Cloud Microservices Platform Market Report

RA08517

Cloud Microservices Platform Market by Component (Platform and Services), Deployment Type (Public, Private, and Hybrid) Application (Data Analytics, Database Applications, Customer Relationship Management, and Others), End User (BFSI, IT and Telecommunications, Government, Healthcare, Retail and E-commerce, Manufacturing, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast 2022–2031

Global Cloud Microservices Platform Market Analysis

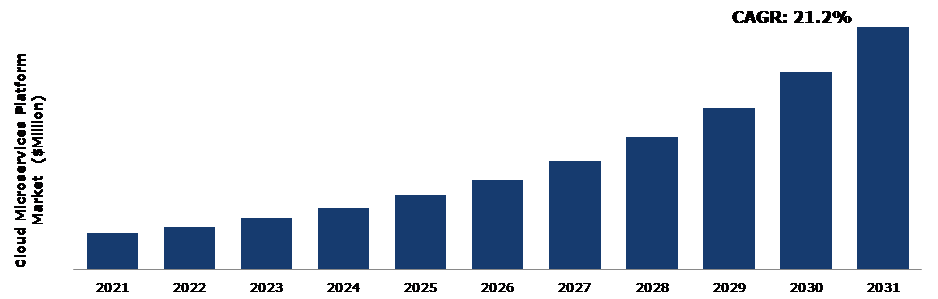

The Global Cloud Microservices Platform Market Size was $952.60 million in 2021 and is predicted to grow with a CAGR of 21.2%, by generating a revenue of $6,370.70 million by 2031.

Global Cloud Microservices Platform Market Synopsis

Cloud microservices platform enables organizations to scale their applications quickly and easily, without the need for significant investments in infrastructure. By using cloud microservices platforms, businesses can achieve greater agility and flexibility, which is essential in today's rapidly changing market conditions. In addition, microservices architecture enables faster development cycles and easier maintenance, which can further drive business agility. The scalability offered by cloud microservices platforms also helps organizations save costs by only using the resources they need at any given time, rather than investing in additional infrastructure that may be underutilized. This makes it easier for smaller businesses to compete with larger enterprises, as they can scale their applications more efficiently and effectively. These factors are anticipated to boost the cloud microservices platform market growth in the upcoming years.

However, some of the disadvantages of cloud microservices platforms include lack of network security. In addition, the distributed nature of microservices makes it difficult to detect and respond to security threats in real-time. The complex nature of microservices architecture, which involves multiple independent components that work together to provide a complete application. Each of these components may have its own vulnerabilities, and a breach in any one of them can potentially compromise the entire system, while security concerns remain a challenge for the cloud microservices platform, which is expected to hamper the cloud microservices platform market growth.

The cloud microservices platforms allows businesses to easily increase or decrease the amount of resources allocated to their applications and services based on demand. This scalability is made possible by the use of containerization and orchestration technologies, which allow for easy deployment, management, and scaling of individual microservices. As businesses continue to adopt cloud technology, they are also looking for ways to optimize their applications and services. Microservices architecture can help them achieve this goal by providing a more modular, scalable approach to application development and deployment. In addition, cloud microservices platforms often offer automatic scaling capabilities, which means that they can automatically adjust the number of resources allocated to an application or service based on usage patterns. This helps to ensure that businesses always have the resources they need to meet demand. Cloud microservices platforms that offer support for containerization can provide added value to businesses looking to adopt a microservices architecture.

According to regional analysis, the North America cloud microservices platform market forecast accounted for the largest market share in 2021. The increase in demand for digital transformation across various industries is driving the growth of the cloud microservices platform market share in North America. As organizations continue to adopt cloud computing for their IT infrastructure, the demand for cloud-based microservices platforms is also increasing. Cloud microservices provide greater flexibility, scalability, and cost-effectiveness compared to traditional on-premise solutions.

Cloud Microservices Platform Overview

A cloud microservices platform is a type of cloud computing platform that allows developers to build, deploy, and manage microservices-based applications in the cloud. Microservices are a modern software architecture approach that involves breaking down large monolithic applications into small, independent services that can be developed, deployed, and scaled independently. A cloud microservices platform typically provides a set of tools and services to support the development and deployment of microservices-based applications.

COVID-19 Impact on Global Cloud Microservices Platform Market

The COVID-19 pandemic has brought several uncertainties leading to severe economic losses as various businesses across the world were standstill. The COVID-19 pandemic has had a significant impact on the cloud microservices platform market. This has led to an increase in demand for cloud microservices platforms as businesses seek to optimize their operations and improve their efficiency. The pandemic has also accelerated digital transformation initiatives in many businesses, as they seek to adapt to the changing business environment. This has led to an increase in demand for cloud microservices platforms that can help businesses quickly and easily develop, deploy, and manage their digital applications. Furthermore, the pandemic has also disrupted supply chains and caused economic uncertainty, which has led some businesses to delay or cancel IT projects, including those related to cloud adoption. The pandemic has also disrupted global supply chains, which has affected the availability of hardware and software components used in cloud microservices platforms. This has led to delays in the delivery of some platforms and increase in prices for others.

Rising Digital Transformation of Cloud Microservices Platform to Drive the Market Growth

The cloud microservices platform market is being driven by several factors including scalability, agility, cost-effectiveness, flexibility, and DevOps. Cloud microservices platforms are becoming increasingly popular among organizations as they help in modernizing their IT infrastructure and driving digital transformation. In the digital economy, speed and agility are critical for businesses to stay competitive. Microservices-based architectures provide a way to achieve faster development and deployment of applications, making it easier for businesses to respond quickly to changing market demands. This approach allows developers to work on different parts of the application simultaneously, leading to faster development cycles. The driver of cloud microservices platform adoption is the need for faster, more agile development and deployment of applications. As businesses look to stay competitive in the digital economy, they need to embrace modern technologies that enable them to innovate quickly and respond to changing cloud microservices platform market demands.

To know more about global cloud microservices platform market drivers, get in touch with our analysts here.

The Security Concerns of Cloud Microservices Platform to Restrain the Market Growth

The security concerns are a major restraint for the growth of the cloud microservices platform market. Cloud microservices architecture involves breaking down the application into smaller independent services that interact with each other through APIs. While this approach offers benefits such as scalability, flexibility, and agility, it also creates security challenges. The primary security concerns of cloud microservices platform are data security. With cloud microservices, data is distributed across multiple services and storage locations, making it difficult to manage and secure. A breach in any one service can lead to the compromise of sensitive data across the entire application. All these are major factors projected to hamper the market growth during the forecast period.

Increase in Demand for Cloud Based Applications to Create Excellent Opportunities in the Market

The rise of cloud-native applications is expected to create significant growth opportunities for the key players operating in the cloud microservices platform market. Cloud-native applications are built using microservices, which are small, independently deployable services that work together to form a complete application. These microservices are typically packaged in containers, which provide a lightweight and portable runtime environment. Cloud microservices platforms provide developers with a set of tools and services to build, deploy, and manage cloud-native applications. These platforms offer a range of benefits, including improved agility, scalability, and resilience. They also enable developers to focus on writing code and building features, rather than worrying about the underlying infrastructure. Factors are driving the growth of the cloud microservices platform market such as increasing adoption of cloud-native architectures, growing need for faster software delivery cycles, and rising demand for scalable and resilient applications.

To know more about global cloud microservices platform market opportunities, get in touch with our analysts here.

Global Cloud Microservices Platform Market, by Component

Based on component, the market has been divided into platform and services. Among these, the platform sub-segment accounted for the highest market share in 2021, whereas the services sub-segment is estimated to show the fastest growth during the forecast period.

Global Cloud Microservices Platform Market Share, by Component, 2021

Source: Research Dive Analysis

The platform sub-segment accounted for the largest market share in 2021. The increasing demand for efficient and scalable microservices architecture are expected to drive the segment growth. As organizations continue to adopt cloud computing and migrate their applications to the cloud, they need a platform that can manage their microservices architecture effectively. Cloud-based microservices platforms provide an ideal environment for developing and deploying microservices-based applications as they offer the scalability, flexibility, and cost-efficiency required for these applications. The platform segment in the cloud microservices platform market is driven by the need for a comprehensive and integrated solution to support the development, deployment, and management of microservices-based applications in a cloud-native environment.

The services sub-segment is anticipated to show the fastest growth in 2031. Cloud microservices platforms offer a range of services to help organizations build, deploy, and manage microservices-based applications in the cloud. The services includes a variety of services that support the development, deployment, and management of microservices-based applications. These services may include consulting and advisory services, training and education, application development and integration services, and ongoing support and maintenance services. Consulting and advisory services are often used by organizations that are just starting to explore the use of microservices-based architectures. These services can help organizations understand the benefits and challenges of using microservices, assess their current IT infrastructure, and develop a roadmap for transitioning to a microservices-based architecture.

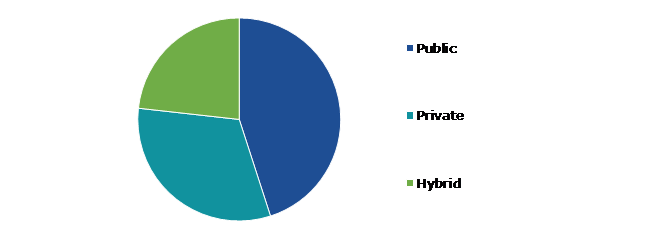

Global Cloud Microservices Platform Market, by Deployment Type

Based on deployment type, the market has been divided into public, private, and hybrid. Among these, the public sub-segment accounted for the highest revenue share in 2021.

Global Cloud Microservices Platform Market Size, by Deployment Type, 2021

Source: Research Dive Analysis

The public sub-segment accounted for the largest market share in 2021. The increasing demand for scalable, flexible, and agile cloud-based solutions that can support the development and deployment of microservices-based applications is expected to drive the segment growth. The public cloud segment offers a range of benefits, including cost savings, faster time-to-market, and greater scalability. Public cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) offer a wide range of cloud-based services that are designed to support microservices-based applications. These services include container orchestration platforms, serverless computing platforms, managed Kubernetes services, and others. These factors are anticipated to boost the growth of the public sub-segment during the forecast time.

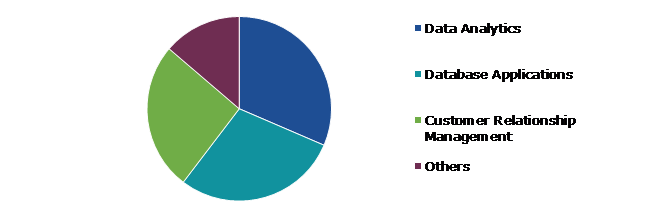

Global Cloud Microservices Platform Market, by Application

Based on application, the market has been divided into data analytics, database applications, customer relationship management, and others. Among these, the data analytics sub-segment accounted for the highest revenue share in 2021.

Global Cloud Microservices Platform Market Growth, by Application, 2021

Source: Research Dive Analysis

The data analytics sub-segment accounted for the largest market share in 2021. The data analytics segment is also driving innovation in the cloud microservices platform market. Cloud microservices platforms are continually evolving to meet the growing demands of organizations for advanced data analytics capabilities. Therefore, vendors are developing new tools and features that enable organizations to analyze data faster, more accurately, and at a lower cost. As more organizations adopt cloud microservices platforms, the demand for advanced data analytics capabilities is expected to continue to increase. These factors are anticipated to boost the growth of the public sub-segment during the forecast period.

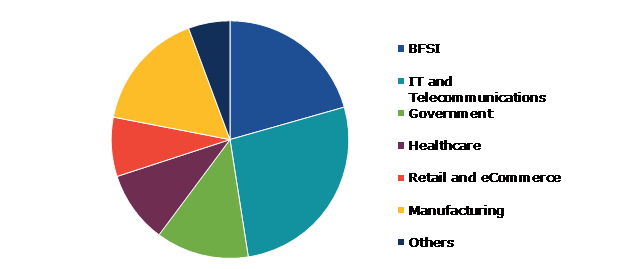

Global Cloud Microservices Platform Market, by End User

Based on end user, the market has been divided into BFSI, IT and telecommunications, government, healthcare, retail and e-commerce, manufacturing, and others. Among these, the IT and telecommunications sub-segment accounted for the highest revenue share in 2021.

Global Cloud Microservices Platform Market Analysis, by End User, 2021

Source: Research Dive Analysis

The IT and telecommunications sub-segment accounted for the largest market share in 2021. IT and telecommunications companies deal with large amounts of data and traffic, which requires a scalable infrastructure. Microservices allow these companies to scale individual components of their application, rather than scaling the entire monolithic application. The demand for services provided by the information technology (IT) and telecommunications (Telecom) sectors has increased owing to the growing use of technologies connected to software and communication. These factors are anticipated to boost the growth of the public sub-segment during the forecast period.

Global Cloud Microservices Platform Market, Regional Insights

The cloud microservices platform market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Cloud Microservices Platform Market Size & Forecast, by region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Cloud Microservices Platform in North America to be the Most Dominant

The North America cloud microservices platform market accounted for the largest market share in 2021. North America is home to some of the world's largest cloud service providers, including Amazon Web Services, Microsoft Azure, and Google Cloud Platform. These providers are leading the way in the adoption and implementation of microservices architecture. Cloud microservices platforms allow organizations to break down large monolithic applications into smaller, modular components, making it easier to develop, test, deploy, and manage them. Furthermore, The region's strong technological infrastructure, favorable government policies, and high adoption of cloud technology are contributing to the growth of the cloud microservices platform market. In addition, the increase in demand for agile, scalable, and cost-effective software solutions is driving the adoption of microservices architecture in the region. The increase in popularity of DevOps practices and containerization technologies such as Docker and Kubernetes has contributed to the growth of the cloud microservices platform market in North America. Moreover, the availability of robust cloud infrastructure, increasing investments in cloud-based technologies by large organizations, and the presence of major cloud service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform have also contributed to the growth of the cloud microservices platform market trend in North America. These factors have created a favorable environment for the growth of the cloud microservices platform market in the region.

Competitive Scenario in the Global Cloud Microservices Platform Market

Investment and agreement are common strategies followed by major market players. For instance, in February 2022, the development of industry- and domain-specific solutions for healthcare, financial services, and telecom is now possible owing to a multi-year Strategic Cooperation Agreement (SCA) between Amazon Web Services, Inc. and UST, a supplier of solutions for digital transformation. UST will invest in expanding its in-depth understanding of AWS and enterprise digital transformation. These solutions will enable businesses to modernize through AWS services.

Source: Research Dive Analysis

Some of the leading cloud microservices platform market analysis players are Salesforce.com, Infosys Limited, Cisco Systems, TATA Consultancy Services Limited, Amazon Web Services Inc., IBM CORPORATION, Oracle Corporation, SAP SE, Microsoft Corporation, and F5 Networks, Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Component |

|

| Segmentation by Deployment Type |

|

| Segmentation by Application |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

Q1. What is the size of the global cloud microservices platform market?

A. The size of the global cloud microservices platform market size was over $952.6 million in 2021 and is projected to reach $6,370.70 million by 2031.

Q2. Which are the major companies in the cloud microservices platform market?

A. Salesforce.com, Infosys ltd., and Cisco Systems are some of the key players in the global cloud microservices platform market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific cloud microservices platform market?

A. Asia-Pacific cloud microservices platform market share is anticipated to grow at 21.7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. TATA Consultancy Services Limited, Amazon Web Services Inc., and IBM Corporation are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Cloud Microservices Platform market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Cloud Microservices Platform market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Cloud Microservices Platform Market Analysis, by Component

5.1.Overview

5.2.Platform

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region,2021-2031

5.2.3.Market share analysis, by country,2021-2031

5.3.Services

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region,2021-2031

5.3.3.Market share analysis, by country,2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Cloud Microservices Platform Market Analysis, by Deployment Type

6.1.Public

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region,2021-2031

6.1.3.Market share analysis, by country,2021-2031

6.2.Private

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region,2021-2031

6.2.3.Market share analysis, by country,2021-2031

6.3.Hybrid

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region,2021-2031

6.3.3.Market share analysis, by country,2021-2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Cloud Microservices Platform Market Analysis, by Application

7.1.Data Analytics

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region,2021-2031

7.1.3.Market share analysis, by country,2021-2031

7.2.Database Applications

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region,2021-2031

7.2.3.Market share analysis, by country,2021-2031

7.3.Customer Relationship Management

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region,2021-2031

7.3.3.Market share analysis, by country,2021-2031

7.4.Others

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region,2021-2031

7.4.3.Market share analysis, by country,2021-2031

7.5.Research Dive Exclusive Insights

7.5.1.Market attractiveness

7.5.2.Competition heatmap

8.Cloud Microservices Platform Market Analysis, by End User

8.1.BFSI

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region,2021-2031

8.1.3.Market share analysis, by country,2021-2031

8.2.IT and Telecommunications

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region,2021-2031

8.2.3.Market share analysis, by country,2021-2031

8.3.Government

8.3.1.Definition, key trends, growth factors, and opportunities

8.3.2.Market size analysis, by region,2021-2031

8.3.3.Market share analysis, by country,2021-2031

8.4.Healthcare

8.4.1.Definition, key trends, growth factors, and opportunities

8.4.2.Market size analysis, by region,2021-2031

8.4.3.Market share analysis, by country,2021-2031

8.5.Retail and E-commerce

8.5.1.Definition, key trends, growth factors, and opportunities

8.5.2.Market size analysis, by region,2021-2031

8.5.3.Market share analysis, by country,2021-2031

8.6.Manufacturing

8.6.1.Definition, key trends, growth factors, and opportunities

8.6.2.Market size analysis, by region,2021-2031

8.6.3.Market share analysis, by country,2021-2031

8.7.Others

8.7.1.Definition, key trends, growth factors, and opportunities

8.7.2.Market size analysis, by region,2021-2031

8.7.3.Market share analysis, by country,2021-2031

8.8.Research Dive Exclusive Insights

8.8.1.Market attractiveness

8.8.2.Competition heatmap

9.Cloud Microservices Platform Market, by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Component,2021-2031

9.1.1.2.Market size analysis, by Deployment Type,2021-2031

9.1.1.3.Market size analysis, by Application,2021-2031

9.1.1.4.Market size analysis, by End User,2021-2031

9.1.2.Canada

9.1.2.1.Market size analysis, by Component,2021-2031

9.1.2.2.Market size analysis, by Deployment Type,2021-2031

9.1.2.3.Market size analysis, by Application,2021-2031

9.1.2.4.Market size analysis, by End User,2021-2031

9.1.3.Mexico

9.1.3.1.Market size analysis, by Component,2021-2031

9.1.3.2.Market size analysis, by Deployment Type,2021-2031

9.1.3.3.Market size analysis, by Application,2021-2031

9.1.3.4.Market size analysis, by End User,2021-2031

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Component,2021-2031

9.2.1.2.Market size analysis, by Deployment Type,2021-2031

9.2.1.3.Market size analysis, by Application,2021-2031

9.2.1.4.Market size analysis, by End User,2021-2031

9.2.2.UK

9.2.2.1.Market size analysis, by Component,2021-2031

9.2.2.2.Market size analysis, by Deployment Type,2021-2031

9.2.2.3.Market size analysis, by Application,2021-2031

9.2.2.4.Market size analysis, by End User,2021-2031

9.2.3.France

9.2.3.1.Market size analysis, by Component,2021-2031

9.2.3.2.Market size analysis, by Deployment Type,2021-2031

9.2.3.3.Market size analysis, by Application,2021-2031

9.2.3.4.Market size analysis, by End User,2021-2031

9.2.4.Spain

9.2.4.1.Market size analysis, by Component,2021-2031

9.2.4.2.Market size analysis, by Deployment Type,2021-2031

9.2.4.3.Market size analysis, by Application,2021-2031

9.2.4.4.Market size analysis, by End User,2021-2031

9.2.5.Italy

9.2.5.1.Market size analysis, by Component,2021-2031

9.2.5.2.Market size analysis, by Deployment Type,2021-2031

9.2.5.3.Market size analysis, by Application,2021-2031

9.2.5.4.Market size analysis, by End User,2021-2031

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Component,2021-2031

9.2.6.2.Market size analysis, by Deployment Type,2021-2031

9.2.6.3.Market size analysis, by Application,2021-2031

9.2.6.4.Market size analysis, by End User,2021-2031

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia-Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Component,2021-2031

9.3.1.2.Market size analysis, by Deployment Type,2021-2031

9.3.1.3.Market size analysis, by Application,2021-2031

9.3.1.4.Market size analysis, by End User,2021-2031

9.3.2.Japan

9.3.2.1.Market size analysis, by Component,2021-2031

9.3.2.2.Market size analysis, by Deployment Type,2021-2031

9.3.2.3.Market size analysis, by Application,2021-2031

9.3.2.4.Market size analysis, by End User,2021-2031

9.3.3.India

9.3.3.1.Market size analysis, by Component,2021-2031

9.3.3.2.Market size analysis, by Deployment Type,2021-2031

9.3.3.3.Market size analysis, by Application,2021-2031

9.3.3.4.Market size analysis, by End User,2021-2031

9.3.4.Australia

9.3.4.1.Market size analysis, by Component,2021-2031

9.3.4.2.Market size analysis, by Deployment Type,2021-2031

9.3.4.3.Market size analysis, by Application,2021-2031

9.3.4.4.Market size analysis, by End User,2021-2031

9.3.5.South Korea

9.3.5.1.Market size analysis, by Component,2021-2031

9.3.5.2.Market size analysis, by Deployment Type,2021-2031

9.3.5.3.Market size analysis, by Application,2021-2031

9.3.5.4.Market size analysis, by End User,2021-2031

9.3.6.Rest of Asia-Pacific

9.3.6.1.Market size analysis, by Component,2021-2031

9.3.6.2.Market size analysis, by Deployment Type,2021-2031

9.3.6.3.Market size analysis, by Application,2021-2031

9.3.6.4.Market size analysis, by End User,2021-2031

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Component,2021-2031

9.4.1.2.Market size analysis, by Deployment Type,2021-2031

9.4.1.3.Market size analysis, by Application,2021-2031

9.4.1.4.Market size analysis, by End User,2021-2031

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Component,2021-2031

9.4.2.2.Market size analysis, by Deployment Type,2021-2031

9.4.2.3.Market size analysis, by Application,2021-2031

9.4.2.4.Market size analysis, by End User,2021-2031

9.4.3.UAE

9.4.3.1.Market size analysis, by Component,2021-2031

9.4.3.2.Market size analysis, by Deployment Type,2021-2031

9.4.3.3.Market size analysis, by Application,2021-2031

9.4.3.4.Market size analysis, by End User,2021-2031

9.4.4.South Africa

9.4.4.1.Market size analysis, by Component,2021-2031

9.4.4.2.Market size analysis, by Deployment Type,2021-2031

9.4.4.3.Market size analysis, by Application,2021-2031

9.4.4.4.Market size analysis, by End User,2021-2031

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Component,2021-2031

9.4.5.2.Market size analysis, by Deployment Type,2021-2031

9.4.5.3.Market size analysis, by Application,2021-2031

9.4.5.4.Market size analysis, by End User,2021-2031

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1.Salesforce.com

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2.Infosys Limited

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3.Cisco Systems

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4.TATA Consultancy Services Limited

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5.Amazon Web Services Inc.

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6.IBM CORPORATION

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.Oracle Corporation

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8.SAP SE

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.Microsoft Corporation

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10.F5 Networks, Inc.

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

12.Appendix

12.1.Parent & peer market analysis

12.2.Premium insights from industry experts

12.3.Related reports

In today’s rapidly evolving digital landscape, businesses face the constant challenge of delivering robust, scalable, and highly available software solutions. To meet these demands, traditional monolithic architectures have given way to a more agile and efficient approach known as cloud microservices. At its core, microservices architecture decomposes complex applications into smaller, loosely coupled services that can be developed, deployed, and scaled independently. Each microservice is responsible for a specific business capability, and they communicate with each other through lightweight APIs. With the cloud, businesses can leverage on-demand resources, elastic scalability, and managed services, eliminating the need for upfront infrastructure investments. Cloud providers offer a wide range of tools and services, such as containers, serverless computing, and auto-scaling, which facilitate the deployment and management of microservices at scale.

Moreover, fault isolation is a key feature of microservices architecture. In a monolithic application, a failure in one component could bring down the entire system. With microservices, failures are isolated, ensuring that if one service goes down, the rest of the system can continue to function, minimizing the impact on end users.

Forecast Analysis of the Global Cloud Microservices Platform Market

According to the report published by Research Dive, the global cloud microservices platform market is projected to generate a revenue of $6,370.70 million and grow at a stunning CAGR of 21.2% throughout the forecast timeframe from 2022 to 2031.

The increasing popularity of cloud microservices platforms among organizations as they help to bring digital transformation and modernize their IT infrastructure is expected to fortify the growth of the cloud microservices platform market during the analysis timeframe. Moreover, the increasing demand for cloud-native applications among the leading market players due to their lightweight and portable runtime environment is predicted to create immense growth opportunities for the market throughout the estimated period. However, the security concerns of cloud microservices platforms may hamper the growth of the market over the analysis period.

The major players of the cloud microservices platform market includes IBM CORPORATION, Amazon Web Services Inc., Oracle Corporation, TATA Consultancy Services Limited, SAP SE, Cisco Systems, Microsoft Corporation, Infosys Limited, F5 Networks, Inc., Salesforce.com, and many more.

Key Developments of the Cloud Microservices Platform Market

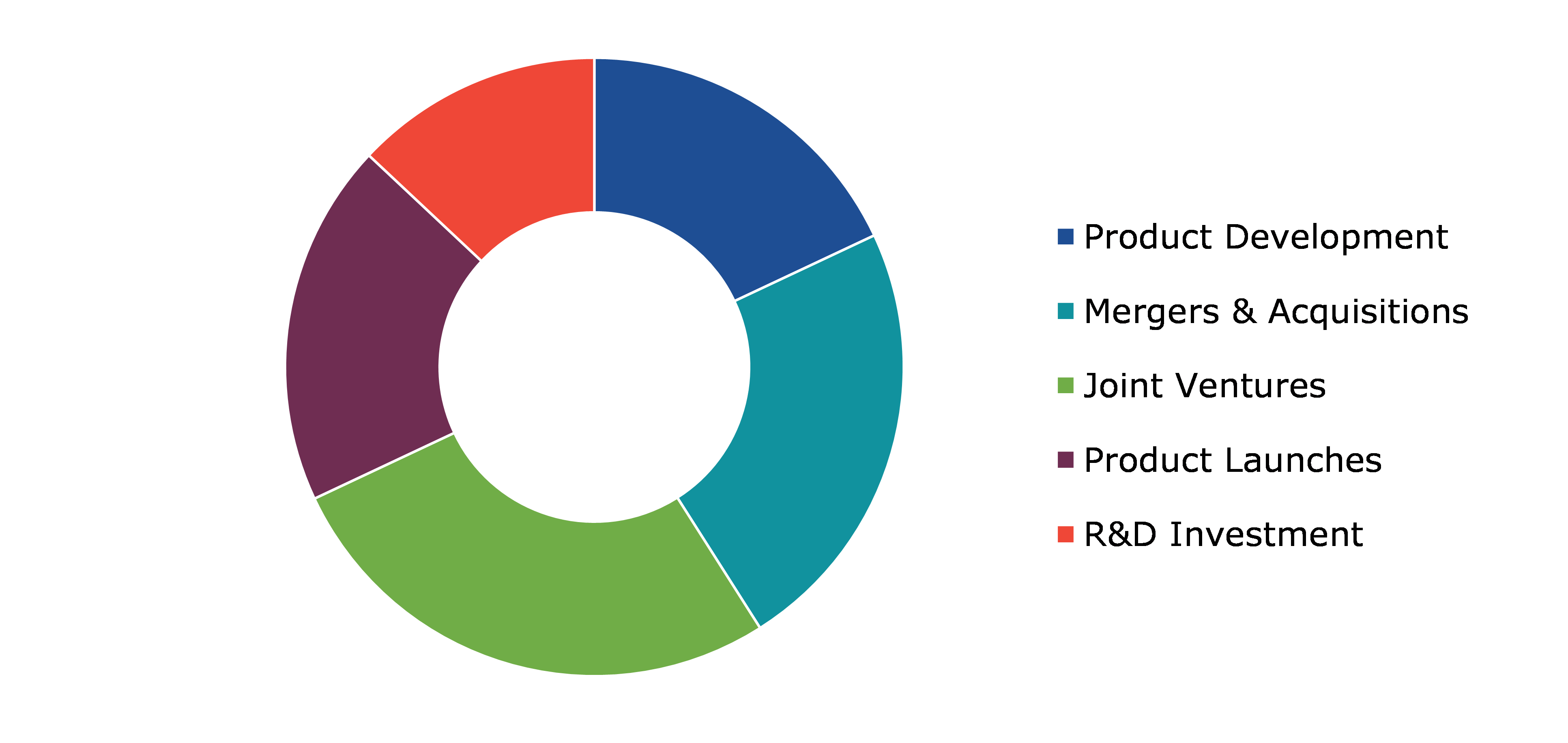

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global cloud microservices platform market to grow exponentially. For instance:

- In October 2022, Westech, an established UK digital marketing agency launched its microservices-based application, namely, Red Hat OpenShift Dedicated, a fully controlled solution that runs in an Amazon Web Services (AWS) cloud. With this application, the company aimed to deliver intelligent marketing solutions with the help of DevOps and continuous integration of (CI/CD) approaches.

- In February 2023, Infosys Ltd., a leading provider of next-generation digital services and consulting announced its collaboration with Microsoft, an American multinational technology corporation. With this collaboration, the companies aimed to benefit enterprises by providing the best cloud computing technologies.

- In April 2023, Catchpoint, a leading provider of innovative web and infrastructure monitoring solutions announced its acquisition of Thundra.io, a developer platform company that allows application teams to develop, debug, test, and deliver modern microservices on the cloud. With this acquisition, Catchpoint aimed to strengthen its Application Experience Solution with advanced microservices and API monitoring capabilities.

Most Profitable Region

The North America region of the cloud microservices platform market generated the highest market share in 2021. This is mainly due to the strong existence of the world’s largest cloud service providers in this region. Moreover, the rising implementation of microservices infrastructure, supportive government policies, and the increasing demand for scalable, agile, and cost-effective software are the major factors expected to drive the regional growth of the market throughout the forecast period.

Covid-19 Impact on the Global Cloud Microservices Platform Market

The rise of the novel coronavirus has brought several uncertainties across various industries. However, it has had a positive impact on the cloud microservices platform market. This is mainly due to the increasing demand for cloud microservices platforms across businesses to enhance their operations and improve their efficiency. Though the market has experienced huge growth opportunities over the pandemic, the disruption in supply chains has affected the availability of hardware and software components used in microservices platforms which further delayed many IT projects throughout the crisis.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com