Chromatography Systems Market Report

RA00037

Chromatography Systems Market, by Type (Liquid Chromatography, Gas Chromatography, Others), End-Use (Hospital & Research industry, Pharmaceutical & Biotechnology, Agricultural & Food industry, Others), Regional Analysis (North America, Europe, Asia-Pacific, LAMEA): Global Opportunity Analysis and Industry Forecast, 2019–2026

Update Available On-Demand

Global Chromatography Systems Market Overview 2026

The chromatography systems in global market is anticipated to reach $ 16014.9 million by 2026, at a growth rate of 6.6%, and increasing from $ 9739.4 Million in 2018, owing to increasing the usage of this technique in pharmaceutical & biotechnology and hospital & research industry.

Chromatography is an analytic technique that is used for separation of components in a mixture. The components of the mixture are separated on the basis of their different interactions with stationary and mobile phase. chromatography is most power full analytical tool to identity the components present in the mixture. Liquid and gas chromatography techniques are the major types of chromatography system.

Chromatography Systems Market Drivers:

Rising demand from hospital & research industry and pharmaceutical & biotechnology industry are giving significant boost to the growth of Global Chromatography Systems Market

Chromatography technique has a rapid growth in the hospital & research industry especially in cancer treatment along with the identification of cancer cells. The chromatography is strong analytic tool for identification of cancer cells, which is expected drive the market growth. In pharmaceutical & biotechnology industry the chromatography system is used for separation of compounds that have an asymmetric center (Chiral compound), analysis of various functional groups and purity of drug compounds. In addition to this, chromatography technique has various application, such as in environmental laboratory to observe air quality, in production industry to check water quality and quality control in food & agriculture industry.

Market Restraints:

Price of instrument and alternatives to chromatography technique are restraining the growth of Chromatography Systems Market

The market is mainly restrained by cost of the instrument and it requires skilled personal to conduct analysis and operate the instrument. Additionally, less accuracy and uncertainty of analytical results when compare with alternative techniques may hinder the Chromatography Systems Market growth.

Global Opportunities and Forecast of Chromatography Systems Market:

Forensic laboratory usage will provide significant investment opportunities for the growth of Chromatography Systems Market

Growing the importance of chromatography system in research laboratories, protein purification and forensic laboratory is expected to drive the market growth over the forecast period. Additionally, rising the number of research & developments and improvements in chromatography techniques in order to improve the accuracy and precision of analytical results will create better growth opportunities in the near future. Increasing investments from governments in forensic labs to determine the reason for death, to identify alcohol content in body of the victims by using body parts, this is achieved with the help of chromatography system. These factors will enhance growth of the market.

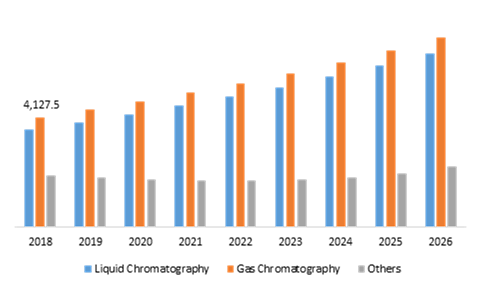

Chromatography Systems Market Segmentation, by Type:

Gas Chromatography segment is predicted to be most lucrative till the end of 2026

Source: Research Analysis

The chromatography system in global market is segmented into type and end-use. Based on type, the market is classified into liquid chromatography, gas chromatography and others. Among these, gas Chromatography Systems Market led the market share in the year 2018, generated a revenue of $4127.5 million and anticipated to account for $7145.1 million over forecast period, owing to wide range of usage in quality control in production of petroleum chemicals and R&D in pharmaceutical, environmental and biomedical industries. Along with gas chromatography, the Chromatography Systems Market for liquid type will experience substantial growth in the coming years, due to increase usage in biotechnology and pharmaceutical industry. This market is anticipated to reach $6567.9 million during forecast time frame.

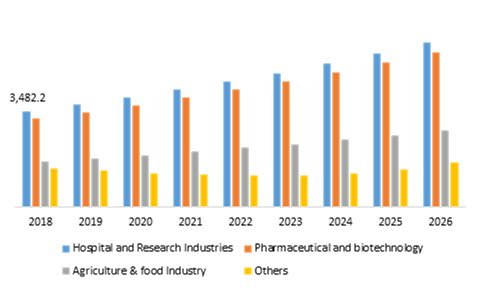

Chromatography Systems Market, by End-Use

Pharmaceutical & Biotechnology segment is will grow at a CAGR of 7.3% during the projected period

Source: Research Analysis

Based on end-use, the chromatography system in global market is classified into pharmaceutical & biotechnology, hospital & research industry, agricultural & food industry and others. Among these, hospital & research segment generated a revenue of $3482.2 million in 2018, and it is expected to account for $5983.1 million by 2026, at a CAGR of 7.0%. Chromatography is the most powerful diagnostic technique in hospital & research sector. Additionally, the chromatography system industry size for pharmaceutical & biotechnology industry is expected to reach $5651.4 million over forecast period, owing to growing the pharmaceutical industries in Asia Pacific region countries.

Chromatography Systems Market, by Region:

Asia Pacific region will have enormous opportunities for the market investors to grow over the coming years

The Chromatography Systems Market for Europe will experience a robust growth over forecast period. Owing to strong presence of pharmaceutical companies in this region, and these manufacturers are investing on research activities and geographical expansion. Along with Europe, Asia Pacific Chromatography Systems Market is experience substantial growth in the coming years and it is anticipated to account for $3283.9 million by 2026, and increasing from $1841.3 million in 2018, due to rising the pharmaceutical industries, medicines developments and biological research.

North America Chromatography Systems Market:

North America chromatography system in global market is accounted for largest share and registered for $ 3521.5 Million in 2018, and anticipated to reach $5960.6 Million over forecast period, and at a growth rate of 6.8%. Owing to growth in the government investments, pharmaceutical medicines research and high occurrence of cancer in this region. Additionally, the presence of major key participants in this region is expected to drive the market growth.

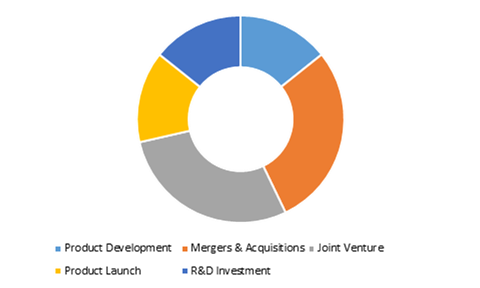

Top Key Players and Recent Developments in Global Chromatography Systems Market:

Product development and joint ventures are the most common strategies followed by the market players

Source: Research Dive Analysis

Top key players for Chromatography Systems Market include Agilent Technologies Inc., Shimadzu Corporation, JASCO Inc., PerkinElmer Inc., Pall Corporation, Novasep Holding, GE Healthcare, Thermo Fisher Scientific, Waters Corporation, GL Sciences Inc., Bio-Rad Laboratories Inc. and Quadrex Corporation among many others.

These manufacturers are continuously increasing their efforts on new product developments, as it will enhance to rise the company position at the global level. In September 2019, Shimadzu is launched a new product “Nexera UC Prep” which is Supercritical Fluid Chromatography System for purification process in pharmaceutical industry.

Scope of the Market Report:

| Aspect | Particulars |

| Historical Market Estimations | 2016-2018 |

| Base Year for Market Estimation | 2018 |

| Forecast timeline for Market Projection | 2019-2026 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by End-Use |

|

| Key Countries covered | U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, and Saudi Arabia |

| Key Companies Profiled |

|

Source: Research Dive Analysis

Q1. What are chromatography techniques?

A. Chromatography is an essential biophysical technique, used for the separation, purification and identification several constituents in a mixture. Some of the major chromatography techniques includes column chromatography, paper chromatography, gas chromatography, liquid chromatography, ion exchange chromatography, supercritical fluid chromatography and many other techniques.

Q2. How Important of chromatography system in research laboratories?

A. Chromatography is an important laboratory technique, it is mainly utilized for separating the solutes or components of a mixture based on relative quantities of each solute distributed between a moving fluid streams. Also, chromatography systems will play crucial role in research laboratories including identification and purity of chemical composites of biological origin. In the petroleum laboratory the technique is employed to examine complex mixtures of hydrocarbons. It is capable of purifying all the constituents in the multi component mixture without requiring of any foreknowledge of number and relative amounts present in the substance.

Q3. What will be the future of Pharmaceutical & Biotechnology segment in Chromatography Systems Market?

A. Chromatography is currently most widely used separation laboratory technique in pharmaceutical & biotechnology industry. Advancing the chromatography techniques by the pharmaceutical & biotechnology industry for quantification and identification of drugs during the process of discovery, manufacturing and development. Also, growing utilization of chromatography systems to prepare huge quantities of extremely pure materials and chemicals as well as to identify and analyze the purified compounds even in trace amounts.

Q4. Which countries have immense opportunities in the growth of the Chromatography Systems Market?

A. The major developed economies such as U.S., UK, Japan as well as top developing countries including India, China, Australia and many other countries have immense opportunities in the global chromatography systems market.

Q5. How new product developments will affect the growth of the Chromatography Systems Market?

A. The new product launches and growing demand for chromatography techniques in environmental pollution laboratories as well as continuous development of chromatography systems is expected to create huge growth opportunities in the global market. However, the availability of alternative systems are projected to limit the market growth.

Q6. Which application segment will dominate the Chromatography Systems Market?

A. The application of chromatography systems in hospitals & research industry has dominated the global market in the previous years.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Type trends

2.3. End-use trends

3. Market overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Pricing overview

3.8.1. By type

3.8.2. By end-use

3.8.3. By region

3.9. Market value chain analysis

3.9.1. Stress point analysis

3.9.2. Raw material analysis

3.9.3. Manufacturing process

3.9.4. Distribution channel analysis

3.9.5. Operating vendors

3.9.5.1. Raw material suppliers

3.9.5.2. Product manufacturers

3.9.5.3. Product distributors

3.10. Strategic overview

4. Chromatography System Market, by Type

4.1. Liquid Chromatography

4.1.1. Market size and forecast, by region, 2016-2026

4.1.2. Comparative market share analysis, 2018 & 2026

4.2. Gas Chromatography

4.2.1. Market size and forecast, by region, 2016-2026

4.2.2. Comparative market share analysis, 2018 & 2026

4.3. Others

4.3.1. Market size and forecast, by region, 2016-2026

4.3.2. Comparative market share analysis, 2018 & 2026

5. Chromatography System Market, by End-use

5.1. Pharmaceutical & Biotechnology Industry

5.1.1. Market size and forecast, by region, 2016-2026

5.1.2. Comparative market share analysis, 2018 & 2026

5.2. Hospital & Research Laboratories

5.2.1. Market size and forecast, by region, 2016-2026

5.2.2. Comparative market share analysis, 2018 & 2026

5.3. Agricultural & Food Industry

5.3.1. Market size and forecast, by region, 2016-2026

5.3.2. Comparative market share analysis, 2018 & 2026

5.4. Others

5.4.1. Market size and forecast, by region, 2016-2026

5.4.2. Comparative market share analysis, 2018 & 2026

6. Chromatography System Market, by Region

6.1. North America

6.1.1. Market size and forecast, by type, 2016-2026

6.1.2. Market size and forecast, by end-use, 2016-2026

6.1.3. Market size and forecast, by country, 2016-2026

6.1.4. Comparative market share analysis, 2018 & 2026

6.1.5. U.S.

6.1.5.1. Market size and forecast, by type, 2016-2026

6.1.5.2. Market size and forecast, by end-use, 2016-2026

6.1.5.3. Comparative market share analysis, 2018 & 2026

6.1.6. Canada

6.1.6.1. Market size and forecast, by type, 2016-2026

6.1.6.2. Market size and forecast, by end-use, 2016-2026

6.1.6.3. Comparative market share analysis, 2018 & 2026

6.1.7. Mexico

6.1.7.1. Market size and forecast, by type, 2016-2026

6.1.7.2. Market size and forecast, by end-use, 2016-2026

6.1.7.3. Comparative market share analysis, 2018 & 2026

6.2. Europe

6.2.1. Market size and forecast, by type, 2016-2026

6.2.2. Market size and forecast, by end-use, 2016-2026

6.2.3. Market size and forecast, by country, 2016-2026

6.2.4. Comparative market share analysis, 2018 & 2026

6.2.5. UK

6.2.5.1. Market size and forecast, by type, 2016-2026

6.2.5.2. Market size and forecast, by end-use, 2016-2026

6.2.5.3. Comparative market share analysis, 2018 & 2026

6.2.6. Germany

6.2.6.1. Market size and forecast, by type, 2016-2026

6.2.6.2. Market size and forecast, by end-use, 2016-2026

6.2.6.3. Comparative market share analysis, 2018 & 2026

6.2.7. France

6.2.7.1. Market size and forecast, by type, 2016-2026

6.2.7.2. Market size and forecast, by end-use, 2016-2026

6.2.7.3. Comparative market share analysis, 2018 & 2026

6.2.8. Spain

6.2.8.1. Market size and forecast, by type, 2016-2026

6.2.8.2. Market size and forecast, by end-use, 2016-2026

6.2.8.3. Comparative market share analysis, 2018 & 2026

6.2.9. Italy

6.2.9.1. Market size and forecast, by type, 2016-2026

6.2.9.2. Market size and forecast, by end-use, 2016-2026

6.2.9.3. Comparative market share analysis, 2018 & 2026

6.2.10. Rest of Europe

6.2.10.1. Market size and forecast, by type, 2016-2026

6.2.10.2. Market size and forecast, by end-use, 2016-2026

6.2.10.3. Comparative market share analysis, 2018 & 2026

6.3. Asia Pacific

6.3.1. Market size and forecast, by type, 2016-2026

6.3.2. Market size and forecast, by end-use, 2016-2026

6.3.3. Market size and forecast, by country, 2016-2026

6.3.4. Comparative market share analysis, 2018 & 2026

6.3.5. China

6.3.5.1. Market size and forecast, by type, 2016-2026

6.3.5.2. Market size and forecast, by end-use, 2016-2026

6.3.5.3. Comparative market share analysis, 2018 & 2026

6.3.6. Japan

6.3.6.1. Market size and forecast, by type, 2016-2026

6.3.6.2. Market size and forecast, by end-use, 2016-2026

6.3.6.3. Comparative market share analysis, 2018 & 2026

6.3.7. India

6.3.7.1. Market size and forecast, by type, 2016-2026

6.3.7.2. Market size and forecast, by end-use, 2016-2026

6.3.7.3. Comparative market share analysis, 2018 & 2026

6.3.8. Australia

6.3.8.1. Market size and forecast, by type, 2016-2026

6.3.8.2. Market size and forecast, by end-use, 2016-2026

6.3.8.3. Comparative market share analysis, 2018 & 2026

6.3.9. South Korea

6.3.9.1. Market size and forecast, by type, 2016-2026

6.3.9.2. Market size and forecast, by end-use, 2016-2026

6.3.9.3. Comparative market share analysis, 2018 & 2026

6.3.10. Rest of Asia Pacific

6.3.10.1. Market size and forecast, by type, 2016-2026

6.3.10.2. Market size and forecast, by end-use, 2016-2026

6.3.10.3. Comparative market share analysis, 2018 & 2026

6.4. LAMEA

6.4.1. Market size and forecast, by type, 2016-2026

6.4.2. Market size and forecast, by end-use, 2016-2026

6.4.3. Market size and forecast, by country, 2016-2026

6.4.4. Comparative market share analysis, 2018 & 2026

6.4.5. Brazil

6.4.5.1. Market size and forecast, by type, 2016-2026

6.4.5.2. Market size and forecast, by end-use, 2016-2026

6.4.5.3. Comparative market share analysis, 2018 & 2026

6.4.6. Saudi Arabia

6.4.6.1. Market size and forecast, by type, 2016-2026

6.4.6.2. Market size and forecast, by end-use, 2016-2026

6.4.6.3. Comparative market share analysis, 2018 & 2026

6.4.7. South Africa

6.4.7.1. Market size and forecast, by type, 2016-2026

6.4.7.2. Market size and forecast, by end-use, 2016-2026

6.4.7.3. Comparative market share analysis, 2018 & 2026

6.4.8. Rest of LAMEA

6.4.8.1. Market size and forecast, by type, 2016-2026

6.4.8.2. Market size and forecast, by end-use, 2016-2026

6.4.8.3. Comparative market share analysis, 2018 & 2026

7. Company profiles

7.1. Agilent Technologies Inc.

7.1.1. Business overview

7.1.2. Financial performance

7.1.3. Product portfolio

7.1.4. Recent strategic moves & developments

7.1.5. SWOT analysis

7.2. Shimadzu Corporation

7.2.1. Business overview

7.2.2. Financial performance

7.2.3. Product portfolio

7.2.4. Recent strategic moves & developments

7.2.5. SWOT analysis

7.3. JASCO Inc.

7.3.1. Business overview

7.3.2. Financial performance

7.3.3. Product portfolio

7.3.4. Recent strategic moves & developments

7.3.5. SWOT analysis

7.4. PerkinElmer Inc.

7.4.1. Business overview

7.4.2. Financial performance

7.4.3. Product portfolio

7.4.4. Recent strategic moves & developments

7.4.5. SWOT analysis

7.5. Pall Corporation

7.5.1. Business overview

7.5.2. Financial performance

7.5.3. Product portfolio

7.5.4. Recent strategic moves & developments

7.5.5. SWOT analysis

7.6. Novasep Holding

7.6.1. Business overview

7.6.2. Financial performance

7.6.3. Product portfolio

7.6.4. Recent strategic moves & developments

7.6.5. SWOT analysis

7.7. GL Sciences Inc.

7.7.1. Business overview

7.7.2. Financial performance

7.7.3. Product portfolio

7.7.4. Recent strategic moves & developments

7.7.5. SWOT analysis

7.8. GE Healthcare

7.8.1. Business overview

7.8.2. Financial performance

7.8.3. Product portfolio

7.8.4. Recent strategic moves & developments

7.8.5. SWOT analysis

7.9. Thermo Fisher Scientific

7.9.1. Business overview

7.9.2. Financial performance

7.9.3. Product portfolio

7.9.4. Recent strategic moves & developments

7.9.5. SWOT analysis

7.10. Waters Corporation

7.10.1. Business overview

7.10.2. Financial performance

7.10.3. Product portfolio

7.10.4. Recent strategic moves & developments

7.10.5. SWOT analysis

7.11. Bio-Rad Laboratories Inc.

7.11.1. Business overview

7.11.2. Financial performance

7.11.3. Product portfolio

7.11.4. Recent strategic moves & developments

7.11.5. SWOT analysis

7.12. Quadrex Corporation

7.12.1. Business overview

7.12.2. Financial performance

7.12.3. Product portfolio

7.12.4. Recent strategic moves & developments

7.12.5. SWOT analysis

Chromatography works by separating the individual parts of a mixture so that each one can be analyzed and identified. With the help of analytical technique of chromatography, scientists can separate chemical compounds from complex mixtures. These mixtures include diverse things as cigarette smoke, smog, petroleum products, and even the delicious aroma of coffee. Chromatography is an analytical technique that is used for separation of components in a mixture. The components of the mixture are separated on the basis of their different interactions with stationary and mobile phase. Chromatography is most power full analytical tool to identity the components present in the mixture. Liquid and gas chromatography techniques are the major types of chromatography system.

Russian botanist Mikhail Semenovich Tsvett invented the first chromatograph. Almost 60% of the chemical analysis across the globe is performed with chromatography or a variation thereon. Chromatography is used in different ways by many different users.

Chromatography in Hospital and Research

Prime areas of application in medicine

Chromatography technique, is, undoubtedly, an essential tool for biochemists. It can also be applied effortlessly during the studies performed in the clinical laboratories. One best instance is the paper chromatography. It is used to define the varied types of amino acids and sugar in bodily fluids which are connected with the hereditary metabolic disorders. Laboratories use gas chromatography to measure barbiturates, steroids, and lipids. Chromatography is also used in the separation process of proteins and vitamins.

Chromatography in Pharmaceutical Industry

Chromatography takes a vital role in many pharmaceutical industries. It helps the environmental testing laboratories in identifying tiny quantities of pollutants such as PCBs in pesticides, and waste oil. The Agency applies the chromatography process to test the drinking water and to monitor the quality of air. Pharmaceutical industries depend on this method both to prepare huge quantities of excessively pure materials, and also to analyze the purified compounds for tracing the contaminants.

Chromatography in Agriculture and Food

Spoilage identification

Defining the amount of organic acids in foods provides the most essential information about the quality of foods. Chromatography is broadly used in the field of food-flavor studies. It is also used to identify any type of decomposition in foods. With the help of column chromatography, the spoilage indicators such as pyruvic acid in milk can be detected and calculated. Pyruvic acid content is a measure of psychrotropic bacteria found in milk.

This method of separation is also used to evaluate the total organic acid profile of milk and to measure lactose, specifying the amount of sweetness in milk. Compared with techniques such as bacterial plating, Chromatography is a fast process of analysis which may deliver swift result. Rapid process of analysis is essential in preventing the outburst of spoilage in the food industry and thus diminishing possible health risks.

Defining nutritional quality of food

Vitamin C diminution in foods can be seen as a sign of depletion of the other nutrients also. Therefore, column chromatography is used during all the stages of food processing to scrutinize the vitamin C content of foods and beverages. This analysis can be processed in complex samples by promptly using modern acid analysis columns amalgamated with electrochemical detection. This technique is used to identify vitamin C in powdered drinks, juices, and both frozen and fresh fruits and vegetables.

Additive Identification

Additives are the substances added to foods to preserve their flavors, to enhance its taste or to give them an attractive visual appeal. For instance, apple juice naturally contains malic acid which makes it more difficult to detect the presence of added malic acid in apple juice. Chromatography was used to detect and quantify fumaric acid in apple juice which has yielded successful results.

Recent Developments and Future Perspective

With the recent developments in the chromatography systems market, companies are seen to be engaged in product developments and joint ventures. The key players for the Chromatography Systems Market include

- Shimadzu Corporation

- Agilent Technologies Inc.

- PerkinElmer Inc.

- JASCO Inc.

- Novasep Holding

- Pall Corporation

- Thermo Fisher Scientific

- GE Healthcare

- GL Sciences Inc.

- Waters Corporation

- Bio-Rad Laboratories Inc

- Quadrex Corporation

In September 2019, Shimadzu is launched a new product “Nexera UC Prep” which is Supercritical Fluid Chromatography System for purification process in pharmaceutical industry. These manufacturers are continuously increasing their efforts on new product developments, as it will enhance to rise the company position at the global level.

According to a report published by ResearchDive, the chromatography systems in global market is predicted to reach $16,014.9 million by 2026, at a growth rate of 6.6%. The rising number of research & developments and improvements in chromatography techniques in order to develop the accuracy and precision of analytical results will create better growth opportunities in the near future.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com