Gel Battery Market Report

RA00363

Gel Battery Market by Type (2V, 6V, and 12V), Application (Electric Mobility, Telecommunication, Energy Storage & Distribution, Oil & Gas, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Gel Battery Market Analysis

The global gel battery market accounted for $2,069.5 million in 2020 and is predicted to grow with a CAGR of 4.0%, by generating a revenue of $2,776.9 million by 2028.

Market Synopsis

Gel battery market is gaining huge popularity as these batteries are used in wide range of applications such as solar systems, marine trolling, electric vehicles, sailboats, golf cars, UPS (Uninterrupted Power Systems), emergency lighting, and others. This is majorly owing to various benefits offered by gel batteries such as they are maintenance free, spill proof, vibration-resistant, and have minimal corrosion due to which they are compatible with sensitive electronic equipment and suitable for variety of applications. Also, these batteries can be installed in places where ventilation is limited as gel batteries do not release any harmful gases or fumes such as sulfur dioxide or flammable hydrogen gas.

However, gel battery requires charging at a slower rate compared to other lead acid batteries and you must stop its charging, immediately after charging is completed as it can develop voids with its electrolyte. This factor is anticipated to restrain the market growth.

According to regional analysis, the Asia-Pacific gel battery market accounted for $674.6 million in 2020 and is predicted to grow with a CAGR of 4.4% in the projected timeframe.

Gel Battery Market Overview

A gel battery is a valve regulated lead-acid battery which is robust and versatile. Gel batteries are best suited for deep cycle applications such as personnel carriers, wheelchairs, floor scrubbers, cable TV, computer backup, and others. They have a lifespan of 500-5000 cycles. The gel batteries are made with flat or tubular positive plates. The sulfuric acid is mixed with finely divided silica to form a gel or thick paste. This gel offers better heat conduction and heat produced due to overcharge is lost efficiently. Hence, the gel battery is similar to lead-acid battery with the addition of silica to the electrolyte that forms gel-like substance. Gel battery can be installed anywhere, and they can be virtually used in any position, they are leak-proof as they are sealed with a valve that removes excess pressure.

Impact Analysis of COVID-19 on the Global Gel battery Market

The global crisis and economic losses caused by COVID-19 pandemic have negatively affected various industries across the globe. The COVID-19 containment measures such as nation-wide lockdown, closed borders, and social distancing norms have severely affected the gel battery market. The raw materials required for the manufacturing of gel battery such as lead, lead oxides, glass, antimony, sulfuric acid, and others are majorly imported from China. But, China being the epicenter of COVID-19 virus supply & procurement of goods, was completely affected. For instance, The Observatory of Economic Complexity, the online data visualization & distribution platform, stated that in 2019, China was the largest exporter of batteries gaining a revenue of $2.4 billion. However, COVID-19 virus has greatly affected the export causing delay in the availability of raw materials due to shortage of labors. In addition, some countries such as India and the U.S. have imposed restrictions on movement of non-essential goods. Also, the gel battery manufacturing units were closed for unprecedented time which resulted in huge revenue losses. All these factors have negatively impacted the demand and sales of gel battery during the pandemic.

Various government initiatives such as incentives for the companies that setup advanced battery manufacturing units to support the use of electric vehicles and reduce the dependence on oil are helping society to recover from pandemic. For instance, as stated on September 26, 2020, in the Times of India, the popular news website, the Indian government to offer $4.6 billion incentives for the companies to setup advanced battery manufacturing units. In addition, India is planning to keep import tax rate of 5% on batteries imported from other countries, until 2022, after which import tax will be increased to 15% to support local manufacturing.

High Demand for Gel Battery in Solar Power System to Drive the Market Growth

Solar power systems have gained huge popularity in recent years as it is renewable source of energy and do not have any harmful environmental impact. Gel batteries outperform other batteries such as absorbent glass mat (AGM) in solar power systems where heat is a concern. This is because gel battery adapts better to extreme temperatures, and they are less prone to thermal runaway as they are valve-regulated sealed batteries. In addition, the use of gel battery in solar, provides twice the lifespan of AGM battery. For instance, the solar batteries by Deka brand, which is popular company in power sports industry, has designed solar batteries with 600-800 complete lifecycles, compared to AGM which has a range of 400-500 lifecycles. Hence, gel battery is preferred in solar batteries as they are easy to install and can sustain different environmental conditions.

To know more about global gel battery market drivers, get in touch with our analysts here.

Gel Battery is Sensitive to Overcharging which is Predicted to Restrain the Market Growth

The charging of gel battery is sensitive as one must not overcharge it which can lead to development of voids in electrolyte that can damage the battery. The extent of damage due to overcharging cannot be fixed or reversed, as a result the battery loses its charging capacity which is estimated to restrain the market growth during the forecast period.

Use of Gel Battery in Deep Cycle Applications to Generate Enormous Opportunities

Gel battery is widely used in deep cycle applications such as camcorders, motorcycles, marine equipment, cell phones, and others. Also, they are used in high-end cars. This is due to low maintenance required by gel battery as users do not have to regularly add water to the battery to ensure electrolyte levels are normal. Gel battery has very less chance of leaks or spills as the electrolyte present in this battery is plasma-like substance and viscous in nature. Due to this, gel battery can be placed at any angle or position. Also, the gel battery has valve that eliminates excessive pressure. As gel battery is less susceptible to heat fluctuations and other environmental conditions which could affect its charging ability. Hence, gel battery is superior and can be used across wide range of applications such as powered scooters and other transportation equipment.

To know more about global gel battery market opportunities, get in touch with our analysts here.

Based on type, the market has been divided into 2V, 6V, and 12V. Among these, the 12V sub-segment accounted for the highest revenue share in 2020 and is estimated to show the fastest growth during the forecast period. Get Sample ReportGel Battery Market

By Type

Source: Research Dive Analysis

The 12V sub-type is anticipated to have a dominant market share and generate a revenue of $1,316.6 million by 2028, growing from $962.3 million in 2020. The 12V battery supplies 12 volts power under nominal load due to which this battery is widely used in electrical components such as lighting, starter, and ignition systems that are designed to operate on 12V. In addition, the 12 voltage DC circuits are safer compared to any higher operating voltages. Most of the domestic appliances such as refrigerators operate on 12-volt systems.

Gel Battery Market

By ApplicationBased on application, the market has been divided into electric mobility, telecommunication, Energy Storage & Distribution, oil & gas, and others. Among these, the Energy Storage & Distribution sub-segment accounted for the dominant market share in 2020 and is anticipated to show the fastest growth during 2021-2028.

Source: Research Dive Analysis

The energy storage & distribution sub-segment is anticipated to have a dominant market share and generate a revenue of $815.0 million by 2028, growing from $596.2 million in 2020. This is majorly owing to use of gel battery in renewable and clean energy sources such as solar and wind power. Gel battery is widely used in these applications because it has low upfront cost, and no maintenance is needed. For instance, Vmaxtanks, the leading company that offers top deep cycle & maintenance free batteries, offers gel battery that has excellent storage capacity and can be used for residential photovoltaic solar panel systems. In addition, one can pair this battery with high-quality inverter and this battery has a life span of up to 10 years.

Gel Battery Market

By RegionThe gel battery market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Gel Battery in Asia-Pacific to be the Most Dominant and Fastest Growing

The Asia-Pacific gel battery market accounted $674.6 million in 2020 and is projected to grow with a CAGR of 4.4%. This growth is majorly attributed to the presence of large number of gel battery manufacturers and suppliers in this region. For instance, as stated on February 11, 2021, in The Washington Post, the popular news website, China dominates the battery production capacity in the world with the presence of 93 “gigafactories” that manufacture different types of batteries. In addition, China is anticipated to have 140 gigafactories by 2030, followed by Europe with 17 gigafactories, and the U.S. with 10 gigafactories. In addition, the U.S. and other countries are dependent on China and other trading partners for its battery supply. Moreover, JYC Battery Manufacturer Co., Ltd., the leading gel battery manufacturer based in China, has designed JYC gel series battery, which is equipped with proven silica gel technology that improves the battery lifecycle and performance at wider temperature range.

Competitive Scenario in the Global Gel Battery Market

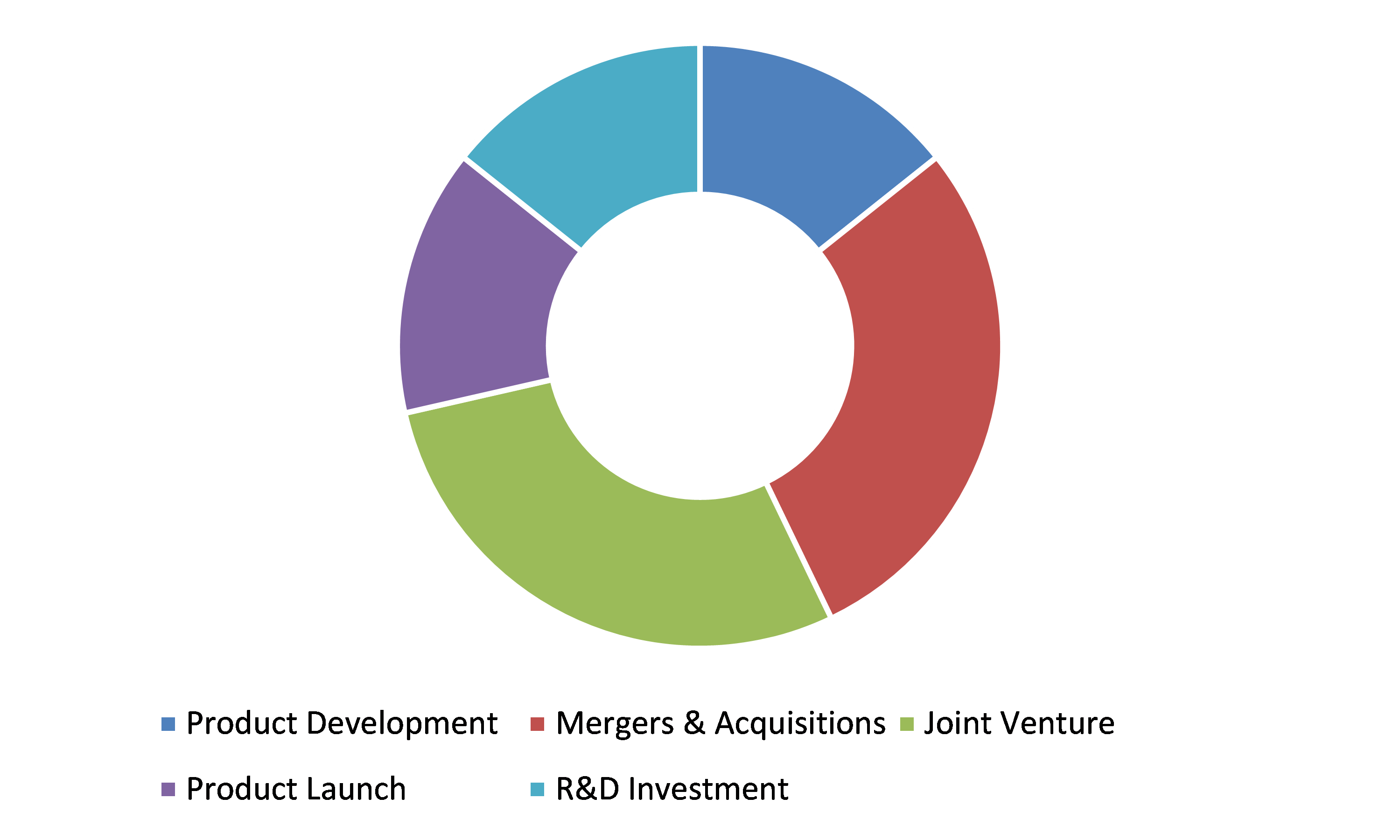

Product launch and investment are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading gel battery market players are Exide Technologies, BSB Power Company Limited, Leoch International Technology Limited Inc., Power Sonic Corporation, Exponential Power, Canbat Technologies Inc., C&D Technologies, Inc., B.B. Battery, Vision Group, and JYC Battery Manufacturer Co. Ltd.

Porter’s Five Forces Analysis for the Global Gel Battery Market:

- Bargaining Power of Suppliers: The bargaining power of suppliers is high as the gel battery manufacturers have to depend on raw material suppliers. For instance, some manufacturers have to rely on chemical suppliers for variety of raw materials such as anode, cathode, separator, lead, and others. Hence, suppliers can use their bargaining potential to grab high profit.

Thus, the bargaining power of suppliers is high. - Bargaining Power of Buyers: The bargaining power of buyers is moderate as there are limited well-known manufacturers in the gel battery industry.

Thus, buyer’s bargaining power will be moderate. - Threat of New Entrants: New entrants entering this market have to invest huge amount in setting up battery manufacturing unit. As well as labor charges, import-export tax, and government regulations on safety standards for batteries lower the threat of new entrants.

Thus, the threat of the new entrants is low. - Threat of Substitutes: The availability of substitute and cost-efficient battery solutions such as lithium-ion batteries which has gained huge popularity due to boost in demand for electric vehicles, increases the threat from substitution.

Thus, the threat of substitutes is high. - Competitive Rivalry in the Market: The companies operating in this market are focusing on product launch, innovation, and increasing the gel battery lifecycle.

Therefore, competitive rivalry in the market is moderate.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global gel battery market?

A. The size of the global gel battery market was over $2,069.5 million in 2020 and is projected to reach $2,776.9 million by 2028.

Q2. Which are the major companies in the gel battery market?

A. Exide Technologies, BSB Power Company Limited, and Leoch International Technology Limited Inc. are some of the key players in the global gel battery market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific gel battery market?

A. Asia-Pacific gel battery market is anticipated to grow at 4.4% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product launch and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. B.B. Battery, Vision Group, and JYC Battery Manufacturer Co. Ltd. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Type trends

2.3.Application trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Gel Battery Market, by Type

4.1.2V

4.1.1.Market size and forecast, by region, 2020-2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.6V

4.2.1.Market size and forecast, by region, 2020-2028

4.2.2.Comparative market share analysis, 2020 & 2028

4.3.12V

4.3.1.Market size and forecast, by region, 2020-2028

4.3.2.Comparative market share analysis, 2020 & 2028

5.Gel Battery Market, by Application

5.1.Electric Mobility

5.1.1.Market size and forecast, by region, 2020-2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Telecommunication

5.2.1.Market size and forecast, by region, 2020-2028

5.2.2.Comparative market share analysis, 2020 & 2028

5.3.Energy Storage & Distribution

5.3.1.Market size and forecast, by region, 2020-2028

5.3.2.Comparative market share analysis, 2020 & 2028

5.4.Oil & Gas

5.4.1.Market size and forecast, by region, 2020-2028

5.4.2.Comparative market share analysis, 2020 & 2028

5.5.Others

5.5.1.Market size and forecast, by region, 2020-2028

5.5.2.Comparative market share analysis, 2020 & 2028

6.Gel Battery Market, by Region

6.1.North America

6.1.1.Market size and forecast, by Type, 2020-2028

6.1.2.Market size and forecast, by Application, 2020-2028

6.1.3.Market size and forecast, by country, 2020-2028

6.1.4.Comparative market share analysis, 2020 & 2028

6.1.5.U.S.

6.1.5.1.Market size and forecast, by Type, 2020-2028

6.1.5.2.Market size and forecast, by Application, 2020-2028

6.1.5.3.Comparative market share analysis, 2020 & 2028

6.1.6.Canada

6.1.6.1.Market size and forecast, by Type, 2020-2028

6.1.6.2.Market size and forecast, by Application, 2020-2028

6.1.6.3.Comparative market share analysis, 2020 & 2028

6.1.7.Mexico

6.1.7.1.Market size and forecast, by Type, 2020-2028

6.1.7.2.Market size and forecast, by Application, 2020-2028

6.1.7.3.Comparative market share analysis, 2020 & 2028

6.2.Europe

6.2.1.Market size and forecast, by Type, 2020-2028

6.2.2.Market size and forecast, by Application, 2020-2028

6.2.3.Market size and forecast, by country, 2020-2028

6.2.4.Comparative market share analysis, 2020 & 2028

6.2.5.Germany

6.2.5.1.Market size and forecast, by Type, 2020-2028

6.2.5.2.Market size and forecast, by Application, 2020-2028

6.2.5.3.Comparative market share analysis, 2020 & 2028

6.2.6.UK

6.2.6.1.Market size and forecast, by Type, 2020-2028

6.2.6.2.Market size and forecast, by Application, 2020-2028

6.2.6.3.Comparative market share analysis, 2020 & 2028

6.2.7.France

6.2.7.1.Market size and forecast, by Type, 2020-2028

6.2.7.2.Market size and forecast, by Application, 2020-2028

6.2.7.3.Comparative market share analysis, 2020 & 2028

6.2.8.Spain

6.2.8.1.Market size and forecast, by Type, 2020-2028

6.2.8.2.Market size and forecast, by Application, 2020-2028

6.2.8.3.Comparative market share analysis, 2020 & 2028

6.2.9.Italy

6.2.9.1.Market size and forecast, by Type, 2020-2028

6.2.9.2.Market size and forecast, by Application, 2020-2028

6.2.9.3.Comparative market share analysis, 2020 & 2028

6.2.10.Rest of Europe

6.2.10.1.Market size and forecast, by Type, 2020-2028

6.2.10.2.Market size and forecast, by Application, 2020-2028

6.2.10.3.Comparative market share analysis, 2020 & 2028

6.3.Asia Pacific

6.3.1.Market size and forecast, by Type, 2020-2028

6.3.2.Market size and forecast, by Application, 2020-2028

6.3.3.Market size and forecast, by country, 2020-2028

6.3.4.Comparative market share analysis, 2020 & 2028

6.3.5.China

6.3.5.1.Market size and forecast, by Type, 2020-2028

6.3.5.2.Market size and forecast, by Application, 2020-2028

6.3.5.3.Comparative market share analysis, 2020 & 2028

6.3.6.Japan

6.3.6.1.Market size and forecast, by Type, 2020-2028

6.3.6.2.Market size and forecast, by Application, 2020-2028

6.3.6.3.Comparative market share analysis, 2020 & 2028

6.3.7.India

6.3.7.1.Market size and forecast, by Type, 2020-2028

6.3.7.2.Market size and forecast, by Application, 2020-2028

6.3.7.3.Comparative market share analysis, 2020 & 2028

6.3.8.South Korea

6.3.8.1.Market size and forecast, by Type, 2020-2028

6.3.8.2.Market size and forecast, by Application, 2020-2028

6.3.8.3.Comparative market share analysis, 2020 & 2028

6.3.9.Australia

6.3.9.1.Market size and forecast, by Type, 2020-2028

6.3.9.2.Market size and forecast, by Application, 2020-2028

6.3.9.3.Comparative market share analysis, 2020 & 2028

6.3.10.Rest of Asia Pacific

6.3.10.1.Market size and forecast, by Type, 2020-2028

6.3.10.2.Market size and forecast, by Application, 2020-2028

6.3.10.3.Comparative market share analysis, 2020 & 2028

6.4.LAMEA

6.4.1.Market size and forecast, by Type, 2020-2028

6.4.2.Market size and forecast, by Application, 2020-2028

6.4.3.Market size and forecast, by country, 2020-2028

6.4.4.Comparative market share analysis, 2020 & 2028

6.4.5.Latin America

6.4.5.1.Market size and forecast, by Type, 2020-2028

6.4.5.2.Market size and forecast, by Application, 2020-2028

6.4.5.3.Comparative market share analysis, 2020 & 2028

6.4.6.Middle East

6.4.6.1.Market size and forecast, by Type, 2020-2028

6.4.6.2.Market size and forecast, by Application, 2020-2028

6.4.6.3.Comparative market share analysis, 2020 & 2028

6.4.7.Africa

6.4.7.1.Market size and forecast, by Type, 2020-2028

6.4.7.2.Market size and forecast, by Application, 2020-2028

6.4.7.3.Comparative market share analysis, 2020 & 2028

7.Company profiles

7.1.Exide Technologies

7.1.1.Business overview

7.1.2.Financial performance

7.1.3.Product portfolio

7.1.4.Recent strategic moves & developments

7.1.5.SWOT analysis

7.2.BSB Power Company Limited

7.2.1.Business overview

7.2.2.Financial performance

7.2.3.Product portfolio

7.2.4.Recent strategic moves & developments

7.2.5.SWOT analysis

7.3.Leoch International Technology Limited Inc.

7.3.1.Business overview

7.3.2.Financial performance

7.3.3.Product portfolio

7.3.4.Recent strategic moves & developments

7.3.5.SWOT analysis

7.4.Power Sonic Corporation

7.4.1.Business overview

7.4.2.Financial performance

7.4.3.Product portfolio

7.4.4.Recent strategic moves & developments

7.4.5.SWOT analysis

7.5.Exponential Power

7.5.1.Business overview

7.5.2.Financial performance

7.5.3.Product portfolio

7.5.4.Recent strategic moves & developments

7.5.5.SWOT analysis

7.6.Canbat Technologies Inc.

7.6.1.Business overview

7.6.2.Financial performance

7.6.3.Product portfolio

7.6.4.Recent strategic moves & developments

7.6.5.SWOT analysis

7.7.C&D Technologies, Inc.

7.7.1.Business overview

7.7.2.Financial performance

7.7.3.Product portfolio

7.7.4.Recent strategic moves & developments

7.7.5.SWOT analysis

7.8.B.B. Battery

7.8.1.Business overview

7.8.2.Financial performance

7.8.3.Product portfolio

7.8.4.Recent strategic moves & developments

7.8.5.SWOT analysis

7.9.Vision Group

7.9.1.Business overview

7.9.2.Financial performance

7.9.3.Product portfolio

7.9.4.Recent strategic moves & developments

7.9.5.SWOT analysis

7.10.JYC Battery Manufacturer Co. Ltd.

7.10.1.Business overview

7.10.2.Financial performance

7.10.3.Product portfolio

7.10.4.Recent strategic moves & developments

7.10.5.SWOT analysis

Continuous developments in battery technology have paved way for outstanding electrical advances, eventually resulting in the invention of mobile phones, portable computers, electric cars, and several other electrical devices. Also, as the world attempts to switch from fossil fuels to renewables, the need for efficient energy storage systems is becoming vital. The invention for advanced batteries is now on the verge of a powerful revolution.

Various leading technology firms and car companies are aware of the downsides of lithium-ion batteries. The batteries that are gaining more popularity these days are the gel batteries owing to need for reliable energy storage options in an extensive range of applications in various areas such as marine trolling, emergency lighting, solar systems, electric vehicles, golf cars, sailboats, UPS (Uninterrupted Power Systems), and many more.

What is a Gel Battery?

A gel battery is also referred as a “Gel Cell”. It is a valve-regulated lead–acid (VRLA) battery, a type of sealed acid battery that is strong and adaptable. Gel batteries were mainly developed to resolve some of the glitches in the wet lead-acid batteries. These batteries can be fitted in almost any position, as they do not leak. This significantly surges the scope of their application areas. They are widely used in deep cycle applications like personnel carriers, floor scrubbers, wheelchairs, computer backup, cable TV, and others.

As per a report by Research Dive, the global gel battery market is projected to observe outstanding growth with a CAGR of 4.0% and garner $2,776.9 million by 2028; owing to several factors such as cost-effectiveness, easy recyclability, and many more. Gel batteries also offer various benefits such as they are spill proof, vibration-resistant, maintenance free, and have negligible corrosion owing to which they are well-suited with sensitive electronics devices and ideal for a wide array of applications. Moreover, as gel batteries do not emit dangerous gases or fumes like sulfur dioxide or flammable hydrogen gas, they can be fitted in areas where ventilation is limited.

Recent Advances in the Gel Battery Industry

Various companies focused on developing energy storage systems, such as Canbat Technologies Inc., BSB Power Company Limited, Leoch International Technology Limited Inc., Exide Technologies, Power Sonic Corporation, Exponential Power, C&D Technologies, Inc., B.B. Battery, Vision Group, and JYC Battery Manufacturer Co. Ltd., are greatly investing in the gel battery industry. These market players are putting in efforts to develop advanced gel battery technologies to increase the quality of energy storage for smooth functioning of battery operated devices. Moreover, these players are undertaking various strategies, such as novel product launches, partnerships, and collaborations, to obtain a cutting-edge in the global market.

For instance,

- In September 2018, Exide Technologies, an American multinational lead-acid batteries manufacturing company, introduced a VRLA gel battery for its truck series.

- In February 2019, Gelion Technologies, an Australian battery innovator, entered into the $70bn storage market to fast-track worldwide development in the renewable energy segment by launching a zinc bromine gel battery to take on lithium mainstays.

- In November 2020, Eternity Technologies, a global advanced industrial battery plant, launched their new range of Gel Bloc batteries. This new batteries are maintenance free products equipped with advanced VRLA Gel technology and offer high resilience to deep discharge, extensive cycle performance, long-life in harsh conditions, and are completely recyclable.

- In April 2021, Interstate Batteries, a US privately owned battery marketing and distribution firm, launched Pure Gel Sealed Lead-Acid (SLA) batteries for the medical mobility sector. These batteries offer quality performance and can power scooters and wheelchairs.

How has the Covid-19 Pandemic Impacted the Gel Battery Market?

The global gel battery market growth has been negatively impacted with the rise of the COVID-19 pandemic in 2020. The pandemic has resulted in the enforcement of strict lockdowns, thus hampering the production of gel batteries. As industrial activities worldwide were curbed during the pandemic, the demand for energy storage systems has significantly reduced, thus hindering the market growth. However, as and when the pandemic relaxes, the demand for gel batteries is likely to augment with the growing need for efficient energy storage systems across various industrial verticals in the upcoming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com