Construction Chemicals Market Report

RA00175

Construction Chemicals Market, by Type (Concrete Admixtures, Water Proofing & Roofing, Repair, Flooring, Sealants & Adhesives, Others), by Application (Industrial/Commercial, Residential, Repair Structures, Infrastructure), Regional Analysis (North America, Europe, Asia Pacific, LAMEA): Global Opportunity Analysis and Industry Forecast, 2019–2026

Update Available On-Demand

The global construction chemicals market forecast shall be $48.9 billion by 2026, surging from $31.7 billion in 2018 at a healthy rate of 5.6%. Asia-Pacific construction chemicals market is projected to rise at a noteworthy CAGR of 6.2% by registering a revenue of $11.3 billion throughout the analysis period. Massively increasing urbanization rate, and the strong presence of market leaders of construction chemicals in this region is expected to accelerate the Asia-Pacific market growth.

Construction Chemicals Market Analysis:

Construction chemicals are primarily used by the civil repair and construction industry for infrastructure-based development. Construction chemicals help to improve concrete strength and quality, along with protecting concrete structures from atmospheric degradation. Construction chemicals have a wide range of applications like waterproofing, concrete modification, and repair.

Substantial growth in the global construction projects is expected to drive the global construction chemicals market

Significantly growing urbanization along with booming construction activities across the globe are the key factors for the rising demand for construction chemicals, during the forecast period. For instance, as per the study conducted by the UN (United Nations), the global population is expected to reach approximately 11.2 billion by the year 2100. Thus, it is projected that globally around 2 billion new homes will be needed in the coming 80 years. In addition, heavy downpours, wetter winters, and milder climate drastically reduce the durability of construction projects such as roads and buildings. The vulnerability of climate also affects the indoor climate of buildings as well. Thus, to overcome such problems, builders and developers highly prefer the construction chemicals. This element will fuel the growth of the construction chemicals market, over the analysis period. Furthermore, these construction chemicals improve the properties of construction such as compressive strength, durability, and resistance to undesirable working conditions. Due to these aforementioned factors, it is anticipated that construction chemicals will have potential growth, over the forecast period.

To know more about construction chemicals market drivers, get in touch with our analysts here.

Environmental regulations against VOC emissions are projected to restrain the global construction chemicals industry growth

Extensively rising environmental regulatory policies regarding VOC (volatile organic compounds) emissions are anticipated to obstruct the demand for construction chemicals, during the forecast period.

Rising concern about eco-friendly chemicals are anticipated to create huge opportunities in the global market

The governments of developed as well as developing countries are focusing highly on green building standards. The new policies are exerting more pressure on construction ventures to use chemicals that have the lowest carbon footprint and are less resource-intensive. The invention of the newest chemicals is becoming more preferable in the construction industry. Established players are emphasizing more on eco-binders and silicate binder system, which have a longer shelf life, high efficiency, and lower environmental impact. A silicate binder system protects buildings' surfaces from salts, aggressive media and acids. This silicate binder system has unique, innovative features and are environment-friendly and inorganic in nature. The environmental initiatives by global industry players are further anticipated to create enormous opportunities for the construction chemicals in the global market.

To know more about construction chemicals Market Opportunities, get in touch with our analysts here.

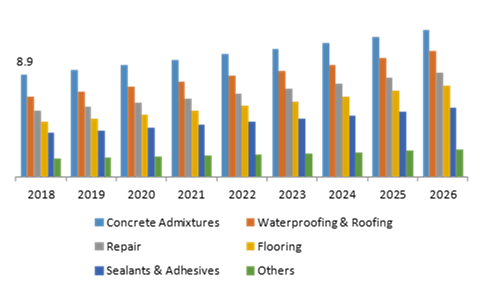

Construction Chemicals Market, by Type:

Concrete admixtures have a significant market share in the global market and it shall generate a revenue of $12.7 billion by 2026; this is mainly because it reduces concrete construction cost

Source: Research Dive Analysis

The global concrete admixtures segment is the leading segment in the global market and it is expected to surpass $12.7 billion by 2026, increasing from $8.9 billion significantly at a rate of 4.6%. The increasing demand for concrete consumption worldwide is one of the key factors for the growth of this segment. Moreover, concrete admixtures minimize concrete construction cost and provide excellent quality during mixing, placing, transporting, and curing. In addition, these admixtures also reduce overall water usage, along with time equired to set. Furthermore, availability of ligno-based, PCE-based and SNF (sulfonated naphthalene formaldehyde) & SMF (sulfonated melamine formaldehyde)-based highly advanced admixtures, are projected to drive the market.

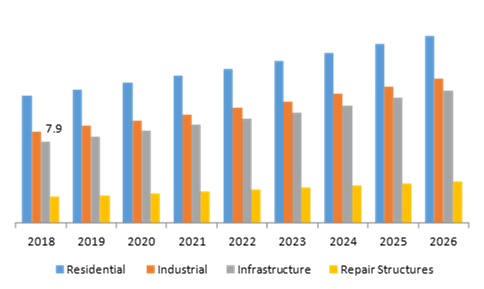

Construction Chemicals Market, by Application:

The infrastructure segment shall have rapid growth in the global market, over the forecast period

Source: Research Dive Analysis

The infrastructure segment for the construction chemicals market shall experience substantial growth in the global market and it is expected to register a revenue of $12.8 billion during the forecast period, increasing at a CAGR of 6.2%. Extensively growing urbanization and increasing population are the major reasons for the growth of infrastructure in the global market. Also, the fastest growth in middle-class residential housing, along with huge infrastructure initiatives funded by the government especially in emerging economies is anticipated to the growth of the global infrastructure segment of this market. Furthermore, recent advancements in the construction chemicals are also expected to foster this market, over the forecast period.

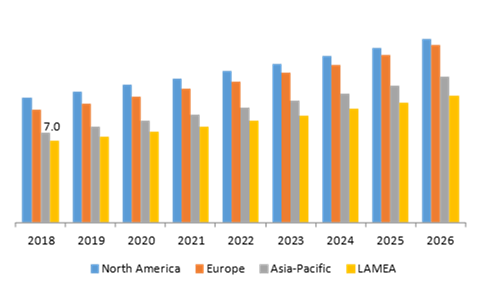

Regional Insights:

Asia-Pacific region has experienced the fastest growth in the global market and it will reach up to $11.3 billion by the end of 2026, surging at a 6.2% CAGR.

Source: Research Dive Analysis

Asia-Pacific construction chemicals market has experienced substantial growth. This market is expected to reach $11.3 billion in 2026 and it is projected to surge at a CAGR of 6.2%. Significantly growing construction projects, growing demand for luxury homes, and optimal adoption of product development in the construction industry, mainly in Asian countries such as China, India, and South-east Asia, are expected to augment the growth of the construction chemicals in the Asian market. Moreover, Asian countries such as India and China have significant growth in the urbanization rate, across the world, which eventually fuels the demand for construction chemicals market. In addition, to strengthening the global footprint across the world key players are following various strategies. For instance, Pidilite Industries’ Construction Chemicals Division (CCD) is emphasizing to expand its footprint in the developing African and Asian markets. Pidilite Industries has wholly-owned subsidiaries in the UAE, Singapore, and Thailand. These key factors are expected to accelerate the growth of construction chemicals in the global market.

North-America construction chemicals market is a dominating market in the global market. This market has generated revenue of $14.2 billion over the forecast period. The booming economy and significant market fundamentals for commercial real estate projects are anticipated to drive the demand for construction chemicals in this region. Also, an increase in state and federal funding for public works and institutional infrastructure also expected to boost the construction chemicals market, particularly in the US and Canada. Moreover, the growing population and upcoming projects that are in the pipeline for the construction sector may fuel the growth of construction chemicals market in this region.

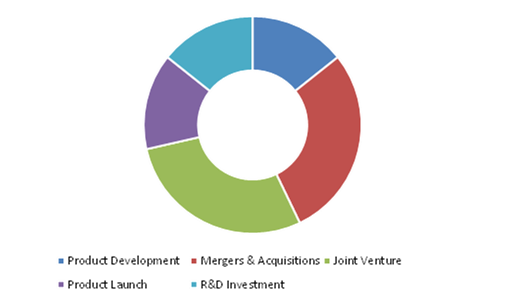

Competitive Scenario in the Global Construction Chemicals Market:

Advanced product development coupled with mergers & acquisitions are the frequent strategies followed by significant market players

Source: Research Dive Analysis

Construction chemicals market industry players are Arkema SA, Fosroc, Inc., Sika A.G., BASF SE, Dow, RPM International Inc., W. R. GRACE & CO., Ashland., MAPEI S.p.A., and Pidilite Industries Ltd. Construction chemicals industry players are focusing on strategic merger & acquisition and advanced product developments. These are the multiple strategies followed by established key players. For instance, in December 2019, Lone Star has acquired BASF’s Construction Chemicals business for $3.54 billion.

Porter’s Five Forces Analysis for Construction Chemicals Market:

- Bargaining Power of Suppliers: A high number of suppliers, significant geographical spread, and high price sensitivity is resulting in low bargaining power of suppliers. Moreover, a very low switching cost for buyers gives LOW bargaining power to the supplier.

- Bargaining Power of Buyer: Buyers have high negotiation power majorly because of the variety of construction chemicals, in the global market. Moreover, market leaders of building and construction projects prefer bulk buying of chemicals.

Thus, the bargaining power of the buyer is HIGH. - Threat of New Entrants: The emerging companies do not pose any huge threat for the existing market brands. Moreover, high maintenance and distribution cost obstructs to new startups of the construction chemicals industry. So,

the threat of the new entrant is LOW. - Threat of Substitutes: Threat is very low as there is no alternative available in construction chemicals in industry.

The threat of substitutes is VERY LOW. - Competitive Rivalry in the Market: Competition is deep as market leaders compete with each other on the quoted price to win a contract amid high price sensitivity. Moreover, Lower switching costs from the customer boost the competition.

Competitive Rivalry in the Market is VERY HIGH.

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2018 |

| Forecast timeline for Market Projection | 2019-2026 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Countries Covered | U.S., Canada, Mexico, Germany, France, UK, Italy, Spain, Russia, Rest of Europe, China, Japan, India, Australia, South Korea, Rest of Asia-Pacific, Brazil, Saudi Arabia, United Arab Emirates, Rest of LAMEA |

| Key Companies Profiled |

|

Q1. What is the size of the construction chemicals market?

A. The global construction chemicals market size was over $31.7 billion in 2018 and is projected to reach $48.9 billion by 2026.

Q2. Which are the major companies in the construction chemicals Market?

A. Arkema SA, Fosroc, Inc., and Sika A.G., are some of the key players in the global construction chemicals Market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. The Asia-Pacific region possesses great investment opportunities for the investors to witness the most promising growth in the future.

Q4. What is the growth rate of the Asia-Pacific market?

A. The Asia-Pacific market construction chemicals Market is anticipated to grow at 6.2% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological advancements, product development, along with joint ventures are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. BASF SE and Dow Company are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By Type Trends

2.3.By Application Trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Pricing overview

3.8.1.By Type

3.8.2.By Application

3.9.Market value chain analysis

3.10.Strategic overview

4.Construction Chemicals Market, by Type

4.1.Asphalt Additives

4.1.1.Market size and forecast, by region, 2018-2026

4.1.2.Comparative market share analysis, 2018 & 2026

4.2.Concrete Admixtures

4.2.1.Market size and forecast, by region, 2018-2026

4.2.2.Comparative market share analysis, 2018 & 2026

4.3.Flooring

4.3.1.Market size and forecast, by region, 2018-2026

4.3.2.Comparative market share analysis, 2018 & 2026

4.4.Flame-retardants

4.4.1.Market size and forecast, by region, 2018-2026

4.4.2.Comparative market share analysis, 2018 & 2026

4.5.Repair

4.5.1.Market size and forecast, by region, 2018-2026

4.5.2.Comparative market share analysis, 2018 & 2026

4.6.Water Proofing & Roofing

4.6.1.Market size and forecast, by region, 2018-2026

4.6.2.Comparative market share analysis, 2018 & 2026

4.7.Sealants & Adhesives

4.7.1.Market size and forecast, by region, 2018-2026

4.7.2.Comparative market share analysis, 2018 & 2026

4.8.shrinkage reducing agents

4.8.1.Market size and forecast, by region, 2018-2026

4.8.2.Comparative market share analysis, 2018 & 2026

4.9.mold release agents

4.9.1.Market size and forecast, by region, 2018-2026

4.9.2.Comparative market share analysis, 2018 & 2026

4.10.bond breakers

4.10.1.Market size and forecast, by region, 2018-2026

4.10.2.Comparative market share analysis, 2018 & 2026

5.Construction Chemicals Market, by Application

5.1.Industrial/Commercial

5.1.1.Market size and forecast, by region, 2018-2026

5.1.2.Comparative market share analysis, 2018 & 2026

5.2.Residential

5.2.1.Market size and forecast, by region, 2018-2026

5.2.2.Comparative market share analysis, 2018 & 2026

5.3.Repair structures

5.3.1.Market size and forecast, by region, 2018-2026

5.3.2.Comparative market share analysis, 2018 & 2026

5.4.Infrastructure

5.4.1.Market size and forecast, by region, 2018-2026

5.4.2.Comparative market share analysis, 2018 & 2026

6.Construction Chemicals Market, by region

6.1.North America

6.1.1.Market size and forecast, by type, 2018-2026

6.1.2.Market size and forecast, by application, 2018-2026

6.1.3.Market size and forecast, by country, 2018-2026

6.1.4.Comparative market share analysis, 2018 & 2026

6.1.5.U.S.

6.1.5.1.Market size and forecast, by type, 2018-2026

6.1.5.2.Market size and forecast, by application, 2018-2026

6.1.5.3.Comparative market share analysis, 2018 & 2026

6.1.6.Canada

6.1.6.1.Market size and forecast, by type, 2018-2026

6.1.6.2.Market size and forecast, by application, 2018-2026

6.1.6.3.Comparative market share analysis, 2018 & 2026

6.1.7.Mexico

6.1.7.1.Market size and forecast, by type, 2018-2026

6.1.7.2.Market size and forecast, by application, 2018-2026

6.1.7.3.Comparative market share analysis, 2018 & 2026

6.2.Europe

6.2.1.Market size and forecast, by type, 2018-2026

6.2.2.Market size and forecast, by application, 2018-2026

6.2.3.Market size and forecast, by country, 2018-2026

6.2.4.Comparative market share analysis, 2018 & 2026

6.2.5.Germany

6.2.5.1.Market size and forecast, by type, 2018-2026

6.2.5.2.Market size and forecast, by application, 2018-2026

6.2.5.3.Comparative market share analysis, 2018 & 2026

6.2.6.UK

6.2.6.1.Market size and forecast, by type, 2018-2026

6.2.6.2.Market size and forecast, by application, 2018-2026

6.2.6.3.Comparative market share analysis, 2018 & 2026

6.2.7.France

6.2.7.1.Market size and forecast, by type, 2018-2026

6.2.7.2.Market size and forecast, by application, 2018-2026

6.2.7.3.Comparative market share analysis, 2018 & 2026

6.2.8.Spain

6.2.8.1.Market size and forecast, by type, 2018-2026

6.2.8.2.Market size and forecast, by application, 2018-2026

6.2.8.3.Comparative market share analysis, 2018 & 2026

6.2.9.Italy

6.2.9.1.Market size and forecast, by type, 2018-2026

6.2.9.2.Market size and forecast, by application, 2018-2026

6.2.9.3.Comparative market share analysis, 2018 & 2026

6.2.10.Rest of Europe

6.2.10.1.Market size and forecast, by type, 2018-2026

6.2.10.2.Market size and forecast, by application, 2018-2026

6.2.10.3.Comparative market share analysis, 2018 & 2026

6.3.Asia Pacific

6.3.1.Market size and forecast, by type, 2018-2026

6.3.2.Market size and forecast, by application, 2018-2026

6.3.3.Market size and forecast, by country, 2018-2026

6.3.4.Comparative market share analysis, 2018 & 2026

6.3.5.China

6.3.5.1.Market size and forecast, by type, 2018-2026

6.3.5.2.Market size and forecast, by application, 2018-2026

6.3.5.3.Comparative market share analysis, 2018 & 2026

6.3.6.India

6.3.6.1.Market size and forecast, by type, 2018-2026

6.3.6.2.Market size and forecast, by application, 2018-2026

6.3.6.3.Comparative market share analysis, 2018 & 2026

6.3.7.Australia

6.3.7.1.Market size and forecast, by type, 2018-2026

6.3.7.2.Market size and forecast, by application, 2018-2026

6.3.7.3.Comparative market share analysis, 2018 & 2026

6.3.8.Rest of Asia Pacific

6.3.8.1.Market size and forecast, by type, 2018-2026

6.3.8.2.Market size and forecast, by application, 2018-2026

6.3.8.3.Comparative market share analysis, 2018 & 2026

6.4.LAMEA

6.4.1.Market size and forecast, by type, 2018-2026

6.4.2.Market size and forecast, by application, 2018-2026

6.4.3.Market size and forecast, by country, 2018-2026

6.4.4.Comparative market share analysis, 2018 & 2026

6.4.5.Latin America

6.4.5.1.Market size and forecast, by type, 2018-2026

6.4.5.2.Market size and forecast, by application, 2018-2026

6.4.5.3.Comparative market share analysis, 2018 & 2026

6.4.6.Middle East

6.4.6.1.Market size and forecast, by type, 2018-2026

6.4.6.2.Market size and forecast, by application, 2018-2026

6.4.6.3.Comparative market share analysis, 2018 & 2026

6.4.7.Africa

6.4.7.1.Market size and forecast, by type, 2018-2026

6.4.7.2.Market size and forecast, by application, 2018-2026

6.4.7.3.Comparative market share analysis, 2018 & 2026

7.Company profiles

7.1.Arkema SA

7.1.1.Business overview

7.1.2.Financial performance

7.1.3.Product portfolio

7.1.4.Recent strategic moves & developments

7.1.5.SWOT analysis

7.2.Fosroc, Inc.

7.2.1.Business overview

7.2.2.Financial performance

7.2.3.Product portfolio

7.2.4.Recent strategic moves & developments

7.2.5.SWOT analysis

7.3. Sika A.G.

7.3.1.Business overview

7.3.2.Financial performance

7.3.3.Product portfolio

7.3.4.Recent strategic moves & developments

7.3.5.SWOT analysis

7.4.BASF SE

7.4.1.Business overview

7.4.2.Financial performance

7.4.3.Product portfolio

7.4.4.Recent strategic moves & developments

7.4.5.SWOT analysis

7.5.Dow

7.5.1.Business overview

7.5.2.Financial performance

7.5.3.Product portfolio

7.5.4.Recent strategic moves & developments

7.5.5.SWOT analysis

7.6.RPM International Inc.

7.6.1.Business overview

7.6.2.Financial performance

7.6.3.Product portfolio

7.6.4.Recent strategic moves & developments

7.6.5.SWOT analysis

7.7.W. R. GRACE & CO.

7.7.1.Business overview

7.7.2.Financial performance

7.7.3.Product portfolio

7.7.4.Recent strategic moves & developments

7.7.5.SWOT analysis

7.8.Ashland.

7.8.1.Business overview

7.8.2.Financial performance

7.8.3.Product portfolio

7.8.4.Recent strategic moves & developments

7.8.5.SWOT analysis

7.9.MAPEI S.p.A.

7.9.1.Business overview

7.9.2.Financial performance

7.9.3.Product portfolio

7.9.4.Recent strategic moves & developments

7.9.5.SWOT analysis

7.10. Pidilite Industries Ltd.

7.10.1.Business overview

7.10.2.Financial performance

7.10.3.Product portfolio

7.10.4.Recent strategic moves & developments

7.10.5.SWOT analysis

The construction industry is under constant pressure of megatrends such as scarcity of materials and resources as well as the impact of climate change. For fulfilling these demands, there arises a need to manufacture chemical additives that can enhance the properties of several construction materials. Construction chemicals are among the vital components that are extensively used in the construction industry to meet the requirements of modern constructions.

Applications of construction chemicals

Construction chemicals are widely used by the civil repair and construction industry for different purposes. These chemicals are used for enhancing the quality and strength of concrete, prevent leakages, and safeguard building structures from climatic changes. Construction chemicals comprises of various products that help in modification of concrete, waterproofing, repair & maintenance of constructions. These products are admixtures for concrete, concrete curing compounds, grouts, sealants, tile fixing adhesives, waterproofing chemicals, crack repair, jointing compounds, membranes, and special application mortars.

They can be used in the building and construction industry for various applications areas such as airports and metro transit, bridges and roads, architectural building, as well as in commercial, industrial, and residential construction projects and repair & rehabilitation activities.

Growing demand for construction chemicals

Currently, the trend to develop highly classy and sophisticated constructions in boosting every passing day. With this trend, construction activities are booming all across the world. Wetter winters and heavy monsoons severely reduce the durability of construction projects such as roads and buildings. The vulnerability of climate also disturbs the interior of building structures. Hence, to tackle such issues developers and builders highly prefer construction chemicals. These construction chemicals enhance the quality of construction projects by offering durability, compressive strength, and resistance to uninvited climatic circumstances. All these factors are highly responsible to boost the demand for construction chemicals all across the world.

Moreover, requirement for sustainable socio-economic constructions, rising demand for advanced structures with an extended lifespan, focus on minimizing the costs, impacting climate & environmental conditions, and speedy growth of construction projects are greatly influencing the growth of global construction chemical market.

Trends in construction chemicals industry

Considering the growing demand for construction chemicals several manufactures in the construction chemical business are hugely investing for development of advanced products. Moreover, many companies are looking forward to increase their construction chemicals business, For instance, in 2019, Lone Star Funds, a leading private equity firm acquires the Construction Chemicals Business of BASF, the second biggest manufacturer and vender of chemicals & related products in the North America. This acquisition was aimed to offer full leverage to the Construction Chemicals business for using its full potential.

Many other companies are currently actively taking up activities such as new product development, merges & collaborations to boost their business and obtain a strong foothold in the global chemical construction industry. Some of these companies are RPM International Inc., Arkema SA, W. R. GRACE & CO., Sika A.G., BASF SE, Dow, Ashland., MAPEI S.p.A., Fosroc, Inc., and Pidilite Industries Ltd.

Future scope of the industry

As per a report by Research Dive, the global chemical construction market s growing at an increased speed and is forecasted to grow with a CAGR of 5.6% from 2019 to 2020. Among several countries, the Asian countries such as India and China have shown a significant contribution to the development of the chemical construction industry. These countries are experiencing an increased rate of urbanization, which in the long run will fuel the demand for construction chemicals. Taking note of all these factors, it is clear that the global chemical construction market is climbing the steps of success and is sure to show exponential growth in the coming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com