India AAC Blocks And Non-reinforced Panels Market Report

RA08393

India AAC Blocks and Non-reinforced Panels Market by Product Type (AAC Blocks and Non-reinforced Panels), End User (Residential, Commercial, and Others), and Regional Analysis (Bangalore, Chennai, and Hyderabad): Industry Forecast, 2020–2027

India AAC Blocks and Non-reinforced Panels Market Analysis

The India AAC blocks and non-reinforced panels market is predicted to garner 11095.0 thousand cubic meters in the 2020–2027 timeframe, growing from 5323.8 thousand cubic meters in 2019 at a healthy CAGR of 14.3%.

Market Synopsis

Growth in the infrastructure sector, growing preferences for low-cost houses, and an ever-increasing focus on green and soundproof buildings are the factors driving the market.

However, the cost associated with AAC and the lack of awareness of it is expected to restrain this market.

According to the city wise analysis of the market, Bangalore India AAC blocks and non-reinforced panels market is anticipated to grow at a CAGR of 15.2% by generating a revenue of INR 239.3 crores during the review period.

India AAC Blocks and Non-reinforced Panels Overview

Autoclaved aerated concrete (AAC), also known as autoclaved cellular concrete (ACC) or autoclaved lightweight concrete (ALC), is an eco-friendly green building material. The raw material used for the production of AAC is fly ash, which is a leftover product of thermal power plants. AAC has various advantages over other building materials like brick and concrete. AAC blocks offers a unique combination of low weight, rigidity of construction, durability, and cost-effectiveness, and also facilitates speedy construction. Furthermore, it also offers thermal and acoustic insulation, providing better safety and lower energy cost of heating or cooling.

Non-reinforced thermoplastic panels are derived from crude oil. Non-reinforced thermoplastic panels contain a small percentage of recycled plastic and the higher the recycled plastic component, the lower the performance characteristics.

Impact Analysis of COVID-19 on the India AAC Blocks and Non-reinforced Panels Market

The outbreak of COVID-19 has had a severe impact on commercial and industrial activities of the Indian AAC blocks and panels market. Lockdown rules laid by government bodies of various countries owing to COVID-19 pandemic resulted in the cancellation of construction projects which is one of the major factors that negatively affected the market in the short term. Furthermore, as the severity and duration of the pandemic continues to increase, uncertainties of the economy continue to weigh heavily on the Indian construction industry. In addition to this, decreasing raw material production, increasing financial burden on builders, and disruption in supply chains for material and production equipment are adversely influencing the market developments, during the pandemic. On the other hand, government initiatives, product innovations, and strategic collaborations among key players in the construction industry may provide impetus to the Indian AAC blocks and non-reinforced panels in the post COVID-19 period.

Increasing Urbanization to Surge the Market Growth

The key factors driving the market growth are rising urbanization & industrialization across India, growing developments in the infrastructure sector, rising demand for budget-friendly houses, increasing demand for lightweight construction materials, and increasing emphasis on the development of green and soundproof buildings. However, high costs involved in AAC and the lack of awareness about AAC blocks and reinforce panels are predicted to obstruct the market growth.

To know more about India AAC blocks and non-reinforce panels market drivers, get in touch with our analysts here.

High Cost of AAC Blocks to Restrain the Market Growth

The cost associated with AAC and the lack of awareness is expected to restrain the market. In addition to this, a large part of AAC block market is unorganized and characterized by the presence of large number of small-scale manufacturers, who compete with one another at the regional level. Hence, ensuring quality standards as well as inexpensive AAC blocks and panels in commercial segment is one of the major challenges for the construction industry.

Surge in Construction and Infrastructure Projects to Create Investment Opportunities

Market players are increasingly focusing on construction projects. The growth in construction industry has triggered the demand for traditional building materials across India. Overall surge in construction as well as infrastructure projects has boosted the demand for residential, commercial, and industrial construction, thus resulting in steady development in the construction materials sector. These factors are said to increase the opportunities for the Indian AAC blocks and non-reinforced panels market.

To know more about India AAC blocks and non-reinforced panels market opportunities, get in touch with our analysts here.

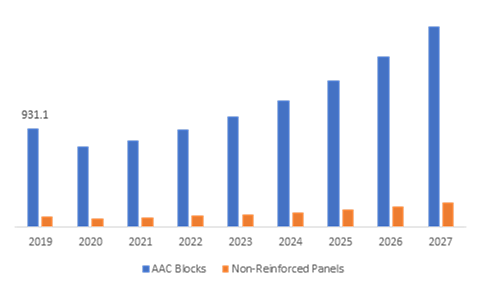

India AAC Blocks and Non-reinforced Panels Market, by Product Type

Based on product type, the market has been divided into AAC blocks and non-reinforced panels sub-segments of which the floor panels of non-reinforced panels sub-segment is projected to experience a fastest growth and AAC blocks sub-segment is predicted to generate the maximum revenue.

Source: Research Dive Analysis

The AAC Blocks is predicted to have a dominating market share in the construction industry and is expected to register a revenue of INR 1,894.9 crores during the forecast period. The rising number of construction projects across India is likely to drive the market during the forecast period. AAC, owing to its thermally insulated and energy-efficient properties, along with being fire-resistant, termite or pest-resistant, seismic-resistant, lightweight, sustainable, and quick and easy in application, is extensively used in construction. This factor is predicted to significantly drive the market growth in the forecast years. Furthermore, some of the leaders in the Indian market are continuously taking various initiatives such as capacity expansion to compete in the overall market. For instance, in 2019, Renacon, a leading AAC manufacturer in Chennai, completed the construction of new AAC blocks manufacturing plant at Gangaikondan, Tirunelveli that increased the company’s production capacity.

The non-reinforced panel is anticipated to have the fastest market growth and it is predicted that the market shall generate a revenue of INR 229.2 crores by 2027, growing from INR 102.1 crores in 2019. This segment majorly consists of wall panel, floor panel, roof panel, and cladding panel. Non-reinforced panels are composite materials consisting of polymers to improve the mechanical strength of the panel and have properties like chemical resistance, strong & light, high temperature tolerance, and others. Due to these benefits, there is increasing utilization of non-reinforced panels in the building construction applications, which is predicted to upsurge the sub-segment market growth in the forecast timeframe.

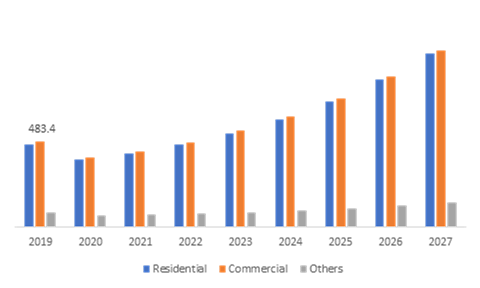

India AAC Blocks and Non-reinforced Panels Market, by End-use

On the basis of end user, the market has been sub-segmented into residential, commercial, and others. Among the mentioned sub-segments, the residential sub-segment is predicted to show the fastest growth, whereas the commercial sub-segment is projected to garner a dominant market share.

Source: Research Dive Analysis

The residential sub-segment of the India AAC blocks and non-reinforced panels market is projected to have the fastest growth and it is projected to surpass INR 983.2 crores by 2027, with an increase from INR 467.3 crores in 2019. Growing demand for AAC blocks and non-reinforced panels in the construction of residential buildings is estimated to fuel the growth of the market in the forecast time. This growth is majorly due to AAC blocks playing a key role in energy-efficient homes since they utilize minimal energy for heat/cooling purposes, thereby, minimizing the utilization of fossil fuels’ consumption.

The commercial sub-segment is anticipated to have a dominating market share in the Indian market and register a revenue of INR 1,001.3 crores during the analysis timeframe. Indian government is taking various initiatives to promote energy efficient buildings in the commercial sector to minimize energy consumption. For instance, in 2018, the Bureau of Energy Efficiency (BEE), an agency of the Government of India, launched a new mission under the Indian Ministry of Power to design and develop strategies for minimizing energy utilization in India by promoting energy efficiency policies in the country. This factor is directly increasing demand for AAC blocks and non-reinforced in the commercial end use, which is projected to propel the growth of the market in the forecast time.

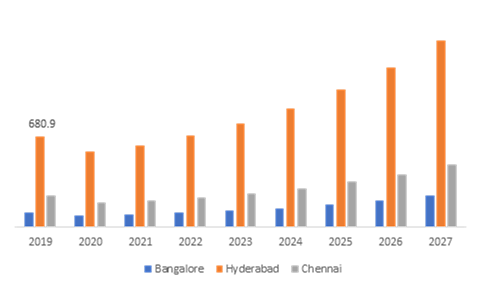

India AAC Blocks and Non-reinforced Panels Market, Regional Insights:

The India AAC blocks and non-reinforced panels market was investigated across Bangalore, Hyderabad and Chennai.

Source: Research Dive Analysis

The Market for India AAC Blocks and Non-reinforced Panels in Hyderabad to be the Most Dominant

The Hyderabad AAC blocks and non-reinforced panels market accounted INR 680.9 crores in 2019 and is projected to register a revenue of INR 1,411.5 crores by 2027. Rising demand for AAC blocks and non-reinforced panels from the construction sector is significantly predicted to drive the Hyderabad market growth in the forecast years. This growth will be majorly owing to Hyderabad construction sector experiencing a constant growth in the previous years. Further, the government of Telangana is continuously taking various initiatives to promote green buildings to minimize local resources and energy efficiency. The Telangana Roads and Building, legislative affairs and housing minister Vemula Prasanth Reddy invited Indian Green Building Council (IGBC) to promote sustainable and green building initiatives at 17th Green Building Congress 2019.

The Market for India AAC Blocks and Non-reinforced Panels in Bangalore to be the Fastest Growing

The share of Bangalore AAC blocks and non-reinforced panels market is anticipated to grow at a CAGR of 15.2% by registering a revenue of INR 239.3 crores by 2027. Increasing demand for green building materials in the Bangalore construction sector is a major factor predicted to drive the market growth in the forecast years. This is majorly owing to construction sector being largely different from the previous years because most of the builders are focusing and adopting green building technologies.

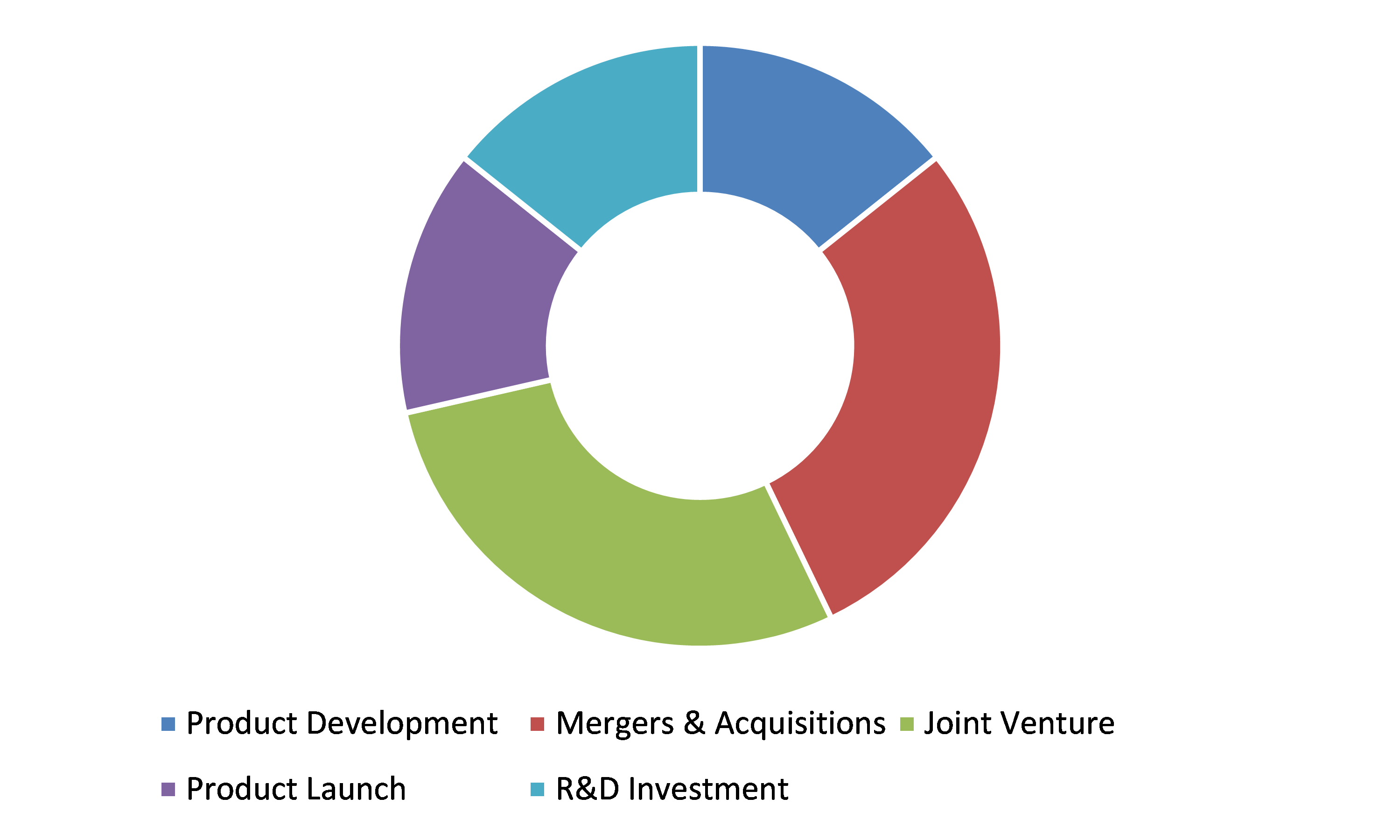

Competitive Scenario in the India AAC Blocks and Non-reinforced Panels Market

Product launches and mergers & acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

The companies involved in the India AAC blocks and non-reinforced panels are Maxlite AAC Blocks (India) Private Limited, GR Enterprises, Fusion Block, Brickwell, Mepcrete, Renacon.

Porter’s Five Forces Analysis for the India AAC Blocks and Non-reinforced Panels Market:

- Bargaining Power of Suppliers: The suppliers in the AAC blocks and non-reinforced panels market are moderate in number. Several companies are working on product designs that use different raw materials to avoid changing the supplier if the there is a hike in the price of a particular material. Thus, there is less threat from the suppliers.

Thus, the bargaining power suppliers is low. - Bargaining Power of Buyers: Buyers have moderate bargaining power; they demand best services at low prices. This increases the pressure on the AAC blocks and non-reinforced panels to offer good service in a cost-effective way. Thus, buyers can freely choose the convenient service that best fits their preference.

Thus, the bargaining power of the buyers is moderate. - Threat of New Entrants: Many companies entering the AAC blocks and non-reinforced panels market are adopting new and sustainable technologies. Also, these companies are implementing various effective strategies such as offering discounts and value propositions.

Thus, the threat of the new entrants is high. - Threat of Substitutes: There is no alternative product for application security solutions.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense. These companies are coming up with new innovations and strategies.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2019 |

| Forecast Timeline for Market Projection | 2020-2027 |

| Segmentation by City | Bangalore, Hyderabad, and Chennai. |

| Segmentation by Product Type |

|

| Segmentation by End-use |

|

| Key Companies Profiled |

|

Q1. What is the size of the India AAC blocks and non-reinforced panels market?

A. The India AAC blocks and non-reinforced panels market is predicted to garner INR 11095.0 crores in the 2020–2027 timeframe, growing from INR 5323.8 crores in 2019.

Q2. Which region, among others, possesses greater investment opportunities in the near future?

A. The Hyderabad region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q3. What will be the growth rate of the Hyderabad India AAC blocks and non-reinforced panels market?

A. Hyderabad India AAC blocks and non-reinforced panels market is anticipated to grow at 13.7% CAGR during the forecast period.

Q4. What are the strategies opted by the leading players in this market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Type trends

2.3.End-Use trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Pricing overview

3.8.1.By Type

3.8.2.By end user

3.8.3.By region

3.9.Market value chain analysis

3.9.1.Stress point analysis

3.9.2.Raw material analysis

3.9.3.Manufacturing process

3.9.4.Distribution channel analysis

3.9.5.Operating vendors

3.9.5.1.Raw material suppliers

3.9.5.2.Product manufacturers

3.9.5.3.Product distributors

3.10.Strategic overview

4.AAC Blocks & Non-Reinforced Panels Market , by Type

4.1.AAC Blocks

4.1.1.Market size and forecast, by region, 2019-2027

4.1.2.Comparative market share analysis, 2019-2027

4.2.Non-Reinforced Panels

4.2.1.Market size and forecast, by region, 2019-2027

4.2.2.Comparative market share analysis, 2019-2027

4.2.2.1.Wall Panel

4.2.2.1.1.Market size and forecast, by region, 2019-2027

4.2.2.1.2.Comparative market share analysis, 2019-2027

4.2.2.2.Floor Panel

4.2.2.2.1.Market size and forecast, by region, 2019-2027

4.2.2.2.2.Comparative market share analysis, 2019-2027

4.2.2.3.Road Panel

4.2.2.3.1.Market size and forecast, by region, 2019-2027

4.2.2.3.2.Comparative market share analysis, 2019-2027

4.2.2.4.Cladding Panel

4.2.2.4.1.Market size and forecast, by region, 2019-2027

4.2.2.4.2.Comparative market share analysis, 2019-2027

4.2.2.5.Others

4.2.2.5.1.Market size and forecast, by region, 2019-2027

4.2.2.5.2.Comparative market share analysis, 2019-2027

5.AAC Blocks & Non-Reinforced Panels Market , by End Use

5.1.Residential

5.1.1.Market size and forecast, by region, 2019-2027

5.1.2.Comparative market share analysis, 2019-2027

5.2.Commercial

5.2.1.Market size and forecast, by region, 2019-2027

5.2.2.Comparative market share analysis, 2019-2027

5.3.Others

5.3.1.Market size and forecast, by region, 2019-2027

5.3.2.Comparative market share analysis, 2019-2027

6.AAC Blocks & Non-Reinforced Panels Market , by Region

6.1.Bangalore

6.1.1.Market size and forecast, by Type, 2019-2027

6.1.2.Market size and forecast, by End user, 2019-2027

6.1.3.Comparative market share analysis, 2019-2027

6.2.Hyderabad

6.2.1.Market size and forecast, by Type, 2019-2027

6.2.2.Market size and forecast, by End user, 2019-2027

6.2.3.Comparative market share analysis, 2019-2027

6.3.Chennai

6.3.1.Market size and forecast, by Type, 2019-2027

6.3.2.Market size and forecast, by End user, 2019-2027

6.3.3.Comparative market share analysis, 2019-2027

The construction sector is an ever evolving field which continues to grow along with the increasing population. One of the primary changes that construction companies are making is the use of more energy efficient and eco-friendly products. The autoclaves aerated concrete is one such product and is made using fly ash that is left over in thermal power plants. The product is light weight, durable, and cost effective, which makes it one of the most sought-after products in the market.

In addition, the non-reinforced panels are made from crude and they also contain some traces of recycled plastic. All of these construction materials are environmentally friendly and have been slowly but surely replacing the conventional materials that have been used for years.

COVID-19 Impact on the Indian AAC and Non-reinforced Panels Market

Every country around the world was severely affected by the pandemic including India. The total lockdown that was implemented led to a lot of uncertainty among the construction sector. This caused a majority of them to shut down their projects indefinitely leading to a standstill for many companies. The severity of the situation was also felt when the entire supply chain was affected and production of raw material was also stopped which also added to the woes of many builders.

Companies, in the meantime, have been working of several innovative methods and practices of construction. They are also building up on their product inventory while the government has been working on several initiatives to bring business back on track. These efforts are set to help revive the AAC blocks and non-reinforced panels market.

Forecast Analysis of the Global India AAC Blocks and Non-reinforced Panels Market

Many organizations have been taking initiatives to ensure that their future products are made keeping in mind, the environmental factors. Many buildings today are moving towards a sustainable path are also built without compromising on the need or requirements of the customers. Since the products are made from recycled waste found in factories and other industries, it is also ensuring the sustenance of fossil fuels. Many of the renowned market players are hence ensuring the both the planet and homes are safe to live in.

According to the latest report by Research Dive, the India AAC Blocks and Non-reinforced Panels Market is set to witness an increase in revenue from INR 5,323.8 crores in 2019 to over INR 11,095.0 Crores in 2027 at a steady CAGR of 14.3%. The Hyderabad region is set to gain prominence in the market with a revenue growth from over INR 680.9 crores in 2019 to over INR 1,411.5 crores by 2027.

The market is witnessing rapid growth due to the increase in the urban crowd leading to urbanization and industrialization as well. Many consumers today are looking towards keeping their homes environment friendly which is why they demand for more eco-friendly raw materials. The fact products like AAC and non-reinforced panels make the homes lighter yet durable has led to a rise of the market.

On the contrary, many of these products need to maintain their quality which is majority of the times not found in the market. A lot of brands in the market also lack awareness about them which is also adds to the restraining factors of the market.

In recent times though, many infrastructure organizations have been placing emphasis on constructing structures that can withstand calamities such as earthquakes or even floods. This along with the rising demand for more innovative buildings is said to act as a factor for future growth for the market.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com