Wine Chocolate Market Report

RA08539

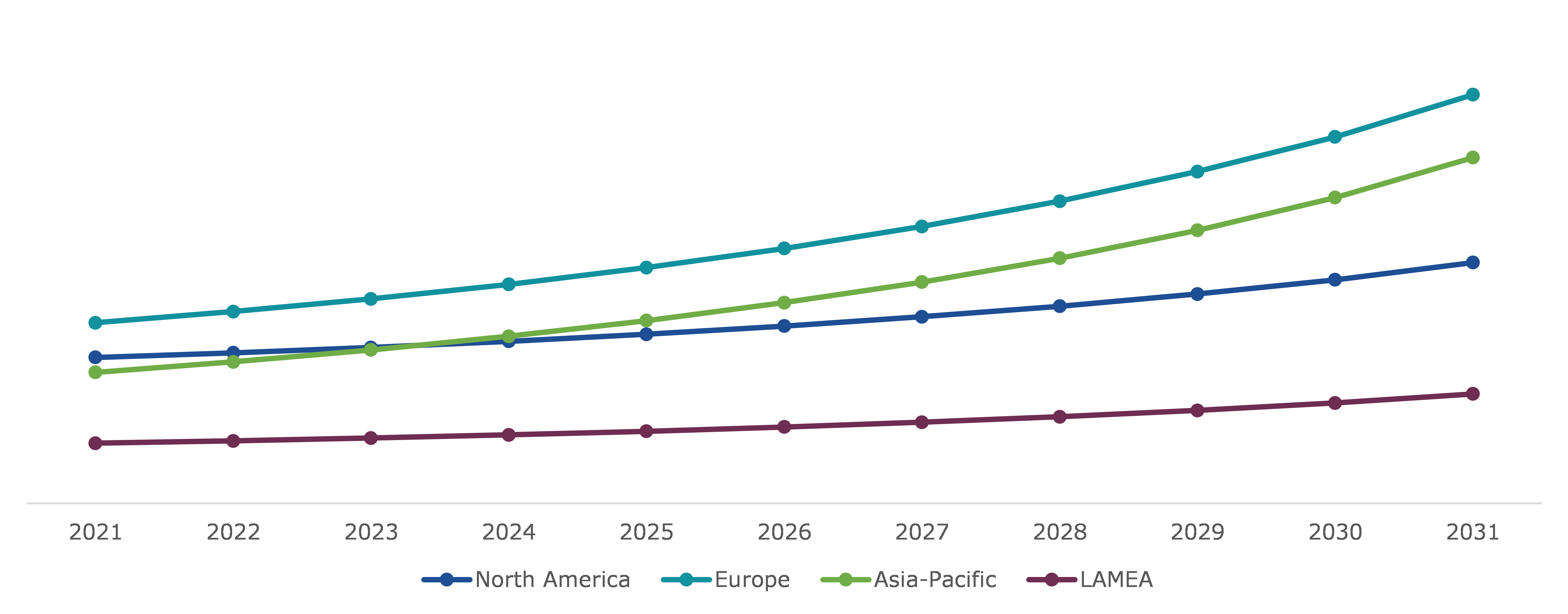

Wine Chocolate Market by Product Form (Solid and Liquid), Wine Type (Red Wine and White Wine), Sales Channel (Super Market/Hyper Markets, Convenience Stores & Specialty Stores, and Online), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Wine Chocolate Market Analysis

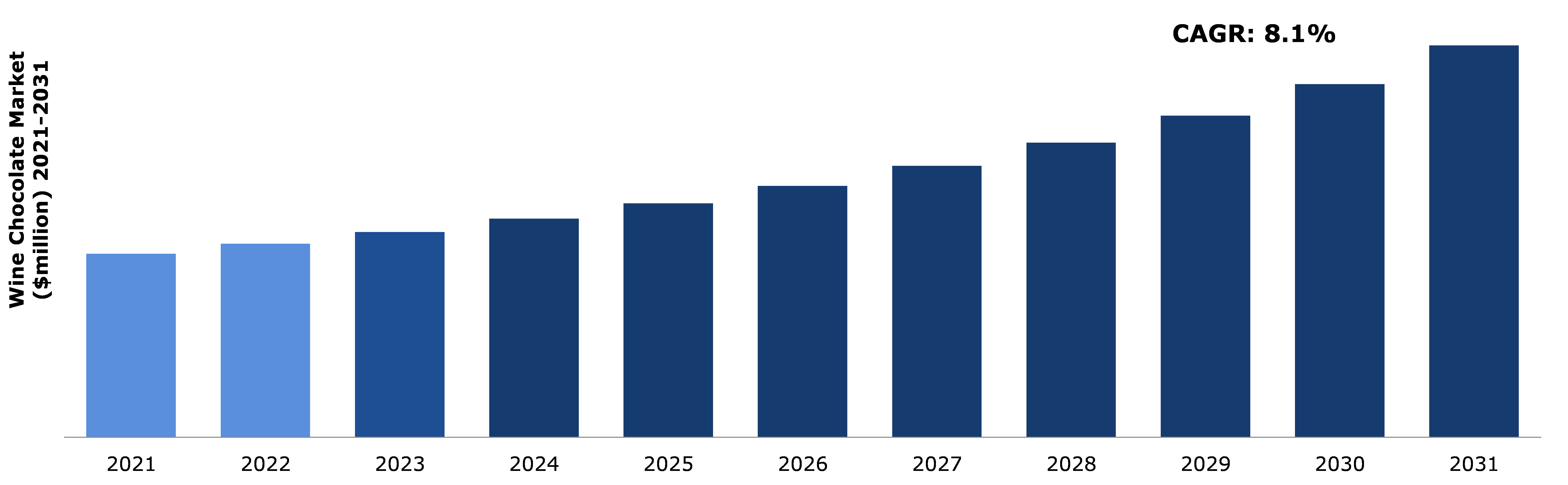

The Global Wine Chocolate Market Size is estimated to generate a revenue of $1,621.4 million by 2031, increasing from $759.6 million in 2021, at a noteworthy CAGR of 8.1%.

Market Synopsis

However, lack of knowledge about the beneficial health effects of consuming wine chocolate among people is expected to restrain the wine chocolate market growth. Moreover, many people avoid consuming any alcoholic product due to their religious and cultural beliefs, which is further expected to hamper the wine chocolate market in during the forecast period.

The demand for an exclusive range of wine chocolates is increasing among people, especially young and middle-aged consumers. They regard wine chocolates and other customized chocolate flavors as a pleasing gift on several occasions in the corporate world. This increase in demand for customized chocolate products is likely to fuel the market growth in the next few years.

According to the regional analysis of the market, the Europe wine chocolate market is anticipated to grow at a significant CAGR. The preference and consumption of wine chocolates among people in European countries is one of the major factors driving the wine chocolates market during the forecast time period.

Wine Chocolate Overview

Wine chocolates have become popular among people due to their high antioxidant content, which helps to improve their health and wellbeing. Wine is added in proper quantity, either red wine or white wine, during the chocolate-making process to create wine chocolates. Wine chocolate is great option for giving as gifts during various holidays including Thanksgiving and Christmas.

COVID-19 Impact on the Global Wine Chocolate Market

The occurrence of COVID-19 pandemic declined the growth of wine chocolate market. As the impact of COVID-19 pandemic had a severe impact on the health and wellbeing of the people across the world, the demand and production of wine chocolate has decreased unexpectedly. Amid high rate of corona virus transmission and prevalence of serious symptoms, worldwide restrictions and lockdown were imposed due to which the supply of raw ingredients such as grapes, wine, and cocoa to the confectionery industries was hampered. This factor had a negative impact on the growth of the wine chocolate market during the pandemic. Consumer behavior has undoubtedly changed over the previous two years as a result of lockdown. It was observed that the consumer demand for chocolates has increased and may have even switch toward higher quality chocolate goods. However, the manufacturers still attempted to grasp the change in consumer purchasing behavior, however their manufacturing capabilities were not able to fulfill their customer’s demands.

Surge in Awareness about the Health Benefits of Wine Chocolate to Boost the Market Growth

Wine chocolate market share is expected to increase during the forecast period due to rising consumer awareness of the benefits of its consumption on health. Since it is made of fruits such as grapes and cocoa, wine chocolate has several health benefits, which include improving heart health, lowering blood pressure, and strengthening brain health. Wine chocolates are abundant in polyphenol, vitamin A, B, E, and C as well as trace minerals including potassium and magnesium. These components significantly contribute to raising a person's immunity levels. In addition, the red wine chemical resveratrol aids in the prevention of diseases including cancer and heart problems. Furthermore, the market for wine chocolate is expected to grow in the next few years due to the younger generation's preference for flavored chocolates, both for personal consumption and as gifts for friends and family.

To know more about global wine chocolate market drivers, get in touch with our analysts here.

High Cost of Wine Chocolates to Restrain the Market Growth

Wine chocolates are particularly expensive as they are made with two premium ingredients: cocoa and wine. many cultures do not think of wine as a good drink to consume, thus they choose to stay away from wine-flavored chocolates. In the upcoming years, it is also projected that these issues can limit the growth of the wine chocolate market.

Development of Product Portfolio by Major Companies to Fuel the Market Growth

Wine chocolate market growth is anticipated to be fueled by new product releases and improvements to currently available wine chocolate products. To satisfy the growing demand for nutrient-dense and tasty wine chocolates, major market participants in the industry have begun concentrating on creating and releasing new goods. For instance, according to a news published on the official site of Cargill, a leading American global food organization, in August 2021, the company acquired a Singapore-based chocolate manufacturing company Aalst to expand its wine chocolate product portfolio in Asia-Pacific. This acquisition boosted Cargill’s cocoa products sales and helped the company to understand & follow the region’s retail business and customer insights, preferences, and ongoing trends. Thus, the wine chocolate industry is expected to expand in the future.

To know more about global wine chocolate market opportunities, get in touch with our analysts here.

Global Wine Chocolate Market, by Product Form

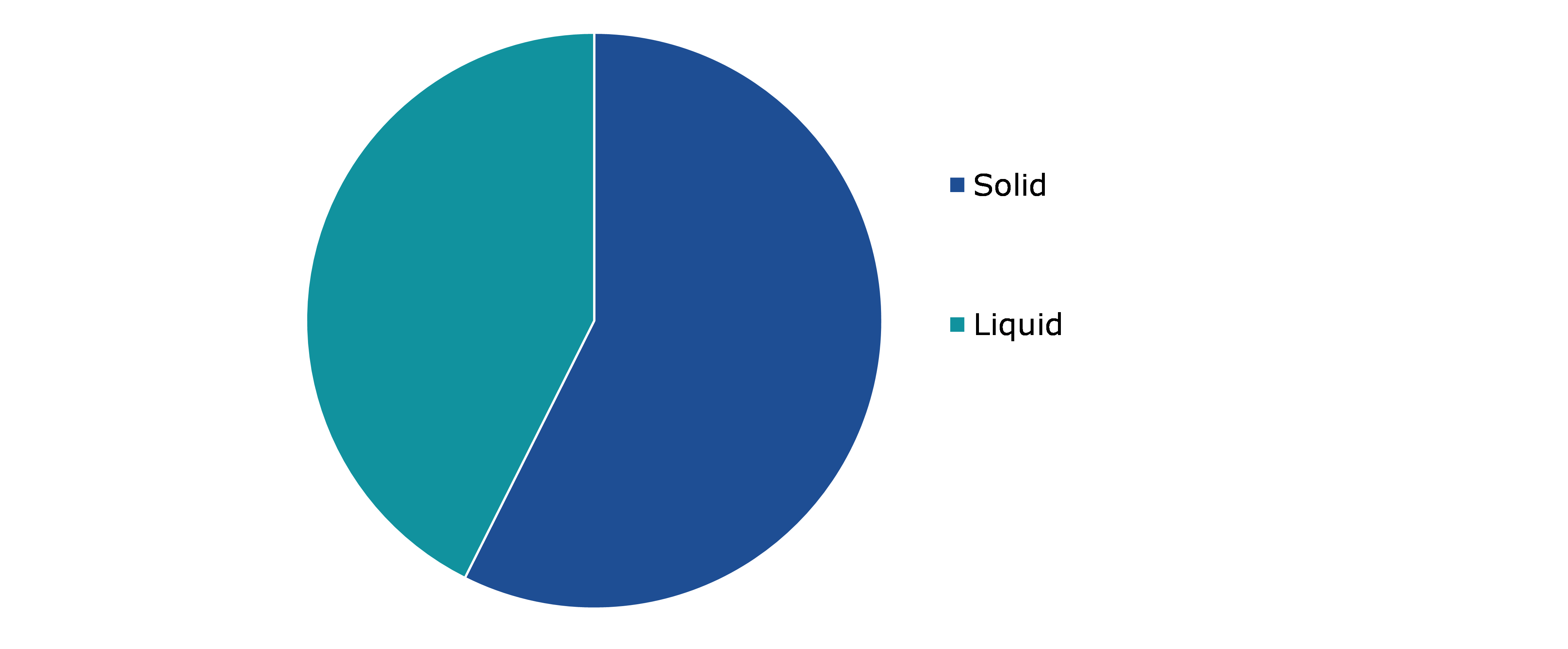

By product form, the wine chocolate market by product form is bifurcated into solid and liquid wine chocolates. Solid segment is projected to generate maximum revenue and liquid wine chocolate is expected to register the fastest growth.

Global Wine Chocolate Market Size, by Product Form, 2021

The solid wine chocolate segment accounted for the highest revenue in the global market in 2021. The increase is attributable to people's growing desire for chocolates in a variety of forms, including bars. In addition, individuals choose to give wine chocolates in their solid form as gifts to friends and family members on special occasions such as weddings and festivals. Such elements are predicted to significantly increase market revenue for wine and chocolate.

The liquid form wine chocolate segment is anticipated to have the fastest growth during the forecast period. The increase in after-dinner dessert demand in western nations such as Europe and America is responsible for the fastest growth.

Global Wine Chocolate Market, by Wine Type

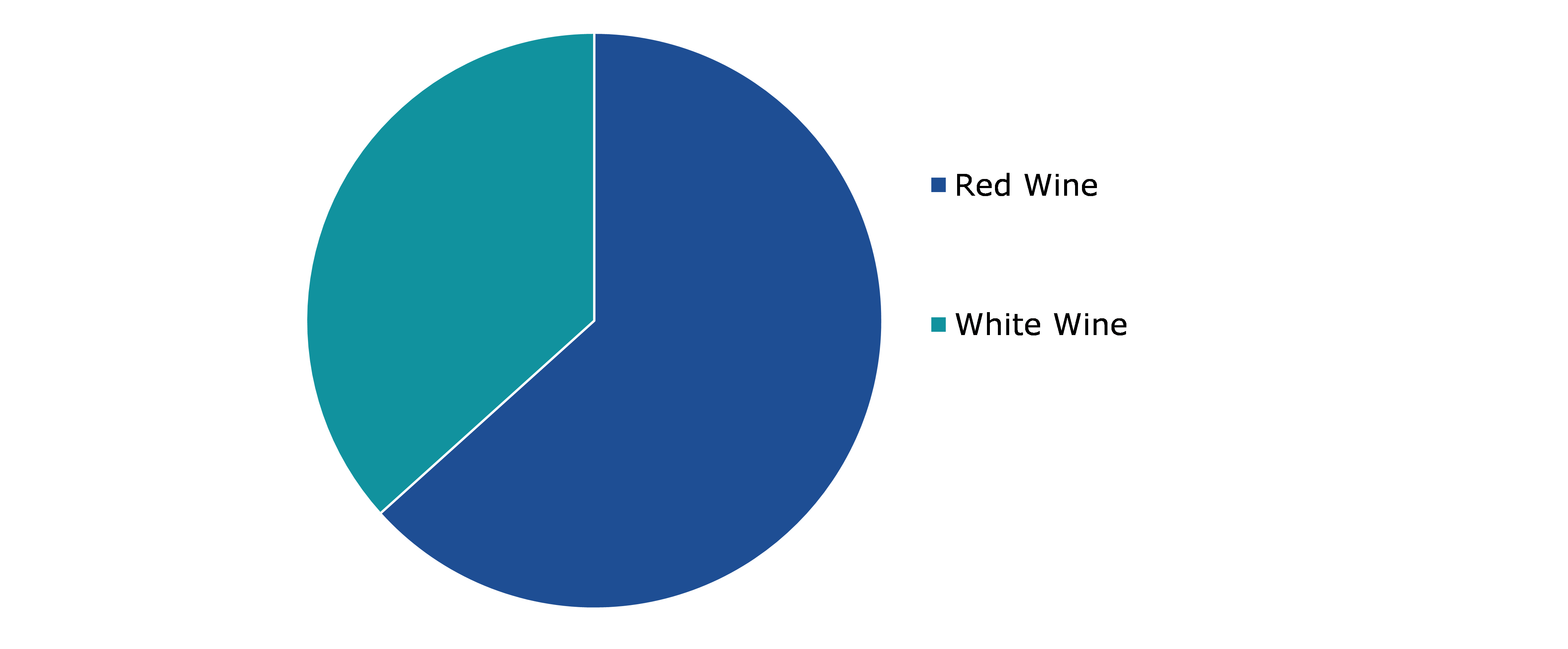

By wine type, the market is divided into red wine and white wine chocolates. Red wine segment is projected to generate both maximum revenue and register the fastest growth.

Global Wine Chocolate Market Share, by Wine Type, 2021

The red wine chocolate segment accounted for the highest revenue in the global market in 2021. Red wine consumption has been increasing globally, which is thought to be the cause of the growth. People in western nations such as Germany and the UK enjoy red wine liqueur. In addition, red wine imparts a distinct flavor to the chocolates that satisfies the taste buds of those who enjoy drinking red wine. Red wine is beneficial for maintaining heart health, which is projected to boost market revenue in the future.

Global Wine Chocolate Market, by Sales Channel

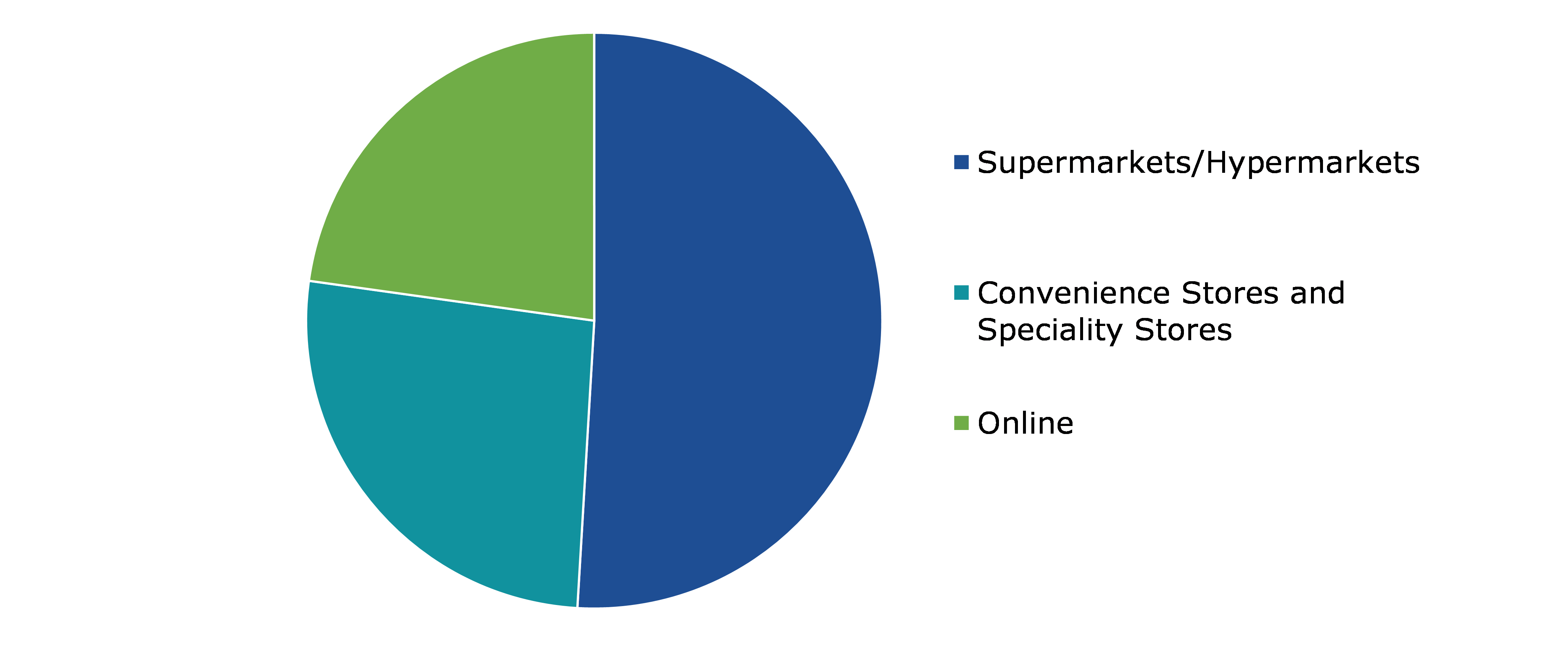

By sales channel, the market is fragmented into supermarket/hypermarkets, convenience stores & specialty stores, and online. Supermarket/hypermarket segment is projected to generate maximum revenue and online segment is anticipated to generate fastest growth.

Global Wine Chocolate Market Growth, by Sales Channel, 2021

The supermarkets/hypermarket segment is predicted to have a dominating market share in the global market in 2021. A vast number of retail establishments around the world are expected to contribute to the segment's future growth. The delight of choosing one's own purchases can be found at supermarkets and hypermarkets. Furthermore, the products are neatly arranged on the shelves, which gives customers a clearer idea of the item they want to purchase. In addition, customers can purchase wine chocolate right away in any form or size they choose. The market expansion in the upcoming years is probably going to be boosted by all of these variables.

Global Wine Chocolate Market, Regional Insights:

The Wine Chocolate market has been analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Wine Chocolate Market Size & Forecast, by Region, 2021-2031 ($Million)

The Market for Wine Chocolate in Europe to be the Most Dominant

The Europe wine chocolate market is expected to have a dominant share in 2021. Major wine and chocolate-producing & consuming nations such as Germany and France are said to be responsible for the growth. People in these nations are more likely to consume nutritious chocolates and confections as they are more concerned with their health. These nations consume the most flavored chocolates and drinks, such as wine chocolate, which are a great source of nutrients. Such factors are anticipated to boost market expansion in the region.

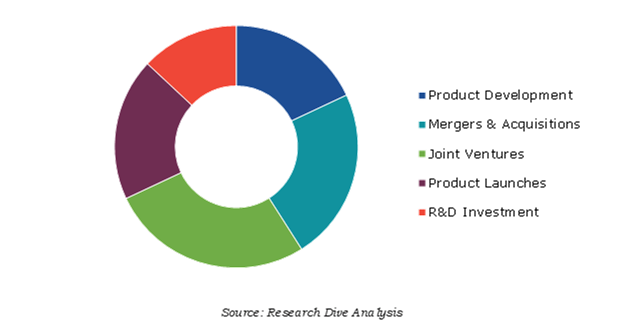

Competitive Scenario in the Global Wine Chocolate Market

Product launches and acquisitions are common strategies followed by major market players.

The companies involved in the wine chocolate market are Underberg AG, Duc d’O, Alfred Ritter, NEUHAUS, Raaka, Toms International, Ferrero S.p.a., Yildiz Holdings, Amedei Tuscany, and Halloren.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Regional Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product Form |

|

| Segmentation by Wine Type |

|

| Segmentation by Sales Channel |

|

| Key Companies Profiled |

|

Q1. Which country captures the largest share of wine chocolate market?

A. Germany captures the largest share of wine chocolate market.

Q2. What is the impact of COVID-19 on the wine chocolate market?

A. Wine chocolate market is expected to experience a negative impact due to prevalence of COVID-19 pandemic.

Q3. What are the key market trends impacting the growth of the wine chocolate market?

A. Rise in the consumption of wine chocolate owing to good health benefits is expected to boost the market growth in future.

Q4. What focused approach and constraints are holding the wine chocolate market?

A. Constant development in wine chocolate product portfolio by companies is likely to drive the market in future whereas a taboo of consuming wine chocolates by people in many countries is likely to impede the market growth.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Wine chocolate market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Wine chocolate market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Wine chocolate Market Analysis, by Product form

5.1.Overview

5.2.Solid

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Liquid

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Wine chocolate Market Analysis, by Wine Type

6.1.Overview

6.2.Red Wine

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.White Wine

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Wine chocolate Market Analysis, by Sales channel

7.1.Supermarkets/Hypermarkets

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2021-2031

7.1.3.Market share analysis, by country, 2021-2031

7.2.Convenience stores/Specialty stores

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2021-2031

7.2.3.Market share analysis, by country, 2021-2031

7.3.Online

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2021-2031

7.3.3.Market share analysis, by country, 2021-2031

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.Wine chocolate Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Product form, 2021-2031

8.1.1.2.Market size analysis, by Wine Type, 2021-2031

8.1.1.3.Market size analysis, by Sales channel, 2021-2031

8.1.2.Canada

8.1.2.1.Market size analysis, by Product form, 2021-2031

8.1.2.2.Market size analysis, by Wine Type, 2021-2031

8.1.2.3.Market size analysis, by Sales channel, 2021-2031

8.1.3.Mexico

8.1.3.1.Market size analysis, by Product form, 2021-2031

8.1.3.2.Market size analysis, by Wine Type, 2021-2031

8.1.3.3.Market size analysis, by Sales channel, 2021-2031

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Product form, 2021-2031

8.2.1.2.Market size analysis, by Wine Type, 2021-2031

8.2.1.3.Market size analysis, by Sales channel, 2021-2031

8.2.2.UK

8.2.2.1.Market size analysis, by Product form, 2021-2031

8.2.2.2.Market size analysis, by Wine Type, 2021-2031

8.2.2.3.Market size analysis, by Sales channel, 2021-2031

8.2.3.France

8.2.3.1.Market size analysis, by Product form, 2021-2031

8.2.3.2.Market size analysis, by Wine Type, 2021-2031

8.2.3.3.Market size analysis, by Sales channel, 2021-2031

8.2.4.Spain

8.2.4.1.Market size analysis, by Product form, 2021-2031

8.2.4.2.Market size analysis, by Wine Type, 2021-2031

8.2.4.3.Market size analysis, by Sales channel, 2021-2031

8.2.5.Italy

8.2.5.1.Market size analysis, by Product form, 2021-2031

8.2.5.2.Market size analysis, by Wine Type, 2021-2031

8.2.5.3.Market size analysis, by Sales channel, 2021-2031

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Product form, 2021-2031

8.2.6.2.Market size analysis, by Wine Type, 2021-2031

8.2.6.3.Market size analysis, by Sales channel, 2021-2031

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Product form, 2021-2031

8.3.1.2.Market size analysis, by Wine Type, 2021-2031

8.3.1.3.Market size analysis, by Sales channel, 2021-2031

8.3.2.Japan

8.3.2.1.Market size analysis, by Product form, 2021-2031

8.3.2.2.Market size analysis, by Wine Type, 2021-2031

8.3.2.3.Market size analysis, by Sales channel, 2021-2031

8.3.3.India

8.3.3.1.Market size analysis, by Product form, 2021-2031

8.3.3.2.Market size analysis, by Wine Type, 2021-2031

8.3.3.3.Market size analysis, by Sales channel, 2021-2031

8.3.4.Australia

8.3.4.1.Market size analysis, by Product form, 2021-2031

8.3.4.2.Market size analysis, by Wine Type, 2021-2031

8.3.4.3.Market size analysis, by Sales channel, 2021-2031

8.3.5.South Korea

8.3.5.1.Market size analysis, by Product form, 2021-2031

8.3.5.2.Market size analysis, by Wine Type, 2021-2031

8.3.5.3.Market size analysis, by Sales channel, 2021-2031

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Product form, 2021-2031

8.3.6.2.Market size analysis, by Wine Type, 2021-2031

8.3.6.3.Market size analysis, by Sales channel, 2021-2031

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Product form, 2021-2031

8.4.1.2.Market size analysis, by Wine Type, 2021-2031

8.4.1.3.Market size analysis, by Sales channel, 2021-2031

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Product form, 2021-2031

8.4.2.2.Market size analysis, by Wine Type, 2021-2031

8.4.2.3.Market size analysis, by Sales channel, 2021-2031

8.4.3.UAE

8.4.3.1.Market size analysis, by Product form, 2021-2031

8.4.3.2.Market size analysis, by Wine Type, 2021-2031

8.4.3.3.Market size analysis, by Sales channel, 2021-2031

8.4.4.South Africa

8.4.4.1.Market size analysis, by Product form, 2021-2031

8.4.4.2.Market size analysis, by Wine Type, 2021-2031

8.4.4.3.Market size analysis, by Sales channel, 2021-2031

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Product form, 2021-2031

8.4.5.2.Market size analysis, by Wine Type, 2021-2031

8.4.5.3.Market size analysis, by Sales channel, 2021-2031

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Underberg AG

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Duc d’O

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Alfred Ritter

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.NEUHAUS

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Raaka

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Toms International

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7. Ferrero S.p.a.

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Yildiz Holdings

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Amedei Tuscany

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Halloren

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

Wine chocolates are growing in demand among people of all age groups because of the health benefits they provide. Wine chocolates are prepared by adding an appropriate amount of wine, either red or white, during the manufacturing phase. Foods like these have a rich dosage of antioxidants that help in boosting immunity and offer benefits like lower blood pressure, lower cholesterol levels, improved blood circulation, and lower risks of stroke. In general, one glass serving of wine chocolate has an average of 15% alcohol strength with a calorie count of about 300-400 calories.

Forecast Analysis of the Wine Chocolate Market

The rising demand for flavored chocolates among customers is the main factor estimated to drive the growth of the global wine chocolate market by 2031. In addition, the rising awareness about the health benefits of wine chocolates like improved heartbeat rate, weight loss, enhanced mental health, etc. is also expected to accelerate the demand for wine chocolates, thus boosting the market growth further during the analysis timeframe. Furthermore, improvements in the existing wine chocolates along with launches of new products by market players is projected to offer ample growth opportunities for the global wine chocolates market by 2031. However, their high cost is expected to impede the global market growth during the forecast period.

According to the report published by Research Dive, the global wine chocolate market is estimated to register a revenue of $1,621.4 million, growing at a CAGR of 8.1% in the 2022–2031 timeframe. Some significant players of the global market include Underberg AG, Alfred Ritter, Duc d’O, NEUHAUS, Toms International, Raaka, Ferrero S.p.a., Amedei Tuscany, Yildiz Holdings, and Halloren.

Wine Chocolate Market Trends & Developments

The significant organizations operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall wine chocolate market, which is subsequently helping the global market to flourish. For instance:

- In August 2021, Cargill, a leading American global food organization, announced its decision to acquire Singapore-based chocolate manufacturer, Aalst to expand its wine chocolate product portfolio in the Asia-Pacific region. This acquisition will boost Cargill’s cocoa products along with focusing on the consumer and retail business to get more customer insights, preferences, and ongoing trends.

- In October 2021, Willa’s Kitchen, a leading organic and non-dairy oat milk provider, announced its partnership with Raaka Chocolate, a renowned unroasted dark chocolate manufacturer, to introduce a new organic dark chocolate oat milk made with Peruvian cacao, which is both single-origin and produced sustainably. Raaka funded for the cacao powder while Willa utilized its unique milling approach to yield more nutrients, fiber, and protein oat milk.

Covid-19 Impact on the Wine Chocolate Market

The onset of the deadly Covid-19 pandemic has hit every business and industry, including the global wine chocolate market. The pandemic had a severe effect on people’s health and mental wellbeing and greatly declined the demand and production of wine chocolates. In addition, due to the fear of the coronavirus transmission along with their prevailing symptoms, several governmental bodies worldwide imposed mobility restrictions, travel bans, and strict lockdowns. This led to disruptions in the supply of raw materials like grapes, cocoa, and wine, thus hampering the market growth during the pandemic period.

Most Profitable Region

Regionally, the wine chocolate market in the Europe region is estimated to have an exponential growth in the 2022-2031 timeframe due to the existence of prominent wine chocolate producing as well as consuming countries in the region like France and Germany. In addition, people in this region are highly health conscious and therefore, are greatly inclined towards consuming healthy chocolates that are rich in nutrition.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com