Radio Frequency Front End Market Report

RA08634

Radio Frequency Front End Market by Type (RF Filters, RF Power Amplifiers, RF Switches, and Others), End Use Industry (Consumer Electronics, Automotive Systems, Wireless Networks, Military, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Radio Frequency Front End Market Analysis

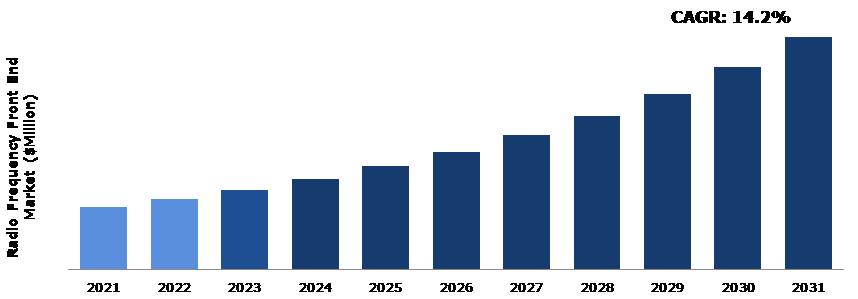

The Global Radio Frequency Front End Market Size was $18,799.4 million in 2021 and is predicted to grow with a CAGR of 14.2%, by generating a revenue of $69,926.4 million by 2031.

Global Radio Frequency Front End Market Synopsis

The RF front end, short for radio frequency front end, refers to all of the circuitry between a receiver's antenna input and the mixer stage. It consists of all the receiver components that process the signal at the original incoming radio frequency (RF) before converting it to a lower intermediate frequency (IF).

The RF front end module is made up of all the components in the receiver that process the original incoming signal before it is converted to a lower intermediate frequency (IF). It consists of an RF amplifier, a local oscillator, a band pass RF filter, and a mixer. A band-pass filter (BPF) reduces the image response. It also prevents strong out-of-band signals from saturating the input stages. An RF amplifier/low-noise amplifier (LNA) is used to improve receiver sensitivity by amplifying weak signals without contaminating them with noise. In addition, nowadays there is an increase in next generation wireless networks, which is expected to fuel the radio frequency front end market growth.

However, the increased need for large investments in R&D and the need for large space for RF antennas are expected to limit market growth. During the forecast period, each of these factors is expected to have a significant impact on the radio frequency front end market size.

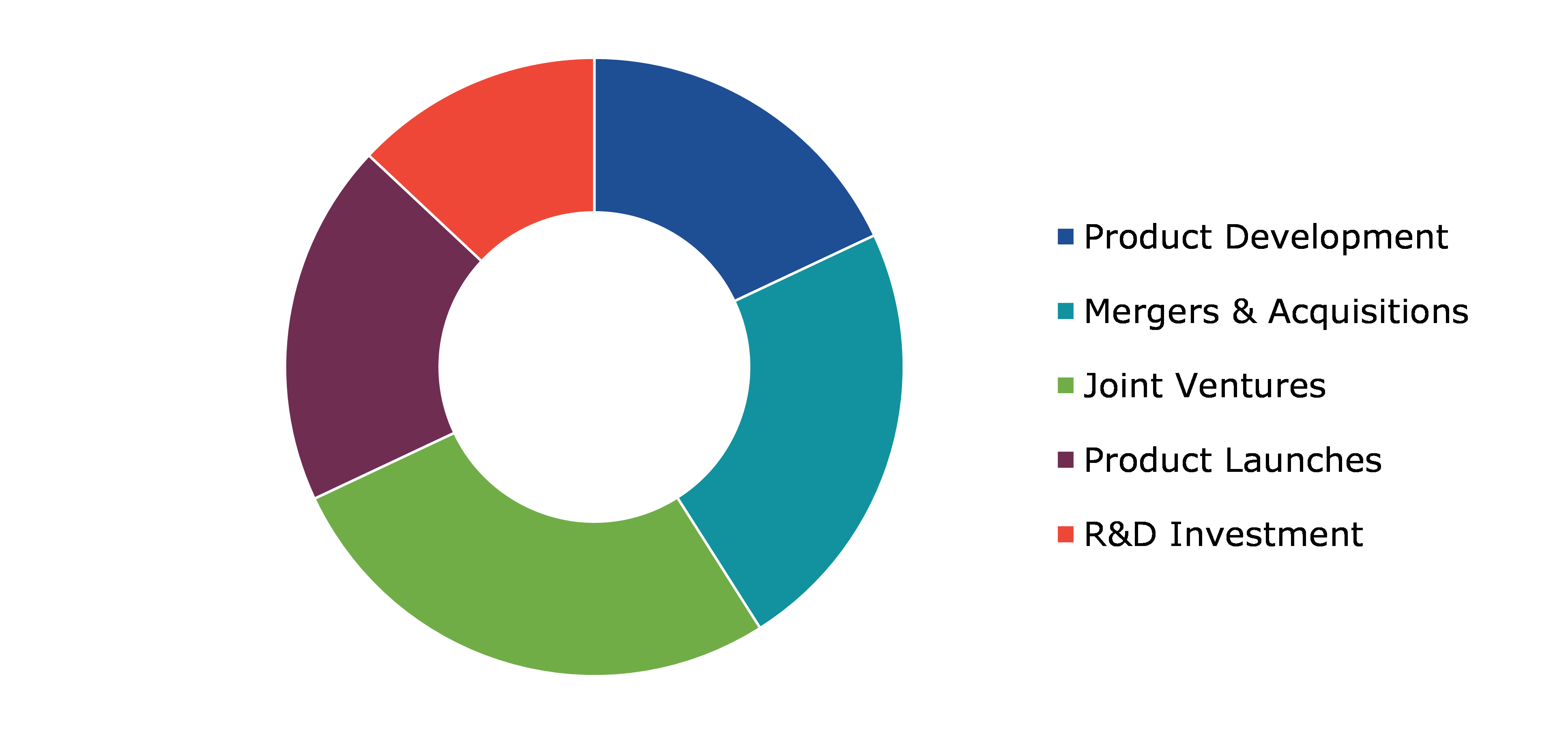

The industry players are investing a lot of effort on the research and development of smart and unique strategies to sustain their growth in the market. These strategies include product launches, mergers & acquisitions, collaborations, partnerships, and refurbishing of existing technology. In June 2022, Qualcomm Technologies, Inc. introduced RFFE modules designed for best-in-class Wi-Fi and Bluetooth experiences. These modules were created for Bluetooth, Wi-Fi 6E, and the next-generation Wi-Fi 7 standard, and were capable of serving a wide range of device segments such as automotive, smartphones, XR, PCs, wearables, mobile broadband, IoT, and others. Furthermore, In October 2021, One of the smallest multi-band RF front end (RFFE) modules, the SKY68031-11 from Skyworks Solutions, was released for use in licensed and low power wide area network (LTE-M/NB-IoT) applications.

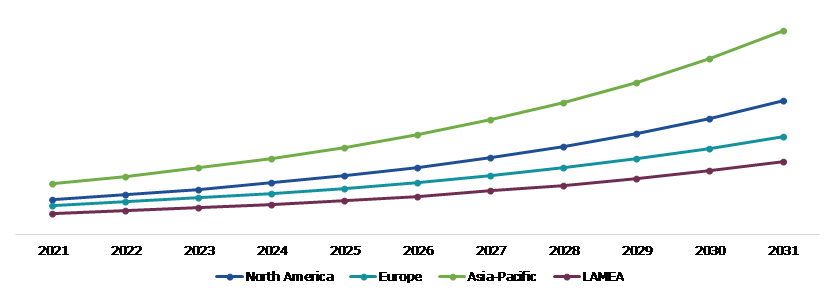

According to regional analysis, the Asia-Pacific radio frequency front end market share accounted for a highest market share in 2021. The Asia-Pacific region is expected to grow significantly. The advancement of consumer electronics and growing defense equipment requirements, combined with the significant growth of major emerging economies such as China, India, and South Korea, will drive demand for the radio frequency front end market size even further.

Radio Frequency Front End Overview

The RF Front end is the generic name for all the circuitry between a receiver Antenna input up to the Mixer Stage. For most architectures, the RF Front End consists of an RF Filter (which is actually a band-pass filter) which receives the electromagnetic wave from the Antenna. The primary responsibility of the RF front end is to increase the sensitivity of the receiver by amplifying weak signals without contaminating them with noise, so that they can remain above the noise level in subsequent stages. It must have an extremely low noise figure (NF).

A smartphone's RFFE is a crucial component that affects user experience and overall radio communication. The situation of RFFE for smartphones will evolve, starting with design and continuing through production, assembly, testing, and packaging, in light of the recent development in 5G commercialization and the necessity to meet high standards.

COVID-19 Impact on Global Radio Frequency Front End Market

The COVID-19 impact has slowed the growth of the radio frequency front end market. Most clients of global IC design firms placed orders ahead of time, with some orders already fulfilled and shipped. As a result, despite the pandemic's impact, IC design revenue was not expected to fall significantly in the first quarter of 2020. However, the pandemic has reduced device manufacturers' demand for IC design, affecting the RF front end market. More specifically, IC designers for smartphones and other consumer electronics have been hit the hardest, affecting radio frequency front end market growth.

However, economic relief packages from national governments to recoup industrial losses are likely to stabilize the industry during the forecast period. For example, in November 2020, the Canadian government announced an investment of approximately CAD 1.75 billion to enable high-speed data connections for all citizens while also propelling business. By 2026, the country hopes to have fast internet for 98% of Canadians, and the program aims to reach all residents by 2030.

Rapid Adoption of Smart Devices or Smart Consumer Electronic Products to Drive the market

Increased emphasis on designing RF modules or RF components capable of providing faster data transmission, significant product development of RF-SOI front-end modules, and growing consumer penetration of smart devices for health, fitness, or entertainment purposes are factors contributing to the market growth. UltraCMOS 13 was announced in June 2019 by pSemi Corporation, a Murata company focused on semiconductor integration. This advancement represented the next generation of proprietary RFSOI technology produced in high-volume 300mm foundries. This allows for improved performance and integration of RF front-end components. According to a GFU survey, the German market sold nearly 7.4 million wearables in 2021, representing a 9% increase over the previous year. Furthermore, the survey found that the average device costs more than €180, representing a 10% increase over 2020.

To know more about global radio frequency front end market drivers, get in touch with our analysts here.

Complexity In Design of RF Antennas to Restrain the Market Growth

The fabrication process for these RF modules is comparatively complex due to an increase in the number of bands or frequencies, variation of multiplexity methods, utilization of smaller wafer sizes and so on. As a result, skilled professionals are required to design these components with the utmost precision and accuracy. This lengthens the manufacturing process. Silicon-germanium, on the other hand, is widely used for facilitating integration with front-end modules or designing RF front-end circuits with lower complexities when compared to other substrate materials. In August 2021 Amkor Technology Inc. discussed advancing the evolution of 5G RF module design, characterization, and packaging technology. With the introduction of 5G, cellular frequency bands have grown significantly, necessitating innovative solutions for improving the packaging of RF front-end modules used in smartphones and other 5G-enabled devices.

Use of Radio Frequency Front End in 3G and 4G for Technology to Drive Excellent Opportunities

The increasing popularity of mobile communication devices is increasing network traffic. As a result, the global deployment of next-generation wireless networks such as 3G, 4G, and 5G is increasing. These technologies provide wireless connections that are comparable to home broadband connections. This increases the number of users who can access the Internet at any time and from any location. As a result of their ability to connect multiple mobile computing devices using data services such as 3G and 4G with RF front-end modules as interfaces, mobile hotspots are in high demand among individuals and business consumers. Additionally, radio frequency front end demodulators, power amplifiers, and other radio frequency devices have a high demand for tuners and switches to provide specialized functionality, which is expected to propel the global radio frequency front end market size.

To know more about global radio frequency front end market opportunities, get in touch with our analysts here.

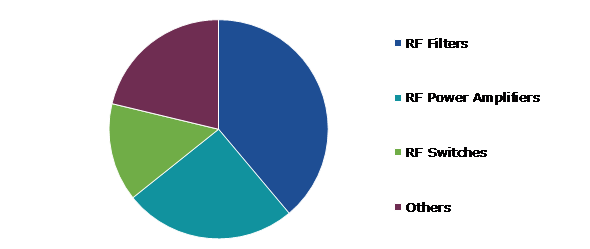

Global Radio Frequency Front End Market, by Type

On the basis of type, the market has been classified into RF filters, RF power amplifiers, RF switches, and others. Among these, the RF filters sub-segment accounted for the highest market share in 2021, whereas the RF power amplifiers sub-segment is estimated to witness the fastest growth during the forecast period.

Global Radio Frequency Front End Market Share, by Type, 2021

Source: Research Dive Analysis

The RF filters sub-type accounted for the highest market share in 2021. RF filters are becoming an increasingly important component in smartphones, which must tune into a dozen or more frequency bands. Radio frequency (RF) and microwave filters are a type of electronic filter that operates on signals with frequencies ranging from megahertz to gigahertz (medium frequency to extremely high frequency). Radio receivers that reject picture frequencies, broadcast receivers that select desired channel frequencies, EMI filters that reduce noise levels, transceivers that reduce LO leakage levels, and other applications use RF filters. An RF Filter (which is actually a band-pass filter) receives the Electromagnetic wave from the Antenna. Its role is to remove the image frequency and to prevent strong out-of-band signals from saturating the input stages. These factors are predicted to drive the Rf filter subsegment growth in radio frequency front end market size.

The RF power amplifiers sub-type accounted for the second highest market share in 2021. An RF power amplifier is essentially a tuned amplifier that allows a broadcast or transmitted signal to control an output signal. The RF amplifier converts the input signal into an output signal using frequency-determining networks to provide the required response at a given frequency. The RF amplifiers are used in super heterodyne receivers. The advantages of using RF receivers are they have better sensitivity i.e., they have improved gain to the signal. They have better signal to noise ration than other amplifiers. The selectivity is better as they have better rejection to the adjacent undesired signals. These factors drive are predicted to drive the RF amplifiers subsegment growth.

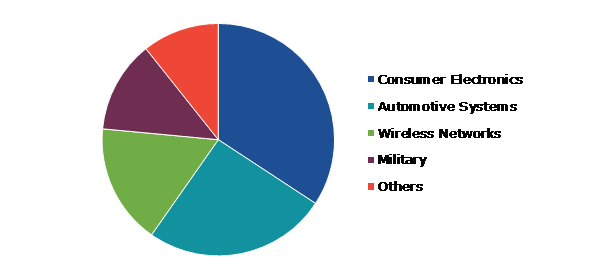

Global Radio Frequency Front End Market, by End Use Industry

On the basis of end use industry, the market has been divided into consumer electronics, automotive systems, wireless networks, military, and others. Among these, the consumer electronics sub-segment accounted for the highest revenue share in 2021.

Global Radio Frequency Front End Market Size, by End Use Industry, 2021

Source: Research Dive Analysis

The consumer electronics sub-segment accounted for the highest market share in 2021. The segment is also expected to grow significantly during the forecast period. This could be attributed to rising disposable income and increased spending on consumer electronics such as smartphones, tablets, laptops and notebook computers, smart wearables, and smart home accessories. The growing use of RF components in consumer electronic devices such as smartphones, tablets, laptops, and wearable electronics is attributed to the industry's growth. To achieve high-end wireless connectivity, these consumer electronic devices require RF antennas, filters, multiplexers, and amplifiers. Increased mobile subscriptions around the world will amplify radio frequency front end market opportunities.

Global Radio Frequency Front End Market, Regional Insights

The radio frequency front end market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Radio Frequency Front End Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Radio Frequency Front End in Asia-Pacific to be the Most Dominant

The Asia-Pacific Radio Frequency Front end market accounted for the highest market share in 2021 and is anticipated to show the fastest growth during the forecast period. Significant growth is predicted for the Asia-Pacific regional market. The need for RF components will increase as consumer electronics develop and defense equipment requirements rise along with the significant expansion of important rising economies like China, India, and South Korea. Furthermore, front-end modules are critical to many wireless applications, such as base stations and 5G smartphones. The project is scheduled to last five years and has a budget of YUAN 204.15 billion (USD 28.9 billion). The introduction of GPS-enabled handsets is also driving a large market, particularly in Asia Pacific. The market is also being driven by the use of Bluetooth-enabled handsets. The growing use of 2G and 3G services is also driving growth in the Asia Pacific radio frequency front end market. These factors are expected to have a combined impact on radio frequency front end market share during the forecast period.

Competitive Scenario in the Global Radio Frequency Front End Market

Product launch and mergers & acquisitions are common strategies followed by the major market players. In June 2022, Qualcomm Technologies Inc. announced the availability of Wi-Fi 7 front-end modules, which provide improved wireless performance in automotive and internet-connected devices. The launch of the RFFE modules was in line with the company's goal of expanding its handset lineup with modem-to-antenna solutions for automotive and IoT.

Source: Research Dive Analysis

Some of the leading radio frequency front end market players are Broadcom Inc, Infineon Technologies AG., Murata Manufacturing Co. Ltd.., NXP Semiconductors N.V., Qorvo Inc.., Skyworks Solutions, Inc.., STMicroelectronics N.V., Taiyo Yuden Co., Murata Manufacturing Co., Ltd., and Analog Devices, Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by End Use Industry |

|

| Key Companies Profiled |

|

Q1. What is the size of the global Radio Frequency Front end market?

A. The size of the global radio frequency front end market was over $18,799.4 million in 2021 and is projected to reach $ 69,926.4 million by 2031.

Q2. Which are the major companies in the Radio Frequency Front end market?

A. Broadcom Inc, Infineon Technologies AG, and Murata Manufacturing Co. Ltd are some of the key players in the global radio frequency front end market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific radio frequency front end market?

A. Asia-Pacific radio frequency front end market is anticipated to grow at 14.9% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in the market?

A. Product launch and merger & acquisition are the two key strategies opted by the operating companies in the market.

Q6. Which companies are investing more on R&D practices?

A. Broadcom Inc, Infineon Technologies AG, and Murata Manufacturing Co. Ltd. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global radio frequency front end market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on radio frequency front end market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Radio Frequency Front End Market Analysis, by Type

5.1.Overview

5.2.RF Filters

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.RF Power Amplifiers

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.RF Switches

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2021-2031

5.4.3.Market share analysis, by country, 2021-2031

5.5.Others

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2021-2031

5.5.3.Market share analysis, by country, 2021-2031

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.Radio Frequency Front End Market Analysis, by End Use Industry

6.1.Consumer Electronics

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2021-2031

6.1.3.Market share analysis, by country, 2021-2031

6.2.Automotive Systems

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Wireless Networks

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Military

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2021-2031

6.4.3.Market share analysis, by country, 2021-2031

6.5.Others

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region, 2021-2031

6.5.3.Market share analysis, by country, 2021-2031

6.6.Research Dive Exclusive Insights

6.6.1.Market attractiveness

6.6.2.Competition heatmap

7.Radio Frequency Front End Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type, 2021-2031

7.1.1.2.Market size analysis, by End Use Industry, 2021-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Type, 2021-2031

7.1.2.2.Market size analysis, by End Use Industry, 2021-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Type, 2021-2031

7.1.3.2.Market size analysis, by End Use Industry, 2021-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type, 2021-2031

7.2.1.2.Market size analysis, by End Use Industry, 2021-2031

7.2.2.UK

7.2.2.1.Market size analysis, by Type, 2021-2031

7.2.2.2.Market size analysis, by End Use Industry, 2021-2031

7.2.3.France

7.2.3.1.Market size analysis, by Type, 2021-2031

7.2.3.2.Market size analysis, by End Use Industry, 2021-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Type, 2021-2031

7.2.4.2.Market size analysis, by End Use Industry, 2021-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Type, 2021-2031

7.2.5.2.Market size analysis, by End Use Industry, 2021-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type, 2021-2031

7.2.6.2.Market size analysis, by End Use Industry, 2021-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type, 2021-2031

7.3.1.2.Market size analysis, by End Use Industry, 2021-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Type, 2021-2031

7.3.2.2.Market size analysis, by End Use Industry, 2021-2031

7.3.3.India

7.3.3.1.Market size analysis, by Type, 2021-2031

7.3.3.2.Market size analysis, by End Use Industry, 2021-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Type, 2021-2031

7.3.4.2.Market size analysis, by End Use Industry, 2021-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type, 2021-2031

7.3.5.2.Market size analysis, by End Use Industry, 2021-2031

7.3.6.Rest of Asia-Pacific

7.3.6.1.Market size analysis, by Type, 2021-2031

7.3.6.2.Market size analysis, by End Use Industry, 2021-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type, 2021-2031

7.4.1.2.Market size analysis, by End Use Industry, 2021-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type, 2021-2031

7.4.2.2.Market size analysis, by End Use Industry, 2021-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Type, 2021-2031

7.4.3.2.Market size analysis, by End Use Industry, 2021-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type, 2021-2031

7.4.4.2.Market size analysis, by End Use Industry, 2021-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type, 2021-2031

7.4.5.2.Market size analysis, by End Use Industry, 2021-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Broadcom Inc

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Infineon Technologies AG

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Murata Manufacturing Co. Ltd

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.NXP Semiconductors N.V

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Qorvo Inc

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Skyworks Solutions, Inc.

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.STMicroelectronics N.V.

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Taiyo Yuden Co.

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.Murata Manufacturing Co., Ltd.

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Analog Devices, Inc.

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

A radio frequency front end, also called RF front end, is an all-encompassing term used to refer the complete circuitry from the mixer stage to the receiver antenna of the radio receiver circuit. A typical RF front end consists of a band-pass filter to cut down image response, an RF amplifier for amplifying weak incoming signals at the receiver, a local oscillator to generate a radio frequency signal, and a mixer to combine the incoming signal and the signal from the local oscillator. RF front end systems are mostly used in wireless consumer electronics goods and smart devices.

Forecast Analysis of Radio Frequency Front End Market

According to the report published by Research Dive, the global radio frequency front end market is expected to gather a revenue of $69,926.4 million by 2031 and grow at 14.2% CAGR in the 2022–2031 timeframe.

In recent years, there has been a steady increase in the adoption of smart consumer electronics products which is predicted to be the primary growth driver of the radio frequency front end market in the forecast period. Additionally, increasing prevalence of next generation wireless networks is anticipated to push the market forward. Along with this, increasing use of radio frequency front end in 3G and 4G technology is projected to offer numerous growth and investment opportunities to the market in the analysis timeframe. However, the complex nature of RF antenna designs is estimated to create hurdles in the full-fledged growth of the radio frequency front end market in the coming period.

Regionally, the radio frequency front end market in the Asia-Pacific region is expected to be the most dominant by 2031. Growing demand for RF front end systems from the consumer electronics manufacturing industries of developing economies like India and China is expected to be the leading factor behind the growth of the market in this region.

Some prominent market players include Broadcom Inc., Qorvo Inc., Taiyo Yuden Co., Infineon Technologies AG., Skyworks Solutions, Inc., Murata Manufacturing Co., Ltd., Murata Manufacturing Co. Ltd., STMicroelectronics N.V., Analog Devices, Inc., NXP Semiconductors N.V., and many others.

Covid-19 Impact on the Radio Frequency Front End Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The radio frequency front end market, too, faced a negative impact of the pandemic. The disruptions in the global supply chains immensely affected the consumer electronics manufacturing industries which led to a decline in demand for RF front end systems. At the same time, the supply of RF front end systems was also hampered due to lack of availability of raw materials. All these factors collectively brought down the growth rate of the market.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the radio frequency front end market to flourish. For instance:

- In August 2021, Knowles, a precision device solutions provider, announced the acquisition of Integrated Microwave Corporation, an RF filter manufacturing company. This acquisition is expected to play a huge role in helping Knowles to achieve its aim of expanding its global business.

- In September 2021, Linwave Technology, an RF technology specialist, announced a collaboration with Marki Microwave, a global leader in the RF and microwave industry. This collaboration is aimed at developing switched filter bank solutions specifically designed for defense contractors. The collaboration is anticipated to help both the companies to increase their footprint in the radio frequency front end market in the near future.

- In October 2021, Akoustis, a BAW RF solutions provider, announced the acquisition of RFM Integrated Device, Inc., a leading manufacturer of radio frequency (RF) components. This acquisition is expected to boost the market share of the acquiring company, i.e., Akoustis significantly.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com