Multiplex Assay Market Report

RA00847

Multiplex Assay Market by Type (Nucleic Acid and Protein), Product (Instruments, Consumable, and Software), Application (Research and Diagnosis), End User (Diagnostic Laboratories & Clinic, Hospitals, Pharmaceutical & Biotechnological Companies, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021-2028

Global Multiplex Assay Market Analysis

The global multiplex assay market is predicted to garner $4,162.5 million in the 2021-2028 timeframe, growing from $2,666.7 million in 2020 at a healthy CAGR of 5.8%.

Market Synopsis

Increasing pace of research and development activities to study the nature of diseases and the causative agent’s mechanism in the host body is expected to drive the market in the future.

However, the high investment cost of multiplex assays and lack of skilled labor for operating the apparatus is a growth-restricting factor for the market.

According to the regional analysis of the market, the Asia-Pacific multiplex assay market is anticipated to grow at a CAGR of 7.20% by generating a revenue of $882.5 million during the review period.

Multiplex Assay Overview

Multiplex assay is a technique in which multiple biomolecule analytes are profiled in a single run. These biomolecules include protein, nucleic acid, growth factors and more. Multiplex assay is used to amplify multiple targets in a PCR (polymerase chain reaction). Besides, this technique is widely used to collect more information from small quantities of proteins or other analytes in lesser time compared to the conventional methods. Multiplex assays are extensively used for pathogen identification, RNA detection, mutation analysis, gene detection analysis, forensic studies, linkage analysis, and others.

Impact Analysis of COVID-19 on the Global Multiplex Assay Market

The multiplex assay market has been observed to experience significant growth during this period. With quick transformation and mutation of the coronavirus genome, the application of multiple assays has played a crucial role in helping many researchers to study about the interaction of the virus with the biomolecules present in a COVID-19 patient’s body. For instance, according to a research ‘Development and Validation of a Multiplex, Bead-based Assay to Detect Antibodies Directed Against SARS-CoV-2 Proteins’, published on January 2021, multiplex assays proved to be efficient and more sensitive compared to singleplex assay in detecting the presence of antibodies against the virus in the patient’s body. This factor is expected to flourish the growth of the market in the pandemic duration.

Increasing Cases of Chronic Diseases to Surge the Market Growth

Rapid increase in chronic disease cases among old age population is expected to accelerate the growth of the global multiplex assay market. This rapid growth is attributed to rising research and development activities in the field of pharmaceutical and biotechnological fields to study and find a potent treatment option for various diseases. Cancer is one of the chronic diseases that is affecting people across the world rapidly. Multiplex assay is widely used in the diagnosis of diseases, study the mechanism, and develop a potential treatment option. Also, these assays are used in conducting clinical trials as they are highly sensitive & efficient and decrease the cost of research & labor. In addition, multiplex assays offer faster & easier analysis of diseases, thus fueling the market growth.

To know more about global multiplex assay market drivers, get in touch with our analysts here.

High Cost of Multiplex Assays to Restrain the Market Growth

Multiplex assays have a high procedural and setup cost and hence, can be opted by those patients who can afford the treatment. This factor restrains the market from growth. Furthermore, lack of skilled man power to perform the procedures with multiplex assays will hinder the market growth.

Technological Advancements and Innovations to flourish the Market Growth of Multiplex Assays

Increased company investments in the research and development activities in the multiplex assays are expected to raise the share of multiplex assay market. The COVID-19 pandemic has given many opportunities to the biotechnology and biopharmaceutical companies to invest in R&D activities related to multiplex assays. Many companies have initiated collaborations to develop effective diagnostic methods using multiplex assays for COVID-19 patients. Apart from this, increasing demand for multiplex assays in research and development activities to study the mechanism of chronic diseases and find a proper treatment option is further likely to accelerate the market growth.

To know more about global multiplex assay market opportunities, get in touch with our analysts here.

Global Multiplex Assay Market, by Type

Based on product, the global multiplex assay market is segmented into protein and nucleic acid. Protein sub-segment is projected to generate the maximum revenue and nucleic acid sub-segment is predicted to show the fastest growth.

Source: Research Dive Analysis

The protein sub-segment is predicted to have a dominating market share in the global market and is expected to register a revenue of $ 2,713.30 million during the forecast period. This growth is projected to increasing research activities to analyze unknown proteins and predict their mechanism. Also, multiplex protein assays provide more detailed information about biological systems as the protein biomarkers have a major role in the biological mechanism of living beings.

The nucleic acid sub-segment is anticipated to have the fastest market growth and generate a revenue of $892.4 million in 2020. This increase owes to wide use of nucleic acids in clinical diagnostics as they are highly specific and can determine the presence of foreign nucleic acids in the host body. A multiplex nucleic acid assay is widely used for the identification of microorganisms in the blood samples.

Global Multiplex Assay Market, by Product

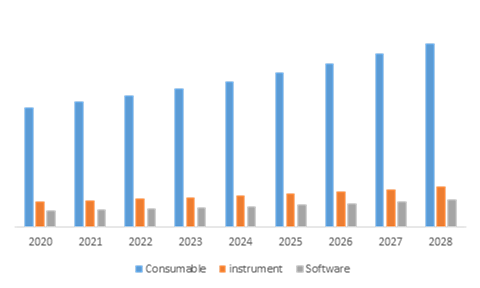

On the basis of product, the market has been sub-segmented into instruments, consumables, and software. Among the mentioned sub-segments, the software sub-segment is predicted to show the fastest growth, whereas the consumables sub-segment is projected to garner a dominant market share.

Source: Research Dive Analysis

The software sub-segment of the global multiplex assay market is projected to have the fastest growth and it is projected to surpass $ 454.8 million by 2028, with an increase from $267.9 million in 2020. This fast growth is due to the technological advancements in the latest multiplex assay products to make it more feasible. Software plays a major role to determine accurate, simple and rapid test results in the multiplex assay technique.

The consumable sub-segment is anticipated to have a dominating market share in the global market and register a revenue of $ 3,040.20 million during the analysis timeframe. This sub-segment growth is attributed to the increasing demand for reagents and kits and bulk purchasing by laboratories and hospitals. Duse to rising number of patients with chronic diseases, the demand for rapid reagents & kits have increased and thus the manufacturing companies have also paced up the production and supply of multiplex consumable products.

Global Multiplex Assay Market, by Application

Based on application, the market has been divided into research and diagnosis. Out of these, the diagnostic sub-segment is predicted to have the fastest growth and research sub-segment is anticipated to garner the maximum revenue share in the global market.

Source: Research Dive Analysis

The diagnostic sub-segment of the global multiplex assay market is predicted to have rapid growth and it is expected to surpass $ 2,871.80 million by 2028, with an increase from $ 1,869.50 million in 2020 owing to the rising demand for rapid and accurate diagnosis for various chronic diseases. Multiplex assay provides fast result delivery for multiple biomolecule targets in a single run which makes it a preferable choice of disease detection in the patients.

The research sub-segment is predicted to have a dominating market share in the global market and is expected to register a revenue of $ 2,871.80 million during the analysis timeframe owing to increase in the research activities to diagnose the chronic and unknown diseases prevailing at an exceptionally high rate.

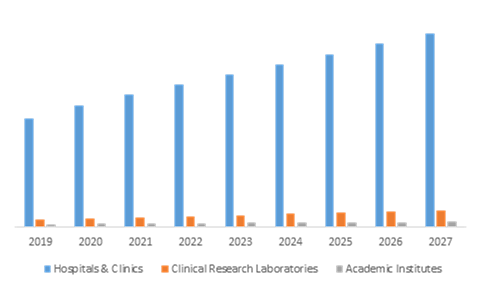

Global Multiplex Assay Market, by End User

Based on end-users, the market has been divided into diagnostic laboratories & clinic, hospitals, pharmaceutical & biotechnological companies, and others. Out of these, the diagnostic laboratories & clinic sub-segment is predicted to have the fastest growth and pharmaceutical & biotechnological companies sub-segment is anticipated to garner the maximum revenue share in the global market.

Source: Research Dive Analysis

The diagnostic laboratories & clinics of the global multiplex assay market are predicted to have rapid growth and surpass $1,310.00 million by 2028, with an increase from $800.9 million in 2020 owing to the rising demand for diagnosis for various chronic diseases. This has led to increased utilization of multiplex assay kits and reagents in the diagnostic labs and clinics. Also, presence of skilled labor to operate multiplex assays is expected to drive the market growth in future.

The pharmaceutical & biotechnological companies are predicted to have a dominating market share in the global market and is expected to register a revenue of $2,043.80 million during the analysis timeframe owing to constant efforts by the companies to innovate new and efficient assay techniques.

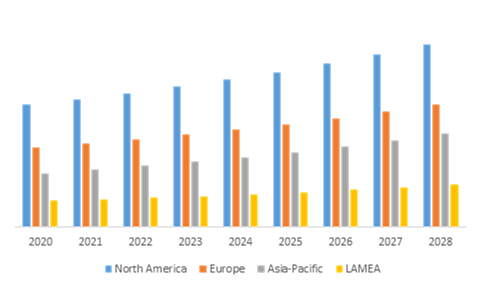

Global Multiplex Assay Market, Regional Insights:

The multiplex assay market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Multiplex Assay in North America to be the Most Dominant

The North America multiplex assay market accounted $1,157.30 million in 2020 and is projected to register a revenue of $1,723.30 million by 2028. This growth is due to per capita healthcare expenditure in the U.S., and rising demand for better and advanced healthcare diagnostic facilities among patients. Also, adoption of new and advanced technologies will further increase the market revenue of North America.

The Market for Multiplex Assay in Asia-Pacific to be the Fastest Growing

The share of Asia-Pacific multiplex assay market is anticipated to grow at a CAGR of 7.20% by registering a revenue of $882.5 million by 2028. This is due to factors such as rising prevalence of chronic diseases in countries like India, and China. Also, constantly improving healthcare infrastructure and facilities will further add on to the market growth.

Competitive Scenario in the Global Multiplex Assay Market

Product launch is a common strategy followed by major market players.

Source: Research Dive Analysis

The key players operating in the global multiplex assay market include Becton, Dickinson and Company, Thermo Fisher Scientific, Luminex Corporation, Bio-Rad Laboratories Inc., Abbott Laboratories, Quest Diagnostics, Agilent Technologies, Quansys Biosciences Inc., Abcam PLC and Seegene Inc.

Porter’s Five Forces Analysis for the Global Multiplex Assay Market:

- Bargaining Power of Suppliers: The suppliers in the multiplex assay market are high in number. Several companies are working on product innovation and development. Thus, there is less threat from the suppliers.

Thus, the bargaining power suppliers is moderate. - Bargaining Power of Buyers: Buyers are high in number and they demand the product in bulk, thus having huge bargaining power; they demand best services at low prices. This increases the pressure on the manufacturing companies to offer the best service in a cost-effective way. Thus, buyers can freely choose the convenient service that best fits their preference.

Thus, the bargaining power of the buyers is high. - Threat of New Entrants: New companies entering the multiplex assay market are adopting advanced technologies for innovations such as developing the best product in the minimum time frame. Also, these companies are implementing various effective strategies such as offering discounts and value propositions. However, new players have to face tough competition from the already established market players as they already have built a trust with their buyers.

Thus, the threat of the new entrants is high. - Threat of Substitutes: As the demand for rapid, accurate and cost effective diagnostic technology is at its height, the currently available singleplex assays cannot guarantee the above mentioned facilities.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense. The companies are launching their products in the international market and strengthening the footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Product |

|

| Segmentation by Application |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

Q1. What is the size of the multiplex assay market?

A. The global multiplex assay market was valued at $2,666.9 million in 2020, and is projected to reach $4,163.3 million by 2028, registering a CAGR of 5.8% from 2021 to 2028.

Q2. Which are the major companies in the multiplex assay market?

A. Bio-Rad Laboratories Inc., Agilent Technologies and Thermo Fisher Scientific are some of the prominent companies in the multiples assay market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific multiplex assay market?

A. The share of Asia-Pacific market is anticipated to grow at a CAGR of 7.20%.

CHAPTER 1:INTRODUCTION

1.1.Research methodology

1.1.1.Desk research

1.1.2.Real-time insights and validation

1.1.3.Forecast model

1.1.4.Assumptions & forecast parameters

1.1.4.1.Assumptions

1.1.4.2.Forecast parameters

CHAPTER 2:EXECUTIVE SUMMARY

2.1.360° summary

2.2.Technology trends

2.3.Mode of operation trends

2.4.Range trends

2.5.Application trends

2.6.Maximum takeoff weight trends

2.7.Propulsion trends

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.2.2.1.Top winning strategies, by year

3.2.2.2.Top winning strategies, by development

3.2.2.3.Top winning strategies, by company

3.2.3.Top player positioning

3.3.Porter's five forces analysis

3.4.Market dynamics

3.5.Drivers

3.5.1.Increasing research & development activities to diagnose the diseases

3.6.Restraints

3.6.1.High investment cost

3.7.Opportunities

3.7.1.Advances and innovation in technology to flourish the market of multiplex assay market

3.8.Technology landscape

3.9.Regulatory landscape

3.10.Patent landscape

3.11.Market value chain analysis

3.12.Strategic overview

CHAPTER 4:IMPACT OF COVID19 ON MULTIPLEX ASSAY MARKET

4.1.Introduction

4.2.COVID-19 health assessment

4.3.Impact of COVID-19 on the global economy

4.4.Impact of COVID-19 on multiplex assay market

4.4.1.Technological impact

4.4.2.Investment scenario

4.5.multiplex assay market size and forecast, by region, 2026-2033

CHAPTER 5:GLOBAL MULTIPLEX ASSAY MARKET, BY TYPE

5.1.Overview

5.1.1.Market size and forecast, by type

5.2.Protein

5.2.1.Key market trends, growth factors and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market share analysis, by country

5.3.Nucleic acid

5.3.1.Key market trends, growth factors and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market share analysis, by country

CHAPTER 6:GLOBAL MULTIPLEX ASSAY MARKET, BY PRODUCT

6.1.Overview

6.1.1.Market size and forecast, by product

6.2.Consumable

6.2.1.Key market trends, growth factors and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market share analysis, by country

6.3.Instrument

6.3.1.Key market trends, growth factors and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market share analysis, by country

6.4.Software

6.4.1.Key market trends, growth factors and opportunities

6.4.2.Market size and forecast, by region

6.4.3.Market share analysis, by country

CHAPTER 7:GLOBAL MULTIPLEX ASSAY MARKET BY APPLICATION

7.1.Overview

7.1.1.Market size and forecast, by range

7.2.Research

7.2.1.Key market trends, growth factors and opportunities

7.2.2.Market size and forecast, by region

7.2.3.Market share analysis, by country

7.3.Diagnosis

7.3.1.Key market trends, growth factors and opportunities

7.3.2.Market size and forecast, by region

7.3.3.Market share analysis, by country

CHAPTER 8:GLOBAL MULTIPLEX ASSAY MARKET, BY END USER

8.1.Overview

8.1.1.Market size and forecast, by end user

8.2.Pharmaceutical & Biotechnology Companies

8.2.1.Key market trends, growth factors and opportunities

8.2.2.Market size and forecast, by region

8.2.3.Market share analysis, by country

8.3.Diagnostic Laboratories & Clinics

8.3.1.Key market trends, growth factors and opportunities

8.3.2.Market size and forecast, by region

8.3.3.Market share analysis, by country

8.4.Hospital

8.4.1.Key market trends, growth factors and opportunities

8.4.2.Market size and forecast, by region

8.4.3.Market share analysis, by country

8.5.Others

8.5.1.Key market trends, growth factors and opportunities

8.5.2.Market size and forecast, by region

8.5.3.Market share analysis, by country

CHAPTER 9:GLOBAL MULTIPLEX ASSAY MARKET, BY REGION

9.1.Overview

9.1.1.Market size and forecast, by region

9.2.North America

9.2.1.Key market trends, growth factors, and opportunities

9.2.2.Market size and forecast, by type

9.2.3.Market size and forecast, by product

9.2.4.Market size and forecast, by application

9.2.5.Market size and forecast, by end user

9.2.6.Market size and forecast, by country

9.2.7.U.S.

9.2.7.1.Market size and forecast, by type

9.2.7.2.Market size and forecast, by product

9.2.7.3.Market size and forecast, by application

9.2.7.4.Market size and forecast, by end user

9.2.8.Canada

9.2.8.1.Market size and forecast, by type

9.2.8.2.Market size and forecast, by product

9.2.8.3.Market size and forecast, by application

9.2.8.4.Market size and forecast, by end user

9.2.9.Mexico

9.2.9.1.Market size and forecast, by type

9.2.9.2.Market size and forecast, by product

9.2.9.3.Market size and forecast, by application

9.2.9.4.Market size and forecast, by end user

9.3.Europe

9.3.1.Key market trends, growth factors, and opportunities

9.3.2.Market size and forecast, by type

9.3.3.Market size and forecast, by product

9.3.4.Market size and forecast, by application

9.3.5.Market size and forecast, by end user

9.3.6.Market size and forecast, by country

9.3.7.Germany

9.3.7.1.Market size and forecast, by type

9.3.7.2.Market size and forecast, by product

9.3.7.3.Market size and forecast, by application

9.3.7.4.Market size and forecast, by end user

9.3.8.UK

9.3.8.1.Market size and forecast, by type

9.3.8.2.Market size and forecast, by product

9.3.8.3.Market size and forecast, by application

9.3.8.4.Market size and forecast, by end user

9.3.9.France

9.3.9.1.Market size and forecast, by type

9.3.9.2.Market size and forecast, by product

9.3.9.3.Market size and forecast, by application

9.3.9.4.Market size and forecast, by end user

9.3.10.Italy

9.3.10.1.Market size and forecast, by type

9.3.10.2.Market size and forecast, by product

9.3.10.3.Market size and forecast, by application

9.3.10.4.Market size and forecast, by end user

9.3.11.Spain

9.3.11.1.Market size and forecast, by type

9.3.11.2.Market size and forecast, by product

9.3.11.3.Market size and forecast, by application

9.3.11.4.Market size and forecast, by end user

9.3.12.Rest of Europe

9.3.12.1.Market size and forecast, by type

9.3.12.2.Market size and forecast, by product

9.3.12.3.Market size and forecast, by application

9.3.12.4.Market size and forecast, by end user

9.4.Asia-Pacific

9.4.1.Key market trends, growth factors, and opportunities

9.4.2.Market size and forecast, by type

9.4.3.Market size and forecast, by product

9.4.4.Market size and forecast, by application

9.4.5.Market size and forecast, by end user

9.4.6.Market size and forecast, by country

9.4.7.China

9.4.7.1.Market size and forecast, by type

9.4.7.2.Market size and forecast, by product

9.4.7.3.Market size and forecast, by application

9.4.7.4.Market size and forecast, by end user

9.4.8.Japan

9.4.8.1.Market size and forecast, by type

9.4.8.2.Market size and forecast, by product

9.4.8.3.Market size and forecast, by application

9.4.8.4.Market size and forecast, by end user

9.4.9.Australia

9.4.9.1.Market size and forecast, by type

9.4.9.2.Market size and forecast, by product

9.4.9.3.Market size and forecast, by application

9.4.9.4.Market size and forecast, by end user

9.4.10.South Korea

9.4.10.1.Market size and forecast, by type

9.4.10.2.Market size and forecast, by product

9.4.10.3.Market size and forecast, by application

9.4.10.4.Market size and forecast, by end user

9.4.11.India

9.4.11.1.Market size and forecast, by type

9.4.11.2.Market size and forecast, by product

9.4.11.3.Market size and forecast, by application

9.4.11.4.Market size and forecast, by end user

9.4.12.Rest of Asia-Pacific

9.4.12.1.Market size and forecast, by type

9.4.12.2.Market size and forecast, by product

9.4.12.3.Market size and forecast, by application

9.4.12.4.Market size and forecast, by end user

9.5.LAMEA

9.5.1.Key market trends, growth factors, and opportunities

9.5.2.Market size and forecast, by type

9.5.3.Market size and forecast, by product

9.5.4.Market size and forecast, by application

9.5.5.Market size and forecast, by end-user

9.5.6.Market size and forecast, by country

9.5.7.Latin America

9.5.7.1.Market size and forecast, by type

9.5.7.2.Market size and forecast, by product

9.5.7.3.Market size and forecast, by application

9.5.7.4.Market size and forecast, by end user

9.5.8.Middle East

9.5.8.1.Market size and forecast, by type

9.5.8.2.Market size and forecast, by product

9.5.8.3.Market size and forecast, by application

9.5.8.4.Market size and forecast, by end user

9.5.9.Africa

9.5.9.1.Market size and forecast, by type

9.5.9.2.Market size and forecast, by product

9.5.9.3.Market size and forecast, by application

9.5.9.4.Market size and forecast, by end user

CHAPTER 10:COMPANY PROFILES

10.1.Thermo Fisher Scientific Inc.

10.1.1.Company overview

10.1.2.Company snapshot

10.1.3.Operating business segments

10.1.4.Product portfolio

10.1.5.Business performance

10.1.6.Key strategic moves and developments

10.2.Becton, Dickinson and Company

10.2.1.Company overview

10.2.2.Company snapshot

10.2.3.Operating business segments

10.2.4.Product portfolio

10.2.5.Business performance

10.2.6.Key strategic moves and developments

10.3.Quest Diagnostics

10.3.1.Company overview

10.3.2.Company snapshot

10.3.3.Operating business segments

10.3.4.Product portfolio

10.3.5.Business performance

10.3.6.Key strategic moves and developments

10.4.Luminex Corporation

10.4.1.Company overview

10.4.2.Company snapshot

10.4.3.Product portfolio

10.4.4.Business performance

10.4.5.Key strategic moves and development

10.5.Abbott Laboratories

10.5.1.Company overview

10.5.2.Company snapshot

10.5.3.Operating business segments

10.5.4.Product portfolio

10.5.5.Business performance

10.5.6.Key strategic moves and developments

10.6.Agilent Technologies

10.6.1.Company overview

10.6.2.Company snapshot

10.6.3.Operating business segments

10.6.4.Product portfolio

10.6.5.Business performance

10.6.6.Key strategic moves and developments

10.7.Quansys Biosciences Inc.

10.7.1.Company overview

10.7.2.Company snapshot

10.7.3.Product portfolio

10.7.4.Key strategic moves and development

10.8.Bio-Rad Laboratories, Inc.

10.8.1.Company overview

10.8.2.Company snapshot

10.8.3.Operating business Segments

10.8.4.Product portfolio

10.8.5.Business performance

10.8.6.Key strategic moves and developments

10.9.Abcam PLC.

10.9.1.Company overview

10.9.2.Company snapshot

10.9.3.Product portfolio

10.9.4.Business performance

10.9.5.Key strategic moves and developments

10.10.Seegene

10.10.1.Company overview

10.10.2.Company snapshot

10.10.3.Product portfolio

10.10.4.Business performance

10.10.5.Key strategic moves and developments

Multiplex assay, in biological terms, is a type of immunoassay that measures analytes simultaneously in just one experiment using magnetic beads. Multiplex assays commonly used in research compared to its usage in clinical settings. These biomolecules includes nucleic acid, protein, and other growth factors. This technique is used widely in the diagnosis of chronic diseases.

Factors Impacting the Growth of the Market

One of the major driving factor of the multiplex assay market is the chronic diseases among the geriatric population. There are many research and development are going on in the pharmaceutical and biotechnological industry which involves application of multiplex assay. Multiplex assay is also used extensively in the diagnosis of various cancers and study of its mechanism in the patient’s body and finally developing a potential treatment option.

Moreover, these assays have other benefits such as they are highly sensitive and efficient and reduces cost of research during clinical trials. These are the main factors enhancing the growth of the global multiplex assay market.

Recent Trends of the Market

According to the report published by Research Dive, the global multiplex assay market include Thermo Fisher Scientific, Becton, Dickinson and Company, Bio-Rad Laboratories Inc., Luminex Corporation, Abbott Laboratories, Agilent Technologies, Quest Diagnostics, Abcam PLC, Seegene Inc., and Quansys Biosciences Inc. among others.

These industry players are investing a lot of efforts on the research and development of smart and unique strategies to sustain the growth of the market. These strategies include product launches, mergers and acquisitions, collaborations, partnerships, and refurbishing of existing technology.

Some of the recent developments of the market are as follows:

- According to a recent press release, In April 2021, Thermo Fisher Scientific Inc., the world leader in serving science, and PPD, Inc., announced that it has entered into a definitive agreement to acquire PPD, leading global provider of clinical research services to the pharma and biotech industry.

- In April 2021, DiaSorin S.p.A., an Italy-based multinational biotechnology company, announced that it signed a definitive merger agreement to acquire Luminex Corporation, a biotechnology company which develops and manufactures proprietary biological testing technologies. The acquisition is aimed at broadening the position of DiaSorin in the molecular diagnostics sphere and reinforce its prevailing value proposition with its tactical primacies.

- In September 2020, Bio-Rad Laboratories, Inc., a global leader of life science research and clinical diagnostic products, announced about its acquisition of Celsee, Inc., a company that provides consumables and instruments for the detection, isolation, and examination of single cells.

- As per a news release, in June 2021, Quest Diagnostics, an American clinical laboratory, has completed its acquisition of Mercy, a leading pharma company. This acquisition is expected to expand the access of both of the companies to innovative, quality and cost-effective laboratory services to deliver affordable patient care throughout the Midwest. The acquisition has expanded the Quest's global footprint throughout Kansas, Arkansas, Oklahoma, and Missouri.

- Another news release states, Agilent Technologies, Inc., an analytical instrumentation development and manufacturing company based in the US, completed the acquisition of Resolution Bioscience, a leader in the development and commercialization of next-generation sequencing (NGS)-based precision oncology solutions in April 2021.

With this agreement, Resolution Bioscience helps Agilent in expanding its competences in NGS-based cancer diagnostics and keeping up with the fast-growing precision medicine market with the application of innovative technology.

Covid-19 Impact Analysis

Because of its wide-ranging application in the biotechnological industry, the multiplex assay market has experienced a remarkable growth during the pandemic period.

The multiplex assay has played a vital role in the research and development of the coronavirus. It has helped researchers and experts in studying the interaction of the virus with biomolecules present in the patient’s body.

According to a research report, ‘Development and Validation of a Multiplex, Bead-based Assay to Detect Antibodies Directed Against SARS-CoV-2 Proteins’ which was published on January 2021, multiplex assays has been able to efficiently and sensitively detecting the presence of antibodies against the virus in the patient’s body.

With the diligence of key players and demand from the end-users, the global multiplex assay market will definitely sustain the competition in the post pandemic period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com