Video-as-a-Service (VaaS) Market Report

RA05803

Video-as-a-Service (VaaS) Market by Enterprise Size (Large Enterprises, Medium-sized Enterprises, and Small-sized Enterprises), Applications (Corporate Communications, Training & Development, Marketing & Client Engagement, and Knowledge Sharing & Collaboration), Verticals (Healthcare, BFSI, Retail, Media & Entertainment, Telecom & IT, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Video-as-a-Service (VaaS) Market Analysis

The global video-as-a-service (VaaS) market size is predicted to garner a revenue of $11,557.3 million in the 2021–2028 timeframe, growing from $3,641.1 million in 2020, at a healthy CAGR of 15.6%.

Market Synopsis

Increase in the demand for remotely accessible and real time video services might drive the global video-as-a-service market growth.

However, the privacy concerns might restrain the market growth during the forecast period.

According to the regional analysis of the market, the Asia-Pacific video-as-a-service market share is anticipated to grow at a CAGR of 16.6%, by generating a revenue of $3,581.6 million during the review period.

Video-as-a-Service (VaaS) Market Overview

Video-as-a-service (VaaS), also called as video conferencing as a service (VCaaS), is a service that provides point-to-point video conferencing over an IP network. An audio video conferencing, on the other hand, is a live, visual connection between two or more people in different locations for the purpose of communication. Furthermore, video conferencing allows for the transfer of static images and text between two places as well as full-motion video and high-quality audio between numerous sites.

Covid-19 Impact on Video-as-a-Service (VaaS) Market

In March 2020, the World Health Organization declared COVID-19 as a pandemic, which resulted in restrictions on travel and disturbances in financial markets, as well as negatively impacted supply chains and production levels. The coronavirus pandemic has unleashed a series of unprecedented events affecting every industry. Demand for video-as-a-service (VaaS) has increased significantly, as many businesses prefer cloud-based virtual meetings to expand their customer base. Furthermore, greater government efforts toward remote company operations, as well as increased investments in video conferencing and virtual meeting technologies like zoom video conference, are important factors driving market expansion.

Increase in the Need of Real Time Video Services is Anticipated to Drive the Market Growth

Demand for video-as-a-service (VaaS) continues to expand in the market, owing to its ability to boost productivity, improve engagement, and keep remote teams linked. Furthermore, demand for real-time and remote access internet video services is increasing, as is the rapid expansion of high-speed communication infrastructure among businesses. The video-as-a-service market is expected to increase as a result of these causes. The switch to remote workflows has caused considerable issues in the aftermath of the COVID-19 pandemic, particularly in the media and entertainment business, and organizations are increasingly seeking real-time video service (ott video) to resume production remotely.

To know about global video-as-a-service (VaaS) market report, get in touch with our analysts here.

Privacy Concerns and Data Security Might Restrict the Market Growth

High acquisition and integration expenses, as well as data security and privacy issues, are limiting market expansion. Due to faulty equipment and adverse weather or environmental circumstances, several false alarms are triggered. This puts a strain on the industry's operations while also increasing the likelihood of system breakdowns and, as a result, security breaches. As a result of the market's inadequate integration or lack of system synchronization, data security and privacy concerns are projected to be a stumbling block.

Technological Advancements are Expected to Increase the Opportunities of Video-as-a-Service (VaaS) market Growth

Key market participants are constantly improving their product offerings in order to gain a competitive advantage and meet the changing needs of end-users. As a result, they're integrating modern technologies like AI, deep learning, and machine learning with VaaS. Furthermore, VaaS market participants are adopting advanced AI-based VaaS to provide an autonomous way to monitor and improve video content service in real-time. For example, Zoom Video Communications, Inc., an American communications technology business, announced additional end-to-end encryption features in its existing video-as-a-service services for free and premium users globally in October 2020. Furthermore, incorporating these sophisticated technologies into VaaS can result in a large increase in accuracy as well as a reduction in false alarms. As a result, these variables are expected to bring up new opportunities for the industry in the approaching years.

To know more about global video-as-a-service market data, get in touch with our analysts here.

Based on enterprise size, the market has been divided into Large Enterprises, medium-sized enterprises, and small enterprises sub-segments of which the small enterprises sub-segment is projected to grow at a faster CAGR during the forecast period. Download PDF Sample ReportVideo-as-a-Service (VaaS) Market

By Enterprise Size

Source: Research Dive Analysis

The small enterprises sub-segment is anticipated to have the fastest market growth during the forecast period. It is predicted that the market shall generate a revenue of $1,893.2 million by 2028, growing from $574.6 million in 2020, with a CAGR of 16.2%. Because many SMEs have limited finances to invest in their company, adopting a video communication solution is a low priority. In the coming years, SMEs are expected to use video conferencing to improve their customer relationships, communication between sales and marketing teams, remote location new product launches, and other activities. As a result, SMEs are expected to increase rapidly during the projection period.

Video-as-a-Service (VaaS) Market

By ApplicationsBased on application, the video-as-a-service market has been segmented into Corporate Communications, training & development, marketing & client engagement, and knowledge sharing & collaboration of which the Corporate Communications sub-segment is projected to generate the maximum revenue during the forecast period.

Source: Research Dive Analysis

The corporate communications sub-segment is predicted to have a dominating market share in the global market and register a revenue of $4,369.5 million during the forecast period. Due to the availability of superior alternatives such as video conferencing, zoom cloud recording and live chat on the market, corporate communication has undergone a transformation. Human beings process and remember visual content better than textual content, according to studies conducted by 3M Visual Systems Division (US). Text-heavy ways of communication take a long time and effort to deliver the desired information, and the chances of the message being received and communicated correctly are much lower. As a result, businesses are increasingly using films for corporate communication because they allow them to share their best practices with others and swiftly seize fresh ideas.

Video-as-a-Service (VaaS) Market

By VerticalsBased on vertical, video-as-a-service market is divided into healthcare, BFSI, retail, media & entertainment, Telecom & IT, and others. Among these, Telecom & IT sub-segment is anticipated to hold the maximum share of the global market revenue.

Source: Research Dive Analysis

The telecom & IT sub-segment is predicted to have a dominating market share in the global market and register a revenue of $2,592.3 million during the forecast period. The use of enterprise video in telecom & IT industry is rapidly increasing. It aids in the connection of faraway places, hence lowering the complexity of organizational communication. Employees can share new ideas with one another through videos in a fun and engaging way. By transmitting authentic messages, they ensure collaboration among many teams located all over the world. Videos also allow for the exchange of knowledge among employees in businesses, encouraging them and increasing their productivity. These factors are expected to increase the sub-segments growth.

Video-as-a-Service (VaaS) Market

By RegionThe VaaS market was inspected across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Video-as-a-Service (VaaS) in Asia-Pacific to be the Fastest Growing

Asia-Pacific is anticipated to be the fastest growing market during the forecast time period and reach $3,581.6 million by 2028, with a CAGR of 16.6%. The Asia-Pacific region plays a vital role in the industry's future. The adoption of VaaS solutions in the region is being driven by government measures to develop digital infrastructure. Several technological service providers in this region are collaborating with solution providers to improve and personalize products based on local clients' business needs. In APAC's developing countries, there is a big untapped opportunity for VaaS providers. China, Japan, Australia, New Zealand, and the rest of APAC are the biggest contributors to the APAC VaaS market.

Competitive Scenario in the Global Video-as-a-Service (VaaS) Market

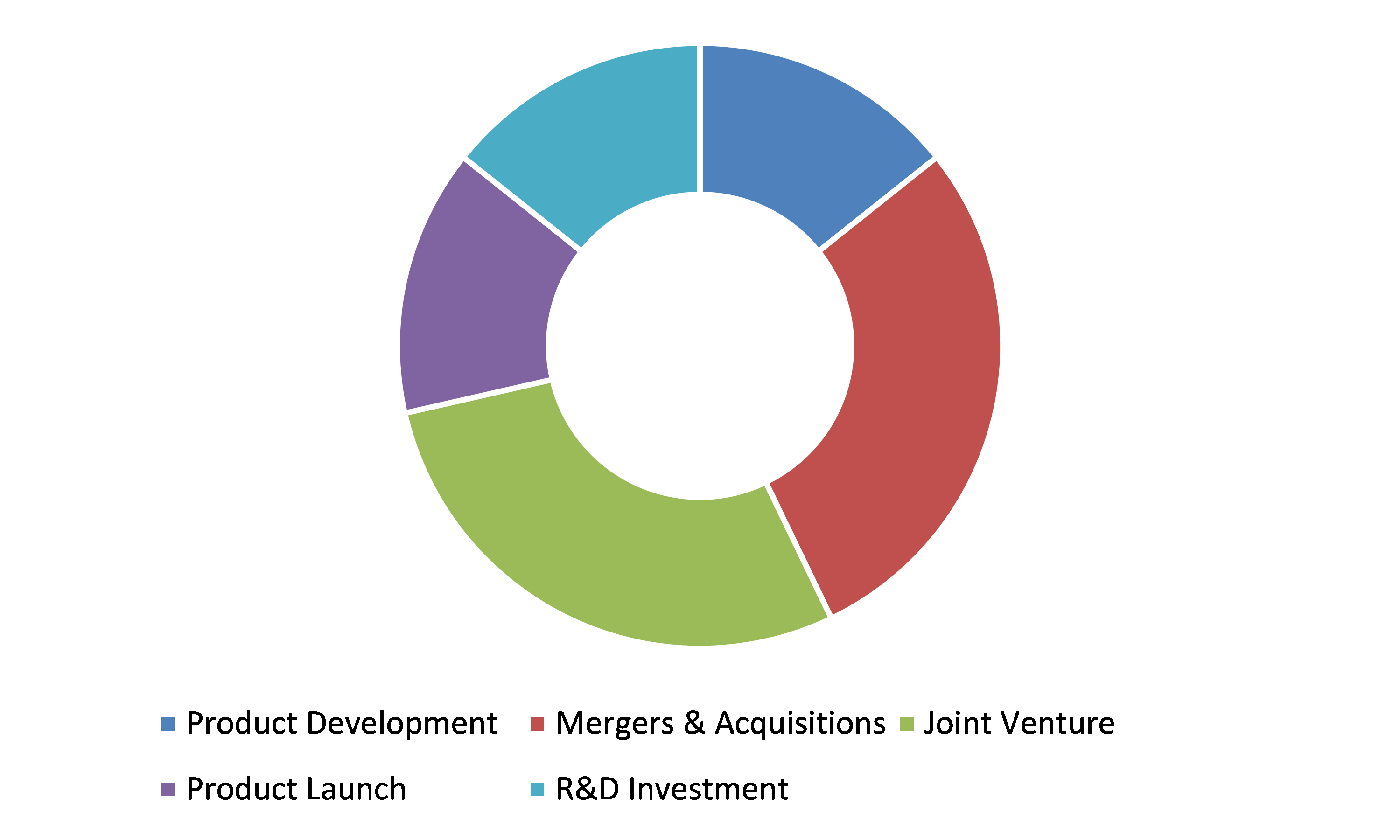

Product launches and mergers & acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading video-as-a-service market players are Amazon Web Services (AWS) Inc., Avaya Inc., Cisco Systems Inc., Huawei Technologies Co., Ltd., Zoom Video Communications Inc., Microsoft, Google, Adobe, LogMeIn Inc., and Plantronics, Inc.

Porter’s Five Forces Analysis for the Global Video-as-a-Service (VaaS) Market:

- Bargaining Power of Suppliers: Video-as-a-service market contains huge concentration of distributors & suppliers and therefore, the distributors & suppliers’ control is predicted to be reasonable, resulting in moderate bargaining power of dealers.

Thus, the bargaining power of the suppliers is considered to be moderate. - Bargaining Power of Buyers: Buyers might have great bargaining power, significantly because of high players functioning in the video-as-a-service market. Therefore,

the bargaining power of the buyer is high. - Threat of New Entrants: Companies entering the video-as-a-service market are adopting technological innovations such as virtual reality to attract clients. But since the investment cost is high,

the threat of the new entrants is moderate. - Threat of Substitutes: There are noticeable number of alternate products for video as a service.

Thus, the threat of substitutes is high. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players including Zoom video communications, Adobe, and Microsoft. These companies are strengthening their footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Enterprise Size |

|

| Segmentation by Application |

|

| Segmentation by Verticals |

|

| Key Companies Profiled |

|

Q1. What is the projected market value of the global VaaS market?

A. The value of the global video-as-a-service market was over $3,641.1 million in 2020 and is projected to reach $11,557.3 million by 2028.

Q2. Which are the major companies in the video-as-a-service market?

A. Microsoft, Google, Adobe, and Cisco WebEx are some of the key players in the global video-as-a-service market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific video-as-a-service market?

A. Asia-Pacific video-as-a-service market is anticipated to grow at 16.6% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

Q6. Which region has the largest market share in the VaaS market?

A. The Asia Pacific region had the largest market share of 68.6% in the VaaS market.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By Application trends

2.3.By Enterprise size trends

2.4.By Verticals trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Verticals landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Pricing overview

3.8.1.by Application

3.8.2.by Enterprise size

3.8.3.By Verticals Application

3.9.Market value chain analysis

3.9.1.Stress point analysis

3.9.2.Raw material analysis

3.9.3.Manufacturing process

3.9.4.Verticals analysis

3.9.5.Operating vendors

3.9.5.1.Raw material suppliers

3.9.5.2.Product manufacturers

3.9.5.3.Product distributors

3.10.Strategic overview

4.Video-as-a-Service (VaaS) Market, by Application

4.1.Corporate communications

4.1.1.Market size and forecast, by region, 2020-2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.Training & development

4.2.1.Market size and forecast, by region, 2020-2028

4.2.2.Comparative market share analysis, 2020 & 2028

4.3.Marketing & client engagement

4.3.1.Market size and forecast, by region, 2020-2028

4.3.2.Comparative market share analysis, 2020 & 2028

4.4.Knowledge sharing & collaboration

4.4.1.Market size and forecast, by region, 2020-2028

4.4.2.Comparative market share analysis, 2020 & 2028

5.Video-as-a-Service (VaaS) Market, by Enterprise size

5.1.Large Enterprises

5.1.1.Market size and forecast, by region, 2020-2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Medium-Sized Enterprises

5.2.1.Market size and forecast, by region, 2020-2028

5.2.2.Comparative market share analysis, 2020 & 2028

5.3.Small-Sized Enterprises

5.3.1.Market size and forecast, by region, 2020-2028

5.3.2.Comparative market share analysis, 2020 & 2028

6.Video-as-a-Service (VaaS) Market, by Verticals

6.1.Healthcare

6.1.1.Market size and forecast, by region, 2020-2028

6.1.2.Comparative market share analysis, 2020 & 2028

6.2.BFSI

6.2.1.Market size and forecast, by region, 2020-2028

6.2.2.Comparative market share analysis, 2020 & 2028

6.3.Retail

6.3.1.Market size and forecast, by region, 2020-2028

6.3.2.Comparative market share analysis, 2020 & 2028

6.4.Media & Entertainment

6.4.1.Market size and forecast, by region, 2020-2028

6.4.2.Comparative market share analysis, 2020 & 2028

6.5.Telecom & IT

6.5.1.Market size and forecast, by region, 2020-2028

6.5.2.Comparative market share analysis, 2020 & 2028

6.6.Others

6.6.1.Market size and forecast, by region, 2020-2028

6.6.2.Comparative market share analysis, 2020 & 2028

7.Video-as-a-Service (VaaS) Market, by Region

7.1.North America

7.1.1.Market size and forecast, by Application, 2020-2028

7.1.2.Market size and forecast, by Enterprise size, 2020-2028

7.1.3.Market size and forecast, by Verticals, 2020-2028

7.1.4.Market size and forecast, by country, 2020-2028

7.1.5.Comparative market share analysis, 2020 & 2028

7.1.6.U.S.

7.1.6.1.Market size and forecast, by Application, 2020-2028

7.1.6.2.Market size and forecast, by Enterprise size, 2020-2028

7.1.6.3.Market size and forecast, by Verticals, 2020-2028

7.1.6.4.Comparative market share analysis, 2020 & 2028

7.1.7.Canada

7.1.7.1.Market size and forecast, by Application, 2020-2028

7.1.7.2.Market size and forecast, by Enterprise size, 2020-2028

7.1.7.3.Market size and forecast, by Verticals, 2020-2028

7.1.7.4.Comparative market share analysis, 2020 & 2028

7.1.8.Mexico

7.1.8.1.Market size and forecast, by Application, 2020-2028

7.1.8.2.Market size and forecast, by Enterprise size, 2020-2028

7.1.8.3.Market size and forecast, by Verticals, 2020-2028

7.1.8.4.Comparative market share analysis, 2020 & 2028

7.2.Europe

7.2.1.Market size and forecast, by Application, 2020-2028

7.2.2.Market size and forecast, by Enterprise size, 2020-2028

7.2.3.Market size and forecast, by Verticals, 2020-2028

7.2.4.Market size and forecast, by country, 2020-2028

7.2.5.Comparative market share analysis, 2020 & 2028

7.2.6.Germany

7.2.6.1.Market size and forecast, by Application, 2020-2028

7.2.6.2.Market size and forecast, by Enterprise size, 2020-2028

7.2.6.3.Market size and forecast, by Verticals, 2020-2028

7.2.6.4.Comparative market share analysis, 2020 & 2028

7.2.7.UK

7.2.7.1.Market size and forecast, by Application, 2020-2028

7.2.7.2.Market size and forecast, by Enterprise size, 2020-2028

7.2.7.3.Market size and forecast, by Verticals, 2020-2028

7.2.7.4.Comparative market share analysis, 2020 & 2028

7.2.8.France

7.2.8.1.Market size and forecast, by Application, 2020-2028

7.2.8.2.Market size and forecast, by Enterprise size, 2020-2028

7.2.8.3.Market size and forecast, by Verticals, 2020-2028

7.2.8.4.Comparative market share analysis, 2020 & 2028

7.2.9.Italy

7.2.9.1.Market size and forecast, by Application, 2020-2028

7.2.9.2.Market size and forecast, by Enterprise size, 2020-2028

7.2.9.3.Market size and forecast, by Verticals, 2020-2028

7.2.9.4.Comparative market share analysis, 2020 & 2028

7.2.10.Spain

7.2.10.1.Market size and forecast, by Application, 2020-2028

7.2.10.2.Market size and forecast, by Enterprise size, 2020-2028

7.2.10.3.Market size and forecast, by Verticals, 2020-2028

7.2.10.4.Comparative market share analysis, 2020 & 2028

7.2.11.Rest of Europe

7.2.11.1.Market size and forecast, by Application, 2020-2028

7.2.11.2.Market size and forecast, by Enterprise size, 2020-2028

7.2.11.3.Market size and forecast, by Verticals, 2020-2028

7.2.11.4.Comparative market share analysis, 2020 & 2028

7.3.Asia-Pacific

7.3.1.Market size and forecast, by Application, 2020-2028

7.3.2.Market size and forecast, by Enterprise size, 2020-2028

7.3.3.Market size and forecast, by Verticals, 2020-2028

7.3.4.Market size and forecast, by country, 2020-2028

7.3.5.Comparative market share analysis, 2020 & 2028

7.3.6.China

7.3.6.1.Market size and forecast, by Application, 2020-2028

7.3.6.2.Market size and forecast, by Enterprise size, 2020-2028

7.3.6.3.Market size and forecast, by Verticals, 2020-2028

7.3.6.4.Comparative market share analysis, 2020 & 2028

7.3.7.Japan

7.3.7.1.Market size and forecast, by Application, 2020-2028

7.3.7.2.Market size and forecast, by Enterprise size, 2020-2028

7.3.7.3.Market size and forecast, by Verticals, 2020-2028

7.3.7.4.Comparative market share analysis, 2020 & 2028

7.3.8.India

7.3.8.1.Market size and forecast, by Application, 2020-2028

7.3.8.2.Market size and forecast, by Enterprise size, 2020-2028

7.3.8.3.Market size and forecast, by Verticals, 2020-2028

7.3.8.4.Comparative market share analysis, 2020 & 2028

7.3.9.South Korea

7.3.9.1.Market size and forecast, by Application, 2020-2028

7.3.9.2.Market size and forecast, by Enterprise size, 2020-2028

7.3.9.3.Market size and forecast, by Verticals, 2020-2028

7.3.9.4.Comparative market share analysis, 2020 & 2028

7.3.10.Australia

7.3.10.1.Market size and forecast, by Application, 2020-2028

7.3.10.2.Market size and forecast, by Enterprise size, 2020-2028

7.3.10.3.Market size and forecast, by Verticals, 2020-2028

7.3.10.4.Comparative market share analysis, 2020 & 2028

7.3.11.Rest of Asia Pacific

7.3.11.1.Market size and forecast, by Application, 2020-2028

7.3.11.2.Market size and forecast, by Enterprise size, 2020-2028

7.3.11.3.Market size and forecast, by Verticals, 2020-2028

7.3.11.4.Comparative market share analysis, 2020 & 2028

7.4.LAMEA

7.4.1.Market size and forecast, by Application, 2020-2028

7.4.2.Market size and forecast, by Enterprise size, 2020-2028

7.4.3.Market size and forecast, by Verticals, 2020-2028

7.4.4.Market size and forecast, by country, 2020-2028

7.4.5.Comparative market share analysis, 2020 & 2028

7.4.6.Latin America

7.4.6.1.Market size and forecast, by Application, 2020-2028

7.4.6.2.Market size and forecast, by Enterprise size, 2020-2028

7.4.6.3.Market size and forecast, by Verticals, 2020-2028

7.4.6.4.Comparative market share analysis, 2020 & 2028

7.4.7.Middle East

7.4.7.1.Market size and forecast, by Application, 2020-2028

7.4.7.2.Market size and forecast, by Enterprise size, 2020-2028

7.4.7.3.Market size and forecast, by Verticals, 2020-2028

7.4.7.4.Comparative market share analysis, 2020 & 2028

7.4.8.Africa

7.4.8.1.Market size and forecast, by Application, 2020-2028

7.4.8.2.Market size and forecast, by Enterprise size, 2020-2028

7.4.8.3.Market size and forecast, by Verticals, 2020-2028

7.4.8.4.Comparative market share analysis, 2020 & 2028

8.Company profiles

8.1.Amazon Web Services (AWS) Inc.

8.1.1.Business overview

8.1.2.Financial performance

8.1.3.Product portfolio

8.1.4.Recent strategic moves & developments

8.1.5.SWOT analysis

8.2.Avaya Inc.

8.2.1.Business overview

8.2.2.Financial performance

8.2.3.Product portfolio

8.2.4.Recent strategic moves & developments

8.2.5.SWOT analysis

8.3.Cisco Systems Inc.

8.3.1.Business overview

8.3.2.Financial performance

8.3.3.Product portfolio

8.3.4.Recent strategic moves & developments

8.3.5.SWOT analysis

8.4.Huawei Technologies Co., Ltd.

8.4.1.Business overview

8.4.2.Financial performance

8.4.3.Product portfolio

8.4.4.Recent strategic moves & developments

8.4.5.SWOT analysis

8.5.Zoom Video Communications Inc.

8.5.1.Business overview

8.5.2.Financial performance

8.5.3.Product portfolio

8.5.4.Recent strategic moves & developments

8.5.5.SWOT analysis

8.6.Microsoft

8.6.1.Business overview

8.6.2.Financial performance

8.6.3.Product portfolio

8.6.4.Recent strategic moves & developments

8.6.5.SWOT analysis

8.7.Google

8.7.1.Business overview

8.7.2.Financial performance

8.7.3.Product portfolio

8.7.4.Recent strategic moves & developments

8.7.5.SWOT analysis

8.8.Adobe

8.8.1.Business overview

8.8.2.Financial performance

8.8.3.Product portfolio

8.8.4.Recent strategic moves & developments

8.8.5.SWOT analysis

8.9.LogMeIn Inc.

8.9.1.Business overview

8.9.2.Financial performance

8.9.3.Product portfolio

8.9.4.Recent strategic moves & developments

8.9.5.SWOT analysis

8.10.Plantronics, Inc.

8.10.1.Business overview

8.10.2.Financial performance

8.10.3.Product portfolio

8.10.4.Recent strategic moves & developments

8.10.5.SWOT analysis

Video-as-a-Service or VaaS is the delivery of point-to-point and mutual video conferencing capabilities over IP network and servers that are managed by service providers. VaaS is a process through which an individual or an organization can view live video coverage in a particular location. Besides, Video-as-a-Service falls under Software as a Service (SaaS), and is also called as Video Conferencing as a Service (VCaaS), providing the infrastructure needed for connected communications between all the endpoints.

Moreover, VaaS can enhance the workplace flexibility in remote work platforms, by allowing members of a team to connect with each other, for developing video-based applications such as video chat tools, live streaming platforms, and video hosting sites.

COVID-19 Impact on Video-as-a-Service (VaaS) Market

The outbreak of COVID-19 across the globe has favorably impacted the global video-as-a-services (VaaS) market growth. The positive VaaS market growth is majorly due to the increasing usage of video conferencing for communication and collaboration during the lockdown period. Besides, the coronavirus pandemic has affected the employee productivity and global corporate efficiency. Thus, the adoption of VaaS solutions and services has dramatically increases during the pandemic, boosting the video-as-a-service (VaaS) market growth.

Moreover, many businesses around the world are now preferring cloud-based virtual meetings in order to expand their customer base. Governments are also taking efforts toward remote company operations. All these factors are responsible for the progressive VaaS market growth in the pandemic period.

Video-as-a-Service (VaaS) Market Trends and Developments

The companies operating in the global industry are adopting several growth strategies and business tactics such as partnerships, collaboration, business expansion, and product launches to obtain a leading position in the global video-as-a-service (VaaS) market, which is predicted to drive the global video-as-a-services (VaaS) market growth in the upcoming years.

For instance, in July 2020, Avaya, an American multinational technology company, and an Australian ICT distributor, VExpress signed a Master Agent agreement in order to enable channel partners to rapidly progress the operational recovery efforts of the midmarket organizations and SMEs in Australia with the help of collaboration solutions and cloud communications from Avaya.

In February 2021, Motorola Solutions, a leading provider of mission-critical communications & analytics around the world, announced a new Video-as-a-Service (VaaS) offering combining of body-worn cameras, cloud-based support, and digital evidence management software for law enforcement agencies. This service plays a crucial role in helping law enforcement to promote accountability and transparency with no straight capital investment, which helps to keep communities and officers safe.

Forecast Analysis of Global Market

The global video-as-a-service (VaaS) market is projected to witness an exponential growth over the forecast period, mainly because VaaS market participants are increasingly adopting advanced AI-based VaaS in order to provide an autonomous way to monitor as well as improve video content service in real-time. Conversely, the high acquisition & integration expenses and the growing privacy concerns are expected to hamper the market growth in the projected timeframe.

The growing demand for remotely accessible and real-time video services across the globe are the significant factors and video-as-a-service (VaaS) market trends estimated to bolster the growth of the global market in the coming future. According to a latest report published by Research Dive, the global video-as-a-service (VaaS) market is expec0-+ted to garner $11,557.3 million during the forecast period (2021-2028). Regionally, the Asia-Pacific video-as-a-service (VaaS) market is estimated to observe the rapid growth by 2028, owing to the measures taken by governments to develop digital infrastructure in the region.

The key players functioning in the global market include Amazon Web Services (AWS) Inc., Cisco Systems Inc., Avaya Inc., Huawei Technologies Co., Ltd., Microsoft, Zoom Video Communications Inc., Google, LogMeIn Inc., Adobe, and Plantronics, Inc.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com