Semiconductor Packaging Market Report

RA08429

Semiconductor Packaging Market by Packaging Platform (Flip Chip, Embedded Die, Fan-in Wafer-level Package, Fan-out Wafer-level Package, and 3D Stacking), Packaging Material (Organic Substrate, Bonding Wire, Lead Frame, Ceramic Package, Die Attach Material, and Others), End-user (Consumer Electronics, Automotive, Healthcare, IT & Telecommunication, Aerospace & Defense, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021-2028

Global Semiconductor Packaging Market Analysis

The global is projected to garner $52,271.6 million in the 2021-2028 timeframe, growing from $30,814.7 million in 2020, at a healthy CAGR of 7.0%.

Market Synopsis

Growing utilization of consumer electronics is anticipated to accelerate the growth of the semiconductor packaging market.

However, the high initial investment required in the semiconductor packaging industry is predicted to restrict the market growth

According to the regional analysis of the market, the Asia-Pacific semiconductor packaging market share is anticipated to grow at a CAGR of 6.8% by generating a revenue of $19,078.5 million during the review period.

Semiconductor Packaging Overview

Semiconductor packaging involves surrounding the semiconductor chip with a casing on which an integrated circuit is formed. Semiconductor packaging uses materials such as organic substrates, bonding wires, lead frames, ceramic packages, die attach materials, and others.

Impact Analysis of COVID-19 on the Global Semiconductor Packaging Market

The Covid-19 impact on semiconductor packaging market has been negative. During the pandemic, a reduction in the demand of electronic products such as devices, sensors in the consumer electronics, telecom, automotive and other industries was observed. Thus, there was a reduction in the production of semiconductor-based goods too due to disturbance in the global supply chains. During the pandemic, companies in the semiconductor industry analyzed the product demand volumes and revised their product schedules to meet immediate needs by implementing AI-supported technologies during the pandemic. The increased emphasis on strategies to mitigate the Covid-19 impact on semiconductor packaging market, may help the market to recover from the losses in the forecast period.

Increasing Utilization of Consumer Electronics is Expected to surge the Semiconductor Packaging Market Growth

The growing utilization of consumer electronics due to increasing per capita income across the world and increased affordability of electronic equipment due to higher standard of living is expected to expand the semiconductor packaging market size globally. Developments in consumer electronic products such as laptops, tablets, fitness bands, smartwatches, and other electronic devices, where complex integration of semiconductors is required, are expected to aid the growth of the semiconductor packaging industry.

In addition to this, a surge in the adoption of (IoT) Internet of Things and artificial intelligence (AI) in consumer electronics, telecommunication, robotics, automotive, aerospace & defense, and others for hardware which are compatible with advanced software is expected to aid the growth of semiconductor packaging market size in the forecast period.

To know more about global semiconductor packaging market insight and drivers, get in touch with our analysts here.

The High Capital Investment Required in Semiconductor Packaging Services to Restrain the Market Growth.

The high initial investment required in the designing, development, and setup of semiconductor packaging units as per the requirement by different industries such as consumer electronics, automotive, healthcare, IT & telecommunication, aerospace & defense, and others can restrict the growth of the semiconductor packaging market. Moreover, the lack of technical awareness in the field of semiconductor packaging is anticipated to act as a restraint in the growth of the semiconductor packaging market.

The Adoption of 3D Semiconductor Packaging in the Market to Create Massive Investment Opportunities

The increasing adoption of 3d semiconductor packaging technology is expected to open new opportunities for the growth of semiconductor packaging market share in the forecast period. The surge in the consumer demand for smaller, lighter, and portable products (e.g., cell phones, PDAs, digital cameras, and others) with require volumetric system miniaturization and interconnection (VSMI), a method of semiconductor fabrication to meet the demand for increased functionality acquiring less space. 3d semiconductor packaging has benefits since it makes the products more compact compared to the traditional semiconductor packaging. Moreover, it enables simplified system level circuit routing for direct chip to chip interconnection and reduces overall system cost. These factors are expected to open new scope of opportunities for this market.

To know more about global semiconductor packaging market opportunities, get in touch with our analysts here.

Based on packaging platform, the market has been divided into Flip Chip, embedded die, fan-in wafer-level package, fan-out wafer-level package, and 3D stacking. Among these, the Flip Chip sub-segment is anticipated to generate the maximum revenue and the 3D stacking sub-segment is expected to show the fastest growth. Download Exclusive Sample ReportSemiconductor Packaging Market

By Packaging Platform

Source: Research Dive Analysis

The flip chip sub-segment is predicted to have a dominating share in the global market and is expected to register a revenue of $24,903.7 million in 2028, growing from $16,654.9 in 2020 during the forecast period.

The increasing demand for advanced high-performance in electronics for retail and commercial uses is expected to aid the growth of this sub-segment. In addition to this, the increased affordability and penetration of consumer electronic devices such as mobiles and wireless due to increasing per capita income across the world are major factors leading to the growth of the sub-segment. Moreover, the presence of large number of electronics manufacturing companies, and surge in the adoption of other high-performance applications such as networks, servers, and data centers in different sectors such as consumer electronics, automotive, healthcare, IT & telecommunication, aerospace & defense, and others is anticipated to grow this sub-segment in the forecast period.

The 3D stacking sub-segment is anticipated to have the fastest market growth and generate a revenue of $9,530.9 million by 2028, growing from $3,749.4 million in 2020, at a healthy CAGR of 12.6% in the forecast period. 3D stacking refers to 3D integration method that relies on traditional methods of interconnection at the package level such as wire bonding and flip chip to achieve vertical stacking. The growing demand for compact and cost-effective technology in semiconductor manufacturing is anticipated to open new scope of opportunities for 3D stacking subsegment in the forecast period. The high cost of traditional packaging restricts electronics manufacturers to adapt competitive pricing strategies, but with the adoption of 3d stacking technique, the cost of semiconductor packaging reduces with more compact and semiconductor chips. These factors are expected to boost the growth of the subsegment in the forecast period.

Semiconductor Packaging Market

By Packaging MaterialBased on packaging material, the market has been divided into Organic Substrate, bonding wire, lead frame, ceramic package, die attach material, and others. Organic Substrate sub-segment is anticipated to generate the maximum revenue and ceramic package sub-segment is expected to show the fastest growth.

Source: Research Dive Analysis

The organic substrate sub-segment is predicted to have a dominating market share in the global market and register a revenue of $ 16,486.2 in year 2028 million during the forecast period. The growing demand for portable electronic devices such as smartphones, tablets, portable digital assistant, audio devices, and others globally with the technological development in the semiconductor technology is predicted to result in the growth of organic substrate packaging materials sub-segment in the forecast period. The utilization of organic substrates has advantages such as temperature control, good dimensional control, and better electrical performance. These factors are expected to grow this sub-segment in the forecast period.

The ceramic package sub-segment is anticipated to have the fastest market growth and generate a revenue of $6,496.1 million by 2028, growing from $3,497.6 million in 2020, at a healthy CAGR of 8.2% in the forecast period. Ceramic packages are made of 90%–94% Al2O3, and the rest of the formulation consists of glass-forming alkaline-earth silicates. The silicon chip is mounted in the package, and the package is sealed with a glass or metal lid. The significant increase in the demand for ceramic packaging from the automotive industry owing to the rapid use of electronic components in various automotive parts, that include safety features, comfort, stability, and high performance is expected to grow this sub-segment in the forecast period.

Semiconductor Packaging Market

By End UserBased on end-user, the market has been sub-segmented into Consumer Electronics, automotive, healthcare, IT & telecommunication, aerospace & defense, and others. Among the mentioned sub-segments, the Consumer Electronics sub-segment is estimated to show a dominant share, whereas the healthcare sub-segment is projected to garner the fastest growth.

Source: Research Dive Analysis

The consumer electronics sub-segment is anticipated to have a dominating share in the global market and surpass $15,826.2 million by 2028, with an increase from $9,855.2 million in 2020. Increasing population coupled with high disposable income globally is expected to aid the growth of consumer electronics sub-segment, with increased expenditure and the presence of large number of electronics equipment manufacturing companies offering consumer electronic products such as smartphones, tablets, portable digital assistant, audio devices, and others especially in the developing countries such as China, India, Vietnam, Indonesia.

The healthcare sub-segment of the global semiconductor packaging market is projected to have the fastest growth and register a revenue of $7,121.4 million during the analysis timeframe, growing at a healthy CAGR of 8.0%. Increasing health disorders such as cardiac arrests, cancers, neurological & musculoskeletal ailments, and other disorders that require technologies such as medical imaging which require medical electronic equipment’s that are made of semiconductors, of which semiconductor packaging is done is expected to aid the growth of the healthcare sector in the forecast period.

Semiconductor Packaging Market

By RegionThe semiconductor packaging market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Semiconductor Packaging in Asia-Pacific to be the Most Dominant

The share of Asia-Pacific semiconductor packaging market is estimated to grow at a CAGR of 6.8%, by registering a revenue of $19,078.5 million by 2028. The Asia-Pacific region is a hub of major electronic equipment manufacturers as the region has a well-established industrial and economic base for consumer electronics production coupled with the presence of major semiconductor manufacturing and processing countries such as China, Japan, and Taiwan. In addition to this, the increased per capita income of citizens of countries in Asia-Pacific region due to increased economic development has led to a growth in the expenditure on semiconductor-based devices and products such as smartphones, personal computers, high-definition (HD) television sets, and others. These factors are expected to aid the growth of the semiconductor packaging market in the Asia-Pacific region.

The Market for Semiconductor Packaging in North America to be the Fastest Growing

The North America semiconductor packaging market generated $7,778.5 million in 2020 and is projected to register a revenue of $13,747.0 million by 2028. The North America region offers the most developed and established infrastructure technology. The presence of developed nations such as U.S and Canada and the early adoption of the latest technologies such as (IoT) Internet of Things and artificial intelligence (AI) in products are expected to aid the growth of semiconductor packaging market in the North America region in the forecast period. These factors are expected to aid the growth of the semiconductor packaging market in the North American region.

Competitive Scenario in the Global Semiconductor Packaging Market

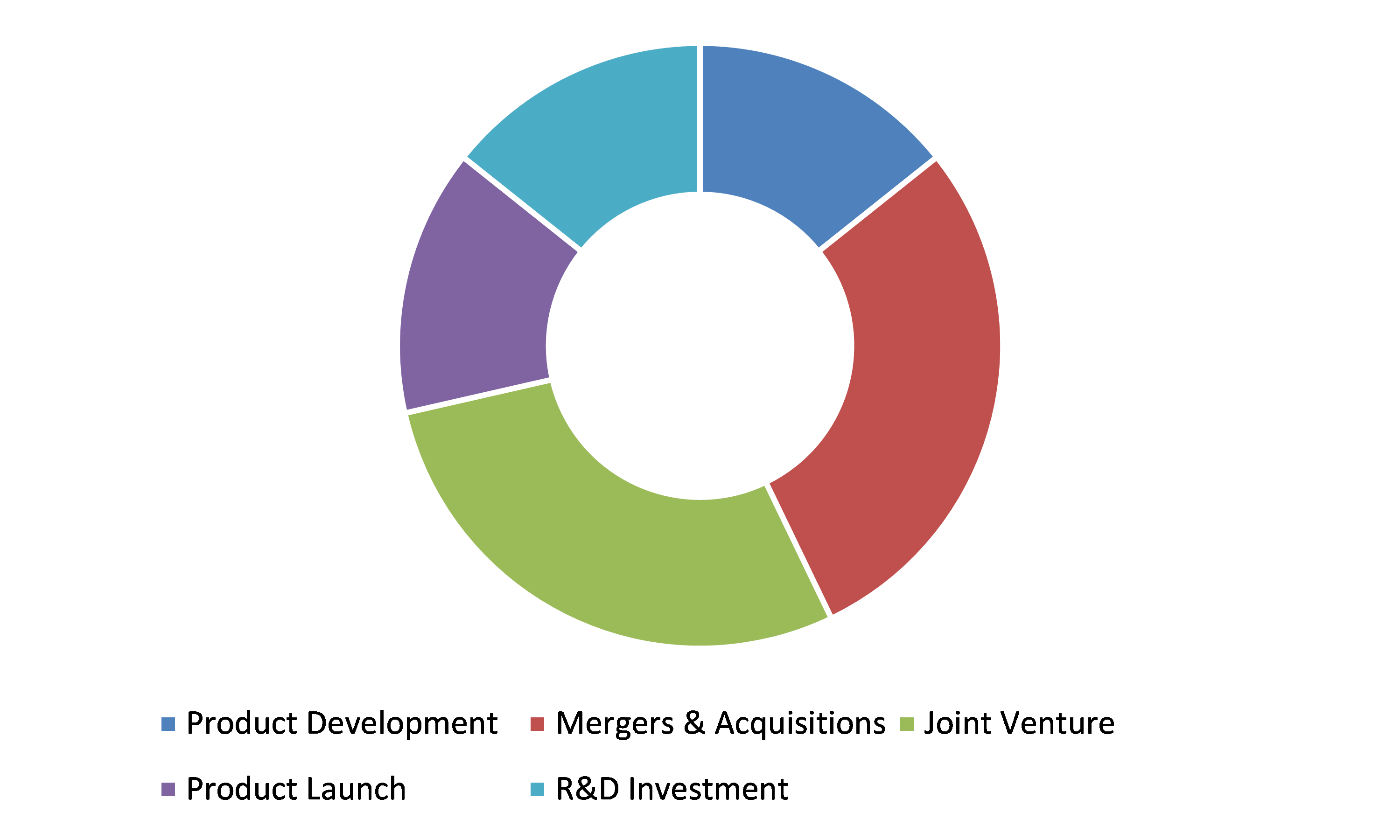

Agreement and acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading semiconductor packaging market players are Intel Corporation, 3M, Applied Materials, Inc, SÜSS MICROTEC SE, Microchip Technology Inc., Amkor Technology Inc., Advanced Semiconductor Engineering, Inc., GlobalFoundries U.S. Inc., Taiwan Semiconductor Manufacturing Company Limited, and SPTS Technologies Ltd.

Porter’s Five Forces Analysis for the Global Semiconductor Packaging Market:

- Bargaining Power of Suppliers: The suppliers in the semiconductor packaging market are moderate in number. Several companies are working on new methodologies such as 3D semiconductor packaging to gain the major market share.Thus, there is less threat from the suppliers.

Thus, the bargaining power of suppliers is moderate. - Bargaining Power of Buyers: Buyers have huge bargaining power; they demand best services at low prices. This increases the pressure on the semiconductor packaging test providers to offer the best service in a cost-effective way. Thus, buyers can freely choose the convenient service that best fits their preference.

Thus, the bargaining power of buyers is moderate. - Threat of New Entrants: Companies entering the semiconductor packaging market are adopting technological innovations such as 3D stacking technique for semiconductor packaging to reduce the cost of production and customize products to attract clients. The initial investment in the semiconductor packaging is high and technology is complex.

Thus, the threat of the new entrants is low. - Threat of Substitutes: There is no alternative product for semiconductor packaging solutions.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players including Advanced Semiconductor Engineering, Inc. and Taiwan Semiconductor Manufacturing Company Limited. Companies in the semiconductor packaging do acquisitions to gain major market share.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Packaging Platform |

|

| Segmentation by Packaging Material |

|

| Segmentation by End-user |

|

| Key Companies Profiled |

|

Q1. What is the size of the global semiconductor packaging market?

A. The size of the global semiconductor packaging market was over $30,814.7 million in 2020 and is projected to reach $52,271.6 million by 2028.

Q2. Which are the major companies in the semiconductor packaging market?

A. Advanced Semiconductor Engineering, Inc. and Taiwan Semiconductor Manufacturing Company Limited are some of the key players in the global semiconductor packaging market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific semiconductor packaging market?

A. Asia-Pacific Semiconductor packaging Market is anticipated to grow at a 6.8% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Acquisition and agreement are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Amkor Technology Inc. and Advanced Semiconductor Engineering, Inc. are investing more on R&D activities for developing new products and technologies.

Q7. What is semiconductor Packaging?

A. Semiconductor packaging comprises of surrounding the semiconductor chip with a casing on which an integrated circuit is formed. Semiconductor packaging uses materials such as organic substrates, bonding wires, lead frames, ceramic packages, die attach materials, and others.

Q8. What is packaging of IC technology?

A. The packaging of IC technology involves surrounding the circuit material to guard it from weathering and allow mounting of the electrical contacts linking it to the printed circuit board (PCB).

Q9. Why semiconductor packages are tightly sealed?

A. Semiconductor packages are sealed for creating a impermeable layer around the semiconductor for prevention against corrosion and physical damages.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Packaging Platform trends

2.3.Packaging Material trends

2.4.End-User trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Pricing overview

3.8.1.By Packaging Platform

3.8.2.By Packaging Material

3.8.3.By End-User

3.8.4.By Region

3.9.Market value chain analysis

3.9.1.Stress point analysis

3.9.2.Raw material analysis

3.9.3.Manufacturing process

3.9.4.Distribution channel analysis

3.9.5.Operating vendors

3.9.5.1.Raw material suppliers

3.9.5.2.Packaging Platform manufacturers

3.9.5.3.Packaging Platform distributors

3.10.Strategic overview

4.Semiconductor Packaging Market, by Packaging Platform

4.1.Flip Chip

4.1.1.Market size and forecast, by region, 2021-2028

4.1.2.Comparative market share analysis, 2021-2028

4.2.Embedded Die

4.2.1.Market size and forecast, by region, 2021-2028

4.2.2.Comparative market share analysis, 2021-2028

4.3.Fan-In Wafer-level Package

4.3.1.Market size and forecast, by region, 2021-2028

4.3.2.Comparative market share analysis, 2021-2028

4.4.Fan-out wafer-level Package

4.4.1.Market size and forecast, by region, 2021-2028

4.4.2.Comparative market share analysis, 2021-2028

4.5.3D Stacking

4.5.1.Market size and forecast, by region, 2021-2028

4.5.2.Comparative market share analysis, 2021-2028

5.Semiconductor Packaging Market, by Packaging Material

5.1.Organic Substrate

5.1.1.Market size and forecast, by region, 2021-2028

5.1.2.Comparative market share analysis, 2021-2028

5.2. Bonding Wire

5.2.1.Market size and forecast, by region, 2021-2028

5.2.2.Comparative market share analysis, 2021-2028

5.3.Lead Frame

5.3.1.Market size and forecast, by region, 2021-2028

5.3.2.Comparative market share analysis, 2021-2028

5.4.Ceramic Package

5.4.1.Market size and forecast, by region, 2021-2028

5.4.2.Comparative market share analysis, 2021-2028

5.5.Die Attach Material

5.5.1.Market size and forecast, by region, 2021-2028

5.5.2.Comparative market share analysis, 2021-2028

5.6.Others

5.6.1.Market size and forecast, by region, 2021-2028

5.6.2.Comparative market share analysis, 2021-2028

6.Semiconductor Packaging Market, by End-User

6.1.Consumer Electronics

6.1.1.Market size and forecast, by region, 2021-2028

6.1.2.Comparative market share analysis, 2021-2028

6.2.Automotive

6.2.1.Market size and forecast, by region, 2021-2028

6.2.2.Comparative market share analysis, 2021-2028

6.3. Healthcare

6.3.1.Market size and forecast, by region, 2021-2028

6.3.2.Comparative market share analysis, 2021-2028

6.4.IT & Telecommunication

6.4.1.Market size and forecast, by region, 2021-2028

6.4.2.Comparative market share analysis, 2021-2028

6.5.Aerospace & Defense

6.5.1.Market size and forecast, by region, 2021-2028

6.5.2.Comparative market share analysis, 2021-2028

6.6.Others

6.6.1.Market size and forecast, by region, 2021-2028

6.6.2.Comparative market share analysis, 2021-2028

7.Semiconductor Packaging Market, by region

7.1.North Region

7.1.1.Market size and forecast, by Packaging Platform, 2021-2028

7.1.2.Market size and forecast, by Packaging Material, 2021-2028

7.1.3.Market size and forecast, by End-User, 2021-2028

7.1.4.Market size and forecast, by country, 2021-2028

7.1.5.Comparative market share analysis, 2021-2028

7.1.6.U.S

7.1.6.1.Market size and forecast, by Packaging Platform, 2021-2028

7.1.7.Market size and forecast, by Packaging Material, 2021-2028

7.1.7.1.Market size and forecast, by End-User, 2021-2028

7.1.8.Canada

7.1.8.1.Market size and forecast, by Packaging Platform, 2021-2028

7.1.9.Market size and forecast, by Packaging Material, 2021-2028

7.1.9.1.Market size and forecast, by End-User, 2021-2028

7.1.10.Mexico

7.1.10.1.Market size and forecast, by Packaging Platform, 2021-2028

7.1.11.Market size and forecast, by Packaging Material, 2021-2028

7.1.11.1.Market size and forecast, by End-User, 2021-2028

7.2.Europe

7.2.1.Market size and forecast, by Packaging Platform, 2021-2028

7.2.2.Market size and forecast, by Packaging Material, 2021-2028

7.2.3.Market size and forecast, by End-User, 2021-2028

7.2.4.Market size and forecast, by country, 2021-2028

7.2.5.Comparative market share analysis, 2021-2028

7.2.6.UK

7.2.6.1.Market size and forecast, by Packaging Platform, 2021-2028

7.2.7.Market size and forecast, by Packaging Material, 2021-2028

7.2.7.1.Market size and forecast, by End-User, 2021-2028

7.2.7.2.Comparative market share analysis, 2021-2028

7.2.8.Germany

7.2.8.1.Market size and forecast, by Packaging Platform, 2021-2028

7.2.9.Market size and forecast, by Packaging Material, 2021-2028

7.2.9.1.Market size and forecast, by End-User, 2021-2028

7.2.9.2.Comparative market share analysis, 2021-2028

7.2.10.France

7.2.10.1.Market size and forecast, by Packaging Platform, 2021-2028

7.2.11.Market size and forecast, by Packaging Material, 2021-2028

7.2.11.1.Market size and forecast, by End-User, 2021-2028

7.2.11.2.Comparative market share analysis, 2021-2028

7.2.12.Spain

7.2.12.1.Market size and forecast, by Packaging Platform, 2021-2028

7.2.13.Market size and forecast, by Packaging Material, 2021-2028

7.2.13.1.Market size and forecast, by End-User, 2021-2028

7.2.13.2.Comparative market share analysis, 2021-2028

7.2.14.Italy

7.2.14.1.Market size and forecast, by Packaging Platform, 2021-2028

7.2.15.Market size and forecast, by Packaging Material, 2021-2028

7.2.15.1.Market size and forecast, by End-User, 2021-2028

7.2.15.2.Comparative market share analysis, 2021-2028

7.2.16.Rest of Europe

7.2.16.1.Market size and forecast, by Packaging Platform, 2021-2028

7.2.17.Market size and forecast, by Packaging Material, 2021-2028

7.2.17.1.Market size and forecast, by End-User, 2021-2028

7.2.17.2.Comparative market share analysis, 2021-2028

7.3.Asia-Pacific

7.3.1.Market size and forecast, by Packaging Platform, 2021-2028

7.3.2.Market size and forecast, by Packaging Material, 2021-2028

7.3.3.Market size and forecast, by End- User, 2021-2028

7.3.4.Market size and forecast, by Country, 2021-2028

7.3.5.Comparative market share analysis, 2021-2028

7.3.6.China

7.3.7.Market size and forecast, by Packaging Platform, 2021-2028

7.3.8.Market size and forecast, by Packaging Material, 2021-2028

7.3.9.Comparative market share analysis, 2021-2028

7.3.10.India

7.3.10.1.Market size and forecast, by Packaging Platform, 2021-2028

7.3.11.Market size and forecast, by Packaging Material, 2021-2028

7.3.12.Market size and forecast, by End- User, 2021-2028

7.3.12.1.Comparative market share analysis, 2021-2028

7.3.13.Japan

7.3.13.1.Market size and forecast, by Packaging Platform, 2021-2028

7.3.14.Market size and forecast, by Packaging Material, 2021-2028

7.3.15.Market size and forecast, by End- User, 2021-2028

7.3.15.1.Comparative market share analysis, 2021-2028

7.3.16.South Korea

7.3.16.1.Market size and forecast, by Packaging Platform, 2021-2028

7.3.17.Market size and forecast, by Packaging Material, 2021-2028

7.3.18.Market size and forecast, by End- User, 2021-2028

7.3.18.1.Comparative market share analysis, 2021-2028

7.3.19.Australia

7.3.19.1.Market size and forecast, by Packaging Platform, 2021-2028

7.3.20.Market size and forecast, by Packaging Material, 2021-2028

7.3.21.Market size and forecast, by End- User, 2021-2028

7.3.22.Rest of Asia-Pacific

7.3.22.1.Market size and forecast, by Packaging Platform, 2021-2028

7.3.23.Market size and forecast, by Packaging Material, 2021-2028

7.3.24.Market size and forecast, by End- User, 2021-2028

7.3.24.1.Comparative market share analysis, 2021-2028

7.4.LAMEA

7.4.1.Market size and forecast, by Packaging Platform, 2021-2028

7.4.2.Market size and forecast, by Packaging Platform, 2021-2028

7.4.3.Market size and forecast, by End-User, 2021-2028

7.4.4.Market size and forecast, by Country, 2021-2028

7.4.5.Comparative market share analysis, 2021-2028

7.4.6.Latin America

7.4.6.1.Market size and forecast, by Packaging Platform, 2021-2028

7.4.7.Market size and forecast, by Packaging Material, 2021-2028

7.4.8.Market size and forecast, by End-User, 2021-2028

7.4.8.1.Comparative market share analysis, 2021-2028

7.4.9.Middle East

7.4.9.1.Market size and forecast, by Packaging Platform, 2021-2028

7.4.10.Market size and forecast, by Packaging Material, 2021-2028

7.4.11.Market size and forecast, by End-User, 2021-2028

7.4.11.1.Comparative market share analysis, 2021-2028

7.4.12.Africa

7.4.12.1.Market size and forecast, by Packaging Platform, 2021-2028

7.4.13.Market size and forecast, by Packaging Material, 2021-2028

7.4.14.Market size and forecast, by End-User, 2021-2028

7.4.14.1.Comparative market share analysis, 2021-2028

8.Company profiles

8.1.AMKOR TECHNOLOGY, INC.

8.1.1.Business overview

8.1.2.Financial performance

8.1.3.Packaging Platform portfolio

8.1.4.Recent strategic moves & developments

8.1.5.SWOT analysis

8.2.Applied Materials, Inc.

8.2.1.Business overview

8.2.2.Financial performance

8.2.3.Packaging Platform portfolio

8.2.4.Recent strategic moves & developments

8.2.5.SWOT analysis

8.3.SPTS Technologies Ltd.

8.3.1.Business overview

8.3.2.Financial performance

8.3.3.Packaging Platform portfolio

8.3.4.Recent strategic moves & developments

8.3.5.SWOT analysis

8.4.MICROCHIP TECHNOLOGY INC.

8.4.1.Business overview

8.4.2.Financial performance

8.4.3.Packaging Platform portfolio

8.4.4.Recent strategic moves & developments

8.4.5.SWOT analysis

8.5.SÜSS MICROTEC SE

8.5.1.Business overview

8.5.2.Financial performance

8.5.3.Packaging Platform portfolio

8.5.4.Recent strategic moves & developments

8.5.5.SWOT analysis

8.6.3M

8.6.1.Business overview

8.6.2.Financial performance

8.6.3.Packaging Platform portfolio

8.6.4.Recent strategic moves & developments

8.6.5.SWOT analysis

8.7.Advanced Semiconductor Engineering, Inc.

8.7.1.Business overview

8.7.2.Financial performance

8.7.3.Packaging Platform portfolio

8.7.4.Recent strategic moves & developments

8.7.5.SWOT analysis

8.8.INTEL CORPORATION

8.8.1.Business overview

8.8.2.Financial performance

8.8.3.Packaging Platform portfolio

8.8.4.Recent strategic moves & developments

8.8.5.SWOT analysis

8.9.Global foundries U.S. Inc.

8.9.1.Business overview

8.9.2.Financial performance

8.9.3.Packaging Platform portfolio

8.9.4.Recent strategic moves & developments

8.9.5.SWOT analysis

8.10.Taiwan Semiconductor Manufacturing Company Limited

8.10.1.Business overview

8.10.2.Financial performance

8.10.3.Packaging Platform portfolio

8.10.4.Recent strategic moves & developments

8.10.5.SWOT analysis

Semiconductor packaging plays a vital role in protecting integrated circuit (IC) chips from the surrounding environment and safeguarding the electrical connection for chip mount on wiring boards. Some of the materials used in semiconductor packaging include organic substrates, lead frames, bonding wires, die attach materials, ceramic packages, and others. Semiconductor packaging prevents corrosion and physical damage to logic units, silicon wafers, and memory during the final stage of semiconductor manufacturing process. The packaging requirement for different ICs is different, which is thereby providing lucrative opportunities for the global semiconductor packaging market over the traditional packaging process.

COVID-19 Impact Analysis

The outbreak of COVID-19 across the globe has unfavorably impacted the global semiconductor packaging market. This is mainly due to the decreasing demand of electronic products such as sensors & devices from telecom, automotive, and other industries. In addition, the disruption in global supply chains has resulted in decreased production of semiconductor-based goods. However, various companies operating in the semiconductor industry are adopting novel technologies and taking measures such as analyzing the product demand volumes and revising the product schedules, in order to meet the needs by implementing AI-supported technologies during the pandemic. This is expected to help the market to recover from the losses during the forecast period.

Key Developments in the Industry

The companies operating in the global industry are adopting various growth strategies and business tactics such as partnerships, acquisitions, business expansion, and product launches to obtain a leading position in the global industry, which is predicted to drive the growth of the global semiconductor packaging market in the upcoming years.

For instance, in December 2019, SÜSS MicroTec, the leading supplier of equipment & process solutions for the semiconductor industry, entered into a collaboration agreement with BRIDG, an enterprise SaaS data infrastructure company, to establish a production-level Applications Center in North America to enable semiconductor process and product innovations.

In September 2020, KLA, the US-based capital equipment company, announced the launch of new semiconductor packaging techniques to enhance its systems portfolio. The new tools include the ICOS T3/T7 Series, the ICOS F160XP, and the Kronos 1190 wafer-level packaging inspection systems. The systems will enable the customers to advance semiconductor device fabrication at the packaging stage.

In March 2021, IBM and Intel, the leading American multinational technology companies entered into a research collaboration to advance next-generation logic and semiconductor packaging technologies. The aim of this collaboration is to enhance the competitiveness of the semiconductor industry in U.S., accelerate semiconductor manufacturing innovation, and support key US government initiatives.

Forecast Analysis of the Global Market

The global semiconductor packaging market is projected to witness an exponential growth during the forecast period, owing to the growing adoption of 3D semiconductor packaging technology. Conversely, the high initial costs associated with the designing, development, and setup of semiconductor packaging units are the factors expected to hamper the market growth in the projected timeframe.

The increasing utilization of consumer electronics owing to rising per capita income across the globe is the significant factor estimated to bolster the growth of the global market in the coming future. According to a latest report published by Research Dive, the global semiconductor packaging market is expected to garner $52,271.6 million during the forecast period (2021-2028). Regionally, the Asia Pacific region is estimated to dominate in the global industry owing to presence of well-established industrial and economic base for consumer electronics production in the region. The key players functioning in the global market include Intel Corporation, Applied Materials, Inc., 3M, SÜSS MICROTEC SE, Amkor Technology Inc., Microchip Technology Inc., Advanced Semiconductor Engineering, Inc., Taiwan Semiconductor Manufacturing Company Limited, GlobalFoundries U.S. Inc., and SPTS Technologies Ltd.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com