Dermacosmetics Market Report

RA08349

Dermacosmetics Market by Product (Skincare and Hair care), Treatment (Skin and Hair), Distribution Channel (Pharmacy & Retail Stores and Online), End Users (Clinics, Medical Spas & Salons, Hospitals, and At-home), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2030

Global Dermacosmetics Market Analysis

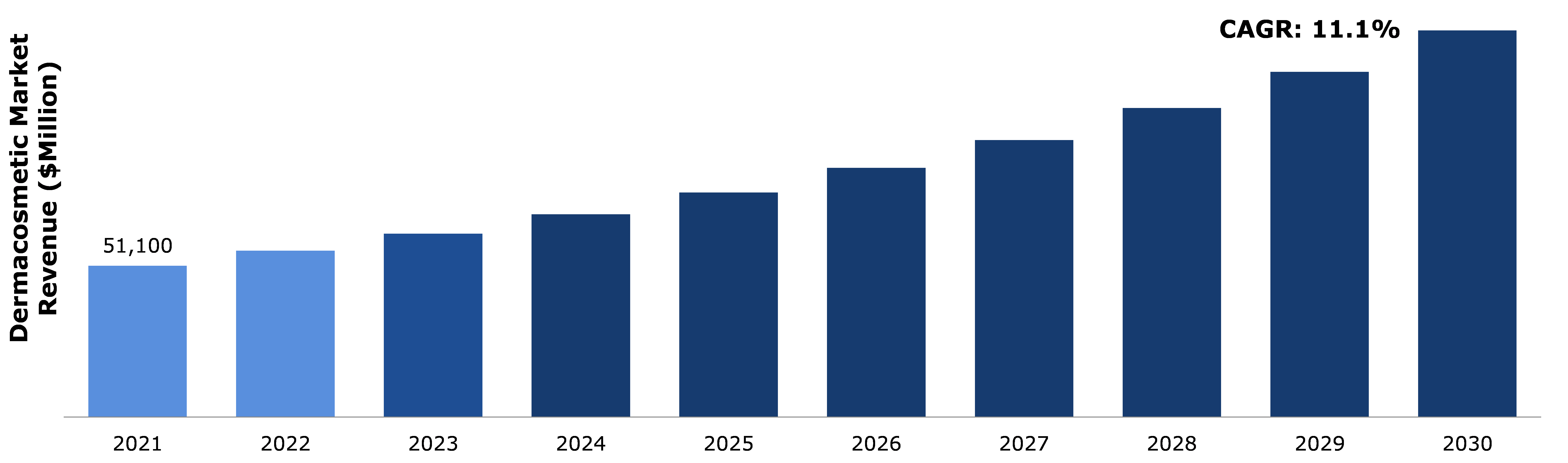

The global dermacosmetics market size was $51,100 million in 2021 and is expected to reach $13, 0460.6 million by 2030, growing at a CAGR of 11.1% from 2022 to 2030.

Dermacosmetics Market Synopsis

Dermacosmetics is a combination of two important medical branches which are cosmetics and dermatology. Women these days are highly careful of their skin because it is such an important feature of our body. People are more likely to take additional care of the body and skin in order to make them look attractive and healthy. All cosmetics that may be applied to the skin or hair and that effectively address certain issues including acne, oily skin, acne scarring, dry skin, blemishes, and other skin ailments like pimples are referred to dermacosmetics. The role of cosmetics in skin care routine has evolved both physically and physiologically as a result of advances in science and technology that have changed our understanding of normal skin physiology and how cosmetics influence it.

Lack of understanding about skin care products among some of the target demographic may limit the dermacosmetics market's growth significantly. Although the cosmetic skin care business is growing at a rapid pace, the government continues to enforce numerous restrictions limiting the use of certain chemicals as ingredients in skin care products. In some of these circumstances, dermacosmetics have harmed a specific skin type because many people do not seek professional advice before using these products. People experienced skin redness, scratching, discoloration, itching, and swelling in certain cases. It can have a long-term impact on a person's skin health as well as their immune system.

People all across the world are developing serious skin problems as a result of increased pollution exposure. The need for hair and skin treatments is increasing every day. It is anticipated that using active ingredients in dermacosmetic products would create new commercial opportunities. It has been witnessed that chemical additions used as cosmetic additives in products have a detrimental effect on the skin. Skin care companies have employed innovative marketing strategies to increase sales of their cosmetics products, such as the introduction of new products with natural ingredients and appealing packaging.

The Asia-Pacific dermacosmetic market was worth $51,100 million in 2021, according to regional analysis, and is expected to rise at a CAGR of % percent in the projected timeframe. In past few years, the Asia-Pacific market has gained from a rise in the frequency of skin problems and also an increase in people's expenditure on skin treatment.

Dermacosmetics Overview

Dermacosmetics is the modern solution for maintaining healthy skin. In this modern technology, two main branches for skin care solution came along to develop and nurture the solutions to the skin diseases. New discoveries in branch of dermatology and cosmetology are creating skincare products which are providing solutions to many skin issues like blemishes, acne, dullness, pimples, ageing, and more. Rising pollution is causing skin diseases which is increasing the demand for the skin care product.

COVID-19 Impact on Global Dermacosmetics Market

The COVID-19 Impact on dermacosmetics market lead huge loss due to many restrictions that were imposed by government on many sectors. International boundaries were sealed due to which shipments were stuck at ports, causing shortage of raw material for manufacturing of skin care products. In the first wave of COVID-19, sudden implication of restrictions caused massive manufacturing failures. In first two quarters of 2020, companies were unable to fulfil demand of customers as there were limitations on manufacturing due to shortage. Delays in delivery of the purchased goods was one of the major setbacks for dermacosmetics market as many people cancelled orders due to unexpected delays. Moreover, many people were unable to complete their skin and hair treatments like chemical peel, microdermabrasion, botox injections, and dermal fillers, especially those who had their treatments abroad due to lockdown restrictions.

COVID-19 connected the world with social media and it widely spread the awareness about the importance of skincare amongst many people. Famous influencers started promoting skin care products developed by dermatologists on their social media handles, which increased the awareness and need for dermacosmetics among customers, during pandemic. For instance, face masks, lotions, and moisturizing creams were trending on the internet. This can be estimated to grow the dermacosmetics market trend in near future.

Increase in the Awareness Amongst Population about Skin Care, Hair Care, and Skin Related Issues May Drive the Dermacosmetics Market Growth.

Dermacosmetics not only provide beautiful skin but also correct the texture and the health of the skin. Dermacosmetics have broad range of products as solutions for different skin issues such as fine lines, wrinkles, acne prone skin, dark spots, skin lightning, anti-ageing, and more. Anti-ageing serums, gel cleansers, exfoliators, pore refiners, and skin hydrating masks are few examples of demacosmetics products. People now a days are very conscious about their skin as it is the essential part of our body. People tend to take extra care of their body and skin to make it look beautiful as well as healthy. Increasing pollution is causing many skin related diseases and these diseases can be cured with the help of these dermacosmetics. Dermacosmetics give long term results and provide flawless skin. People are largely influenced by these products due to their properties and results. Many doctors, spas, and beauticians are suggesting these products as a solution for skin related issues. These factors are propelling the dermacosmetics market demand in the forecasting period.

Allergic Reactions Caused by Dermacosmetics can Restrain the Growth of the Dermacosmetics Market.

In some cases, dermacosmetics have caused harm to a particular skin type as many people do not seek for the experts’ opinion before using these products. People suffered with skin redness, scratches, skin discoloration, itching, and in some cases swelling as well. It can affect person’s skin and immune system in the long run. In some cases, extreme hair loss, thinning of hair line, and prevalence of dandruff was observed as no proper expert opinion was taken before using these products. Dermacosmetics are formulated for certain skin conditions and if not used under the experts’ opinion, they can cause harm to the skin and hair.

Increasing Number of Skin Diseases and Need for Skin and Hair Treatments can Drive Opportunities in the Dermacosmetic Market

Unhealthy lifestyle and lack of nutrition in body are causing fast ageing in the young generation. Fast food contains many preservatives, chemicals, high amount of salt, sugars, and unhealthy fats causing obesity, high blood pressure, and even skin diseases. Lack of nutrition in food is the main cause for hair fall, grey hair, ageing, wrinkles, and more. Increasing exposure to the pollution is causing harmful skin diseases in people around the globe. Dermacosmetics are providing solution to these problems. Demand for hair and skin treatments is boosting daily. According to WHO (World Health Organization), 900 million people have skin & hair diseases. Advancement in the technology and new discoveries have created wide range of products as a solution for skin diseases which will create opportunities in market.

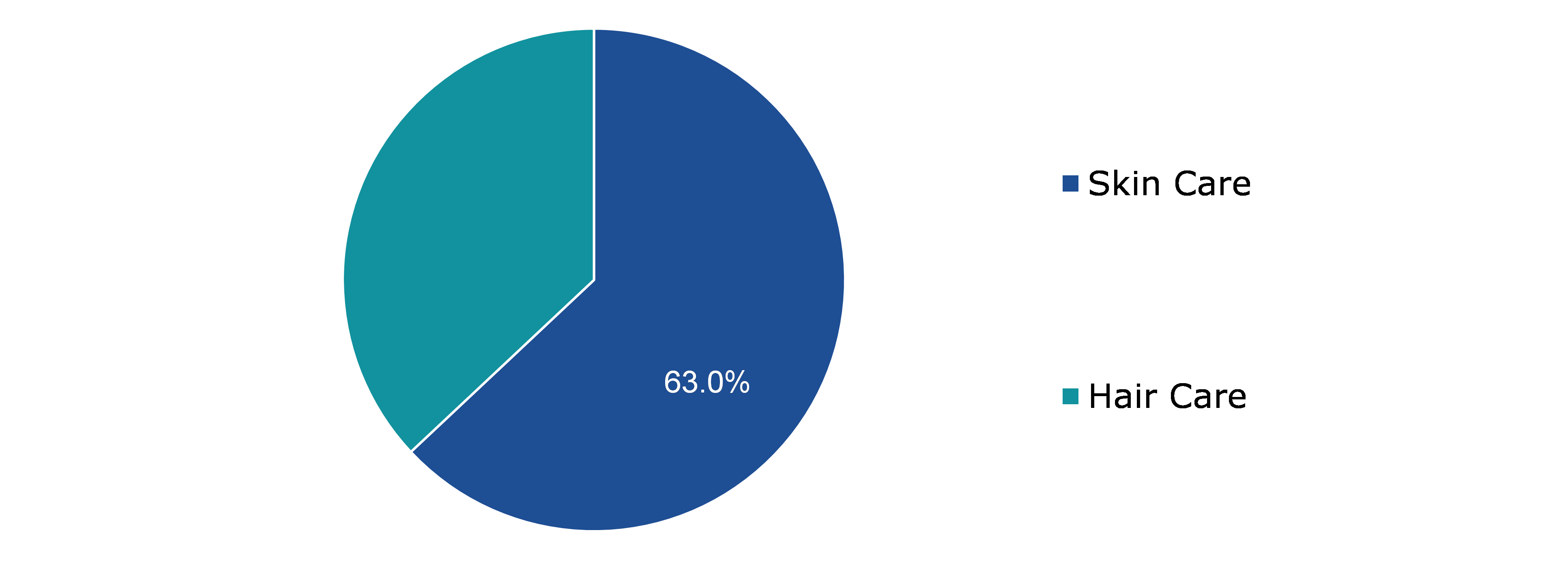

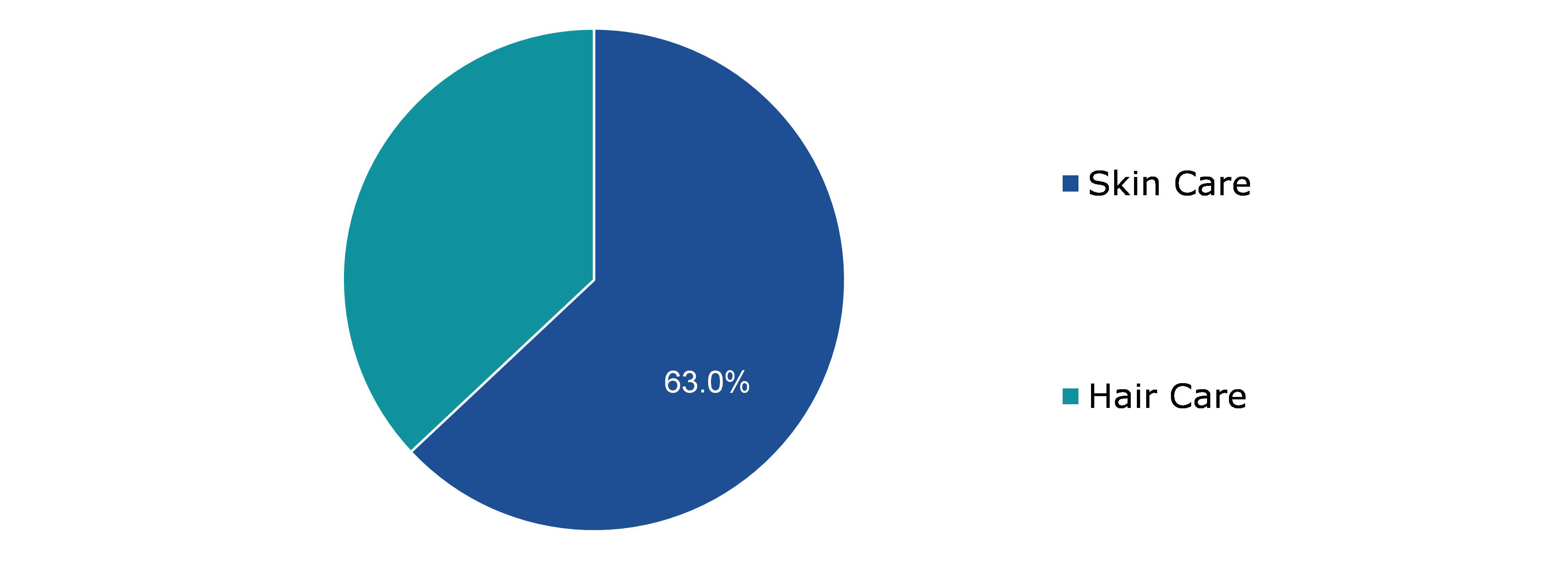

Global Dermacosmetics Market Share, by Product, 2021

Based on product, the market has been divided into hair care and skincare products. Among these, the skincare sub-segment accounted for the highest market share in 2021 and hair care is expected to remain fastest growing.

Source: Research Dive Analysis

The skincare sub-segment is anticipated to have a dominant market share and generate a revenue of $80,894.5 million by 2030, growing from $32,196.4 million in 2021. As skin concerns like wrinkling, acne, discoloration, patches, and scars, are becoming increasingly common due to pollution and unhealthy lifestyles, the skincare sub-segment is expected to dominate the market. Due to the increase in demand for skin care products, manufacturers are providing a variety of products, including sunscreens, body lotions, anti-aging creams, and lotions that brighten the skin. Additionally, new skin care product lines are increasingly including products responsible for taking care of skin near neck, elbows, and knees.

The hair care sub segment is expected to remain the fastest growing and generate a revenue of $49,566.1 million by 2030, growing from $18,903.6 million in 2021. This is due to the increasing pollution and unhealthy lifestyle followed by people. The increasing pollution is causing hair damage resulting into dry and weak hair. The hair care dermacosmetic products such as hair serums and shampoos are developed to tackle the problems such as dandruff, dry hair, dead hair, etc.

Global Dermacosmetic Market, by Treatment

Based on treatment, the market has been divided into hair treatment and skin treatment. Among these, the skin treatment sub-segment accounted for the highest market share in 2021 and hair treatment sub segment is anticipated to be the fastest growing

Global Dermacosmetics Market Share, by Treatment, 2021

Source: Research Dive Analysis

The skin treatment sub-segment is expected to be the dominant and shall generate a revenue of $80,447.5 million by 2030, increasing from $32,211 million in 2021. As a result of greater public knowledge of skin treatments, more people are opting for skin regeneration laser therapy, laser resurfacing, and botox. In order to improve skin's appearance, people are using dermacosmetics rejuvenation operations more frequently. As skin textures vary from person to person, it is important to pay extra attention to it. Thus, people are adopting skin cosmetics for skin treatments. During the projection period, it is projected that such skin treatment applications in the dermacosmetics market would increase the sub segment's growth potential.

The hair treatment sub-segment is anticipated to remain fastest growing and shall generate a revenue of $50,013.1 million by 2030, increasing from $18,889 million in 2021. The raising growth is due to the increasing need for the customized hair solutions as the prevalence of hair problems are increasing. For instance, Bare Anatomy the brand is providing the customized hair related dermacosmetics to repair the damaged hair. These new investments and innovations are expected to propel the growth of the hair treatment sub-segment in forecast period.

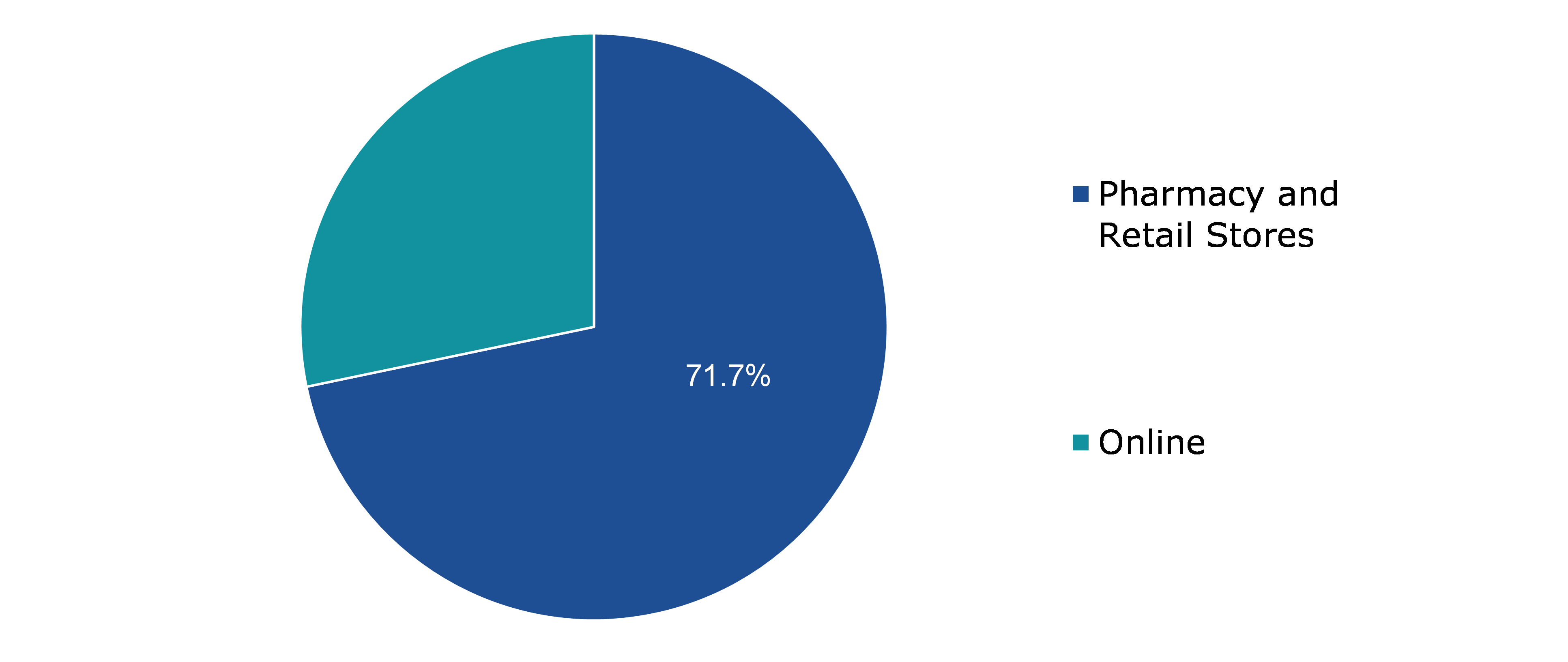

Global Dermacosmetic Market, by Distribution Channel

Based on distribution channel, the market has been divided into pharmacy & retail stores and online. Among these, the pharmacy & retail stores sub-segment is projected to remain the fastest-growing sub-segment and online subsegment to be dominating during forecast period.

Global Dermacosmetic Market Share, by Distribution Channel, 2021

Source: Research Dive Analysis

The pharmacy and retail store sub-type is anticipated to show the fastest growth and shall generate a revenue of $85,736.4million by 2030, increasing from $36,654.2 million in 2021. Pharmacies and retail stores sub-segment is expected to drive market expansion in the analysis period. Due to the availability of a wide variety of consumer items under one roof, abundant parking, and convenient operating hours, pharmacies and retail stores are becoming more and more popular. Additionally, both in developed and developing regions, the popularity of pharmacies and retail stores is increased by urbanization, an increase in the population of the working class, and competitive pricing.

The online sub-type of segment distribution channel is expected to be dominant and generate the revenue of $44,724.2 million by 2030, increasing from $14,445.8 millions in 2021. The dominance of online distribution channel of dermacosmetic products is due to the increasing use of e-commerce websites such as Amazon, Nykaa, Flipkart and other. These platforms were providing home deliveries of dermacosmetics even during the pandemic. The wide variety of products and offers available online are attracting the customers to purchase products from these platforms.

Global Dermacosmetic Market, by End-use

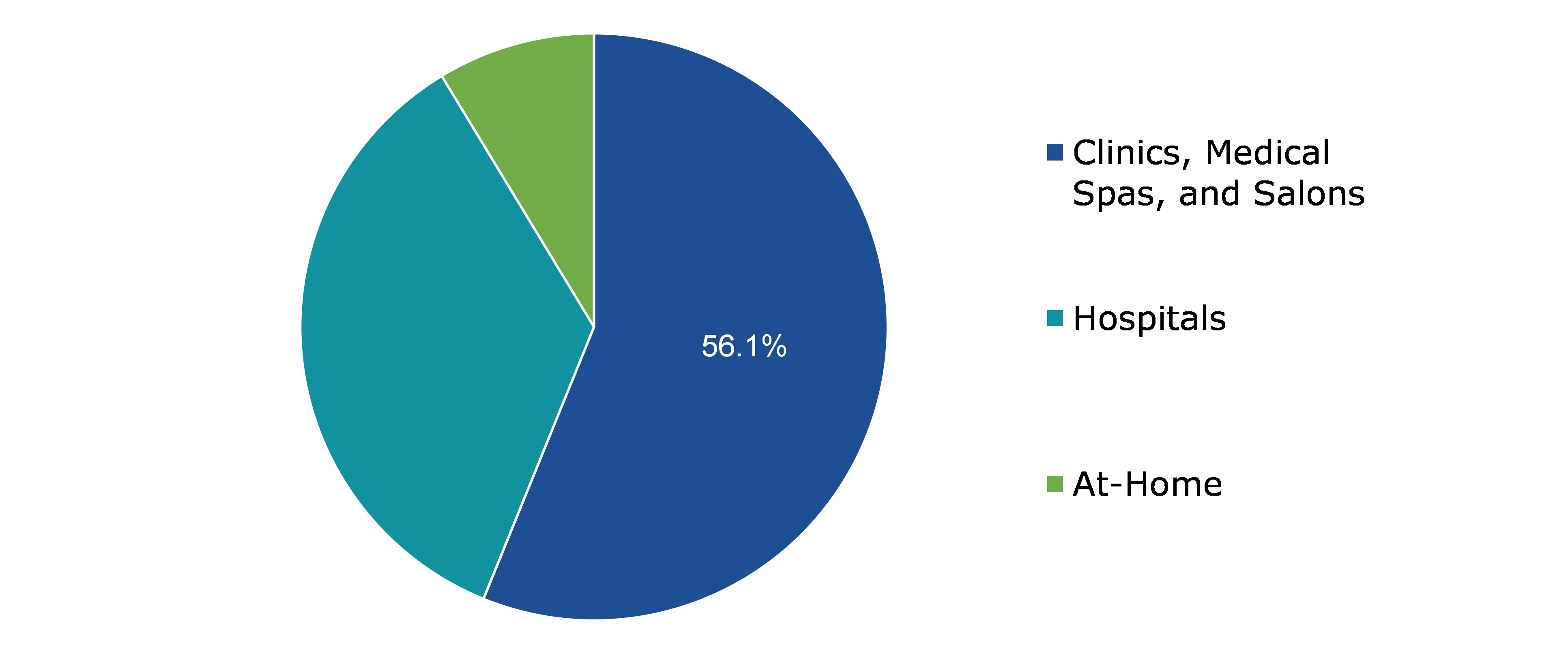

Based on end-use, the market has been divided into hospitals, clinic, medical spa and salons. Hospital sub-segment is projected to remain the fastest-growing sub-segment in dermacosmetics market and clinic, medical spa and salons are expected to be dominating.

Global Dermacosmetic Market Share, by End-use, 2021

Source: Research Dive Analysis

Hospital sub-segment is anticipated to be the fastest-growing and shall generate a revenue of $71,084.5 million by 2030, increasing from $28,688.5 million in 2021 is expected to dominate the growth of the dermacosmetics market in recent years owing to the increased popularity of online medical appointment bookings and the rising need for skin & hair care services. Also, hospitals use cutting-edge technologies and offer advanced skin & hair treatments to draw in customers.

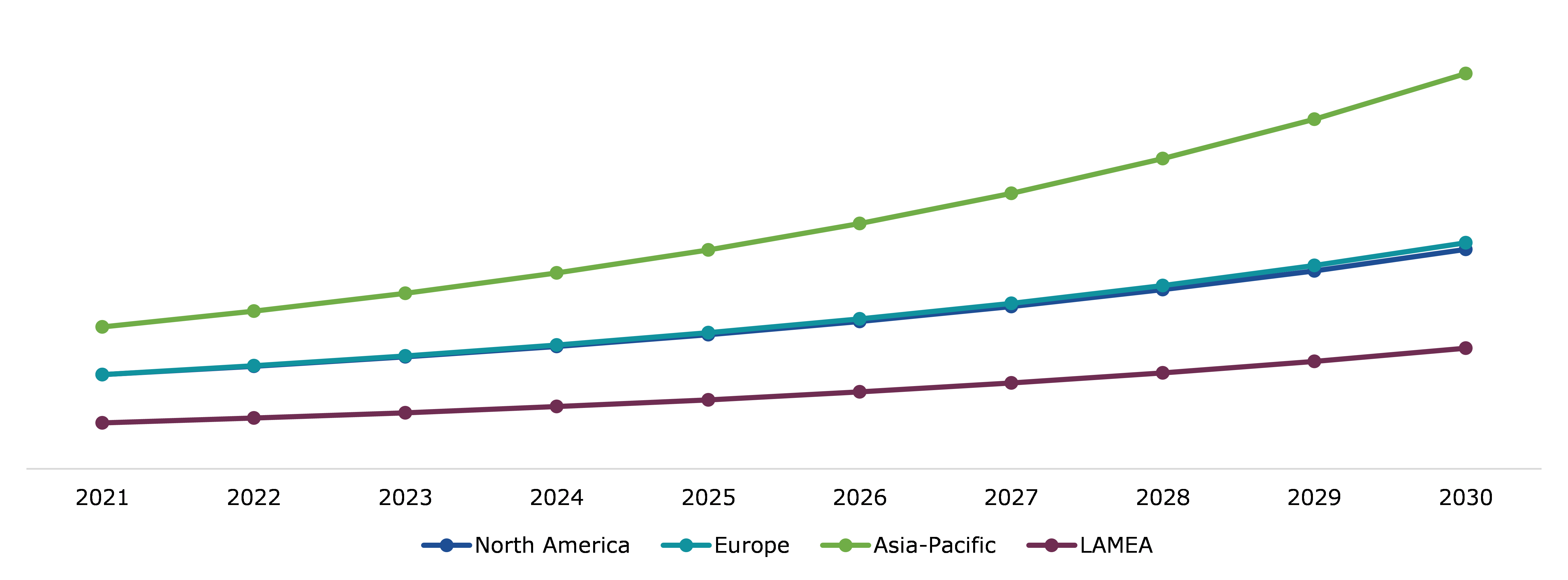

Dermacosmetics Market Regional Insights

Dermacosmetics market was investigated across Asia-Pacific, LAMEA, North America, and Europe.

Global Dermacosmetics Market Size & Forecast, by Region, 2021-2030 (USD Million)

Source: Research Dive Analysis

The market for Dermacosmetics in the Asia-Pacific Region to be the Most Dominating as well as Fastest Growing

The market for dermacosmetics in the Asia-Pacific region had sales of $19,249.4 million in 2021 and is expected to increase at a CAGR of 12.2% percent in the analysis period. The Asia-Pacific region market is expected to dominate the worldwide dermacosmetics market along with being the fastest-growing sub-segment over the forecast period. In recent decades, the Asia-Pacific market has expanded due to a rise in the frequency of skin problems and rising consumer spending on skin care. The growing population of this region is also a big contributor to the dermacosmetics market's increased growth.

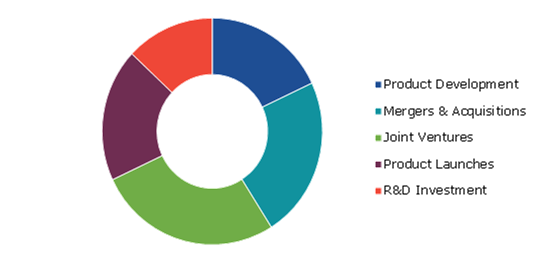

Competitive Scenario in the Global Dermacosmetics Market

Product development, new product launch, merger & acquisitions, and joint ventures are common strategies followed by major players. For instance, in March 2022, L'Oréal went in partnership with EMOTIV, who is the global neurotechnology leader, to launch a new product in device to help customers personalize their fragrance choices for skincare products.

Source: Research Dive Analysis

Some of the leading dermacosmetics market players are Abbvie, Estée Lauder Companies, ZO Skin Health Inc., Kanebo Cosmetics Inc., Galderma, Procter & Gamble, Johnson & Johnson Services, Shiseido Company, L'Oréal, Beiersdorf, and Bausch Health Companies Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast timeline for Market Projection | 2021-2030 |

| Geographical Scope | Asia-Pacific, LAMEA, North America, Europe. |

| Segmentation by Product

|

|

| Segmentation by Treatment |

|

| Segmentation by Distribution Channel |

|

| Segmentation by End-use |

|

| Key Countries Covered | India, Germany, Russia, U.S.,UK, Italy, Russia, Japan, Brazil, Australia, Canada, South Korea, Saudi Arabia, China, Spain. |

| Key Companies Profiled |

|

Q1. What is the size of the global dermacosmetic market?

A. The size of the global dermacosmetic market was $51,100 million in 2021 and is expected to reach $13, 0460.6 million by 2030.

Q2. Which are the major companies in the dermacosmetic market?

A. Abbvie, Estée Lauder companies, and L'Oréal are a few of the most important players in the global dermacosmetics industry.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Investors can take advantage of attractive investment opportunities in the Asia-Pacific market and see some of the most promising future growth.

Q4. What will be the growth rate of the Asia-Pacific dermacosmetic market?

A. During the forecast period, it is expected that the Asia-Pacific market will expand at a CAGR of 12.2% percent.

Q5. What are the strategies opted by the leading players in this market?

A. Product development, new product launch, merger & acquisitions, and joint ventures are common strategies followed by leading players.

Q6. Which companies are investing more on R&D practices?

A. In order to develop new products and innovations L'Oréal, Johnson & Johnson services Inc., Estée Lauder businesses, and Beiersdorf are the corporations that are investing more in R&D.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global dermacosmetics market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on dermacosmetics market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Dermacosmetics Market Analysis, by Product

5.1.Overview

5.2.Skincare

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region,2021-2030

5.2.3.Market share analysis, by country,2021-2030

5.3.Hair care

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region,2021-2030

5.3.3.Market share analysis, by country,2021-2030

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Dermacosmetics Market Analysis, by Treatment

6.1.Hair Treatment

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region,2021-2030

6.1.3.Market share analysis, by country,2021-2030

6.2.Skin Treatment

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region,2021-2030

6.2.3.Market share analysis, by country,2021-2030

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness

6.3.2.Competition heatmap

7.Dermacosmetics Market Analysis, by Distribution Channel

7.1.Pharmacy and retail stores

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region,2021-2030

7.1.3.Market share analysis, by country,2021-2030

7.2.Online

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region,2021-2030

7.2.3.Market share analysis, by country,2021-2030

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness

7.3.2.Competition heatmap

8.Dermacosmetics Market Analysis, by End-use

8.1.Hospitals

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region,2021-2030

8.1.3.Market share analysis, by country,2021-2030

8.2.Medical salons

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region,2021-2030

8.2.3.Market share analysis, by country,2021-2030

8.3.Medical spa

8.3.1.Definition, key trends, growth factors, and opportunities

8.3.2.Market size analysis, by region,2021-2030

8.3.3.Market share analysis, by country,2021-2030

8.4.Medical spa

8.4.1.Definition, key trends, growth factors, and opportunities

8.4.2.Market size analysis, by region,2021-2030

8.4.3.Market share analysis, by country,2021-2030

8.5.Research Dive Exclusive Insights

8.5.1.Market attractiveness

8.5.2.Competition heatmap

9.Dermacosmetics Market, by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Product,2021-2030

9.1.1.2.Market size analysis, by Treatment,2021-2030

9.1.1.3.Market size analysis, by Distribution Channel,2021-2030

9.1.1.4.Market size analysis, by End-use,2021-2030

9.1.2.Canada

9.1.2.1.Market size analysis, by Product,2021-2030

9.1.2.2.Market size analysis, by Treatment,2021-2030

9.1.2.3.Market size analysis, by Distribution Channel,2021-2030

9.1.2.4.Market size analysis, by End-use,2021-2030

9.1.3.Mexico

9.1.3.1.Market size analysis, by Product,2021-2030

9.1.3.2.Market size analysis, by Treatment,2021-2030

9.1.3.3.Market size analysis, by Distribution Channel,2021-2030

9.1.3.4.Market size analysis, by End-use,2021-2030

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Product,2021-2030

9.2.1.2.Market size analysis, by Treatment,2021-2030

9.2.1.3.Market size analysis, by Distribution Channel,2021-2030

9.2.1.4.Market size analysis, by End-use,2021-2030

9.2.2.UK

9.2.2.1.Market size analysis, by Product,2021-2030

9.2.2.2.Market size analysis, by Treatment,2021-2030

9.2.2.3.Market size analysis, by Distribution Channel,2021-2030

9.2.2.4.Market size analysis, by End-use,2021-2030

9.2.3.France

9.2.3.1.Market size analysis, by Product,2021-2030

9.2.3.2.Market size analysis, by Treatment,2021-2030

9.2.3.3.Market size analysis, by Distribution Channel,2021-2030

9.2.3.4.Market size analysis, by End-use,2021-2030

9.2.4.Spain

9.2.4.1.Market size analysis, by Product,2021-2030

9.2.4.2.Market size analysis, by Treatment,2021-2030

9.2.4.3.Market size analysis, by Distribution Channel,2021-2030

9.2.4.4.Market size analysis, by End-use,2021-2030

9.2.5.Italy

9.2.5.1.Market size analysis, by Product,2021-2030

9.2.5.2.Market size analysis, by Treatment,2021-2030

9.2.5.3.Market size analysis, by Distribution Channel,2021-2030

9.2.5.4.Market size analysis, by End-use,2021-2030

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Product,2021-2030

9.2.6.2.Market size analysis, by Treatment,2021-2030

9.2.6.3.Market size analysis, by Distribution Channel,2021-2030

9.2.6.4.Market size analysis, by End-use,2021-2030

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Product,2021-2030

9.3.1.2.Market size analysis, by Treatment,2021-2030

9.3.1.3.Market size analysis, by Distribution Channel,2021-2030

9.3.1.4.Market size analysis, by End-use,2021-2030

9.3.2.Japan

9.3.2.1.Market size analysis, by Product,2021-2030

9.3.2.2.Market size analysis, by Treatment,2021-2030

9.3.2.3.Market size analysis, by Distribution Channel,2021-2030

9.3.2.4.Market size analysis, by End-use,2021-2030

9.3.3.India

9.3.3.1.Market size analysis, by Product,2021-2030

9.3.3.2.Market size analysis, by Treatment,2021-2030

9.3.3.3.Market size analysis, by Distribution Channel,2021-2030

9.3.3.4.Market size analysis, by End-use,2021-2030

9.3.4.Australia

9.3.4.1.Market size analysis, by Product,2021-2030

9.3.4.2.Market size analysis, by Treatment,2021-2030

9.3.4.3.Market size analysis, by Distribution Channel,2021-2030

9.3.4.4.Market size analysis, by End-use,2021-2030

9.3.5.South Korea

9.3.5.1.Market size analysis, by Product,2021-2030

9.3.5.2.Market size analysis, by Treatment,2021-2030

9.3.5.3.Market size analysis, by Distribution Channel,2021-2030

9.3.5.4.Market size analysis, by End-use,2021-2030

9.3.6.Rest of Asia Pacific

9.3.6.1.Market size analysis, by Product,2021-2030

9.3.6.2.Market size analysis, by Treatment,2021-2030

9.3.6.3.Market size analysis, by Distribution Channel,2021-2030

9.3.6.4.Market size analysis, by End-use,2021-2030

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Product,2021-2030

9.4.1.2.Market size analysis, by Treatment,2021-2030

9.4.1.3.Market size analysis, by Distribution Channel,2021-2030

9.4.1.4.Market size analysis, by End-use,2021-2030

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Product,2021-2030

9.4.2.2.Market size analysis, by Treatment,2021-2030

9.4.2.3.Market size analysis, by Distribution Channel,2021-2030

9.4.2.4.Market size analysis, by End-use,2021-2030

9.4.3.UAE

9.4.3.1.Market size analysis, by Product,2021-2030

9.4.3.2.Market size analysis, by Treatment,2021-2030

9.4.3.3.Market size analysis, by Distribution Channel,2021-2030

9.4.3.4.Market size analysis, by End-use,2021-2030

9.4.4.South Africa

9.4.4.1.Market size analysis, by Product,2021-2030

9.4.4.2.Market size analysis, by Treatment,2021-2030

9.4.4.3.Market size analysis, by Distribution Channel,2021-2030

9.4.4.4.Market size analysis, by End-use,2021-2030

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Product,2021-2030

9.4.5.2.Market size analysis, by Treatment,2021-2030

9.4.5.3.Market size analysis, by Distribution Channel,2021-2030

9.4.5.4.Market size analysis, by End-use,2021-2030

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1.AbbVie Inc.

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2. Estée Lauder Companies Inc.

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3. ZO Skin Health Inc.

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4. Kanebo Cosmetics Inc.

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5. GALDERMA

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6. Procter & Gamble

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.Johnson & Johnson Private Limited

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8.Shiseido Company

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.Beiersdorf AG

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10.Bausch Health Companies Inc.

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

12.Appendix

12.1.Parent & peer market analysis

12.2.Premium insights from industry experts

12.3.Related reports

As the life of people in urban areas is becoming increasingly busy, consumer goals for health and well-being are becoming deep-rooted than ever. This has resulted in an increased adoption of healthy lifestyle and more thoughtful consumption in all arenas including beauty. In recent years, the cosmetic sector has experienced an overbearing revolution.

Conventionally, cosmetics have been deliberated as formulations of powders or creams, intended to boost personal appearance by direct application on the skin. However, scientific as well as technological advances have altered the empathy of the composition of normal skin and how cosmetics products can change its look through biological activities and physical alterations. Dermocosmetics has evolved into a branch of dermatology that uses cosmetics in the scientific management of a number of skin ailments.

Today’s consumers no longer hide their skin issues – instead, they prefer treating the problems at their root. They take help from dermatologists to avert possible problems and reinforce their skin’s natural barrier. This desire, which is chiefly engrained in urban people, has boomed the dermocosmetics market.

Newest Insights in the Dermacosmetics Market

As per a report by Research Dive, the global dermacosmetics market is expected to grow with a stunning CAGR of 11.1% in the coming years. The Asia-Pacific dermacosmetics market is expected to perceive dominant and speedy growth in the years to come. This is because, the region has an enormous demand for dermacosmetics products owing to the rising frequency of skin problems and increasing consumer expenditure on skin care in this region. As per the Euromonitor International’s Voice of the Consumer: Beauty Survey in 2021, nearly 19% APAC consumers have sensitive skin problems mainly due to hectic lifestyles, pollution, and inapt usage of cosmetics products. Japan, China, and South Korea are the 3 leading dermocosmetics markets in this region. Hence, dermacosmetics market is experiencing bulging growth in this region.

How are Market Players Responding to the Rising Demand for Dermacosmetics?

Market players are greatly investing in innovative product launches to cater the rising demand for dermacosmetics. Some of the leading players of the dermacosmetics market are Abbvie, L'Oréal, ZO Skin Health Inc., Bausch Health Companies Inc., Kanebo Cosmetics Inc., Galderma, Estée Lauder Companies, Procter & Gamble, Johnson & Johnson Services, Shiseido Company, Beiersdorf, and others. These players are focused on planning and devising tactics such as mergers and acquisitions, collaborations, novel advances, and partnerships to reach a foremost position in the global market.

For instance,

- In December 2021, Avicanna Inc., a biopharmaceutical firm focused on the development, production, and commercialization of plant-derived cannabinoid-based pharmaceuticals, launched a proprietary and clinically backed derma-cosmetics brand called, Pura H&W, through its elite partnership with Red White and Bloom, a company setting a standard in the American cannabis market.

- In Febrauary 2022, BASF, a German multinational chemical firm and the leading chemical producer worldwide, launched Peptovitae™ series – a novel series of dermocosmetic peptides for modernizeing the cosmetics industry.

- In June 2022, Dong-A Pharmaceutical, a leading manufacturer and seller of medical devices, ethical drugs, and diagnostic tests in South Korea, launched dermacosmetic brand ‘Fation’ in Vietnam.

COVID-19 Impact on the Global Dermacosmetics Market

The abrupt rise of the coronavirus pandemic in 2020 has partially impacted the global dermacosmetics market. During the lockdown period, disruptions in the supply chains and closure of manufacturing units were witnessed by numerous dermacosmetics makers, consequently causing a decrease in the production of dermacosmetics. All these factors mired the dermacosmetics market growth in the course of the pandemic.

However, the pandemic impelled the growth of skin health awareness among consumers, which boosted the demand for products with proven efficiency and a background in medical research. This was a bright spot during the pandemic for the market growth. In addition, with the relaxation of the pandemic since the end of 2021, many dermacosmetics making companies have resumed their usual functioning, which is anticipated to thrust the growth of the dermacosmetics market in the future years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com