Automotive Infotainment Market Report

RA08518

Automotive Infotainment Market by System Type (Entertainment System, Connectivity System, and Driver Assistance System), Market Type (Original Equipment Manufacturers (OEMs) and Aftermarket), Vehicle Type (Passenger Vehicles and Commercial Vehicles), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022–2030.

Global Automotive Infotainment Market Analysis

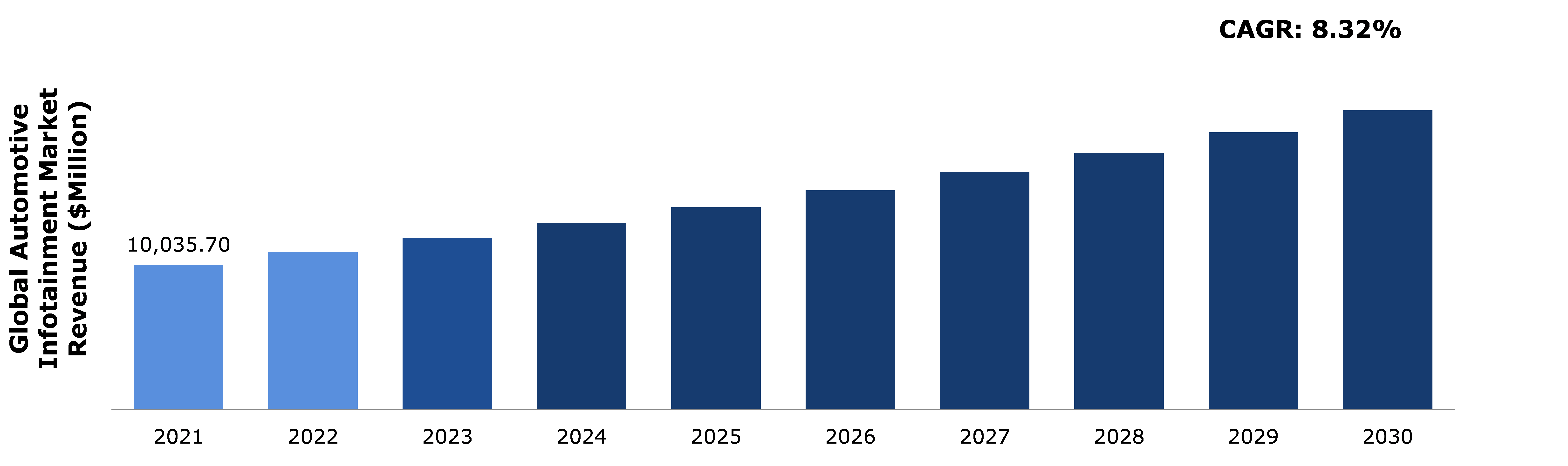

The global automotive infotainment market size was $10,035.7 million in 2021 and is predicted to grow with a CAGR of 8.32%, by generating a revenue of $20,720 million by 2030.

Automotive Infotainment Market Synopsis

The term ‘automotive infotainment system’ consists of a collection of hardware and software elements created to offer entertainment and navigational services that improve driver comfort and convenience. Rear seat entertainment, access to Internet, time information, and multimedia are all integrated into the systems that have been installed. Additionally, result of technological improvements, modern automotive infotainment systems are loaded with pulling technologies such as audio/video (A/V) interfaces, touch screens, keypads, and others that enhance usability. The infotainment system allows providing a blend of entertainment and information for an enhanced in-vehicle experience. Technologically advanced infotainment manufacturing companies are implementing features such as parking recommendations, predictive navigations, pre-trip planning, cloud-enabling syncing, and other essential features.

However, less awareness among new-vehicle buyers regarding how to use technologically advanced infotainment systems can hinder the market growth. Users tend to face challenging problems such as poor sound quality using Bluetooth streaming, balky performance in cold weather, touch-screens that are slow to respond or have indistinct touch points, incorrect destinations on navigation systems, and others. If users ignore the instructions in the user's manual, they can find these systems to be less helpful and more difficult to use.

The automotive infotainment market share is anticipated to see new growth potential as a result of partnerships and collaborations between e-commerce businesses and automakers. For instance, in January 2022, Stellantis NV and Amazon.com Inc. worked together to produce cars and trucks outfitted with the Amazon software dashboard and deploy them into the fleet of Amazon delivery vehicles. These cars will have an entertainment system and use the Amazon cloud service to gather data in real time.

Electronics technology for portable and mobile devices is progressively having an impact on the automobile infotainment sector. Navigation systems, 3G wireless access, high-resolution color screens, speech recognition, USB & Bluetooth connectivity, and other features have all been added in the system in recent years. Increased growth of infotainment system and required reduction in product design cycle time are the result of consumers' increasing expectations for multimedia features in their vehicles. The integrated use of telecommunications and informatics in motor vehicles is also referred to as telematics. This technology uses telecommunications components to transmit, receive, and store data. Integrated with ECUs and mobile communications technology, a telematic system contains Global Positioning System (GPS) technology.

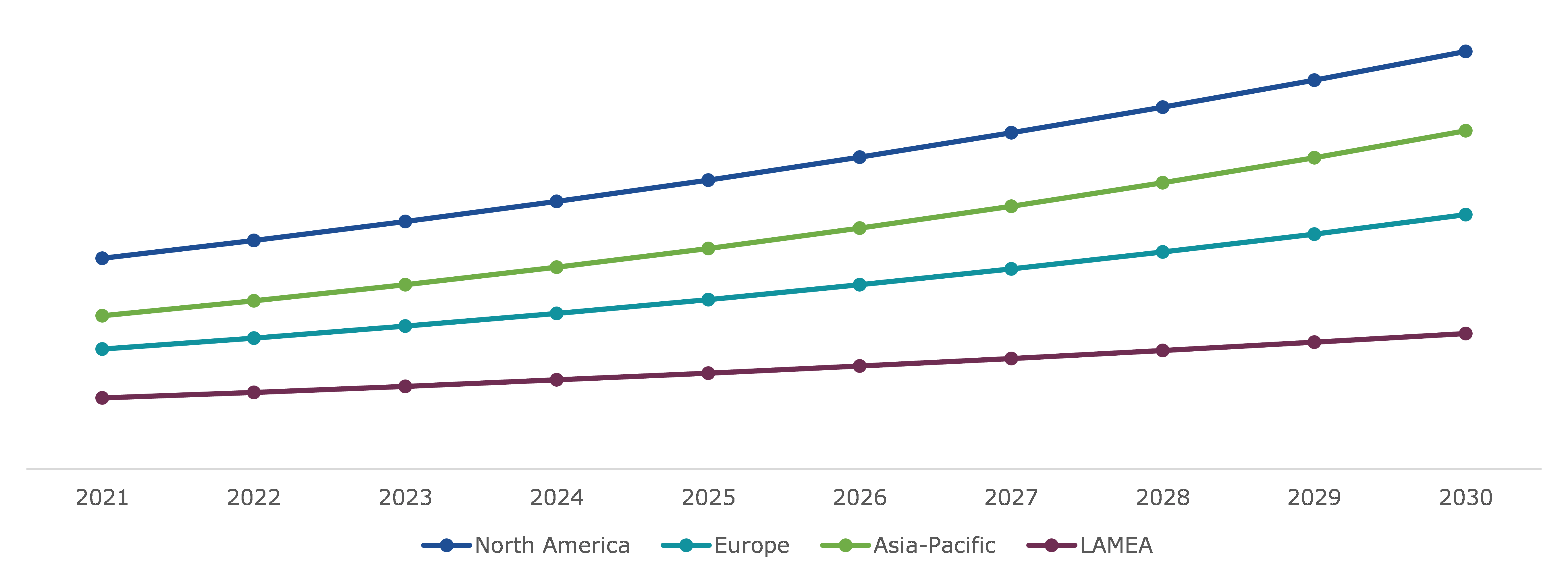

According to regional analysis, the Asia-Pacific automotive infotainment market size accounted for $2,770.9 million in 2021 and is predicted to grow with a CAGR of 9.13% in the projected timeframe. Increasing vehicle production, along with changing consumer preferences and growing per capita income of the middle-class population, is driving the vehicle demand and encouraging automotive infotainment systems.

Automotive Infotainment Overview

Automotive infotainment devices are the equipment that furnish entertainment and information comprising systems for fuel efficiency, safety, connectivity, navigation, and audio. Moreover, it incorporates projects related to playing & running audio content, entertainment including games, movies, social networking, navigation, and locating smart phone or Internet-enabled content.

The technology that provides entertainment and information in automobiles includes systems for connectivity, safety, connectivity, navigation, and audio. Additionally, it includes initiatives for executing and playing audio content, enjoying entertainment such as games, movies, and social networking, navigating, and finding content for smartphones on Internet.

COVID-19 Impact on the Global Automotive Infotainment Market

The impact of COVID-19 on globally integrated automotive infotainment business sector has been swift and significant. Initial concerns over a disruption in exports of hardware and software parts of infotainment system quickly pivoted to large scale manufacturing interruptions across the globe. Additionally, assembly plant closures are contributing to severe pressure on a global supply base that is becoming more distressed. Companies are at risk of failing on agreements, which could necessitate banks stepping in to get loan or financial support. The exogenous shock of the pandemic impaired an existing downshift in global demand for automobiles that will likely lead to increased mergers and acquisitions activity as opportunities for sector consolidation emerge for private equity players. A prolonged lockdown across the globe led the market towards loss and has negatively impacted automakers revenue and profitability.

Rising Applications and Technological Advancements in Automotive Infotainment Systems to Drive the Market Growth

With the increasing demand for safe, lavish, and smart vehicles, automobile manufacturers are manufacturing automobiles equipped with advanced infotainment system technology. The infotainment system allows providing a combination of entertainment and information for an enhanced in-vehicle experience. Technologically advanced infotainment companies are implementing features such as parking recommendations, predictive navigations, pre-trip planning, cloud-enabling syncing, and other essential features. Furthermore, smartphones can be connected with car infotainment via a Wi-Fi hotspot or Bluetooth connectivity. Pairing the smartphone with infotainment system allows the user to access features on the phone. The feature allows consumers to manage incoming, outgoing, and conference calls by infotainment. For instance, in March 2022, Maruti Suzuki entered the line of offering advancement in automotive infotainment system with introducing its all-new Baleno. The car is equipped with Smart Play Pro+ which is top-of-the-line touchscreen infotainment system with an amazing 9-inch display for passengers. While it has all the features of the Smart Play Pro, the company has added several navigation, car play, and advancements made upon the constructive feedbacks from customers.

Highly Upgraded Infotainment System may Hinder the Growth of the Market

Advanced infotainment systems may be just another high-tech challenge that some enthusiasts can’t wait to experience, but several new-vehicle buyers find it complicated to use. They may find these systems to be less informative and more frustrating to use, especially if they ignore the owner's manual directions. Additionally, climate controls, antiquated ‘entertainment’ system, and the AM/FM radio, accompany with music, phone, navigation, and Internet features. As they equipped with number of features, user might need to tap the screen multiple times to move from one feature to the next – assuming the screen reacts quickly.

Collaboration, Partnership, and Advanced Software Technology Expected to Create New Opportunities in the Market

Collaboration & partnership between e-commerce companies and automobile manufacturers are expected to create new growth opportunities for major players in the automotive infotainment market. For instance, in May 2022, ECARX, a global mobility tech company, entered into a merger agreement with COVA Corp., as a leader in the design, development, and delivery of intelligent vehicle technology. ECARX develops hardware and software solutions that are essential for the development of connected, automated, and electrified mobility, which it supplies to the global automotive industry as it rapidly transforms to meet evolving consumer demands. This merger and acquisition will be beneficial to both the companies and its consumers.

Prominent automobile manufacturers are working closely with software development companies for developing a technologically advanced solution that provides an edge over their competitors. In January 2021, General Motors and Cruise took a strategic move by entering into a long-term partnership with Microsoft to accelerate its sales and incorporate cloud computing for self-driving vehicles. The strategic partnership is expected to bring innovations in self-driving vehicles and create new growth opportunities for the automotive infotainment market.

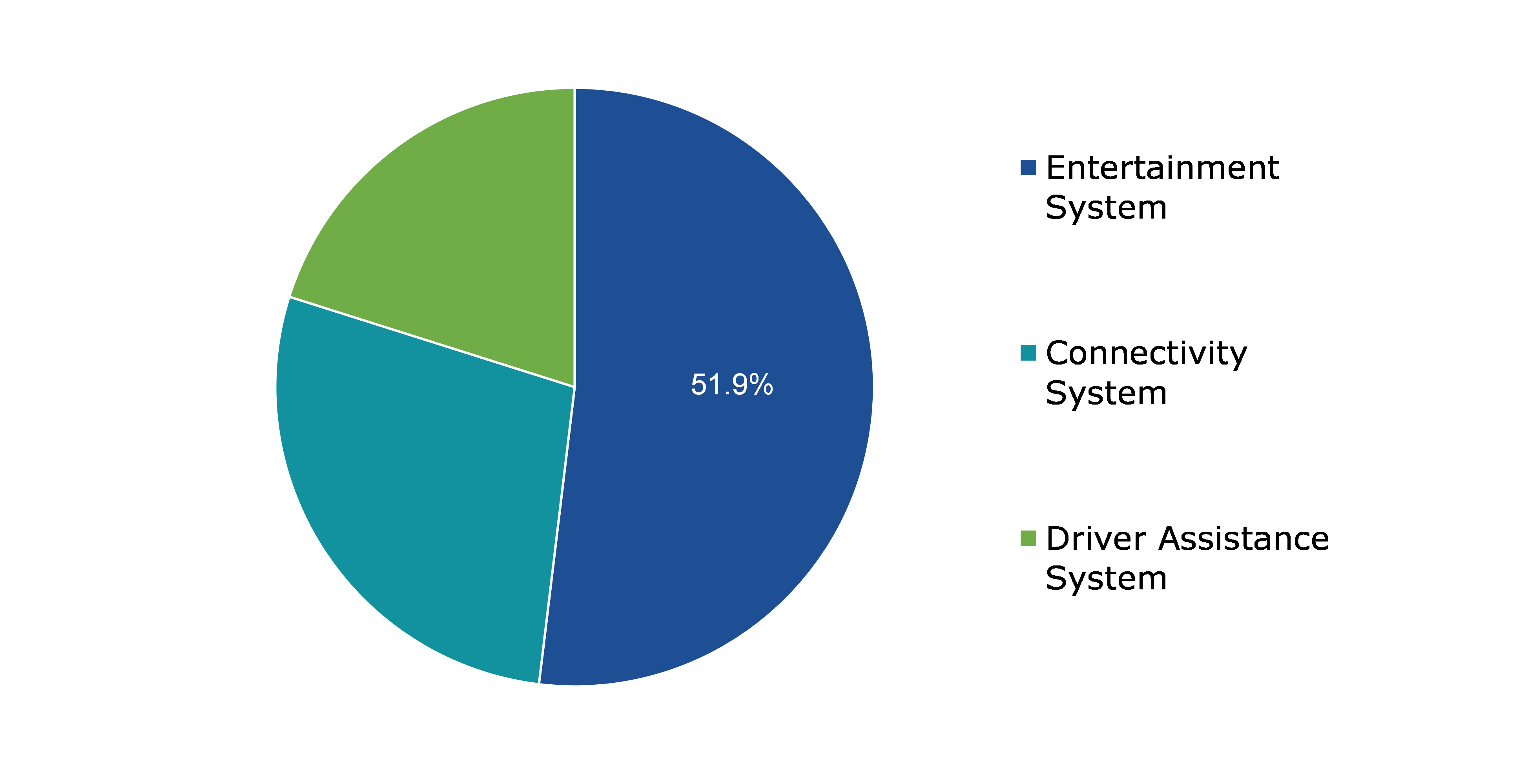

Global Automotive Infotainment Market, by System Type

Based on system type, the market has been divided into entertainment system, connectivity system, and driver assistance system. Among these, the entertainment system sub-segment accounted for the dominating share in the market. Whereas, the connectivity system sub-segment is anticipated to be the fastest growing during the forecast period.

Global Automotive Infotainment Market Share, by System Type, 2021

Source: Research Dive Analysis

The entertainment system sub-segment is predicted to have a dominating market share in the global market and generate a revenue of $10,464.7 million by 2030, growing from $5,209.3 million in 2021. Factors expected to enhance demand for in-car entertainment systems include improved audio/ video interfaces and advanced control features such as touch screen displays, button panel, and voice commands. The system includes automotive navigation systems, video players, USB and Bluetooth connectivity, car-puter, in-car Internet, and Wi-Fi in the vehicles.

The connectivity system sub-segment is predicated to be the fastest growing sub-segment and generate a revenue of $5,920.4 million in 2030, growing from the $2,807.2 million in 2021. The future of mobility is often described as one acronym: ‘CASE’ referring to connectivity, autonomous driving, electrification, and shared mobility. Innovations in automotive connectivity, smart mobility, and automotive Internet of Things (IOT) are geared towards both better experience for the consumer and societal good. CASE technologies aim to lower CO2 emissions, enhance transportation efficiency in smart cities, increase road safety, offer connected vehicle cloud – a connected vehicle platform purpose-built for automotive manufacturers, and others.

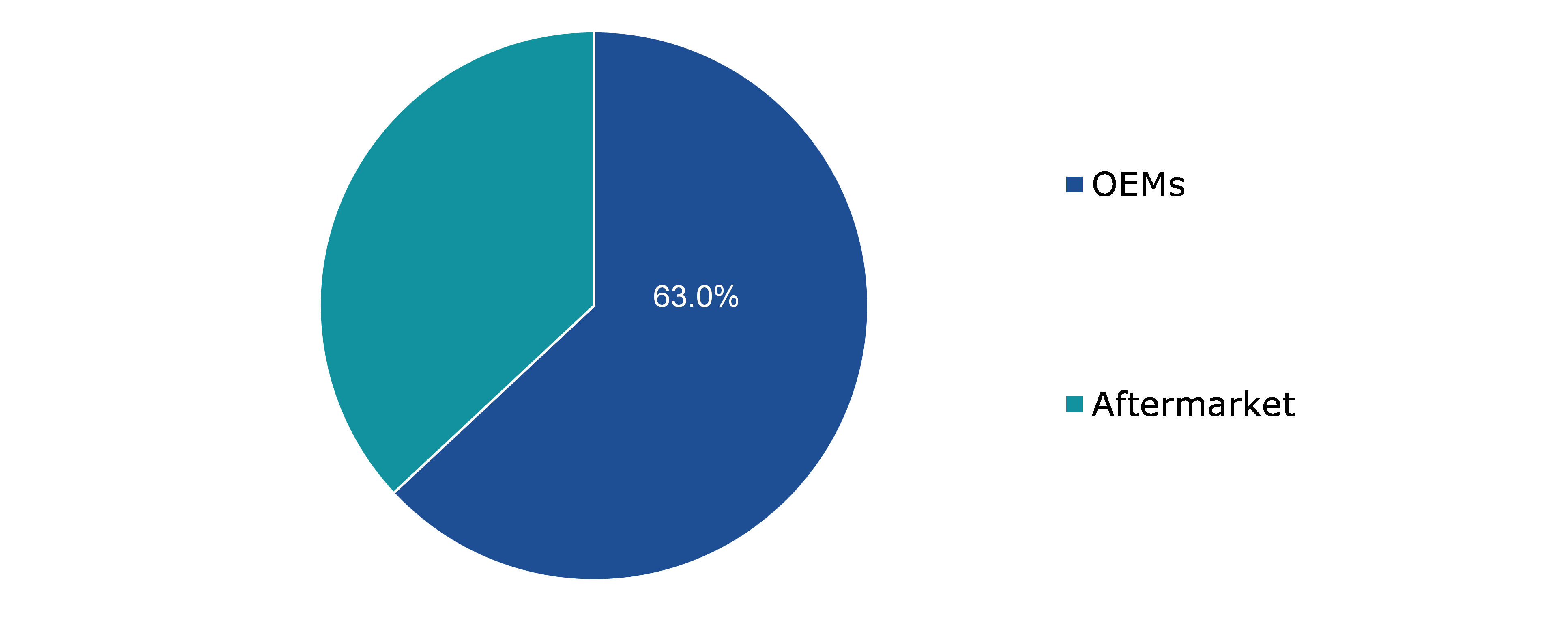

Global Automotive Infotainment Market, by Market Type

Based on market type, the market has been divided into Original Equipment Manufacturers (OEMs) and aftermarket. Among these, the aftermarket sub-segment is anticipated to be the fastest growing in the market. Whereas, the OEMs sub-segment is predicated to be the dominating during the forecast period.

Global Automotive Infotainment Market Share, by Market Type, 2021

Source: Research Dive Analysis

The aftermarket sub-segment is anticipated to have the fastest market growth and is anticipated to generate a revenue of $7,877.9 million by 2030, growing from $3,708.4 million in 2021. There are hundreds of infotainment systems packed with number of features available in the market. Even though most cars come with factory-installed music systems and video systems, the units might not have a lot features to offer. Aftermarket suppliers of car entertainment systems provide these products at a low cost, which is likely to increase demand for these systems. These reasons are accelerating the global expansion of the automotive infotainment market expansion.

The OEMs sub-segment is expected to be the dominating dominant market share and generate a revenue of $12,842.1 million by 2030, growing from $6,327.3million in 2021. Original equipment manufacturer (OEMs) are manufacturers/companies who resell another company’s products under their own name and branding. The first Original Equipment (OE) GPS navigation systems were relatively primitive by modern standards, but the technology progressed quite rapidly. When a more accurate GPS signal was made available to civilians in the early 2000s, OE navigation systems became universal almost overnight. Currently, OE entertainment, navigation, and telematics systems form the hub of many highly-integrated infotainment systems. These powerful infotainment systems often take charge of the climate controls, provide access to vital information about the condition of the engine & other systems, and typically offer navigation option.

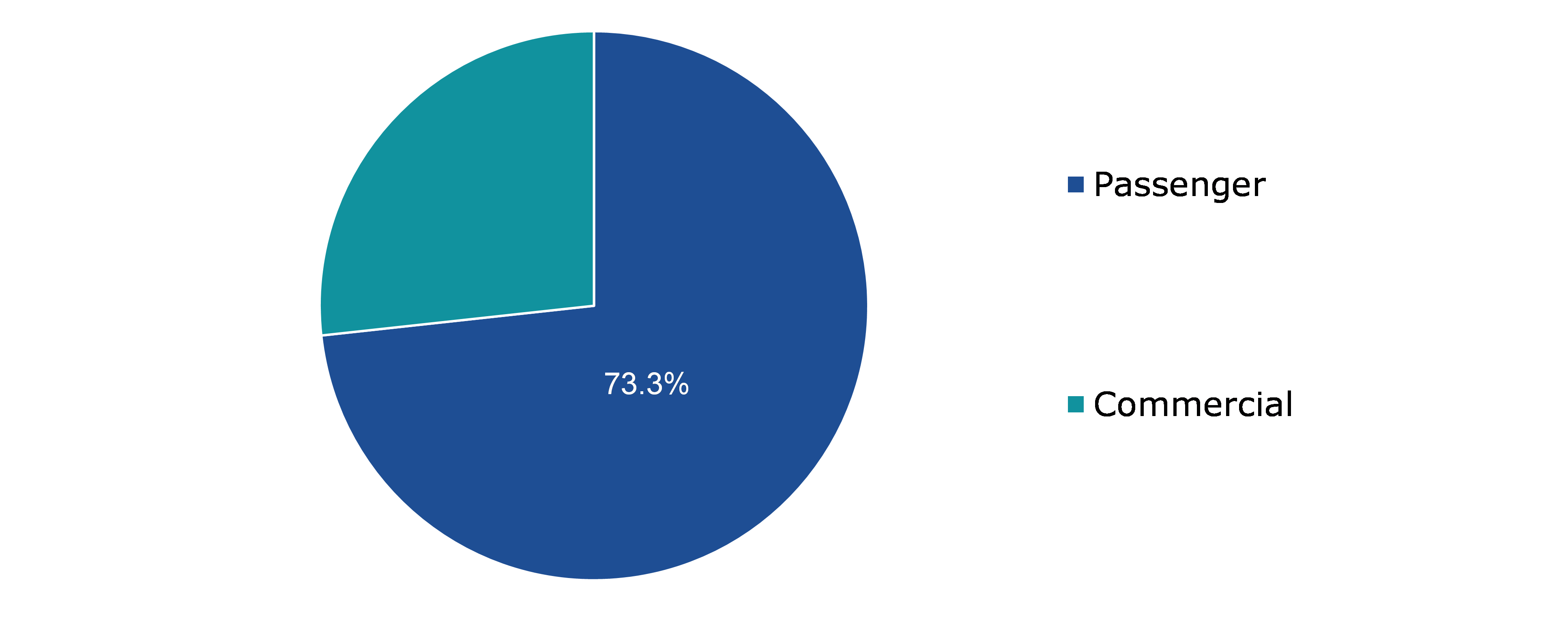

Global Automotive Infotainment Market, by Vehicle Type

Based on vehicle type, the market has been divided into passenger vehicle and commercial vehicle. Among these, the passenger vehicle sub-segment is anticipated to be the fastest growing as well as dominating in the market during the forecast period.

Global Automotive Infotainment Market Share, by Vehicle Type, 2021

Source: Research Dive Analysis

The passenger vehicle sub-segment is predicted to have a dominating market share dominant market share and generate a revenue of $15,451.5million by 2030, growing from $7,353.3million in 2021. The factors that can be attributed to the larger production of passenger cars globally and as well as speedy adoption by consumers coupled with a soaring shift from conventional to electric vehicles. Also, passenger cars offer more technology and safety features, with cabin comforts requiring advanced infotainment systems. Automobile manufacturers provide subscription-based services, better sales, and financing options to customers, making these factors contributors to luxury car sales. Furthermore, companies such as Uber and OLA are trying to make long drives more comfortable and entertaining by making passenger vehicles more interactive and hand-free, thereby maintaining a significant market share.

Global Automotive Infotainment Market, by Region

The automotive infotainment market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Automotive Infotainment Market Size & Forecast, by Region, 20XX-20XX (USD Million)

Source: Research Dive Analysis

The Market for Automotive Infotainment in Asia-Pacific to be the Fastest Growing

Asia-Pacific automotive infotainment is accounted $2,770.9 million in 2021 and is projected to grow with a CAGR of 9.13%. The high demand for automotive infotainment systems is due to an increase in the customer's disposable income within the region. Customers prefer augmented reality technology-based solutions due to their effectiveness. Vehicle production is mostly driven by countries such as China, South Korea, India, and Japan. Thus, increasing vehicle production, along with changing consumer preferences and growing per capita income of the middle-class population, is driving vehicle demand and encouraging automotive OEMs to increase production capacity and offer infotainment systems in the lower-range cars as well.

The Market for Automotive Infotainment in North America to be the Dominating

The market in North America is anticipated to expand at a substantial growth rate during the forecast period. GDP of countries in North America is expanding at a significant growth rate. Moreover, there is an increase in the number of production plants for passenger and commercial vehicles due to high demand for these vehicles in major economies such as Mexico and the U.S. Due to increasing demand for commercial cars and notable investments in advancing technology, commercial vehicle market in North America is expanding at substantial pace. These vehicles are used to transport daily goods and these cars are available with a wide range of innovative infotainment products.

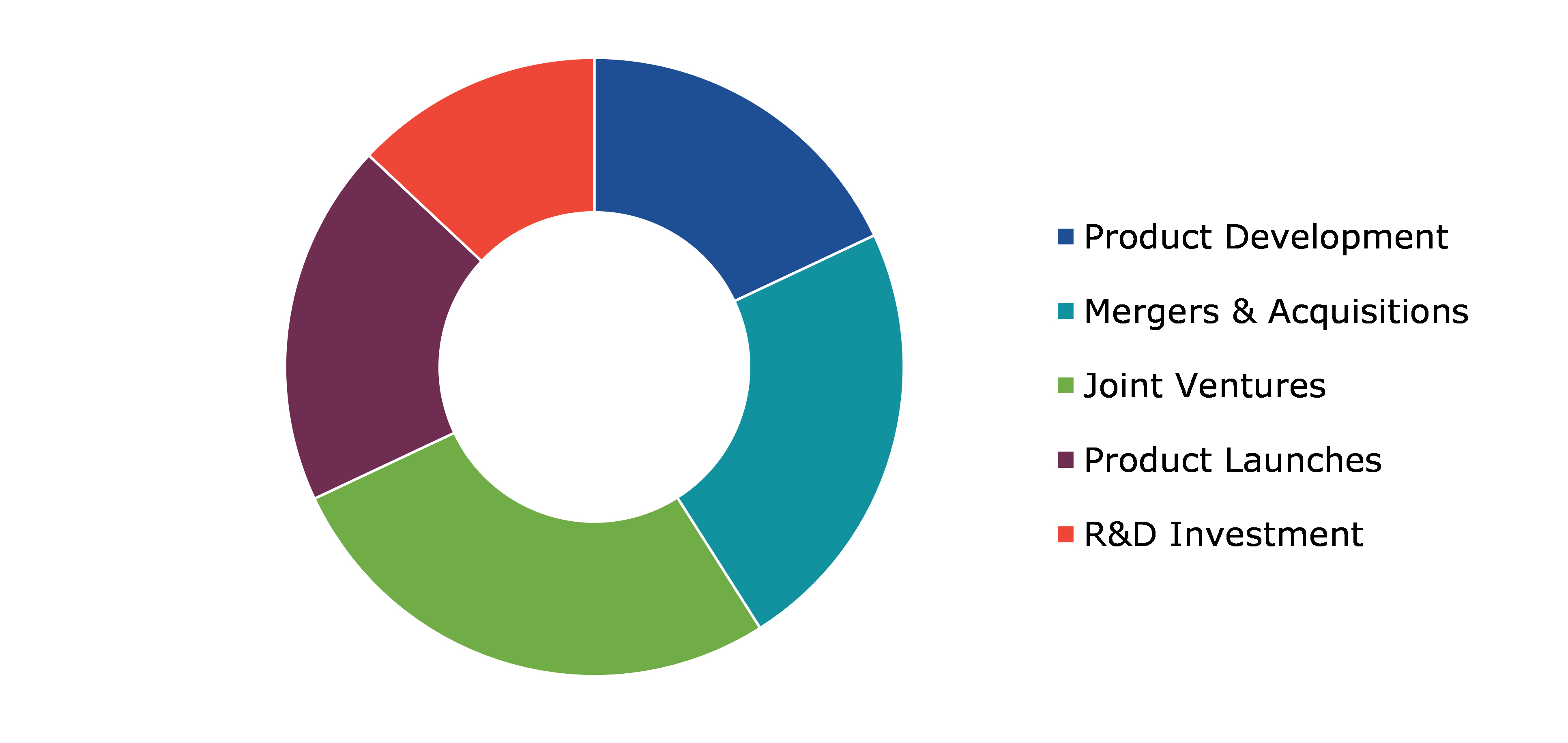

Competitive Scenario in the Global Automotive Infotainment Market

Product launches and mergers & acquisitions are common strategies followed by major market players. For instance, Google’s Android Automotive OS has been gaining traction in the industry, and BMW has announced it will be adopting the platform for some of its future vehicles. The company plans to develop their BMW Operating System 8 infotainment software using Android Automotive for some vehicle models beginning in March 2023, but will also maintain the current Linux-based version for others.

Source: Research Dive Analysis

Some of the leading automotive infotainment market players are Alpine Electronics, Clarion Co., Ltd., Continental AG, Denso Corporation, Harman International, JVC KENWOOD Corporation, Panasonic Corporation, Pioneer Corporation, Robert Bosch, and Mitsubishi Electric Corporation.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2030 |

| Geographical Scope | Asia-Pacific, North America, Europe, and LAMEA |

| Segmentation by System Type |

|

| Segmentation by Market Type |

|

| Segmentation by Vehicle Type |

|

| Key Companies Profiled |

|

Q1. What is the size of the global automotive infotainment market?

A. The size of the global automotive infotainment market was over $10,035.7 million in 2021 and is projected to reach $ 20,720 million by 2030.

Q2. Which are the major companies in the automotive infotainment market?

A. Harman International, Robert Bosch and Mitsubishi Electric Corporation are some of the key players in the global automotive infotainment market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific automotive infotainment market?

A. Asia-Pacific automotive infotainment market is anticipated to grow at 9.13% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product launches and mergers & acquisitions the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Panasonic Corporation, Continental AG, Alpine Electronics, and Clarion Co., Ltd. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global automotive infotainment market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on automotive infotainment market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Automotive Infotainment Market Analysis, by System Type

5.1.Overview

5.2.Entertainment System

5.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.2.2.Market size analysis, by region, 2021-2030

5.2.3.Market share analysis, by country, 2021-2030

5.3.Connectivity system

5.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.3.2.Market size analysis, by region, 2021-2030

5.3.3.Market share analysis, by country, 2021-2030

5.4.Driver Assistance System

5.4.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.4.2.Market size analysis, by region, 2021-2030

5.4.3.Market share analysis, by country, 2021-2030

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness, 2021-2030

5.5.2.Competition heatmap, 2021-2030

6.Automotive Infotainment Market Analysis, by Market Type

6.1.Original Equipment Manufacturers (OEMs)

6.1.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.1.2.Market size analysis, by region, 2021-2030

6.1.3.Market share analysis, by country, 2021-2030

6.2.Aftermarket

6.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.2.2.Market size analysis, by region, 2021-2030

6.2.3.Market share analysis, by country, 2021-2030

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness, 2021-2030

6.3.2.Competition heatmap, 2021-2030

7.Automotive Infotainment Market Analysis, by Vehicle type

7.1.Passenger Vehicle

7.1.1.Definition, key trends, growth factors, and opportunities, 2021-2030

7.1.2.Market size analysis, by region, 2021-2030

7.1.3.Market share analysis, by country, 2021-2030

7.2.Commercial Vehicle

7.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

7.2.2.Market size analysis, by region, 2021-2030

7.2.3.Market share analysis, by country, 2021-2030

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness, 2021-2030

7.3.2.Competition heatmap, 2021-2030

8.Automotive Infotainment Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by System Type, 2021-2030

8.1.1.2.Market size analysis, by Market Type, 2021-2030

8.1.1.3.Market size analysis, by Vehicle Type, 2021-2030

8.1.2.Canada

8.1.2.1.Market size analysis, by System Type, 2021-2030

8.1.2.2.Market size analysis, by Market Type, 2021-2030

8.1.2.3.Market size analysis, by Vehicle Type, 2021-2030

8.1.3.Mexico

8.1.3.1.Market size analysis, by System Type, 2021-2030

8.1.3.2.Market size analysis, by Market Type, 2021-2030

8.1.3.3.Market size analysis, by Vehicle Type, 2021-2030

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness, 2021-2030

8.1.4.2.Competition heatmap, 2021-2030

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by System Type, 2021-2030

8.2.1.2.Market size analysis, by Market Type, 2021-2030

8.2.1.3.Market size analysis, by Vehicle Type, 2021-2030

8.2.2.U.K.

8.2.2.1.Market size analysis, by System Type, 2021-2030

8.2.2.2.Market size analysis, by Market Type, 2021-2030

8.2.2.3.Market size analysis, by Vehicle Type, 2021-2030

8.2.3.France

8.2.3.1.Market size analysis, by System Type, 2021-2030

8.2.3.2.Market size analysis, by Market Type, 2021-2030

8.2.3.3.Market size analysis, by Vehicle Type, 2021-2030

8.2.4.Spain

8.2.4.1.Market size analysis, by System Type, 2021-2030

8.2.4.2.Market size analysis, by Market Type, 2021-2030

8.2.4.3.Market size analysis, by Vehicle Type, 2021-2030

8.2.5.Italy

8.2.5.1.Market size analysis, by System Type, 2021-2030

8.2.5.2.Market size analysis, by Market Type, 2021-2030

8.2.5.3.Market size analysis, by Vehicle Type, 2021-2030

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by System Type, 2021-2030

8.2.6.2.Market size analysis, by Market Type, 2021-2030

8.2.6.3.Market size analysis, by Vehicle Type, 2021-2030

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness, 2021-2030

8.2.7.2.Competition heatmap, 2021-2030

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by System Type, 2021-2030

8.3.1.2.Market size analysis, by Market Type, 2021-2030

8.3.1.3.Market size analysis, by Vehicle Type, 2021-2030

8.3.2.Japan

8.3.2.1.Market size analysis, by System Type, 2021-2030

8.3.2.2.Market size analysis, by Market Type, 2021-2030

8.3.2.3.Market size analysis, by Vehicle Type, 2021-2030

8.3.3.India

8.3.3.1.Market size analysis, by System Type, 2021-2030

8.3.3.2.Market size analysis, by Market Type, 2021-2030

8.3.3.3.Market size analysis, by Vehicle Type, 2021-2030

8.3.4.Australia

8.3.4.1.Market size analysis, by System Type, 2021-2030

8.3.4.2.Market size analysis, by Market Type, 2021-2030

8.3.4.3.Market size analysis, by Vehicle Type, 2021-2030

8.3.5.South Korea

8.3.5.1.Market size analysis, by System Type, 2021-2030

8.3.5.2.Market size analysis, by Market Type, 2021-2030

8.3.5.3.Market size analysis, by Vehicle Type, 2021-2030

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by System Type, 2021-2030

8.3.6.2.Market size analysis, by Market Type, 2021-2030

8.3.6.3.Market size analysis, by Vehicle Type, 2021-2030

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness, 2021-2030

8.3.7.2.Competition heatmap, 2021-2030

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by System Type, 2021-2030

8.4.1.2.Market size analysis, by Market Type, 2021-2030

8.4.1.3.Market size analysis, by Vehicle Type, 2021-2030

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by System Type, 2021-2030

8.4.2.2.Market size analysis, by Market Type, 2021-2030

8.4.2.3.Market size analysis, by Vehicle Type, 2021-2030

8.4.3.UAE

8.4.3.1.Market size analysis, by System Type, 2021-2030

8.4.3.2.Market size analysis, by Market Type, 2021-2030

8.4.3.3.Market size analysis, by Vehicle Type, 2021-2030

8.4.4.South Africa

8.4.4.1.Market size analysis, by System Type, 2021-2030

8.4.4.2.Market size analysis, by Market Type, 2021-2030

8.4.4.3.Market size analysis, by Vehicle Type, 2021-2030

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by System Type, 2021-2030

8.4.5.2.Market size analysis, by Market Type, 2021-2030

8.4.5.3.Market size analysis, by Vehicle Type, 2021-2030

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness, 2021-2030

8.4.6.2.Competition heatmap, 2021-2030

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1. Alpine Electronics

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Clarion Co., Ltd

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Continental AG

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4. Denso Corporation

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Herman International

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.JVC KENWOOD Corporation

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Panasonic Corporation

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Pioneer Corporation

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Robert Bosch

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Mitsubishi Electric Corporation

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

With the rising demand for luxury, safety, and smart features in vehicles, automobile makers are progressively developing vehicles with in-built infotainment systems – which offer a combination of entertainment as well as information for a boosted in-vehicle experience. The term Infotainment” (IVI) is becoming highly imperative for automakers and is currently seen as a novel technology that has taken the place of a radio unit inside a car.

The Evolution of Automotive Infotainment Systems

Diving into the future, infotainment systems are expected to progress considerably. As per a report by Research Dive, the global automotive infotainment market is foreseen to grow at a CAGR of 8.32% and garner a revenue of $20,720 million by 2030. This growth is chiefly owing to the rising adoption of infotainment systems in cars by automakers.

As autonomous driving is gaining prominence, the entertainment angle is gradually taking over, and huge, safe, daytime visible displays are becoming an essential element. Along with passenger and rear seat screens, improvements in flexible screens denote that auxiliary screens will endure to gain demand in the coming years.

Technologies such, as Alexa or Google voice integration, have already obtained key significance in modern-day cars, and besides all the web centric features, managing auxiliary car features, navigation as well as entertainment through voice is possibly far safe and easy.

The integration of voice in cars also facilitates original equipment manufacturers (OEMs) an ideal solution to the discoverability challenge. The extensive array of features in modern-day vehicles and the large investments OEMs make to develop them are paying way for the smarter transportation systems of the future.

Key Trends & Developments in the Global Automotive Infotainment Market

The technologies inside the cabin of today’s cars have turned out to be the most important, as they boost drive competencies and enhance safety features in present times.

Among many other technologies, the infotainment systems have become the key focus of almost every car maker. With technological innovations, these systems are not only packed to the rim with gadgets and technology competences but are also growing in dimensions.

Some of the leading players of the automotive infotainment market are Alpine Electronics, Clarion Co., Ltd., Continental AG, Denso Corporation, Harman International, JVC KENWOOD Corporation, Panasonic Corporation, Pioneer Corporation, Robert Bosch, and Mitsubishi Electric Corporation. Market players are focused on developing strategies such as partnerships, product development, mergers and acquisitions, and collaborations to achieve a foremost position in the global market. For instance,

- In July 2018, Blaupunkt, a German manufacturer of mostly car audio equipment, launched Osaka 760 and Monte Carlo 760 in the Indian market. These are the first car infotainment systems from the company that will support Apple Car Play as well as Android Auto.

- In July 2020, Pioneer, a leading developer of car audio and DJ Equipment products, launched 3 Amazon Alexa enabled car infotainment systems: DMH-Z6350BT with 6.8-inch touchscreen, DMH-ZS9350BT with 9-inch touchscreen system, and DMH-ZF9350BT with a 9-inch system but with a floating design.

- In September 2021, Tata Motors, an Indian multinational automotive manufacturing company, installed the Harman touchscreen infotainment system in the upcoming Punch micro-SUV, well before of its expected launch.

Impact of the COVID-19 Pandemic on the Global Automotive Infotainment Market

The sudden outburst of the coronavirus pandemic has negatively impacted the global automotive infotainment market. The implementation of stringent lockdown rules to avert the spread of the virus had caused disruptions in the supply chain and normal functioning of the automotive industry. This has greatly affected the demand as well as supply of infotainment systems, thus hindering its market growth. However, as the pandemic situation is relaxing, automakers are gearing up to boost car manufacturing with advance features, which is likely to propel the growth of the global automotive infotainment market in the near future.

Most Profitable Region

The North America automotive infotainment market is anticipated to expand at a substantial growth rate and generate dominant revenue during the forecast period. This growth of the region is majorly owing to the expansion of GDP of the countries in the region at a significant rate and the rising number of production plants for commercial as well as passenger vehicles due to high demand from the U.S. and Mexico.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com