Green Packaging Market Report

RA08577

Green Packaging Market by Packaging Type (Recyclable, Reusable, and Degradable), Application (Food and Beverage Industry, Pharmaceuticals and Healthcare, Personal Care, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Green Packaging Market Analysis

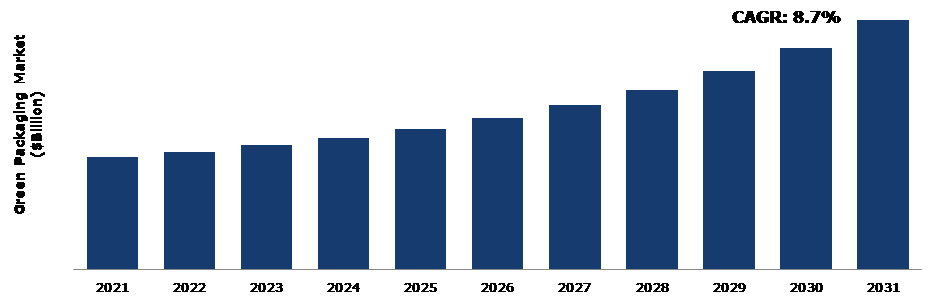

The Global Green Packaging Market size was $253.8 billion in 2021 and is predicted to grow with a CAGR of 8.7%, by generating a revenue of $561.6 billion by 2031.

Global Green Packaging Market Synopsis

There has been an increase in consumer awareness and demand for sustainable products that are eco-friendly and environmentally sustainable in the past few years. This has led to a rise in demand for green packaging solutions that reduce waste and are recyclable. As consumers become more environmentally conscious, they are preferring products that have a lower environmental impact, including packaging. In response to this, many companies are investing in green packaging solutions, including biodegradable materials, compostable packaging, and reusable containers. These solutions not only help to reduce waste but also help to improve the sustainability of the entire supply chain. Therefore, the green packaging market is expected to continue to grow as more companies adopt sustainable packaging solutions to meet consumer demand. These factors are anticipated to boost the green packaging industry growth in the upcoming years.

However, the lack of government initiatives such as recycling subsidies particularly in developing countries is expected to hinder the market growth. Also, natural disasters such as floods, tornadoes, and earthquakes have an impact on the availability of raw materials for bioplastic and biodegradable packaging solutions because these raw materials are often generated from fruits and vegetables. In addition to production costs, the mechanical strength of bioplastics is lower than that of their petrochemical-based counterparts, which is expected to restrict the market growth in the future.

Governments of various countries are increasingly implementing green procurement policies, which require public agencies to prioritize sustainable products and services in their procurement processes. This is driving the demand for green packaging solutions in the public sector. Some governments are implementing eco-labeling schemes, which provide information to consumers about the environmental impact of products and packaging. This is driving the demand for packaging that can be labeled as eco-friendly. Moreover, governments are implementing taxes on carbon emissions, which incentivizes companies to reduce their carbon footprint. All of these factors are predicted to create significant growth opportunities for the key players operating in the green packaging market.

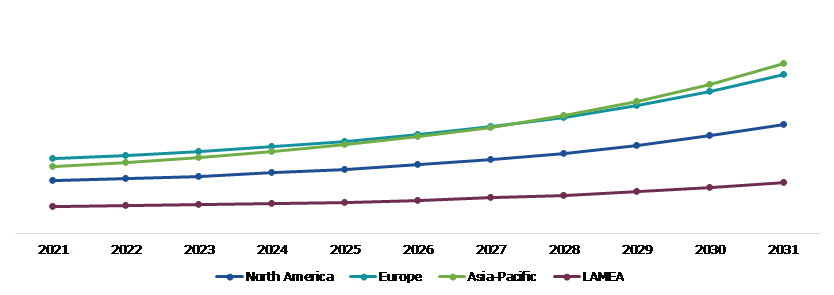

According to regional analysis, the Europe green packaging market accounted for the highest market share in 2021. Europe is the world's largest market for green packaging due to stringent regulations imposed by the European Union and other European countries concerning the use of single-use plastics. The European Directive introduced the concept of a circular economy, along with sustainability guidelines and goals.

Green Packaging Market Overview

Green packaging refers to the use of environmentally friendly, sustainable materials and products that have a minimal impact on the environment throughout their lifecycle. Green packaging aims to reduce the use of nonrenewable resources, waste, and the packaging industry's carbon footprint. Green packaging can be achieved in a variety of ways, including the use of recycled materials, biodegradable plastics, sustainable materials like bamboo or sugarcane, and other environmentally friendly solutions. Food & beverage packaging, cosmetics & personal care products, electronics, and other products are expected to benefit from green packaging.

COVID-19 Impact on Global Green Packaging Market

The COVID-19 pandemic had a moderate impact on the green packaging market. During the pandemic, people shifted their shopping preferences from offline shopping to online shopping. Moreover, e-commerce companies use paper-based packaging for delivering products. Furthermore, the COVID-19 pandemic brought several uncertainties, leading to severe economic losses as various businesses across the world were standstill. The outbreak led to a rise in demand for green packaged products, such as beverages, as consumers stocked up on essential goods. The global green packaging market witnessed significant growth due to the rise in demand for safe, hygienic, and disposable packaging. As a result of many governments' lockdown restrictions, countries around the globe shifted to online shopping for both essential and non-essential goods.

Governments across the globe had implemented lockdowns due to the high rate of coronavirus transmission and the prevalence of serious symptoms. Therefore, numerous industries stopped operating their industrial facilities, which resulted in a sharp decline in the need for green packaging materials for product packaging. This further reduced the market share growth for green packaging during the pandemic period. Therefore, the majority of the e-commerce platforms, including Amazon, Flipkart, and others increased their focus on the use of protective packaging. Many companies have increased their production capabilities to meet the growing demand for green packaging. The COVID-19 pandemic had both positively and negatively impacted the green packaging market. Companies in the green packaging industry have responded to these challenges by developing innovative and sustainable solutions that can meet the demand for packaging while minimizing their environmental impact.

Increase in Awareness Regarding the Negative Environmental Effects of Plastic and Other Non-Biodegradable Materials to Drive the Market Growth

Green packaging has immense applications across day-to-day products. For instance, the increase in awareness about the environmental impact of plastic and other non-biodegradable materials has led to a rise in demand for green packaging. Consumers are increasingly looking for sustainable and eco-friendly products, and green packaging is considered as an effective way to reduce the amount of waste generated. Green packaging offers several benefits over traditional packaging materials. Green packaging also reduces the amount of waste generated by products, as it can be easily recycled or composted. In addition, it helps businesses reduce their carbon footprint and meet their sustainability goals. There has been a significant shift towards the use of green packaging in recent years. Companies are now investing in sustainable packaging solutions to meet the growing demand for eco-friendly products. This has led to the development of new and innovative packaging materials and designs that are both functional and environmentally friendly. These are the major factors projected to drive the green packaging market growth during the forecast period.

To know more about global green packaging market drivers, get in touch with our analysts here.

High Cost of Raw Materials to Restrain the Green Packaging Market Growth

The high cost of raw materials used to manufacture food packaging cartons is projected to hamper the green packaging market growth. Raw materials used in the production of green packaging can vary depending on the type of packaging, the intended use, and the market demand. Sustainable packaging materials are usually more expensive than traditional materials, making it difficult for businesses to implement green packaging practices while remaining competitive in their pricing. The cost of these materials can fluctuate depending on factors such as supply and demand, transportation costs, and government regulations. These are the major factors anticipated to hamper the green packaging market growth during the forecast period.

Growing Demand for Sustainable Packaging to Drive Excellent Opportunities in the Market

Sustainable packaging is becoming increasingly important in the packaging industry as consumers demand environmentally friendly products. Consumers are increasingly looking for eco-friendly and sustainable products, and packaging is no exception. Sustainable packaging options like biodegradable, compostable, and reusable packaging are becoming more popular in the industry. Also, sustainable packaging options can often be cost-effective in the long run. For example, reusable packaging can reduce the need for constant replacements and save money on shipping costs. Sustainable packaging options help to reduce waste, conserve resources, and minimize the environmental impact of packaging. Many countries and regions are implementing regulations and policies to reduce the use of single-use plastics and promote sustainable packaging. The sustainable and green packaging market presents a range of opportunities for companies to meet customer demand, save costs, differentiate themselves, comply with regulations, and reduce their environmental impact. All these factors are projected to create several growth opportunities for the major players operating in the market during the forecast period.

To know more about global green packaging market opportunities, get in touch with our analysts here.

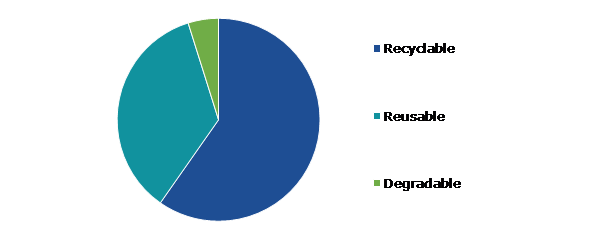

Global Green Packaging Market, by Packaging Type

Based on packaging type, the market has been divided into recyclable, reusable, and degradable. Among these, the recyclable sub-segment accounted for the highest market share in 2021 and is estimated to show the fastest growth during the forecast period.

Global Green Packaging Market Size, by Packaging Type, 2021

Source: Research Dive Analysis

The recyclable sub-segment accounted for the highest market share in 2021 and is anticipated to show the fastest growth by 2031. Recycled content packaging makes better use of environmentally friendly techniques and resources. It is made up of a variety of materials such as paper, plastic, metal, glass, and others. These materials are reused as raw materials by manufacturers to create new packaging products, reducing excess pollution produced by packaging waste. Efforts by industry groups, brand owners, packaging companies, and others to promote sustainability programs aimed at increasing recycling rates of several types of packaging materials are expected to benefit the segment growth.

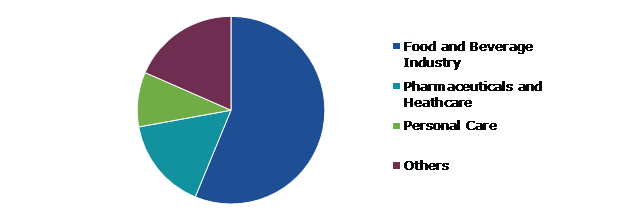

Global Green Packaging Market, by Application

Based on application, the market has been divided into food & beverage industry, pharmaceuticals and healthcare, personal care, and others. Among these, the food and beverage industry sub-segment accounted for the highest revenue share in 2021.

Global Green Packaging Market Growth, by Application, 2021

Source: Research Dive Analysis

The food & beverage industry sub-segment accounted for the highest market share in 2021. Many restaurants, fast food chains, packaged food companies, and casual dining venues are adopting molded pulp packaging and compostable packaging, which is expected to drive the food and beverages segment growth. Convenience food is driving the demand for food and beverage packaging owing to its portability, long shelf life, and ease of manufacturing. Frozen foods, snacks, finger foods, beverages, and other items are examples of convenience foods. Food products are typically served in hot, ready-to-go containers and require less preparation time. Consumers' hectic lifestyles, combined with the geriatric population, have resulted in the high use of convenience food.

Global Green Packaging Market, Regional Insights

The green packaging market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Green Packaging Market Size & Forecast, by Region, 2021-2031 (USD Billion)

Source: Research Dive Analysis

The Market for Green Packaging in Europe was the Most Dominant

The Europe green packaging market accounted for the highest market share in 2021. Stringent government regulations governing the use of single-use plastics, as well as increased awareness about sustainability, have boosted the demand for green packaging across Europe. Government initiatives to encourage the use of green packaging solutions are a major factor driving the growth of the Europe green packaging market. Technological advancements and the implementation of stringent government regulations in various countries such as Germany, the UK, Italy, and France are expected to drive the regional market growth in the upcoming years.

Competitive Scenario in the Global Green Packaging Market

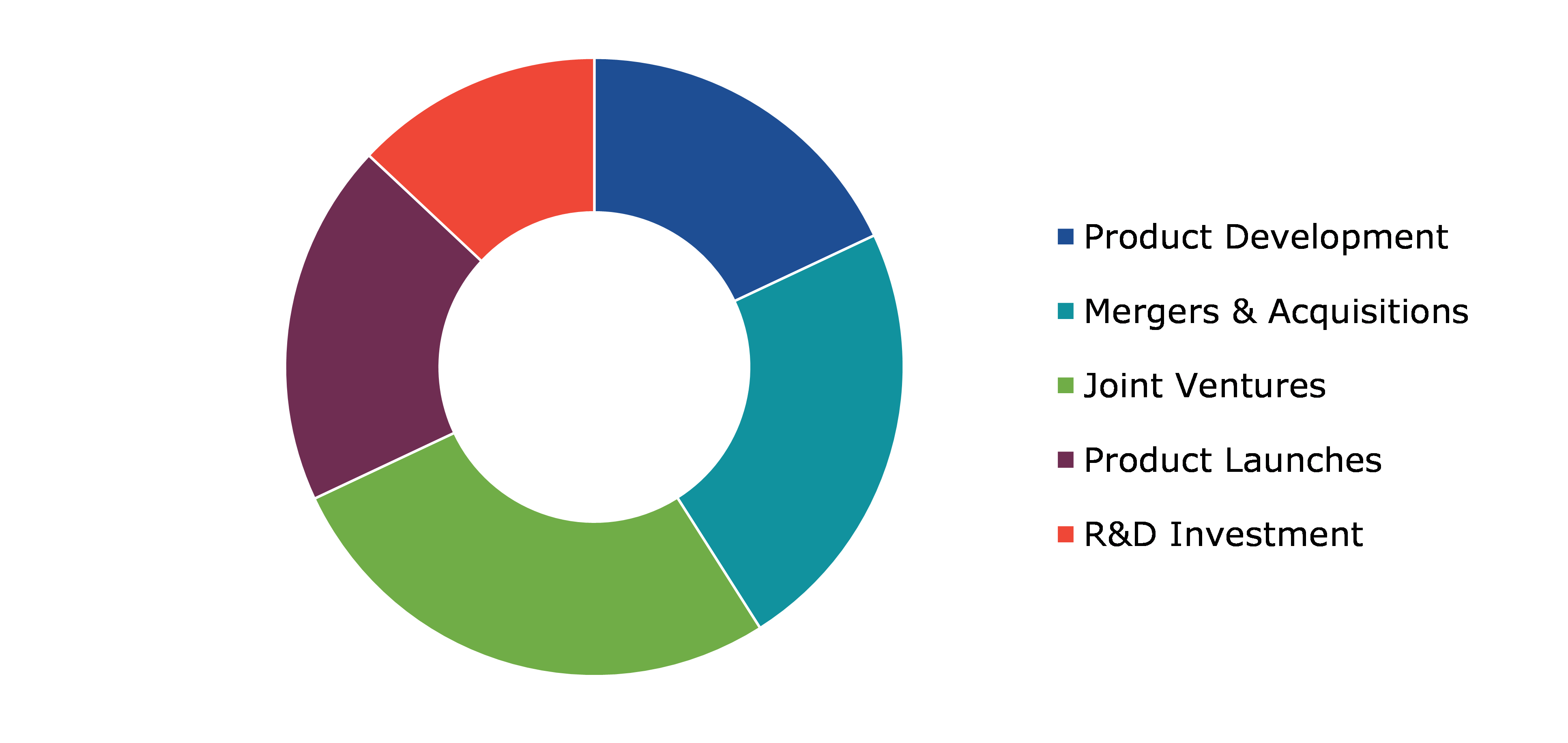

Investment and agreement are common strategies followed by major market players. For instance, in October 2019, L’Oréal announced the development of the first cosmetic tube made of paper to reduce the environmental impact of packaging.

Source: Research Dive Analysis

Some of the leading green packaging market players are Amcor, Tetra Laval, DuPont, Evergreen Packaging, Mondi, DS Smith, Nampak, Ball Corp., Sealed Air, and Be Green Packaging.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Packaging Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global green packaging market?

A. The size of the global green packaging market was over $253.8 billion in 2021 and is projected to reach $561.6 billion by 2031.

Q2. Which are the major companies in the green packaging market?

A. Amcor, Tetra Laval, and DuPont are some of the key players in the global green packaging market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific green packaging market?

A. Asia-Pacific green packaging market is anticipated to grow at 10.2% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Amcor, Tetra Laval, and DuPont are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

3.Overview of the impact of COVID-19 on the global Green Packaging market

4.Executive Summary

5.Market Overview

5.1.Introduction

5.2.Growth impact forces

5.2.1.Drivers

5.2.2.Restraints

5.2.3.Opportunities

5.3.Market value chain analysis

5.3.1.List of raw material suppliers

5.3.2.List of manufacturers

5.3.3.List of distributors

5.4.Innovation & sustainability matrices

5.4.1.Technology matrix

5.4.2.Regulatory matrix

5.5.Porter’s five forces analysis

5.5.1.Bargaining power of suppliers

5.5.2.Bargaining power of consumers

5.5.3.Threat of substitutes

5.5.4.Threat of new entrants

5.5.5.Competitive rivalry intensity

5.6.PESTLE analysis

5.6.1.Political

5.6.2.Economical

5.6.3.Social

5.6.4.Technological

5.6.5.Environmental

6.Impact of COVID-19 on the Green Packaging market

6.1.1.Pre-covid market scenario

6.1.2.Post-covid market scenario

7.Green Packaging Market Analysis, by Packaging Type

7.1.Overview

7.2.Recyclable

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2021-2031

7.2.3.Market share analysis, by country, 2021-2031

7.3.Reusable

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2021-2031

7.3.3.Market share analysis, by country, 2021-2031

7.4.Degradable

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region, 2021-2031

7.4.3.Market share analysis, by country, 2021-2031

7.5.Research Dive Exclusive Insights

7.5.1.Market attractiveness

7.5.2.Competition heatmap

8.Green Packaging Market Analysis, by Application

8.1.Food and Beverage Industry

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region, 2021-2031

8.1.3.Market share analysis, by country, 2021-2031

8.2.Pharmaceuticals and Healthcare

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region, 2021-2031

8.2.3.Market share analysis, by country, 2021-2031

8.3.Personal Care

8.3.1.Definition, key trends, growth factors, and opportunities

8.3.2.Market size analysis, by region, 2021-2031

8.3.3.Market share analysis, by country, 2021-2031

8.4.Others

8.4.1.Definition, key trends, growth factors, and opportunities

8.4.2.Market size analysis, by region, 2021-2031

8.4.3.Market share analysis, by country, 2021-2031

8.5.Research Dive Exclusive Insights

8.5.1.Market attractiveness

8.5.2.Competition heatmap

9.Green Packaging Market, by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Packaging Type, 2021-2031

9.1.1.2.Market size analysis, by Application, 2021-2031

9.1.2.Canada

9.1.2.1.Market size analysis, by Packaging Type, 2021-2031

9.1.2.2.Market size analysis, by Application, 2021-2031

9.1.3.Mexico

9.1.3.1.Market size analysis, by Packaging Type, 2021-2031

9.1.3.2.Market size analysis, by Application, 2021-2031

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Packaging Type, 2021-2031

9.2.1.2.Market size analysis, by Application, 2021-2031

9.2.2.UK

9.2.2.1.Market size analysis, by Packaging Type, 2021-2031

9.2.2.2.Market size analysis, by Application, 2021-2031

9.2.3.France

9.2.3.1.Market size analysis, by Packaging Type, 2021-2031

9.2.3.2.Market size analysis, by Application, 2021-2031

9.2.4.Spain

9.2.4.1.Market size analysis, by Packaging Type, 2021-2031

9.2.4.2.Market size analysis, by Application, 2021-2031

9.2.5.Italy

9.2.5.1.Market size analysis, by Packaging Type, 2021-2031

9.2.5.2.Market size analysis, by Application, 2021-2031

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Packaging Type, 2021-2031

9.2.6.2.Market size analysis, by Application, 2021-2031

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia-Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Packaging Type, 2021-2031

9.3.1.2.Market size analysis, by Application, 2021-2031

9.3.2.Japan

9.3.2.1.Market size analysis, by Packaging Type, 2021-2031

9.3.2.2.Market size analysis, by Application, 2021-2031

9.3.3.India

9.3.3.1.Market size analysis, by Packaging Type, 2021-2031

9.3.3.2.Market size analysis, by Application, 2021-2031

9.3.4.Australia

9.3.4.1.Market size analysis, by Packaging Type, 2021-2031

9.3.4.2.Market size analysis, by Application, 2021-2031

9.3.5.South Korea

9.3.5.1.Market size analysis, by Packaging Type, 2021-2031

9.3.5.2.Market size analysis, by Application, 2021-2031

9.3.6.Rest of Asia-Pacific

9.3.6.1.Market size analysis, by Packaging Type, 2021-2031

9.3.6.2.Market size analysis, by Application, 2021-2031

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Packaging Type, 2021-2031

9.4.1.2.Market size analysis, by Application, 2021-2031

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Packaging Type, 2021-2031

9.4.2.2.Market size analysis, by Application, 2021-2031

9.4.3.UAE

9.4.3.1.Market size analysis, by Packaging Type, 2021-2031

9.4.3.2.Market size analysis, by Application, 2021-2031

9.4.4.South Africa

9.4.4.1.Market size analysis, by Packaging Type, 2021-2031

9.4.4.2.Market size analysis, by Application, 2021-2031

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Packaging Type, 2021-2031

9.4.5.2.Market size analysis, by Application, 2021-2031

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1.Amcor

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2.Tetra Laval

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3.DuPont

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4.Evergreen Packaging

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5.Mondi

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6.DS Smith

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.Nampak

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8. Ball Corp.

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.Sealed Air

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10.Be Green Packaging

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

In today’s world, environmental concerns are at an all-time high. Consumers are becoming increasingly aware of their impact on the environment and are demanding more sustainable products. Green packaging is becoming increasingly popular as consumers seek to reduce their carbon footprint. This type of packaging is designed to reduce the environmental impact of packaging by minimizing waste, reducing energy consumption, and using sustainable materials. Green packaging can take many forms, including biodegradable packaging, compostable packaging, recyclable packaging, and reusable packaging.

One of the most important aspects of green packaging is its use of sustainable materials. Traditional packaging materials such as plastics and metals are not sustainable as they are made from non-renewable resources and are not biodegradable. On the other hand, green packaging uses materials such as paper, cardboard, and biodegradable plastics. These materials are renewable, biodegradable, and compostable, which means they can be easily broken down by natural processes and returned to the environment. Apart from various environmental benefits, green packaging can also help to improve brand image and customer loyalty. In addition, green packaging can also help to reduce costs by reducing the amount of material used, reducing shipping costs, and improving efficiency.

Forecast Analysis of the Global Green Packaging Market

According to the report published by Research Dive, the global green packaging market is anticipated to garner a revenue of $561.6 billion and grow at a CAGR of 8.7% during the analysis timeframe from 2022 to 2031. The increasing awareness about the adverse environmental effects of plastics and other non-biodegradable materials among consumers across the globe is expected to bolster the growth of the green packaging market over the estimated period. Besides, the increasing investment in sustainable environmental solutions by leading companies to reduce their carbon footprint and meet sustainability goals is predicted to fuel the growth of the market during the forecast period. Moreover, the growing demand for sustainable packaging among consumers worldwide is expected to create wide growth opportunities for the green packaging market over the estimated timeframe. However, the high cost of raw materials used to manufacture food packaging cartons may impede the growth of the market over the analysis period.

The major players of the green packaging market include Mondi, Nampak, DS Smith, Evergreen Packaging, Ball Corp., DuPont, Sealed Air, Tetra Laval, Be Green Packaging, Amcor, and many more.

Key Developments of the Green Packaging Market

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global green packaging market to grow exponentially. For instance:

- In September 2022, Huhtamaki, a Finnish consumer packaging company announced its acquisition of Elif Holding A.S., a leading supplier of sustainable flexible packaging. With this acquisition, Huhtamaki aimed to strengthen its position as a renowned flexible packaging company in growing markets and expand its business by providing attractive consumer product categories.

- In March 2023, Parason, one of the biggest manufacturers and suppliers of pulp and paper machinery announced its collaboration with ABB, a pioneering technology leader. With this collaboration, the companies aimed to automate and scale up the manufacturing of sustainable and compostable packaging solutions. These solutions would be used across various industries including restaurants and cafes, transport, food catering, industry canteens, and many more.

- In January 2023, Cascades, a leading Canadian company that produces, converts, and markets packaging and tissue products announced the launch of its new closed basket which is prepared from recyclable and recycled cardboard. This product is the latest addition of Cascades in the line of eco-friendly packaging.

Most Profitable Region

The Europe region of the green packaging market generated the highest revenue in 2021. This is mainly due to the strict government regulations on the use of single-use plastics along with increased awareness about sustainability in this region. Moreover, the increasing government initiatives on the use of green packaging solutions and the growing technological advancements across the region are expected to boost the regional growth of the market over the estimated timeframe.

Covid-19 Impact on the Green Packaging Market

Though the rise of the Covid-19 pandemic has devastated several industries, it has had a moderate impact on the green packaging market. The growing shift in preferences of consumers from offline shopping to online one and the growing use of paper-based packaging by e-commerce companies for delivering products have increased the demand for green packaging solutions during the pandemic. Moreover, the growing demand for safe, hygienic, and disposable packaging has further inclined the growth of the market over the crisis. However, the government-imposed lockdowns due to the spread of the deadly virus, and the shutdown of various industries have affected the green packaging market growth to some extent over that period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com