Seeds Market Report

RA04897

Seeds Market by Seeds Type (Genetically Modified and Conventional), Crop Type (Cereals and Grains, Fruits and Vegetables, and Other Crop Types), Traits (Herbicide Tolerant, Insecticide Resistant, and Other Traits), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Seeds Market Analysis

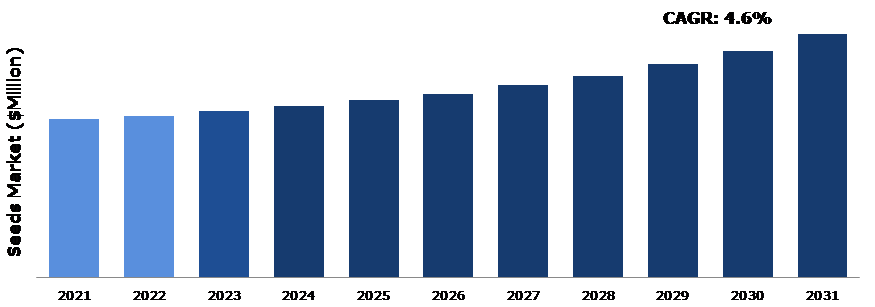

The Global Seeds Market Size was $69,042.0 million in 2021 and is predicted to grow with a CAGR of 4.6%, by generating a revenue of $106,179.0 million by 2031.

Global Seeds Market Synopsis

The increase in world population is leading to rise in pressure on the agricultural industry to produce more food. This demand for food is projected to drive the growth of the seeds market as farmers are looking for new and improved seed varieties that can increase crop yields and improve their quality. In addition, there is also a rising trend towards sustainable and organic farming practices, which has led to an increase in the demand for non-GMO and organic seeds. Moreover, technological advancements in the seeds industry, such as the development of genetically modified seeds, have also contributed to the growth of the seeds market. These seeds have been engineered to resist pests, diseases, and adverse weather conditions, which has increased their appeal among farmers. These factors are anticipated to boost the seeds market growth in the upcoming years.

However, seed production and distribution are heavily regulated by governments around the world, with various rules and requirements regarding seed quality, labeling, and testing. While these regulations are intended to protect consumers and the environment, they can also create barriers to entry for new players in the market, especially small or independent seed companies. While regulations are essential to ensure seed quality and safety, they can create barriers to entry for small or independent seed companies, as compliance with regulations can be costly and time-consuming. Therefore, regulations can favor large, established seed companies that have the resources to comply with regulations, while smaller companies struggle to compete.

The seeds market presents a significant opportunity for the agriculture and food industries globally. The demand for seeds is driven by the increase in global population, which puts pressure on agricultural productivity to meet the rising food demand. Seeds are also critical for the development of high-yield crops, resistant to pests, diseases, and environmental stress, which can increase the productivity and profitability of farms. In recent years, there has been a rise in demand for organic and non-GMO seeds, driven by the increasing consumer awareness of healthy eating and environmental sustainability. This presents an opportunity for seed companies to expand their product portfolios and cater to this segment of the market. Moreover, the adoption of precision agriculture practices, such as soil testing, crop mapping, and variable rate technology, has increased the demand for customized seed solutions that can maximize crop yield and quality.

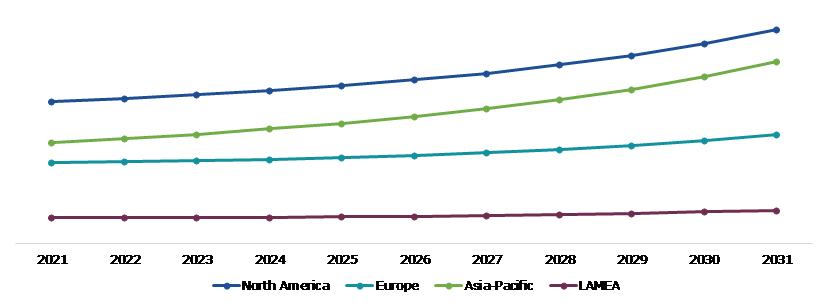

According to regional analysis, the North America seeds market accounted for the highest market share in 2021. North America is one of the largest seed markets in the world, accounting for a significant share of the global market. The seeds market in North America is expanding due to various factors, including the increasing demand for food products, the rising population, and the adoption of modern agricultural practices.

Seeds Overview

A seed is a fertilized, matured ovule that contains an embryonic plant, stored material, and a protective coat or coats. A seed is a mature ovule that contains an embryo or a miniature undeveloped plant as well as food reserves, all contained within a protective seed coat. They are produced by the process of fertilization, which occurs when pollen from the male part of a plant (the stamen) reaches the female part (the pistil) and fertilizes the ovule. Seeds come in different shapes and sizes and can be dispersed in various ways, including by wind, water, or animals. Some seeds are edible and are commonly used as food, such as sunflower seeds, pumpkin seeds, and chia seeds.

COVID-19 Impact on Global Seeds Market

The COVID-19 pandemic had a significant impact on the global seeds market. The pandemic disrupted supply chains, caused labor shortages, and created logistical challenges for seed producers, distributors, and retailers. The major impact of the pandemic on the seeds market has been the disruption of international trade. Restrictions on movement and trade have made it difficult for seed companies to import and export seeds, which has caused shortages in some regions and an oversupply in others. The pandemic also led to a surge in demand for seeds, as more people turned to gardening and home farming during lockdowns. This created a challenge for seed companies, as they struggle to meet the increase in demand while also dealing with supply chain disruptions and labor shortages. In addition, the pandemic led to disruptions in the availability of agricultural inputs such as fertilizers, pesticides, and machinery. This had an impact on seed production, as farmers struggled to access the inputs, they needed to grow crops.

Increase in Global Population to Drive the Market Growth

As the global population continues to rise, the demand for food increases, and this is expected to drive the demand for quality seeds that can produce high-yielding crops. This is because the quality of the seeds used to grow crops plays a critical role in determining the yield and quality of the crop produced. Farmers are under pressure to produce more food per unit of land while also improving the quality of the crops produced. Quality seeds can help farmers achieve these goals by producing crops that are resistant to pests, diseases, and adverse weather conditions. Moreover, the increase in awareness among farmers about the importance of using quality seeds is also expected to drive the growth of the seeds market. Farmers are now more aware of the benefits of using high-quality seeds and are willing to pay a premium price for them. This has created a lucrative market for seed companies that produce and sell high-quality seeds. Therefore, the increase in global population is a significant driver of the seeds market, as it creates a higher demand for high-quality seeds that can produce high-yielding crops.

To know more about global seeds market drivers, get in touch with our analysts here.

Regulatory Challenges Over Seeds to Restrain the Market Growth

The seeds market is subject to extensive regulation due to its crucial role in agriculture and food production. New varieties of seeds, including genetically modified seeds, need to go through a rigorous approval process before they can be sold to farmers. The regulatory process involves testing and evaluating the safety, quality, and performance of the seeds, as well as their impact on the environment. This process can be time-consuming and expensive, and it can take several years to complete. The costs and resources required to navigate the regulatory process can be prohibitive, making it difficult for them to bring new seed varieties to market, which is anticipated to hamper the seeds market growth in the upcoming years.

Increase in Use of Genetically Modified Seeds to Drive Excellent Opportunities in the Market

The use of genetically modified seeds has been on the rise in recent years, driven by their ability to enhance crop productivity, reduce the use of pesticides, and increase resilience to environmental stresses. This presents an opportunity for seed companies that specialize in genetically modified seeds to expand their market share. Genetically modified seeds offer several advantages over traditional seeds, including increased yields, improved resistance to pests and diseases, and greater tolerance to environmental stresses such as drought and heat. As farmers and growers become more aware of these benefits, demand for genetically modified seeds is likely to continue to grow. This presents a significant market opportunity for seed companies that specialize in genetically modified seeds, who can leverage their expertise in this area to develop new and innovative products that meet the needs of farmers and growers. All these factors are anticipated to create excellent opportunities in the market.

To know more about global seeds market opportunities, get in touch with our analysts here.

Global Seeds Market, by Seeds Type

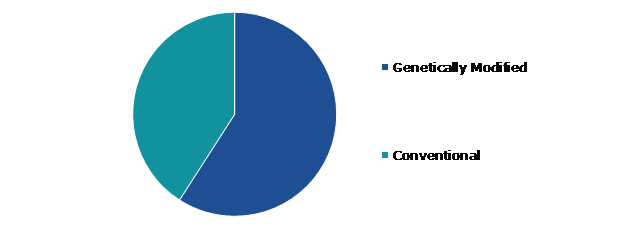

Based on seeds type, the market has been divided into genetically modified and conventional. Among these, the genetically modified sub-segment accounted for the highest market share in 2021 and is estimated to show the fastest growth during the forecast period.

Global Seeds Market Size, by Seeds Type, 2021

Source: Research Dive Analysis

The genetically modified sub-segment accounted for the highest market share in 2021 and is estimated to show the fastest growth during the forecast period. GM seeds can be designed to produce crops that are more resistant to pests, diseases, and environmental stress factors such as drought or extreme temperatures, resulting in higher yields. By producing crops that are naturally resistant to pests and diseases, farmers can reduce their reliance on chemical pesticides, which can be costly and have negative environmental impacts. GM seeds can be designed to produce crops with specific characteristics, such as increased nutrient content, longer shelf life, or improved flavor. GM seeds can help farmers reduce their costs by reducing the need for pesticides and other inputs, and by improving yields and quality. Some governments have policies that promote the use of genetically modified seeds to increase food production and reduce food prices.

Global Seeds Market, by Crop Type

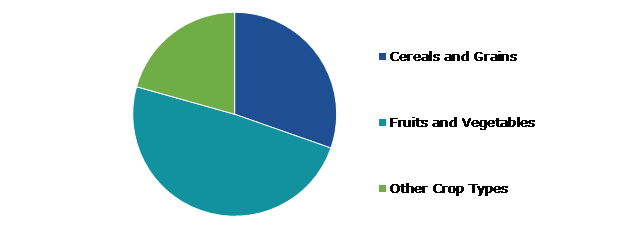

Based on crop type, the market has been divided into cereals and grains, fruits and vegetables, and others crop types. Among these, the fruits and vegetables sub-segment accounted for the highest revenue share in 2021.

Global Seeds Market Analysis, by Crop Type, 2021

Source: Research Dive Analysis

The fruits and vegetables sub-segment accounted for the highest market share in 2021. The rising demand for fresh and healthy produce among consumers is predicted to drive the growth of the fruit and vegetable segment in the seeds market. With an increasing focus on health and wellness, consumers are seeking out fruits and vegetables that are not only nutritious but also flavorful and visually appealing. To meet this demand, growers and seed companies are developing new varieties of fruits and vegetables that offer improved taste, texture, and appearance. They are also investing in sustainable farming practices to ensure that their crops are grown in an environmentally friendly manner. The fruits and vegetables segment in the seeds market is being driven by consumer demand for healthy, sustainable, and flavorful produce, as well as the need for reliable seeds that can meet the needs of growers and support the growth of the industry. These factors are anticipated to boost the growth of the fruits and vegetables sub-segment during the forecast time.

Global Seeds Market, by Traits

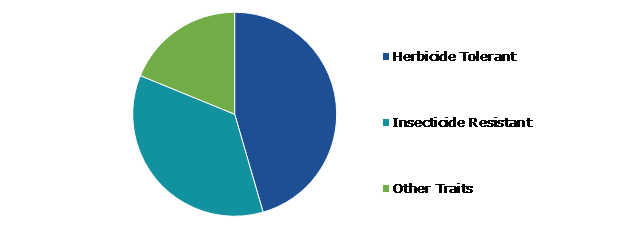

Based on traits, the market has been divided into herbicide-tolerant, insecticide-resistant, and other traits. Among these, the herbicide-tolerant sub-segment accounted for the highest revenue share in 2021.

Global Seeds Market Share, by Traits, 2021

Source: Research Dive Analysis

The herbicide-tolerant sub-segment accounted for the highest market share in 2021. The increase in demand for higher crop yields and more efficient farming practices are factors driving the herbicide-tolerant traits segment growth. Herbicide-tolerant traits enable farmers to control weeds more effectively, reducing yield losses due to weed competition and minimizing the need for costly and time-consuming manual weed control methods. In addition, the adoption of herbicide-tolerant traits can also help reduce the use of other agricultural inputs, such as tillage and irrigation, leading to reduced costs and increased sustainability. Therefore, many farmers are willing to pay a premium for herbicide-tolerant seeds, making them a profitable segment of the seeds market. Furthermore, advances in biotechnology have enabled the development of newer and more effective herbicide-tolerant traits, which is further predicted to drive the demand for these products.

Global Seeds Market, Regional Insights

The seeds market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Seeds Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Seeds in North America was the Most Dominant

The North America seeds market accounted for the highest market share in 2021. There is a rise in demand for food as the population of North America is increasing. Therefore, there is a need for high-yield crops that can produce more food with less land and resources. Modern farming techniques, such as precision agriculture and genetically modified crops, are becoming increasingly popular in North America. These techniques can help farmers produce more crops with less effort and resources. Governments in North America are providing subsidies and other incentives to farmers to encourage them to adopt modern farming techniques and increase crop yields. There is a rising trend towards organic and non-GMO products in North America, which is driving the demand for organic and non-GMO seeds. Advancements in technology, such as seed coatings and seed treatments, are improving seed quality and enhancing crop yields. The North America seeds market is expected to continue to grow in the upcoming years due to all these factors.

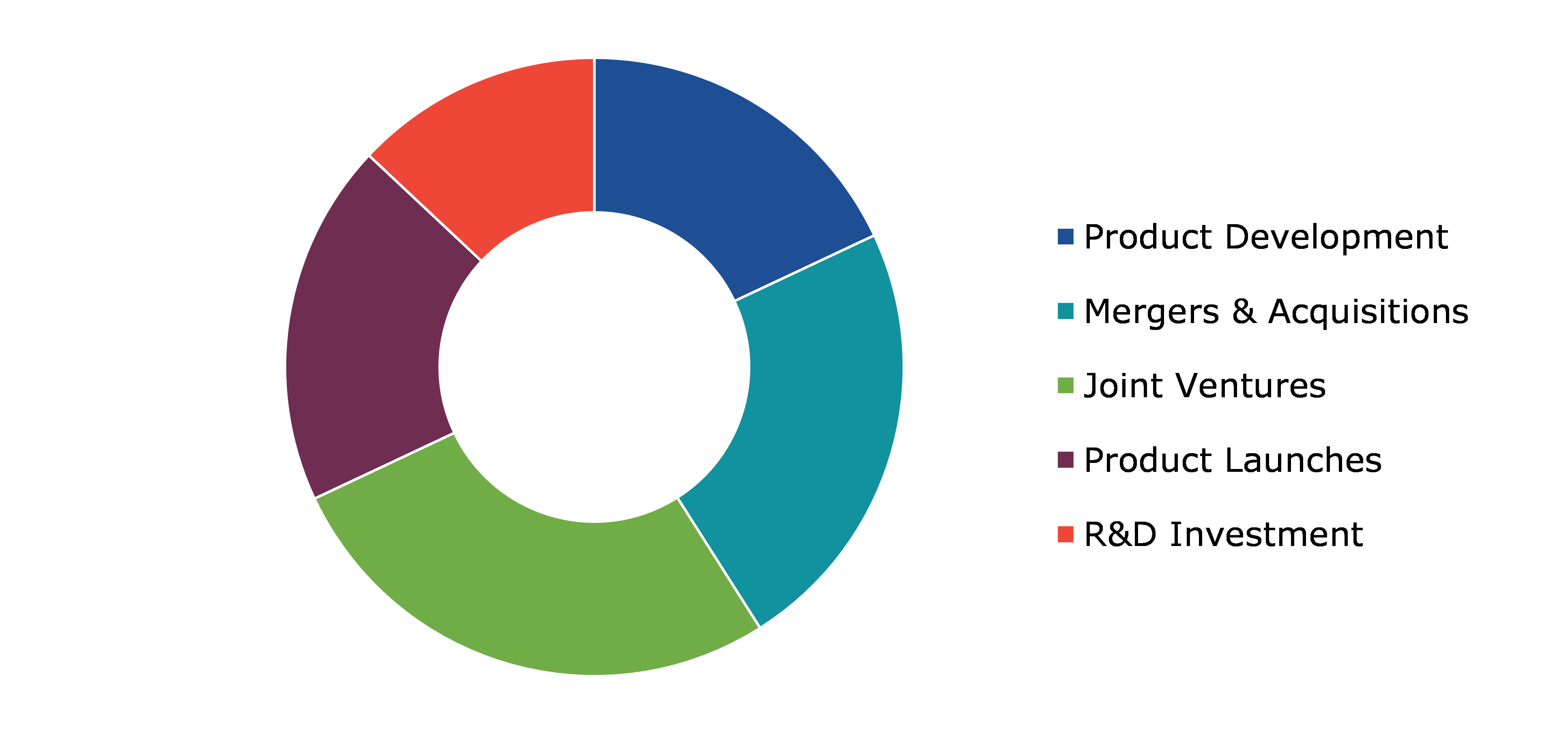

Competitive Scenario in the Global Seeds Market

Investment and agreement are common strategies followed by major market players. For instance, in July 2022, Corteva Agriscience, BASF, and MS Technologies signed an agreement to create next-generation Enlist E3 soybeans with the NRS trait for farmers in the U.S. and Canada.

Source: Research Dive Analysis

Some of the leading seeds market players are Bayer Crop Science AG, Corteva, Syngenta AG, BASF, Limagrain, KWS SAAT SE, Sakata Seed Corporation, AgReliant Genetics, LLC,DLF Seeds A/S, and Yuan Longping High-tech Agriculture Co., Ltd.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Seeds Type |

|

| Segmentation by Crop Type |

|

| Segmentation by Traits |

|

| Key Companies Profiled |

|

Q1. What is the size of the global seeds market?

A. The size of the global seeds market was over $69,042.0 million in 2021 and is projected to reach $106,179.0 million by 2031.

Q2. Which are the major companies in the seeds market?

A. Bayer Crop Science AG, Corteva, and Syngenta AG are some of the key players in the global seeds market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific seeds market?

A. Asia-Pacific seeds market is anticipated to grow at 6.3% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. BASF, Limagrain, and KWS SAAT SE. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Seeds market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Seeds market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Seeds Market Analysis, by Seeds Type

5.1.Overview

5.2.Genetically Modified

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region,2021-2031

5.2.3.Market share analysis, by country,2021-2031

5.3.Conventional

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region,2021-2031

5.3.3.Market share analysis, by country,2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Seeds Market Analysis, by Crop Type

6.1.Cereals And Grains

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region,2021-2031

6.1.3.Market share analysis, by country,2021-2031

6.2.Fruits And Vegetables

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region,2021-2031

6.2.3.Market share analysis, by country,2021-2031

6.3.Other Crop Types

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region,2021-2031

6.3.3.Market share analysis, by country,2021-2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Seeds Market Analysis, by Traits

7.1.Herbicide Tolerant

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region,2021-2031

7.1.3.Market share analysis, by country,2021-2031

7.2.Insecticide Resistant

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region,2021-2031

7.2.3.Market share analysis, by country,2021-2031

7.3.Other Traits

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region,2021-2031

7.3.3.Market share analysis, by country,2021-2031

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

1.1.1.Competition heatmap

8.Seeds Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Seeds Type, 2021-2031

8.1.1.2.Market size analysis, by Crop Type, 2021-2031

8.1.1.3.Market size analysis, by Traits, 2021-2031

8.1.2.Canada

8.1.2.1.Market size analysis, by Seeds Type, 2021-2031

8.1.2.2.Market size analysis, by Crop Type, 2021-2031

8.1.2.3.Market size analysis, by Traits, 2021-2031

8.1.3.Mexico

8.1.3.1.Market size analysis, by Seeds Type, 2021-2031

8.1.3.2.Market size analysis, by Crop Type, 2021-2031

8.1.3.3.Market size analysis, by Traits, 2021-2031

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Seeds Type, 2021-2031

8.2.1.2.Market size analysis, by Crop Type, 2021-2031

8.2.1.3.Market size analysis, by Traits, 2021-2031

8.2.2.UK

8.2.2.1.Market size analysis, by Seeds Type, 2021-2031

8.2.2.2.Market size analysis, by Crop Type, 2021-2031

8.2.2.3.Market size analysis, by Traits, 2021-2031

8.2.3.France

8.2.3.1.Market size analysis, by Seeds Type, 2021-2031

8.2.3.2.Market size analysis, by Crop Type, 2021-2031

8.2.3.3.Market size analysis, by Traits, 2021-2031

8.2.4.Spain

8.2.4.1.Market size analysis, by Seeds Type, 2021-2031

8.2.4.2.Market size analysis, by Crop Type, 2021-2031

8.2.4.3.Market size analysis, by Traits, 2021-2031

8.2.5.Italy

8.2.5.1.Market size analysis, by Seeds Type, 2021-2031

8.2.5.2.Market size analysis, by Crop Type, 2021-2031

8.2.5.3.Market size analysis, by Traits, 2021-2031

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Seeds Type, 2021-2031

8.2.6.2.Market size analysis, by Crop Type, 2021-2031

8.2.6.3.Market size analysis, by Traits, 2021-2031

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Seeds Type, 2021-2031

8.3.1.2.Market size analysis, by Crop Type, 2021-2031

8.3.1.3.Market size analysis, by Traits, 2021-2031

8.3.2.Japan

8.3.2.1.Market size analysis, by Seeds Type, 2021-2031

8.3.2.2.Market size analysis, by Crop Type, 2021-2031

8.3.2.3.Market size analysis, by Traits, 2021-2031

8.3.3.India

8.3.3.1.Market size analysis, by Seeds Type, 2021-2031

8.3.3.2.Market size analysis, by Crop Type, 2021-2031

8.3.3.3.Market size analysis, by Traits, 2021-2031

8.3.4.Australia

8.3.4.1.Market size analysis, by Seeds Type, 2021-2031

8.3.4.2.Market size analysis, by Crop Type, 2021-2031

8.3.4.3.Market size analysis, by Traits, 2021-2031

8.3.5.South Korea

8.3.5.1.Market size analysis, by Seeds Type, 2021-2031

8.3.5.2.Market size analysis, by Crop Type, 2021-2031

8.3.5.3.Market size analysis, by Traits, 2021-2031

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Seeds Type, 2021-2031

8.3.6.2.Market size analysis, by Crop Type, 2021-2031

8.3.6.3.Market size analysis, by Traits, 2021-2031

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Seeds Type, 2021-2031

8.4.1.2.Market size analysis, by Crop Type, 2021-2031

8.4.1.3.Market size analysis, by Traits, 2021-2031

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Seeds Type, 2021-2031

8.4.2.2.Market size analysis, by Crop Type, 2021-2031

8.4.2.3.Market size analysis, by Traits, 2021-2031

8.4.3.UAE

8.4.3.1.Market size analysis, by Seeds Type, 2021-2031

8.4.3.2.Market size analysis, by Crop Type, 2021-2031

8.4.3.3.Market size analysis, by Traits, 2021-2031

8.4.4.South Africa

8.4.4.1.Market size analysis, by Seeds Type, 2021-2031

8.4.4.2.Market size analysis, by Crop Type, 2021-2031

8.4.4.3.Market size analysis, by Traits, 2021-2031

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Seeds Type, 2021-2031

8.4.5.2.Market size analysis, by Crop Type, 2021-2031

8.4.5.3.Market size analysis, by Traits, 2021-2031

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Bayer Crop Science AG

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Corteva

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Syngenta AG

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.BASF

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Limagrain

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.KWS SAAT SE

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Sakata Seed Corporation

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.AgReliant Genetics, LLC

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.DLF Seeds A/S

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Yuan Longping High-tech Agriculture Co., Ltd.

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

In the past few years, the need for food has undoubtedly increased with the growing world population. There is enormous demand for agricultural systems to produce more food due to the increasing number of people who need to be fed. Thus, to solve this issue, the development and use of better seeds are critical.

The seeds market plays a vital role in horticulture, agriculture, and sustainable food production. A seed is a fertilized, developed ovule that includes stored material, an embryonic plant, and a protective coat or coats. A seed is a mature ovule that includes an embryo or a tiny, immature plant along with food reserves, all enclosed in a protective seed coat. They are formed during the fertilization process, which occurs when pollen from the male component of a plant (the stamen) meets the female part (the pistil) and fertilizes the ovule. Seeds come in a variety of forms and sizes and can be disseminated in a variety of ways, including by water, wind, and animals. Some seeds, such as pumpkin, sunflower, and chia seeds are edible and frequently consumed as food.

Recent Trends in the Seeds Market

The seeds market is continuously evolving with new varieties and technologies. With rising worries about climate change and its influence on agriculture, there is an increased focus on producing climate-resilient seeds. These seeds are specifically developed or manufactured to withstand extreme weather conditions such as heat, drought, and flooding, resulting in increased crop yield and sustainability. In addition, trait stacking is the process of combining several desirable features into a single variety. This practice has become more popular since it gives farmers access to a wider range of advantageous features, like herbicide tolerance, insect resistance, and increased yield potential, in a single seed variety.

Newest Insights in the Seeds Market

As per a report by Research Dive, the global seeds market is expected to grow at a CAGR of 4.6% and generate revenue of $106,179.0 million by 2031. The primary factors driving the growth of the market are the growing trend towards sustainable and organic agricultural methods, which has increased the demand for non-GMO and organic seeds, the rise in world population, and the increased awareness among farmers about the significance of utilizing quality seeds. However, regulatory issues with seeds are expected to hinder the market growth.

The seeds market in North America is expected to remain dominant in the coming years. The region's high revenue in 2021 was driven by the growing need for food as a result of population growth, as well as the rising trend towards organic and non-GMO products. This has led to an increased demand for high-quality seeds for crop production.

How are Market Players Responding to the Rising Demand for Seeds?

Market players are responding to the rising demand for seeds by investing in research and development to create new and enhanced seed varieties. They are also expanding their manufacturing capacity and distribution networks to satisfy the growing market demand.

In addition, market players are increasingly focusing on strategic partnerships and collaborations with other players in the industry to leverage their strengths and expand their reach. Some of the foremost players in the seeds market are Corteva, Bayer Crop Science AG, Syngenta AG, Limagrain, KWS SAAT SE, BASF, Sakata Seed Corporation, AgReliant Genetics, LLC, Yuan Longping High-tech Agriculture Co., Ltd., DLF Seeds A/S, and others. These players are focused on implementing strategies such as mergers and acquisitions, novel developments, collaborations, and partnerships to reach a leading position in the global market.

For instance:

- In June 2022, Corteva Agriscience, a prominent American agricultural chemical and seed firm, BASF, a company offering sustainable business solutions, and MS Technologies™, a company focused on inventing trait and technology innovations for enhancing the future of farming, announced that they had engaged into a collaborative trait licensing arrangement to create next-generation Enlist E3® soybeans using the NRS (nematode-resistant soybean) trait for farmers in Canada and the US.

- In September 2022, Corteva Agriscience, a multinational agriculture company, launched the "Seed Applied Technology" seed treatment solutions for the rice and maize crops in India, with plans to expand to additional crops later. SAT can boost production by 3 to 5% while protecting rice crops from brown plant hopper infestation and yellow stem borer.

- In March 2023, Syngenta Crop Protection, a provider of agricultural technologies and science, and Aphea.Bio, a company involved in maintaining a safe and healthy food chain, joined forces to introduce a novel wheat seed treatment technique to all the markets throughout Europe, with the goal of assisting farmers in increasing sustainability through higher yields and less fertilizer usage.

COVID-19 Impact on the Global Seeds Market

The COVID-19 pandemic made a moderate impact on the global seeds market. The outbreak caused labor shortages, disrupted supply chains, and created logistical issues for seed distributors, producers, and retailers. The pandemic's primary impact on the seeds market was the disruption of international trade. In addition, the pandemic caused a disturbance in the supply of agricultural supplies like pesticides, agricultural machinery, and fertilizers. This had an effect on seed production, since farmers were unable to obtain the inputs necessary to cultivate crops. However, the pandemic raised the need for seeds as more individuals turned to gardening and home farming during lockdowns. As a result, seed manufacturers faced a problem in fulfilling growing demand while simultaneously struggling with labor shortages and supply chain disruptions. These factors had a significant impact on the global seeds market growth amidst the pandemic.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com