Astaxanthin Market Report

RA00258

Astaxanthin Market, by Source [Natural(Yeast, Krill/Shrimp, Microalgae, Others), Synthetic], Product (Dried Algae Meal, Oil, Softgel, Liquid, Others), Application (Nutraceutical, Cosmetics, Aquaculture and Animal Feed, Others), Regional Analysis (North America, Europe, Asia-Pacific, LAMEA): Global Opportunity Analysis and Industry Forecast, 2019–2026

Astaxanthin Market Analysis:

Astaxanthin is a chemical compound often known as keto-carotenoid. Astaxanthin is majorly found in yeast, shrimp, microalgae, trout, salmon, crab, lobster, other aquatic animals, and plants. Astaxanthin is a great source of antioxidant and helps human cells from any kind of inflammation and also oxidation. Astaxanthin is naturally reddish in color and is used by multiple industries as a coloring agent. A majority of its use as a coloring agent comes from the food industry and from farmers in aquaculture business, who use astaxanthin for coloring fishes and other aquatic animals to enhance their texture.

Increased consumption of supplements, growing demand for a natural food coloring agent, and rising chronic diseases to boost the market growth, during the forecast period

The global demand for astaxanthin as a natural food coloring agent has grown exponentially. Increased awareness regarding the health benefits and natural occurrence of astaxanthin are the major reasons driving it in the food coloring market. Astaxanthin antioxidant properties help to preserve the freshness, quality, taste, and color of edible items. These factors are expected to drive the growth of the global astaxanthin market, during the analysis period. Moreover, astaxanthin is mostly naturally procured; thus it has less adverse side effects compared to other chemically developed food colors. Furthermore, the growing supplement industry which provides the human body with various vitamins, minerals, and other necessary nutrients is positively impacting the astaxanthin market. Astaxanthin provides a wide range of benefits to the human body and helps to lead a healthy lifestyle by keeping the body fit and fine from diseases and infections and further improving immunity and stamina of a person. Owing to these benefits multiple supplements have started using astaxanthin as a raw material. Also growing chronic diseases like diabetes, cancer, high blood pressure and other cardiovascular diseases have been on the rise. Astaxanthin has shown positive signs of improving patient conditions when given in the form of medicine. Owing to its antioxidant qualities it can help in the treatment of multiple diseases. This has led to a rise in astaxanthin consumption from the healthcare sector and is expected to help the astaxanthin market to grow.

High manufacturing costs and stringent rules to negatively impact the astaxanthin market’s growth

Astaxanthin market is highly dependent on the prices of its main sources which are aquatic animals. The scarcity of appropriate sources of astaxanthin and high extraction cost due to underdeveloped technology

is majorly impacting the market growth. Further, some regions have limited the consumption and usage of astaxanthin, as it is still a new element and requires deep research work on its impacts and side effects.

Technological advancements to create a lucrative opportunity for market growth, in the future years

Due to the scarce availability of resources and high extraction costs, astaxanthin manufacturers have been on the continuous lookout to develop new methods and technology to reduce the overall product cost. Astaxanthin market has been able to develop new processes and technologies such as microalgae cultivation, harvesting, extraction, and drying for increasing the raw material availability at low prices. Further, the usage of micro modules and photo-bioreactors has helped in reducing power consumption and excess water wastage. Also, the development of manufacturing technology like sealed microalgae cultivation has helped in limiting the risks related to microbial contamination and entrapment of foreign objects, leading to increased production of raw material with minimum wastage.

Astaxanthin Market, by Source:

Natural astaxanthin segment will be the most lucrative till 2026

The natural astaxanthin segment will have a dominating share in the global market and it is expected to register a significant revenue during the forecast timeframe. Rising awareness and health concerns globally to consume more natural substances is going to drive the segment’s growth. Also, the demand for natural astaxanthin supplements has increased majorly owing to healthy lifestyle changes. Natural astaxanthin are least harmful compared to its synthetic counterpart and also has scarce side effects.

Astaxanthin Market, by Product:

Softgel segment will register significant growth during the forecast period

Softgel segment is expected to register significant growth during the forecast period owing to its wide acceptance as an oral nutraceutical. Astaxanthin softgels are a more stable form in comparison to liquids and tablets. They originate naturally from glycerine and corn starch and rarely have any negative impacts on its consumption, making softgels the priority of nutraceutical producers. Also, it has various positive impacts on the eyesight and skin of its user. All these factors are the major contributors to softgels segment’s growth.

Astaxanthin Market, by Application:

Nutraceutical segment is anticipated to grow exponentially, in the global market

The nutraceutical segment will be the fastest-growing application in the astaxanthin market during the forecast timeframe. Nutraceuticals are pharmaceutical substitutes or alternatives which provide physiological benefits to its consumer. Owing to astaxanthin benefits, which help in the treatment of various chronic diseases such as diabetes, gastritis, cardiovascular diseases, and other diseases, the nutraceuticals segment has become highly popular. Furthermore, astaxanthin’s antioxidant properties, low side effects, and high nutritional value have made them the priority choice as raw material in the nutraceutical segment.

Astaxanthin Market, by Region:

North America region to hold the largest market share

North America region is expected to hold the largest market share in the astaxanthin market during the forecast period this is mainly due to growing awareness about astaxanthin and availability of market leaders in the region. In addition, the rising prevalence of chronic diseases, particularly in the U.S. and Canada are expected to drive the demand for astaxanthin in this region, during the forecast period. Astaxanthin is used as a food supplement worldwide and has multiple health benefits like it strengthens the immune system, prevents chronic migraine pains, lowers blood cholesterol, and offers cardiovascular benefits. Also, the market is anticipated to grow even more owing to the presence of an organization such as the Natural Algae Astaxanthin Association (NAXA). NAXA is completely dedicated to increasing awareness about the health benefits of astaxanthin in the North America region.

Asia Pacific region will grow at a fast pace

Asia Pacific region is expected to grow at a fast pace in the astaxanthin market during the forecast period. Rising health ailment and growing demand for supplements owing to the large aging population from the region have created a lucrative market opportunity. Moreover, the rise in demand for animal feed products with astaxanthin present in it will increase the investment inflow, particularly in India, China, and Japan. Also, the flourishing cosmeceutical industry in the region has increased demand for natural products. All these factors will drive the astaxanthin market’s growth in the Asia Pacific region.

To explore more about Astaxanthin Market, get in touch with our analysts here.

https://www.researchdive.com/connect-to-analyst/258

Key Participants in the Global Astaxanthin Market:

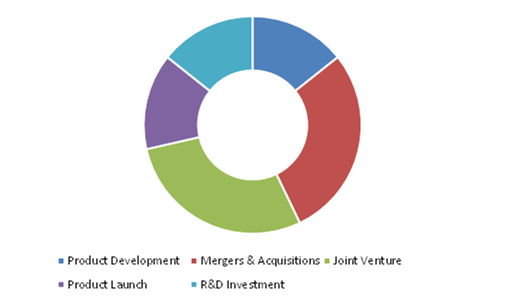

Merger & acquisition and advanced product development are the frequent strategies followed by the market players

Some of the leading astaxanthin market players include FENCHEM, Beijing Gingko Group, E.I.D.-Parry (India) Limited, JXTG Nippon Oil & Energy Corporation, Heliae Development, LLC, Cyanotech Corporation, Algatech LTD, Fuji Chemical Industries Co., Ltd., BASF SE, DSM.

Astaxanthin market players are emphasizing more on technology advancement and product development. These are the strategies followed by established organizations. To emphasize more on the competitor analysis of market players, the porter’s five force model is explained in the report.

|

Aspect |

Particulars |

|

Historical Market Estimations |

2018-2019 |

|

Base Year for Market Estimation |

2018 |

|

Forecast timeline for Market Projection |

2019-2026 |

|

Geographical Scope |

North America, Europe, Asia-Pacific, LAMEA |

|

Segmentation by Source |

|

|

Segmentation by Product |

|

|

Segmentation by Application |

|

|

Key Countries Covered |

U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, and Saudi Arabia |

|

Key Companies Profiled |

|

Source: Research Dive Analysis

Q1. Which are the leading companies in the astaxanthin market?

A. Beijing Gingko Group, E.I.D.-Parry (India) Limited, BASF SE are the leading companies in the astaxanthin market.

Q2. Which region possesses greater investment opportunities in the coming future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q3. What are the strategies opted by the leading players in this market?

A. Technological advancements, product development, along with joint ventures are the key strategies opted by the operating companies in this market.

Q4. Which companies are investing more in R&D practices?

A. Beijing Gingko Group and Algatech LTD are investing more in R&D practices.

-

1. RESEARCH METHODOLOGY

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

-

2. REPORT SCOPE

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on Global Astaxanthin Market

-

3. EXECUTIVE SUMMARY

-

4. MARKET OVERVIEW

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Environmental

4.7. Impact of COVID-19 on Astaxanthin Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

-

5. Astaxanthin Market, By Product

5.1. Overview

5.2 Dried algae meal or Biomass

5.2.1 Definition, key trends, growth factors, and opportunities

5.2.2 Market size analysis, by region, 2020-2027

5.2.3 Market share analysis, by country, 2020-2027

5.3 Oil

5.3.1 Definition, key trends, growth factors, and opportunities

5.3.2 Market size analysis, by region, 2020-2027

5.3.3 Market share analysis, by country, 2020-2027

5.4 Softgel

5.4.1 Definition, key trends, growth factors, and opportunities

5.4.2 Market size analysis, by region, 2020-2027

5.4.3 Market share analysis, by country, 2020-2027

5.5 Liquid

5.5.1 Definition, key trends, growth factors, and opportunities

5.5.2 Market size analysis, by region, 2020-2027

5.5.3 Market share analysis, by country, 2020-2027

5.6 Others

5.6.1 Definition, key trends, growth factors, and opportunities

5.6.2 Market size analysis, by region, 2020-2027

5.6.3 Market share analysis, by country, 2020-2027

5.7 Research Dive Exclusive Insights

5.7.1 Market attractiveness

5.7.2 Competition heatmap

-

6. Astaxanthin Market, By Application

6.1. Overview

6.2 Nutraceuticals

6.2.1 Definition, key trends, growth factors, and opportunities

6.2.2 Market size analysis, by region, 2020-2027

6.2.3 Market share analysis, by country, 2020-2027

6.3 Cosmetics

6.3.1 Definition, key trends, growth factors, and opportunities

6.3.2 Market size analysis, by region, 2020-2027

6.3.3 Market share analysis, by country, 2020-2027

6.4 Aquaculture and animal feed

6.4.1 Definition, key trends, growth factors, and opportunities

6.4.2 Market size analysis, by region, 2020-2027

6.4.3 Market share analysis, by country, 2020-2027

6.5 Others

6.5.1 Definition, key trends, growth factors, and opportunities

6.5.2 Market size analysis, by region, 2020-2027

6.5.3 Market share analysis, by country, 2020-2027

6.6 Research Dive Exclusive Insights

6.6.1 Market attractiveness

6.6.2 Competition heatmap

-

7. Astaxanthin Market, By Source

7.1. Overview

7.2 Natural

7.2.1 Definition, key trends, growth factors, and opportunities

7.2.2 Market size analysis, by region, 2020-2027

7.2.3 Market share analysis, by country, 2020-2027

7.3 Synthetic

7.3.1 Definition, key trends, growth factors, and opportunities

7.3.2 Market size analysis, by region, 2020-2027

7.3.3 Market share analysis, by country, 2020-2027

7.4 Research Dive Exclusive Insights

7.4.1 Market attractiveness

7.4.2 Competition heatmap

8. Astaxanthin Market, By Region

8.1 North America

8.1.1 U.S

8.1.1.1 Market size analysis, By Product, 2020-2027

8.1.1.2 Market size analysis, By Application, 2020-2027

8.1.1.3 Market size analysis, By Source, 2020-2027

8.1.2 Canada

8.1.2.1 Market size analysis, By Product, 2020-2027

8.1.2.2 Market size analysis, By Application, 2020-2027

8.1.2.3 Market size analysis, By Source, 2020-2027

8.1.3 Mexico

8.1.3.1 Market size analysis, By Product, 2020-2027

8.1.3.2 Market size analysis, By Application, 2020-2027

8.1.3.3 Market size analysis, By Source, 2020-2027

8.1.4 Research Dive Exclusive Insights

8.1.4.1 Market attractiveness

8.1.4.2 Competition heatmap

8.2 Europe

8.2.1 Germany

8.2.1.1 Market size analysis, By Product, 2020-2027

8.2.1.2 Market size analysis, By Application, 2020-2027

8.2.1.3 Market size analysis, By Source, 2020-2027

8.2.2 UK

8.2.2.1 Market size analysis, By Product, 2020-2027

8.2.2.2 Market size analysis, By Application, 2020-2027

8.2.2.3 Market size analysis, By Source, 2020-2027

8.2.3 France

8.2.3.1 Market size analysis, By Product, 2020-2027

8.2.3.2 Market size analysis, By Application, 2020-2027

8.2.3.3 Market size analysis, By Source, 2020-2027

8.2.4 Spain

8.2.4.1 Market size analysis, By Product, 2020-2027

8.2.4.2 Market size analysis, By Application, 2020-2027

8.2.4.3 Market size analysis, By Source, 2020-2027

8.2.5 Italy

8.2.5.1 Market size analysis, By Product, 2020-2027

8.2.5.2 Market size analysis, By Application, 2020-2027

8.2.5.3 Market size analysis, By Source, 2020-2027

8.2.6 Rest of Europe

8.2.6.1 Market size analysis, By Product, 2020-2027

8.2.6.2 Market size analysis, By Application, 2020-2027

8.2.6.3 Market size analysis, By Source, 2020-2027

8.2.7 Research Dive Exclusive Insights

8.2.7.1 Market attractiveness

8.2.7.2 Competition heatmap

8.3 Asia-Pacific

8.3.1 China

8.3.1.1 Market size analysis, By Product, 2020-2027

8.3.1.2 Market size analysis, By Application, 2020-2027

8.3.1.3 Market size analysis, By Source, 2020-2027

8.3.2 Japan

8.3.2.1 Market size analysis, By Product, 2020-2027

8.3.2.2 Market size analysis, By Application, 2020-2027

8.3.2.3 Market size analysis, By Source, 2020-2027

8.3.3 India

8.3.3.1 Market size analysis, By Product, 2020-2027

8.3.3.2 Market size analysis, By Application, 2020-2027

8.3.3.3 Market size analysis, By Source, 2020-2027

8.3.4 Australia

8.3.4.1 Market size analysis, By Product, 2020-2027

8.3.4.2 Market size analysis, By Application, 2020-2027

8.3.4.3 Market size analysis, By Source, 2020-2027

8.3.5 South Korea

8.3.5.1 Market size analysis, By Product, 2020-2027

8.3.5.2 Market size analysis, By Application, 2020-2027

8.3.5.3 Market size analysis, By Source, 2020-2027

8.3.6 Rest of Asia-Pacific

8.3.6.1 Market size analysis, By Product, 2020-2027

8.3.6.2 Market size analysis, By Application, 2020-2027

8.3.6.3 Market size analysis, By Source, 2020-2027

8.3.7 Research Dive Exclusive Insights

8.3.7.1 Market attractiveness

8.3.7.2 Competition heatmap

8.4 LAMEA

8.4.1 Brazil

8.4.1.1 Market size analysis, By Product, 2020-2027

8.4.1.2 Market size analysis, By Application, 2020-2027

8.4.1.3 Market size analysis, By Source, 2020-2027

8.4.2 Saudi Arabia

8.4.2.1 Market size analysis, By Product, 2020-2027

8.4.2.2 Market size analysis, By Application, 2020-2027

8.4.2.3 Market size analysis, By Source, 2020-2027

8.4.3 UAE

8.4.3.1 Market size analysis, By Product, 2020-2027

8.4.3.2 Market size analysis, By Application, 2020-2027

8.4.3.3 Market size analysis, By Source, 2020-2027

8.4.4 South Africa

8.4.4.1 Market size analysis, By Product, 2020-2027

8.4.4.2 Market size analysis, By Application, 2020-2027

8.4.4.3 Market size analysis, By Source, 2020-2027

8.4.5 Rest of LAMEA

8.4.5.1 Market size analysis, By Product, 2020-2027

8.4.5.2 Market size analysis, By Application, 2020-2027

8.4.5.3 Market size analysis, By Source, 2020-2027

8.4.6 Research Dive Exclusive Insights

8.4.6.1 Market attractiveness

8.4.6.2 Competition heatmap

9. Competitive Landscape

9.1 Top winning strategies, 2020-2027

9.1.1 By strategy

9.1.2 By year

9.2 Strategic overview

9.3 Market share analysis, 2020-2027

10. Company Profiles

10.1 Algatech LTD

10.1.1 Overview

10.1.2 Business segments

10.1.3 Product portfolio

10.1.4 Financial performance

10.1.5 Recent developments

10.1.6 SWOT analysis

10.2 Cyanotech Corporation

10.2.1 Overview

10.2.2 Business segments

10.2.3 Product portfolio

10.2.4 Financial performance

10.2.5 Recent developments

10.2.6 SWOT analysis

10.3 Fuji Chemical Industries Co., Ltd.

10.3.1 Overview

10.3.2 Business segments

10.3.3 Product portfolio

10.3.4 Financial performance

10.3.5 Recent developments

10.3.6 SWOT analysis

10.4 BlueOcean NutraSciences

10.4.1 Overview

10.4.2 Business segments

10.4.3 Product portfolio

10.4.4 Financial performance

10.4.5 Recent developments

10.4.6 SWOT analysis

10.5 FENCHEM

10.5.1 Overview

10.5.2 Business segments

10.5.3 Product portfolio

10.5.4 Financial performance

10.5.5 Recent developments

10.5.6 SWOT analysis

10.6 MicroA

10.6.1 Overview

10.6.2 Business segments

10.6.3 Product portfolio

10.6.4 Financial performance

10.6.5 Recent developments

10.6.6 SWOT analysis

10.7 E.I.D. - Parry (India) Limited

10.7.1 Overview

10.7.2 Business segments

10.7.3 Product portfolio

10.7.4 Financial performance

10.7.5 Recent developments

10.7.6 SWOT analysis

10.8 Beijing Gingko Group (BGG)

10.8.1 Overview

10.8.2 Business segments

10.8.3 Product portfolio

10.8.4 Financial performance

10.8.5 Recent developments

10.8.6 SWOT analysis

10.9 JXTG Nippon Oil & Energy Corporation

10.9.1 Overview

10.9.2 Business segments

10.9.3 Product portfolio

10.9.4 Financial performance

10.9.5 Recent developments

10.9.6 SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com