Silk Market Report

RA07698

Silk Market by Type (Mulberry Silk, Tussar Silk, Eri Silk, and Others), End user (Textile and Cosmetics & Medical), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022–2031

Global Silk Market Analysis

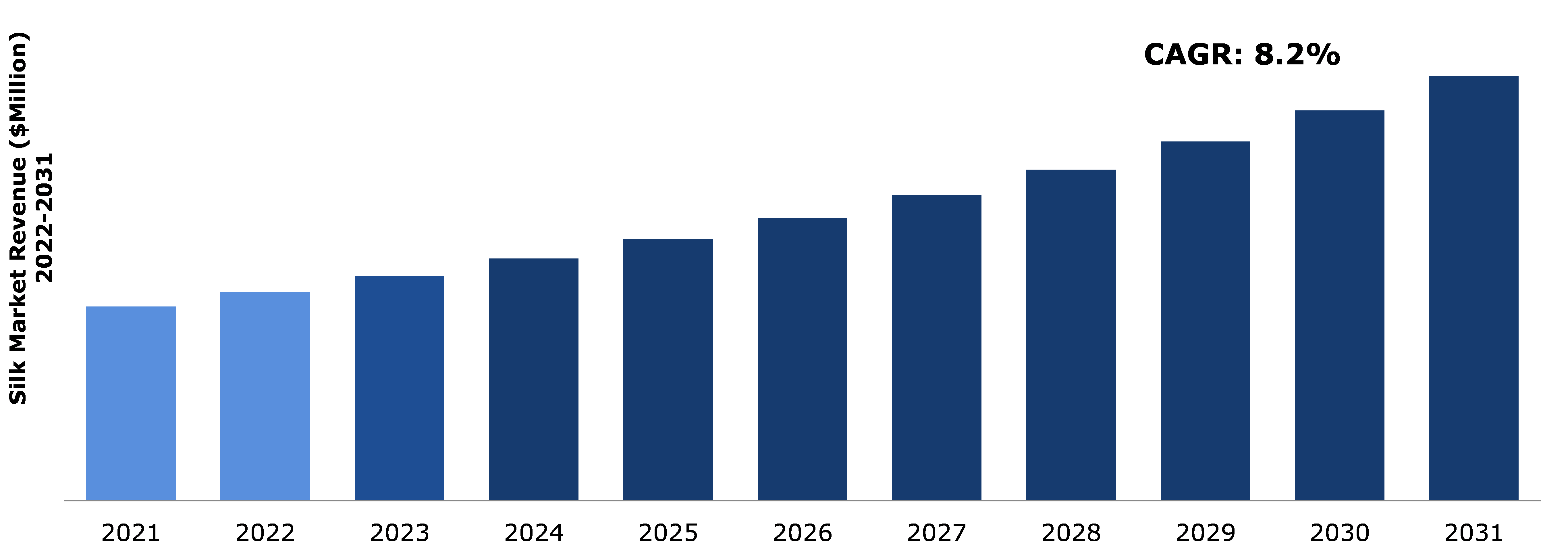

The global silk market size was $15,608.3 million in 2021 and is predicted to grow with a CAGR of 8.2%, by generating a revenue of $34,102.5 million by 2031.

Global Silk Market Synopsis

Silk is one of the most significant contributors to the textile & apparel market worldwide, which is consistently increasing and evolving in terms of demand. Various qualities of silk fiber include its opulent feel, lustrous appearance, resilience, strength, and light weight. Silk is widely used in many different types of clothing, such as gowns, wedding gowns, neckties, and scarves, as well as in many different household items, such as wall hangings, pillows, upholstery, and draperies. In addition, silk has less conductivity than other materials, which promotes its use in ties, shirts, haute couture garments, formal dress suits, robes, kimonos, and sundresses. The demand for silk is expected to increase as a result of the aforementioned crucial factors, which could ultimately lead to a flourishing global silk market growth.

The silk market requires less investment because it does not require complex machines and equipment to produce. It is more labor-intensive than investment-intensive industries. These factors contribute to the market's expansion. Increasing research and knowledge about seri-by-products and seri-waste products will be crucial for the growth of the silk market trend in the upcoming years. One of the major reasons for the increased use of silk protein in a variety of industries is the presence of dipeptides and tripeptides within it, which can easily penetrate the bloodstream from the dermis skin layer. In addition, the presence of components such as natural amino acids in silk protein makes it desirable for various cosmetics and supplement manufacturing end users.

One of the factors limiting the growth of the global silk market size is the fluctuation of silk material prices. Additionally, inadequate market and storage facilities, inadequate transportation options, and inadequate market trend information, particularly in the developing countries such as India, Brazil, and Uzbekistan, are some of the factors that are causing impediments in the global silk industry.

With a yearly turnover of billions of euros, the textile industry, particularly the silk industry, is one of the most strategic economic activities in Europe. The biggest markets for silk textiles in Europe are in Germany and Italy. Customers in Italy and Germany prefer natural fibers, which have led to the importation of a huge variety of silk fabrics for clothing, accessories, and home décor. Additionally, despite the fact that the European apparel and textile industry is a diverse sector, silk is one of the most significant textiles produced in Italy due to its distinctive qualities such as breathability, elasticity, and absorbency. For investors, these factors may present opportunities in the years to come. Furthermore, new companies working in the global silk industry are developing novel ideas that may have a favorable effect on the sector.

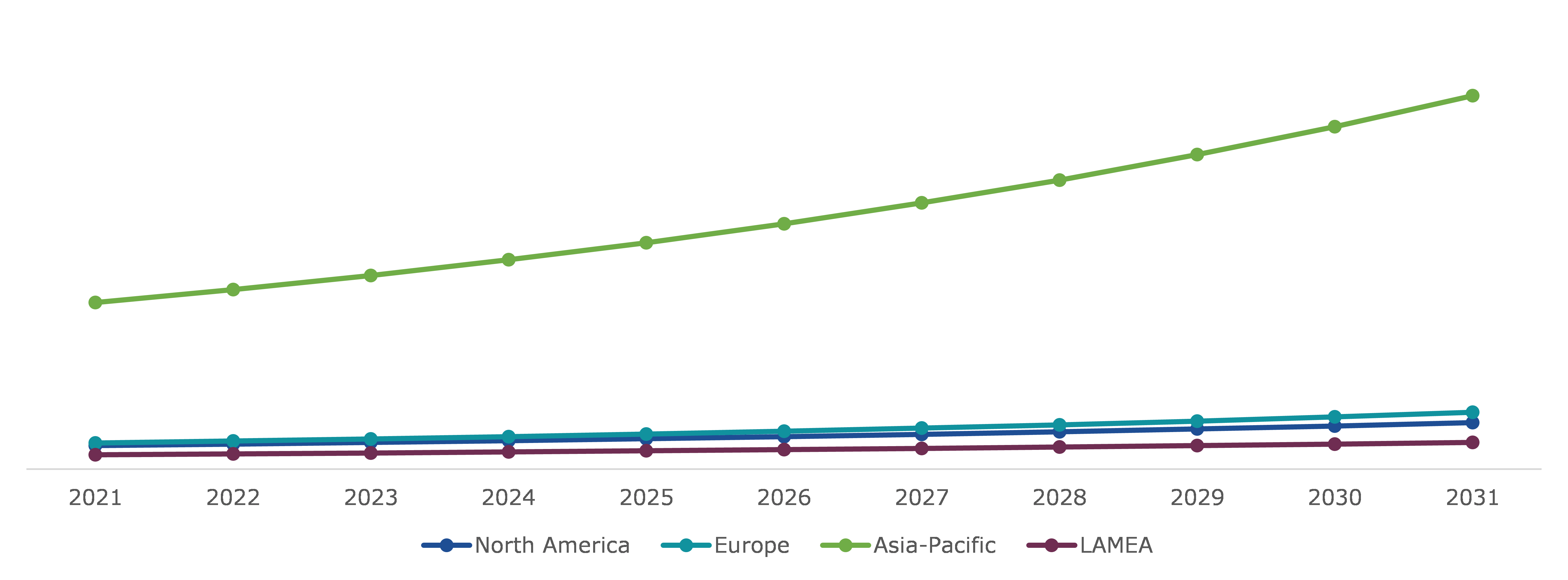

According to regional analysis, the Asia-Pacific silk market share accounted for dominant market share in 2021. Asian countries such as India, Thailand, China, and Uzbekistan are the prominent players in the silk industry in Asia-Pacific.

Silk Market Overview

The natural protein fiber, silk, is taken from the insect's larvae. Raw silk, domesticated silkworms like Bombyx mori, and spider species such as Araneus diadematus are the main sources of commercial silk production. Silk proteins are useful substances that are created following the biosynthesis process in specialized glands. The Bombyx mori mulberry silkworm larvae's cocoons yield the best silk. Since it takes about 10,000 cocoons to produce that calibre of silk, real silk is very expensive.

COVID-19 Impact on Global Silk Market

The global silk market share suffered negative growth as a result of the COVID-19 virus outbreak. The silk industry experienced a variety of production-related challenges during the COVID-19 period, including fluctuating cocoon and raw silk prices, transportation problems, a labor shortage, a decline in the sale of raw silk and silk-related products, a decline in working capital and cash flow, fewer export/import orders, and other limitations. During the peak of COVID-19, orders and supply in recent months revealed a falling trend in silk production, which is currently noticeably improving. Furthermore, changes in consumption habits and silk marketing methods have been brought on by the pandemic. Businesses in the China, India, and France region have had significant issues with their supply chains. Value chain, market channels, and consumption trends have all been significantly impacted by COVID. The operations of numerous businesses, including the silk industry, were considered as being in risk. Simultaneously, to deal with these situations many companies have made efforts to combine the Internet and new technologies in the silk market in order to innovate, develop, transform and upgrade to adapt to market changes, thereby combating the economic crisis caused by the pandemic. Thus, implementing strategies and finding solutions to the problems were the major problem solvers in such crucial times.

Less Initial Investment and More Profit for Farmers are Expected to Drive the Global Silk Market Growth

Due to the lack of complicated machinery and equipment needed to produce it, the silk market requires less investment. Compared to investment-intensive industries, it is more labor-intensive. These elements aid in the market's expansion. For the silk protein market to expand in the coming years, more research and understanding about seri-byproducts and seri-waste products will be essential. Because they contain dipeptides and tripeptides that can readily enter the bloodstream from the dermal skin layer, silk proteins are increasingly used in a variety of industries. This is one of the main causes. In addition, silk protein is desirable for use in the production of various cosmetics and supplements due to the presence of ingredients such as natural amino acids. These features are expected to boost the global silk market share growth of the market during analysis timeframe.

Changing Silk Material Prices in Global Market to Restrain the Growth of the Market

One of the factors limiting the growth of the global silk market size is the fluctuation of silk material prices. Additionally, inadequate market and storage facilities, inadequate transportation options, and inadequate market trend information, particularly in the developing countries such as India, Brazil, and Uzbekistan, are some of the factors that are causing obstructions in the global silk industry. One of the main factors restricting the global silk market opportunity growth is the high price of raw silk. India, Japan, and Italy are among the developed as well as developing countries that rely heavily on China for their raw silk needs. These factors hamper the silk market growth.

Use of Silk in Clothing and Apparels to drive Excellent Opportunities in Global Silk Market

The clothing industry, or mostly the silk industry, is one of the strategic economic activities in countries like Europe. The biggest markets for silk textiles in Europe are in Germany and Italy. Customers in Italy and Germany prefer natural fibers, along with the importation of a huge variety of silk fabrics for clothing, accessories, and home décor. Even though the European apparel and textile industry is a diverse sector, silk is one of the most significant textiles produced in Italy because of its distinctive qualities such as breathability, elasticity, and absorbency. For investors, these factors may present opportunities in the years to come. New companies working in the global silk industry are also developing novel ideas that may have a favorable effect on the sector which is projected to boost the growth of the global silk market demand in the near future.

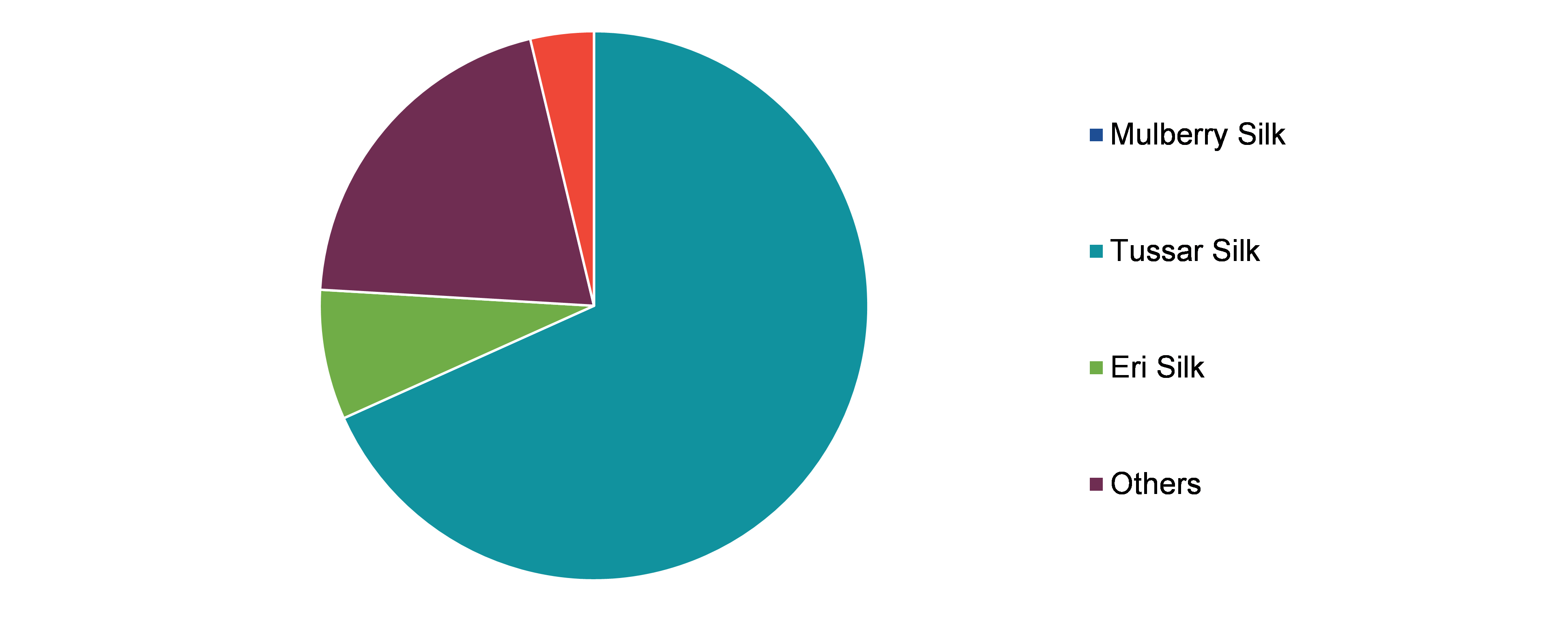

Global Silk Market Share, by Type

Based on type, the market has been divided into mulberry silk, tussar silk, eri silk, and others. Among these, the mulberry silk segment accounted for the highest market share in 2021 and also throughout the forecast period.

Global Silk Market Share, by Type, 2021

Source: Research Dive Analysis

The mulberry silk sub-type accounted dominant market share in 2021. Throughout the analysis period, mulberry silk is expected to be the dominant type in the silk market, mainly owing to its huge prominence in the textile industry. Mulberry silk is also one of the highest quality silks, being pure white in colour and completely natural and odourless. Owing to such unique features, there is a huge demand for mulberry silk in the global market. Furthermore, novel and innovative product launches are propelling the mulberry silk segment. For instance, in June 2020, MayfairSilk, London-based significant silk product company, announced the official launch of elegant 100% mulberry silk bed linen and sleep accessories collection. This collection provides customers with excellent resistance against mould, mildew, and dust mites, enabling them to maintain strict levels of cleanliness and hygiene. Such product developments can have a positive impact on the mulberry silk segment.

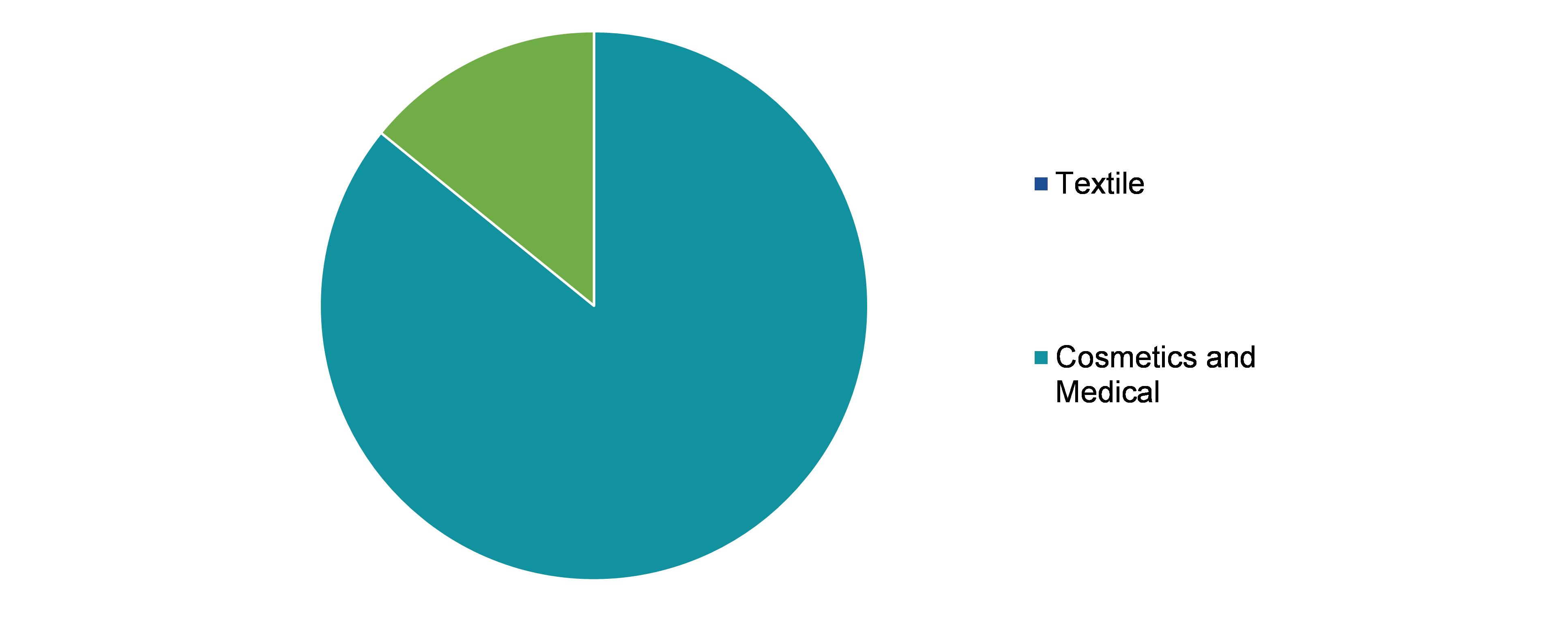

Global Silk Market Size, by End user

On the basis of end user, the market has been divided into textile and cosmetics & medical. Among these, the textile segment is anticipated to garner the maximum revenue and extensive market growth in the global industry in the forecasted period.

Global Silk Market Growth, by End user, 2021

Source: Research Dive Analysis

The textile segment accounted dominant market share in 2021. Textile is the rapidly growing end user of silk, as it is a crucial contributor to the textile industry owing to its remarkable features such as luxurious feel, lustrous appearance, light weightiness, and great strength. Moreover, silk plays a key role in the production of surgical sutures, clothing, silk comforters, and parachutes, which is further projected to propel the segment, over the analysis timeframe.

Global Silk Market Value, Regional Analysis

The global silk market trend was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Silk Market Size & Forecast, by Region, 2021-2031(USD Million)

Source: Research Dive Analysis

The Market for Silk in Asia-Pacific to be the most Dominant

The Asia-Pacific silk market is projected to account for a significant growth rate during the forecast period. Silk market for Asia-Pacific is highly competitive, and leading companies in the market prefer numerous strategies to garner prominent Asia-Pacific silk market share. Asian countries such as India, Thailand, China, and Uzbekistan are the prominent players in the silk industry in Asia-Pacific. The demand for silk is significantly attributed to the growing population worldwide, along with the increase in number of startups with their novel innovations.

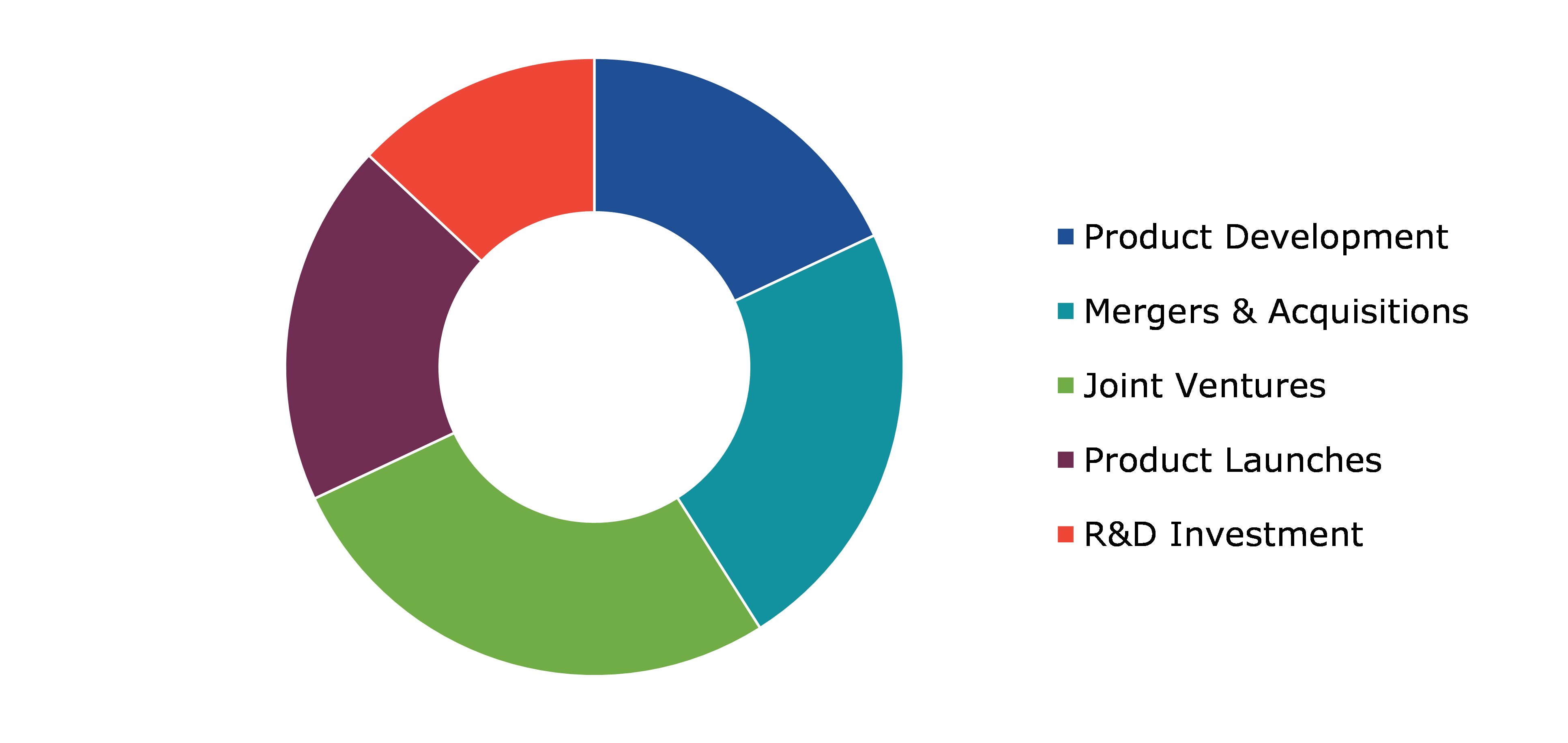

Competitive Scenario in the Global Silk Market

Technological advancements and partnerships are common strategies followed by major market players. For instance, in January 2022, AMSilk GmbH, a world leader in supplying innovative high-performance bio-based silk materials, announced that it had entered into a partnership with Mercedes-Benz, for the development of novel, sustainable car door pulls, as part of the car manufacturer’s latest technology program, the VISION EQXX.

Source: Research Dive Analysis

Some of the leading global silk market players are Anhui Silk Co. Ltd., AMSilk GmbH, EntoGenetics Inc., Bolt Threads, Sichuan Nanchong Liuhe (Group) Corp., China Silk Group Co. Ltd., Zhejiang Jiaxin Silk Co., Ltd., Xuzhou Shengkun Silk Manufacturing Co., Ltd., Spiber Technologies , and Libas Textiles Ltd.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by End user |

|

| Key Companies Profiled |

|

Q1. What is the size of the global silk market?

A. The size of the global silk market was over $15,608.3million in 2021 and is projected to reach $34,102.5 million by 2031.

Q2. Which are the major companies in the silk market?

A. Anhui Silk Co. Ltd., AMSilk GmbH, EntoGenetics Inc., and Bolt Threads are some of the key players in the global silk market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific silk market?

A. Asia-Pacific silk market is anticipated to grow at 8.5% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological advancements and partnerships are the two key strategies adopted by the operating companies in this market.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global silk market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on silk market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Silk Market Analysis, by Type

5.1.Overview

5.2.Mulberry silk

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3.Tussar silk

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4.Eri silk

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region

5.4.3.Market share analysis, by country

5.5.Others

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region

5.5.3.Market share analysis, by country

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.Silk Market Analysis, by End User

6.1.Textile

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region

6.1.3.Market share analysis, by country

6.2.Cosmetics & Medicals

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region

6.2.3.Market share analysis, by country

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness

6.3.2.Competition heatmap

7.Silk Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type

7.1.1.2.Market size analysis, by End User

7.1.2.Canada

7.1.2.1.Market size analysis, by Type

7.1.2.2.Market size analysis, by End User

7.1.3.Mexico

7.1.3.1.Market size analysis, by Type

7.1.3.2.Market size analysis, by End User

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type

7.2.1.2.Market size analysis, by End User

7.2.2.UK

7.2.2.1.Market size analysis, by Type

7.2.2.2.Market size analysis, by End User

7.2.3.France

7.2.3.1.Market size analysis, by Type

7.2.3.2.Market size analysis, by End User

7.2.4.Spain

7.2.4.1.Market size analysis, by Type

7.2.4.2.Market size analysis, by End User

7.2.5.Italy

7.2.5.1.Market size analysis, by Type

7.2.5.2.Market size analysis, by End User

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type

7.2.6.2.Market size analysis, by End User

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type

7.3.1.2.Market size analysis, by End User

7.3.2.Japan

7.3.2.1.Market size analysis, by Type

7.3.2.2.Market size analysis, by End User

7.3.3.India

7.3.3.1.Market size analysis, by Type

7.3.3.2.Market size analysis, by End User

7.3.4.Australia

7.3.4.1.Market size analysis, by Type

7.3.4.2.Market size analysis, by End User

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type

7.3.5.2.Market size analysis, by End User

7.3.6.Rest of Asia Pacific

7.3.6.1.Market size analysis, by Type

7.3.6.2.Market size analysis, by End User

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type

7.4.1.2.Market size analysis, by End User

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type

7.4.2.2.Market size analysis, by End User

7.4.3.UAE

7.4.3.1.Market size analysis, by Type

7.4.3.2.Market size analysis, by End User

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type

7.4.4.2.Market size analysis, by End User

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type

7.4.5.2.Market size analysis, by End User

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Anhui Silk Co.Ltd

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.1.7.Research Dive Analyst View

9.2.AMSilk GmbH

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.2.7.Research Dive Analyst View

9.3.EntoGenetics Inc

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.3.7.Research Dive Analyst View

9.4.Bolt Threads

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.4.7.Research Dive Analyst View

9.5.Sichuan Nanchong Liuhe (Group) Corp

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.5.7.Research Dive Analyst View

9.6.China Silk Group Co.Ltd

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.6.7.Research Dive Analyst View

9.7.Zhejiang Jiaxin Silk Co.Ltd.

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.7.7.Research Dive Analyst View

9.8.Xuzhou Shengkun Silk Manufacturing Co.Ltd

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.8.7.Research Dive Analyst View

9.9.Spiber Technologies

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.9.7.Research Dive Analyst View

9.10.Libas Textiles Ltd

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

9.10.7.Research Dive Analyst View

Silk is a natural fiber rich in fibroin protein and is produced by certain insects while they are in their larvae-cocoon phase. While there are quite a few insects capable of producing silk like mayflies, leafhoppers, spiders, thrips, beetles, etc., the larva of mulberry silkworm is the best-known insect for producing fine-quality silk. Silk has a wide applicability in the textile sector and apart from silk textiles, it is also used to manufacture shirts, haute couture garments, formal dress suits, robes, sundresses, etc.

Forecast Analysis of the Market

A rising trend is being witnessed wherein sericulture, i.e., silk farming is becoming profitable for the farmers. The growing profitability of sericulture is predicted to assist the silk market to register huge growth in the coming years. Along with this, since the silk sector isn’t a capital-intensive sector, many farmers are taking up this profession; which is expected to boost the market further. Furthermore, the growing use of silk in the manufacturing of different apparels is predicted to offer numerous growth opportunities to the market in the analysis timeframe. However, changing silk material prices may hamper the growth of the silk market in the 2022-2031 timeframe.

Regionally, the silk market in the Asia-Pacific region is expected to be the most dominant in the forecast period. The presence of prominent silk producing countries like India, China, Thailand, etc. is expected to be the primary growth driver of the market in this region.

As per a report by Research Dive, the global silk market is expected to reach a revenue of $34,102.5 million in the 2021–2031 timeframe, thereby growing at a stunning CAGR of 8.2% by 2031. Some prominent market players include Anhui Silk Co. Ltd., Sichuan Nanchong Liuhe (Group) Corp., Xuzhou Shengkun Silk Manufacturing Co., Ltd., AMSilk GmbH, China Silk Group Co. Ltd., Spiber Technologies, EntoGenetics Inc., Zhejiang Jiaxin Silk Co., Ltd, Libas Textiles Ltd., Bolt Threads, and many others.

Covid-19 Impact on the Silk Market

The Covid-19 pandemic and the subsequent lockdowns have had a catastrophic impact on various businesses and markets worldwide. The silk market, too, faced a similar impact. Travel restrictions and shortage of labor caused a massive decline in the supply of raw silk to silk processing and manufacturing companies. Further, the shutdown of industries and import-export restrictions caused a massive decline in the sale of silk textiles which plummeted the growth rate of the market substantially.

Significant Market Developments

The key players of the market are adopting various business strategies such as partnerships, mergers & acquisitions, and launches to gain a leading position in the market, thus helping the silk market to flourish. For instance:

- In December 2020, Freudenberg Performance Materials, a leading textiles supplier, announced that it was partnering with Ratti, an Italian fashion textile company. The partnership is aimed at establishing a process for reusing manufactured silk textiles and producing high-performance thermal insulation materials.

- In January 2021, The Chatterjee Group (TCG), an Indian conglomerate, announced the acquisition of Garden Silk Mills Ltd., a famous silk saree manufacturer in India. This acquisition is expected to boost the market share of the acquiring company, i.e., The Chatterjee Group in the coming period.

- In February 2022, Benu Balc, a beauty product supplier based in France, announced that it was collaborating with Sericyne, a French textile company. The collaboration is aimed at weaving and manufacturing silk textiles and creating high-end silk products. This collaboration is expected to help both companies immensely.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com