Mini LED Market Report

RA00178

Mini LED Market by Application (Consumer Electronics, Mobile Phone, Laptop, Television, Automotive, and Others) and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022–2030

Global Mini LED Market Analysis

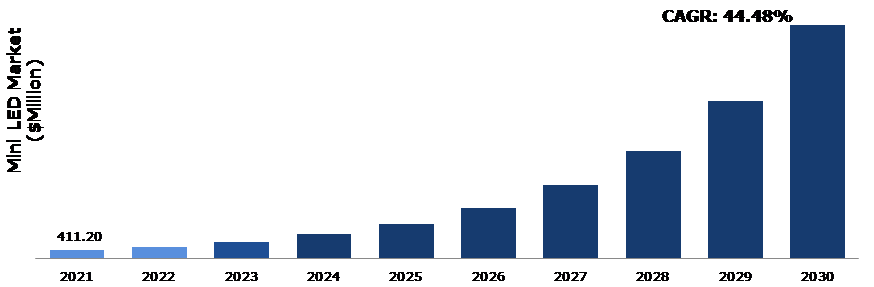

The global mini LED market share value was $411.20 million in 2021 and is predicted to grow with a CAGR of 44.48%, by generating a revenue of $10,931.10 million by 2030.

Global Mini LED Market Synopsis

Mini LED is advanced technology developed from traditional LED, which is consist of many mini LEDs in the display substrate to have better contrast and brightness than LCD. Mini LED is being rapidly adopted by the manufacturers for due to its advantages over LCD, as LCD cannot create true level of blackness in screen, where mini LED has greater control over the light, illuminating better contrast and brightness level. Mini LED market trend in consumer’s electronic market as it is becoming popular in display units such as TVs, smartphones, and others. In the coming years, the rising demand for consumer electronics with improved performance and efficiency will drive the demand for ultra-high output mini LEDs.

However, mini LEDs require much higher precision in the substrate than traditional LEDs. Glass is the ideal substrate for mini LED applications due to its ease of placement, surface flatness, and low cost. The time consuming process compared to the traditional LEDs is expected to restrain the mini LED market size growth.

The LCD display have limited dimming capability and produces deeper shades of grey rather than true black. The traditional LED display has LED arranged in backplane to produce images. For dark and black colored image, the LED in display is switched off for particular area but the light still passes from the other LED which are not turned off in bright area of image. Mini LED used in modern LCD display addresses the issue by increasing the dimming capabilities of LCD panels. Thus it has popularized among many manufacturers to adopt the mini LED for backlighting of LCD panels for better performance of display to create immersive picture. These factors are projected to create mini LED market demand opportunities.

TCL, a market leader in TV electronics, is preparing to launch a new Mini LED 4K Google TV. TCL has integrated several unrivalled TV technologies in its latest innovation, working tirelessly towards its ultimate goal of providing high-powered TV sets that are perfectly suited to modern-age customers.

Mini LED Market Overview

Mini LED is a more advanced version of the current LED display technology, having smaller version of inorganic LEDs used in display. Mini Led display achieves high dynamic ratio, higher image quality and power saving feature than traditional LED display due to thousands of mini led over the several thousand.

COVID-19 Impact on Global Mini LED Market

The COVID-19 impact on mini LED market outbreak has had a significant impact on the global mini LED display market. The spread of coronavirus has deemed the entire world inoperable. Almost every country had implemented lockdowns and strict social distancing measures. As a result, supply chains have been disrupted. The mini LED display production facilities have been halted due to the global slowdown and lack of workforce. The COVID-19 outbreak resulted in a significant and prolonged drop in manufacturing utilization, while travel bans and facility closures and shortage of laborer resulting in a slowdown in the growth of the mini LED display market in 2020. These factors have had a significant negative impact on the demand for mini LEDs during this pandemic period. North America is one of the most affected regions by the COVID-19 outbreak, which has reduced demand for consumer electronics and, as a result, demand for mini LEDs. Asia is the world's largest producer and exporter of a wide range of products used in the automotive, electronics, and other industries. COVID-19's impact on this market is only temporary, as only production and supply chain were halted in 2020. As the situation has improved, production, supply chains, and demand for these products gradually improved in 2021. The current scenario is expected to provide opportunities for businesses to consider ways to increase production, conduct technological research and improve current products.

The average replacement cycle of monitors for gamers is only two-three years, prompting computer manufacturers to actively deploy desktop monitors to drive the mini LED market growth.

With the recent growth in the digital gaming market, e-sports has officially become one of the international sports events. In comparison to mature desktop monitors market, the average replacement cycle for gamers is only two-three years, and the specifications and prices of e-sports monitors are higher than those of general demand products, prompting computer manufacturers to actively deploy. Currently, gaming monitors are 27" or larger LED panel, with curved surfaces and 144Hz refresh rates as the norm, and in the future, they will be mini LED panel supporting 240Hz or 360Hz or higher refresh rate.

The rising popularity of smart screen products and LED projectors, as well as rising demand for OLED smart televisions, will drive demand for mini LEDs in the consumer electronics market. Furthermore, rising demand for smartphones as a result of advancements in the telecommunications industry and the launch of LTE services is expected to drive the mini LED market growth.

To know more about global mini LED market drivers, get in touch with our analysts here.

Mini LEDs require much higher precision in the substrate than traditional LEDs which is expected to impede the mini LED market

Mini LEDs require much higher precision in the substrate than traditional LEDs. Although Flexible Printed Circuit (FPC) and Flame Retardant (FR4) are commonly used, glass is the ideal substrate for mini LED applications due to its ease of placement, surface flatness, and low cost of production. All substrate technology requires quality improvement with a rigid and semi-grid substrate, but specific development for circuitry, materials, and placement methodologies is required to adopt the use of glass. Due to this process it increases the time required for mini LEDs compared to the traditional LEDs is expected to restrain the mini LED market size growth.

To know more about global mini LED market restrains, get in touch with our analysts here.

Increasing use of mini LED in higher-tech application such as laptop and television panels' to satisfy various market demands to drive the market growth

In terms of panel specifications, television panels with thin and narrow bezels have become a must to match the trend of slim and stylish designs. While the penetration rate of IPS wide viewing angle is increasing year by year, so far more than half of the products have wide viewing angle specifications and narrow bezel. This factor is the fastest growing trend and will become the standard specification for notebook panels in recent years. With Mini LED it is possible to create narrow bezels and thin panels.

There has always been a demand for endurance for notebooks, and the continuous reduction of panel power consumption has become one of the key development points. Panels with 16:10 or 3:2 aspect ratio are mostly used in high-end models. High refresh rate notebook panels are primarily for the gaming market. The future will be towards 240Hz or 360Hz with HDR1000 or more, and the development of privacy panels to protect trade secrets. There is a demand for mini LED backplanes to improve resolution and enhance contrast in the future. Laptop panels are a higher-tech application, and specifications will become more diverse in the future to meet different mini LED market needs.

To know more about global mini LED market opportunities, get in touch with our analysts here.

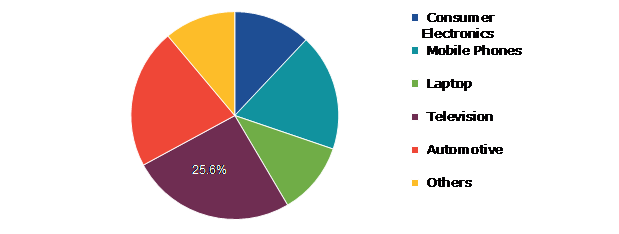

Global Mini LED Market, by Application

The application segment is classified into consumer electronics, mobile phone, laptop/notebook, television, automotive, and others. Among these, the television sub-segment is expected to dominate the market share and the laptop sub-segment is expected to show fastest market growth in global mini LED market.

Global Mini LED Market Share, by Application, 2021

Source: Research Dive Analysis

The television sub-segment is anticipated to have a dominant market share and generate a revenue of $2,709.60 million by 2030, growing from $105.20 million in 2021. The continuous evolution in panel technology is helping the mini LED market grow. In 2021, LG announced that it would be unveiling its first QNED Mini LED television at virtual-CES, as well as TCL and Samsung revealing similar display technologies, which has amazed many consumers and created the hype for the mini LED technology.

The laptop sub-segment is anticipated to show the fastest growth and shall generate a revenue of $1,367.50 million by 2030, increasing from $46.40 million in 2021. Since COVID-19 the change in concept of work has caused major impact on the laptop market. Several manufacturers such as Apple, Samsung, and others has integrating mini LED technology into their laptops for better dynamic and screen resolution. Thus, development in screen technology to provide better viewing capability is driving the mini LED market growth.

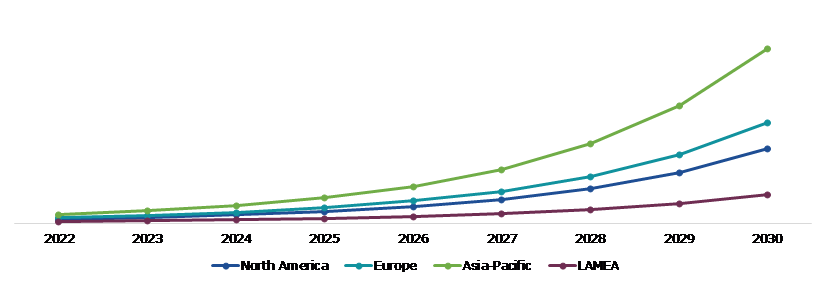

Global Mini LED Market, Regional Insights

The mini LED market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Mini LED Market Size & Forecast, by Region, 2021-2030 (USD Million)

Source: Research Dive Analysis

The Market for Mini LED in Asia-Pacific to be the Most Dominant

The Asia-Pacific mini LED market analysis accounted $179.70 million in 2021 and is projected to grow with a CAGR of 45.34%. The Asia is considered the most profitable market for mini LEDs, due to the region's strong semiconductor industry's expansion, particularly in the area of smart displays with longer lifespans and higher efficiency. China and South Korea are major players in the manufacturing and distribution of mini LEDs, owing to their economies of scale in terms of production facilities. This growth is fuelled by improvements in the region's consumer electronics industry. For instance, Samsung, South Korea based leading electronic device manufacturer, launched new premium 240Hz 4K gaming monitor, the Odyssey Neo G8 providing photorealistic image quality, fast response times, and superior performance.

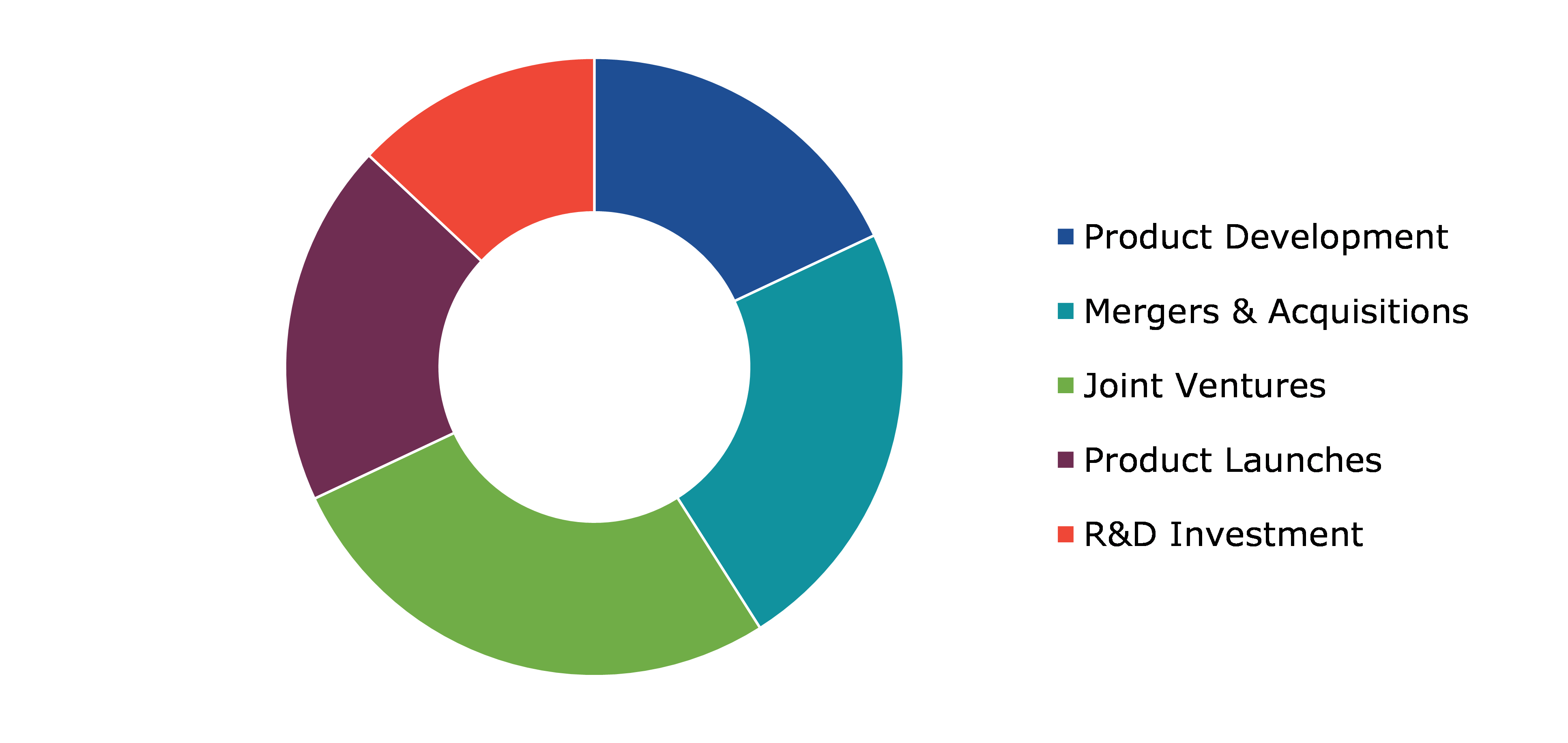

Competitive Scenario in the Global Mini LED Market

Acquisitions and product development are the key strategies that are being opted by the key industry participants to continue their market position in the regional and global markets. The mini LED key players are prominently focusing on technological developments, mergers and acquisitions, new product launches, and geographical expansion. These are some of the growth strategies adopted by these companies.

Source: Research Dive Analysis

Some of the leading mini LED market players include AUO Corporation. BOE Technology Group Co., Ltd., EVER LIGHT ELECTRONICS CO. LTD., Japan Display, Inc., Harvatek Corporation, Unity Opto, Innolux Optoelectronics Co., Ltd., and Tianma Microelectronics Co., Ltd.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast timeline for Market Projection | 2022-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global mini LED market?

A. The size of the global mini LED market share was over $411.20 million in 2021 and is projected to reach $10,931.10 million by 2030.

Q2. Which are the major companies in the mini LED market?

A. AUO Corporation, BOE Technology Group Co., Ltd., and EVER LIGHT ELECTRONICS CO. Ltd. are some of the key players in the global mini LED market.

Q3. Which region, among others, possesses greater investment opportunities in the near future for mini LED Market?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific mini LED market?

A. Asia-Pacific mini LED market is anticipated to grow at 45.34% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in Mini LED market?

A. Product development and joint ventures are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices for Mini LED Market?

A. Tianma Microelectronics Co., Ltd. and Unity Opto Technology Co., Ltd. are investing more in R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Mini LED market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Mini LED market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Mini LED Market Analysis, by Application

5.1.Overview

5.2.Consumer Electronics

5.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.2.2.Market size analysis, by region, 2021-2030

5.2.3.Market share analysis, by country, 2021-2030

5.3.Mobile Phones

5.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.3.2.Market size analysis, by region, 2021-2030

5.3.3.Market share analysis, by country, 2021-2030

5.4.Laptop

5.4.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.4.2.Market size analysis, by region, 2021-2030

5.4.3.Market share analysis, by country, 2021-2030

5.5.Television

5.5.1. Definition, key trends, growth factors, and opportunities, 2021-2030

5.5.2.Market size analysis, by region, 2021-2030

5.5.3.Market share analysis, by country, 2021-2030

5.6.Automotive

5.6.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.6.2.Market size analysis, by region, 2021-2030

5.6.3.Market share analysis, by country, 2021-2030

5.7.Others

5.7.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.7.2.Market size analysis, by region, 2021-2030

5.7.3.Market share analysis, by country, 2021-2030

5.8.Research Dive Exclusive Insights, 2021-2030

5.8.1.Market attractiveness, 2021-2030

5.8.2.Competition heatmap, 2021-2030

6.Mini LED Market, by Region

6.1.North America

6.1.1.U.S.

6.1.1.1.Market size analysis, by Application, 2021-2030

6.1.2.Canada

6.1.2.1.Market size analysis, by Application, 2021-2030

6.1.3.Mexico

6.1.3.1.Market size analysis, by Application, 2021-2030

6.1.4.Research Dive Exclusive Insights, 2021-2030

6.1.4.1.Market attractiveness, 2021-2030

6.1.4.2.Competition heatmap, 2021-2030

6.2.Europe

6.2.1.Germany

6.2.1.1.Market size analysis, by Application, 2021-2030

6.2.2.UK

6.2.2.1.Market size analysis, by Application, 2021-2030

6.2.3.France

6.2.3.1.Market size analysis, by Application, 2021-2030

6.2.4.Spain

6.2.4.1.Market size analysis, by Application, 2021-2030

6.2.5.Italy

6.2.5.1.Market size analysis, by Application, 2021-2030

6.2.6.Rest of Europe

6.2.6.1.Market size analysis, by Application, 2021-2030

6.2.7.Research Dive Exclusive Insights, 2021-2030

6.2.7.1.Market attractiveness, 2021-2030

6.2.7.2.Competition heatmap, 2021-2030

6.3.Asia-Pacific

6.3.1.China

6.3.1.1.Market size analysis, by Application, 2021-2030

6.3.2.Japan

6.3.2.1.Market size analysis, by Application, 2021-2030

6.3.3.India

6.3.3.1.Market size analysis, by Application, 2021-2030

6.3.4.Australia

6.3.4.1.Market size analysis, by Application, 2021-2030

6.3.5.South Korea

6.3.5.1.Market size analysis, by Application, 2021-2030

6.3.6.Rest of Asia-Pacific

6.3.6.1.Market size analysis, by Application, 2021-2030

6.3.7.Research Dive Exclusive Insights, 2021-2030

6.3.7.1.Market attractiveness, 2021-2030

6.3.7.2.Competition heatmap, 2021-2030

6.4.LAMEA

6.4.1.Brazil

6.4.1.1.Market size analysis, by Application, 2021-2030

6.4.2.Saudi Arabia

6.4.2.1.Market size analysis, by Application, 2021-2030

6.4.3.UAE

6.4.3.1.Market size analysis, by Application, 2021-2030

6.4.4.South Africa

6.4.4.1.Market size analysis, by Application, 2021-2030

6.4.5.Rest of LAMEA

6.4.5.1.Market size analysis, by Application, 2021-2030

6.4.6.Research Dive Exclusive Insights, 2021-2030

6.4.6.1.Market attractiveness, 2021-2030

6.4.6.2.Competition heatmap, 2021-2030

7.Competitive Landscape

7.1.Top winning strategies, 2021

7.1.1.By strategy

7.1.2.By year

7.2.Strategic overview

7.3.Market share analysis, 2021

8.Company Profiles

8.1.AUO Corporation

8.1.1.Overview

8.1.2.Business segments

8.1.3.Product portfolio

8.1.4.Financial performance

8.1.5.Recent developments

8.1.6.SWOT analysis

8.2.BOE Technology Group Co.,Ltd

8.2.1.Overview

8.2.2.Business segments

8.2.3.Product portfolio

8.2.4.Financial performance

8.2.5.Recent developments

8.2.6.SWOT analysis

8.3.EVERLIGHT ELECTRONICS CO.LTD

8.3.1.Overview

8.3.2.Business segments

8.3.3.Product portfolio

8.3.4.Financial performance

8.3.5.Recent developments

8.3.6.SWOT analysis

8.4.Harvatek Corporation.

8.4.1.Overview

8.4.2.Business segments

8.4.3.Product portfolio

8.4.4.Financial performance

8.4.5.Recent developments

8.4.6.SWOT analysis

8.5.Japan Display, Inc.

8.5.1.Overview

8.5.2.Business segments

8.5.3.Product portfolio

8.5.4.Financial performance

8.5.5.Recent developments

8.5.6.SWOT analysis

8.6.Innolux Optoelectronics Co.,Ltd

8.6.1.Overview

8.6.2.Business segments

8.6.3.Product portfolio

8.6.4.Financial performance

8.6.5.Recent developments

8.6.6.SWOT analysis

8.7.Tianma Microelectronics Co.,Ltd

8.7.1.Overview

8.7.2.Business segments

8.7.3.Product portfolio

8.7.4.Financial performance

8.7.5.Recent developments

8.7.6.SWOT analysis

8.8.Unity Opto

8.8.1.Overview

8.8.2.Business segments

8.8.3.Product portfolio

8.8.4.Financial performance

8.8.5.Recent developments

8.8.6.SWOT analysis

9.Appendix

9.1.Parent & peer market analysis

9.2.Premium insights from industry experts

9.3.Related reports

The world of electronics is an ever-evolving domain. The introduction of mini LEDs has taken the consumer electronics industry by storm. Mini LEDs are transforming and modernizing the lighting sector by attaining prime importance in evolutionary products such as realistic displays, exceptionally thin consumer electronics devices, and lighting devices in automobiles. Mini LEDs help eradicate innumerable design challenges and give the freedom of design to manufacturers, thus giving rise to innovative electronics products. As per experts, the mini LED technology is expected to dominate the next generation of lighting technology in a horde of application areas.

Electronic manufacturers and LED developers have made noteworthy advancements in the process of the placement of mini LEDs in products like computer keyboards, automotive lighting, display backlights, direct emission displays, and consumer electronics. Mini LEDs are nowadays widely used to substitute prevailing traditional incandescent, halogens, and fibre optic-based devices in application areas like pools and spas. The rising fame of mini LEDs in a wide array of applications, owing to their potential to offer greater control over the light and give out better contrast and brightness level, has impelled the demand for mini LEDs in recent years. Moreover, the growing adoption of smart screen products, LED projectors, and OLED smart televisions systems is fueling the demand for mini LEDs in the consumer electronics market. All these factors are likely to propel the mini LED market growth in the coming years.

Latest Trends in the Mini LED Market

As per a report by Research Dive, the global mini LED market is expected to grow from $411.20 million in 2021 to $10,931.10 million by 2030. The Asia-Pacific region is the leading user of mini LED and is expected to grow speedily in the mini LED market by rising with a CAGR of 45.34% in the 2022 to 2030 timeframe. This is because the region has an evolving consumer electronics industry and the presence of leading manufacturers of mini LED.

Market players are profoundly investing in research and development to fulfil the mounting demand for mini LEDs. Some of the leading players in the mini LED market are Japan Display, Inc., Harvatek Corporation, Unity Opto, AUO Corporation., Innolux Optoelectronics Co., Ltd., EVER LIGHT ELECTRONICS CO. LTD., Tianma Microelectronics Co., Ltd., BOE Technology Group Co., Ltd., and others. These players are concentrated on developing strategies such as mergers and acquisitions, partnerships, novel developments, and collaborations to achieve a prominent position in the global market.

For instance,

- In March 2022, Apple Inc., an American multinational technology firm that specializes in consumer electronics, software, and online services, increased the production of Mini LED chips and hired extra manufacturers for meeting the demand for its new orders of Mini LED displays.

- In May 2022, Huawei, a foremost global supplier of information & communications technology (ICT) infrastructure and smart devices, launched Smart Screen V Pro mini LED TVs with auto low latency mode (ALLM) and variable refresh rate (VRR).

- In June 2022, TCL, launched a 4K Mini LED TV with 144Hz VR and Google TV in India to deliver a high-quality viewing experience for its consumers.

COVID-19 Impact on the Mini LED Market

The abrupt rise of the coronavirus pandemic in 2020 has adversely impacted the global mini LED market. This is mainly due to the cessation of electronics manufacturing companies during the pandemic period. Also, several disruptions in the supply chains of production companies and labour shortages during the pandemic have hampered the market’s growth. However, as the global economy is recovering with the relaxation of the pandemic, the mini LED market is expected to gain traction with a notable surge in the demand for consumer electronics products across the globe.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com