IoT Insurance Market Report

RA08411

IoT Insurance Market by Insurance Type (Life Insurance, Property & Casualty (P&C), Insurance, Health Insurance, and Others), Application (Automotive, Transportation & Logistics, Life & Health, Commercial & Residential Buildings, Business & Enterprise, and Agriculture), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2020–2027

Global IoT Insurance Market Analysis

The global IoT insurance market accounted for $13,540.0 million in 2020 and is predicted to grow with a CAGR of 54.4% by generating a revenue of $402,990.0 million by 2027.

Market Synopsis

Growing use of IoT products is predicted to be the major driving factor for the global IoT insurance market growth in the estimated period.

However, the lack of skilled labors is a major restraint for the market in the forecast period.

According to the regional analysis, the North America IoT insurance market accounted for $3,984.8 million in 2020 and is predicted to grow with a CAGR of 53.6% in the projected timeframe.

IoT Insurance Overview

IOT insurance is used to help and create better insurance products which predict and evaluate risk, make claim process more efficient, and improve customer experience. IOT connected insurance uses data from connected devices to evaluate risk more accurately.

Impact Analysis of COVID-19 on the Global IoT Insurance Market

The pandemic created a positive impact on the global IoT insurance market. IOT in the insurance sector has played an important role giving organizations a better understanding of the insurer. Most people adopted the insurance to protect themselves unforeseen events resulting due to the novel coronavirus pandemic. With the help of cloud managed services and connected devices, the insurance company could get the details of customers who needed and purchased the insurance.

Rise in the Demand for IoT Products in the Insurance Sector to Boost the Market

The global IoT insurance market is predicted to experience growth due to the rise in the adoption of IoT products and related services among the customers. The Internet of Things (IoT) is a network of internet-connected devices transmitting, collecting, and sharing data. IoT-connected insurance uses data from internet-connected devices to improve the understanding of risks. Insurance sector has adopted IoT vastly so that they can track the consumer health and manage and mitigate risks. Advances in IoT can improve productivity, overall profitability of the business, and the profile the amount of risk.

Moreover, increasing adoption of cloud services is predicted to drive the market in the forecast period. At present, the insurance sector relies on IT and networks vastly for adoption of cloud technology. Cloud services help the person to keep a track claim the insurance with ease.

Moreover, implementation of the AI in the IoT Insurance is predicted to create more investment opportunities for the global IoT insurance market in the estimated period.

To know more about global IoT insurance market drivers, get in touch with our analysts here.

Lack of Skilled Labor and Higher Cost Involved in Implementing IoT is Predicted to Hinder the Market Growth

IoT Insurance is expensive for companies. The software used for operating IoT Insurance is expensive high and the funds required to maintain the network cost high for the organization. Organizations outsource the maintenance of these assets to companies that can operate using cloud services. Moreover, the unavailability of the skilled labor in the market is predicted to hinder the market in the forecast period.

To know more about global IoT insurance market opportunities, get in touch with our analysts here.

IoT Insurance Market

By Insurance TypeBased on insurance type, the IoT Insurance market has been divided into life insurance, property, and casualty (P&C) insurance, Health Insurance and others. The Health Insurance sub-segment is projected to generate the maximum revenue and life insurance sub-segment is predicted to have the maximum growth rate.

Source: Research Dive Analysis

The health insurance sub-segment is predicted to have a dominating market share in the global market. The health insurance sub-segment accounted for $4,055.6 million in 2020 and is predicted to grow with a CAGR of 53.9% in the estimated period. Increasing popularity of IoT in health insurance which helps in determining the trend of replacing long-term insurance policies with short-term customized solutions is predicted to boost the sub-segment market in the estimated period.

The life insurance sub-segment is predicted to have the maximum market share in the global market. The life insurance sub-segment accounted for $3,250.0 million in 2020 and is predicted to grow with a CAGR of 55.2% in the estimated period. Increasing awareness among people for securing life of their families is predicted to drive the sub-segment market in the estimated period.

IoT Insurance Market

By ApplicationOn the basis of application, the market has been sub-segmented into automotive transportation & logistics, Life & Health, commercial & residential buildings, business & enterprise, agriculture and others. The Life & Health sub-segment is estimated to have the maximum market share and maximum growth rate in the estimated period.

Source: Research Dive Analysis

The life & health sub-segment of the global IoT Insurance market is predicted to have the highest market share in terms of revenue along with maximum growth rate in the estimated period. Life and health sub-segment accounted for $3,145.2 million in 2020 and is predicted to grow with a CAGR of 55.2% in the estimated period. Life and health insurance for securing life among the consumer and better tracking of health of the consumer by the insurance companies is predicted to drive the sub-segment market in the estimated period.

IoT Insurance Market

By RegionThe IoT Insurance market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for IoT Insurance in North America to be the Most Dominant

The North America IoT Insurance market accounted $3,984.8 million in 2020 and is projected to grow with a CAGR of 53.6%. The growth of the North American market is mainly driven due to the presence of large number of IT companies that provide cloud services to the insurance companies where they can store all the related data. Moreover, the headquarters of major key players in the insurance market are also located in the region which is predicted to boost the region market in the estimated period.

The Market for IoT Insurance in Asia-Pacific to be the Fastest Growing

The Asia-Pacific IoT Insurance market registered a revenue of $3,276.7 million in 2020 and is anticipated to grow at a CAGR of 55.5% in the forecast period. Increasing investment by majority of the company and availability of low wages worker in the region is predicted to be the major driving factor for the region market in the estimated period.

Competitive Scenario in the Global IoT Insurance Market

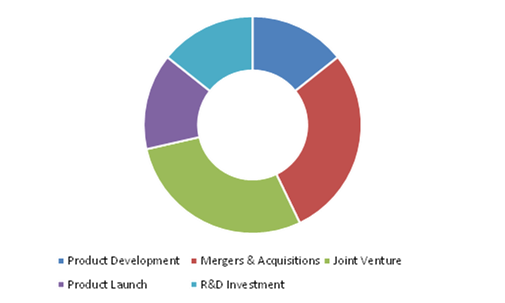

Product launches and collaboration are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading IoT Insurance market players are SAP SE, Cisco Systems Inc., Alphabet, International Business Machines Corporation, Accenture PLC, Microsoft Corporation, Oracle Corporation Aeris Group Ltd, Concirrus and Telit among others.

Porter’s Five Forces Analysis for the Global IoT Insurance Market:

- Bargaining Power of Suppliers: The switching cost from one supplier to another is projected to be low.

Thus, the bargaining power suppliers is low. - Bargaining Power of Buyers: In this market, the concentration of buyers is high

Thus, buyer’s bargaining power will be moderate. - Threat of New Entrants: Huge investment is required to adopt the technological advancements in building automation system.

Thus, the threat of the new entrants is low. - Threat of Substitutes: There are very less numerous alternative products in the IoT Insurance market.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: Due to the presence of large number of manufacturers there is huge competitive rivalry among the suppliers and manufacturers.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2020-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Insurance Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global IoT Insurance market?

A. The size of the global IoT Insurance market was over $13,540.0 million in 2020 and is projected to reach $402,990.0 million by 2027.

Q2. Which are the major companies in the IoT Insurance market?

A. IBM and SAP SE are some of the key players in the global IoT Insurance market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific IoT Insurance market?

A. Asia Pacific IoT Insurance market is anticipated to grow at 55.5% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product development and merger and acquisition are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. IBM is the company investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Insurance Type trends

2.3.Application trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.IoT Insurance Market, by Insurance Type

4.1.Life Insurance

4.1.1.Market size and forecast, by region, 2020-2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.Property & Casualty (P&C) Insurance

4.2.1.Market size and forecast, by region, 2020-2028

4.2.2.Comparative market share analysis, 2020 & 2028

4.3.Health Insurance

4.3.1.Market size and forecast, by region, 2020-2028

4.3.2.Comparative market share analysis, 2020 & 2028

4.4.Others

4.4.1.Market size and forecast, by region, 2020-2028

4.4.2.Comparative market share analysis, 2020 & 2028

5.IoT Insurance Market, by Application

5.1.Automotive Transportation & Logistics

5.1.1.Market size and forecast, by region, 2020-2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Life & Health

5.2.1.Market size and forecast, by region, 2020-2028

5.2.2.Comparative market share analysis, 2020 & 2028

5.3.Commercial & Residential Buildings

5.3.1.Market size and forecast, by region, 2020-2028

5.3.2.Comparative market share analysis, 2020 & 2028

5.4.Business & Enterprise

5.4.1.Market size and forecast, by region, 2020-2028

5.4.2.Comparative market share analysis, 2020 & 2028

5.5.Agriculture

5.5.1.Market size and forecast, by region, 2020-2028

5.5.2.Comparative market share analysis, 2020 & 2028

5.6.Others

5.6.1.Market size and forecast, by region, 2020-2028

5.6.2.Comparative market share analysis, 2020 & 2028

6.IoT Insurance Market, by Region

6.1.North America

6.1.1.Market size and forecast, by Insurance Type, 2020-2028

6.1.2.Market size and forecast, by Application, 2020-2028

6.1.3.Comparative market share analysis, 2020 & 2028

6.1.4.U.S.

6.1.4.1.Market size and forecast, by Insurance Type, 2020-2028

6.1.4.2.Market size and forecast, by Application, 2020-2028

6.1.4.3.Comparative market share analysis, 2020 & 2028

6.1.5.Canada

6.1.5.1.Market size and forecast, by Insurance Type, 2020-2028

6.1.5.2.Market size and forecast, by Application, 2020-2028

6.1.5.3.Comparative market share analysis, 2020 & 2028

6.1.6.Mexico

6.1.6.1.Market size and forecast, by Insurance Type, 2020-2028

6.1.6.2.Market size and forecast, by Application, 2020-2028

6.1.6.3.Comparative market share analysis, 2020 & 2028

6.2.Europe

6.2.1.Market size and forecast, by Insurance Type, 2020-2028

6.2.2.Market size and forecast, by Application, 2020-2028

6.2.3.Market size and forecast, by country, 2020-2028

6.2.4.Comparative market share analysis, 2020 & 2028

6.2.5.Germany

6.2.5.1.Market size and forecast, by Insurance Type, 2020-2028

6.2.5.2.Market size and forecast, by Application, 2020-2028

6.2.5.3.Comparative market share analysis, 2020 & 2028

6.2.6.UK

6.2.6.1.Market size and forecast, by Insurance Type, 2020-2028

6.2.6.2.Market size and forecast, by Application, 2020-2028

6.2.6.3.Comparative market share analysis, 2020 & 2028

6.2.7.France

6.2.7.1.Market size and forecast, by Insurance Type, 2020-2028

6.2.7.2.Market size and forecast, by Application, 2020-2028

6.2.7.3.Comparative market share analysis, 2020 & 2028

6.2.8.Russia

6.2.8.1.Market size and forecast, by Insurance Type, 2020-2028

6.2.8.2.Market size and forecast, by Application, 2020-2028

6.2.8.3.Comparative market share analysis, 2020 & 2028

6.2.9.Italy

6.2.9.1.Market size and forecast, by Insurance Type, 2020-2028

6.2.9.2.Market size and forecast, by Application, 2020-2028

6.2.9.3.Comparative market share analysis, 2020 & 2028

6.2.10.Rest of Europe

6.2.10.1.Market size and forecast, by Insurance Type, 2020-2028

6.2.10.2.Market size and forecast, by Application, 2020-2028

6.2.10.3.Comparative market share analysis, 2020 & 2028

6.3.Asia Pacific

6.3.1.Market size and forecast, by Insurance Type, 2020-2028

6.3.2.Market size and forecast, by Application, 2020-2028

6.3.3.Market size and forecast, by country, 2020-2028

6.3.4.Comparative market share analysis, 2020 & 2028

6.3.5.China

6.3.5.1.Market size and forecast, by Insurance Type, 2020-2028

6.3.5.2.Market size and forecast, by Application, 2020-2028

6.3.5.3.Comparative market share analysis, 2020 & 2028

6.3.6.Japan

6.3.6.1.Market size and forecast, by Insurance Type, 2020-2028

6.3.6.2.Market size and forecast, by Application, 2020-2028

6.3.6.3.Comparative market share analysis, 2020 & 2028

6.3.7.India

6.3.7.1.Market size and forecast, by Insurance Type, 2020-2028

6.3.7.2.Market size and forecast, by Application, 2020-2028

6.3.7.3.Comparative market share analysis, 2020 & 2028

6.3.8.Australia

6.3.8.1.Market size and forecast, by Insurance Type, 2020-2028

6.3.8.2.Market size and forecast, by Application, 2020-2028

6.3.8.3.Comparative market share analysis, 2020 & 2028

6.3.9.South Korea

6.3.9.1.Market size and forecast, by Insurance Type, 2020-2028

6.3.9.2.Market size and forecast, by Application, 2020-2028

6.3.9.3.Comparative market share analysis, 2020 & 2028

6.3.10.Rest of Asia-Pacific

6.3.10.1.Market size and forecast, by Insurance Type, 2020-2028

6.3.10.2.Market size and forecast, by Application, 2020-2028

6.3.10.3.Comparative market share analysis, 2020 & 2028

6.4.LAMEA

6.4.1.Market size and forecast, by Insurance Type, 2020-2028

6.4.2.Market size and forecast, by Application, 2020-2028

6.4.3.Market size and forecast, by country, 2020-2028

6.4.4.Comparative market share analysis, 2020 & 2028

6.4.5.Latin America

6.4.5.1.Market size and forecast, by Insurance Type, 2020-2028

6.4.5.2.Market size and forecast, by Application, 2020-2028

6.4.5.3.Comparative market share analysis, 2020 & 2028

6.4.6.Middle East

6.4.6.1.Market size and forecast, by Insurance Type, 2020-2028

6.4.6.2.Market size and forecast, by Application, 2020-2028

6.4.6.3.Comparative market share analysis, 2020 & 2028

6.4.7.Africa

6.4.7.1.Market size and forecast, by Insurance Type, 2020-2028

6.4.7.2.Market size and forecast, by Application, 2020-2028

6.4.7.3.Comparative market share analysis, 2020 & 2028

6.4.8.Rest of LAMEA

6.4.8.1.Market size and forecast, by Insurance Type, 2020-2028

6.4.8.2.Market size and forecast, by Application, 2020-2028

6.4.8.3.Comparative market share analysis, 2020 & 2028

7.Company profiles

7.1.SAP SE

7.1.1.Business overview

7.1.2.Financial performance

7.1.3.Product portfolio

7.1.4.Recent strategic moves & developments

7.1.5.SWOT analysis

7.2.Cisco Systems Inc.

7.2.1.Business overview

7.2.2.Financial performance

7.2.3.Product portfolio

7.2.4.Recent strategic moves & developments

7.2.5.SWOT analysis

7.3.Alphabet

7.3.1.Business overview

7.3.2.Financial performance

7.3.3.Product portfolio

7.3.4.Recent strategic moves & developments

7.3.5.SWOT analysis

7.4.International Business Machines Corporation

7.4.1.Business overview

7.4.2.Financial performance

7.4.3.Product portfolio

7.4.4.Recent strategic moves & developments

7.4.5.SWOT analysis

7.5.Accenture PLC

7.5.1.Business overview

7.5.2.Financial performance

7.5.3.Product portfolio

7.5.4.Recent strategic moves & developments

7.5.5.SWOT analysis

7.6.Microsoft Corporation

7.6.1.Business overview

7.6.2.Financial performance

7.6.3.Product portfolio

7.6.4.Recent strategic moves & developments

7.6.5.SWOT analysis

7.7.Oracle Corporation

7.7.1.Business overview

7.7.2.Financial performance

7.7.3.Product portfolio

7.7.4.Recent strategic moves & developments

7.7.5.SWOT analysis

7.8.Aeris Group Ltd

7.8.1.Business overview

7.8.2.Financial performance

7.8.3.Product portfolio

7.8.4.Recent strategic moves & developments

7.8.5.SWOT analysis

7.9.Concirrus

7.9.1.Business overview

7.9.2.Financial performance

7.9.3.Product portfolio

7.9.4.Recent strategic moves & developments

7.9.5.SWOT analysis

7.10.Telit

7.10.1.Business overview

7.10.2.Financial performance

7.10.3.Product portfolio

7.10.4.Recent strategic moves & developments

7.10.5.SWOT analysis

Novel technologies are restructuring the insurance sector and opening novel opportunities in areas such as Property and casualty (P&C), health, life, and auto and re-insurance markets. Nowadays, insurance companies are implementing internet of things (IoT) to reorganize field operations, accurately analyze risks, enhance customer engagement, keep pace with compliance, and improve competitive advantage.

IoT technology has entered customers’ everyday lives and renovated business models in various industrial verticals. The implementation of IoT in the insurance sector is paving way for novel opportunities for insurers for developing novel products, open new distribution channels, and outspread their role to include estimation, avoidance, and support in terms of threat.

Why is the Demand for IoT Insurance Rising?

Until now, insurers have mostly utilized IoT technology to enable communications with customers and to fast-track and streamline underwriting as well as claim processing. However, the growing developments in advanced IoT-based service and business models is highly attracting insurers’ attention. In advanced business models, digital networking using IoT can become a tactical factor for insurers. IoT-connected insurance uses information from internet-connected devices to enhance the understanding of threats.

IoT technologies empower insurance providers in determining threats more accurately. For instance, auto insurers have been relying on indirect signs, such as a driver’s address, age, and creditworthiness while setting insurance premiums. Use of IoT technology can help insurers in assessing the risk more precisely.

According to a report by Research Dive, the global IoT insurance market is foreseen to garner $402,990.0 million by 2027, at a striking CAGR of 54.0% from 2020 to 2027. The widespread growth of the market is mainly owing to the rising adoption of IoT technology among the customers. The insurance sector has started implementing IoT massively to track the consumers’ health, and manage and mitigate threats. Further advancements in the IoT technology can enhance overall productivity and efficiency of the business and also estimate the scope of risk.

In addition, the growing usage of cloud services in various sectors is significantly contributing to the growth of the global IoT insurance market. Cloud technology helps the person to maintain a track and claim the insurance without any difficulty. In the recent years, the insurance sector has greatly shifted to digital and is majorly reliant on IT networks for the implementation of cloud technology.

Additionally, the execution of the artificial intelligence in the IoT Insurance platforms is foreseen to be extremely promising for the market growth in the future years. All these factors, are likely to boost the global market growth in the coming years.

Recent trends in the IoT Insurance Market

The IoT insurance market is highly competitive with the presence of both small as well as large scale Iot insurance providers in the global market. Some of the leading IoT insurance market players are Alphabet, SAP SE, Cisco Systems Inc., International Business Machines Corporation, Accenture PLC, Microsoft Corporation, Concirrus, Oracle Corporation Aeris Group Ltd, Telit, and others. These players are performing unique strategies such as partnerships and agreements, collaborations, new product launches, and others, to obtain a competitive edge in the global market. For instance,

- In May 2018, in cooperation with a group of investors, Talkpool, a global provider of IoT solutions and telecommunication network services, founded Nordic IoT Networks (Niot) with an aim to safeguard a quick roll out of a LoRa network. This initiative is undertaken with an aim to fulfill the growing customer demands for IoT services owing to the rising number of IoT projects and deployment of sensors.

- In April 2021, the enterprise arm of Vodafone Idea (VIL), Vi Business, reinforced its IoT product range with the launch of Integrated IoT solutions for enterprises. With this launch, Vodafone Idea has become the only telecom firm in India to provide a secure end-to-end IoT solution that includes hardware, connectivity, network, analytics, security, application, and support.

- In June 2021, Chubb, the world's largest publicly traded property & casualty insurance company, serving consumers & companies of all sizes, launched its Internet of Things (IoT) service in Colombia. This service facilitates risk management to insured companies through integrated monitoring of their critical systems. This technology also helps insured companies in real time monitoring of their operations and predict risks to cope with conditions that might affect their security and operational permanency.

Impact of COVID-19 on the Global IoT Insurance Market

With the outburst of the COVID-19 pandemic in 2020, the global IoT insurance market experienced accelerated growth. Implementation of IOT in the insurance sector has played a vital role, thus giving various companies a better understanding of the insurer. Most people have invested in insurance policies to safeguard themselves from unforeseen events during these unprecedented times. It is expected that the global IoT insurance market will observe significant growth even after the relaxation of the COVID-19 pandemic.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com