Surgical Table Market Report

RA02761

Surgical Table Market, by Product Category (Generalized Surgical Table and Specialized Surgical Table), Product Type (Powered and Non-Powered), and End Use (Hospitals and Ambulatory Surgical Centers): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Surgical Table Market Analysis

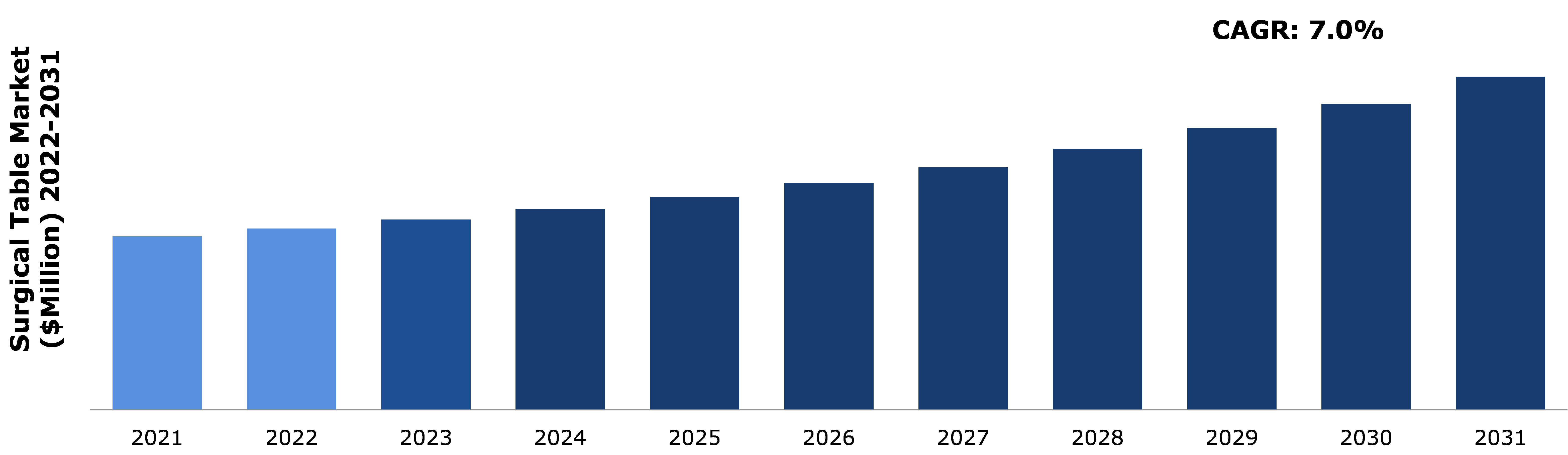

The Global Surgical Table Market Size was $1,277.8 million in 2021 and is predicted to expand with a CAGR of 7.0%, generating revenue of $2,452.8 million by 2031.

Global Surgical Table Market Synopsis

The main purpose of surgical tables is to keep patients in the most beneficial position for surgical procedures being performed while allowing the surgeon to make any necessary adjustments without stopping the operation.

The increasing use of modern surgical tables by hospitals and healthcare institutions for enhanced surgical experiences for patients and surgeons is expected to drive the global surgical table market growth. Increased global investment in the healthcare industry has greatly helped the market for surgical tables. Healthcare organizations in developing regions like the Middle East, Asia-Pacific, and Latin America are becoming significant players in the global healthcare sector. Developed nations have taken the lead in modernizing their healthcare sectors and incorporating significant technological advancements.

However, the expansion of the surgical table sector may be hampered by a shortage of skilled staff to operate the advanced surgical tables. There is a rapid decline in the number of skilled experts handling surgical tables, mainly in emerging and underdeveloped nations, despite an increase in the number of surgeries due to many variables that contribute to an increase in healthcare expenditure around the world. Furthermore, the high price of composite surgical tables makes market demand in less developed economies challenging.

The increase in number of surgeries performed worldwide is the main factor that contributes to the market's expansion. This is due to the rise in disturbance and injury cases across the globe. Rising competition in the surgical instrument industry is expected to boost demand for technologically advanced surgical tables. The growing geriatric population base around the world is also expected to drive up product demand during the forecast period. In addition, the rise in prevalence of chronic diseases around the world offers market players a variety of opportunities.

Surgical Table Overview

The surgical table is one of the most effective and beneficial tools in the operating room for a complex surgery. Patients' survival rates have grown as a result of many advantages offered by technologically upgraded operating tables. Every effective surgical operation necessitates the use of an operating table. Today, a wide range of surgical tables are available for both regular and significantly more complicated procedures. The primary functions of the surgical table are to keep the patient in the most advantageous posture for the specific surgical treatment and to allow the surgeon to make any necessary changes without interference with the operation.

COVID-19 Impact on Global Surgical Table Market

The surgical table industry was negatively impacted by the COVID-19 outbreak. The market value remained steady throughout the pandemic due to increased demand for surgical tables for COVID-19 treatment and the requirement for surgical tables during urgent elective surgeries. The growth of non-profit organizations, along with the growth of hospitals and ambulatory care facilities, is one of the primary drivers that influence market growth. Businesses suffered due to restrictions on product delivery and temporary facility closures caused by the outbreak. However, hospitals progressively began to resume elective treatments as the COVID-19 recovery rate increased.

Major Factor Contributing to Growth of the Market is Rising Number of Surgeries Across the World

The increasing number of surgeries worldwide is the main factor contributing to the market's growth. This is due to rise in trauma and injury cases around the world. Furthermore, as end-stage chronic diseases usually require surgery, the burden of chronic disease is expanding globally. This is one of the main factors driving up demand for surgical tables. For example, according to the American Health Association, operating rooms resumed their operations in 2022 and witnessed a rise in medical health treatments and surgeries, resulting in just a 10% decrease in the rate of surgery at the end of 2020 compared to 2019. In addition, the Organization for Economic Cooperation and Development (OECD) estimates that the number of cataract surgery procedures reported in 2020 in Turkey was 393,901.

To know more about the global surgical table market drivers, get in touch with our analysts here.

High Cost of Surgical Table Materials Hindering Expansion of the Surgical Table Market

The high cost of surgical tables is one of the main issues that restrain the growth of the global market for surgical tables. For medical facilities, specialty surgical tables have large acquisition and maintenance expenses. The surgical table market is always evolving with the addition of new features and designs, which has resulted in the high price of the items. Moreover, the high cost of composite surgical tables limits the growth of the surgical table market. Composite surgical tables are very costly, which has a significant impact on their extensive utilization. Limited investment in healthcare facilities in emerging and underdeveloped nations has affected the acquisition of high-end surgical tables.

Increasing Number of Surgical Procedures Expanding Demand for Surgical Tables

The market for surgical tables is benefiting from the rise in procedures related to accidents, illnesses, and childbirth. Hospitals, clinics, and ambulatory surgery centers are important end users of the surgical table market. Hospitals hold the largest surgical table market share in the healthcare sector. A major factor driving the market for surgical tables is the modernization of the healthcare infrastructure in developing nations. The improvement of medical services in public hospitals is getting significant investment from the governments of various developing nations. This is boosting the market for surgical tables by increasing the demand for surgical tables. Hospital administration is adopting the expert advice of medical consultants to improve the surgical environment and maximize its comfort and utility, which is resulting in the replacement of old surgical tables with new ones. This is boosting the market for surgical tables.

To know more about global surgical table market opportunities, get in touch with our analysts here.

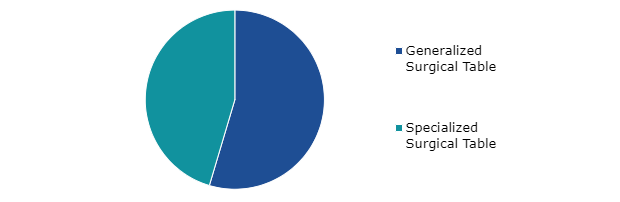

Global Surgical Table Market, by Product Category

On the basis of product category, the market is divided into generalized surgical table and specialized surgical table. Among these, the generalized segment accounted for the highest market share in 2021, whereas the specialized segment is estimated to show the fastest growth during the forecast period.

Global Surgical Table Market Size, by Product Category, 2021

Source: Research Dive Analysis

The generalized surgical table segment accounted for the highest market share in 2021. General surgery tables are tools used in surgery. These tables make surgeries easier by providing ergonomic features, advanced technologies, and safety measures to ensure patients' well-being during surgery sessions. The tables' adjustable height settings make it simple to convert them from a stretcher to a bed by utilizing hydraulic actuators or a pneumatic system. General surgery tables are mostly used in the operating room to treat and provide patient care.

The specialized surgical table segment is anticipated to witness the fastest growth during the forecast period due to the rise in need for specialized operations, including orthopedic surgeries, neurological surgeries, spine surgeries, and others. Demand for specialized surgical tables is growing due to increasing surgical treatments, such as orthopedic and bariatric surgeries. Surgeons need to use a variety of surgical techniques and specialized patient postures to execute specialized surgical procedures. Moreover, increasing investments from various hospitals and organizations to improve surgical treatments and procedures, especially specialized operations, will increase segment growth.

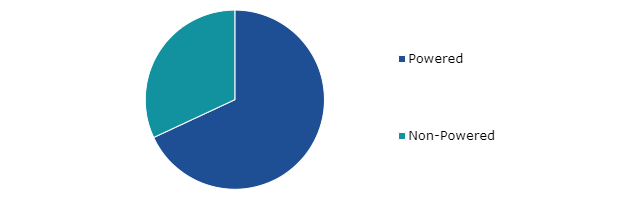

Global Surgical Table Market, by Product Type

On the basis of product type, the market is classified into powered and non-powered. Among these, the powered segment accounted for the highest revenue share in 2021.

Global Surgical Table Market Share, by Product Type, 2021

Source: Research Dive Analysis

The powered segment accounted to the highest market share in 2021. The powered surgical table segment is anticipated to have the greatest revenue share during the forecast period due to its flexibility and maneuverability as well as a growth in demand from healthcare facilities around the world and an increase in surgeries, particularly general, gynecologic, and cardiac operations. Operating table demand is significantly increasing as a result of rising prevalence of cardiovascular illnesses (CVDs). For instance, according to the CDC, about 655,000 Americans die of heart disease each year. In addition, 17.9 million individuals globally pass away each year due to CVDs, according to the WHO.

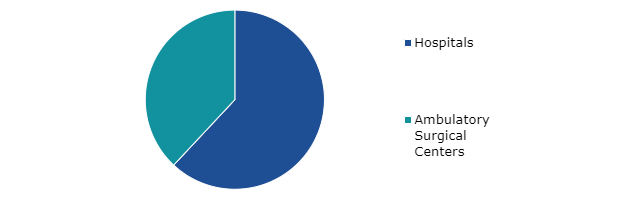

Global Surgical Table Market, by End Use

On the basis of end use, the market is classified into hospitals and ambulatory surgical centers. Among these, the hospitals segment accounted for the highest revenue share in 2021.

Global Surgical Table Market Growth, by End Use, 2021

The hospitals segment accounted for the highest market share in 2021. Hospitals offer primary care in the majority of developing countries around the world and have favorable payment policies. Hospitals do more procedures than any other type of healthcare facility. Hospital investments in surgical equipment, such as operating tables, are gradually expanding, fueling industry expansion.

Global Surgical Table Market, Regional Insights

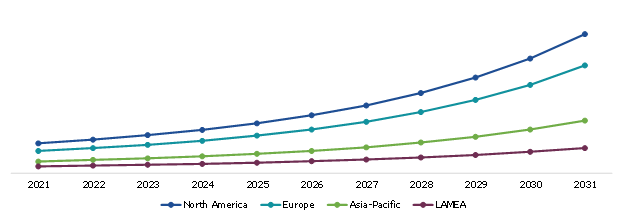

The surgical table market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Surgical Table Market Size & Forecast, by Region, 2021-2031 ($Million)

Source: Research Dive Analysis

Market for Surgical Tables in North America to be the Most Dominant

North America is anticipated to lead the market for surgical tables during the forecast period. The main factors driving the growth of the surgical table market in North America are the favorable economic situation in the U.S., increase in preference for minimally invasive surgeries, and massive number of surgeries. In addition, rise in public awareness regarding the need for surgical operations to treat injuries and complications associated with chronic diseases are anticipated to drive the surgical table market opportunities.

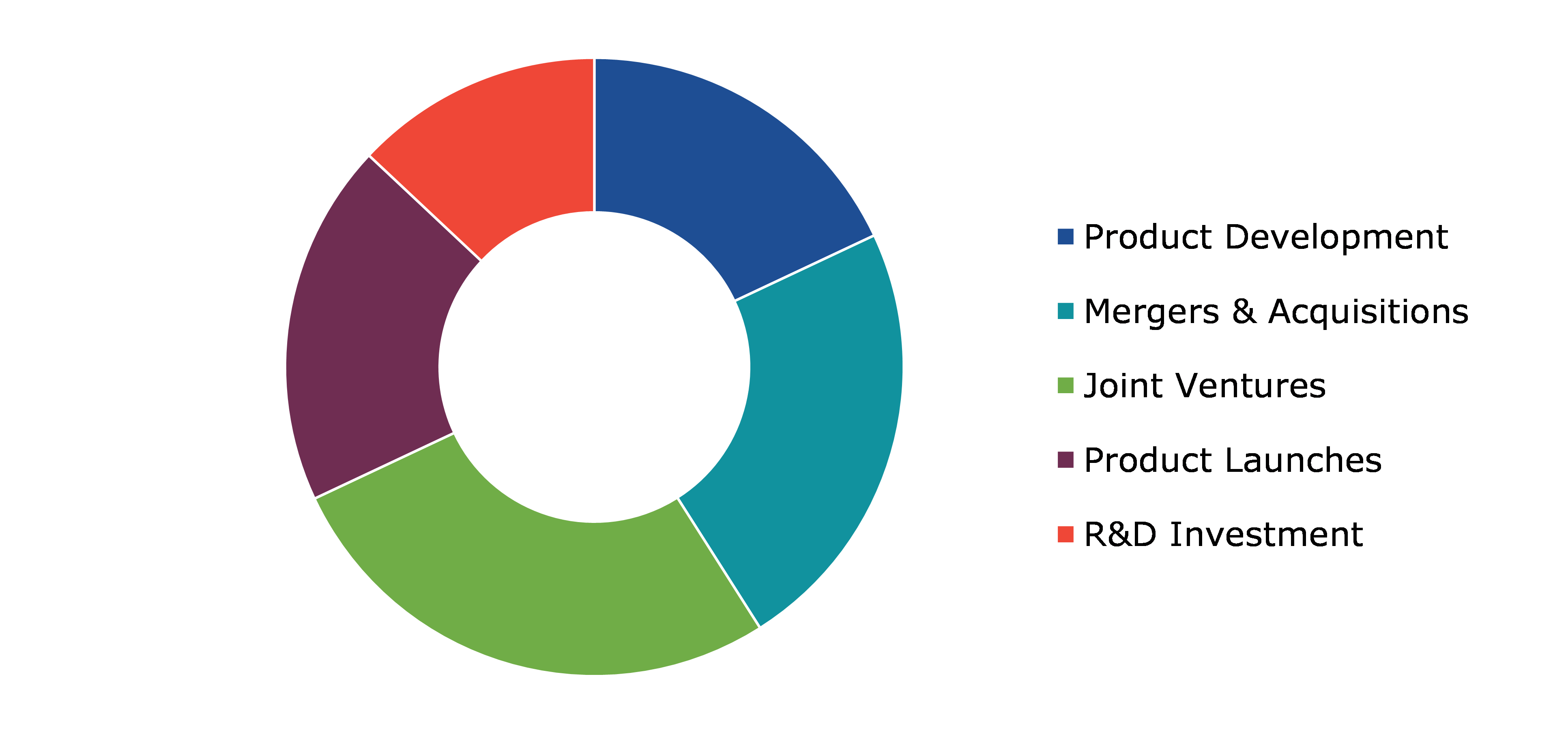

Competitive Scenario in the Global Surgical Table Market

Investments and agreements are common strategies followed by major market players. For instance, in March 2022, Proman, the leading petrochemicals company, entered into a cooperation agreement with Maersk, a Denmark-based shipping company for the development of green surgical table supply solutions.

Source: Research Dive Analysis

Some of the leading surgical table market players include Steris PLC, Skytron LLC, Stryker Corporation, Mizuho OSI, Getinge AB, Schaerer Medical USA Inc., NUVO Inc., Allengers Medical Systems Limited, Invacare Corp., and Elekta AB.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product Category |

|

| Segmentation by Product Type |

|

| Segmentation by End Use |

|

| Key Companies Profiled |

|

Q1. What is the size of the global surgical table market?

A. The size of the global surgical table market was over $1,277.8million in 2021 and is projected to reach $2,452.8 million by 2031.

Q2. Which are the major companies in the surgical table market?

A. Hill-Rom Holdings, Inc., Steris Plc., and Stryker Corp. are some of the key players in the global surgical table market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific surgical table market?

A. Asia-Pacific surgical table market is anticipated to expand at a 7.7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in the market?

A. Product launches and mergers& acquisitions are the two key strategies opted by the operating companies in the market.

Q6. Which companies are investing more in R&D practices?

A. Getinge AB, Shenzhen Mindray, and Bio-Medical Electronics Co., Ltd. are the companies investing more in R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global surgical table market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Surgical Table Market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Surgical Table Market Analysis, by Product Category

5.1.Overview

5.2.Generalized Surgical Table

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3.Specialized Surgical Table

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Surgical Table Market Analysis, by Product Type

6.1.Powered

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region

6.1.3.Market share analysis, by country

6.2.Non-Powered

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region

6.2.3.Market share analysis, by country

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness

6.3.2.Competition heatmap

7.Surgical Table Market Analysis, by End-Use

7.1.Hospitals

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region

7.1.3.Market share analysis, by country

7.2.Ambulatory Surgical Centers

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region

7.2.3.Market share analysis, by country

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness

7.3.2.Competition heatmap

8.Surgical Table Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Product category

8.1.1.2.Market size analysis, by Product type

8.1.1.3.Market size analysis, by End-use

8.1.2.Canada

8.1.2.1.Market size analysis, by Product category

8.1.2.2.Market size analysis, by Product type

8.1.2.3.Market size analysis, by End-use

8.1.3.Mexico

8.1.3.1.Market size analysis, by Product category

8.1.3.2.Market size analysis, by Product type

8.1.3.3.Market size analysis, by End-use

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Product category

8.2.1.2.Market size analysis, by Product type

8.2.1.3.Market size analysis, by End-use

8.2.2.UK

8.2.2.1.Market size analysis, by Product category

8.2.2.2.Market size analysis, by Product type

8.2.2.3.Market size analysis, by End-use

8.2.3.France

8.2.3.1.Market size analysis, by Product category

8.2.3.2.Market size analysis, by Product type

8.2.3.3.Market size analysis, by End-use

8.2.4.Spain

8.2.4.1.Market size analysis, by Product category

8.2.4.2.Market size analysis, by Product type

8.2.4.3.Market size analysis, by End-use

8.2.5.Italy

8.2.5.1.Market size analysis, by Product category

8.2.5.2.Market size analysis, by Product type

8.2.5.3.Market size analysis, by End-use

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Product category

8.2.6.2.Market size analysis, by Product type

8.2.6.3.Market size analysis, by End-use

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Product category

8.3.1.2.Market size analysis, by Product type

8.3.1.3.Market size analysis, by End-use

8.3.2.Japan

8.3.2.1.Market size analysis, by Product category

8.3.2.2.Market size analysis, by Product type

8.3.2.3.Market size analysis, by End-use

8.3.3.India

8.3.3.1.Market size analysis, by Product category

8.3.3.2.Market size analysis, by Product type

8.3.3.3.Market size analysis, by End-use

8.3.4.Australia

8.3.4.1.Market size analysis, by Product category

8.3.4.2.Market size analysis, by Product type

8.3.4.3.Market size analysis, by End-use

8.3.5.South Korea

8.3.5.1.Market size analysis, by Product category

8.3.5.2.Market size analysis, by Product type

8.3.5.3.Market size analysis, by End-use

8.3.6.Rest of Asia Pacific

8.3.6.1.Market size analysis, by Product category

8.3.6.2.Market size analysis, by Product type

8.3.6.3.Market size analysis, by End-use

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Product category

8.4.1.2.Market size analysis, by Product type

8.4.1.3.Market size analysis, by End-use

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Product category

8.4.2.2.Market size analysis, by Product type

8.4.2.3.Market size analysis, by End-use

8.4.3.UAE

8.4.3.1.Market size analysis, by Product category

8.4.3.2.Market size analysis, by Product type

8.4.3.3.Market size analysis, by End-use

8.4.4.South Africa

8.4.4.1.Market size analysis, by Product category

8.4.4.2.Market size analysis, by Product type

8.4.4.3.Market size analysis, by End-use

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Product category

8.4.5.2.Market size analysis, by Product type

8.4.5.3.Market size analysis, by End-use

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Hill-Rom Holdings, Inc.

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Steris Plc.

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Stryker Corp.

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Getinge AB

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Mizuho Corporation (Mizuho OSI, Inc.)

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Skytron LLC

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Alvo Medical

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Allengers Medical Systems Ltd.

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Elekta AB.

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

In the past few years, a lot of new equipment and instruments have been introduced and developed in the operating rooms. Depending on the surgical procedures performed in the operating theatre, a hospital's equipment needs will vary. Generally, the standard equipment includes oxygen concentrators, defibrillators, suction machines, sterilizer machines, surgical tables, anaesthesia machines, and light. Among, surgical tables are the breath, the heart of a hospital. Surgical treatments in the future will be safer, faster, and less stressful with the help of surgical tables.

An operating room is designed to provide surgeons with the most advanced equipment possible so they can do surgeries efficiently. A surgical table is a crucial component of the operating room and one of the most important pieces of equipment on the list of requirements for an operating room. As an essential component of the operating room, the surgical table necessitates innovative technology and high-end requirements in order to allow healthcare providers to perform a variety of treatments. This resulted in a persistent focus on innovation by industry players, both incumbent and new entrants, resulting in the introduction of advanced surgical tables onto the market. Different surgical procedures call for different strategies, patient placement, and other considerations. Thus, general surgery tables are made to suit most of the requirements as well as the practical requirements of surgical procedures. The global surgical table market is expanding at a rapid pace due to a growing number of surgeries owing to increasing cases of trauma and injuries across the globe.

Newest Insights in the Surgical Table Market

The increasing adoption of advanced surgical tables for better surgical experience for surgeons and patients by various healthcare and hospital facilities is the key factor expected to augment the surgical table market growth. As per a report by Research Dive, the global surgical table market is expected to surpass a revenue of $2,452.8 million in the 2022-2031 timeframe. The North America surgical table market is expected to perceive foremost and dominant growth in the years to come. This is because the region has a gigantic demand for surgical tables owing to an increase in public awareness regarding the demand for surgical operations to treat injuries and the issues brought on by chronic conditions in the region.

How are Market Players Responding to the Rising Demand for Surgical Table?

Market players are greatly investing in pioneering research and inventions to cater for the rising demand for advanced electric operation tables. Some of the foremost players in the surgical table market are Skytron LLC, Steris PLC, Mizuho OSI, Stryker Corporation, Schaerer Medical USA Inc., Getinge AB, Allengers Medical Systems Limited, NUVO Inc., Elekta AB, Invacare Corp., and others. These players are focused on planning and devising tactics such as mergers and acquisitions, collaborations, novel advances, and partnerships to reach a notable position in the global market. For instance:

- In March 2021, Mediland, a leading manufacturer of medical equipment in Asia, introduced a new product: the C800 electro-hydraulic surgical table enabling operators to have an improved operating experience.

- In October 2021, Stille AB (publ), a Swedish manufacturer of medical equipment, announces a unique partnership with GE Healthcare to develop a new general surgical table in the US.

- In May 2022, Mindray, a large Chinese manufacturer of medical equipment, launched the HyBase V8 classic surgical table. It has modern features that enable it to adapt to a larger range of surgical requirements while boosting operational safety.

COVID-19 Impact on the Global Surgical Table Market

The unpredicted rise of the coronavirus pandemic in 2020 has adversely impacted the global surgical table market. The market value remained stable during the pandemic period because of the increasing demand for operating tables for COVID-19 treatment and the need for surgical tables during emergency elective surgeries. One of the main factors influencing surgical table market growth is the expansion of non-profit organizations, along with hospitals and ambulatory care centres. Businesses suffered as a result of the outbreak's limits on product distribution and temporary facility closures. However, as the COVID-19 recovery rate improved, hospitals gradually started to resume medical surgeries.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com