Agriculture Robot Market Report

RA00052

Agriculture Robot Market, by Type (Material Management, Automated Harvest Robots, Milking Robots, Unmanned Aerial Vehicles (UAVs), Driverless Tractors and Others) by Application (Inventory Management, Soil Management, Harvest Management, Irrigation Management, Dairy Management, Others) Regional Outlook (North America, Europe, Asia-Pacific, LAMEA), Global Opportunity Analysis and Industry Forecast, 2018-2026

Update Available On-Demand

Global Agriculture Robot Market Overview and Forecast 2026:

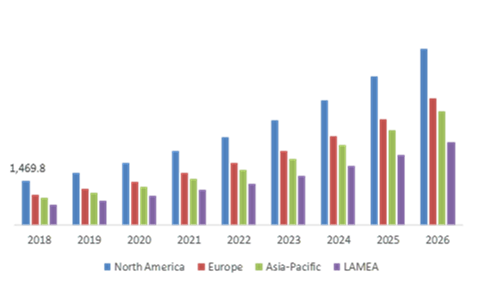

The agriculture robot market size was $ 4,082.8 Million in 2018, and is expected to reach $ 16,640.4 Million by 2026, and will grow at a CAGR of 19.2%. North America region generated a revenue of $ 1,469.8 Million in 2018, and is expected to grow at a CAGR of 18.9%.

An agricultural robot is a robot, which is developed for doing agriculture works. At present, these robots are mainly used at the harvesting stage. These robots are completely automated and are very helpful in farming which reduces the time and manual workforce in the agricultural works. The agriculture robot is also capable of soil exploration, weed control, plant seeding, environmental monitoring, cloud seeding, harvesting and many more. These robots are equipped with many tools so that it can do multiple tasks at the same time.

Agriculture Robot Market Synopsis

The increasing shift of farmers towards vertical farming and the rise in demand for food supply around the world are the key factors anticipated to drive the agriculture robot market growth.

However, the lack of understanding on the operation of agriculture robots coupled with its high costs are the factors that may restrain the growth of the global industry.

According to the regional analysis, the North America market for agriculture robot is expected to dominate in the global industry throughout the forecast period by growing at a CAGR of 18.9%.

Market Drivers and Restraints of Agriculture Robot:

Rise in demand for food supply, increasing population and increasing use of vertical farming are some of the factors which boost the growth of agriculture robot market.

At present, the world population is increasing at a higher rate, as per the World Health Organization (WHO). It is been predicted that the world population is going to reach 9.7 billion by 2050. In line with this, there will be a significant rise in the demand for food supply. With the help of robots, the work in the agricultural farms can be done faster and get the cultivated food at a minimum span of time. Many farmers are opting vertical farming, as it need less amount of water and also reduce the use of agricultural land.

Cost of the agricultural robots, coupled with the lack of understanding on the new technologies are considered to be the major threats for the growth of agricultural robot

The cost of the robots is considered to be one of the biggest restraints, restricting the market growth. These robots are very expensive, that they are not affordable by the middle-class and below level farmers. Besides cost, lack of understanding on the operation of these robots will also act as a major factor hampering the market growth.

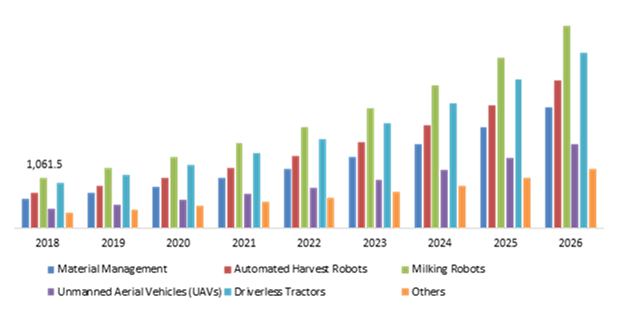

Agriculture Robot Market, by Type:

The Unmanned Aerial Vehicles is predicted to have the highest growth rate till the end of 2026

Source Research dive analysis

Based on the type, the unmanned aerial vehicle segment is expected to hold the largest market share in 2026. This segment generated a revenue of $ 408.3 Million in 2018, and is expected to reach $ 1,763 Million by 2026. These robots help in increasing crop production, and also help in monitoring the growth of the crop. They also help the farmers to optimize the agricultural operation, which will further improve the land efficiency.

Driverless tractor segment was valued at $ 939.0 Million in 2018, and is expected to reach $ 3,714.3 Million by 2026. These vehicles operate without the driver, and are automated in detecting their position, and speed. They are designed in a way to avoid the obstacles while performing the task. Due to these factors, many countries have adopted the driverless tractor in the farming fields, which helps them to cut their regular wages of the workers.

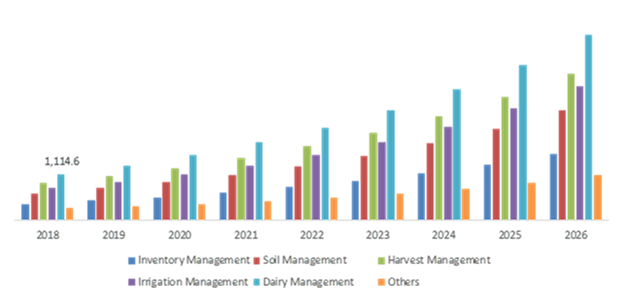

Agriculture Robot Market, by Application:

Dairy Management will possess the high investment opportunities in the coming future

Source Research dive analysis

Dairy management is the most popularly used robotic application in agriculture. This segment generated a revenue of $ 1,146 Million in 2018, and will reach $ 4,492.9 Million by 2026. In Dairy management, the advanced robots are used to take milk from the cows and are also used to graze the agricultural ground.

Harvest management is another application of agricultural robots, and is used in places where the harvested crop is stored. These robots perform operations such as cleaning, cooling, packing and sorting of the harvested farms. If the harvest application goes wrong, then the whole harvested crops has no use and get spoiled. So, with this advanced technology, one can store the harvested crops without any losses. This segment generated a revenue of $ 892.1 Million in 2018, and is projected to surpass $ 3,550.1 Million by 2026 at a CAGR of 18.8%.

Agriculture Robot Market, by Region:

Source Research dive analysis

North America Agriculture Robot Market Outlook 2026:

North America will have huge opportunities for the market investors to grow over the coming years

North America is expected to dominate the agricultural robot industry throughout the forecast period. There is a presence of large number of farmers, who are adopting the automated farm vehicles in this region. The North America market is witnessing constant investments in the technological sector, and are progressing in terms of automation. Moreover, favorable government initiatives in favor of agriculture are consider to be the key driving factor for the North America agriculture robot market. This region generated a revenue of $ 1,469.8 Million in 2018, and is expected to grow at a CAGR of 18.9%.

Asia-Pacific Agriculture Robot Market Growth 2026:

The Asia-Pacific market is accounted to have the highest agriculture robot market growth rate in the global market. The increased use of automation in the farming sector and favorable government initiatives like subsidies are going to drive the Aisa-Pacofoc market in the forecast period. The Asia-Pacific agriculture robot market size is expected to grow at a CAGR of 19.7% by generating a revenue of $ 3,798.3 Million by 2026.

Key Participants in Agriculture Robot Market:

Source: Research Dive Analysis

Key players in the global agriculture robot market are LelyHarvest Automation, DeLaval, Clearpath Robotics, Autonomous Solutions Inc, AGCO, Autonomous Tractor Corporation, Deepfield Robotics, GEA Group and John Deere and others.

Report Scope:

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2019 |

| Forecast timeline for Market Projection | 2018-2026 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Applications |

|

| Key Countries Covered | U.S., Canada, Germany, France, UK, Italy, Japan, China, India, South Korea, Australia, Middle west, Africa |

| Key Companies Profiled |

|

Source: Research Dive Analysis

Q1. What is the size of Agricultural Robot Market?

A. The global Agricultural Robot Market size was over $ XX Million in 2019, and is further anticipated to reach $ xx Million by 2027.

Q2. Who are the leading companies in the Agricultural Robot Market?

A. John Deere and GEA Group are some of the key players in the global Agricultural Robot Market.

Q3. Which region possess greater investment opportunities in the coming future?

A. North America possess great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of North America for agriculture robot market?

A. North America Agricultural Robot Market is projected to grow at xx% CAGR during the forecast period.

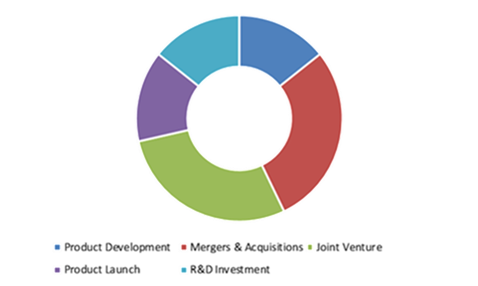

Q5. What are the strategies opted by the leading players in this market?

A. Product development is the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices of agriculture robot market?

A. John Deere and GEA Group are the companies investing more on R&D activities for developing new products and technologies.

Q7. Will robot take over Farming?

A. The robots have already taken over farming in many areas farmers are being using robots for the farming purposes like driverless tractor, use of automated drones and many more.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Type trends

2.3. Application trends

2.4. End-use trends

3. Market Overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Pricing overview

3.8.1. By type

3.8.2. By application

3.8.3. By region

3.9. Market value chain analysis

3.9.1. Stress point analysis

3.9.2. Raw material analysis

3.9.3. Manufacturing process

3.9.4. Distribution channel analysis

3.9.5. Operating vendors

3.9.5.1. Raw material suppliers

3.9.5.2. Product manufacturers

3.9.5.3. Product distributors

3.10. Strategic overview

4. Agriculture Robot Market, by Type

4.1. Material Management

4.1.1. Market size and forecast, by region, 2017-2028

4.1.2. Comparative market share analysis, 2018 & 2028

4.2. Automated Harvest Robots

4.2.1. Market size and forecast, by region, 2017-2028

4.2.2. Comparative market share analysis, 2018 & 2028

4.3. Milking Robots

4.3.1. Market size and forecast, by region, 2017-2028

4.3.2. Comparative market share analysis, 2018 & 2028

4.4. Unmanned Aerial Vehicles (UAVs)

4.4.1. Market size and forecast, by region, 2017-2028

4.4.2. Comparative market share analysis, 2018 & 2028

4.5. Driverless Tractors

4.5.1. Market size and forecast, by region, 2017-2028

4.5.2. Comparative market share analysis, 2018 & 2028

4.6. Others

4.6.1. Market size and forecast, by region, 2017-2028

4.6.2. Comparative market share analysis, 2018 & 2028

5. Agriculture Robot Market, by Applications

5.1. Inventory Management

5.1.1. Market size and forecast, by region, 2017-2028

5.1.2. Comparative market share analysis, 2018 & 2028

5.2. Soil Management

5.2.1. Market size and forecast, by region, 2017-2028

5.2.2. Comparative market share analysis, 2018 & 2028

5.3. Harvest Management

5.3.1. Market size and forecast, by region, 2017-2028

5.3.2. Comparative market share analysis, 2018 & 2028

5.4. Irrigation Management

5.4.1. Market size and forecast, by region, 2017-2028

5.4.2. Comparative market share analysis, 2018 & 2028

5.5. Dairy Management

5.5.1. Market size and forecast, by region, 2017-2028

5.5.2. Comparative market share analysis, 2018 & 2028

5.6. Others

5.6.1. Market size and forecast, by region, 2017-2028

5.6.2. Comparative market share analysis, 2018 & 2028

6. Agriculture Robot Market, by Region

6.1. North Region

6.1.1. Market size and forecast, by type, 2017-2028

6.1.2. Market size and forecast, by application, 2017-2028

6.1.3. Market size and forecast, by end-use, 2017-2028

6.1.4. Market size and forecast, by country, 2017-2028

6.1.5. Comparative market share analysis, 2018 & 2028

6.1.6. U.S

6.1.6.1. Market size and forecast, by type, 2017-2028

6.1.6.2. Market size and forecast, by application, 2017-2028

6.1.6.3. Market size and forecast, by end-use, 2017-2028

6.1.6.4. Comparative market share analysis, 2018 & 2028

6.1.7. Canada

6.1.7.1. Market size and forecast, by type, 2017-2028

6.1.7.2. Market size and forecast, by application, 2017-2028

6.1.7.3. Market size and forecast, by end-use, 2017-2028

6.1.7.4. Comparative market share analysis, 2018 & 2028

6.2. Europe

6.2.1. Market size and forecast, by type, 2017-2028

6.2.2. Market size and forecast, by application, 2017-2028

6.2.3. Market size and forecast, by end-use, 2017-2028

6.2.4. Market size and forecast, by country, 2017-2028

6.2.5. Comparative market share analysis, 2018 & 2028

6.2.6. UK

6.2.6.1. Market size and forecast, by type, 2017-2028

6.2.6.2. Market size and forecast, by application, 2017-2028

6.2.6.3. Market size and forecast, by end-use, 2017-2028

6.2.6.4. Comparative market share analysis, 2018 & 2028

6.2.7. Germany

6.2.7.1. Market size and forecast, by type, 2017-2028

6.2.7.2. Market size and forecast, by application, 2017-2028

6.2.7.3. Market size and forecast, by end-use, 2017-2028

6.2.7.4. Comparative market share analysis, 2018 & 2028

6.2.8. France

6.2.8.1. Market size and forecast, by type, 2017-2028

6.2.8.2. Market size and forecast, by application, 2017-2028

6.2.8.3. Market size and forecast, by end-use, 2017-2028

6.2.8.4. Comparative market share analysis, 2018 & 2028

6.2.9. Italy

6.2.9.1. Market size and forecast, by type, 2017-2028

6.2.9.2. Market size and forecast, by application, 2017-2028

6.2.9.3. Market size and forecast, by end-use, 2017-2028

6.2.9.4. Comparative market share analysis, 2018 & 2028

6.2.10. Rest of Europe

6.2.10.1. Market size and forecast, by type, 2017-2028

6.2.10.2. Market size and forecast, by application, 2017-2028

6.2.10.3. Market size and forecast, by end-use, 2017-2028

6.2.10.4. Comparative market share analysis, 2018 & 2028

6.3. Asia-Pacific

6.3.1. Market size and forecast, by type, 2017-2028

6.3.2. Market size and forecast, by application, 2017-2028

6.3.3. Market size and forecast, by end-use, 2017-2028

6.3.4. Market size and forecast, by country, 2017-2028

6.3.5. Comparative market share analysis, 2018 & 2028

6.3.6. China

6.3.6.1. Market size and forecast, by type, 2017-2028

6.3.6.2. Market size and forecast, by application, 2017-2028

6.3.6.3. Market size and forecast, by end-use, 2017-2028

6.3.6.4. Comparative market share analysis, 2018 & 2028

6.3.7. India

6.3.7.1. Market size and forecast, by type, 2017-2028

6.3.7.2. Market size and forecast, by application, 2017-2028

6.3.7.3. Market size and forecast, by end-use, 2017-2028

6.3.7.4. Comparative market share analysis, 2018 & 2028

6.3.8. Japan

6.3.8.1. Market size and forecast, by type, 2017-2028

6.3.8.2. Market size and forecast, by application, 2017-2028

6.3.8.3. Market size and forecast, by end-use, 2017-2028

6.3.8.4. Comparative market share analysis, 2018 & 2028

6.3.9. South Korea

6.3.9.1. Market size and forecast, by type, 2017-2028

6.3.9.2. Market size and forecast, by application, 2017-2028

6.3.9.3. Market size and forecast, by end-use, 2017-2028

6.3.9.4. Comparative market share analysis, 2018 & 2028

6.3.10. Australia

6.3.10.1. Market size and forecast, by type, 2017-2028

6.3.10.2. Market size and forecast, by application, 2017-2028

6.3.10.3. Market size and forecast, by end-use, 2017-2028

6.3.10.4. Comparative market share analysis, 2018 & 2028

6.3.11. Rest of Asia-Pacific

6.3.11.1. Market size and forecast, by type, 2017-2028

6.3.11.2. Market size and forecast, by application, 2017-2028

6.3.11.3. Market size and forecast, by end-use, 2017-2028

6.3.11.4. Comparative market share analysis, 2018 & 2028

6.4. LAMEA

6.4.1. Market size and forecast, by type, 2017-2028

6.4.2. Market size and forecast, by application, 2017-2028

6.4.3. Market size and forecast, by end-use, 2017-2028

6.4.4. Market size and forecast, by country, 2017-2028

6.4.5. Comparative market share analysis, 2018 & 2028

6.4.6. Middle East

6.4.6.1. Market size and forecast, by type, 2017-2028

6.4.6.2. Market size and forecast, by application, 2017-2028

6.4.6.3. Market size and forecast, by end-use, 2017-2028

6.4.6.4. Comparative market share analysis, 2018 & 2028

6.4.7. Africa

6.4.7.1. Market size and forecast, by type, 2017-2028

6.4.7.2. Market size and forecast, by application, 2017-2028

6.4.7.3. Market size and forecast, by end-use, 2017-2028

6.4.7.4. Comparative market share analysis, 2018 & 2028

7. Company Profiles

7.1. Lely

7.1.1. Business overview

7.1.2. Financial performance

7.1.3. Product portfolio

7.1.4. Recent strategic moves & developments

7.1.5. SWOT analysis

7.2. Harvest Automation

7.2.1. Business overview

7.2.2. Financial performance

7.2.3. Product portfolio

7.2.4. Recent strategic moves & developments

7.2.5. SWOT analysis

7.3. DeLaval

7.3.1. Business overview

7.3.2. Financial performance

7.3.3. Product portfolio

7.3.4. Recent strategic moves & developments

7.3.5. SWOT analysis

7.4. Autonomous Solutions Inc.

7.4.1. Business overview

7.4.2. Financial performance

7.4.3. Product portfolio

7.4.4. Recent strategic moves & developments

7.4.5. SWOT analysis

7.5. AGCO

7.5.1. Business overview

7.5.2. Financial performance

7.5.3. Product portfolio

7.5.4. Recent strategic moves & developments

7.5.5. SWOT analysis

7.6. Autonomous Tractor Corporation.

7.6.1. Business overview

7.6.2. Financial performance

7.6.3. Product portfolio

7.6.4. Recent strategic moves & developments

7.6.5. SWOT analysis

7.7. Deepfield Robotics

7.7.1. Business overview

7.7.2. Financial performance

7.7.3. Product portfolio

7.7.4. Recent strategic moves & developments

7.7.5. SWOT analysis

7.8. GEA Group

7.8.1. Business overview

7.8.2. Financial performance

7.8.3. Product portfolio

7.8.4. Recent strategic moves & developments

7.8.5. SWOT analysis

7.9. John Deere.

7.9.1. Business overview

7.9.2. Financial performance

7.9.3. Product portfolio

7.9.4. Recent strategic moves & developments

7.9.5. SWOT analysis

Agriculture is swiftly becoming an exciting high-tech industry, which is drawing new investors, new companies, and new professionals. As technology is advancing rapidly, it is also developing the production capabilities of farmers and advancing automation & robotics. Agriculture robot is thus proving to be the most useful machine in increasing production yields for farmers.

An agricultural robot is also known as an ‘Agribot’. As per a Research Dive blog, the agriculture robot is designed and developed for use in the agriculture industry. The agriculture robots are fully automated to carry out tasks for farmers, which boosts the efficacy of production and also reduces the reliance on human labor. The agriculture robot is also capable of weed control, soil exploration, plant seeding, cloud seeding, environmental monitoring, and many more. Moreover, in order to carry out multiple tasks, these robots are equipped with a number of technological tools. One of the biggest advantages of agriculture robot is that it can operate 24/7, 365 days a year.

Recent Developments in Agriculture Robot Market

Already incorporated in many areas of farming work, the agriculture robots are still largely missing in the harvesting of several crops. Companies have now started to build robots that completes numerous tasks on the farm field and minimizes human work. The major concern over agriculture robots is the harvesting of soft crops such as strawberries. This type of crops can be missed entirely or damaged easily. In spite of these concerns, a progress in this area is being made.

The Florida-based company, Harvest Croo Robotics recently tested one of their strawberry pickers. This robot takes only three days to pick a 25-acre field, which replaces a crew of nearly 30 farm workers. Parallel development is being made in harvesting grapes, apples, and other crops.

Until now, the productivity of farming was measured in the time it took humans to do a task. Moving forward, the robot-to-human could become the new measure of productivity, i.e. the number of agriculture robots needed to do the jobs of human and support them by minimizing their efforts.

To monitor nearly 3 million egg-laying hens, the CP Group of China is using 18 “robot nannies”. The robots of this third largest poultry business company by scanning the birds inform their human co-workers if a particular bird is not healthy. The aim of CP Group is to address the problem of reliability and food quality.

A Chilean business, AgrIcola Ancali, is using 64 robotic machines from the Sweden’s DeLaval to milk nearly 4,500 cows. This farm is one of the biggest robot-based milk production sites all across the globe. A 10% increase in milk production has been already seen by this farm.

A weed-killing robot in Australia is expected to save nearly $1.3 billion in terms of costs a year to the farmers. Still, there is a lot of refinement and research yet to be done.

Potential Future of Agriculture Robot Market

Global agriculture robot market is estimated to witness a positive growth during the forecast period. The lack of workforce for farming is predicted to drive the market growth from 2019 to 2026. With the help of agriculture robots, the farming work can be done faster and the cultivated food cab be obtained at a minimum span of time. However, the lack of understanding of new technologies and cost of the agricultural robots are considered to be the major factors restricting the growth of agriculture robot market.

Increase in demand for food supply, rising population, and growing use of vertical farming are some of the significant factors giving substantial uplift to the growth of the global market in the near future. As per the Research Dive report statistics, the global agriculture robot market is expected to reach up to $16,640.4 million by the end of 2026. Geographically, the Asia Pacific agriculture robot market is likely to dominate the industry owing to the favorable government initiatives and increased use of automation in farming in this region. Additionally, the report profiles top gaining players operating in the global market who are focusing more on product development and R&D activities to increase their market size in the global agriculture robot industry.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com