Medical Sensors Market Report

RA01291

Medical Sensors Market by Type (Flow Sensor, Image Sensor, Temperature Sensor, Pressure Sensor, and Others), Application (Diagnostic, Therapeutic, Monitoring, Wellness & Fitness, and Others), Technology (Wearable Sensors, Implantable Sensors, Wireless, and Others), End User (Hospitals, Clinics, Home Care Settings, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Medical Sensors Overview

Medical sensors are essential devices used in healthcare to monitor various physiological parameters, gather data, and provide real-time information to healthcare professionals for diagnosis, treatment, and patient management. These sensors have revolutionized healthcare by enabling remote monitoring, early disease detection, and personalized medicine.

Medical sensors have been helpful in the safe operation of several medical devices. They are used in a range of medical applications and have saved many lives over the years. Medical sensors are used in hospital wards, intensive care units, GP offices, dental practices, in-home care products, and lab equipment.

Global Medical Sensors Market Analysis

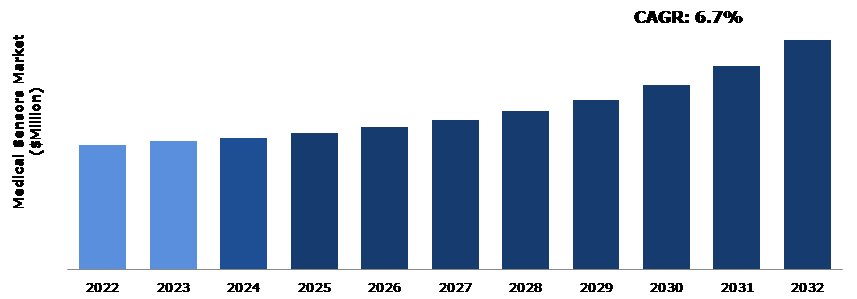

The global medical sensors market size was $16,434.00 million in 2022 and is predicted to grow with a CAGR of 6.7%, by generating a revenue of $30,111.40 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Medical Sensors Market

Since the COVID-19 viral outbreak in December 2019, the disease spread to over 100 nations worldwide, and the World Health Organization designated it a public health emergency on January 30, 2020. The pandemic had a direct impact on drug supply and demand, disrupted distribution routes, and had a financial impact on enterprises and financial markets. Several countries, including China, India, Saudi Arabia, the United Arab Emirates, Egypt, and others, experienced difficulties in transporting medicines from one location to another as a result of nationwide lockdowns.

However, the COVID-19 pandemic had a beneficial impact on the worldwide medical sensors market due to the introduction of new products in the healthcare sector. For instance, in May 2020, GOQii, a healthcare business, announced the release of Vital 3.0, which includes temperature sensors capable of measuring heart rate, body temperature, and blood pressure. The temperature sensors in Vital3.0 reduced the need for frequent contact between COVID-19 patients and caregivers. These sensors aided in identifying the early COVID-19 signs.

Growing Utilization of Sensors in Portable and Interconnected Medical Instruments to Drive Market Growth

The expansion of sensor utilization in portable and interconnected medical devices is propelling the growth of the medical sensors market. Because of their applications in portable and linked medical devices, there has been a significant increase in demand for low-cost sensors in recent years. Portable medical devices are noninvasive electronic components that are mostly employed in patient monitoring applications. Advances in wireless technology for healthcare have enhanced patient mobility in medical settings and at home. Portable medical equipment includes CPAP machines, sleep apnea monitors, blood glucose monitors, pulse oximeters, ultrasonography devices, and blood pressure monitors, among others. Medical device manufacturers are concentrating their efforts on the development of portable devices equipped with sensors. Because of their rising utilization in various applications, the demand for low-cost advanced sensors with a tiny form factor, better capabilities, low power consumption, and high reliability is increasing.

Challenges in Developing Medical Sensors with Interoperability to Restrain the Market Growth

Globally, there is an increasing demand for small, light, portable, and cost-effective medical devices. Sensor makers must verify that their sensors are compatible with the specifications of the medical equipment in which they will be utilized. Manufacturers must ensure the typical operations of medical devices in which these sensors will be included while building tiny and lightweight medical sensors. For example, it is extremely difficult for sensor makers to achieve the required accuracy and signal-to-noise ratio (SNR) when manufacturing sensors based on device specifications. Another issue that sensor manufacturers confront when designing medical sensors is the need for calibration and testing of the analog components. These factors are anticipated to restrain the medical sensors market growth.

Advancements in Sensors and Digital Technologies to Drive Excellent Opportunities

Advanced sensors and digital technology have improved patient monitoring and remote connectivity. The increasing advancements in smart medical devices with advanced sensors coupled with modern computing and communication technologies are likely to fuel the growth of the sensors market. The revolutionary character of IOT technologies, as a result of advancements in computing and processing capability of linked medical devices, as well as in wireless technologies, can be fully utilized by the creation of medical sensors. Similarly, component miniaturization encourages innovation in the development of small medical equipment. The increase in the number of connected medical devices, as well as developments in medical systems and software that facilitate patient data collecting and transmission, are predicted to provide growth opportunities for the medical industry.

Global Medical Sensors Market Share, by Type, 2022

Source: Research Dive Analysis

The temperature sensor sub-segment accounted for the highest market share in 2022.

Temperature sensors are devices that detect and measure coldness and heat and convert it into an electrical signal. Temperature sensors are utilized in our daily lives, be it in the form of domestic water heaters, thermometers, refrigerators, or microwaves. In the medical sensor market, cost-effectiveness is a primary driver of temperature sensors’ adoption. Many medical facilities, particularly those in resource-constrained settings, seek cost-effective solutions that do not compromise accuracy or reliability. Temperature sensors are a more cost-effective option of temperature monitoring than infrared cameras or specialized thermal imaging equipment. Temperature sensors' decreased cost makes them more affordable to a broader range of healthcare professionals and facilities, adding to their widespread use.

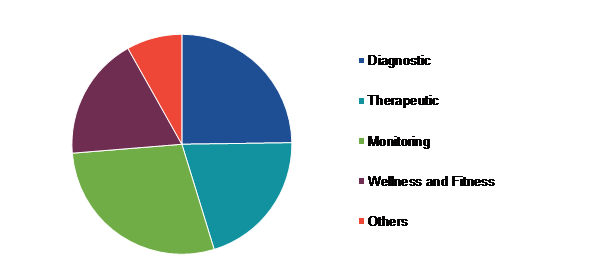

Global Medical Sensors Market Share, by Application, 2022

Source: Research Dive Analysis

The monitoring sub-segment accounted for the highest medical sensors market share in 2022. The expansion in the monitoring sub-segment is due to the rapid development of various types of monitoring devices that use various types of sensors, such as pressure sensors, to provide various types of therapies. The integration monitoring devices with smart devices and other wireless medical sensor instruments for patient care is boosting this segment's growth even further. Monitoring patients remotely is made possible by monitoring sensors, which allow healthcare providers to keep track of patients' health without necessitating regular in-person visits. This is especially useful for people with chronic illnesses or those living in rural places. These factors are anticipated drive the monitoring sub segment in medical sensors market.

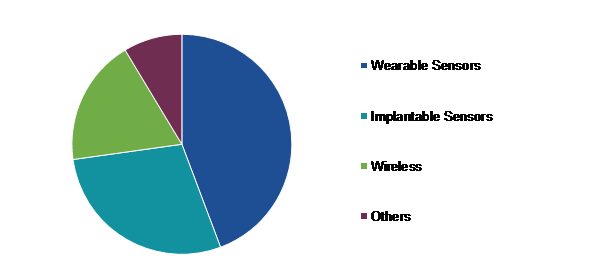

Global Medical Sensors Market Share, by Technology, 2022

Source: Research Dive Analysis

The wearable sensors sub-segment accounted for the highest market share in 2022. Wearable sensors have grown in popularity in the realm of medical sensors, providing numerous benefits to both patients and healthcare providers. Wearable sensors monitor vital signs and health data continuously, providing for a more comprehensive assessment of a patient's health status over time. Patients and healthcare practitioners can get real-time data from wearable sensors, allowing them to notice irregularities or changes in health conditions immediately. Wearable sensors help detect health problems early by continually monitoring vital signs, allowing for quick action and potentially preventing complications.

Global Medical Sensors Market Share, by End User, 2022

Source: Research Dive Analysis

The hospitals sub-segment accounted for the highest market share in 2022. Greater financing capabilities, high patient volumes, and the availability of adequate staff contributed to the dominance of this segment in the industry. In the healthcare industry, the ability to service a large number of patients is a crucial driver of dominance. When a segment can attract and serve a large number of patients, it can make significant income and sustain a strong client base. High patient volumes are frequently the outcome of high-quality care, a wide range of services, and a strong reputation for healthcare expertise, which are provided by hospitals.

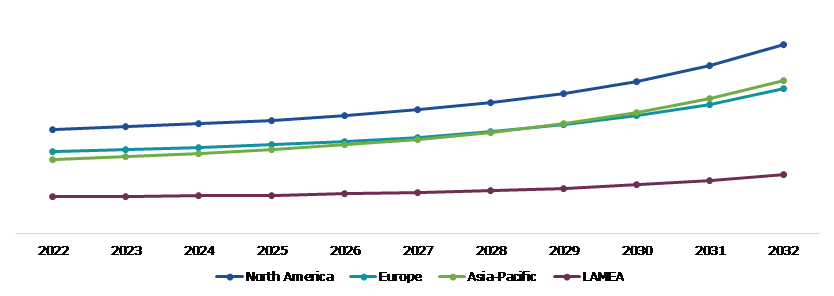

Global Medical Sensors Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The North America medical sensors market generated the highest revenue in 2022. North America's medical device market is one of the largest among other regions, and it is predicted to grow at a rapid pace throughout the forecast period. The industry's growth in the region is attributed to reasons such as a well-developed healthcare infrastructure, the presence of adequate and favorable reimbursement regulations, the quick adoption of sophisticated medical technologies, and important companies in the region. Furthermore, the increasing number of patients undergoing diagnosis and treatment in the regions as a result of the rising incidence and prevalence of chronic illnesses has boosted acceptance of modern medical equipment and associated sensors in recent years.

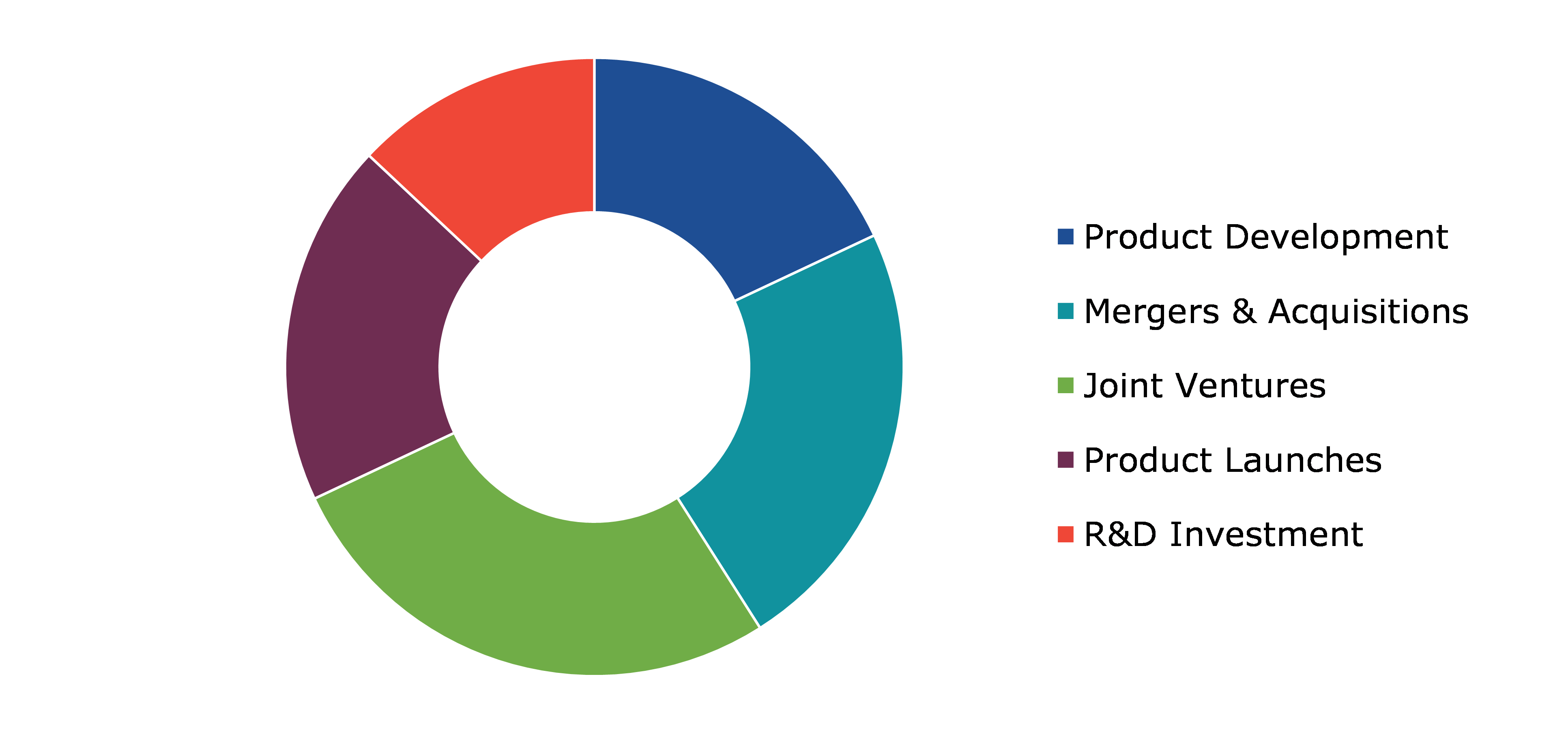

Competitive Scenario in the Global Medical Sensors Market

Investment and agreement are common strategies followed by major market players. One of the market players in the industry is Sibel Health. In August 2022, Sibel Health reported that its Series B investment round had raised USD 33 million. The funding is intended to scale wearable sensors for remote hospital monitoring.

Source: Research Dive Analysis

Some of the companies operating in the medical sensors market are TE Connectivity, Medtronic, Analog Devices, Texas Instruments, STMicroelectronics, Tekscan, NXP Semiconductors, Sensirion , ON Semiconductor Corporation, and Amphenol Corporation.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

|

Segmentation by Technology

|

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

Q1. What is the size of the global medical sensors market?

A. The size of the global medical sensors market was over $16,434.00 million in 2022 and is projected to reach $30,111.40 million by 2032.

Q2. Which are the major companies in the medical sensors market?

A. TE Connectivity and Tekscan are some of the key players in the global medical sensors market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific medical sensors market?

A. The Asia-Pacific medical sensors market is anticipated to grow at 7.9% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. TE Connectivity, Medtronic, Analog Devices, and Texas Instruments. are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global medical sensors market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Environmental

4.7. Impact of COVID-19 on Medical Sensors Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Medical Sensors Market Analysis, by Type

5.1. Overview

5.2. Flow Sensor

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Image Sensor

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Temperature Sensor

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Pressure Sensor

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2022-2032

5.5.3. Market share analysis, by country, 2022-2032

5.6. Others

5.6.1. Definition, key trends, growth factors, and opportunities

5.6.2. Market size analysis, by region, 2022-2032

5.6.3. Market share analysis, by country, 2022-2032

5.7. Research Dive Exclusive Insights

5.7.1. Market attractiveness

5.7.2. Competition heatmap

6. Medical Sensors Market Analysis, by Application

6.1. Diagnostic

6.1.1. Definition, key trends, growth factors, and opportunities

6.1.2. Market size analysis, by region, 2022-2032

6.1.3. Market share analysis, by country, 2022-2032

6.2. Therapeutic

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Monitoring

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. wellness & Fitness

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Others

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2022-2032

6.5.3. Market share analysis, by country, 2022-2032

6.6. Research Dive Exclusive Insights

6.6.1. Market attractiveness

6.6.2. Competition heatmap

7. Medical Sensors Market Analysis, by Technology

7.1. Wearable Sensors

7.1.1. Definition, key trends, growth factors, and opportunities

7.1.2. Market size analysis, by region, 2022-2032

7.1.3. Market share analysis, by country, 2022-2032

7.2. Implantable Sensors

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2022-2032

7.2.3. Market share analysis, by country, 2022-2032

7.3. wireless

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2022-2032

7.3.3. Market share analysis, by country, 2022-2032

7.4. Others

7.4.1. Definition, key trends, growth factors, and opportunities

7.4.2. Market size analysis, by region, 2022-2032

7.4.3. Market share analysis, by country, 2022-2032

7.5. Research Dive Exclusive Insights

7.5.1. Market attractiveness

7.5.2. Competition heatmap

8. Medical Sensors Market Analysis, by End User

8.1. Hospitals

8.1.1. Definition, key trends, growth factors, and opportunities

8.1.2. Market size analysis, by region, 2022-2032

8.1.3. Market share analysis, by country, 2022-2032

8.2. Clinics Home

8.2.1. Definition, key trends, growth factors, and opportunities

8.2.2. Market size analysis, by region, 2022-2032

8.2.3. Market share analysis, by country, 2022-2032

8.3. Home Care Settings

8.3.1. Definition, key trends, growth factors, and opportunities

8.3.2. Market size analysis, by region, 2022-2032

8.3.3. Market share analysis, by country, 2022-2032

8.4. Others

8.4.1. Definition, key trends, growth factors, and opportunities

8.4.2. Market size analysis, by region, 2022-2032

8.4.3. Market share analysis, by country, 2022-2032

8.5. Research Dive Exclusive Insights

8.5.1. Market attractiveness

8.5.2. Competition heatmap

9. Medical Sensors Market, by Region

9.1. North America

9.1.1. U.S.

9.1.1.1. Market size analysis, by Type, 2022-2032

9.1.1.2. Market size analysis, by Application, 2022-2032

9.1.1.3. Market size analysis, by Technology, 2022-2032

9.1.1.4. Market size analysis, by End User, 2022-2032

9.1.2. Canada

9.1.2.1. Market size analysis, by Type, 2022-2032

9.1.2.2. Market size analysis, by Application, 2022-2032

9.1.2.3. Market size analysis, by Technology, 2022-2032

9.1.2.4. Market size analysis, by End User, 2022-2032

9.1.3. Mexico

9.1.3.1. Market size analysis, by Type, 2022-2032

9.1.3.2. Market size analysis, by Application, 2022-2032

9.1.3.3. Market size analysis, by Technology, 2022-2032

9.1.3.4. Market size analysis, by End User, 2022-2032

9.1.4. Research Dive Exclusive Insights

9.1.4.1. Market attractiveness

9.1.4.2. Competition heatmap

9.2. Europe

9.2.1. Germany

9.2.1.1. Market size analysis, by Type, 2022-2032

9.2.1.2. Market size analysis, by Application, 2022-2032

9.2.1.3. Market size analysis, by Technology, 2022-2032

9.2.1.4. Market size analysis, by End User, 2022-2032

9.2.2. UK

9.2.2.1. Market size analysis, by Type, 2022-2032

9.2.2.2. Market size analysis, by Application, 2022-2032

9.2.2.3. Market size analysis, by Technology, 2022-2032

9.2.2.4. Market size analysis, by End User, 2022-2032

9.2.3. France

9.2.3.1. Market size analysis, by Type, 2022-2032

9.2.3.2. Market size analysis, by Application, 2022-2032

9.2.3.3. Market size analysis, by Technology, 2022-2032

9.2.3.4. Market size analysis, by End User, 2022-2032

9.2.4. Spain

9.2.4.1. Market size analysis, by Type, 2022-2032

9.2.4.2. Market size analysis, by Application, 2022-2032

9.2.4.3. Market size analysis, by Technology, 2022-2032

9.2.4.4. Market size analysis, by End User, 2022-2032

9.2.5. Italy

9.2.5.1. Market size analysis, by Type, 2022-2032

9.2.5.2. Market size analysis, by Application, 2022-2032

9.2.5.3. Market size analysis, by Technology, 2022-2032

9.2.5.4. Market size analysis, by End User, 2022-2032

9.2.6. Rest of Europe

9.2.6.1. Market size analysis, by Type, 2022-2032

9.2.6.2. Market size analysis, by Application, 2022-2032

9.2.6.3. Market size analysis, by Technology, 2022-2032

9.2.6.4. Market size analysis, by End User, 2022-2032

9.2.7. Research Dive Exclusive Insights

9.2.7.1. Market attractiveness

9.2.7.2. Competition heatmap

9.3. Asia-Pacific

9.3.1. China

9.3.1.1. Market size analysis, by Type, 2022-2032

9.3.1.2. Market size analysis, by Application, 2022-2032

9.3.1.3. Market size analysis, by Technology, 2022-2032

9.3.1.4. Market size analysis, by End User, 2022-2032

9.3.2. Japan

9.3.2.1. Market size analysis, by Type, 2022-2032

9.3.2.2. Market size analysis, by Application, 2022-2032

9.3.2.3. Market size analysis, by Technology, 2022-2032

9.3.2.4. Market size analysis, by End User, 2022-2032

9.3.3. India

9.3.3.1. Market size analysis, by Type, 2022-2032

9.3.3.2. Market size analysis, by Application, 2022-2032

9.3.3.3. Market size analysis, by Technology, 2022-2032

9.3.3.4. Market size analysis, by End User, 2022-2032

9.3.4. Australia

9.3.4.1. Market size analysis, by Type, 2022-2032

9.3.4.2. Market size analysis, by Application, 2022-2032

9.3.4.3. Market size analysis, by Technology, 2022-2032

9.3.4.4. Market size analysis, by End User, 2022-2032

9.3.5. South Korea

9.3.5.1. Market size analysis, by Type, 2022-2032

9.3.5.2. Market size analysis, by Application, 2022-2032

9.3.5.3. Market size analysis, by Technology, 2022-2032

9.3.5.4. Market size analysis, by End User, 2022-2032

9.3.6. Rest of Asia-Pacific

9.3.6.1. Market size analysis, by Type, 2022-2032

9.3.6.2. Market size analysis, by Application, 2022-2032

9.3.6.3. Market size analysis, by Technology, 2022-2032

9.3.6.4. Market size analysis, by End User, 2022-2032

9.3.7. Research Dive Exclusive Insights

9.3.7.1. Market attractiveness

9.3.7.2. Competition heatmap

9.4. LAMEA

9.4.1. Brazil

9.4.1.1. Market size analysis, by Type, 2022-2032

9.4.1.2. Market size analysis, by Application, 2022-2032

9.4.1.3. Market size analysis, by Technology, 2022-2032

9.4.1.4. Market size analysis, by End User, 2022-2032

9.4.2. Saudi Arabia

9.4.2.1. Market size analysis, by Type, 2022-2032

9.4.2.2. Market size analysis, by Application, 2022-2032

9.4.2.3. Market size analysis, by Technology, 2022-2032

9.4.2.4. Market size analysis, by End User, 2022-2032

9.4.3. UAE

9.4.3.1. Market size analysis, by Type, 2022-2032

9.4.3.2. Market size analysis, by Application, 2022-2032

9.4.3.3. Market size analysis, by Technology, 2022-2032

9.4.3.4. Market size analysis, by End User, 2022-2032

9.4.4. South Africa

9.4.4.1. Market size analysis, by Type, 2022-2032

9.4.4.2. Market size analysis, by Application, 2022-2032

9.4.4.3. Market size analysis, by Technology, 2022-2032

9.4.4.4. Market size analysis, by End User, 2022-2032

9.4.5. Rest of LAMEA

9.4.5.1. Market size analysis, by Type, 2022-2032

9.4.5.2. Market size analysis, by Application, 2022-2032

9.4.5.3. Market size analysis, by Technology, 2022-2032

9.4.5.4. Market size analysis, by End User, 2022-2032

9.4.6. Research Dive Exclusive Insights

9.4.6.1. Market attractiveness

9.4.6.2. Competition heatmap

10. Competitive Landscape

10.1. Top winning strategies, 2022

10.1.1. By strategy

10.1.2. By year

10.2. Strategic overview

10.3. Market share analysis, 2022

11. Company Profiles

11.1. TE Connectivity

11.1.1. Overview

11.1.2. Business segments

11.1.3. Product portfolio

11.1.4. Financial performance

11.1.5. Recent developments

11.1.6. SWOT analysis

11.2. Medtronic

11.2.1. Overview

11.2.2. Business segments

11.2.3. Product portfolio

11.2.4. Financial performance

11.2.5. Recent developments

11.2.6. SWOT analysis

11.3. Analog Devices

11.3.1. Overview

11.3.2. Business segments

11.3.3. Product portfolio

11.3.4. Financial performance

11.3.5. Recent developments

11.3.6. SWOT analysis

11.4. Texas Instruments

11.4.1. Overview

11.4.2. Business segments

11.4.3. Product portfolio

11.4.4. Financial performance

11.4.5. Recent developments

11.4.6. SWOT analysis

11.5. STMicroelectronics

11.5.1. Overview

11.5.2. Business segments

11.5.3. Product portfolio

11.5.4. Financial performance

11.5.5. Recent developments

11.5.6. SWOT analysis

11.6. Tekscan

11.6.1. Overview

11.6.2. Business segments

11.6.3. Product portfolio

11.6.4. Financial performance

11.6.5. Recent developments

11.6.6. SWOT analysis

11.7. NXP Semiconductors

11.7.1. Overview

11.7.2. Business segments

11.7.3. Product portfolio

11.7.4. Financial performance

11.7.5. Recent developments

11.7.6. SWOT analysis

11.8. Sensirion

11.8.1. Overview

11.8.2. Business segments

11.8.3. Product portfolio

11.8.4. Financial performance

11.8.5. Recent developments

11.8.6. SWOT analysis

11.9. ON Semiconductor Corporation

11.9.1. Overview

11.9.2. Business segments

11.9.3. Product portfolio

11.9.4. Financial performance

11.9.5. Recent developments

11.9.6. SWOT analysis

11.10. Amphenol Corporation

11.10.1. Overview

11.10.2. Business segments

11.10.3. Product portfolio

11.10.4. Financial performance

11.10.5. Recent developments

11.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com