhattan is one of the greatest construction projects in the United States, and it employs concrete densifiers in a variety of ways. The project includes numerous high-rise buildings, a public square, and a retail center, all of which will have polished concrete floors treated with densifiers for durability and aesthetic appeal. All these factors are anticipated to boost the concrete densifier market.

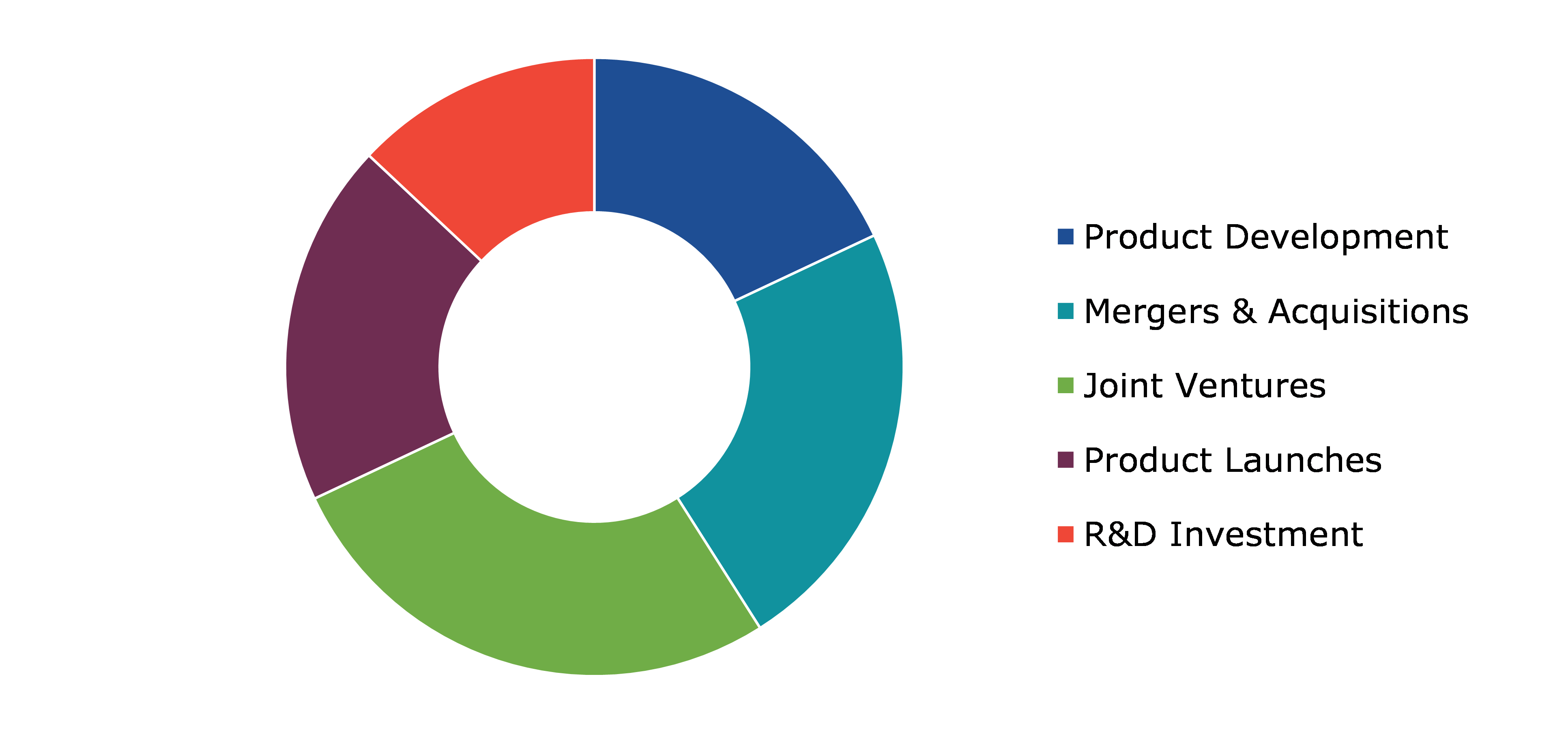

Competitive Scenario in the Global Concrete Densifier Market

Investment, product launches, and agreements are common strategies followed by major market players. For instance, in August 2022, Prosoco Inc., a commercial construction chemicals producer, launched the DensiKure in its concrete flooring products. The DensiKure is a time saver for projects involving newly laid, smooth, steel-trowel-finished concrete floors. DensiKure eliminates the typical wait times between the two phases while the concrete hardens, dries, and cures by integrating the chemistries that densify and harden concrete with those that cure concrete.

Source: Research Dive Analysis

Some of the leading concrete densifier market players are BASF SE, W.R. Grace & Co., Sika AG, The Euclid Chemical Company, The Sherwin Williams Company, W. R. Meadows, Inc., Evonik, Laticrete International, Inc., Jon Don LLC, and Solomon Colors Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2022 |

| Base Year for Market Estimation | 2023 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Method |

|

|

Segmentation by Construction Type

|

|

|

Segmentation by End Use

|

|

| Key Companies Profiled |

|

Q1. What is the size of the global concrete densifier market?

A. The size of the global concrete densifier market was over $844.70 million in 2022 and is projected to reach $1,5370 million by 2032.

Q2. Which are the major companies in the concrete densifier market?

A. BASF SE, W.R. Grace & Co., and Sika AG are some of the key players in the global concrete densifier market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific concrete densifier market?

A. Asia-Pacific concrete densifier market is anticipated to grow at 6.7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. The Euclid Chemical Company, The Sherwin Williams Company, and W. R. Meadows are the companies investing more on R&D activities for developing new products.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on the global concrete densifier market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on the concrete densifier market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Concrete Densifier Market Analysis, by Type

5.1.Overview

5.2.Sodium Silicate

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2022-2032

5.2.3.Market share analysis, by country, 2022-2032

5.3.Potassium silicate

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2022-2032

5.3.3.Market share analysis, by country, 2022-2032

5.4.Lithium Silicate

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2022-2032

5.4.3.Market share analysis, by country, 2022-2032

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Concrete Densifier Market Analysis, by Method

6.1.Dry

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2022-2032

6.1.3.Market share analysis, by country, 2022-2032

6.2.Wet

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2022-2032

6.2.3.Market share analysis, by country, 2022-2032

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness

6.3.2.Competition heatmap

7.Concrete Densifier Market Analysis, by Construction Type

7.1.New Construction

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2022-2032

7.1.3.Market share analysis, by country, 2022-2032

7.2.Renovation

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2022-2032

7.2.3.Market share analysis, by country, 2022-2032

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness

7.3.2.Competition heatmap

8.Concrete Densifier Market Analysis, by End-Use

8.1.Residential

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region, 2022-2032

8.1.3.Market share analysis, by country, 2022-2032

8.2.Non-residential

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region, 2022-2032

8.2.3.Market share analysis, by country, 2022-2032

8.3.Research Dive Exclusive Insights

8.3.1.Market attractiveness

8.3.2.Competition heatmap

9.Concrete Densifier Market , by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Type, 2022-2032

9.1.1.2.Market size analysis, by Method, 2022-2032

9.1.1.3.Market size analysis, by Construction Type, 2022-2032

9.1.1.4.Market size analysis, by End-Use, 2022-2032

9.1.2.Canada

9.1.2.1.Market size analysis, by Type, 2022-2032

9.1.2.2.Market size analysis, by Method, 2022-2032

9.1.2.3.Market size analysis, by Construction Type, 2022-2032

9.1.2.4.Market size analysis, by End-Use, 2022-2032

9.1.3.Mexico

9.1.3.1.Market size analysis, by Type, 2022-2032

9.1.3.2.Market size analysis, by Method, 2022-2032

9.1.3.3.Market size analysis, by Construction Type, 2022-2032

9.1.3.4.Market size analysis, by End-Use, 2022-2032

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Type, 2022-2032

9.2.1.2.Market size analysis, by Method, 2022-2032

9.2.1.3.Market size analysis, by Construction Type, 2022-2032

9.2.1.4.Market size analysis, by End-Use, 2022-2032

9.2.2.UK

9.2.2.1.Market size analysis, by Type, 2022-2032

9.2.2.2.Market size analysis, by Method, 2022-2032

9.2.2.3.Market size analysis, by Construction Type, 2022-2032

9.2.2.4.Market size analysis, by End-Use, 2022-2032

9.2.3.France

9.2.3.1.Market size analysis, by Type, 2022-2032

9.2.3.2.Market size analysis, by Method, 2022-2032

9.2.3.3.Market size analysis, by Construction Type, 2022-2032

9.2.3.4.Market size analysis, by End-Use, 2022-2032

9.2.4.Spain

9.2.4.1.Market size analysis, by Type, 2022-2032

9.2.4.2.Market size analysis, by Method, 2022-2032

9.2.4.3.Market size analysis, by Construction Type, 2022-2032

9.2.4.4.Market size analysis, by End-Use, 2022-2032

9.2.5.Italy

9.2.5.1.Market size analysis, by Type, 2022-2032

9.2.5.2.Market size analysis, by Method, 2022-2032

9.2.5.3.Market size analysis, by Construction Type, 2022-2032

9.2.5.4.Market size analysis, by End-Use, 2022-2032

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Type, 2022-2032

9.2.6.2.Market size analysis, by Method, 2022-2032

9.2.6.3.Market size analysis, by Construction Type, 2022-2032

9.2.6.4.Market size analysis, by End-Use, 2022-2032

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Type, 2022-2032

9.3.1.2.Market size analysis, by Method, 2022-2032

9.3.1.3.Market size analysis, by Construction Type, 2022-2032

9.3.1.4.Market size analysis, by End-Use, 2022-2032

9.3.2.Japan

9.3.2.1.Market size analysis, by Type, 2022-2032

9.3.2.2.Market size analysis, by Method, 2022-2032

9.3.2.3.Market size analysis, by Construction Type, 2022-2032

9.3.2.4.Market size analysis, by End-Use, 2022-2032

9.3.3.India

9.3.3.1.Market size analysis, by Type, 2022-2032

9.3.3.2.Market size analysis, by Method, 2022-2032

9.3.3.3.Market size analysis, by Construction Type, 2022-2032

9.3.3.4.Market size analysis, by End-Use, 2022-2032

9.3.4.Australia

9.3.4.1.Market size analysis, by Type, 2022-2032

9.3.4.2.Market size analysis, by Method, 2022-2032

9.3.4.3.Market size analysis, by Construction Type, 2022-2032

9.3.4.4.Market size analysis, by End-Use, 2022-2032

9.3.5.South Korea

9.3.5.1.Market size analysis, by Type, 2022-2032

9.3.5.2.Market size analysis, by Method, 2022-2032

9.3.5.3.Market size analysis, by Construction Type, 2022-2032

9.3.5.4.Market size analysis, by End-Use, 2022-2032

9.3.6.Rest of Asia Pacific

9.3.6.1.Market size analysis, by Type, 2022-2032

9.3.6.2.Market size analysis, by Method, 2022-2032

9.3.6.3.Market size analysis, by Construction Type, 2022-2032

9.3.6.4.Market size analysis, by End-Use, 2022-2032

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Type, 2022-2032

9.4.1.2.Market size analysis, by Method, 2022-2032

9.4.1.3.Market size analysis, by Construction Type, 2022-2032

9.4.1.4.Market size analysis, by End-Use, 2022-2032

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Type, 2022-2032

9.4.2.2.Market size analysis, by Method, 2022-2032

9.4.2.3.Market size analysis, by Construction Type, 2022-2032

9.4.2.4.Market size analysis, by End-Use, 2022-2032

9.4.3.UAE

9.4.3.1.Market size analysis, by Type, 2022-2032

9.4.3.2.Market size analysis, by Method, 2022-2032

9.4.3.3.Market size analysis, by Construction Type, 2022-2032

9.4.3.4.Market size analysis, by End-Use, 2022-2032

9.4.4.South Africa

9.4.4.1.Market size analysis, by Type, 2022-2032

9.4.4.2.Market size analysis, by Method, 2022-2032

9.4.4.3.Market size analysis, by Construction Type, 2022-2032

9.4.4.4.Market size analysis, by End-Use, 2022-2032

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Type, 2022-2032

9.4.5.2.Market size analysis, by Method, 2022-2032

9.4.5.3.Market size analysis, by Construction Type, 2022-2032

9.4.5.4.Market size analysis, by End-Use, 2022-2032

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1.BASF SE

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2.W.R. Grace & Co.

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3.Sika AG

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4.The Euclid Chemical Company

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5.The Sherwin Williams Company

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6.W. R. Meadows, Inc.

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.Evonik

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8.Laticrete International, Inc.

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.Jon Don LLC

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10.Solomon Colors Inc.

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

In the early days, concrete densifiers were not considered as a viable solution for sealing, protecting, hardening, and covering industrial concrete floors. However, since concrete densifiers have begun to utilize silicate and siliconate enhanced agents, they are increasingly used in the construction industry. The use of silicate and siliconate enhanced agents in concrete densifiers leads to moisture resistant and water resilient floors. Concrete densifiers are majorly used on non-polished concrete in order to reduce dusting and improve stain resistance. Its numerous applications include floors in industrial plants, warehouses, shopping malls, schools, stores, hospitals, and food-processing plants. Concrete floors become more durable with concrete densifiers.

COVID-19 Impact on Concrete Densifier Market

The outbreak of COVID-19 across the globe has unfavorably impacted the global concrete densifier market growth. The negative impact on the market is majorly owing to the lack of raw materials available, disruptions in supply chain, and the shortage of labor due to lockdown imposed across the globe. In addition, the existing as well as new construction projects were postponed due to lockdown restrictions. Moreover, the migration of workers from cities to their native places increased during the pandemic period. All these factors affected the concrete densifier market growth during the period of crisis.

However, several companies operating in the global industry are adopting several strategies such as company acquisitions and product launches, which is expected to help the market recover after the COVID-19 pandemic.

Concrete Densifier Market Trends and Developments

The companies operating in the global industry are adopting several growth strategies and business tactics such as partnerships, collaboration, business expansion, and product launches to obtain a leading position in the global industry, which is predicted to drive the global concrete densifier market growth in the upcoming years.

For instance, in August 2020, ChemMasters, the specialty concrete chemicals manufacturer announced the acquisition of Vexcon Chemicals, the concrete chemical manufacturer with an aim to expand their business in the construction industry. The addition of Vexcon Chemical to the growing brand portfolio of ChemMasters is a reflection of the company’s long-term strategy to offer industry-leading products and technology to customers.

In February 2021, Meridian Adhesives Group, a leading manufacturer of high-value adhesive technologies, completed the acquisition of Convergent Concrete Technologies that specializes in high-performing concrete products and treatments. The company’s line of technology include densifiers, hardeners, finishes, and adhesive promoting treatments.

In June 2021, Convergent Concrete Technologies, a supplier for reactive silicate-based concrete treatments, announced the launch of ‘STRiON,’ the revolutionary new concrete hardener & densifier. STRiON a new method of concrete hardening and densification using groundbreaking new silica-free technology. STRiON uses an ionic transfer process, instead of silica, to disperse deep into concrete making it more resilient, dustproof, resistant to traffic, prepped for polishing, and easy to clean.

Forecast Analysis of Global Market

The global concrete densifier market is projected to witness an exponential growth over the forecast period, owing to the rapid urbanization and the rising demand for affordable houses across the globe. Conversely, the impact on environment associated with the use of concrete densifier is expected to hamper the market growth in the projected timeframe.

The growing population along with the rising construction activities and the reconstruction & remodeling activities in commercial and residential sector across the globe are the significant factors estimated to bolster the growth of the global market in the coming future. According to a latest report published by Research Dive, the global concrete densifier market is expected to garner $1,599.2 million during the forecast period (2021-2030). Regionally, the North America market is estimated to observe dominant growth by 2030, owing to the rapid advancements in e-commerce industry have increased the demand for construction of new warehouses and logistics hubs.

The key players functioning in the global market include

- Pittsburgh Plate Glass Industries, Inc.

- 3M

- BASF SE

- Sika AG

- Ultra Tech Cement Limited

- The Sherwin Williams Company

- Boral Limited

- Solomon Colors Inc.

- Vexcon Chemicals Inc.

- The Euclid Chemical Company

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com