Liquid Packaging Market Report

RA07782

Liquid Packaging Market by Material (Plastics, Paperboards, Glass, Metal, and Others), Technology (Aseptic Liquid Packaging, Blow Molding, and Form Fill Seal), Packaging Format (Flexible and Rigid), End-use Industry (Food & Beverage, Personal Care, Pharmaceutical, Household Care, and Industrial), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Liquid Packaging Market Analysis

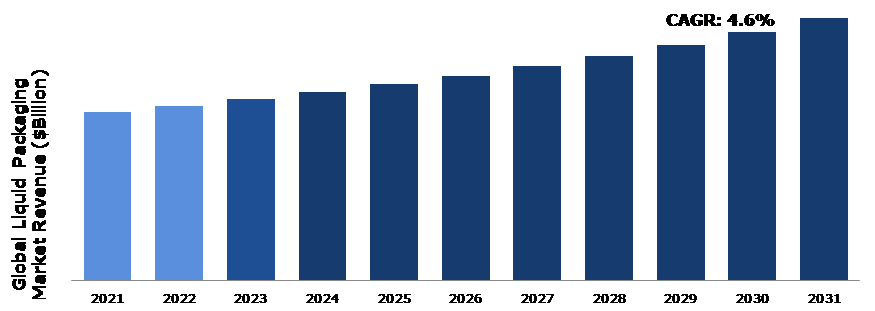

The Global Liquid Packaging Market Size was $363.4 billion in 2021 and is predicted to grow with a CAGR of 4.6%, by generating a revenue of $566.3 billion by 2031.

Global Liquid Packaging Market Synopsis

The increase in demand for packaged liquids from various industries such as food and beverage, pharmaceuticals, personal care, and household chemicals is expected to drive the liquid packaging market during the forecast period. Currently, many manufacturers across the world are looking for ways to reduce the environmental impact of their packaging. Materials such as cornstarch, biodegradable polymers, and recycled paper are more sustainable and decompose much faster than traditional petroleum-based plastics. This reduces the amount of waste that ends up in landfills and helps to reduce the carbon footprint of the manufacturing process. Consumers are looking for packaging solutions that are easy to use, store, and carry while traveling. Manufacturers are offering packaging solutions that are compact and lightweight, thereby making them ideal for on-the-go consumers. These factors are anticipated to boost the liquid packaging industry growth in the upcoming years.

However, the cost of producing and distributing liquid packaging can be high, especially for smaller companies with limited resources. This can limit their ability to compete with larger players in the market. Furthermore, the market for liquid packaging is majorly dependent on the growth of industries that use liquid products, such as food and beverage, pharmaceuticals, and cosmetics. Any slowdown or decline in these industries can have a negative impact on the demand for liquid packaging products.

The increase in demand for liquid packaging for packaged beverages, dairy products, and pharmaceuticals is driving the growth of the market. The rising consumer preference for convenience, portability, and ease of use is also contributing to the market expansion. Moreover, the growing concerns regarding environmental sustainability and the need for eco-friendly packaging solutions are creating new opportunities for the liquid packaging market growth. Many companies are investing in sustainable packaging solutions owing to the increase in popularity and use of recyclable and biodegradable materials. The liquid packaging market is expected to continue to grow and evolve, as new technologies and materials emerge, and as consumer preferences and environmental concerns continue to shape the industry. The liquid packaging market offers significant opportunities for manufacturers to meet the changing needs and preferences of consumers, particularly in the areas of convenience, sustainability, and quality.

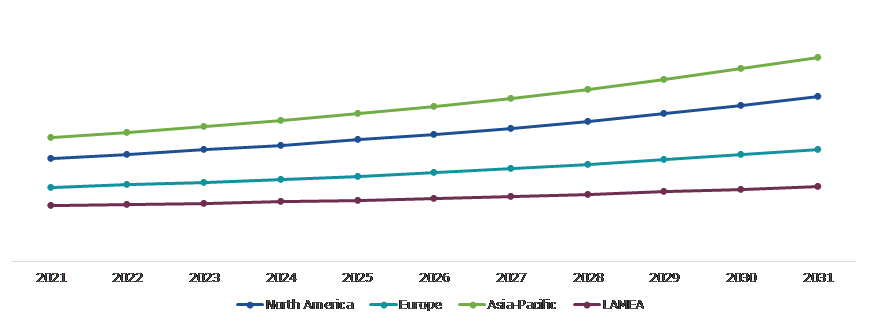

According to regional analysis, the Asia-Pacific liquid packaging market accounted for the highest market share in 2021 and is anticipated to be the fastest growing region during the forecast period. The Asia-Pacific liquid packaging market is predicted to witness significant growth in the upcoming years, driven by the region's rapidly growing demand and developing economy, as well as changing consumer preferences for convenient and sustainable packaging options.

Liquid Packaging Overview

Liquid packaging is a kind of multilayer packaging, used to protect different liquid items such as juices, water, milk, purees, sauces, and others during transportation from spilling or physical or chemical damage. Liquid packaging includes protective layers that operate as a barrier, protecting the product from exterior influences such as light exposure or contamination from external viruses and germs. Glass, metal, polymers, and paperboard are some of the materials used to package liquid items. Liquid packaging is used in the food and beverage industry to pack a variety of liquid items such as carbonated drinks, milk, alcohol, beverages, dairy products, and others.

COVID-19 Impact on Global Liquid Packaging Market

The COVID-19 pandemic had a moderate impact on the liquid packaging market. There was an increase in demand for liquid packaging in sectors such as healthcare, as well as for products like hand sanitizers and cleaning solutions during the pandemic. The COVID-19 pandemic brought several uncertainties, leading to severe economic losses as various businesses across the world were standstill. The outbreak led to a rise in demand for packaged liquid products, such as beverages and cleaning products, as consumers stocked up on essential goods. The global liquid packaging market saw significant growth due to the rise in demand for safe, hygienic, and disposable packaging. As a result of many governments' lockdown restrictions, the globe shifted to online shopping for both essential and non-essential goods. Therefore, the majority of e-commerce platforms, including Amazon, Flipkart, and others increased their focus on the use of protective packaging. Many companies have increased their production capabilities to meet the growing demand.

Growing Applications of Liquid Packaging in the Food and Beverage Sector to Drive the Market Growth

Liquid packaging has immense applications across day-to-day products. For instance, the food and beverage industry is one of the largest consumers of liquid packaging products. The increase in popularity of on-the-go food and drinks and the convenience of pre-packaged items has led to a surge in demand for liquid packaging products. This has resulted in the development of innovative packaging solutions that are specifically designed for the food and beverage industry. These packaging solutions are not only safe and secure but also enhance the shelf life and appearance of the products. The growing trend of health consciousness among consumers has also boosted the demand for liquid packaging products. People are more concerned about the nutritional value and quality of the food and drinks they consume, and therefore, prefer products that are packaged in safe and hygienic containers. The food and beverage industry uses liquid packaging to offer healthier food options to consumers, while also ensuring the safety and quality of the products. The growing demand for packaged food and drinks, the increasing trend of health consciousness, and the need for eco-friendly packaging solutions are the major drivers of the liquid packaging market growth.

To know more about global liquid packaging market drivers, get in touch with our analysts here.

High Cost of Raw Materials to Restrain the Liquid Packaging Market Growth

The high cost of raw materials used to manufacture food packaging cartons is projected to hamper the liquid packaging market growth. The cost of raw materials is one of the most significant factors affecting the pricing of liquid packaging products. Raw materials used in the production of liquid packaging can vary depending on the type of packaging, the intended use, and the market demand. Some of the primary raw materials used in the liquid packaging industry include paperboard, plastic resins, aluminum, and glass. The cost of these materials can fluctuate depending on factors such as supply and demand, transportation costs, and government regulations. These are the major factors anticipated to hamper the liquid packaging market growth during the forecast period.

Growing Demand for Premium Packaging to Drive Excellent Opportunities in the Market

The increase in demand for high-end and premium products is leading to the growth of premium liquid packaging options. Consumers are willing to pay extra for premium packaging that not only protects the product but also adds to its aesthetic appeal. This has led to the introduction of various innovative liquid packaging solutions such as airtight containers, shatterproof bottles, and sleek designs that cater to the high-end market. Moreover, the rise in e-commerce and online shopping has increased the need for premium packaging solutions that can withstand rough handling during transportation and ensure that the product reaches the customer in its original condition. All these are the factors projected to further create several growth opportunities for the key players operating in the liquid packaging market in the upcoming years.

To know more about global liquid packaging market opportunities, get in touch with our analysts here.

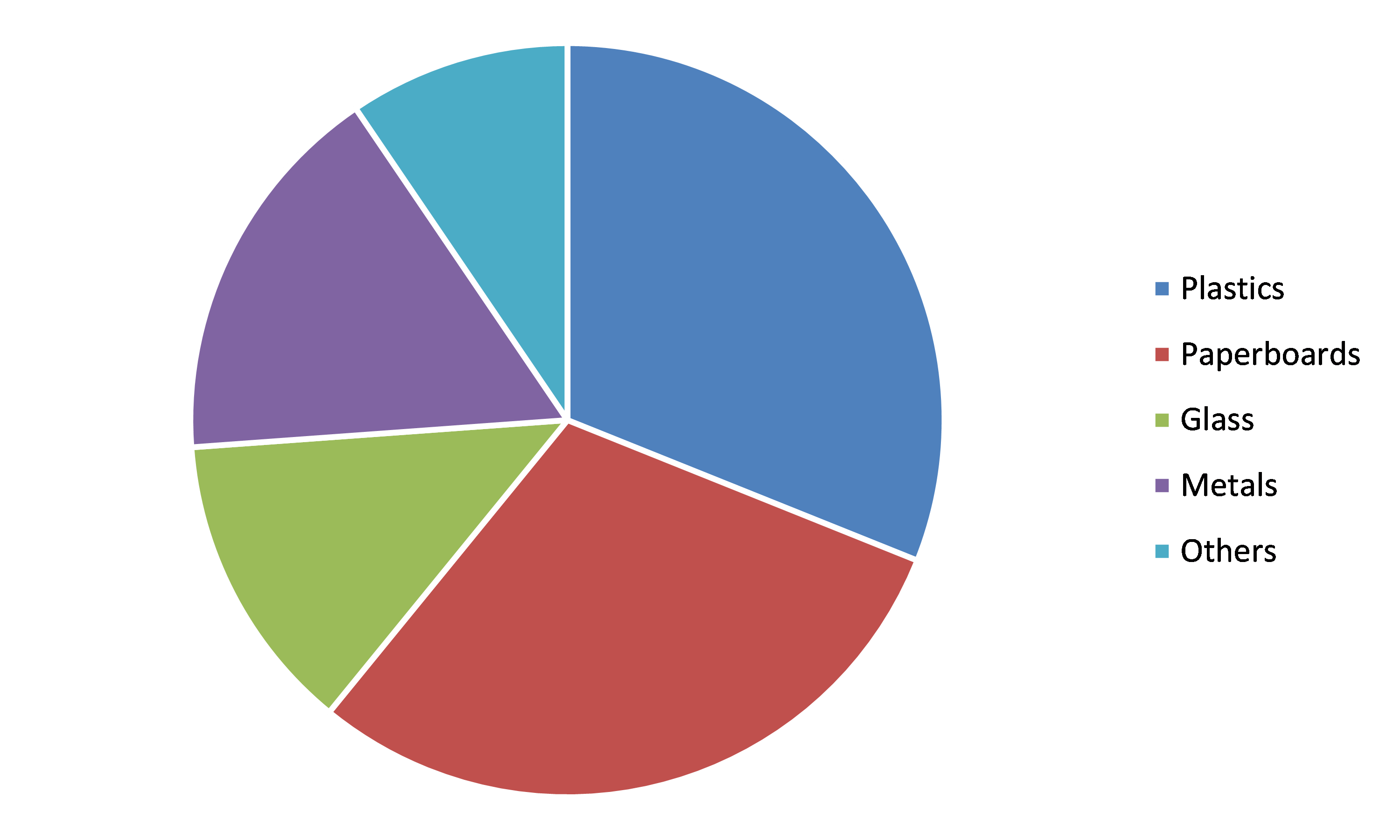

Global Liquid Packaging Market, by Material

Based on material, the market has been divided into plastics, paperboards, glass, metal, and others. Among these, the plastics sub-segment accounted for the highest market share in 2021, as well as it is estimated to show the fastest growth during the forecast period.

Global Liquid Packaging Market Size, by Material, 2021

Source: Research Dive Analysis

The plastics sub-segment accounted for the largest market share in 2021. Plastics are widely used in packaging due to several factors, including the increase in demand for lightweight and durable packaging materials, and the versatility and affordability of plastic packaging. The use of plastic packaging in the food and beverage industry is also growing, as it provides a barrier against moisture, air, and other contaminants, helping to extend the shelf life of products. The rise in e-commerce and online food delivery services is also driving the growth of the plastic segment, as these businesses require lightweight and leak-proof packaging to protect products during transportation. These factors are expected to increase the demand for the plastics segment during the forecast period.

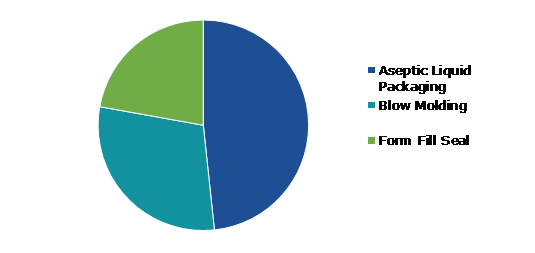

Global Liquid Packaging Market, by Technology

Based on technology, the market has been divided into aseptic liquid packaging, blow molding, and form fill seal. Among these, the aseptic liquid packaging segment accounted for the highest revenue share in 2021.

Global Liquid Packaging Market Share, by Technology, 2021

Source: Research Dive Analysis

The aseptic liquid packaging sub-segment accounted for the largest market share in 2021. Aseptic liquid packaging provides an airtight and sterile environment for the contents, ensuring that the product remains fresh for an extended period without the need for refrigeration. This is particularly important for products such as juices, smoothies, and other functional drinks that are often consumed on the go. Aseptic liquid packaging is also cost-effective and versatile, making it ideal for a range of products and applications. It can be used for a wide range of liquid products such as soups, broths, and sauces. These factors are anticipated to boost the growth of the aseptic liquid packaging sub-segment during the forecast timeframe.

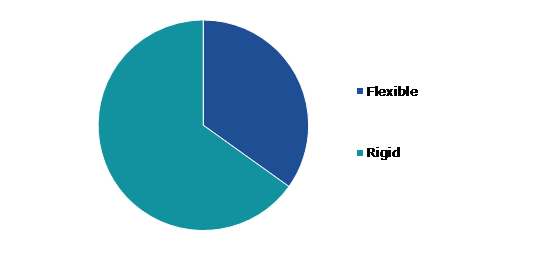

Global Liquid Packaging Market, by Packaging Format

Based on packaging format, the market has been divided into flexible and rigid. Among these, the rigid segment accounted for the highest revenue share in 2021.

Global Liquid Packaging Market Growth, by Packaging Format, 2021

Source: Research Dive Analysis

The rigid sub-segment accounted for the largest market share in 2021. The use of hard plastics and other materials in rigid packaging boosts its strength, which drives the market demand. Rigid packaging does not affect the quality or flavor of the food. Rigid packaging may be enclosed in any form and utilized to create space that properly fits around the product. Furthermore, hard packaging is extremely protective when compared to other types of packaging. If a package falls off a store shelf, for example, the stiff plastic can safeguard your product by absorbing the impact. These factors are anticipated to boost the growth of the rigid sub-segment during the forecast period.

Global Liquid Packaging Market, by End-use Industry

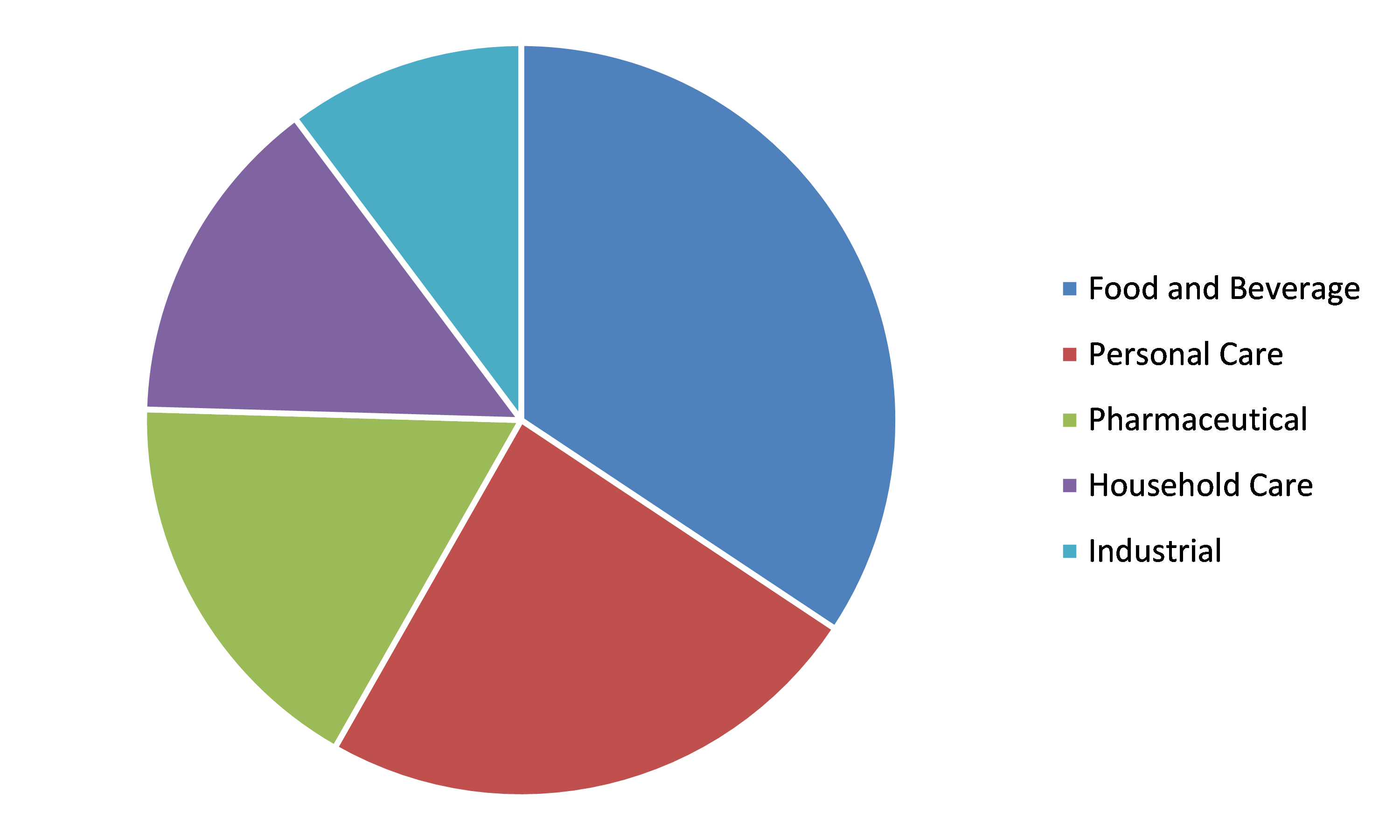

Based on end-use industry, the market has been divided into food & beverage, personal care, pharmaceutical, household care, and industrial. Among these, the food & beverage segment accounted for the highest revenue share in 2021.

Global Liquid Packaging Market Analysis, by End-use Industry, 2021

Source: Research Dive Analysis

The food & beverage sub-segment accounted for the largest market share in 2021. There are several factors contributing to the growth of the food & beverage segment in the liquid packaging market. One of the main drivers is the increase in demand for packaged liquids such as juices, soft drinks, dairy products, and alcoholic beverages. Liquid packing is important in the food and beverage sector as it maintains quality, minimizes wastage, and reduces the need for preservatives to be added to beverages and food. Consumers are becoming more environmentally conscious and are looking for packaging options that are sustainable and eco-friendly. These factors are anticipated to boost the growth of the food & beverage sub-segment in the upcoming years.

Global Liquid Packaging Market, Regional Insights

The liquid packaging market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Liquid Packaging Market Size & Forecast, by region, 2021-2031 ($ Billion)

Source: Research Dive Analysis

The Market for Liquid Packaging in Asia-Pacific to be the Most Dominant

The Asia-Pacific liquid packaging market accounted for the largest market share in 2021. The region is expected to show substantial growth in the liquid packaging market in the upcoming years. Asia-Pacific has a rapidly growing population and a developing economy, leading to increased demand for packaged liquid products such as beverages, food, and personal care items. In addition, the region's increasing urbanization and rising disposable income levels are driving the growth of the consumer goods sector, which in turn is driving demand for liquid packaging. China and India are expected to be the largest markets for liquid packaging in Asia-Pacific, due to their large populations, rapidly growing economies, and increasing consumer demand for packaged goods. Other countries in the region, such as Indonesia, Thailand, and Vietnam, are also expected to show significant growth as they develop their economies and improve their infrastructure. The rise in demand for convenient, single-serving packaging, and sustainable packaging options is also expected to drive the growth of the liquid packaging market in Asia-Pacific. For example, there is a growing demand for biodegradable and compostable packaging materials, as consumers become more environmentally conscious. These are the major factors anticipated to drive the regional market growth during the forecast period.

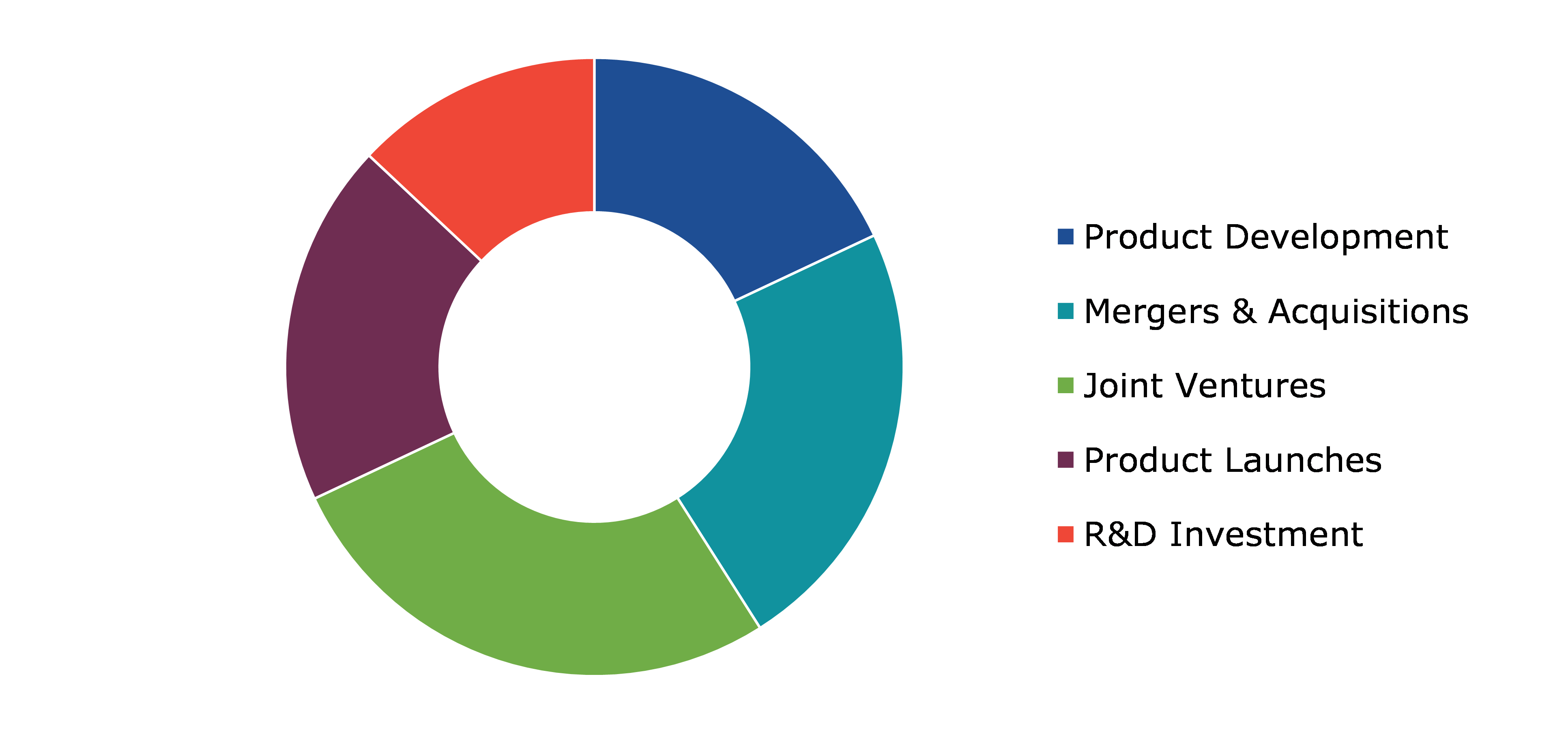

Competitive Scenario in the Global Liquid Packaging Market

Investment and agreement are common strategies followed by major market players. For instance, in February 2020, Liquibox acquired DS Smith plc's plastic division in order to expand its flexible packaging and dispensers business. This has also broadened the assortment of bags, films, and dispensing accessories available to global clients.

Source: Research Dive Analysis

Some of the leading liquid packaging market players are Amcor plc, Berry Global, Inc, Constantia Flexibles, Gerresheimer AG, Goglio S.p.A., Mondi, ProAmpac, Sealed Air, Smurfit Kappa, and Tetra Laval Group.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Material |

|

| Segmentation by Technology |

|

| Segmentation by Packaging Format |

|

| Segmentation by End-use Industry |

|

| Key Companies Profiled |

|

Q1. What is the size of the global liquid packaging market?

A. The size of the global liquid packaging market was over $363.4 billion in 2021 and is projected to reach $566.3 billion by 2031.

Q2. Which are the major companies in the liquid packaging market?

A. Amcor plc, Berry Global, Inc, and Constantia Flexibles are some of the key players in the global liquid packaging market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific liquid packaging market?

A. Asia-Pacific liquid packaging market is anticipated to grow at 5.2% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. merger and aquisitions are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Gerresheimer AG, Goglio S.p.A., and ProAmpac Intermediate, Inc. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Liquid Packaging Market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Liquid Packaging market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Liquid Packaging Market Analysis, by Material

5.1.Overview

5.2.Plastics

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country,2021-2031

5.3.Paperboards

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Glass

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2021-2031

5.4.3.Market share analysis, by country, 2021-2031

5.5.Metal

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2021-2031

5.5.3.Market share analysis, by country, 2021-2031

5.6.Others (stretch film, shrink film)

5.6.1.Definition, key trends, growth factors, and opportunities

5.6.2.Market size analysis, by region, 2021-2031

5.6.3.Market share analysis, by country,2021-2031

5.7.Research Dive Exclusive Insights

5.7.1.Market attractiveness

5.7.2.Competition heatmap

6.Liquid Packaging Market Analysis, by Technology

6.1.Aseptic Liquid Packaging

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2021-2031

6.1.3.Market share analysis, by country, 2021-2031

6.2.Blow Molding

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country,2021-2031

6.3.Form Fill Seal

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4. Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Liquid Packaging Market Analysis, by Packaging Format

7.1.Flexible

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2021-2031

7.1.3.Market share analysis, by country, 2021-2031

7.2.Rigid

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2021-2031

7.2.3.Market share analysis, by country, 2021-2031

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness

7.3.2.Competition heatmap

8.Liquid Packaging Market Analysis, by End-use Industry

8.1.Food & Beverage

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region, 2021-2031

8.1.3.Market share analysis, by country, 2021-2031

8.2.Personal Care

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region 2021-2031

8.2.3.Market share analysis, by country 2021-2031

8.3. Pharmaceutical

8.3.1.Definition, key trends, growth factors, and opportunities

8.3.2.Market size analysis, by region, 2021-2031

8.3.3.Market share analysis, by country, 2021-2031

8.4.Household Care

8.4.1.Definition, key trends, growth factors, and opportunities

8.4.2.Market size analysis, by region, 2021-2031

8.4.3.Market share analysis, by country, 2021-2031

8.5.Industrial

8.5.1.Definition, key trends, growth factors, and opportunities

8.5.2.Market size analysis, by region, 2021-2031

8.5.3.Market share analysis, by country, 2021-2031

8.6.Research Dive Exclusive Insights

8.6.1.Market attractiveness

8.6.2.Competition heatmap

9.Liquid Packaging Market, by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Material, 2021-2031

9.1.1.2.Market size analysis, by Technology, 2021-2031

9.1.1.3.Market size analysis, by Packaging Format,2021-2031

9.1.1.4.Market size analysis, by End-use Industry, 2021-2031

9.1.2.Canada

9.1.2.1.Market size analysis, by Material, 2021-2031

9.1.2.2.Market size analysis, by Technology, 2021-2031

9.1.2.3.Market size analysis, by Packaging Format, 2021-2031

9.1.2.4.Market size analysis, by End-use Industry, 2021-2031

9.1.3.Mexico

9.1.3.1.Market size analysis, by Material, 2021-2031

9.1.3.2.Market size analysis, by Technology, 2021-2031

9.1.3.3.Market size analysis, by Packaging Format, 2021-2031

9.1.3.4.Market size analysis, by End-use Industry, 2021-2031

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Material, 2021-2031

9.2.1.2.Market size analysis, by Technology, 2021-2031

9.2.1.3.Market size analysis, by Packaging Format, 2021-2031

9.2.1.4.Market size analysis, by End-use Industry, 2021-2031

9.2.2.UK

9.2.2.1.Market size analysis, by Material, 2021-2031

9.2.2.2.Market size analysis, by Technology, 2021-2031

9.2.2.3.Market size analysis, by Packaging Format, 2021-2031

9.2.2.4.Market size analysis, by End-use Industry, 2021-2031

9.2.3.France

9.2.3.1.Market size analysis, by Material, 2021-2031

9.2.3.2.Market size analysis, by Technology, 2021-2031

9.2.3.3.Market size analysis, by Packaging Format, 2021-2031

9.2.3.4.Market size analysis, by End-use Industry, 2021-2031

9.2.4.Spain

9.2.4.1.Market size analysis, by Material, 2021-2031

9.2.4.2.Market size analysis, by Technology, 2021-2031

9.2.4.3.Market size analysis, by Packaging Format, 2021-2031

9.2.4.4.Market size analysis, by End-use Industry, 2021-2031

9.2.5.Italy

9.2.5.1.Market size analysis, by Material, 2021-2031

9.2.5.2.Market size analysis, by Technology, 2021-2031

9.2.5.3.Market size analysis, by Packaging Format, 2021-2031

9.2.5.4.Market size analysis, by End-use Industry, 2021-2031

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Material, 2021-2031

9.2.6.2.Market size analysis, by Technology, 2021-2031

9.2.6.3.Market size analysis, by Packaging Format, 2021-2031

9.2.6.4.Market size analysis, by End-use Industry, 2021-2031

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia-Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Material, 2021-2031

9.3.1.2.Market size analysis, by Technology, 2021-2031

9.3.1.3.Market size analysis, by Packaging Format, 2021-2031

9.3.1.4.Market size analysis, by End-use Industry, 2021-2031

9.3.2.Japan

9.3.2.1.Market size analysis, by Material, 2021-2031

9.3.2.2.Market size analysis, by Technology, 2021-2031

9.3.2.3.Market size analysis, by Packaging Format, 2021-2031

9.3.2.4.Market size analysis, by End-use Industry, 2021-2031

9.3.3.India

9.3.3.1.Market size analysis, by Material, 2021-2031

9.3.3.2.Market size analysis, by Technology, 2021-2031

9.3.3.3.Market size analysis, by Packaging Format, 2021-2031

9.3.3.4.Market size analysis, by End-use Industry, 2021-2031

9.3.4.Australia

9.3.4.1.Market size analysis, by Material, 2021-2031

9.3.4.2.Market size analysis, by Technology, 2021-2031

9.3.4.3.Market size analysis, by Packaging Format, 2021-2031

9.3.4.4.Market size analysis, by End-use Industry, 2021-2031

9.3.5.South Korea

9.3.5.1.Market size analysis, by Material, 2021-2031

9.3.5.2.Market size analysis, by Technology, 2021-2031

9.3.5.3.Market size analysis, by Packaging Format, 2021-2031

9.3.5.4.Market size analysis, by End-use Industry, 2021-2031

9.3.6.Rest of Asia-Pacific

9.3.6.1.Market size analysis, by Material, 2021-2031

9.3.6.2.Market size analysis, by Technology, 2021-2031

9.3.6.3.Market size analysis, by Packaging Format, 2021-2031

9.3.6.4.Market size analysis, by End-use Industry, 2021-2031

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Material, 2021-2031

9.4.1.2.Market size analysis, by Technology, 2021-2031

9.4.1.3.Market size analysis, by Packaging Format, 2021-2031

9.4.1.4.Market size analysis, by End-use Industry, 2021-2031

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Material,2021-2031

9.4.2.2.Market size analysis, by Technology, 2021-2031

9.4.2.3.Market size analysis, by Packaging Format, 2021-2031

9.4.2.4.Market size analysis, by End-use Industry, 2021-2031

9.4.3.UAE

9.4.3.1.Market size analysis, by Material, 2021-2031

9.4.3.2.Market size analysis, by Technology, 2021-2031

9.4.3.3.Market size analysis, by Packaging Format, 2021-2031

9.4.3.4.Market size analysis, by End-use Industry, 2021-2031

9.4.4.South Africa

9.4.4.1.Market size analysis, by Material, 2021-2031

9.4.4.2.Market size analysis, by Technology, 2021-2031

9.4.4.3.Market size analysis, by Packaging Format, 2021-2031

9.4.4.4.Market size analysis, by End-use Industry, 2021-2031

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Material, 2021-2031

9.4.5.2.Market size analysis, by Technology, 2021-2031

9.4.5.3.Market size analysis, by Packaging Format, 2021-2031

9.4.5.4.Market size analysis, by End-use Industry, 2021-2031

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1.Amcor plc

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2.Berry Global, Inc

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3.Constantia Flexibles

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4.Gerresheimer AG

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5.Goglio S.p.A.

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6.Mondi

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.ProAmpac

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8.Sealed Air

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.Smurfit Kappa

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10. Tetra Laval Group

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

Liquid packaging refers to packaging of liquid food products, beverages, medicines, etc., so as to ensure their safe and tamper-proof transportation. Though, traditionally, plastic has been the primary material used for liquid packaging, in recent years, the demand for sustainable packaging materials has grown which has led many companies to opt for materials which are biodegradable in nature. Ease of convenience, portability, and sustainability are thus the main factors which liquid packaging industries consider while manufacturing liquid packaging materials.

Forecast Analysis of the Liquid Packaging Market

In recent years, there has been an increase in the demand for packaged liquids from various industries such as food and beverage, pharmaceuticals, personal care, household chemicals, etc. This growth in demand is predicted to be the primary growth driver of the global liquid packaging market in the forecast period. Additionally, growing demand for premium packaging is anticipated to push the market forward. Along with this, the changing needs and preferences of consumers, particularly in the areas of convenience, sustainability, and quality is projected to offer numerous growth and investment opportunities to the market in the analysis timeframe. However, the high cost of raw materials is estimated to create hurdles in the full-fledged growth of the liquid packaging market in the coming period.

Regionally, the liquid packaging market in the Asia-Pacific region is expected to be the most dominant by 2031. Growing demand for packaged liquid products such as beverages, food, and personal care items is expected to be the leading factor behind the growth of the market in this region.

According to the report published by Research Dive, the global liquid packaging market is expected to gather a revenue of $566.3 billion by 2031 and grow at 4.6% CAGR in the 2022–2031 timeframe. Some prominent market players include Amcor plc, Goglio S.p.A., Sealed Air, Berry Global, Inc, Mondi, Smurfit Kappa, Constantia Flexibles, ProAmpac, Tetra Laval Group, Gerresheimer AG, and many others.

Covid-19 Impact on the Liquid Packaging Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The liquid packaging market, however, faced a moderate impact of the pandemic. Though there were massive supply chain disruptions which lowered the market growth rate during the pandemic, the overall demand for liquid packaging increased due to a rise in demand for sanitizers, liquid soaps, and cleaning products. This growth in demand for such liquid products helped the market to put up a stiff resistance in the pandemic period.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the liquid packaging market to flourish. For instance:

- In February 2022, Elopak ASA, a carton producing company, announced that it had signed a partnership agreement with Nippon Paper Industries. This partnership is aimed at developing strategies to strengthen the liquid paper packaging of both the companies and cater to the demands of the global market in a comprehensive way.

- In February 2023, Sealed Air (SEE), a packaging company based in the US, announced the acquisition of Liquibox, a liquid packaging firm. This acquisition is predicted to increase the market share of the acquiring company i.e., SEE substantially in the next few years.

- In February 2023, Oji Holdings Corporation, a global leader in paper and pulp industry, announced the acquisition of IPI Srl, a leading carton manufacturer. This acquisition is predicted to boost the market share of Oji Holdings Corporations and help the company to expand its business globally.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com